North America Health And Wellness Food Market

Market Size in USD Million

CAGR :

%

USD

341.53 Million

USD

565.24 Million

2024

2032

USD

341.53 Million

USD

565.24 Million

2024

2032

| 2025 –2032 | |

| USD 341.53 Million | |

| USD 565.24 Million | |

|

|

|

|

North America Health and Wellness Food Market Size

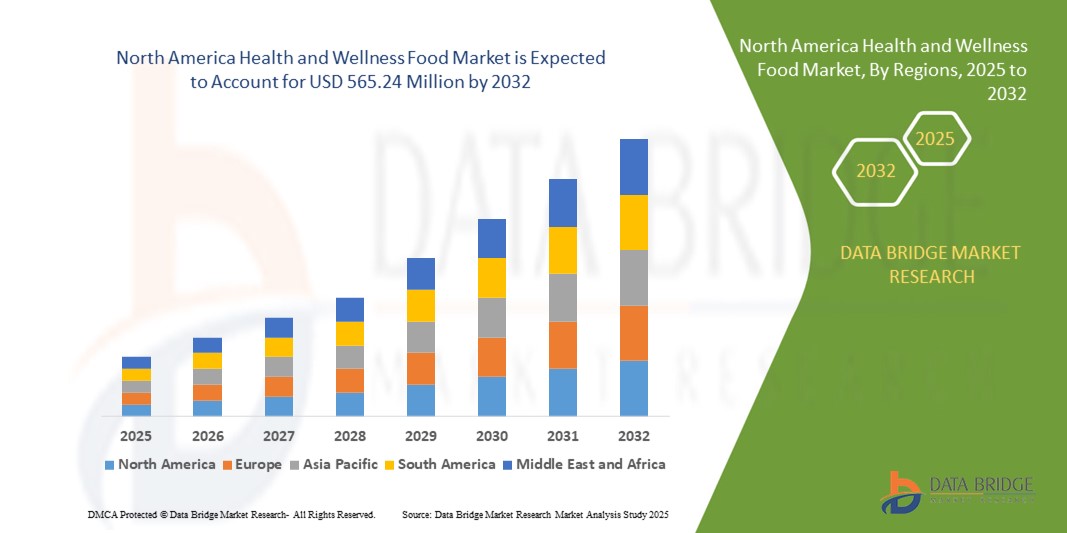

- The North America health and wellness food market size was valued at USD 341.53 million in 2024 and is expected to reach USD 565.24 million by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of healthy eating habits, rising demand for functional and nutrient-rich foods, and growing concerns about obesity and lifestyle-related diseases

- Growing adoption of plant-based diets, organic products, and allergen-free foods is further propelling the demand for health & wellness foods across both retail and e-commerce channels

North America Health and Wellness Food Market Analysis

- The health & wellness food market in North America is experiencing robust growth due to heightened consumer focus on preventive healthcare, fitness, and sustainable food choices

- Increasing demand from millennials and Gen Z for clean-label, organic, and functional foods is encouraging manufacturers to innovate with nutrient-dense and environmentally friendly products

- The U.S. dominates the North America health & wellness food market with the largest revenue share of 65.2% in 2024, driven by a well-established food industry, high consumer spending on health-focused products, and widespread availability of organic and functional foods

- Canada is expected to be the fastest-growing country in the North America health & wellness food market during the forecast period, fueled by rising health consciousness, increasing adoption of plant-based and organic diets, and supportive government initiatives promoting healthy eating

- The functional food segment dominated the largest market revenue share of 22.44% in 2024, driven by rising consumer demand for products offering health benefits beyond basic nutrition, such as probiotics, vitamins, and fiber-enriched foods

Report Scope and North America Health and Wellness Food Market Segmentation

|

Attributes |

North America Health and Wellness Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Health and Wellness Food Market Trends

Increasing Integration of AI and Big Data Analytics

- The North America Health & Wellness Food Market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, offering deeper insights into consumer preferences, purchasing behavior, and nutritional needs

- AI-powered solutions are being utilized to personalize product offerings, such as recommending tailored health foods based on individual dietary requirements or predicting demand for specific wellness products

- For instances, companies are leveraging AI-driven platforms to analyze consumer trends and optimize product development, such as formulating new functional foods or low-calorie snacks based on real-time market data

- This trend enhances the value proposition of health and wellness foods, making them more appealing to health-conscious consumers and retailers

- AI algorithms can analyze vast datasets, including consumer feedback, dietary patterns, and health outcomes, to improve product innovation and marketing strategies

North America Health and Wellness Food Market Dynamics

Driver

Rising Demand for Health-Conscious and Functional Food Products

- The growing consumer demand for health-focused food products, such as functional foods, organic options, and nutrient-enriched beverages, is a primary driver for the North America Health & Wellness Food Market

- Health and wellness foods enhance consumer well-being by offering benefits such as improved gut health, immunity support, and weight management through features such as probiotics, low-calorie content, and non-GMO ingredients

- Government initiatives and regulations, particularly in the U.S., promoting transparent food labeling and nutritional standards, are contributing to the widespread adoption of health and wellness foods

- The proliferation of e-commerce and advancements in supply chain technology are further enabling market expansion, providing faster and more accessible distribution channels for health-focused products

- Food manufacturers are increasingly offering health and wellness products as standard or premium options to meet consumer expectations and enhance market competitiveness, with the U.S. dominating due to high consumer awareness and disposable income

Restraint/Challenge

High Cost of Production and Regulatory Compliance Concerns

- The substantial costs associated with sourcing high-quality ingredients, such as organic or non-GMO materials, and developing health-focused products can be a significant barrier to market entry, particularly for smaller companies in North America

- Formulating and manufacturing specialized products, such as gluten-free or low-fat foods, often involves complex and costly processes

- In addition, regulatory compliance and food safety concerns pose major challenges. Health and wellness foods are subject to stringent regulations regarding labeling, health claims, and ingredient transparency, raising concerns about adherence to diverse standards across the U.S. and Canada

- The fragmented regulatory landscape across North American regions regarding food safety, allergen labeling, and nutritional claims complicates operations for manufacturers and retailers

- These factors can deter market expansion, particularly in Canada, the fastest-growing market, where cost sensitivity and regulatory awareness are increasing

North America Health and Wellness Food market Scope

The market is segmented on the basis of type, calorie content, nature, fat content, category, free-from category, and distribution channel.

- By Type

On the basis of type, the North America Health & Wellness Food Market is segmented into functional food, fortified & healthy bakery products, healthy snacks, BFY (better-for-you) foods, beverages, chocolates, and others. The functional food segment dominated the largest market revenue share of 22.44% in 2024, driven by rising consumer demand for products offering health benefits beyond basic nutrition, such as probiotics, vitamins, and fiber-enriched foods. These products cater to health-conscious consumers seeking immunity, digestive, and cognitive support.

The fortified & healthy bakery products segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is fueled by increasing consumer preference for nutrient-enriched baked goods, such as those fortified with fiber, vitamins, and minerals, as healthier alternatives to traditional bakery items. Innovations in clean-label and natural ingredient formulations further drive adoption.

- By Calorie Content

On the basis of calorie content, the North America Health & Wellness Food Market is segmented into no-calorie, low-calorie, and reduced-calorie. The low-calorie segment dominated with a 46.68% market share in 2024, driven by the growing number of health-conscious consumers seeking weight management solutions without compromising taste. Low-calorie products, such as snacks and beverages, are increasingly popular among millennials and Gen Z.

The no-calorie segment is anticipated to experience significant growth from 2025 to 2032, as consumers increasingly opt for zero-calorie options such as sparkling waters and sugar-free beverages to support weight control and overall wellness.

- By Nature

On the basis of nature, the North America Health & Wellness Food Market is segmented into non-GMO and GMO. The non-GMO segment held the largest market share of 81.34% in 2024, driven by rising consumer awareness of genetically modified organisms and preference for natural, minimally processed foods. Non-GMO products are perceived as safer and healthier, boosting their demand.

The GMO segment is expected to grow steadily from 2025 to 2032, as it enables manufacturers to maximize yield and reduce costs, appealing to price-sensitive consumers while maintaining nutritional benefits.

- By Fat Content

On the basis of fat content, the North America Health & Wellness Food Market is segmented into no-fat, low-fat, and reduced-fat. The no-fat segment dominated with a 37.94% market share in 2024, driven by increasing consumer preference for fat-free products to prevent chronic diseases such as obesity and cardiovascular issues.

The low-fat segment is anticipated to witness robust growth from 2025 to 2032, as consumers seek balanced dietary options that maintain flavor while reducing fat intake, supported by innovations in low-fat snacks and dairy products.

- By Category

On the basis of category, the North America Health & Wellness Food Market is segmented into conventional and organic. The conventional segment held the largest market share of 69.00% in 2024, due to its affordability, long shelf life, and widespread availability in supermarkets and convenience stores.

The organic segment is expected to grow at the fastest rate from 2025 to 2032, driven by rising consumer awareness of the health and environmental benefits of organic foods, free from synthetic pesticides and GMOs. This segment is particularly popular in Canada, where health-conscious trends are accelerating.

- By Free-From Category

On the basis of free-from category, the North America Health & Wellness Food Market is segmented into gluten-free, dairy-free, soy-free, nut-free, lactose-free, artificial flavor-free, artificial color-free, and others. The gluten-free segment held a significant market share in 2024, driven by increasing diagnoses of celiac disease and consumer preference for gluten-free products such as Oreos and snacks.

The dairy-free segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising lactose intolerance, veganism, and demand for plant-based alternatives such as oat milk and dairy-free yogurts, particularly in the U.S. and Canada.

- By Distribution Channel

On the basis of distribution channel, the North America Health & Wellness Food Market is segmented into store-based retailers and non-store retailers. Store-based retailers held the largest market share in 2024, driven by the expansion of supermarkets and hypermarkets offering a wide range of health and wellness products, particularly in the U.S.

The non-store retailers segment, including e-commerce platforms, is anticipated to grow at the fastest rate from 2025 to 2032. The convenience of online shopping, coupled with increasing consumer trust in digital platforms for purchasing organic and specialty foods, is driving this growth, especially in Canada.

North America Health and Wellness Food Market Regional Analysis

- The U.S. dominates the North America health & wellness food market with the largest revenue share of 65.2% in 2024, driven by a well-established food industry, high consumer spending on health-focused products, and widespread availability of organic and functional foods

- Growing awareness of dietary benefits, such as gluten-free and low-calorie options, drives market expansion

- The trend towards personalized nutrition and increasing regulations promoting transparent labeling further boost market growth. Retail giants and e-commerce platforms complement traditional sales, creating a diverse product ecosystem

Canada Health & Wellness Food Market Insight

Canada is expected to witness the fastest growth rate in the North America health & wellness food market, driven by rising consumer interest in health-conscious diets and sustainable food choices in urban and suburban settings. Increased demand for organic, non-GMO, and free-from products, such as gluten-free and dairy-free options, encourages adoption. Evolving food safety and labeling regulations influence consumer choices, balancing nutritional benefits with compliance.

North America Health and Wellness Food Market Share

The health and wellness food industry is primarily led by well-established companies, including:

- PepsiCo (U.S.)

- Nestlé (Switzerland)

- Danone S.A. (France)

- General Mills Inc. (U.S.)

- WK Kellogg Co (U.S.)

- Abbott (U.S.)

- Maspex (Poland)

- Hu Kitchen (U.S.)

- Chobani, LLC (U.S.)

- Yakult Honsha Co., Ltd. (Japan)

- Huel Inc. (U.K.)

- Stonyfield Farm, Inc. (U.S.)

- Kite Hill (U.S.)

- So Delicious Dairy Free (U.S.)

- Kashi LLC (U.S.)

- Forager Project (U.S.)

- Lake Champlain Chocolates (U.S.)

- Alter Eco (U.S.)

- LAVVA (U.S.)

What are the Recent Developments in North America Health and Wellness Food Market?

- In July 2025, Tropicale Foods issued a recall of 14 ice cream products under its Helados Mexico and La Michoacana brands due to undeclared milk allergens. Although the ingredient lists included “cream,” the common allergen “milk” was not properly declared, posing a serious risk to individuals with milk allergies. The recall followed an internal label audit and was prompted by at least one reported consumer illness. This incident highlights the critical importance of accurate labeling and rigorous quality control in the food industry, especially for products marketed to health-conscious and allergy-sensitive consumers

- In June 2025, Cal-Maine Foods, the largest U.S. producer of shell eggs, acquired Echo Lake Foods—a Wisconsin-based supplier of frozen pre-cooked egg products and breakfast. After factoring in a USD 28 million tax benefit, the effective purchase price was USD 230 million. This strategic acquisition enables Cal-Maine to expand into the value-added breakfast segment, offering ready-to-eat products such as waffles, omelets, and egg patties. It reflects the company’s broader goal to diversify its portfolio, strengthen customer relationships, and meet rising consumer demand for convenient and nutritious breakfast options across North America

- In April 2025, the American Heart Association, in partnership with Deloitte and Research!America, released a comprehensive report titled “U.S. Health & The Future of Food.” This initiative aims to address the urgent need for sustainable food and healthcare systems that provide nutritious, affordable, and accessible foods to all communities. The report emphasizes the growing collaboration between health organizations and industry leaders to tackle chronic diseases, improve nutrition security, and promote public health. It calls for integrated solutions that link food systems with healthcare to ensure long-term well-being and equity across the U.S

- In March 2025, Nestlé USA issued a voluntary recall of select Lean Cuisine® and Stouffer’s® frozen meals due to the potential presence of wood-such as material in the products. The affected items, produced between August 2024 and March 2025, include specific batches of ravioli, shrimp stir fry, and chicken lasagna. The recall followed consumer complaints, including one reported choking incident. Nestlé emphasized that this was an isolated issue and is working with the FDA and USDA to investigate and ensure product safety. This event highlights the ongoing need for rigorous quality control to maintain consumer trust and regulatory compliance

- In February 2025, Flowers Foods & Subsidiaries, one of the largest producers of packaged baked goods in the U.S., completed its USD 795 million acquisition of Simple Mills, a leading natural foods brand known for its clean-label crackers, cookies, and baking mixes. This strategic move expands Flowers’ portfolio into the better-for-you snacking segment, aligning with growing consumer demand for health-conscious and natural products. Simple Mills will continue to operate independently under its founder and CEO, Katlin Smith, while benefiting from Flowers’ scale and distribution. The acquisition underscores a broader industry trend of legacy food companies investing in wellness-driven brands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Health And Wellness Food Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Health And Wellness Food Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Health And Wellness Food Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.