North America Frozen Ready Meals Market Analysis and Insights.

North America frozen ready meals market is growing faster, owing to the busy lifestyles of consumers. The growing number of individuals altering their eating habits and embracing a balanced nutritional diet and active lifestyle is a major element driving the growth of the frozen-ready meals industry. People worldwide have hectic lifestyles and thus prefer ready meals to save energy and time, which benefits the market's growth. However, high prices of frozen ready meals may hamper the market's growth.

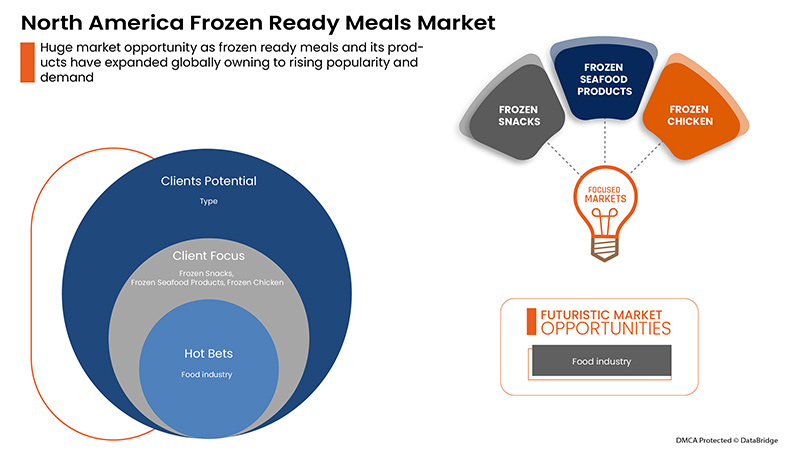

The rising consumption of frozen chicken, beef, and seafood will open new opportunities for the global market. In contrast, competition among market players may challenge the market's growth.

Various companies are making strategic decisions, such as launching innovative frozen-ready meal foods and acquiring other companies to improve their market share. As a result, the global frozen-ready meals market is growing rapidly.

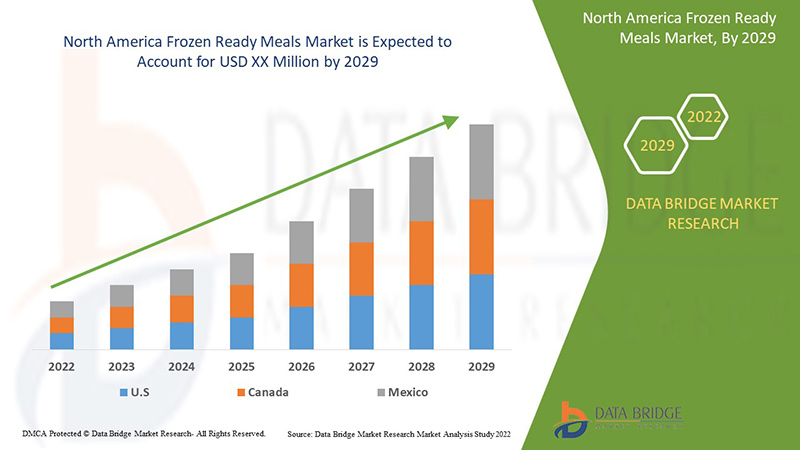

Data Bridge Market Research analyses that the North America frozen ready meals market will grow at a CAGR of 5.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Frozen Rice Mixes, Frozen Quinoa Food Mixes, Frozen Pizza, Frozen Pasta, Frozen Wraps & Rolls, Frozen Snacks, Frozen Ice Cream, Frozen Yogurt, Frozen Cakes, Frozen Sorbet And Sherbet, Frozen Custard, Frozen Drinks, Frozen Savory Products And Frozen Soup, Frozen Dairy Products, Frozen Chicken Products, Frozen Seafood Products, And Others), Category(Organic And Conventional) Technology (Flash-Freezing/ Individual Quick Freezing (IQF), Belt Freezing, High Pressure-Assisted Freezing, And Others), End User (Food Service Sector And Households), Packaging Technique (Freezing Technique And Equipment And Freezing Ready Meals Packaging And Distribution Channel (Store-Based And Non-Store Retailers) |

|

Countries Covered |

U.S. Canada and Mexico |

|

Market Players Covered |

McCain Foods Limited, Kraft Foods, Kellogg's Company, Tyson Foods, Inc., Nomad Foods, Grupo Virto, Ajinomoto Co., Inc., Gulf West Company, Sidco Foods Trading L.L.C., Al Kabeer Group ME, JBS Foods, Mosaic Foods, AdvancePierre, Wawona, Nestlé, General Mills Inc., Conagra Brands, Inc., Amy's Kitchen, Inc., Safco International Gen. Trading Co. L.L.C., Hakan Agro DMCC, Dr. Oetker |

Market Definition

Frozen-ready meals are usually cooked and packaged in a factory. This process includes heating the ingredients and packaging them into containers. Once the meal is prepared and placed in a freezer to cool down, they are popular among consumers because they provide a diverse menu and are convenient to prepare. Frozen meals may contain a meat entree, a vegetable, and starch-based food such as pasta and sauce. Some frozen meals are prepared specifically for vegetarians or individuals with certain dietary needs. The manufacture of such a product requires careful attention from the food processor.

North America Frozen Ready Meals Market Dynamics

Drivers

- Rising preference for ready-to-eat organic foods

Ready-to-eat food has evolved as one of the most diversified sections of the global ready-meal business in recent years. A growth in convenience patterns and an increase in demand for organic meals have led to a growing need for organic frozen packaged meals. The organic frozen food and beverage sector is another stop for on-the-go consumers, offering anything from frozen sweets to appetizers and meals. Organic frozen ready meals are popular among consumers due to their lack of microbiological and fungal contamination. Also, the nutritional and health benefits offered by organic frozen ready meals have led to the growth in market demand. So to appeal to a larger consumer seeking health and flavor, frozen packaged food makers are also integrating nutritious benefits with taste leading to the growth of the global frozen ready meals market. Changing consumer preferences for plant-based, vegan products are paving the way for organic, convenient food products, resulting in increased demand for frozen ready meals in the global market.

For instance,

- In December 2021, Organic Prairie's new organic ground beef comes pre-seasoned with all-organic seasonings, reducing prep time for some of America's favorite home-cooked dishes. Home cooks now have an option of high-quality protein that is quick and easy to prepare, thanks to the introduction of new organic, seasoned ground beef. Customers can 'grab and go,' and the meat is thoroughly cooked in about 8 minutes

- Change in lifestyle and eating patterns of consumers

In the fast-paced on-the-go world, half of the population prefers convenience food which aids the consumers in saving time and effort in meal preparation. Owing to fast and busy life, the consumption pattern of consumers shifts from raw food to convenience foods. Also, the rapid urbanization and the changing lifestyle of the people are increasing the demand for frozen ready meals. Due to the constant evolution in the consumption pattern of consumers, convenient food has grown substantially globally because of the expanding consumer health consciousness and increasing urban lifestyles. Along with that, consumers are moving towards a fast-moving corporate setup that diversifies their eating patterns due to less time availability and more workload. Frozen-ready meals are easy to cook, readily available, affordable, and accessible, making them a smart solution to cater to the daily nutritional need of the consumers. Growing consumer health and wellness awareness is hastening the adoption of a healthy lifestyle, increasing acceptance of positive lifestyles, and consuming healthy frozen food, which has preserved nutrients, is moving the frozen ready meals market forward.

Opportunities

-

An increasing number of initiatives taken by frozen ready meals manufacturers

An increase in the number of initiatives taken by the manufacturers for frozen ready meals, such as product launches, expansion, raised funding, and others, will create a great opportunity for the growth of the global frozen ready meals market. The demand for frozen ready meals is increasing among consumers owing to the hectic schedule, increasing disposable income, and growing demand for ready-to-eat food products to save time for cooking. Consumers' increasing demand for frozen ready meals enables manufacturers to launch new products in the market, expand their manufacturing facility and raise investments to manufacture different frozen ready meals products for varied end-users.

For instance,

- In November 2021, Mosaic Foods raised USD 6 Million in funding in a seed round led by Gather Ventures. They planned to expand their direct-to-consumer business, develop new products, and expand into offline channels with the help of funding

Restraints/Challenges

- Limited self-life of frozen food

Food processing and freezing techniques limit the self of frozen food products. Freezing foods avoids deterioration and maintains flavor. However, it also gives a limited shelf life to certain frozen food products. Foods that have outlived their freezer shelf life are normally not safe, as when defrosted, they lack flavor, nutrients, or both or have an odd texture. That is why, Packaged frozen items, such as meat, vegetables, or completely cooked entrees, typically have an expiration date. Because the items have beyond their sell-by date, they can no longer be lawfully offered for sale.

The restricted shelf-life of a frozen food product is determined by the quality of the raw ingredients, the pace of freezing, the storage temperature and regular maintenance, and the retailer and consumer's treatment of the product. Microbiological testing has limited applicability. However, chemical tests can provide a direct measure of limited shelf-life.

Post-COVID-19 Impact on North America Frozen Ready Meals Market

The COVID-19 epidemic has had a significant impact on consumer behavior. Consumers are hoarding shelf-stable foods, such as frozen ready meals. Stockpiling has caused a dramatic increase in the market value of the frozen snacks and meals market worldwide in 2020, which will normalize with an outbreak-free condition because of the longer shelf life and easy storage of frozen meals.

Recent Developments

- In November 2020, Gerber Products Co., a Nestle SA subsidiary, launched Freshful Start bowls and nibbles in the frozen category. The USDA-certified organic, clean label items, made with whole grains and veggies, are ideal for toddlers 12 months and up and are ready to reheat and serve in minutes

North America Frozen Ready Meals Market Scope

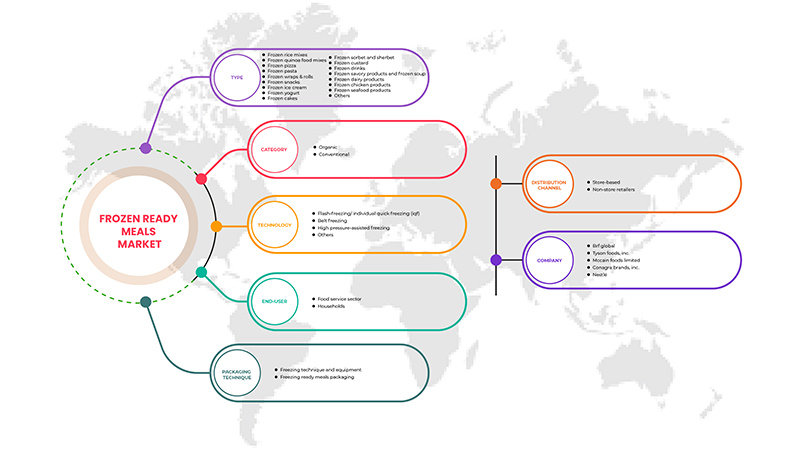

North America frozen ready meals market is segmented into six notable segments based on type, category, technology, end user, Packaging technique, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Frozen Snacks

- Frozen Pizza

- Frozen Ice Cream

- Frozen Seafood Products

- Frozen Chicken Products

- Frozen Yoghurt

- Frozen Dairy Products

- Frozen Pasta

- Frozen Drinks

- Frozen Vegetarian Meals

- Frozen Sorbet and Sherbet

- Frozen Cakes

- Frozen Wraps & Rolls

- Frozen Custard

- Frozen Soup

- Frozen Quinoa Food Mixes

- Frozen Rice Mixes

- Others

On the basis of type, the North America frozen ready meals market is segmented into frozen rice mixes, frozen quinoa food mixes, frozen pizza, frozen pasta, frozen wraps & rolls, frozen snacks, frozen ice cream, frozen yogurt, frozen cakes, frozen sorbet and sherbet, frozen custard, frozen drinks, frozen savory products and frozen soup, frozen dairy products, frozen chicken products, frozen seafood products, and others.

Category

- Conventional

- Organic

On the basis of category, the North America frozen ready meals market is segmented into organic and conventional

Technology

- Flash-Freezing/ Individual Quick Freezing (IQF)

- Belt Freezing

- High Pressure-Assisted Freezing

- Others

On the basis of technology, the North America frozen ready meals market is segmented into flash-freezing/ individual quick freezing (IQF), belt freezing, high pressure-assisted freezing, and others.

End User

- Food Service Sector

- Household/Retail Sector

Based on end user, the North America frozen ready meals market is segmented into food service and household/retail sectors.

Packaging Technique

- freezing technique and equipment

- freezing ready meals packaging

On the basis of packaging technique, the North America frozen ready meals market is segmented into freezing technique and equipment and freezing ready meals packaging

Distribution Channel

- Store Based Retailers

- Non-Store Based Retailers

Based on the distribution channel, the North America frozen ready meals market is segmented into the store- and non-store-based retailers.

North America Frozen Ready Meals Market Regional Analysis/Insights

North America frozen ready meals market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the North America frozen ready meals market report are U.S., Mexico, and Canada.

U.S. is expected to dominate the North America frozen ready meals market in terms of market share and market revenue. It is estimated to maintain its dominance during the forecast period due to the increasing demand from food service and hospitality industries within North America.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands, their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Frozen Ready Meals Market Share Analysis

The competitive North America frozen ready meals market provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points are only related to the companies' focus on the North America frozen ready meals market.

Some of the major players operating in the North America frozen ready meals market are McCain Foods Limited, Kraft Foods, Kellogg's Company, Tyson Foods, Inc., Nomad Foods, Grupo Virto, Ajinomoto Co., Inc., Gulf West Company, Sidco Foods Trading L.L.C., Al Kabeer Group ME, JBS Foods, Mosaic Foods, AdvancePierre, Wawona, Nestlé, General Mills Inc., Conagra Brands, Inc., Amy's Kitchen, Inc., Safco International Gen. Trading Co. L.L.C., Hakan Agro DMCC, Dr. Oetker among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FROZEN READY MEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER TYPE AND THEIR BUYING PERCEPTIONS

4.3.1 OVERVIEW

4.3.2 MILLENNIALS

4.3.3 GEN X

4.3.4 BABY BOOMERS

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 PRICING OF FROZEN READY MEALS PRODUCTS

4.4.2 CERTIFIED FROZEN READY MEALS PRODUCTS

4.4.3 QUALITY OF READY MEAL PRODUCTS

4.5 PRICING ANALYSIS FOR FROZEN READY MEALS MARKET

4.6 EXPORT & IMPORT ANALYSIS

4.7 LABELING AND CLAIMS

4.7.1 UNITED NATIONS ENVIRONMENT PROGRAMME SALE OF FROZEN FOODS REGULATIONS

4.7.2 DIRECTIVE 89/108/EEC ON QUICK-FROZEN FOODSTUFFS FOR HUMAN CONSUMPTION

4.7.3 FOOD CLAIMS ON LABELS – THE EUROPEAN PERSPECTIVE

4.8 LIST OF TOP EXPORTING COMPANIES OF NORTH AMERICA FROZEN READY MEALS MARKET

4.9 LIST OF TOP IMPORTING COMPANIES FOR FROZEN READY MEALS MARKET

4.1 MARKET TRENDS

4.11 NEW PRODUCT LAUNCH STRATEGY

4.11.1 OVERVIEW

4.11.2 NUMBER OF PRODUCT LAUNCHES

4.11.2.1 LINE EXTENSION

4.11.2.2 NEW PACKAGING

4.11.2.3 RELAUNCHED

4.11.2.4 NEW FORMULATION

4.11.3 DIFFERENTIAL PRODUCT OFFERING

4.11.4 MEETING CONSUMER REQUIREMENT

4.11.5 PACKAGE DESIGNING

4.11.6 PRICING ANALYSIS

4.11.7 PRODUCT POSITIONING

4.11.8 CONCLUSION

4.12 BRAND LABEL

4.13 PROMOTIONAL ACTIVITIES

4.14 SHOPPING BEHAVIOUR AND DYNAMICS

4.14.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.14.2 RESEARCH

4.14.3 IMPULSIVE

4.14.4 ADVERTISEMENT

4.14.5 TELEVISION ADVERTISEMENT

4.14.6 ONLINE ADVERTISEMENT

4.14.7 IN-STORE ADVERTISEMENT

4.14.8 OUTDOOR ADVERTISEMENT

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING PROCESS

4.15.3 INDIVIDUAL QUICK FREEZER

4.15.4 INSPECTION OF FROZEN FOOD

4.15.5 PACKING OF FROZEN FOOD

4.15.6 AUTOMATIC PACKAGING UNIT

4.15.7 MARKETING AND DISTRIBUTION

4.15.8 END-USERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY

6.1.2 RISING PREFERENCE FOR READY-TO-EAT ORGANIC FOODS

6.1.3 EXPANSIONS OF CONVENIENCE STORES

6.1.4 CHANGE IN LIFESTYLE AND EATING PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 PRESENCE OF FATS IN FROZEN READY MEALS

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.2.3 LIMITED SELF-LIFE OF FROZEN FOOD

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN READY MEALS MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING PREFERENCE FOR FRESH AND NATURAL FOOD PRODUCTS

7 NORTH AMERICA FROZEN READY MEALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN SNACKS

7.2.1 FRENCH FRIES

7.2.2 NUGGETS

7.2.3 BITES

7.2.4 WEDGES

7.2.5 OTHERS

7.3 FROZEN PIZZA

7.3.1 FROZEN VEG PIZZA

7.3.1.1 WITH CHEESE

7.3.1.2 WITHOUT CHEESE

7.3.2 FROZEN NON-VEG PIZZA

7.3.2.1 FROZEN NON-VEG PIZZA, BY MEAT TYPE

7.3.2.1.1 PEPPERONI PIZZA

7.3.2.1.2 CHICKEN PIZZA

7.3.2.1.3 BEEF PIZZA

7.3.2.1.4 OTHERS

7.3.2.2 FROZEN NON-VEG PIZZA, BY BASE TYPE

7.3.2.2.1 WITH CHEESE

7.3.2.2.2 WITHOUT CHEESE

7.4 FROZEN ICE CREAM

7.4.1 FROZEN SOFT SERVE

7.4.2 FROZEN GELATO

7.4.3 OTHERS

7.5 FROZEN SEAFOOD PRODUCTS

7.5.1 FROZEN FISH FILLETS

7.5.2 FROZEN SHRIMP POPCORN

7.5.3 FROZEN FISH NUGGETS

7.5.4 FROZEN FISH BITES

7.5.5 OTHERS

7.6 FROZEN CHICKEN PRODUCTS

7.6.1 FROZEN CHICKEN NUGGETS

7.6.2 FROZEN CHICKEN STRIPS

7.6.3 FROZEN CHICKEN BITES

7.6.4 FROZEN CHICKEN WINGS

7.6.5 FROZEN CHICKEN POPCORN

7.6.6 OTHERS

7.7 FROZEN YOGHURT

7.7.1 LOW FAT

7.7.2 FAT FREE

7.7.3 FULL FAT

7.8 FROZEN DAIRY PRODUCTS

7.8.1 FROZEN DAIRY PRODUCTS, BY SOURCE

7.8.1.1 ANIMAL-BASED DAIRY

7.8.1.2 PLANT-BASED DAIRY

7.8.1.2.1 ALMOND MILK

7.8.1.2.2 SOY MILK

7.8.1.2.3 COCONUT MILK

7.8.1.2.4 OAT MILK

7.8.1.2.5 OTHERS

7.8.2 FROZEN DAIRY PRODUCTS, BY FLAVOR

7.8.2.1 REGULAR

7.8.2.2 FLAVOR

7.8.2.2.1 CHOCOLATES

7.8.2.2.2 VANILLA

7.8.2.2.3 STRAWBERRY

7.8.2.2.4 CARAMEL

7.8.2.2.5 BLACKBERRY

7.8.2.2.6 NUTS

7.8.2.2.7 BUTTERSCOTCH

7.8.2.2.8 PEPPERMINT

7.8.2.2.9 MOCHA

7.8.2.2.10 BLUEBERRY

7.8.2.2.11 BANANA

7.8.2.2.12 CHERRY

7.8.2.2.13 PEACH

7.8.2.2.14 AMARETTO

7.8.2.2.15 POMEGRANATE

7.8.2.2.16 PUMPKIN

7.8.2.2.17 COTTON CANDY

7.8.2.2.18 ORCHARD CHERRY

7.8.2.2.19 COCONUT

7.8.2.2.20 HONEY

7.8.2.2.21 HERBAL

7.8.2.2.22 OTHERS

7.9 FROZEN PASTA

7.9.1 SPAGHETTI

7.9.2 PENNE

7.9.3 RAVIOLI

7.9.4 MACARONI / MACCHERONI / ELBOW

7.9.5 LASAGNA

7.9.6 FETTUCCINE

7.9.7 GNOCCHI

7.9.8 OTHERS

7.1 FROZEN DRINKS

7.11 FROZEN VEGETARIAN MEALS

7.11.1 POWER BOWL

7.11.2 BUDDHA BOWL

7.11.3 SOUP BOWL

7.11.4 CURRY BOWL

7.12 FROZEN SORBET AND SHERBET

7.13 FROZEN CAKES

7.13.1 FLAVORED CAKES

7.13.2 PLUM CAKES

7.13.3 SPONGE CAKES

7.13.4 CHEESE CAKES

7.13.5 CUP CAKES

7.13.6 OTHERS

7.14 FROZEN WRAPS & ROLLS

7.14.1 FROZEN VEG WRAPS & ROLLS

7.14.2 FROZEN NON-VEG WRAPS & ROLLS

7.15 FROZEN CUSTARD

7.16 FROZEN SOUP

7.17 FROZEN QUINOA FOOD MIXES

7.17.1 QUINOA WITH VEGETABLES

7.17.2 QUINOA WITH CHICKEN

7.17.3 QUINOA WITH PORK

7.17.4 QUINOA WITH SEAFOOD

7.17.5 OTHERS

7.18 FROZEN RICE MIXES

7.18.1 FROZEN RICE MIXES, BY TYPE

7.18.1.1 WHITE RICE

7.18.1.2 BROWN RICE

7.18.1.3 BLACK RICE

7.18.1.4 WILD RICE

7.18.1.5 OTHERS

7.18.2 FROZEN RICE MIXES, BY RICE MIX CATEGORY

7.18.2.1 RICE WITH CHICKEN

7.18.2.1.1 WHITE RICE

7.18.2.1.2 BROWN RICE

7.18.2.1.3 BLACK RICE

7.18.2.1.4 WILD RICE

7.18.2.1.5 OTHERS

7.18.2.2 RICE WITH BEEF

7.18.2.2.1 WHITE RICE

7.18.2.2.2 BROWN RICE

7.18.2.2.3 BLACK RICE

7.18.2.2.4 WILD RICE

7.18.2.2.5 OTHERS

7.18.2.3 RICE WITH PORK

7.18.2.3.1 WHITE RICE

7.18.2.3.2 BROWN RICE

7.18.2.3.3 BLACK RICE

7.18.2.3.4 WILD RICE

7.18.2.3.5 OTHERS

7.18.2.4 RICE WITH SEAFOOD

7.18.2.4.1 WHITE RICE

7.18.2.4.2 BROWN RICE

7.18.2.4.3 BLACK RICE

7.18.2.4.4 WILD RICE

7.18.2.4.5 OTHERS

7.18.2.5 RICE WITH VEGETABLES

7.18.2.5.1 WHITE RICE

7.18.2.5.2 BROWN RICE

7.18.2.5.3 BLACK RICE

7.18.2.5.4 WILD RICE

7.18.2.5.5 OTHERS

7.18.2.6 OTHERS

7.19 OTHERS

8 NORTH AMERICA FROZEN READY MEALS MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 NORTH AMERICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

9.1 OVERVIEW

9.2 FROZEN READY MEALS PACKAGING

9.2.1 FROZEN READY MEALS PACKAGING, BY TYPE

9.2.1.1 OXYGEN SCAVENGERS

9.2.1.2 MOISTURE CONTROL

9.2.1.3 ANTIMICROBIALS

9.2.1.4 TIME TEMPERATURE INDICATORS

9.2.1.5 EDIBLE FILMS

9.3 FREEZING TECHNIQUE & EQUIPMENT

9.3.1 FREEZING TECHNIQUE & EQUIPMENT, BY TYPE

9.3.1.1 AIR BLAST FREEZERS

9.3.1.2 TUNNEL FREEZERS

9.3.1.3 BELT FREEZERS

9.3.1.4 CONTACT FREEZERS

10 NORTH AMERICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

10.3 BELT FREEZING

10.4 HIGH PRESSURE-ASSISTED FREEZING

10.5 OTHERS

11 NORTH AMERICA FROZEN READY MEALS MARKET, BY END-USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL SECTOR

11.3 FOOD SERVICE SECTOR

11.3.1 RESTAURANTS

11.3.2 QUICK SERVICE RESTAURANTS

11.3.3 DINING RESTAURANTS

11.3.4 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

11.3.5 OTHERS

11.3.6 CAFES

11.3.7 HOTEL

11.3.8 OTHERS

12 NORTH AMERICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 GROCERY RETAILERS

12.2.2 SUPERMARKETS/HYPERMARKETS

12.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

12.2.4 CONVENIENCE STORES

12.2.5 SPECIALTY STORES

12.2.6 WHOLESALERS

12.2.7 OTHERS

12.3 NON- STORE BASED RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITE

13 NORTH AMERICA FROZEN READY MEALS MARKET BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BRF NORTH AMERICA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TYSON FOODS, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MCCAIN FOODS LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CONAGRA BRANDS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NESTLÉ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCE PIERRE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AJINOMOTO CO., INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AL KABEER GROUP ME

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMY’S KITCHEN

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL MILLS INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 NORTH AMERICA FOOD INDUSTRIES LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIRTO GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GULF WEST COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HAKAN AGRO DMCC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JBS S/A

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 KELLOGG CO. (2021)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MOSAIC FOODS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NOMAD FOODS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SAFCO INTERNATIONAL GEN. TRADING CO. L.L.C.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SCHWAN'S HOME DELIVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SIDCO FOODS TRADING L.L.C.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 THE KRAFT HEINZ COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 WAWONA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE:

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

List of Figure

FIGURE 1 NORTH AMERICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FROZEN READY MEALS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FROZEN READY MEALS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FROZEN READY MEALS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FROZEN READY MEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FROZEN READY MEALS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FROZEN READY MEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FROZEN READY MEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA FROZEN READY MEALS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA FROZEN READY MEALS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FROZEN READY MEALS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA FROZEN READY MEALS MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 NORTH AMERICA FROZEN READY MEALS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FROZEN READY MEALS MARKET

FIGURE 17 NORTH AMERICA FROZEN READY MEALS MARKET, BY TYPE

FIGURE 18 NORTH AMERICA FROZEN READY MEALS MARKET, BY CATEGORY

FIGURE 19 NORTH AMERICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

FIGURE 20 NORTH AMERICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

FIGURE 21 NORTH AMERICA FROZEN READY MEALS MARKET, BY END USER

FIGURE 22 NORTH AMERICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 23 NORTH AMERICA FROZEN READY MEALS MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA FROZEN READY MEALS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 NORTH AMERICA FROZEN READY MEALS MARKET: COMPANY SHARE 2021 (%)

North America Frozen Ready Meals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Frozen Ready Meals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Frozen Ready Meals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.