North America Iga Nephropathy Market

Market Size in USD Million

CAGR :

%

USD

259.67 Million

USD

1,094.42 Million

2024

2032

USD

259.67 Million

USD

1,094.42 Million

2024

2032

| 2025 –2032 | |

| USD 259.67 Million | |

| USD 1,094.42 Million | |

|

|

|

|

North America IgA Nephropathy Market Size

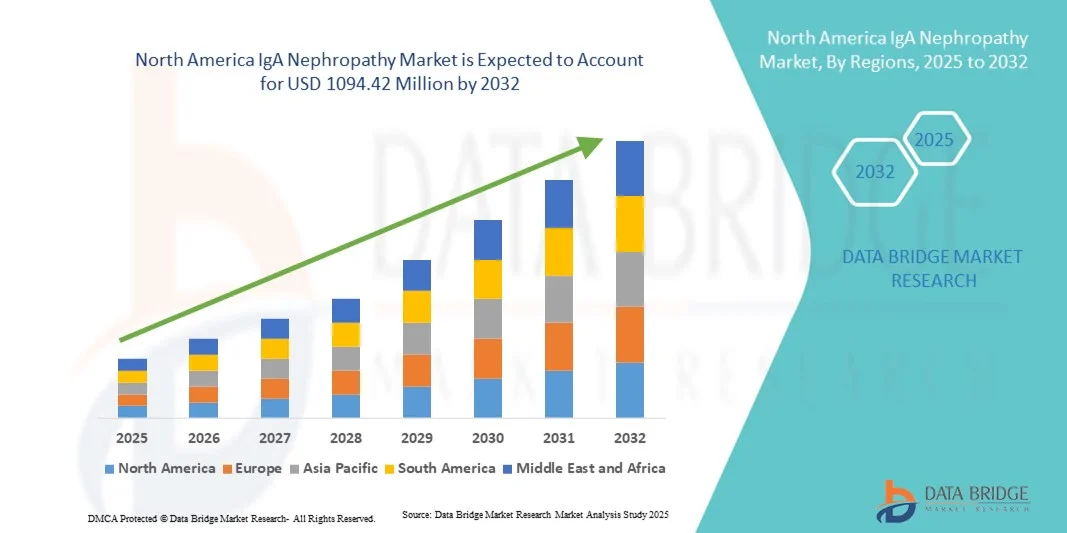

- The North America IgA nephropathy market size was valued at USD 259.67 Million in 2024 and is expected to reach USD 1094.42 Million by 2032, at a CAGR of 19.7% during the forecast period

- The market growth is largely fueled by the increasing prevalence of kidney-related disorders worldwide and the rising awareness regarding early diagnosis and disease management, which are driving demand for effective IgA nephropathy (IgAN) treatments. Advancements in diagnostic techniques such as kidney biopsies and biomarker testing are further improving disease detection and enabling timely intervention

- Furthermore, the growing focus on precision medicine, coupled with the development of novel biologics and targeted therapies aimed at reducing proteinuria and preserving renal function, is accelerating the adoption of innovative IgA nephropathy treatment solutions. These converging factors are significantly boosting the industry's growth and supporting the transition toward personalized renal care

North America IgA Nephropathy Market Analysis

- IgA Nephropathy (IgAN), also known as Berger’s disease, is an autoimmune kidney disorder characterized by the buildup of the immunoglobulin A (IgA) protein in the glomeruli, leading to inflammation and impaired kidney function. The market is witnessing significant growth due to the increasing prevalence of chronic kidney diseases, rising awareness of early diagnosis, and advancements in nephrology therapeutics

- The growing demand for innovative treatment options, including targeted biologics and complement pathway inhibitors, is fueling the expansion of the IgA Nephropathy market. In addition, the surge in clinical trials, favorable regulatory approvals, and improved diagnostic capabilities are contributing to the overall growth of this sector

- The U.S. dominated the IgA nephropathy market with the largest revenue share of 41.3% in 2024, driven by a well-established healthcare infrastructure, high awareness regarding kidney diseases, and the presence of major biopharmaceutical companies actively engaged in nephrology research

- Canada is expected to be the fastest-growing country in the IgA nephropathy market, registering a CAGR of 8.9% during the forecast period. This growth is primarily attributed to rising healthcare expenditure, increasing prevalence of renal disorders, and expanding access to innovative treatment solutions

- The Adults segment dominated the market with the largest revenue share of 79.0% in 2024, as most clinically significant IgAN cases and commercial treatment activity occur in adult populations

Report Scope and IgA Nephropathy Market Segmentation

|

Attributes |

IgA Nephropathy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America IgA Nephropathy Market Trends

Advancements in Targeted and Complement-Based Therapeutics

- A significant and accelerating trend in the global IgA Nephropathy (IgAN) market is the growing adoption of targeted therapies that focus on disease-specific mechanisms such as complement inhibition, B-cell modulation, and mucosal immunity regulation. This shift from conventional immunosuppressants to more personalized and mechanism-based treatments is transforming the treatment landscape

- For instance, in December 2023, Novartis received FDA approval for Iptacopan (Fabhalta), a first-in-class oral factor B inhibitor for IgA Nephropathy, marking a major milestone in targeted renal therapies. Similarly, Calliditas Therapeutics’ Tarpeyo (budesonide) gained strong market traction as a first approved drug that addresses the underlying pathophysiology of IgAN by targeting the gut mucosal immune system

- Research is increasingly focused on the complement pathway, which plays a key role in IgAN progression. Companies such as Omeros Corporation (narsoplimab) and Vera Therapeutics (atacicept) are advancing late-stage clinical trials, highlighting the market’s movement toward immune-modulatory precision therapies

- The integration of biomarker-driven diagnostics and patient stratification approaches allows more effective monitoring of disease progression and response to therapy. This precision-medicine model improves clinical outcomes and reduces unnecessary exposure to broad-spectrum immunosuppressants

- In addition, collaborations between pharmaceutical companies, biotechnology firms, and research institutions are accelerating drug discovery pipelines. For example, multiple Phase II and III trials across the U.S., Europe, and Asia-Pacific are exploring novel biologics and RNA-based therapies aimed at slowing kidney damage progression

- This trend toward precision-based, targeted, and biologic treatment options is reshaping the IgA Nephropathy market, positioning it as one of the most rapidly evolving therapeutic areas in nephrology

North America IgA Nephropathy Market Dynamics

Driver

Rising Disease Prevalence and Growing Adoption of Novel Therapeutics

- The global increase in the incidence of IgA Nephropathy, coupled with heightened awareness of chronic kidney diseases, is a major driver for market growth. The disease affects approximately 2.5 individuals per 100,000 annually, with higher prevalence rates in Asian populations

- For instance, in March 2024, Travere Therapeutics received FDA approval for Sparsentan, a dual endothelin and angiotensin receptor antagonist, for the treatment of IgA Nephropathy. This milestone demonstrates a growing trend toward therapies that reduce proteinuria and preserve renal function more effectively than traditional corticosteroids.

- Improved diagnostic techniques, including genetic and protein biomarkers, are enabling earlier detection and improved disease monitoring, expanding the potential treatment pool

- Government and private research funding, along with partnerships for clinical trials, have further stimulated therapeutic development across North America, Europe, and Asia-Pacific

- Moreover, the availability of multiple advanced drug classes—including corticosteroids, targeted-release formulations, and complement inhibitors—has diversified treatment options

- As a result, the global IgA Nephropathy market is expected to grow at a CAGR of 7.2% from 2025 to 2032, driven by expanding patient awareness, rising drug approvals, and improved access to nephrology care services

Restraint/Challenge

High Treatment Costs and Clinical Complexity

- Despite promising advancements, high treatment costs remain a significant barrier to widespread adoption of advanced IgA Nephropathy therapies. Newly approved biologics and complement inhibitors often cost over USD 100,000 annually, limiting access in low- and middle-income countries

- For instance, while Tarpeyo and Fabhalta offer major therapeutic benefits, their premium pricing and limited reimbursement coverage present affordability challenges for patients and healthcare systems alike

- In addition, the complex and heterogeneous pathophysiology of IgAN creates challenges in standardizing treatment approaches, as disease progression and response to therapy vary widely between individuals

- Many clinical trials require long follow-up periods to measure endpoints such as proteinuria reduction and kidney function preservation, slowing the pace of new drug approvals

- The limited availability of specialized nephrology centers in developing regions also hinders early diagnosis and consistent treatment, further restricting market reach

- Addressing these challenges through pricing reforms, patient-assistance programs, and collaborative research efforts will be critical to sustaining long-term market growth. Despite these restraints, continuous innovation and increasing R&D investment are expected to drive steady progress in improving patient outcomes worldwide

North America IgA Nephropathy Market Scope

The market is segmented on the basis of disease type, symptoms, type, population type, route of administration, end user, and distribution channel.

- By Disease Type

On the basis of disease type, the IgA Nephropathy market is segmented into Primary IgA Nephropathy and Secondary IgA Nephropathy. The Primary IgA Nephropathy segment dominated the market with the largest revenue share of 68.4% in 2024, reflecting its higher prevalence and greater clinical focus worldwide. Primary IgAN represents the majority of diagnosed cases presenting with characteristic mesangial IgA deposition, and it drives demand for specialized nephrology care and targeted therapeutic development. Clinical guidelines and registries prioritize primary disease cohorts for enrolment in trials, increasing visibility and treatment activity. Diagnostic pathways, including renal biopsy and proteinuria monitoring, are most frequently applied in primary IgAN, leading to higher utilization of diagnostic and therapeutic services. The concentration of research funding and the majority of late-stage pipeline candidates are aimed at primary disease mechanisms, reinforcing market share. Payer policies and specialist referral patterns also skew resources toward primary IgAN management. Overall, the centrality of primary IgAN in epidemiology, research, and clinical practice underpins its dominant market role.

The Secondary IgA Nephropathy segment is expected to register the fastest CAGR of 11.2% from 2025 to 2032, driven by improved recognition of secondary causes and greater screening in at-risk populations. Secondary IgAN arises in association with conditions such as liver disease, infections, autoimmune disorders, and certain medications — contexts where expanding surveillance and integrated care models are uncovering previously underdiagnosed patients. As hepatology, infectious disease, and rheumatology services integrate renal monitoring into chronic care pathways, referral rates to nephrology increase. Development of tailored management protocols and more accessible diagnostic algorithms for secondary forms are accelerating treatment uptake. In addition, targeted therapies tested in broader IgAN cohorts are being evaluated for secondary indications, supporting market growth. Growing collaboration across specialties and broader guideline inclusion for secondary IgAN are expected to sustain this higher CAGR.

- By Symptoms

On the basis of symptoms, the IgA Nephropathy market is segmented into hematuria, proteinuria, edema, and others. The Proteinuria segment dominated the market with the largest revenue share of 55.1% in 2024, given proteinuria’s central role as both a diagnostic marker and a therapeutic endpoint in IgAN. Persistent proteinuria correlates strongly with disease progression and is the primary metric used in clinical trials and treatment guidelines to assess efficacy. Consequently, therapies and monitoring tools that reduce proteinuria capture substantial clinical and commercial attention. Nephrologists prioritize interventions proven to lower proteinuria, driving demand for pharmacologic options, renal function monitoring, and outpatient follow-up services. The regulatory focus on proteinuria reduction as an approvable surrogate endpoint has also incentivized R&D investments targeting this symptom. Reimbursement frameworks frequently tie coverage to proteinuria metrics, further strengthening its market dominance. In short, proteinuria’s prognostic and regulatory importance explains its leading share.

The Hematuria segment is forecasted to achieve the fastest CAGR of 10.6% from 2025 to 2032, as improved urinalysis screening, point-of-care diagnostics, and public awareness programs increase early detection rates. Interventions that address underlying inflammation and prevent recurrent gross or microscopic hematuria are gaining traction, prompting wider adoption of diagnostic pathways in primary care and nephrology clinics. Clinical trials increasingly report hematuria improvement as a secondary outcome, supporting broader therapeutic claims. In addition, hematuria identification in routine health checks is driving earlier nephrology referrals, expanding the treated population and boosting demand for both diagnostics and early intervention therapies. The growth of telemedicine and remote urinalysis monitoring also contributes to faster uptake of hematuria-focused care.

- By Type

On the basis of type, the IgA Nephropathy market is segmented into diagnosis and treatment. The Treatment segment dominated the market with the largest revenue share of 62.7% in 2024, reflecting sustained spending on pharmacotherapies, biologics, supportive medicines, and interventional care for IgAN patients. Treatment encompasses medications (immunomodulators, corticosteroids, angiotensin pathway agents), specialized formulations, and supportive regimens such as SGLT2 inhibitors and protein-lowering agents; these products represent the bulk of healthcare expenditure. The intensifying pipeline of disease-modifying agents and several high-value approvals have amplified market revenues in treatment. Commercialization activities—manufacturer partnerships, marketing to specialists, and hospital formulary placements—concentrate on therapeutics, furthering revenue concentration. Treatment services also include long-term monitoring and adjunctive clinical support which add recurring revenue streams. Overall, active therapeutic development and clinical reliance on drug therapy cement treatment’s dominance.

The Diagnosis segment is projected to post the fastest CAGR of 12.0% from 2025 to 2032, owing to advancements in non-invasive biomarkers, multiplex assays, and imaging modalities that reduce reliance on invasive biopsy. The market is seeing rapid innovation in urinary proteomics, serologic biomarkers, and imaging analytics that enable earlier and more precise disease stratification. Companion diagnostics paired with targeted therapies are accelerating diagnostic uptake, as clinicians increasingly use biomarker profiles to personalize therapy. Growth in decentralized and point-of-care diagnostic platforms also improves access in community settings, widening the patient funnel. Expansion of screening programs and digital health tools for remote monitoring are further propelling diagnostic services at a higher rate than historically observed.

- By Population Type

On the basis of population type, the IgA Nephropathy market is segmented into pediatrics and adults. The Adults segment dominated the market with the largest revenue share of 79.0% in 2024, as most clinically significant IgAN cases and commercial treatment activity occur in adult populations. Adult patients present more frequently with progressive proteinuria and decline in renal function that necessitates pharmacologic intervention, driving demand for therapeutics, hospital care, and long-term management. Clinical trial populations are predominantly adult, aligning drug approval strategies and market launches toward adult indications. Health systems allocate a larger portion of nephrology resources to adult care due to the higher absolute case numbers and comorbidity burden, reinforcing revenue concentration. Market access strategies, payer reimbursement, and specialty services therefore target adult cohorts, maintaining their dominant share.

The Pediatrics segment is expected to record the fastest CAGR of 13.5% from 2025 to 2032, driven by heightened screening in pediatric populations, early intervention programs, and growing evidence that timely management improves long-term outcomes. Pediatric nephrology centers are expanding capabilities for genetic testing, biomarker monitoring, and tailored therapeutic regimens suitable for children. Increasing awareness among pediatricians and school-based health initiatives contributes to earlier detection of hematuria and proteinuria. Pediatric clinical studies and pediatric-friendly formulations are also growing, prompting manufacturers to pursue pediatric labeling and expand market reach. Collectively, these dynamics accelerate pediatric market growth at a pace exceeding that of adult care.

- By Route of Administration

On the basis of route of administration, the IgA Nephropathy market is segmented into oral, parenteral, and others. The Oral segment dominated the market with the largest revenue share of 58.2% in 2024, as oral agents (small molecules, receptor antagonists, and many supportive drugs) represent the most commonly prescribed, cost-effective, and patient-preferred therapeutic form. Oral medications enable chronic outpatient management, improve adherence, and reduce infusion center burden; they are therefore broadly adopted in nephrology practice. Many new oral targeted agents in development and several recent approvals are oral formulations, reinforcing commercial activity and prescription volumes. Payer systems and formularies favor oral therapies for ambulatory management, contributing to higher sales and utilization. The convenience and scalability of oral dosing account for the segment’s dominant position.

The Parenteral segment is projected to achieve the fastest CAGR of 14.1% from 2025 to 2032, driven by the maturation and commercialization of biologics, monoclonal antibodies, and emerging injectable complement inhibitors. Parenteral therapies, while typically higher priced, address severe or refractory disease and often deliver potent mechanism-specific effects that oral drugs cannot replicate. The growing number of clinic-administered or infusion-based regimens, combined with improved outpatient infusion infrastructure and home-infusion services, is facilitating greater access. Regulatory approvals of parenteral agents for IgAN and expanding evidence of durable clinical benefit are major factors pushing this rapid growth.

- By End User

On the basis of end user, the IgA Nephropathy market is segmented into hospitals, clinics, home healthcare, and others. The Hospitals segment dominated the market with the largest revenue share of 51.6% in 2024, owing to hospitals’ role in diagnosing complex cases, performing renal biopsies, administering parenteral therapies, and managing acute exacerbations. Tertiary care centers and academic hospitals host multidisciplinary teams and advanced diagnostic imaging, concentrating high-value procedures and specialist consultations within hospital settings. Hospitals also serve as primary sites for clinical trials and early adoption of novel therapeutics, driving institutional purchases and revenue. Inpatient stays for severe flares and procedures contribute substantially to total market spend. The infrastructure, specialist workforce, and reimbursement models that favor hospital-based care underpin the segment’s leading share.

The Home Healthcare segment is expected to post the fastest CAGR of 15.0% from 2025 to 2032, fueled by expansion of remote monitoring, home-infusion services, and tele-nephrology initiatives that allow chronic IgAN management outside hospital settings. Advances in portable diagnostic devices, at-home laboratory collection services, and patient education platforms are enabling more routine follow-up and therapy administration at home. Payer interest in reducing inpatient utilization and improving patient convenience supports greater uptake of home care models. The rise of specialty pharmacy services and home delivery of oral and parenteral medications further accelerates this shift, supporting rapid growth in the home healthcare channel.

- By Distribution Channel

On the basis of distribution channel, the IgA Nephropathy market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. The Hospital Pharmacy segment dominated the market with the largest revenue share of 44.7% in 2024, reflecting hospitals’ central role in stocking high-cost therapeutics, parenteral biologics, and specialist supportive medications for inpatient and outpatient clinics. Hospital pharmacies manage procurement for nephrology units, infusion centers, and clinical trials, creating concentrated purchasing volumes. Institutional formularies and negotiated contracts favor hospital pharmacy channels for complex therapies, reinforcing revenue share. The clinical integration between prescribing physicians and hospital pharmacy services further drives utilization and immediate access to newer agents.

The Online Pharmacy segment is forecasted to grow at the fastest CAGR of 17.8% from 2025 to 2032, driven by increased digitalization of drug procurement, greater patient preference for home delivery, and the growth of specialty e-pharmacies offering chronic disease medications and patient support programs. Online channels improve access to oral therapies and maintenance medicines, provide subscription and reminder services that boost adherence, and enable remote patient support. Increased trust in e-commerce, regulatory adaptation for prescription delivery, and integration with telemedicine platforms are expanding online pharmacy reach. The convenience, competitive pricing, and data-driven patient engagement tools offered by digital distributors are accelerating adoption across patient and provider groups

North America IgA Nephropathy Market Regional Analysis

- North America dominated the IgA nephropathy market with the largest revenue share in 2024, driven by the presence of advanced healthcare infrastructure, favorable reimbursement policies, and growing investment in renal disease research and development. Increasing awareness about kidney health and the availability of innovative diagnostic and therapeutic options have further contributed to the region’s market leadership

- The growing adoption of advanced biologics and immunosuppressive therapies, along with ongoing clinical trials focused on novel treatment modalities, continues to strengthen North America’s position as a key hub for IgA Nephropathy advancements

- Moreover, supportive government initiatives and an increasing number of patient assistance programs aimed at improving access to treatment are expected to sustain the region’s dominance in the coming years

U.S. IgA Nephropathy Market Insight

The U.S. IgA nephropathy market dominated the IgA Nephropathy market with the largest revenue share of 41.3% in 2024, driven by a well-established healthcare infrastructure, high awareness regarding kidney diseases, and the presence of major biopharmaceutical companies actively engaged in nephrology research. The country’s robust clinical research ecosystem and strong regulatory support have facilitated the approval and commercialization of novel therapeutic agents, thereby fueling market expansion. The growing incidence of chronic kidney diseases and an increasing focus on personalized medicine are further driving demand for advanced IgA Nephropathy treatments.

Canada IgA Nephropathy Market Insight

Canada IgA nephropathy market is expected to be the fastest-growing country in the IgA Nephropathy market, registering a CAGR of 8.9% during the forecast period. This growth is primarily attributed to rising healthcare expenditure, increasing prevalence of renal disorders, and expanding access to innovative treatment solutions. The country’s emphasis on early diagnosis, supported by improved screening programs and enhanced healthcare coverage, is fostering greater treatment adoption. In addition, ongoing collaborations between research institutions and pharmaceutical companies are promoting clinical innovation, positioning Canada as an emerging leader in IgA Nephropathy management.

North America IgA Nephropathy Market Share

The IgA Nephropathy industry is primarily led by well-established companies, including:

- Travere Therapeutics (U.S.)

- Calliditas Therapeutics (Sweden)

- Novartis (Switzerland)

- Omeros Corporation (U.S.)

- CSL Vifor (U.S.)

- Ionis Pharmaceuticals (U.S.)

- Bayer AG (Germany)

- Roche (Switzerland)

- Pfizer Inc. (U.S.)

- Bristol Myers Squibb (U.S.)

- AbbVie Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.S.)

- Regulus Therapeutics (U.S.)

Latest Developments in North America IgA Nephropathy Market

- In December 2021, the U.S. Food and Drug Administration granted accelerated approval to TARPEYO (targeted-release budesonide) to reduce proteinuria in adults with primary IgA nephropathy at risk of rapid disease progression, marking the first regulatory approval specifically for IgAN focused on proteinuria reduction

- In March 2023, the U.S. FDA granted accelerated approval to FILSPARI (sparsentan) from Travere Therapeutics as the first non-immunosuppressive therapy to reduce proteinuria in adults with primary IgAN at risk of rapid disease progression, creating an important new treatment class for the condition

- In October–December 2023, topline and regulatory milestones for complement-pathway and targeted agents advanced: interim/ongoing Phase-3 data for narsoplimab (Omeros) reported strong proteinuria and safety signals in ARTEMIS-IGAN, and regulatory filings and priority review activity increased across several late-stage programs, underscoring a shift toward mechanism-targeted IgAN therapies

- In August 2024, Novartis’ Fabhalta (iptacopan) — a first-in-class oral complement inhibitor for IgAN — received accelerated approval (U.S.) for reduction of proteinuria in primary IgAN based on Phase 3 interim results showing substantial proteinuria reduction versus placebo, expanding the complement-inhibition treatment option for IgAN patients

- In September 2024, Travere Therapeutics announced full/expanded FDA approval for FILSPARI (sparsentan) (conversion from accelerated to full approval/expanded indication) after confirmatory PROTECT data demonstrated durable benefit on proteinuria and kidney-function preservation, strengthening the commercial and clinical positioning of sparsentan in IgAN

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.