North America Hunter Syndrome Treatment Market

Market Size in USD Million

CAGR :

%

USD

499.83 Million

USD

1,018.09 Million

2025

2033

USD

499.83 Million

USD

1,018.09 Million

2025

2033

| 2026 –2033 | |

| USD 499.83 Million | |

| USD 1,018.09 Million | |

|

|

|

|

North America Hunter Syndrome Treatment Market Size

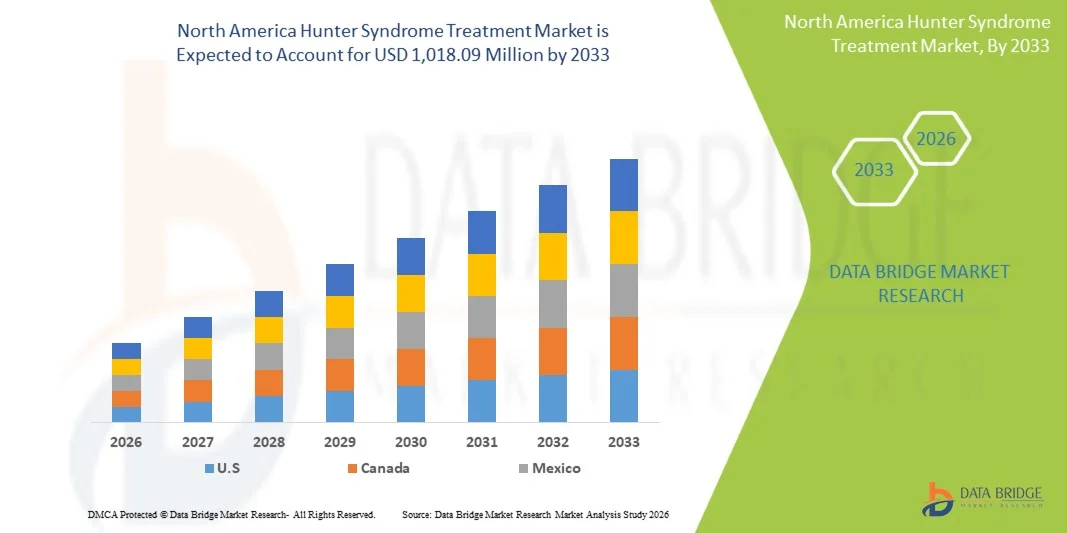

- The North America Hunter Syndrome treatment market size was valued at USD 499.83 million in 2025 and is expected to reach USD 1,018.09 million by 2033, at a CAGR of 9.3% during the forecast period

- The market growth is largely fueled by the strong adoption of orphan-drug therapies, including enzyme replacement therapy (ERT) and emerging gene therapies, along with increasing diagnosis rates and improved patient awareness in the region

- Furthermore, favorable regulatory support, reimbursement policies, and rising demand for effective, safe, and targeted treatments for Hunter syndrome patients are positioning these therapies as the standard of care, thereby accelerating the uptake of Hunter syndrome treatment solutions and significantly boosting the market’s growth

North America Hunter Syndrome Treatment Market Analysis

- Hunter Syndrome treatments, including enzyme replacement therapies (ERT) and emerging gene therapies, are increasingly vital for managing Mucopolysaccharidosis II (MPS II) in both pediatric and adult patients due to their ability to address the underlying enzyme deficiency, improve quality of life, and slow disease progression

- The escalating demand for Hunter Syndrome treatments in the U.S. is primarily fueled by rising disease awareness, better diagnostic capabilities, and increasing access to specialized therapies, alongside the growing focus on orphan drug development in rare diseases

- The U.S. dominated the North America Hunter Syndrome treatment market with the largest revenue share of 80.4% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and a strong presence of key biopharmaceutical players, with substantial growth in patient access to ERT and clinical trials for novel therapies driven by innovations from both established pharmaceutical companies and biotech startups focusing on gene therapy and CNS-penetrant treatments

- Canada is expected to show notable growth in the Hunter Syndrome treatment market during the forecast period due to increasing newborn screening initiatives and government support for rare disease management

- Enzyme Replacement Therapy (ERT) segment dominated the North America Hunter Syndrome treatment market with a market share of 70.2% in 2025, driven by its established efficacy, widespread regulatory approvals, and accessibility in clinical practice

Report Scope and North America Hunter Syndrome Treatment Market Segmentation

|

Attributes |

North America Hunter Syndrome Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Hunter Syndrome Treatment Market Trends

“Advancements in Gene Therapy and CNS-Targeted Treatments”

- A significant and accelerating trend in the North America Hunter Syndrome treatment market is the growing development and clinical adoption of gene therapies and central nervous system (CNS)-penetrant enzyme replacement therapies, enhancing treatment outcomes beyond traditional ERT

- For instance, Sangamo Therapeutics’ gene therapy candidates are advancing in clinical trials, targeting the underlying IDS gene mutation to potentially provide longer-term benefits for patients

- Innovations in CNS-targeted therapies enable better management of neurological symptoms and cognitive decline, improving quality of life and potentially altering disease progression trajectories. For instance, therapies such as JR-141 are designed to cross the blood-brain barrier effectively and address CNS involvement

- These advanced therapies also integrate with personalized treatment plans and biomarker-driven patient monitoring, facilitating more precise dosing and optimized therapeutic outcomes for individual patients

- This trend toward more targeted, long-acting, and disease-modifying treatment options is fundamentally reshaping expectations among healthcare providers and caregivers. For instance, pharmaceutical companies such as Shire/Takeda are developing combination approaches to address both systemic and neurological symptoms

- The demand for therapies that offer sustained efficacy, improved neurological outcomes, and reduced infusion burden is growing rapidly across both pediatric and adult patient populations, as families and clinicians increasingly prioritize comprehensive disease management

North America Hunter Syndrome Treatment Market Dynamics

Driver

“Rising Awareness and Increased Diagnostic Capabilities”

- The increasing awareness of Hunter Syndrome among healthcare providers, patients, and advocacy groups, coupled with improved diagnostic and newborn screening programs, is a significant driver of market growth

- For instance, the National MPS Society and pharmaceutical companies are conducting awareness campaigns and educational programs to identify patients earlier and increase treatment uptake

- As clinicians become more adept at recognizing early signs and using genetic testing, treatment initiation can occur sooner, improving patient outcomes and increasing therapy adoption

- Furthermore, favorable insurance coverage and orphan drug incentives in the U.S. are making Hunter Syndrome therapies more accessible, encouraging adoption among newly diagnosed patients

- The availability of multiple treatment options, including ERT and investigational gene therapies, alongside growing clinical trial activity, is fueling the market expansion. For instance, ongoing trials by companies such as BioMarin and Shire/Takeda provide hope for patients and support broader treatment uptake

- The integration of patient registries, telemedicine follow-ups, and home infusion services also contributes to the rising convenience and accessibility of treatments, driving consistent market growth

Restraint/Challenge

“High Treatment Costs and Limited Patient Pool”

- The high cost of Hunter Syndrome therapies, particularly enzyme replacement and emerging gene therapies, poses a significant challenge to broader market penetration in North America

- For instance, annual ERT treatment costs can exceed hundreds of thousands of USD, making therapy access difficult for uninsured or underinsured patients

- The rarity of the disease also limits the number of treatable patients, creating challenges in achieving large-scale commercial adoption and return on investment for manufacturers

- Furthermore, logistical hurdles such as infusion administration requirements, hospital visits, and specialized monitoring increase the burden on patients and caregivers. For instance, regular intravenous ERT infusions require trained personnel and clinical oversight

- While new therapies promise longer-lasting benefits or reduced treatment frequency, high upfront costs and limited reimbursement for novel approaches can delay adoption

- Overcoming these challenges through insurance support programs, patient assistance initiatives, and ongoing cost-reduction strategies will be crucial for sustained growth in the North America Hunter Syndrome treatment market

North America Hunter Syndrome Treatment Market Scope

The market is segmented on the basis of severity, type, complications, end user, and distribution channel.

- By Severity

On the basis of severity, the North America Hunter Syndrome treatment market is segmented into mild to moderate and moderate to severe. The Moderate to Severe segment dominated the market in 2025, accounting for the largest share, as patients in this category often require comprehensive enzyme replacement therapies (ERT) and additional supportive care to manage progressive symptoms. These patients typically experience more pronounced systemic and neurological complications, which necessitate continuous monitoring and specialized clinical interventions. The higher treatment costs and longer-term care requirements for moderate to severe cases also contribute to their dominance in market revenue. Furthermore, pharmaceutical companies focus heavily on therapies for severe patients due to the higher unmet medical need, encouraging R&D and market penetration. Hospitals and specialty clinics are the primary treatment centers, reinforcing the segment’s leading market position. Early diagnosis and timely initiation of treatment in severe cases further strengthen the market share for this subsegment.

The Mild to Moderate segment is anticipated to witness the fastest growth during the forecast period due to increasing awareness and early diagnosis programs. Early-stage patients benefit from timely enzyme replacement therapies and emerging gene therapies, slowing disease progression and improving quality of life. Expanding newborn screening initiatives in the U.S. and Canada are identifying more mild to moderate patients, driving treatment uptake. Caregivers and healthcare providers are increasingly seeking therapies that prevent long-term complications, enhancing adoption in this patient population. The introduction of less invasive and home-administered treatment options further supports growth. Pharmaceutical companies are investing in clinical trials specifically targeting mild to moderate cases, which is expected to accelerate segment expansion.

- By Type

On the basis of type, the market is segmented into Enzyme Replacement Therapy (ERT), Stem Cell Transplant, Surgical Treatment, and Others. The ERT segment dominated the market in 2025, capturing the largest revenue share of 70.2%, as it is the standard of care for Hunter Syndrome and has been widely approved for systemic treatment. ERT helps reduce glycosaminoglycan accumulation, improves organ function, and enhances patient survival, driving high adoption across hospitals, clinics, and home healthcare settings. The established clinical efficacy, regulatory approvals, and extensive physician familiarity make ERT the preferred therapy for both pediatric and adult patients. Continuous innovation in infusion protocols and formulation stability also supports widespread usage. Partnerships between biotech companies and healthcare providers for patient assistance programs further strengthen market dominance. Patients with moderate to severe symptoms especially rely on regular ERT infusions, contributing to consistent revenue generation.

The Stem Cell Transplant segment is expected to witness the fastest growth during the forecast period, driven by advancements in gene-modified hematopoietic stem cell therapies. Stem cell treatments offer the potential for long-term enzyme production, addressing both systemic and neurological symptoms more effectively than traditional ERT. Growing clinical trial activity and promising early-stage results are increasing physician confidence and patient interest. Awareness campaigns highlighting curative potential and reduced treatment frequency further accelerate adoption. Stem cell therapy integration with hospital-based specialized treatment centers ensures precise patient management. Rising investments by biotech firms to commercialize stem cell approaches support rapid segment growth, particularly in severe patient populations.

- By Complications

On the basis of complications, the market is segmented into respiratory disorders, neurological disorders, gastrointestinal disorders, cardiovascular, ophthalmic, audiologic, dental, musculoskeletal, and others. The Neurological Disorders segment dominated the market in 2025 due to the severe impact of CNS involvement on patient quality of life. Neurological symptoms, including cognitive decline, behavioral issues, and motor impairments, drive the need for specialized therapies and frequent clinical monitoring. Hospitals and specialty clinics focus on combined systemic and CNS-targeted treatments, increasing treatment costs and market revenue. The severity of neurological complications also encourages ongoing R&D and the development of gene therapy solutions targeting CNS pathology. The adoption of multidisciplinary care programs in North America further supports market dominance. Insurance coverage and reimbursement for CNS-involved therapies enhance access and reinforce market share.

The Respiratory Disorders segment is expected to witness the fastest growth due to increasing recognition of airway complications and pulmonary involvement in Hunter Syndrome. Improved diagnostic capabilities, such as pulmonary function testing and sleep studies, are identifying more patients who require proactive treatment. Therapeutic interventions, including ERT and respiratory support, reduce hospitalizations and improve patient outcomes, accelerating adoption. Clinical guidelines now emphasize early management of respiratory complications, expanding the treatable patient pool. Home healthcare providers are increasingly involved in respiratory therapy management, enhancing accessibility. Research into combination therapies targeting both systemic and pulmonary symptoms further supports rapid growth in this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, and others. The Hospitals segment dominated the market in 2025, capturing the largest revenue share due to the need for specialized treatment administration, monitoring, and multidisciplinary care. Hospitals are equipped to provide intravenous ERT infusions, stem cell therapies, and manage severe complications, ensuring high adoption among moderate to severe patients. The presence of experienced healthcare professionals and specialized infusion centers supports treatment efficacy and patient safety. Hospitals also collaborate with pharmaceutical companies on clinical trials and patient support programs, driving market revenue. Comprehensive diagnostic facilities within hospitals contribute to early disease detection and treatment initiation. Government and private insurance reimbursements for hospital-based therapies further reinforce market dominance.

The Home Healthcare segment is expected to witness the fastest growth due to the increasing availability of at-home ERT infusion services and remote monitoring technologies. Home administration improves patient comfort, reduces hospital visits, and supports continuity of care. Caregivers can manage treatment schedules more conveniently, boosting adherence and outcomes. Expanding telehealth initiatives and home nursing services further enhance market accessibility. Rising patient preference for home-based care and cost-efficiency accelerates adoption. Biopharmaceutical companies are increasingly offering home infusion kits and training programs, fueling growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The Hospital Pharmacy segment dominated the market in 2025 due to centralized procurement of high-cost therapies such as ERT and stem cell treatments, ensuring controlled distribution and proper cold chain management. Hospital pharmacies provide critical patient support services, including therapy counseling and monitoring for adverse events. Their strong integration with clinical protocols and infusion centers drives high adoption of prescribed therapies. Collaboration with insurance providers ensures reimbursement compliance, contributing to consistent revenue. Bulk purchasing agreements with pharmaceutical manufacturers reinforce market dominance. Hospitals’ established relationships with rare disease specialists enhance patient access and continuity of care.

The Online Pharmacy segment is expected to witness the fastest growth due to increasing digitalization in healthcare and patient preference for home delivery of treatments. Online pharmacies offer convenience, timely delivery, and access to patient support programs. Telemedicine integration allows healthcare providers to prescribe and monitor therapy remotely, facilitating adherence. Growth in e-pharmacy platforms and partnerships with biotech companies enhances accessibility for both urban and remote patients. Patients benefit from discreet delivery, educational support, and home-based monitoring options. Expanding regulatory frameworks supporting online distribution of orphan drugs further accelerate adoption in this segment.

North America Hunter Syndrome Treatment Market Regional Analysis

- The U.S. dominated the North America Hunter Syndrome treatment market with the largest revenue share of 80.4% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and a strong presence of key biopharmaceutical players

- Patients and caregivers in the region highly value access to established therapies such as enzyme replacement therapy (ERT), emerging gene therapies, and specialized clinical care, which improve quality of life and slow disease progression

- This widespread adoption is further supported by favorable reimbursement policies, increasing awareness of Hunter Syndrome among healthcare providers, and a well-established rare-disease treatment ecosystem, establishing the U.S. as the primary market within North America for both pediatric and adult patients

Canada Hunter Syndrome Treatment Market Insight

The Canada Hunter Syndrome treatment market is projected to grow at a substantial CAGR during the forecast period, primarily driven by increasing awareness, government support for rare diseases, and expanding healthcare coverage. The country’s emphasis on early diagnosis and proactive management of Hunter Syndrome is fostering the adoption of enzyme replacement therapies and emerging treatment modalities. Canadian patients and clinicians are drawn to therapies that improve long-term outcomes and reduce the burden of complications. The market is experiencing steady growth across hospitals, specialty clinics, and home healthcare settings, supported by patient assistance programs and clinical initiatives.

Mexico Hunter Syndrome Treatment Market Insight

The Mexico Hunter Syndrome treatment market is anticipated to expand at a noteworthy CAGR during the forecast period, fueled by growing awareness of rare diseases and improving access to specialized therapies. The increasing availability of enzyme replacement therapy and the gradual introduction of advanced therapies, including investigational gene therapies, are supporting market growth. Efforts to strengthen diagnostic infrastructure and rare disease registries are helping identify more patients early. In addition, government initiatives and private healthcare investments are facilitating therapy access, particularly in urban centers. The market is seeing increased adoption across hospitals, clinics, and specialty care centers, contributing to consistent revenue growth.

North America Hunter Syndrome Treatment Market Share

The North America Hunter Syndrome Treatment industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- REGENXBIO (U.S.)

- NIPPON SHINYAKU CO., LTD. (Japan)

- Sumitomo Pharma Co., Ltd. (Japan)

- GC Corp. (South Korea)

- Denali Therapeutics (U.S.)

- AVROBIO, Inc. (U.S.)

- Homology Medicines, Inc. (U.S.)

- ArmaGen Technologies, Inc. (U.S.)

- Capsida Biotherapeutics (U.S.)

- Sangamo Therapeutics (U.S.)

- Amicus Therapeutics, Inc. (U.S.)

- CANbridge Life Sciences Ltd. (China)

- BioMarin (U.S.)

- Inventiva Pharma (France)

- Abeona Therapeutics, Inc. (U.S.)

- Arcturus Therapeutics, Inc. (U.S.)

What are the Recent Developments in North America Hunter Syndrome Treatment Market?

- In August 2025, REGENXBIO announced that the FDA extended the review timeline for the RGX‑121 BLA (for Hunter syndrome) by three months after the company submitted updated clinical pharmacology information (classified as a “Major Amendment”) in the review process. The company indicated this extension was not related to new efficacy or safety data

- In July 2025, Denali announced that the FDA accepted its BLA for Tividenofusp Alfa for Hunter syndrome and granted it Priority Review, with a PDUFA target action date of January 5, 2026. The therapy is designed to deliver the missing IDS enzyme across the blood‑brain barrier, potentially addressing neurological manifestations of MPS II, which current standard treatments do not.

- In September 2024, Denali Therapeutics announced a successful meeting with the FDA to align on the accelerated‑approval pathway for its next‑generation therapy Tividenofusp Alfa (DNL310) for MPS II, including agreement that cerebrospinal fluid heparan sulfate (CSF HS) could serve as a surrogate endpoint for neurological benefit

- In May 2023, REGENXBIO received RMAT (Regenerative Medicine Advanced Therapy) designation from the FDA for RGX‑121 in Hunter syndrome. This regulatory milestone recognised that preliminary clinical evidence indicated the therapy could address the unmet neurological and systemic needs in MPS II, potentially accelerating its development and review

- In August 2022, REGENXBIO announced its intention to file a Biologics License Application (BLA) in 2024, via the accelerated approval pathway, for its gene‑therapy candidate RGX‑121 (a one‑time AAV9 vector delivering the IDS gene) for the treatment of MPS II (Hunter syndrome). The announcement highlighted that the pivotal programme (CAMPSIITE™) was active and enrolling, and roadmap discussions with the U.S. Food & Drug Administration (FDA) had supported using cerebrospinal fluid glycosaminoglycan (GAG) biomarkers as a surrogate endpoint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.