North America Heart Valve Devices Market Analysis and Insights

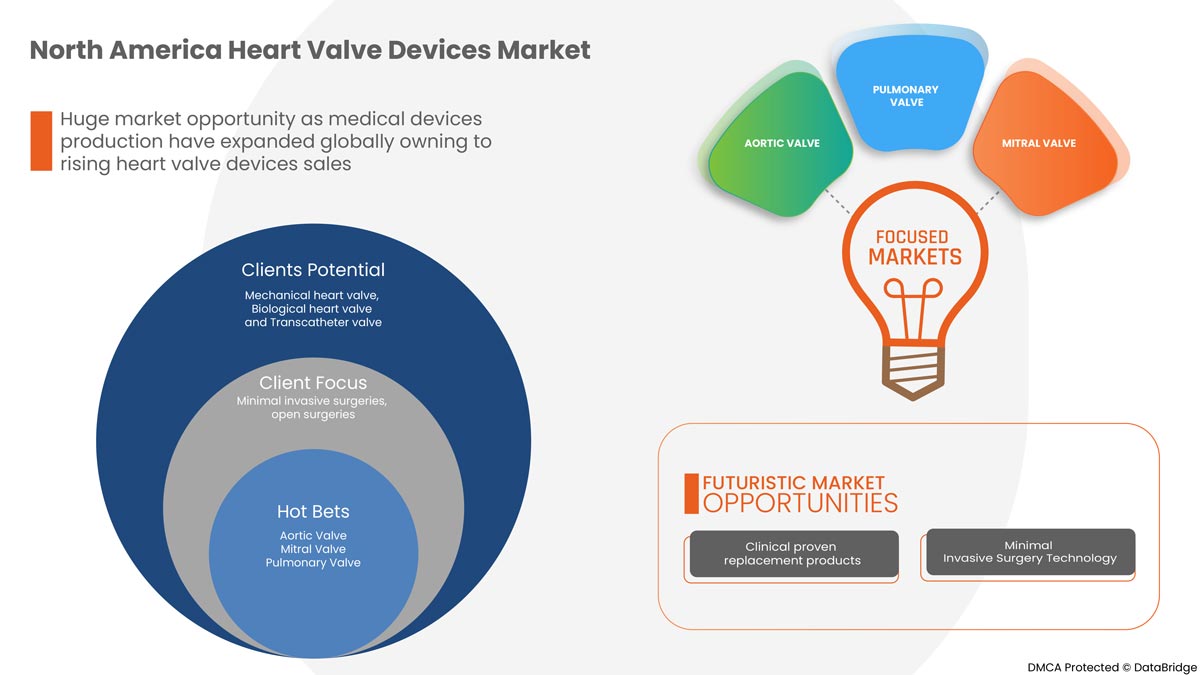

Heart valve devices are used to treat blocked heart valves, and implanting these devices is one of the most common procedures. Structural heart valve devices available on the market include mechanical, biological, and transcatheter valves. The North America heart valve devices market is likely to grow steadily during the forecast period due to the increasing number of heart valve surgeries across the globe. The growth of the North America heart valve devices market is anticipated to be driven by developments in structural heart devices and procedures such as aortic valves, left atrial occlusion devices and tissue or biological valves. Tissue valves have already revolutionized the market for heart valve devices. Next-generation heart valve surgeries offering low delivery patient profiles, more controlled surgeries, better valve function, reduced paravalvular regurgitation, increased durability, and lower costs. Product innovations by key market players have boosted the growth of market by enabling them to address a larger patient population and achieve better clinical outcomes.

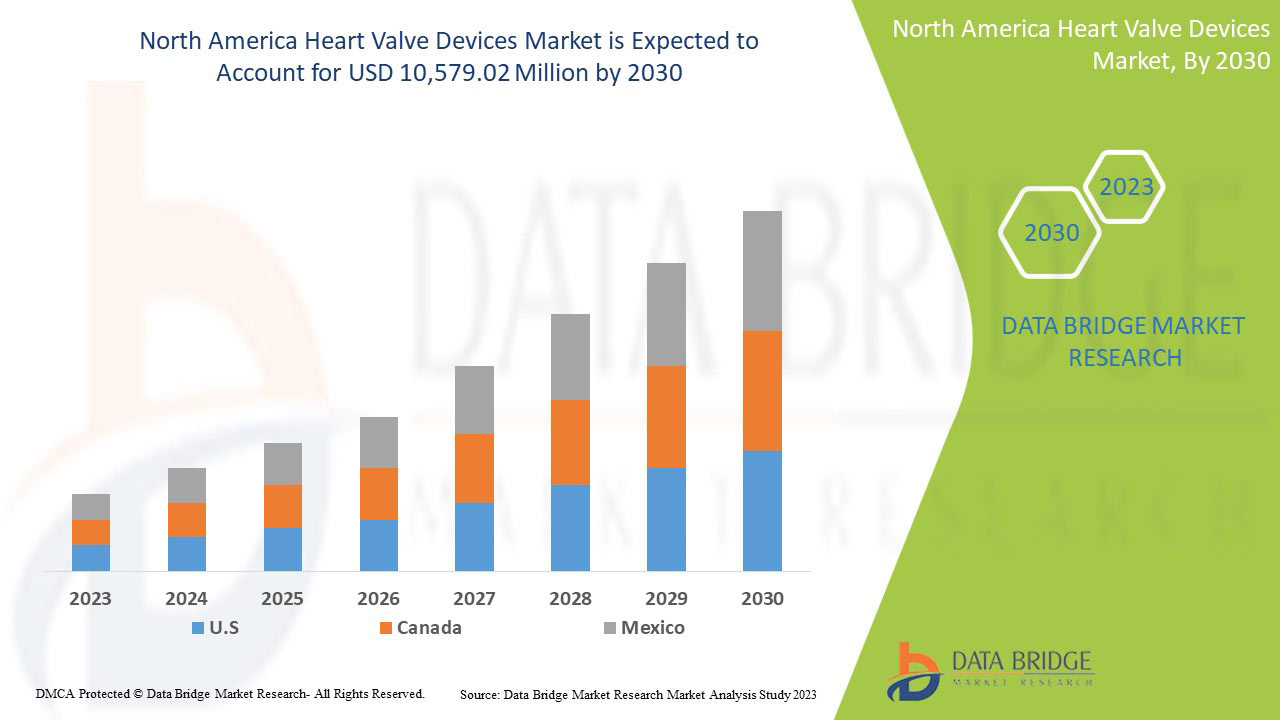

Data Bridge Market Research analyzes that the heart valve devices market is expected to reach the value of USD 10,579.02 million by 2030, at a CAGR of 13.6% during the forecast period. Product type accounts for the largest type segment in the market due to rapid demand of heart valves devices globally. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

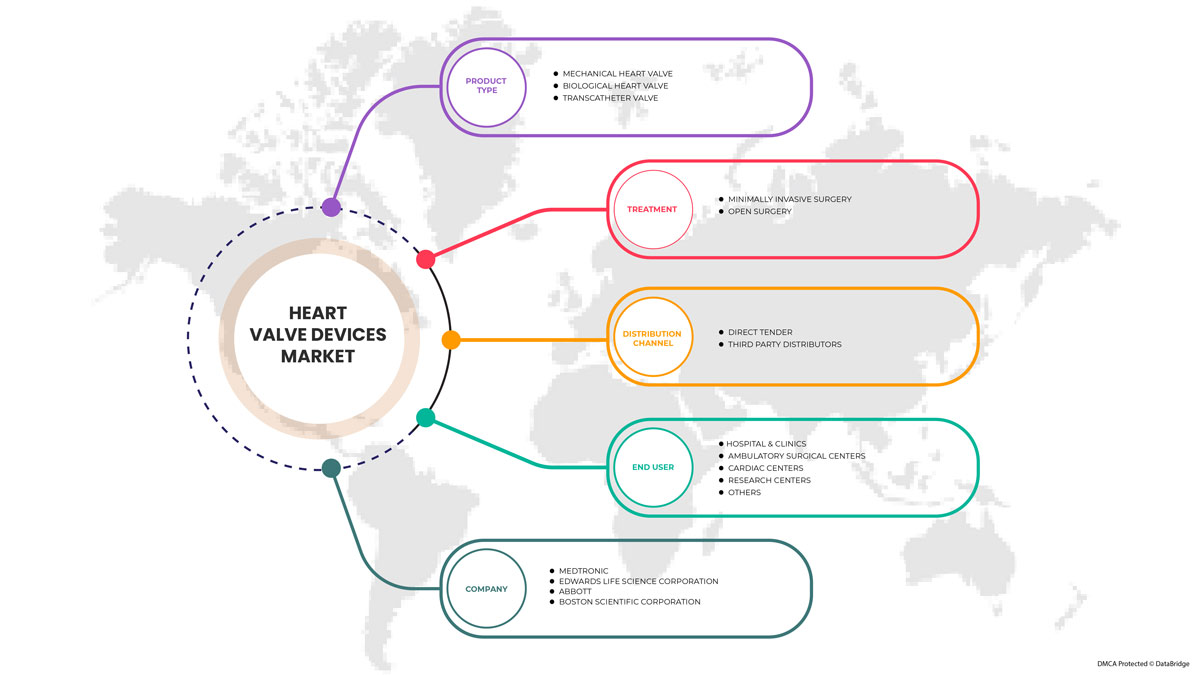

By Product Type (Mechanical Heart Valves, Biological Heart Valves and Transcatheter Valves), Treatment (Open Surgery and Minimally Invasive Surgery (MIS)), End User (Hospitals & Clinics, Ambulatory Surgical Centers, Cardiac Centers, Research Centers and Others), Distribution Channel (Direct Tender, Third Party Distributors). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Abbott, Boston Scientific Corporation or its affiliates, Artivion, Inc., Edwards Lifesciences Corporation, Medtronic, NeoVasc, Micro Interventional Devices Incorporated, XELTIS, TTK, Meril Life Sciences Pvt. Ltd, Foldax, Inc., Venus Medtech (Hangzhou) Inc., Colibri Heart Valve among others. |

Heart Valve Devices Market Definition

Heart valves are necessary to smooth blood movement in the right direction in the body. Heart valves are responsible for constant blood flow, and maintaining blood pressure. If they don't work properly cutting off the heart causes stenosis. Heart disease generally includes several diseases that significantly affect the heart. The regulation of heart valves has increased rapidly in the last ten years as the number of patients suffering from cardiovascular diseases has increased. The market growth of heart valves is accelerated by factors such as unstable lifestyles, lifestyle diseases, increasing smoking population, aging population, and increasing quality of healthcare, and rapid development of healthcare reimbursement during the forecast period. In addition, the high cost of heart valves and the risk of infection of heart implants may be the reason that is likely to slow down the growth of the heart valve market during the above-mentioned forecast period. Growth in medical business aspects and groundwork in emerging economies is fueling growth in medical tourism, driving the heart valve device market. The need for minimally invasive procedures to treat cardiac abnormalities has greatly increased. Current applications of automation in heart valve surgery, such as Transcatheter Aortic Valve Replacement (TAVR), have given way to a growing variety of similar surgeries. Judging by the increasing proportion of the aging population, the increase in life insurance policies is also expected to contribute to the growth of the heart valve market.

Heart Valve Devices Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Innovations in Heart Valve Devices Offer Improved Clinical Outcome

Launching new products for minimally invasive procedures will likely drive the North America heart valve devices market. Tissue valves have revolutionized the heart valve market. The next generation of heart valve surgery offers fewer delivery curves, more controlled placement, improved valve function, reduced valve regurgitation, increased durability, and reduced cost. Product innovation has boosted the growth prospects of heart valve device market players as it can treat a larger number of patients with superior clinical outcomes. Despite significant advances in recent years, structural interventional cardiology remains an emerging market with great potential.

Moreover, intelligent designs, new technologies, and biomaterials applications continue to push the boundaries of new product development, ensuring that these devices will be at the forefront of interventional product innovation for years to come. Design innovations are helping market players tap profitable growth opportunities in heart valve devices.

Thus, the growth of the North America heart valve devices market is expected to propel due to the rise in innovations in heart valve devices.

- Rising number of various heart diseases

Heart attacks and strokes are usually acute events and are primarily caused by a blockage that blocks blood flow to the heart or brain. During the first year of the COVID-19 pandemic, heart disease and stroke deaths increased by 5.8% and 6.8%, respectively. However, the age-associated increases were 1.6% and 1.7% for heart disease and stroke, respectively. The most common cause is the build-up of fatty deposits in the lining of the blood vessels that supply the heart or brain. A stroke can be caused by bleeding or blood clots in a blood vessel in the brain. This trend suggests that the incidence of cardiovascular disease may increase dramatically due to population growth and aging.

Furthermore, High diabetes and blood pressure, high blood cholesterol, and smoking are key risk factors for heart disease. About half of people in the United States (47%) have at least one of these three risk factors. Other medical conditions and lifestyle choices can also put people at a higher risk for heart disease, including unhealthy diet, physical inactivity, and excessive alcohol use.

Moreover, the rising number of heart diseases is expected to act as a driver for the North America heart valve devices market.

Opportunity

- Increasing Awareness of Prosthetic Devices

A prosthesis is a device designed to replace a missing body part or to improve the function of a body part. Prosthetic heart valves are increasingly used in cases of abnormalities of the natural valves that require intervention. Generally, they can be divided into mechanical heart valves, biological valves, and allogeneic grafts. The goal of artificial valves is to act hemodynamically like a natural valve with minimal side effects. Cardiovascular prostheses devices have been developed to replace damaged heart tissue. These medical devices are designed to mimic the function of normal cardiovascular organs. Artificial hearts allow heart surgeons to increase the treatment of heart blocks.

Moreover, the prevalence of prosthetic valves ranges from 0.2 per 1,000 in people years of age or younger to 5.3 in people years of age or younger.

Thus the increasing awareness about prosthetic devices acts as an opportunity for the market's growth.

Restraint/Challenge

- Expensive Production Cost of Equipment

The number of patients treated for aortic valve disease in the United States is growing quickly. Transcatheter aortic valve replacement (TAVR) replaces surgical aortic valve replacement (SAVR) and medical treatment (M.T.). The economic consequences of these trends are unknown. Therefore, the total cost of TAVR is higher than SAVR and much more expensive than M.T. alone. TAVR costs have decreased over time, while SAVR and M.T. costs have remained the same.

In addition, the high surgical cost of TAVI is mainly due to the high cost of the production. However, due to the shorter hospital stay, the cost of non-surgical TAVI is lower compared to AVR. The cost of the TAVI implant kit alone (valve, balloon, sheath) is $32,500, while the surgical valve only costs about $5,000, just like in Switzerland, the TAVI implant set costs about 32,000 francs (around of $35,000), while the cost of a biosurgical prosthesis is about 3,000 Swiss francs (about US$3,300). Depending on comorbidities and complications, reimbursement in the United States is between $ 0,000 and $ 5,000, TAVI in Switzerland is about 72,000 francs ($78,000), and AVR is about 3,000 francs ($ 7,000), which means a financial loss for the hospital.

Thus, the rising production cost of equipment may hamper the market's growth.

Recent Developments

- In September 2023, Abbott released data from five late-stage presentations showing the benefits of its minimally invasive devices in treating people with various structural heart diseases. The data includes findings that support the value of MitraClip™. It is the world's first and leading transcatheter edge-to-edge repair (TEER) to treat leaky valves in people with mitral regurgitation (MR). New data on Abbott's structural heart therapies were presented at the Cardiovascular Research Foundation's 34th Annual Transcatheter Cardiovascular Therapy (TCT) Scientific Symposium in Boston. This has helped the company to increase its business position in the market.

- In September 2020, Boston Scientific Corporation announced that it had introduced a controlled launch of the ACURATE neo2™ aortic valve system in Europe. This next-generation transcatheter aortic valve implantation (TAVI) technology is a new platform designed with multiple features to improve the clinical performance of the original ACURATE new platform. Compared to the previous generation, the ACURATE neo2 valve system has an expanded indication for patients with aortic stenosis. This has helped the company to gain its product portfolio.

Heart Valve Devices Market Scope

The heart valve devices market is segmented into product type, treatment, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Mechanical Heart Valves

- Biological Heart Valve

- Transcatheter Valves

On the basis of product type, the heart valve devices market is segmented into mechanical heart valve, biological heart valve and transcatheter valve.

BY TREATMENT

- OPEN SURGERY

- MINIMALLY INVASIVE SURGERY

On the basis of treatment, the heart valve devices market is segmented into open surgery and minimal invasive surgery.

BY END USER

- HOSPITAL & CLINICS

- AMBULATORY SURGICAL CENTERS

- CARDIAC CENTERS

- RESEARCH CENTERS

- OTHERS

On the basis of end user, the heart valve devices market is segmented into hospitals & clinics, ambulatory surgical centers, cardiac centers, research centers and others.

BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- THIRD PARTY DISTRIBUTORS

On the basis of distribution channel, the heart valve devices market is segmented into direct tender and third party distributors.

North America Heart Valve Devices Market Regional Analysis/Insights

The heart valve devices market is analyzed and market size information is provided product type, treatment, end user, and distribution channel.

The countries covered in this market report U.S., Canada, Mexico.

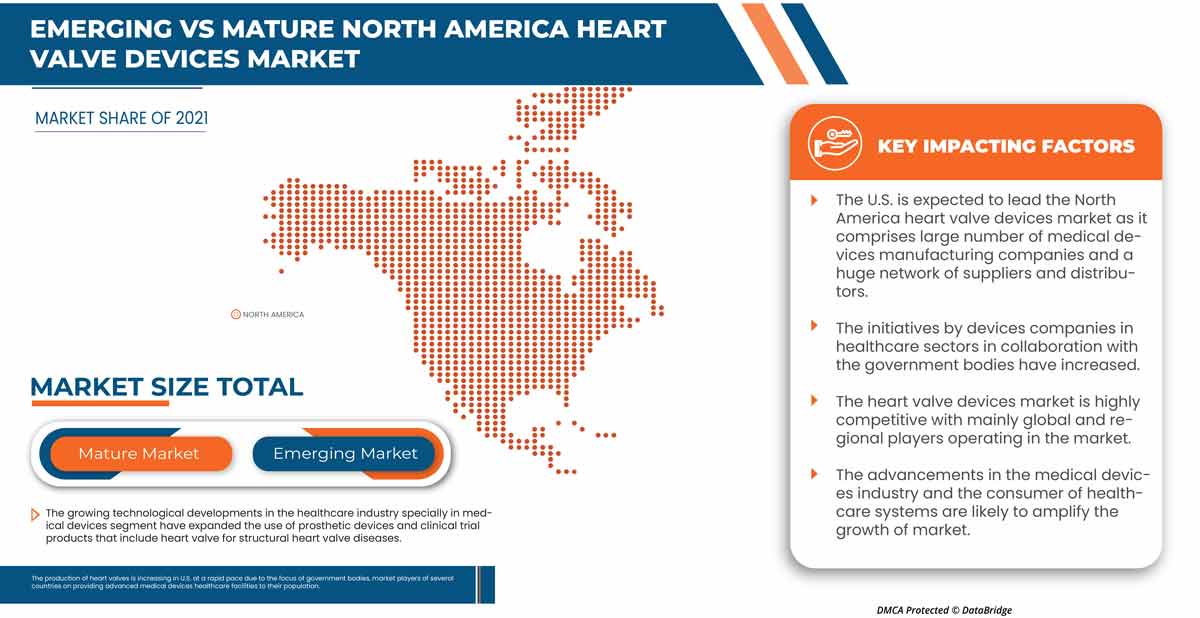

North America is dominating the market due to the increasing investment in R&D. The U.S. dominates North America region due to strong presence of key players.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Heart Valve Devices Market Share Analysis

The heart valve devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the heart valve devices market.

Some of the key players operating in the heart valve devices market are Abbott, Boston Scientific Corporation or its affiliates, Artivion, Inc., Edwards Lifesciences Corporation, Medtronic, NeoVasc, Micro Interventional Devices Incorporated, XELTIS, TTK, Meril Life Sciences Pvt. Ltd, Foldax, Inc., Venus Medtech (Hangzhou) Inc., Colibri Heart Valve among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMIOLOGY

3.2 PESTEL ANALYSIS

3.3 PORTER'S FIVE FORCE

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 INNOVATIONS IN HEART VALVE DEVICES OFFER IMPROVED CLINICAL OUTCOME

4.1.2 RISING NUMBER OF VARIOUS HEART DISEASES

4.1.3 ADVANCEMENTS IN TRANSCATHETER VALVE TECHNOLOGY

4.1.4 INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES

4.2 RESTRAINTS

4.2.1 HIGH COST ASSOCIATED WITH THE SURGERIES

4.2.2 COMPLICATIONS ASSOCIATED WITH HEART VALVE REPLACEMENT

4.3 OPPORTUNITIES

4.3.1 INCREASING AWARENESS OF PROSTHETIC DEVICES

4.3.2 RISING PREVALENCE OF STROKE & CARDIAC ARREST TO REINFORCE DEMAND FOR HEART VALVE DEVICES

4.3.3 INCREASING FDA APPROVALS OF TRANSCATHETER AORTIC VALVES

4.4 CHALLENGES

4.4.1 STRICT GOVERNMENT REGULATIONS

4.4.2 EXPENSIVE PRODUCTION COST OF EQUIPMENT

5 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE

5.1 OVERVIEW

5.2 MECHANICAL HEART VALVES

5.2.1 AORTIC VALVE

5.2.2 MITRAL VALVE

5.3 BIOLOGICAL HEART VALVES

5.3.1 AORTIC VALVE

5.3.2 MITRAL VALVE

5.3.3 PULMONARY VALVE

5.3.4 TRICUSPID VALVE

5.4 TRANSCATHETER VALVE

5.4.1 AORTIC VALVE

5.4.2 MITRAL VALVE

5.4.3 PULMONARY VALVE

6 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT

6.1 OVERVIEW

6.2 MINIMALLY INVASIVE SURGERY (MIS)

6.2.1 CARDIAC VALVE REPLACEMENT

6.2.2 CARDIAC VALVE REPAIR

6.3 OPEN SURGERY

6.3.1 CARDIAC VALVE REPLACEMENT

6.3.2 CARDIAC VALVE REPAIR

7 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITAL & CLINICS

7.3 AMBULATORY SURGICAL CENTERS

7.4 CARDIAC CENTERS

7.5 RESEARCH CENTERS

7.6 OTHERS

8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA HEART VALVE DEVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 EDWARDS LIFESCIENCES CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ARTIVION, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 COLIBRI HEART VALVE

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 FOLDAX, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 MERIL LIFE SCIENCES PVT. LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 MICRO INTERVENTIONAL DEVICES, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 NEOVASC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 TTK

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 VENUS MEDTECH (HANGZHOU) INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 XELTIS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS & CLINICS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CARDIAC CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIRECT TENDER IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HEART VALVE DEVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 U.S. HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 35 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 36 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 38 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 39 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 41 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 42 U.S. HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 43 U.S. MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 44 U.S. OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 45 U.S. HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 U.S. HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 50 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 51 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 53 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 54 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 56 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 57 CANADA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 58 CANADA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 59 CANADA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 MEXICO HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 65 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 66 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 68 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 69 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 71 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 72 MEXICO HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 73 MEXICO MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 74 MEXICO OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 75 MEXICO HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 MEXICO HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEART VALVE DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEART VALVE DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEART VALVE DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEART VALVE DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEART VALVE DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEART VALVE DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEART VALVE DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 11 GROWING PREVALENCE OF VALVULAR DISEASES, SUCH AS AORTIC STENOSIS & AORTIC REGURGITATION, AND INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES ARE EXPECTED TO DRIVE THE NORTH AMERICA HEART VALVE DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 12 MECHANICAL HEART VALVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEART VALVE DEVICES MARKET IN 2023 & 2030

FIGURE 13 INCIDENDE AND PREVALENCE OF HEART VALVE OF NORTH AMERICA

FIGURE 14 INCIDENDE AND PREVALENCE OF HEART VALVE OF EUROPE

FIGURE 15 INCIDENDE AND PREVALENCE OF HEART VALVE OF ASIA-PACIFIC

FIGURE 16 INCIDENDE AND PREVALENCE OF HEART VALVE OF SOUTH AMERICA & MIDDLE EAST AND AFRICA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

FIGURE 18 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2022

FIGURE 23 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2022

FIGURE 27 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEART VALVE DEVICES MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA HEART VALVE DEVICES MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.