Market Analysis and Size

For gamers who spend an average of six hours per day gaming, gaming chairs are essential. These chairs are available in a wide range of sizes, colours, and styles. For gamers who spend an average of six hours per day gaming, gaming chairs are essential.

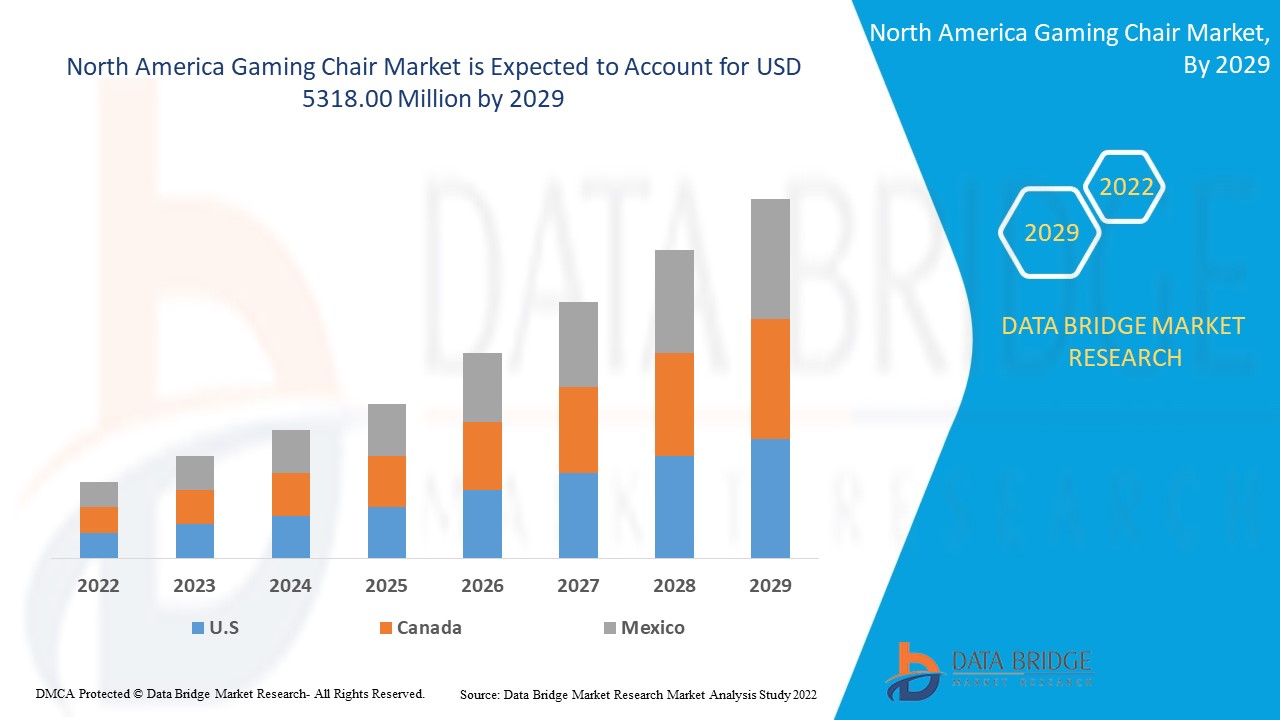

Data Bridge Market Research analyses that the gaming chair market is expected to grow at a CAGR of 14.80% and at a USD 1315.04 million in 2021 and is further estimated to reach USD 5318.00 million by 2029 during the forecast period. PC gaming chair segment is expected to dominate in type segment because these chairs are suitable for PC gaming which is the highest adopted in gaming devices. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

A gaming chair is built specifically for video game enthusiasts. These seats have a head cushion and lumbar support to keep the gamer comfortable while they play. Professional and hard core gamers require a gaming chair. These chairs are available in a wide range of sizes, colours, and styles. For gamers who spend an average of six hours per day gaming, gaming chairs are essential.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (PC Gaming Chair, Racer Chair, Hybrid Gaming Chair, Recliner Gaming Chair, Rocker Gaming Chair, Pedestal Gaming Chair, Beanbag Gaming Chair, Platform Gaming Chair, Others), Electronics Attachment (Without Electronics Attachment, With Electronics Attachment), Wheel Type (With Wheel, Without Wheel), Material (PU Leather, PVC Leather, Others), Weight (Less than 60 Lbs, 60 to 70 Lbs, More than 70 Lbs), Price (Mid Range (151-300 USD), High Range (Above 301 USD), Low Range (Below 150 USD)), End User (Residential, Commercial) |

|

Countries Covered |

U.S., Canada, and Mexico in North America |

|

Market Players Covered |

Ace Casual Furniture (US), CORSAIR (US), GT OMEGA (UK), DXRacer USA LLC (US), ThunderX3 (US), Arozzi North America (US), Secretlab (Singapore), Cooler Master Technology inc. (Taiwan), Herman Miller, Inc. (US), Clutch Chairz US. (Canada), noblechairs (Berlin), Raidmax (US), GENESIS (US), NEEDforSEAT (US), Brazen Gaming Chairs (UK), Karnox (China), Vertagear Inc (US), NITRO CONCEPTS (UK), Playseat (Netherlands) and AKRacing (US). |

|

Market Opportunities |

|

North America Gaming Chair Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

Major factors that are expected to boost the growth of the gaming chair market in the forecast period are as follows:

Drivers

- Technological development

The rising popularity of social media and free business models, which has resulted in the development of e-games, is expected to boost demand for gaming chair market.

- Obtainability of high-speed internet connectivity

Availability of high-speed internet connectivity which leads to growing adoption of online PC gaming is further anticipated to propel the growth of the gaming chair market.

- Introduction of new games

The gaming industry has evolved from board games to high-end video games, resulting in game commercialisation which will further accelerate the growth of the market.

Opportunities

Furthermore, the growing number of game cafes is further estimated to provide potential opportunities for the growth of the gaming chair market in the coming years.

Restraints/Challenges North America Gaming Chair Market

On the other hand, the increase in the cost of gaming chairs is further projected to impede the growth of the gaming chair market in the targeted period. However, the growing concerns of people related to the health and fitness are encourages them to move to outdoor games might further challenge the growth of the gaming chair market in the near future.

This gaming chair market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the gaming chair market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Gaming Chair Market

The pandemic of COVID-19 has had a huge impact on the gaming chair market. With the growing WFH trend, clients are looking for ways to turn their homes into ideal workplaces, and the chair they sit in every day becomes increasingly crucial. Video gaming equipment is in particularly high demand due to the epidemic. However, in the post-COVID scenario, gaming chair Market is projected to be significantly impacted due to the growing demand for gaming chair due to the rise in the popularity of social media.

Recent Developments

- In February 2020, Herman Miller announced partnership with Logitech for designing and manufacturing of high-performance furniture solutions for gamers. The strategic partnership is combination of Herman Miller’s science of seating with the Logitech G’s science of play.

- In November 2019, CORSAIR launched T3 RUSH which is a premium gaming chair, which offers solid steel frame, adjustable 4D armrests and seat back, breathable soft fabric exterior and three different colour options.

North America Gaming Chair Market Scope and Market Size

The gaming chair market is segmented on the basis of type, electronics attachment, wheel type, material, weight, price and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- PC Gaming Chair

- Racer Chair

- Hybrid Gaming Chair

- Recliner Gaming Chair

- Rocker Gaming Chair

- Pedestal Gaming Chair

- Beanbag Gaming Chair

- Platform Gaming Chair

- Others

Electronics Attachment

- Without Electronics Attachment

- With Electronics Attachment

Wheel Type

- With Wheel

- Without Wheel

Material

- PU Leather

- PVC Leather

- Others

Weight

- Less than 60 Lbs

- 60 to 70 Lbs

- More than 70 Lbs

Price

- Mid Range (151-300 USD)

- High Range (Above 301 USD)

- Low Range (Below 150 USD)

End User

- Residential

- Commercial

North America Gaming Chair Market Regional Analysis/Insights

The gaming chair market is analysed and market size insights and trends are provided by country, type, electronics attachment, wheel type, material, weight, price and end user. as referenced above.

The countries covered in the gaming chair market report are U.S., Canada, and Mexico in North America.

The U.S. dominates the North America gaming chair market as country has global leader companies in the segment and has high buying capacity of such products for gaming.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Gaming Chair Market

The gaming chair market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to gaming chair market.

Some of the major players operating in the gaming chair market are

- Ace Casual Furniture (US)

- CORSAIR (US)

- GT OMEGA (UK)

- DXRacer USA LLC (US)

- ThunderX3 (US)

- Arozzi North America (US)

- Secretlab (Singapore)

- Cooler Master Technology inc. (Taiwan)

- Herman Miller, Inc. (US)

- Clutch Chairz US. (Canada)

- noblechairs (Berlin)

- Raidmax (US)

- GENESIS (US)

- NEEDforSEAT (US)

- Brazen Gaming Chairs (UK)

- Karnox (China)

- Vertagear Inc (US)

- NITRO CONCEPTS (UK)

- Playseat (Netherlands)

- AKRacing (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA GAMING CHAIR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING GROWTH OF VIDEO GAMES

5.1.2 INCREASING PENETRATION OF INTERNET SERVICES AND GROWTH OF SMARTPHONES

5.1.3 RISING POPULARITY OF E-SPORTS

5.1.4 DEVELOPMENT AND MANUFACTURING OF ERGONOMIC CHAIRS

5.1.5 INCREASING DEMAND FOR HIGH-END PERSONAL COMPUTERS

5.2 RESTRAINTS

5.2.1 HIGH COST OF GAMING CHAIRS

5.2.2 LIMITATIONS RELATED TO LEATHER COVERINGS

5.3 OPPORTUNITIES

5.3.1 INCREASING GROWTH IN VR GAMING

5.3.2 INCREASING ADOPTION OF GAMING BY TEENAGERS

5.3.3 INCREASING CONCERNS OF PEOPLE REGARDING HEALTH ISSUES

5.3.4 INCREASING NUMBER OF GAMING CENTERS

5.4 CHALLENGES

5.4.1 LIMITED SPENDING CAPACITY OF CONSUMERS

5.4.2 LESS PENETRATION IN UNDERDEVELOPED AND DEVELOPING COUNTRIES

6 COVID-19 IMPACT ON GAMING CHAIR IN SE-ICT INDUSTRY

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA GAMING CHAIR MARKET, BY TYPE

7.1 OVERVIEW

7.2 PC GAMING CHAIR

7.3 RACER CHAIR

7.4 HYBRID GAMING CHAIR

7.5 RECLINER GAMING CHAIR

7.6 ROCKER GAMING CHAIR

7.7 PEDESTAL GAMING CHAIR

7.8 BEANBAG GAMING CHAIR

7.9 PLATFORM GAMING CHAIR

7.1 OTHERS

8 NORTH AMERICA GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT

8.1 OVERVIEW

8.2 WITHOUT ELECTRONICS ATTACHMENT

8.3 WITH ELECTRONICS ATTACHMENT

8.3.1 SPEAKERS

8.3.1 VIBRATION

8.3.2 RGB LIGHTING

8.3.3 OTHERS

9 NORTH AMERICA GAMING CHAIR MARKET, BY WHEEL TYPE

9.1 OVERVIEW

9.2 WITH WHEEL

9.3 WITHOUT WHEEL

10 NORTH AMERICA GAMING CHAIR MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PU LEATHER

10.3 PVC LEATHER

10.4 OTHERS

11 NORTH AMERICA GAMING CHAIR MARKET, BY WEIGHT

11.1 OVERVIEW

11.2 LESS THAN 60 LBS.

11.3 TO 70 LBS.

11.4 MORE THAN 70 LBS.

12 NORTH AMERICA GAMING CHAIR MARKET, BY PRICE

12.1 OVERVIEW

12.2 MID RANGE (151-300 USD)

12.3 HIGH RANGE (ABOVE 301 USD)

12.4 LOW RANGE (BELOW 150 USD)

13 NORTH AMERICA GAMING CHAIR MARKET, BY END USER

13.1 OVERVIEW

13.2 RESIDENTIAL

13.2.1 BY PRICE

13.2.1.1 MID RANGE (151-300 USD)

13.2.1.2 HIGH RANGE (ABOVE 301 USD)

13.2.1.3 LOW RANGE (BELOW 150 USD)

13.3 COMMERCIAL

13.3.1 BY PRICE

13.3.1.1 MID RANGE (151-300 USD)

13.3.1.2 HIGH RANGE (ABOVE 301 USD)

13.3.1.3 LOW RANGE (BELOW 150 USD)

14 NORTH AMERICA GAMING CHAIR MARKET, BY GEOGRAPHY

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA GAMING CHAIR MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT

17 COMPANY PROFILES

17.1 CORSAIR

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 SECRETLAB

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 CLUTCH CHAIRZ US.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 NOBLECHAIRS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 BRAZEN GAMING CHAIRS

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 AROZZI NORTH AMERICA

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 HERMAN MILLER, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 COMPANY SHARE ANALYSIS

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 PLAYSEAT

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 AKRACING

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 VERTAGEAR

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 DXRACER USA LLC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 ACE CASUAL FURNITURE

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 COOLER MASTER TECHNOLOGY INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 GENESIS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 GT OMEGA

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 KARNOX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NEEDFORSEAT USA

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 NITRO CONCEPTS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 RAIDMAX

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 THUNDERX3

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 NORTH AMERICA GAMING CHAIR MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 2 NORTH AMERICA PC GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 3 NORTH AMERICA RACER CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 4 NORTH AMERICA HYBRID GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 5 NORTH AMERICA RECLINER GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 6 NORTH AMERICA ROCKER GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 7 NORTH AMERICA PEDESTAL GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 8 NORTH AMERICA BEANBAG GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 9 NORTH AMERICA PLATFORM GAMING CHAIR IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 11 NORTH AMERICA GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 12 NORTH AMERICA WITHOUT ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 13 NORTH AMERICA WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 14 NORTH AMERICA WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT,2018-2027, (USD THOUSAND)

TABLE 15 NORTH AMERICA GAMING CHAIR MARKET, BY WHEEL TYPE, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 16 NORTH AMERICA WITH WHEEL IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 17 NORTH AMERICA WITHOUT WHEEL IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 18 NORTH AMERICA GAMING CHAIR MARKET, BY MATERIAL, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 19 NORTH AMERICA PU LEATHER IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 20 NORTH AMERICA PVC LEATHER IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 21 NORTH AMERICA OTHERS IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 22 NORTH AMERICA GAMING CHAIR MARKET, BY WEIGHT, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 23 NORTH AMERICA LESS THAN 60 LBS. IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 24 NORTH AMERICA 60 TO 70 LBS. IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 25 NORTH AMERICA MORE THAN 70 LBS. IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 26 NORTH AMERICA GAMING CHAIR MARKET, BY PRICE, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 27 NORTH AMERICA MID RANGE (151-300 USD) IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 28 NORTH AMERICA HIGH RANGE (ABOVE 301 USD) IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 29 NORTH AMERICA LOW RANGE (BELOW 150 USD) IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 30 NORTH AMERICA GAMING CHAIR MARKET, BY END USER, MARKET FORECAST 2020-2027 (USD THOUSAND)

TABLE 31 NORTH AMERICA RESIDENTIAL IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 32 NORTH AMERICA WITH RESIDENTIAL IN GAMING CHAIR MARKET, BY PRICE,2018-2027, (USD THOUSAND)

TABLE 33 NORTH AMERICA COMMERCIAL IN GAMING CHAIR MARKET, BY REGION,2018-2027, (USD THOUSAND)

TABLE 34 NORTH AMERICA WITH COMMERCIAL IN GAMING CHAIR MARKET, BY PRICE,2018-2027, (USD THOUSAND)

TABLE 35 NORTH AMERICA GAMING CHAIR MARKET, BY COUNTRY, 2018-2027 (USD THOUSAND)

TABLE 36 NORTH AMERICA GAMING CHAIR MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 37 NORTH AMERICA GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 38 NORTH AMERICA WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 39 NORTH AMERICA GAMING CHAIR MARKET, BY WHEEL TYPE, 2018-2027 (USD THOUSAND)

TABLE 40 NORTH AMERICA GAMING CHAIR MARKET, BY MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 41 NORTH AMERICA GAMING CHAIR MARKET, BY WEIGHT, 2018-2027 (USD THOUSAND)

TABLE 42 NORTH AMERICA GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 43 NORTH AMERICA GAMING CHAIR MARKET, BY END USER, 2018-2027 (USD THOUSAND)

TABLE 44 NORTH AMERICA RESIDENTIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 45 NORTH AMERICA COMMERCIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 46 U.S. GAMING CHAIR MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 47 U.S. GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 48 U.S. WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 49 U.S. GAMING CHAIR MARKET, BY WHEEL TYPE, 2018-2027 (USD THOUSAND)

TABLE 50 U.S. GAMING CHAIR MARKET, BY MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 51 U.S. GAMING CHAIR MARKET, BY WEIGHT, 2018-2027 (USD THOUSAND)

TABLE 52 U.S. GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 53 U.S. GAMING CHAIR MARKET, BY END USER, 2018-2027 (USD THOUSAND)

TABLE 54 U.S. RESIDENTIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 55 U.S. COMMERCIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 56 CANADA GAMING CHAIR MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 57 CANADA GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 58 CANADA WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 59 CANADA GAMING CHAIR MARKET, BY WHEEL TYPE, 2018-2027 (USD THOUSAND)

TABLE 60 CANADA GAMING CHAIR MARKET, BY MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 61 CANADA GAMING CHAIR MARKET, BY WEIGHT, 2018-2027 (USD THOUSAND)

TABLE 62 CANADA GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 63 CANADA GAMING CHAIR MARKET, BY END USER, 2018-2027 (USD THOUSAND)

TABLE 64 CANADA RESIDENTIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 65 CANADA COMMERCIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 66 MEXICO GAMING CHAIR MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 67 MEXICO GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 68 MEXICO WITH ELECTRONICS ATTACHMENT IN GAMING CHAIR MARKET, BY ELECTRONICS ATTACHMENT, 2018-2027 (USD THOUSAND)

TABLE 69 MEXICO GAMING CHAIR MARKET, BY WHEEL TYPE, 2018-2027 (USD THOUSAND)

TABLE 70 MEXICO GAMING CHAIR MARKET, BY MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 71 MEXICO GAMING CHAIR MARKET, BY WEIGHT, 2018-2027 (USD THOUSAND)

TABLE 72 MEXICO GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 73 MEXICO GAMING CHAIR MARKET, BY END USER, 2018-2027 (USD THOUSAND)

TABLE 74 MEXICO RESIDENTIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

TABLE 75 MEXICO COMMERCIAL IN GAMING CHAIR MARKET, BY PRICE, 2018-2027 (USD THOUSAND)

List of Figure

LIST OF FIGURES

FIGURE 1 NORTH AMERICA GAMING CHAIR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GAMING CHAIR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GAMING CHAIR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GAMING CHAIR MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GAMING CHAIR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GAMING CHAIR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GAMING CHAIR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA GAMING CHAIR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GAMING CHAIR MARKET: SEGMENTATION

FIGURE 10 INCREASING GROWTH OF VIDEO GAMES IS EXPECTED TO DRIVE THE NORTH AMERICA GAMING CHAIR MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 PC GAMING CHAIR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA GAMING CHAIR MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA GAMING CHAIR MARKET

FIGURE 13 NORTH AMERICA GAMING CHAIR MARKET: BY TYPE, 2019

FIGURE 14 NORTH AMERICA GAMING CHAIR MARKET: BY ELECTRONICS ATTACHMENT, 2019

FIGURE 15 NORTH AMERICA GAMING CHAIR MARKET: BY WHEEL TYPE, 2019

FIGURE 16 NORTH AMERICA GAMING CHAIR MARKET: BY MATERIAL, 2019

FIGURE 17 NORTH AMERICA GAMING CHAIR MARKET: BY WEIGHT, 2019

FIGURE 18 NORTH AMERICA GAMING CHAIR MARKET: BY PRICE, 2019

FIGURE 19 NORTH AMERICA GAMING CHAIR MARKET: BY END USER, 2019

FIGURE 20 NORTH AMERICA GAMING CHAIR MARKET: SNAPSHOT (2019)

FIGURE 21 NORTH AMERICA GAMING CHAIR MARKET: BY COUNTRY (2019)

FIGURE 22 NORTH AMERICA GAMING CHAIR MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 NORTH AMERICA GAMING CHAIR MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 NORTH AMERICA GAMING CHAIR MARKET: BY TYPE (2020-2027)

FIGURE 25 NORTH AMERICA GAMING CHAIR MARKET: COMPANY SHARE 2019 (%)

North America Gaming Chair Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Gaming Chair Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Gaming Chair Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.