North America Icu Ventilators Market

Market Size in USD Million

CAGR :

%

USD

866.43 Million

USD

1,639.69 Million

2022

2030

USD

866.43 Million

USD

1,639.69 Million

2022

2030

| 2023 –2030 | |

| USD 866.43 Million | |

| USD 1,639.69 Million | |

|

|

|

North America Intensive Care Unit (ICU) Ventilators Market Analysis and Size

The market for intensive care unit (ICU) ventilators has expanded dramatically in recent years as a result of technological innovations such as advancements in sensor technologies and improved portable ventilators used in ventilators. The growing emphasis of key players on technological advancements in molecular diagnostics, as well as collaboration and partnerships with other organizations, has a significant impact on the intensive care unit (ICU) ventilators market. Thus, the ventilators can be employed on the system either temporarily or permanently and are used across utilized in rehabilitation centers, hospital settings and at home. As a result, various growth determinants are propelling the market forward and it is expected to grow significantly during the forecast period.

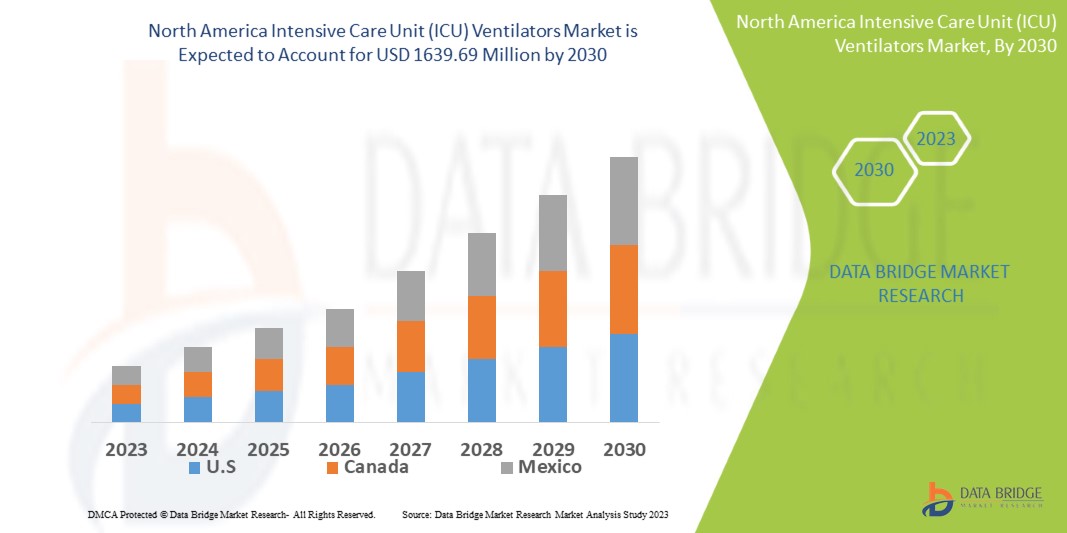

Data Bridge Market Research analyses that the intensive care unit (ICU) ventilators market which is USD 866.43 million in 2022, is expected to reach USD 1639.69 million by 2030, at a CAGR of 8.3% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

North America Intensive Care Unit (ICU) Ventilators Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (High-End ICU, Basic ICU, Mid-End ICU), Type (Adult, Neonatal, Pediatric), Mode (Combined-Mode, Volume-Mode Ventilation, Pressure-Mode, Other), End User (Hospitals, Specialty Clinics, Long Term Care Centres, Rehabilitation Centres) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), Getinge AB (Sweden), ResMed (U.S.), Medtronic (Ireland), Fisher & Paykel Healthcare Limited (New Zealand), Avasarala Technologies Limited (India), Allied Healthcare Products, Inc. (U.S.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd, (China), Drägerwerk AG & CO. KGAA (Germany), Nihon Kohden Corporation (Japan), Asahi Kasei Corporation (Japan), Air Liquide (France), Vyaire (U.S.), General Electric (U.S.), Hamilton Medical (Switzerland), Smiths Group plc (U.K), aXcent Medical (Germany), Metran Co., Ltd (Japan), Airon Corporation (Florida), TRITON Electronic Systems Ltd. (Russia), Bio-Med Devices, (U.S.), Hill-Rom Holdings, Inc. (U.S.), HEYER Medical AG (Germany) |

|

Market Opportunities |

|

Market Definition

The ventilator is essentially an equipment used in intensive care units to assist patients in breathing. Ventilators can be used on the system either temporarily or permanently and are used in hospital settings, rehabilitation centres and at home. A ventilator consists of mechanical ventilation, an endotracheal tube and a nasogastric drain. Mechanical ventilation is used for patients suffering from chronic diseases such as asthma, brain trauma, chronic obstructive pulmonary disease (COPD) and strokes.

North America Intensive Care Unit (ICU) Ventilators Market Dynamics

Drivers

- Surging Prevalence of chronic diseases

Chronic conditions include cardiovascular, cancer, neurological and respiratory disorders are common. For instance, the Centers for Disease Control and Prevention estimates that around 133 Americans are living with at least one chronic illness. They need continual care or monitoring which necessitates prolonged hospitalisation and acute care. As a result, the number of patient admissions in the critical care unit has increased along with the incidence of chronic disease, which is expected to fuel market expansion.

- Higher adoption of equipment in hospitals

Patients' preference for outpatient facilities such as specialty clinics and ambulatory surgical centres is growing as a result of more convenient and cost-effective care. According to a recently published NCBI article, the number of outpatient centres increased by 51% in 2016 compared to 2005. This is expected to increase the adoption of ICU equipment in specialty clinics, favouring market growth.

Opportunities

- Various Advancements in Ventilators

Various technological advancements, such as the development of advanced portable ventilators and advancements in sensor technologies used in ventilators, are expected to create lucrative market opportunities. Furthermore, advancements in non-invasive and microprocessor-controlled portable ventilators will provide the market with numerous growth opportunities.

Restraints/Challenges

- Low Awareness

Many patients go undetected and receive inadequate care because respiratory illnesses are not well-known on the market. The significant number of respiratory disease patients who are not receiving treatment will hamper the market growth.

- Risks Associated with the Ventilators Usage

The risks of using mechanical ventilators may prevent the industry from expanding. It is necessary to breathe more mechanically because there is a risk of infection from germs entering through the artificial airway. Furthermore, repeated opening and closing of the tiny air sacs within the lungs can result in lung damage. As a result of the risks associated with the use of devices, the intensive care unit (ICU) ventilators market is expected to face challenges during the forecast period of 2023-2030.

This intensive care unit (ICU) ventilators market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the intensive care unit (ICU) ventilators market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Covid-19 Impact on Intensive Care Unit (ICU) Ventilators Market

The beneficial effects of the COVID-19 pandemic on market growth were felt positively by the intensive care unit (ICU) ventilators market. COVID-19 infection causes respiratory failure, which necessitates intensive care and ventilator support. COVID-19 patients were mechanically ventilated on a regular basis. In addition, new COVID-19 delta and omicron variants with a rapid rate of spread were discovered in mid-November 2021, raising the prospect of a third wave spreading globally. To meet the rising demand for ICU ventilators during the pandemic, the government and market leaders increased production.

Manufacturers are also focused on a variety of advancements and innovations, industry trends, and other market expansion strategies. These elements will hasten the market's expansion.

Recent Developments

- In 2020, Medtronic was granted permission to use PB560 in the United States by the FDA's EUA authority. Previously, the company sent out approximately 300 ventilators per week. To combat the epidemic, production was to be increased from 300 to 700 ventilators per week.

- In 2020, As a result of the Covid-19 pandemic, Getinge AB increased their ventilator manufacturing capacity by 60% to meet the needs of global intensive care units. The company expands its product portfolio in the market by increasing its production capacity.

North America Intensive Care Unit (ICU) Ventilators Market Scope

The intensive care unit (ICU) ventilators market is segmented on the basis of product type, type, mode and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- High-End ICU

- Basic ICU

- Mid-End ICU

Type

- Adult

- Neonatal

- Pediatric

Mode

- Combined-Mode

- Volume-Mode

- Pressure-Mode

- Other

End User

- Hospitals

- Specialty Clinics

- Long Term Care Centres

- Rehabilitation Centres

Intensive Care Unit (ICU) Ventilators Market Regional Analysis/Insights

The intensive care unit (ICU) ventilators market is analysed and market size insights and trends are provided by country, product type, type, mode and end user as referenced above.

The countries covered in the intensive care unit (ICU) ventilators market report are U.S., Canada and Mexico in North America.

North America is expected to dominate the market because of the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) outbreak in North America. Governments in the North America region have ordered thousands of ICU ventilators and are dramatically increasing ICU ventilator production capacity in order to protect lives in the region. The United States is dominating the market and driving growth in the North American market because it has drastically increased its production capacity and ordered over 150,000 ICU Ventilates.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The intensive care unit (ICU) ventilators market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for intensive care unit (ICU) ventilators market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the intensive care unit (ICU) ventilators market. The data is available for historic period 2011-2021.

Competitive Landscape and Intensive Care Unit (ICU) Ventilators Market Share Analysis

The intensive care unit (ICU) ventilators market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to intensive care unit (ICU) ventilators market.

Some of the major players operating in the intensive care unit (ICU) ventilators market are:

- Koninklijke Philips N.V. (Netherlands)

- Getinge AB (Sweden)

- ResMed (U.S.)

- Medtronic (Ireland)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Avasarala Technologies Limited (India)

- Allied Healthcare Products, Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd, (China)

- Drägerwerk AG & CO. KGAA (Germany)

- Nihon Kohden Corporation (Japan)

- Asahi Kasei Corporation (Japan)

- Air Liquide (France)

- Vyaire (U.S.)

- General Electric (U.S.)

- Hamilton Medical (Switzerland)

- Smiths Group plc (U.K)

- aXcent Medical (Germany)

- Metran Co., Ltd (Japan)

- Airon Corporation (Florida)

- TRITON Electronic Systems Ltd. (Russia)

- Bio-Med Devices, (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- HEYER Medical AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.