North America Healthcare It Market

Market Size in USD Billion

CAGR :

%

USD

5.28 Billion

USD

9.88 Billion

2023

2031

USD

5.28 Billion

USD

9.88 Billion

2023

2031

| 2024 –2031 | |

| USD 5.28 Billion | |

| USD 9.88 Billion | |

|

|

|

|

Healthcare Information Technology (IT) Market Analysis and Size

In the healthcare information technology (IT) market, a groundbreaking application emerges, revolutionizing patient care through advanced data analytics and personalized treatment algorithms. This innovative method integrates AI-driven insights with real-time patient monitoring, enhancing efficiency and efficacy in healthcare delivery while optimizing resource utilization.

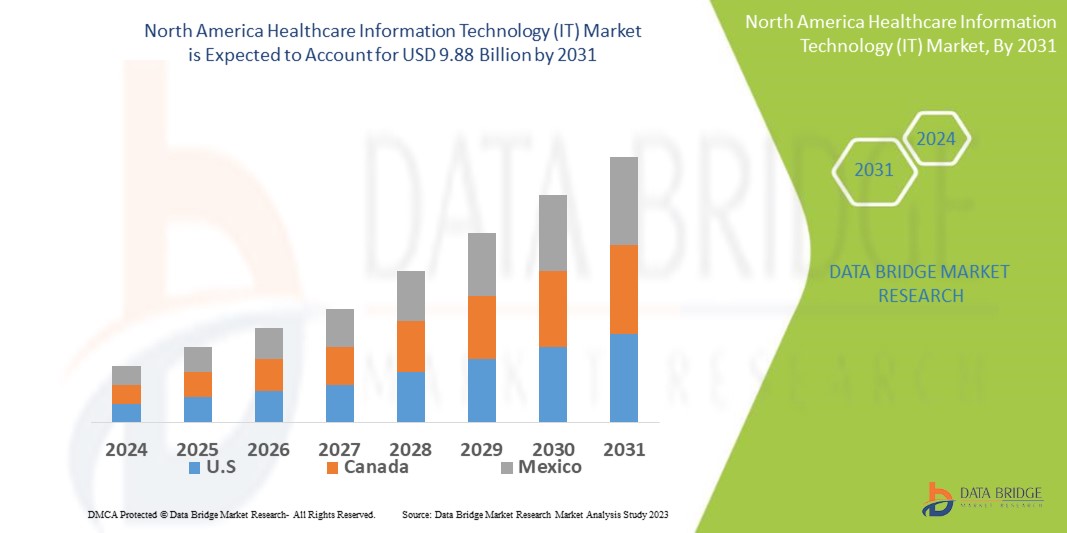

Data Bridge Market Research analyses that the North America healthcare information technology (IT) market which was USD 5.28 billion in 2023, is expected to reach USD 9.88 billion by 2031, and is expected to undergo a CAGR of 8.15% during the forecast period of 2024 to 2031. This indicates that the market value. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Healthcare Information Technology (IT) Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Business Segment (Laboratory Information Systems (LIS), Picture Archiving and Communication System (PACS) and Vendor Neutral Archive (VNA), Radiology Information Systems (RIS), Cardiovascular Information System (CVIS), Electronic Health Records (EHR), Telemedicine, Clinical Decision Support System (CDSS), Claims Management Solutions, Population Health Management Solutions, Fraud Analytics, Provider Management Services, Billing and Accounts Management Services, and Other Business Segments), Product and Services (Healthcare Provider Solutions, Healthcare Payer Solutions, and HCIT Outsourcing Services), Components (Services, Software, and Hardware), Delivery Mode (On-Premises and Cloud-Based), End-Users (Providers and Payers) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Veradigm LLC (U.S.), Epic Systems Corporation (U.S.), MCKESSON CORPORATION (U.S.), Carestream Health (U.S.), athenahealth, Inc. (U.S.), eClinicalWorks (U.S.), Greenway Health, LLC (U.S.), Infor (U.S.), Koninklijke Philips N.V. (Netherlands), Oracle (U.S.), Siilo (Netherlands), BigHealth (U.K.), Sword Health, Inc. (Portugal), Lantum (U.K.), BD (U.S.), and bioAxis (India) |

|

Market Opportunities |

|

Market Definition

Healthcare information technology (IT) refers to the use of technology in managing and delivering healthcare services. It encompasses electronic health records (EHR), telemedicine, medical devices, and health information systems. It improves efficiency, accuracy, and accessibility of healthcare data, facilitating better patient care, decision-making, and overall healthcare management.

Healthcare Information Technology (IT) Market Dynamics

Drivers

- Usage of Mobile Health (mHealth) Applications

Mobile health (mHealth) applications and wearable devices are increasingly prevalent, enabling health monitoring, medication adherence, and patient engagement. These tools empower individuals to actively manage their health, fostering proactive healthcare practices. Through providing convenient access to health-related information and services, mHealth contributes to improved wellness and better healthcare outcomes.

- Growing Trend of Telehealth and Remote Patient Monitoring

Telehealth and remote patient monitoring are increasingly utilized to improve patient care, cut healthcare expenses, and boost accessibility, particularly in remote or underserved regions. These technologies enable remote consultations and real-time monitoring, enhancing healthcare delivery while reducing the need for physical visits, thereby overcoming geographical barriers and improving healthcare outcomes efficiently, which are driving the market growth.

Opportunities

- Growing Patient-Centric Approaches

Patient-centric care models prioritize the individual's needs, preferences, and involvement in healthcare decisions. Leveraging IT solutions, such as mobile apps and telemedicine, enhances patient engagement, satisfaction, and outcomes by promoting personalized interactions, seamless communication, and access to health information. This shift fosters a collaborative and empowering healthcare experience tailored to each patient's unique requirements which is expected to create opportunities for market growth.

- Integration of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML algorithms are revolutionizing healthcare by optimizing diagnostic imaging, expediting drug discovery, and enabling predictive analytics. Their integration enhances clinical decision support, improving treatment outcomes, and streamlining healthcare processes. This transformative technology holds immense potential to revolutionize patient care, fostering a new era of precision medicine and operational efficiency in healthcare systems, which is expected to create opportunities for market growth.

Restraints/Challenges

- Regulatory Compliance

Healthcare IT systems face regulatory hurdles such as HIPAA in the U.S. and GDPR in the European Union, necessitating stringent compliance. Meeting these standards adds complexity and charge to IT implementations. Striking a balance between regulatory adherence and operational efficiency remains a challenge for healthcare organizations navigating the intricate landscape of data protection and privacy laws, which is expected to challenge market growth.

- High Cost of Implementation and Maintenance

The high initial investment and ongoing maintenance expenses of implementing and upgrading healthcare IT systems pose significant barriers, especially for smaller healthcare organizations. These costs can limit access to advanced technology solutions, hindering their ability to improve patient care and operational efficiency within constrained budgets, which is restraining the market growth.

This North America healthcare information technology (IT) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the North America healthcare information technology (IT) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In May 2023, LCH Health and Community Services opted for athenahealth's 'athenaOne' and 'athenaOne Dental,' integrating cloud-based EHR, medical billing, and patient engagement solutions. This selection targets enhanced provider-patient experiences, aligning with growth strategies and showcasing athenahealth's prowess in the healthcare IT market

- In April 2023 saw Philips launch its HealthSuite Imaging PACS on Amazon Web Services (AWS), driving generative AI applications in diagnostics and clinical workflows. This collaboration streamlines administrative tasks and boosts diagnostic capabilities, underscoring Philips' commitment to advancing healthcare through technology in the healthcare IT market

- In April 2023, eClinicalWorks incorporated ChatGPT and Azure OpenAI Service's machine learning models into its Practice Management and EHR solutions. Supported by a USD 100 million investment in Microsoft Azure cloud services, this move enriches eClinicalWorks' technology portfolio, leveraging Microsoft Cloud innovations to reinforce its presence in the healthcare IT market

- In 2022, Sharecare launched Smart Omix, facilitating real-world data collection and digital biomarker creation via mobile research studies. Smart Omix's functionalities are pivotal in enhancing relevance, equity, and data integrity in clinical research, marking a significant advancement in the healthcare IT market

Healthcare Information Technology (IT) Market Scope

The North America healthcare information technology (IT) market is segmented on the basis of business segment, product and services, components, delivery mode, and end-users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Business Segment

- Laboratory Information Systems (LIS)

- Picture Archiving and Communication System (PACS)

- Vendor Neutral Archive (VNA)

- Radiology Information Systems (RIS)

- Cardiovascular Information System (CVIS)

- Electronic Health Records (EHR)

- Telemedicine

- Clinical Decision Support System (CDSS)

- Claims Management Solutions

- Population Health Management Solutions

- Fraud Analytics

- Provider Management Services

- Billing and Accounts Management Services

- Other Business Segments

Product and Services

- Healthcare Provider Solutions

- Healthcare Payer Solutions

- HCIT Outsourcing Services

Components

- Software

- Hardware

- Services

Delivery Mode

- On-Premises

- Cloud-Based

End-Users

- Providers

- Payers

Healthcare Information Technology (IT) Market Regional Analysis/Insights

The North America healthcare information technology (IT) market is analysed and market size insights and trends are provided by country, business segment, product and services, components, delivery mode, and end-users as referenced above.

The countries covered in the North America healthcare information technology (IT) market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America healthcare information technology (IT) market, propelled by stringent legislative and accreditation requirements. Increasing adoption rates of HCIT technologies and regulatory emphasis on patient safety are poised to amplify market growth throughout the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The North America healthcare information technology (IT) market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for North America healthcare information technology (IT) market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the North America healthcare information technology (IT) market. The data is available for historic period 2016-2021.

Competitive Landscape and Healthcare Information Technology (IT) Market Share Analysis

The North America healthcare information technology (IT) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the North America healthcare information technology (IT) market.

Some of the major players operating in the North America healthcare information technology (IT) market are:

- Veradigm LLC (U.S.)

- Epic Systems Corporation (U.S.)

- MCKESSON CORPORATION (U.S.)

- Carestream Health (U.S.)

- athenahealth, Inc. (U.S.)

- eClinicalWorks (U.S.)

- Greenway Health, LLC (U.S.)

- Infor (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Oracle (U.S.)

- Siilo (Netherlands)

- BigHealth (U.K.)

- Sword Health, Inc. (Portugal)

- Lantum (U.K.)

- BD (U.S.)

- bioAxis (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.