North America Hospital Laboratory Information Management Systems Market

Market Size in USD Million

CAGR :

%

USD

147.77 Million

USD

249.76 Million

2024

2032

USD

147.77 Million

USD

249.76 Million

2024

2032

| 2025 –2032 | |

| USD 147.77 Million | |

| USD 249.76 Million | |

|

|

|

|

North America Hospital Laboratory Information Management Systems Market Size

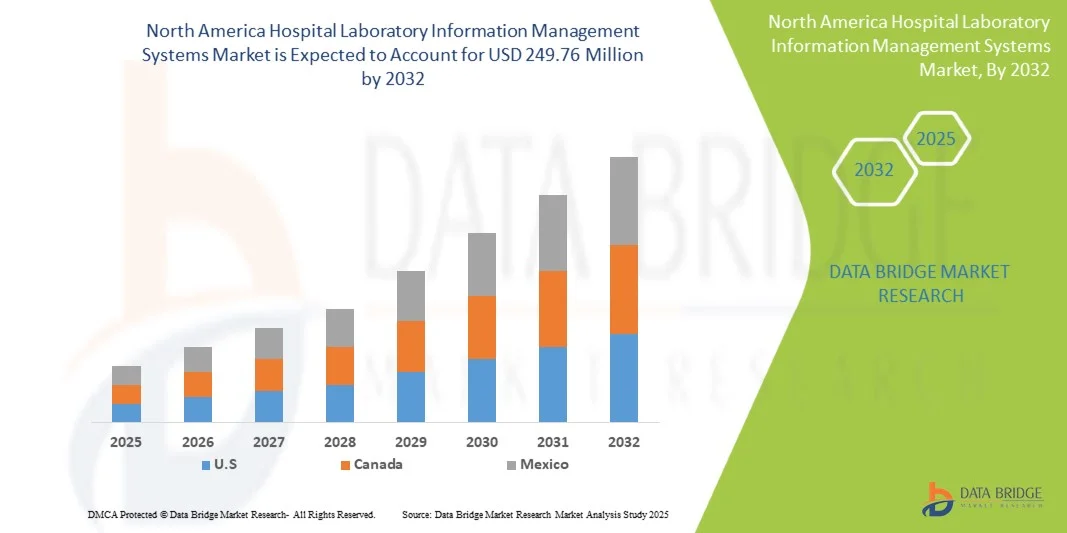

- The North America hospital laboratory information management systems market size was valued at USD 147.77 million in 2024 and is expected to reach USD 249.76 million by 2032, at a CAGR of 6.78% during the forecast period

- The market growth is largely fueled by the increasing adoption of LIMS across hospitals, diagnostic laboratories, and research institutions, enhancing operational efficiency, ensuring regulatory compliance, and facilitating real-time data tracking in modern healthcare environments

- Furthermore, rising demand for automation, advanced diagnostic solutions, and cloud-based LIMS, along with government initiatives supporting healthcare digitization, is establishing these systems as the preferred solution for laboratory management. These converging factors are accelerating the uptake of LIMS, thereby significantly boosting the industry's growth

North America Hospital Laboratory Information Management Systems Market Analysis

- Hospital LIMS, providing digital management of laboratory operations, sample tracking, and data integration, are becoming essential components of modern healthcare infrastructure in hospitals, diagnostic labs, and research facilities due to their enhanced operational efficiency, regulatory compliance support, and real-time data accessibility

- The increasing adoption of LIMS is primarily driven by the need for automation in laboratories, rising clinical testing volumes, and demand for accurate, streamlined data management across hospital networks

- U.S. dominated the North America hospital laboratory information management systems market with the largest revenue share of 81.6% in 2024, characterized by advanced healthcare infrastructure, high adoption of digital solutions, and a strong presence of leading LIMS vendors, with substantial growth in LIMS deployments, particularly in large hospitals and research centers, fueled by innovations in cloud-based, AI-enabled, and integrated laboratory informatics solutions

- Canada is expected to be the fastest growing country in the North America hospital laboratory information management systems market during the forecast period due to increasing government initiatives supporting healthcare digitization and expanding clinical research activities

- Broad-Based LIMS segment dominated the North America hospital laboratory information management systems market with a market share of 52.3% in 2024, driven by its ability to manage multiple laboratory functions across diverse hospital departments, enhance workflow efficiency, and ensure compliance with regulatory standards

Report Scope and North America Hospital Laboratory Information Management Systems Market Segmentation

|

Attributes |

North America Hospital Laboratory Information Management Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Hospital Laboratory Information Management Systems Market Trends

“Enhanced Efficiency Through AI and Cloud Integration”

- A significant and accelerating trend in the North America hospital LIMS market is the growing integration of artificial intelligence (AI) and cloud-based platforms, enabling real-time data access, predictive analytics, and improved workflow automation across hospital laboratories

- For instance, Thermo Fisher’s Watson LIMS platform utilizes AI-driven analytics to identify workflow bottlenecks and suggest efficiency improvements, while cloud deployment allows multiple hospital branches to access and share laboratory data seamlessly

- AI integration in LIMS enables predictive diagnostics, anomaly detection, and automated reporting, enhancing decision-making accuracy and operational efficiency. For instance, LabWare LIMS leverages AI to flag abnormal test results and optimize sample processing schedules

- Cloud and AI-enabled LIMS platforms facilitate centralized management of laboratory operations, enabling hospitals to coordinate multiple departments, track samples, and integrate with hospital information systems through a single interface

- This trend towards more intelligent, automated, and interconnected laboratory management systems is reshaping hospital expectations for operational efficiency and data reliability. Consequently, companies such as STARLIMS are developing AI-enabled LIMS with predictive analytics, cloud access, and workflow optimization capabilities

- The demand for LIMS with AI and cloud integration is growing rapidly across hospitals and diagnostic centers, as healthcare providers increasingly prioritize operational efficiency, regulatory compliance, and seamless data management

North America Hospital Laboratory Information Management Systems Market Dynamics

Driver

“Growing Need Due to Increasing Laboratory Automation and Data Management”

- The rising demand for automation in hospital laboratories, coupled with increasing volumes of diagnostic testing, is a key driver for the adoption of advanced LIMS solutions

- For instance, in March 2024, LabWare announced enhancements to its LIMS platform to support automated sample tracking and integration with clinical instruments, aimed at improving hospital laboratory efficiency

- As hospitals face pressures to reduce turnaround times and ensure accuracy in test results, LIMS provide features such as real-time sample tracking, automated reporting, and regulatory compliance support, offering a compelling advantage over manual processes

- Furthermore, the growing digitization of hospital operations and adoption of electronic health records are making LIMS an integral component of modern laboratory management, enabling seamless integration with broader hospital systems

- The capability to manage large datasets, generate accurate analytics, and provide remote access to laboratory information is propelling LIMS adoption in hospitals, while user-friendly interfaces and customizable modules further support their implementation

Restraint/Challenge

“Integration Complexity and High Implementation Costs”

- Challenges related to integrating LIMS with existing hospital information systems, electronic health records, and laboratory instruments can slow adoption and limit system efficiency

- For instance, hospitals upgrading from legacy lab systems to advanced LIMS often encounter compatibility issues and require extensive IT support for deployment and configuration

- The relatively high cost of enterprise LIMS, including software licenses, hardware requirements, and staff training, poses a barrier for smaller hospitals or budget-constrained healthcare facilities, potentially delaying adoption

- While cloud-based solutions reduce some infrastructure costs, implementation, customization, and compliance with regulatory standards remain resource-intensive, requiring careful planning and investment

- Overcoming these challenges through modular LIMS designs, vendor support services, and scalable deployment options will be essential for encouraging broader adoption and maximizing return on investment in hospital laboratories

North America Hospital Laboratory Information Management Systems Market Scope

The market is segmented on the basis of type, component, deployment model, and industry.

- By Type

On the basis of type, the North America hospital laboratory information management systems market is segmented into Broad-Based LIMS and Industry-Specific LIMS. The Broad-Based LIMS segment dominated the market with the largest revenue share of 52.3% in 2024, driven by its capability to manage multiple laboratory functions across diverse hospital departments. Hospitals prefer Broad-Based LIMS for their flexibility, ability to integrate with hospital information systems, and comprehensive workflow management features. These systems provide modules for sample tracking, instrument integration, reporting, and regulatory compliance, making them suitable for large-scale hospital operations. In addition, Broad-Based LIMS support multi-departmental coordination, improving operational efficiency and reducing errors in patient diagnostics. Hospitals also leverage these systems to centralize data management, enabling faster decision-making and enhanced resource utilization. The extensive vendor support and customizable features further reinforce the dominance of Broad-Based LIMS in the North American hospital market.

The Industry-Specific LIMS segment is anticipated to witness the fastest growth during 2025–2032, fueled by increasing adoption in specialized hospital units such as oncology, pathology, and clinical research departments. Industry-Specific LIMS offer tailored functionalities, ensuring compliance with specific regulatory standards and optimized workflows for specialized testing. Hospitals with niche departments prefer these systems for their ability to handle complex protocols, generate precise reports, and integrate with advanced diagnostic instruments. Growing clinical research activities and the need for precision diagnostics in specialized fields are key drivers of this segment’s rapid adoption. Vendors are increasingly offering modular, industry-focused solutions that can be integrated seamlessly into existing hospital infrastructure, enhancing their appeal to healthcare providers. The growing emphasis on personalized medicine and specialized patient care is expected to accelerate demand for Industry-Specific LIMS.

- By Component

On the basis of component, the North America hospital laboratory information management systems market is segmented into software and services. The Software segment dominated the market in 2024 due to the critical role of LIMS applications in laboratory data management, reporting, and workflow automation. Hospitals require advanced software systems to manage large volumes of patient and sample data accurately, maintain compliance with regulatory standards, and integrate seamlessly with hospital information systems. Software solutions also offer features such as automated reporting, real-time analytics, and AI-enabled predictive diagnostics, which are increasingly preferred by hospitals aiming to enhance operational efficiency. The wide availability of cloud and on-premise software solutions further strengthens this segment’s dominance. Continuous software upgrades and vendor support ensure that hospitals can keep pace with evolving laboratory requirements and regulatory guidelines. The software component also enables scalability, allowing hospitals to expand LIMS functionalities as laboratory operations grow.

The Services segment is expected to witness the fastest growth during 2025–2032, driven by increasing demand for implementation, customization, maintenance, and training services associated with LIMS. Hospitals, particularly smaller facilities with limited IT expertise, rely on vendor-provided services for smooth deployment and effective utilization of LIMS software. Consulting services, technical support, and integration assistance play a crucial role in maximizing system efficiency and minimizing downtime. The growing complexity of laboratory operations and the need for compliance with stringent healthcare regulations are fueling demand for expert LIMS services. In addition, services such as data migration, cloud setup, and software updates are becoming essential for hospital IT teams to maintain seamless laboratory workflows.

- By Deployment Model

On the basis of deployment model, the North America hospital laboratory information management systems market is segmented into On-Premise LIMS, Remote Hosted LIMS, and Cloud LIMS. The On-Premise LIMS segment dominated the market in 2024, driven by hospitals’ preference for direct control over their data, enhanced security, and the ability to customize the system according to specific operational needs. On-premise deployment is particularly favored in large hospital networks where compliance with stringent data privacy regulations is critical. These systems provide robust performance, uninterrupted access, and integration flexibility with existing hospital IT infrastructure. Hospitals also benefit from reduced dependency on internet connectivity and vendor-managed servers, ensuring critical laboratory operations remain uninterrupted. The availability of vendor support and local IT management further reinforces the adoption of on-premise LIMS.

The Cloud LIMS segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing hospital demand for scalable, cost-effective, and remotely accessible laboratory management solutions. Cloud-based LIMS enable hospitals to centralize laboratory data across multiple branches, allow real-time collaboration, and reduce IT infrastructure costs. Cloud deployment also supports AI and analytics tools, providing actionable insights and improving decision-making in patient care. The growing trend of hospital digital transformation and the need for remote monitoring and access are accelerating adoption. Flexibility, subscription-based pricing models, and rapid deployment options make Cloud LIMS particularly attractive for mid-sized and emerging hospitals.

- By Industry

On the basis of industry, the North America hospital laboratory information management systems market is segmented into life sciences, petrochemical refineries and oil & gas, food & beverage and agriculture, chemical, environmental testing laboratories, and other industries. The Life Sciences segment dominated the market in 2024, driven by the high concentration of hospital laboratories, clinical research centers, and biotech facilities in North America. Hospitals leverage LIMS in life sciences for efficient patient sample management, clinical trial support, regulatory compliance, and advanced analytics. The integration of LIMS with laboratory instruments and hospital information systems enhances operational efficiency and ensures accuracy in diagnostic results. Life sciences applications require robust, flexible LIMS capable of handling diverse laboratory workflows, driving strong demand for advanced solutions. Vendors focus on providing comprehensive features tailored for life sciences to maintain market leadership.

The Other Industries segment is expected to witness the fastest growth from 2025 to 2032, driven by expanding adoption of hospital LIMS in emerging sectors such as veterinary hospitals, specialty diagnostic centers, and public health laboratories. These applications demand flexible, cost-effective LIMS solutions capable of handling unique workflows, sample types, and reporting requirements. Increasing awareness about laboratory efficiency, accuracy, and compliance in non-traditional hospital settings is fueling adoption. Vendors are introducing scalable, modular LIMS offerings to cater to diverse needs, supporting rapid growth in these emerging industries.

North America Hospital Laboratory Information Management Systems Market Regional Analysis

- U.S. dominated the North America hospital laboratory information management systems market with the largest revenue share of 81.6% in 2024, characterized by advanced healthcare infrastructure, high adoption of digital solutions, and a strong presence of leading LIMS vendors

- Hospitals in the country highly value the efficiency, regulatory compliance, and real-time data management offered by LIMS, which streamline laboratory operations and enhance diagnostic accuracy

- This widespread adoption is further supported by significant government initiatives, increasing clinical research activities, and a technologically advanced healthcare ecosystem, establishing LIMS as a preferred solution for hospitals, diagnostic centers, and research institutions

U.S. North America Hospital Laboratory Information Management Systems Market Insight

The U.S. hospital laboratory information management systems market captured the largest revenue share of 83.2% in 2024 within North America, fueled by the widespread adoption of digital healthcare solutions and the increasing volume of clinical testing. Hospitals are prioritizing efficient laboratory management and real-time data access to enhance diagnostic accuracy and patient care. The growing preference for cloud-based and AI-enabled LIMS, combined with the integration of laboratory systems with hospital information systems, further propels the market. Moreover, ongoing government initiatives supporting healthcare digitization and a strong presence of key LIMS vendors significantly contribute to market expansion.

Canada North America Hospital Laboratory Information Management Systems Market Insight

The Canada hospital laboratory information management systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising investments in healthcare infrastructure and increasing clinical research activities. Hospitals and diagnostic centers are adopting LIMS to improve workflow efficiency, ensure regulatory compliance, and manage large volumes of patient samples. The integration of laboratory systems with electronic health records and digital hospital platforms is fostering the adoption of advanced LIMS solutions. Canadian healthcare providers are increasingly valuing centralized data management and automation, which are improving overall laboratory productivity and service quality.

Mexico North America Hospital Laboratory Information Management Systems Market Insight

The Mexico hospital laboratory information management systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing need for accurate laboratory testing and modernization of hospital laboratories. The rising prevalence of chronic diseases and demand for improved diagnostic capabilities are encouraging the adoption of LIMS across hospitals. In addition, government healthcare initiatives and partnerships with international vendors are supporting the deployment of advanced laboratory management systems. Hospitals are progressively implementing digital solutions to streamline workflows, reduce errors, and enhance compliance with regulatory standards.

North America Hospital Laboratory Information Management Systems Market Share

The North America hospital laboratory information management systems industry is primarily led by well-established companies, including:

- H&A Scientific, Inc. (U.S.)

- Labworks, Inc. (U.S.)

- Online LIMS (U.S.)

- LabVantage Solutions, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Clinisys, Inc. (U.S.)

- Veeva Systems Inc. (U.S.)

- Sapio Sciences (U.S.)

- Orchard Software Corporation (U.S.)

- Autoscribe Informatics Ltd. (U.K.)

- LigoLab Information System, Inc. (U.S.)

- STARLIMS Corporation (U.S.)

- IQVIA Inc. (U.S.)

- LabLynx, Inc. (U.S.)

- Medrio (U.S.)

- Bio-Optronics, Inc. (U.S.)

What are the Recent Developments in North America Hospital Laboratory Information Management Systems Market?

- In September 2025, LabWare Launches Major Update for Clinical & Public Health LIMS Solution LabWare introduced LabWare Clinical Health 5.06, the latest version of their solution for clinical diagnostics and public health labs. The release focused on enhanced features to drive operational efficiency, streamline workflows, and expand capabilities in key areas such as billing, data management, and laboratory communications. It also introduced a comprehensive automated testing tool to streamline validation efforts

- In April 2025, Labcorp reported a 6% increase in diagnostic laboratory revenue, totaling USD 2.63 billion. This growth was attributed to strong demand for diagnostic tests, particularly among older adults undergoing non-urgent surgeries. Labcorp's expansion into managing hospital laboratories has bolstered its market presence and underscores the increasing reliance on LIMS for efficient laboratory operations

- In October 2024, Xybion completed the acquisition of Autoscribe Informatics and subsequently launched Xybion LIMS 10.0. This release represents a modern SaaS LIMS aimed at enhancing efficiency and scalability for labs across various industries, including those served by Autoscribe's Matrix Gemini LIMS

- In January 2024, STARLIMS Unveils Next-Generation LIMS for Public Health Sector STARLIMS announced the launch of Life Sciences for Public Health (LPH) 1.0, a new Laboratory Information Management System (LIMS) designed specifically for the Public Health sector. The system features an upgrade to HTML5 browser-based technology, offering a modernized user-interface for ease-of-use and marking the first step in a multi-year product roadmap focused on superior user experience and advanced functionalities

- In August 2021, CTI Partners with LabWare for LIMS to Expand Global Laboratory Services CTI Clinical Trial and Consulting Services (CRO) announced a partnership with LabWare, Inc. to implement a Laboratory Information Management System (LIMS) as part of CTI's expansion of laboratory services, including a flagship lab being built in Cincinnati, OH to cover the Americas. The partnership aims to support rare disease and cell & gene therapy research across all regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.