North America Herpes Market

Market Size in USD Million

CAGR :

%

USD

453.34 Million

USD

808.52 Million

2025

2033

USD

453.34 Million

USD

808.52 Million

2025

2033

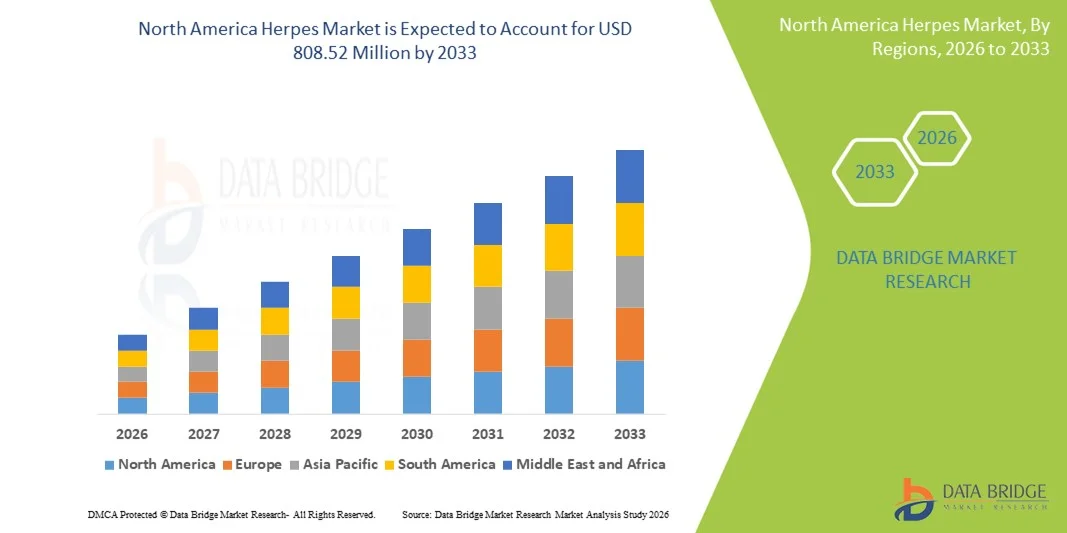

| 2026 –2033 | |

| USD 453.34 Million | |

| USD 808.52 Million | |

|

|

|

|

North America Herpes Market Size

- The North America herpes market size was valued at USD 453.34 million in 2025 and is expected to reach USD 808.52 million by 2033, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by rising prevalence of herpes simplex virus (HSV) infections, well‑established healthcare infrastructure, high awareness levels, and widespread access to diagnostic and antiviral treatment options, which together support increasing uptake of both suppressive and episodic therapies in the region

- Furthermore, increasing investment in research and development, integration of digital health/telemedicine for remote management, and strong presence of leading pharmaceutical companies are enhancing the availability of innovative and user‑friendly treatment solutions for patients in North America, thereby propelling the region’s market expansion

North America Herpes Market Analysis

- Herpes treatments, including antiviral therapies and emerging vaccine candidates, are increasingly critical components of infectious disease management in both clinical and outpatient settings due to their ability to reduce viral outbreaks, limit transmission, and improve patient quality of life

- The escalating demand for herpes treatments is primarily fueled by the rising prevalence of HSV-1 and HSV-2 infections, growing awareness of sexual health, and an increasing focus on early diagnosis and effective management to prevent complications

- The United States dominated the North America herpes market with the largest revenue share of 70.2% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of leading pharmaceutical and biotech companies, with substantial growth in antiviral prescriptions and clinical trials driven by innovations in long-acting antivirals and digital health solutions

- Canada is expected to witness the fastest growth in the North America herpes market during the forecast period due to increasing healthcare access, rising public awareness, and supportive government initiatives for sexual health management

- Oral segment dominated the North America herpes market with a market share of 45.9% in 2025, driven by its proven efficacy, ease of administration, and widespread adoption as both suppressive and episodic therapy for managing recurrent herpes infections

Report Scope and North America Herpes Market Segmentation

|

Attributes |

North America Herpes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Herpes Market Trends

Increasing Focus on Long-Acting Antivirals and Digital Health Solutions

- A significant and accelerating trend in the North America herpes market is the growing development and adoption of long-acting antiviral therapies and digital health platforms for remote patient monitoring, improving adherence and treatment outcomes

- For instance, Valtrex extended-release formulations are being explored in clinical studies to reduce dosing frequency and improve patient convenience while maintaining efficacy in managing recurrent herpes infections

- Digital health integration enables features such as adherence reminders, teleconsultation support, and personalized outbreak tracking, allowing patients and clinicians to manage herpes more effectively. For instance, some mobile apps now provide automated notifications for medication schedules and symptom monitoring, enhancing patient engagement and treatment success

- The seamless incorporation of digital health solutions with antiviral therapies facilitates centralized monitoring of patient health, enabling physicians to adjust treatment plans in real time and provide timely interventions for flare-ups

- This trend towards more convenient, patient-centric, and technology-supported treatment approaches is fundamentally reshaping expectations for herpes management. Consequently, companies such as Hologic and BioLineRX are developing integrated care solutions combining antivirals with telehealth platforms

- The demand for long-acting antiviral therapies and connected health solutions is growing rapidly across both outpatient and clinical settings, as patients increasingly prioritize convenience, adherence, and improved quality of life

- In addition, collaborations between pharmaceutical companies and digital health startups are emerging to create AI-driven outbreak prediction tools, helping patients proactively manage herpes infections

North America Herpes Market Dynamics

Driver

Rising Prevalence and Awareness of Herpes Infections

- The increasing prevalence of HSV-1 and HSV-2 infections, coupled with growing public awareness about sexual health, is a significant driver for the heightened demand for effective herpes therapies

- For instance, in March 2025, Gilead Sciences announced the advancement of a once-daily oral antiviral study to improve patient adherence and reduce recurrent outbreaks, reflecting a strategic push by key players

- As more individuals seek effective management of recurring herpes infections, antiviral therapies offer clinically proven efficacy, preventive benefits, and convenience compared to older treatment options

- Furthermore, increasing sexual health education, screening programs, and public health campaigns are making effective herpes management more accessible and encouraging early diagnosis and treatment

- The convenience of oral antiviral administration, remote consultation options via telehealth, and long-acting treatment formulations are key factors propelling adoption in both clinical and outpatient care

- For instance, awareness campaigns targeting young adults have increased demand for preventive treatments and counseling services, supporting overall market growth

- In addition, collaborations between hospitals and biotech companies are promoting clinical trial participation, accelerating the adoption of next-generation antivirals and digital solutions

Restraint/Challenge

Treatment Resistance and Access Barriers

- Concerns surrounding antiviral resistance and variability in patient response pose significant challenges to broader market penetration and optimal disease management

- For instance, documented cases of acyclovir-resistant HSV strains have made clinicians cautious in long-term prescribing, highlighting the need for alternative therapies

- Addressing these concerns through development of next-generation antivirals, combination therapies, and patient education is crucial for maintaining efficacy and trust. Companies such as Vical and Tonix emphasize clinical trials for resistant HSV strains to reassure physicians

- In addition, high treatment costs and limited insurance coverage in certain U.S. and Canadian regions can be a barrier to access for price-sensitive patients, particularly for novel antiviral formulations or specialty care programs

- While generic antivirals remain widely available, the perceived premium for newer, long-acting, or digital-integrated therapies can still hinder uptake. Overcoming these challenges through broader insurance coverage, patient support programs, and affordable treatment options will be vital for sustained market growth

- For instance, logistical challenges in remote or rural areas can delay access to antiviral therapy, limiting timely treatment during outbreaks

- Furthermore, regulatory hurdles for the approval of innovative antivirals or therapeutic vaccines may slow market introduction and adoption, impacting overall growth potential

North America Herpes Market Scope

The market is segmented on the basis of virus type, product, drug type, age, route of administration, distribution channel, and end users.

- By Virus Type

On the basis of virus type, the North America herpes market is segmented into Herpes Simplex (HSV-1 & HSV-2) and Herpes Zoster (Shingles). The Herpes Simplex segment dominated the market with the largest revenue share of 55% in 2025, driven by its high prevalence, recurrent nature, and the widespread adoption of antiviral therapies such as acyclovir and valacyclovir. Patients often seek suppressive or episodic treatments for HSV outbreaks, creating sustained demand for prescription antivirals. Clinical awareness and screening programs contribute to early diagnosis, further boosting the segment’s market size. The strong presence of leading pharmaceutical companies focusing on HSV therapeutics also reinforces its market dominance. Treatment innovations, including digital adherence tools and long-acting antivirals, continue to support growth in this segment.

The Herpes Zoster segment is expected to witness the fastest growth rate of 18.5% from 2026 to 2033, fueled by the increasing geriatric population and rising incidence of shingles. Vaccination awareness campaigns and prophylactic antiviral therapies are driving adoption in older adults. Improved diagnostic capabilities and educational initiatives about shingles complications, such as postherpetic neuralgia, are accelerating treatment uptake. The growing focus on preventive healthcare and vaccine integration in public health programs is enhancing market penetration. Digital platforms for telehealth consultations further contribute to faster diagnosis and early treatment.

- By Product

On the basis of product, the market is segmented into Acyclovir, Docosanol, Valacyclovir, Famciclovir, and Others. The Valacyclovir segment dominated the market with the largest revenue share of 30% in 2025, owing to its high efficacy, convenient oral dosing schedule, and widespread physician preference for suppressive therapy. Patients favor valacyclovir for its ability to reduce outbreak frequency and transmission risk. Its availability in both brand-name and generic versions supports accessibility. Clinical guidelines recommending valacyclovir for recurrent herpes infections strengthen market adoption. The segment also benefits from ongoing research and extended-release formulations improving adherence.

The Docosanol segment is expected to witness the fastest growth rate of 16.8% from 2026 to 2033, primarily driven by increasing demand for over-the-counter topical treatments for cold sores. Its non-prescription status makes it highly accessible to consumers seeking immediate relief. Marketing campaigns and patient awareness programs highlighting symptom reduction drive adoption. Rising consumer preference for home-based, self-administered therapies enhances growth. Integration with telepharmacy services and online retail channels further accelerates market expansion.

- By Drug Type

On the basis of drug type, the market is segmented into prescription drugs and over-the-counter (OTC) drugs. The Prescription Drug segment dominated the market with a revenue share of 65% in 2025, driven by the need for physician-guided management of recurrent and severe herpes infections. Prescription antivirals such as acyclovir, valacyclovir, and famciclovir form the backbone of treatment protocols. Healthcare provider awareness and monitoring requirements contribute to steady demand. Prescription therapies also benefit from insurance coverage and clinical validation. Advanced formulations with long-acting properties further support the segment’s dominance.

The OTC Drug segment is expected to witness the fastest growth rate of 14.2% from 2026 to 2033, fueled by increasing consumer awareness of cold sore management and self-care practices. Products such as docosanol and topical creams are widely available in retail stores and online pharmacies. Rising emphasis on early symptom intervention drives adoption. Convenience, affordability, and marketing campaigns highlighting symptom relief support growth. OTC product expansion in digital and e-commerce channels also accelerates penetration.

- By Age

On the basis of age, the market is segmented into adult and pediatrics. The Adult segment dominated the market with a revenue share of 80% in 2025, owing to higher prevalence rates of both HSV and shingles among adults. Adults seek both episodic and suppressive antiviral treatments, creating sustained demand. Public awareness campaigns targeting adult populations contribute to early diagnosis and treatment adherence. The segment also benefits from insurance reimbursement and prescription coverage. Rising adoption of long-acting antivirals and preventive measures for shingles supports growth. Adults represent the primary demographic for clinical trials and digital health integration, strengthening market leadership.

The Pediatrics segment is expected to witness the fastest growth rate of 12.5% from 2026 to 2033, driven by increasing awareness of early HSV-1 infections and parental focus on symptom management. Pediatric formulations such as acyclovir suspensions and topical creams support safer dosing. Telehealth platforms and educational initiatives targeting parents enhance treatment adherence. Rising school-based health programs and pediatric care access contribute to rapid adoption. Over-the-counter pediatric treatments also drive segment growth.

- By Route of Administration

On the basis of route of administration, the market is segmented into topical, oral, and parenteral. The Oral segment dominated the market with a revenue share of 45.9% in 2025, driven by convenience, proven efficacy, and widespread physician preference for suppressive and episodic therapy. Oral antivirals reduce outbreak frequency and transmission risk effectively. Extended-release formulations improve patient adherence and reduce dosing frequency. Physician recommendations and clinical guidelines reinforce adoption. Oral administration is preferred for both HSV and shingles management.

The Topical segment is expected to witness the fastest growth rate of 15.8% from 2026 to 2033, fueled by the rising demand for OTC creams and home-based symptom relief for cold sores. Convenience, low side effects, and self-administration support market expansion. Digital channels and pharmacy-based awareness campaigns drive consumer adoption. Increased preference for non-systemic therapy in mild cases also contributes to growth. Telepharmacy and online retail availability enhance market penetration.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospitals Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies, and Others. The Hospital Pharmacies segment dominated the market with a revenue share of 45% in 2025, due to prescriptions being primarily issued and dispensed in hospital settings. Hospitals provide access to specialist care, clinical monitoring, and patient counseling. Insurance coverage for hospital-dispensed medications also contributes to the dominance. Hospital pharmacies support both acute and chronic herpes treatment needs. Integration with telemedicine follow-ups strengthens their role. Clinical awareness programs in hospitals further boost prescriptions.

The Online Pharmacies segment is expected to witness the fastest growth rate of 19.2% from 2026 to 2033, driven by increasing e-commerce adoption, home delivery convenience, and telehealth consultations. Online platforms provide discreet purchasing and easy repeat orders. Digital marketing and awareness campaigns promote OTC and prescription therapies. Accessibility in remote areas enhances penetration. Mobile app-based ordering and automated reminders improve adherence. Growth is also supported by partnerships between pharmaceutical companies and e-pharmacy platforms.

- By End Users

On the basis of end users, the market is segmented into hospitals, specialty clinics, and others. The Hospitals segment dominated the market with a revenue share of 60% in 2025, owing to their role in providing prescriptions, specialist consultations, and patient monitoring for recurrent and severe herpes infections. Hospitals also facilitate vaccination programs for shingles and offer patient education for management. Integration with digital health platforms ensures adherence tracking. Clinical trials and research collaborations reinforce hospital dominance. Insurance coverage for hospital-dispensed treatments supports sustained demand.

The Specialty Clinics segment is expected to witness the fastest growth rate of 16.5% from 2026 to 2033, driven by sexual health clinics and dermatology centers specializing in herpes management. Clinics offer personalized treatment, counseling, and rapid access to antivirals. Teleconsultation services in specialty clinics improve patient engagement and adherence. Awareness campaigns and preventive care programs accelerate adoption. Specialized care, focused patient follow-ups, and digital record integration further support rapid growth.

North America Herpes Market Regional Analysis

- The United States dominated the North America herpes market with the largest revenue share of 70.2% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of leading pharmaceutical and biotech companies

- Patients and healthcare providers in the region highly value effective treatment options, early diagnosis, and the availability of both suppressive and episodic antiviral therapies, which help reduce outbreaks and limit transmission

- This widespread adoption is further supported by strong public awareness campaigns, well-established sexual health programs, and a technologically inclined healthcare system that integrates digital health solutions, telemedicine consultations, and patient adherence tools, establishing antivirals as the primary management solution for both HSV and shingles infections

The U.S. Herpes Market Insight

The U.S. herpes market captured the largest revenue share of 70.2% in 2025 within North America, fueled by high prevalence of HSV-1 and HSV-2 infections and the well-established healthcare infrastructure. Patients are increasingly prioritizing effective antiviral therapies, early diagnosis, and long-term management of recurrent outbreaks. The growing adoption of digital health platforms, telemedicine consultations, and mobile adherence tools further propels the herpes treatment industry. Moreover, awareness campaigns and sexual health education programs are significantly contributing to the market’s expansion. Prescription antivirals such as acyclovir, valacyclovir, and famciclovir remain the most widely used therapies, with new long-acting formulations under clinical development to improve convenience and adherence.

Canada Herpes Market Insight

The Canada herpes market is anticipated to grow at a notable CAGR during the forecast period, primarily driven by increasing awareness of sexually transmitted infections and improved access to healthcare services. The growing adoption of telehealth solutions and digital platforms allows patients to manage herpes infections efficiently while maintaining privacy. Public health initiatives targeting early diagnosis, preventive care, and vaccination for shingles are fostering treatment uptake. Canadian patients are increasingly favoring OTC antiviral creams for cold sores alongside prescription therapies for recurrent HSV infections. Rising government support for sexual health programs and educational campaigns is expected to continue stimulating market growth.

Mexico Herpes Market Insight

The Mexico herpes market is expected to expand at a significant CAGR during the forecast period, fueled by increasing awareness of herpes simplex and herpes zoster infections and improving healthcare accessibility. Rapid urbanization and rising disposable incomes are contributing to higher adoption of antiviral therapies in both outpatient and clinical settings. Prescription antivirals are becoming more widely available, supported by growing insurance coverage and pharmacy networks. Public awareness campaigns highlighting early treatment and symptom management are driving patient engagement. In addition, digital health initiatives and telemedicine services are enabling more efficient patient follow-ups, enhancing treatment outcomes. Mexico’s expanding healthcare infrastructure, combined with increased pharmaceutical penetration, is expected to sustain market growth.

North America Herpes Market Share

The North America Herpes industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Merck & Co. Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- Sanofi (France)

- Abbott (U.S.)

- Fresenius Kabi AG (Germany)

- Glenmark Pharmaceuticals Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Emcure Pharmaceuticals Ltd. (India)

- Apotex Inc. (Canada)

- Aurobindo Pharma Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Agenus Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Bausch Health (Canada)

What are the Recent Developments in North America Herpes Market?

- In December 2025, Assembly Biosciences announced even stronger interim Phase 1b data showing up to a 98 % reduction in high viral load shedding and sustained efficacy with weekly oral dosing of ABI‑5366, reinforcing its potential to improve outcomes for recurrent genital herpes patients

- In November 2025, Moderna decided to discontinue development of its mRNA‑1608 therapeutic HSV vaccine candidate and will not advance it into Phase 3 testing, reflecting ongoing challenges in achieving sufficient efficacy against herpes simplex virus despite earlier clinical activity

- In August 2025, Assembly Biosciences reported positive interim Phase 1b results for its investigational herpes simplex virus (HSV) treatment candidate ABI‑5366, demonstrating a significant reduction in viral shedding rates (94 %) and genital lesion rates in participants with recurrent HSV‑2 genital herpes, underscoring potential clinical benefits over existing therapies

- In May 2025, interim data from Moderna’s Phase 1/2 study of the mRNA‑1608 therapeutic HSV‑2 vaccine candidate showed the vaccine was generally safe, well tolerated, and induced antigen‑specific immune responses in adults with recurrent genital herpes, marking an important early step even as later stages remain uncertain

- In September 2024, pharmaceutical leader GSK officially ceased development of its HSV vaccine candidate GSK3943104 after early clinical trial data failed to demonstrate desired efficacy, highlighting the difficulty in creating a successful herpes vaccine and leaving room for mRNA and other novel approaches to lead future research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.