North America Free Standing Electrical Height-Adjustable Tables Market Analysis and Size

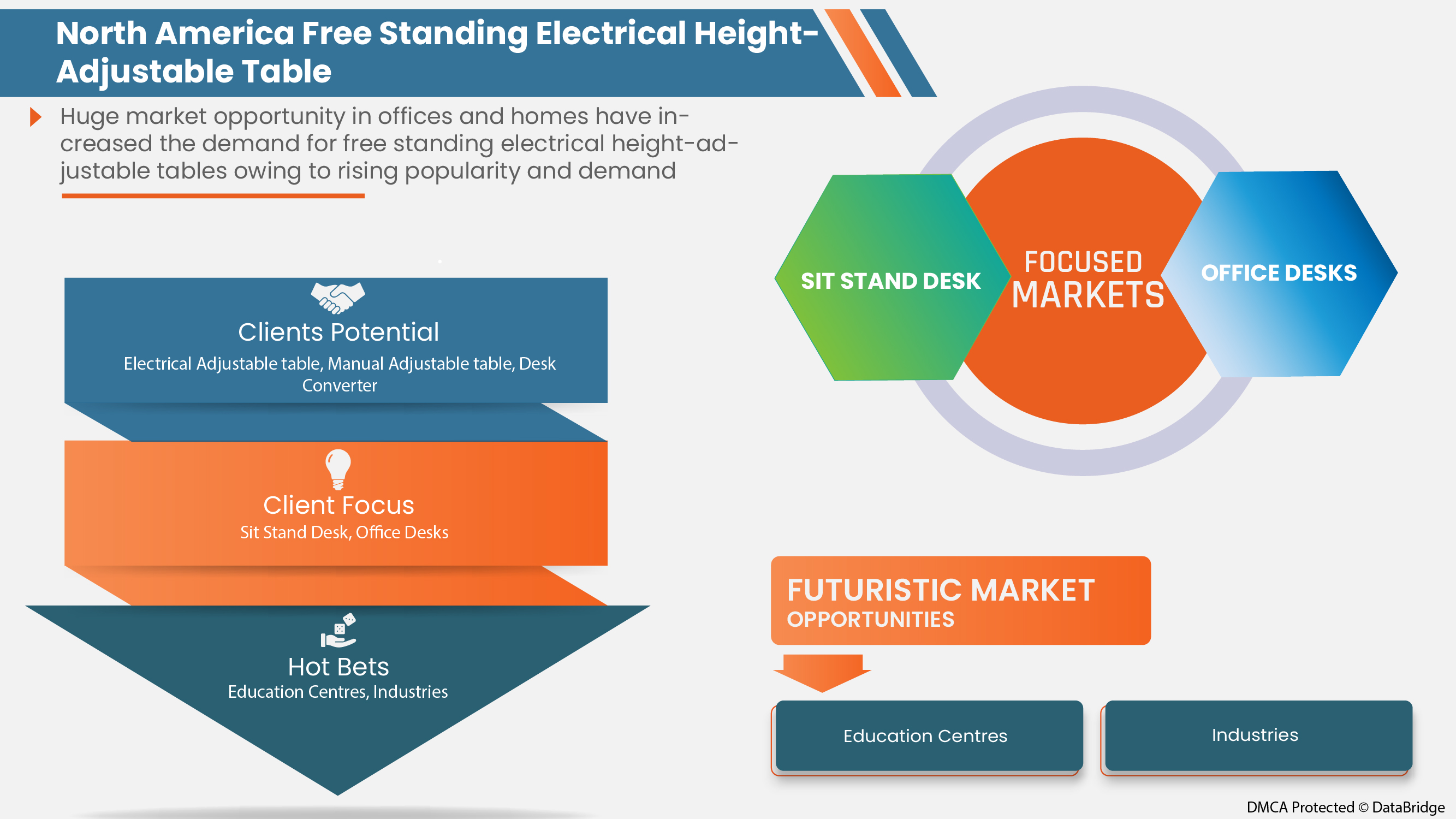

The North America free standing electrical height-adjustable tables market is being driven by the numerous benefits they offer to both companies and employees. The market for contemporary height-adjustable desks is also being driven by an increase in demand for contemporary height-adjustable workstations. The human body naturally works best when it is in a comfortable position, especially during regular office work hours. This improves general health, which creates a market opportunity for modern height-adjustable desks. While the primary factor limiting the North America free-standing electrical height-adjustable tables market is due to an increase in demand for substitutes indicated above are higher. As a result of the rising demand for free standing electrical height-adjustable tables so, growers are putting more effort into manufacturing new designs and new models.

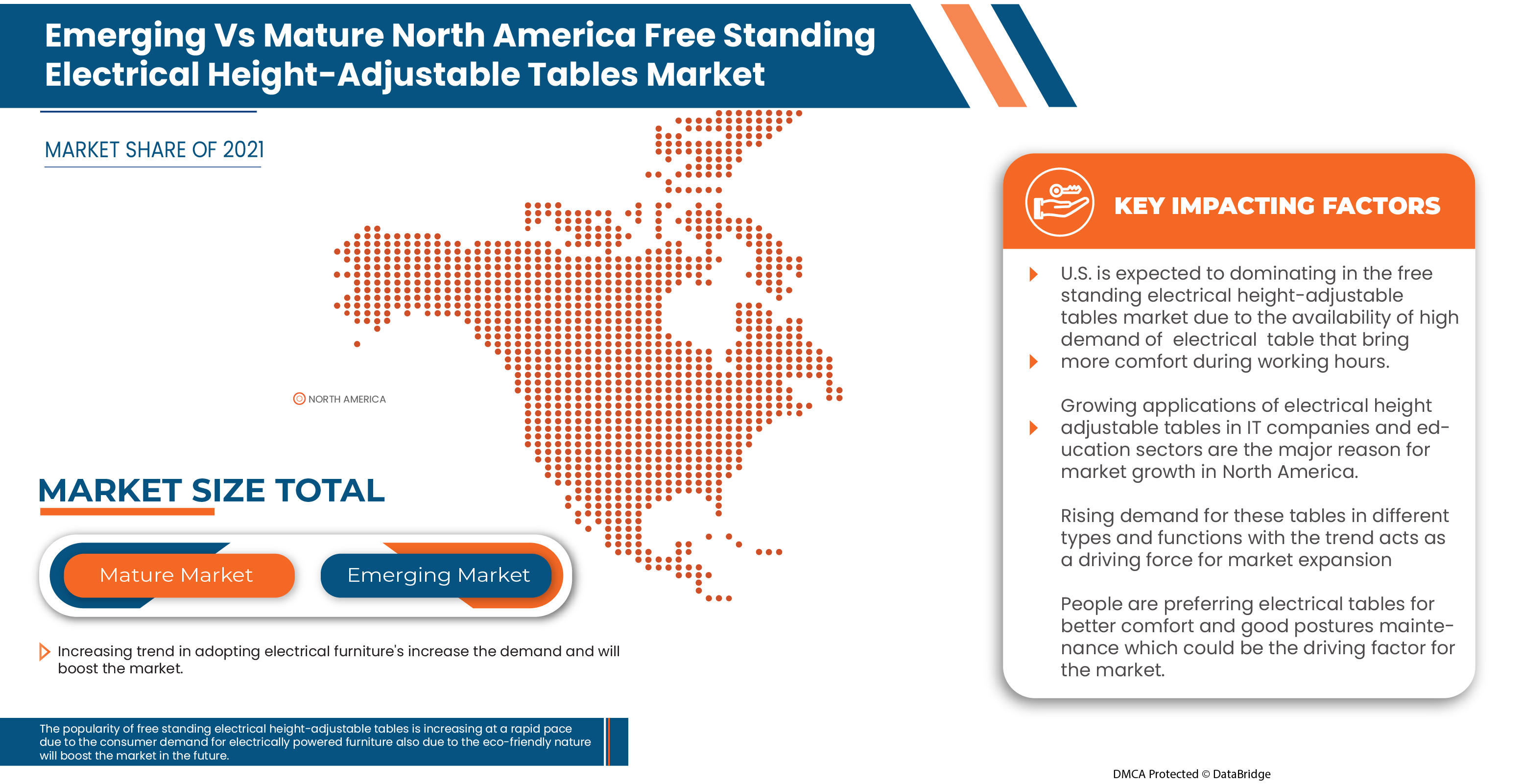

Some of the factors which are driving the market growth are the trend of hybrid working or work-from-home culture and shift of consumer preference towards electrically powered furniture, and the eco-friendly nature of the product. However, limitations in terms of the enormous price difference between smart furniture products and traditional furniture hamper the growth of the market.

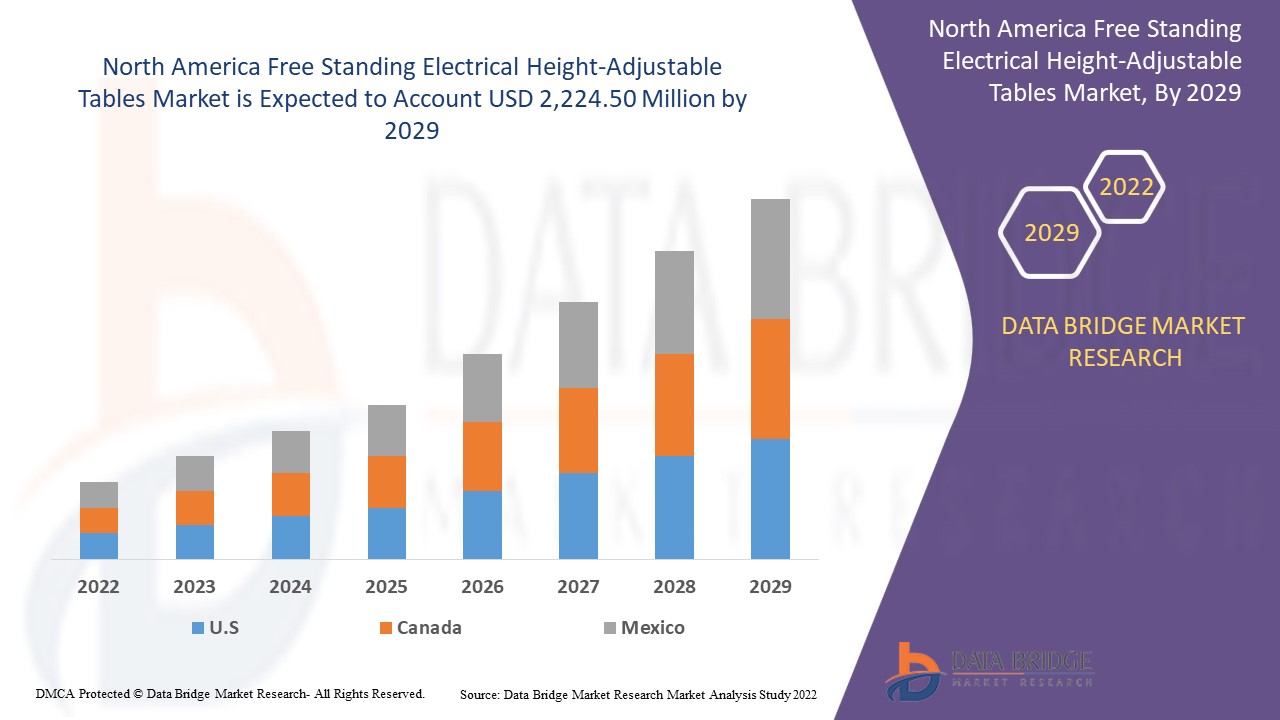

Data Bridge Market Research analyses that the free standing electrical height-adjustable tables market is expected to reach the value of USD 2,224.50 million by 2029 with a CAGR of 7.6% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Thousand Units, Pricing in USD |

|

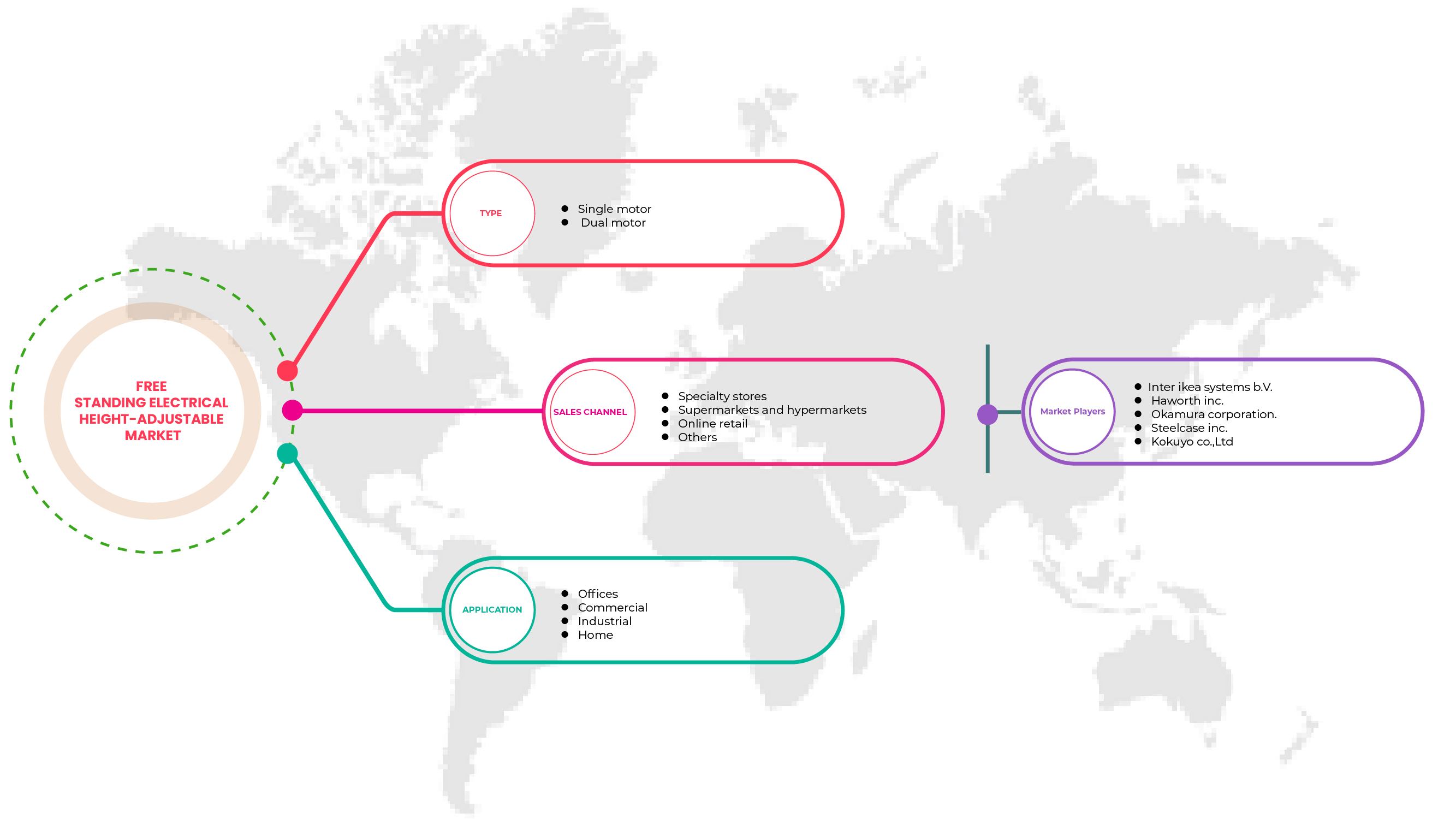

Segments Covered |

By Type (Single Motor, and Dual Motor), Application (Offices, Commercial, Industrial, and Home), Sales Channel (Specialty Stores, Supermarkets and Hypermarkets, Online Retail and Others) |

|

Regions Covered |

U.S., Canada, and Mexico. |

|

Market Players Covered |

Conen Products GmbH, ConSet America, North America Furniture Group, HNI Corporation, Schiavello, KI, Fellowes Brands, Ofita, ROL AB, Teknion, PALMBERG, Haworth Inc., OKAMURA CORPORATION., Kimball International, Steelcase Inc., Gispen, Ergomaster, Inter IKEA Systems B.V., CEKA, RAGNARS, Röhr-Bush GmbH & Co. KG, ACTIU Berbegal y Formas S.A., KOKUYO CO., LTD., and Kinnarps AB, among others. |

Market Definition

Free standing electrical height-adjustable tables that help users alter their height. The back muscles and neck are very relaxed, with sufficient desk mobility. A contemporary option for the spine, knees, and ankles is a height-adjustable table. Additionally, it fosters users' concentration and imagination. A height-adjustable table that can be modified for both sitting and standing is healthier than one that can only be used for sitting. Negative health impacts have been connected to extended stays. Small tabletop models that can be added to or removed from a current desk to shift between standing and sitting are another option for sit-stand workstations.

Free Standing Electrical Height-Adjustable Tables Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers:

- Grow IN awareness in Modern organizations about the health risks brought on by employees' bad posture in the workplace

Poor posture, for instance, can lead to a wide range of health problems by putting unnecessary strain on joints and muscles. This causes overwork and tiredness, which can result in chronic discomfort. As a result, musculoskeletal diseases (MSDs) such as tendonitis or carpal tunnel syndrome may develop. Muscles, blood vessels, nerves, ligaments, and tendons can all be affected by these conditions. Now a day’s, people are more aware of these health issues due to bad posture during office hours. Hence, organizations provide facilities like free standing electrical height-adjustable tables, which provide good posture during working hours. Therefore, the employees don’t face many health problems related to bad posture.

For instance,

- In May 2022, Aayuv Technologies Private Limited published a blog on “Employee health & wellbeing: Do they matter for the company's growth?”. It reveals that in recent days most of the organizations are providing the best infrastructures due to increasing demand for employers who are more aware about their health consciousness

Modern organizations conduct awareness programs and provide better facilities in the office due to this rise in awareness about the drastic health effects of bad posture in modern organizations. This directly acts as a driver and helps the market growth.

- The increasE IN adoption OF ergonomic furniture in a wide range of applications

Ergonomics is the practice of creating the workplace to meet the demands of the worker rather than forcing the worker to adjust to the workplace. A good ergonomic design has been proven to improve work quality and output while also improving worker wellbeing. Unlike traditional office furniture, ergonomic chairs keep the user's body in a secure and upright position, reducing stress on the spine, neck, and hips. This is accomplished through the use of a headrest to support the neck and shoulders, as well as a backrest to maintain the natural curve of the spine. Another increasing trend in ergonomics that is quickly becoming mandatory in certain companies is the sit-stand desk, which is intended to get employees up and moving more. Due to the increasing adoption, people are interested in using various applications.

For instance,

- ImageWorks Commercial Interiors published insight on “What You Need to Know About The Future of Ergonomic Office Furniture.” Modern technology and creative designs are already present in the ergonomic office furniture that is now available, but that doesn't mean that there isn't always potential for development. The future of ergonomic office furniture is brimming with innovative ideas that have the potential to fundamentally alter the way that office furniture is made

There is a wide range of applicability in the market, and in the future also, the applications will increase day by day by using advanced technology will help the market grow.

RESTRAINTS

- The high expense of smart furniture versus regular furniture

Smart furniture is not regular furniture like chairs, desks, and tables, and it is more in modern designs for homes and offices that have an intelligent system or are controlled by a controller. So, its raw material sourcing and manufacturing require high investments, so the ultimate price of the product is higher than regular furniture, because of this reason many consumers avoid purchasing smart furniture like free standing electrical height-adjustable tables.

Therefore, it is anticipated that the enormous price difference between smart furniture products and traditional furniture will significantly hinder the market's expansion.

OPPORTUNITIES

- Increasing openings of retail storeS for physical experience

Customers prefer to visit retail stores to gain a better understanding of furniture products. In recent years, numerous new retail stores with varied branch names have been erected in various locations. The majority of customers in each and every region will be able to access these different branches. Employees will benefit greatly from this simple accessibility, as well as the business itself, by generating more sales.

For instance,

- In June 2022, IKEA opens first big box format store in Bengaluru; to invest Rs 3000 crore in Karnataka. This helps IKEA to increase its sales

This increasing installments of new retail stores will create many opportunities for employees and for companies which helps the market growth.

CHALLENGES

- High cost of raw material

Most consumers these days favor high-quality goods. High-quality raw materials are needed to produce high-quality goods, which is a prerequisite in the manufacturing process. However, the cost of high-quality raw materials is exorbitant, and only a small number of investors are willing to make that kind of investment. The majority of businesses aren't exhibiting interest in investing in these sectors as a result of the high cost of excellent raw materials.

For instance,

- In August 2021, Henkel published an article on “Furniture industry news: How a raw material cost increase could change the furniture industry as we know it?”. It tells that the high price of raw materials during the COVID-19 pandemic due to less availability leads to increasing prices of the final furniture products

Therefore, the main challenge in the market may be caused by these high raw material prices.

Post-COVID-19 Impact On North America Free Standing Electrical Height-Adjustable Tables Market

Post the pandemic, the demand for free standing electrical height-adjustable tables has increased as there won't be any restrictions on movement; hence, the supply of products would be easy. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply furniture products to consumers, initially increasing the demand for products. However, post-COVID, the demand for Free standing electrical height-adjustable tables has increased significantly owing to improves general health and productivity at work.

Recent Developments

- In July 2022, ACTIU Berbegal y Formas S.A. aim was to innovate to be at the top of the class. The company designs working spaces for the students in the classroom for better study and learning by providing agile and comfortable furniture. The development of advanced technologies has led to good facilities for learning, which will attract other learning institutes to adopt the same. This help in the market growth

- In 2019, Conen Produkte GmbHlaunched a height adjustable mount that is a new trend and also developed in tables that has a great effect on the market in both the sectors for tables as well as mounts, leading to an increase in the market of the company. These techniques also help to table market increase because they involve the same techniques

North America Free Standing Electrical Height-Adjustable Tables Market Scope

The North America free standing electrical height-adjustable tables market is segmented into three notable segments based on type, application, and sales channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

TYPE

- Single Motor

- Dual Motor

On the basis of type, the North America free standing electrical height-adjustable tables market is segmented into single-motor, and dual motor.

APPLICATION

- Offices

- Commercial

- Industrial

- Home

On the basis of application, the North America free standing electrical height-adjustable tables market is segmented into offices, commercial, industrial, and home.

SALES CHANNEL

- Specialty Stores

- Supermarkets And Hypermarkets

- Online Retail

- Others

On the basis of sales channels, the North America free standing electrical height-adjustable tables market is segmented into specialty stores, supermarkets, hypermarkets, online retail, and others.

North America Free Standing Electrical Height-Adjustable Tables Market Regional Analysis/Insights

The North America free standing electrical height-adjustable tables market is analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the North America free standing electrical height-adjustable tables market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America free standing electrical height-adjustable tables market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the Growing demand for these tables is the major reason for the growth of free standing electrical height adjustable tables in the North America region.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Free Standing Electrical Height-Adjustable Tables Market Share Analysis

The Competitive North America free standing electrical height-adjustable tables market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the North America free standing electrical height adjustable tables market.

Some of the major players operating in the North America free standing electrical height-adjustable tables market Conen Products Gmbh, Conset America, North America Furniture Group, Hni Corporation, Schiavello, Ki, Fellowes Brands, Ofita, Rol Ab, Teknion, Palmberg Okamura Corporation., Kimball International, Steelcase Inc., Gispen, Ergomaster, Ikea, Ceka, Ragnars, and Röhr-Bush Gmbh & Co. Kg, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF CONSUMERS

4.2 LIST OF KEY RAW MATERIALS

4.3 LIST OF SUPPLIERS

4.4 MARKET DYNAMICS AND EXPANSION PLANS (M&A)

4.4.1 MARKET DYNAMICS

4.4.2 EXPANSION PLANS (M&A)

4.5 TOP MANUFACTURES SALES PRICES (USD/UNIT) -

4.6 TOP MANUFACTURERS TOTAL SALES

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL & COMPONENTS

5.2 PRODUCTION & ASSEMBLY

5.3 RETAILERS & DISTRIBUTION

5.4 END-USERS

6 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROW IN AWARENESS IN MODERN ORGANIZATIONS ABOUT THE HEALTH RISKS BROUGHT ON BY EMPLOYEES' BAD POSTURE IN THE WORKPLACE

7.1.2 THE INCREASE IN ADOPTION OF ERGONOMIC FURNITURE IN A WIDE RANGE OF APPLICATIONS

7.1.3 RAISE IN HEALTH CONSCIOUSNESS AMONG EMPLOYEES

7.1.4 A TREND IN CONSUMER PREFERENCE FOR ELECTRICALLY POWERED FURNITURE

7.1.5 THE INCREASING TREND OF HYBRID WORKING OR WORK FROM HOME CULTURE MAY INCREASE THE DEMAND

7.2 RESTRAINTS

7.2.1 THE HIGH EXPENSE OF SMART FURNITURE VERSUS REGULAR FURNITURE

7.2.2 HIGH COST FOR REPLACEMENT IF ANY PART IS NOT WORKING PROPERLY

7.2.3 HIGH AVAILABILITY OF SUBSTITUTE PRODUCTS

7.3 OPPORTUNITIES

7.3.1 DIFFERENT PRODUCT CATEGORIES IN NEW DESIGNS AND SOLUTIONS ACCORDING TO THE DEMAND

7.3.2 INCREASING OPENINGS OF RETAIL STORES FOR PHYSICAL EXPERIENCE

7.3.3 EXPANSION OF ONLINE RETAIL AND DISTRIBUTION CHANNEL

7.4 CHALLENGES

7.4.1 HIGH COST OF RAW MATERIAL

7.4.2 LACK OF INVESTMENTS FROM END-USER COMPANIES

7.4.3 INTENSE MARKET COMPETITION BY MANUFACTURERS

8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE MOTOR

8.3 DUAL MOTOR

9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OFFICES

9.2.1 HIGH-RISE

9.2.2 MID-RISE

9.2.3 LOW-RISE

9.3 COMMERCIAL

9.3.1 EDUCATIONAL INSTITUTIONS

9.3.2 HEALTHCARE FACILITIES

9.3.3 RESEARCH LABORATORIES

9.3.4 AIRPORTS

9.3.5 RAILWAYS AND METRO STATIONS

9.3.6 HOTELS

9.3.7 MANUFACTURING

9.3.8 BUS STOPS AND STATIONS

9.3.9 RESTAURANTS AND BARS

9.3.10 RETAILS

9.3.11 WAREHOUSES

9.3.12 SHIPPING YARDS

9.3.13 OTHERS

9.4 INDUSTRIAL

9.4.1 PHARMACEUTICALS FACTORY

9.4.2 FOOD AND BEVERAGE

9.4.3 MANUFACTURING

9.4.4 OIL AND GAS

9.4.5 OTHERS

9.5 HOME

9.5.1 CONDOMINIUM

9.5.2 TOWN HOUSE

9.5.3 SINGLE FAMILY HOME

9.5.4 OTHERS

10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 SUPERMARKETS AND HYPERMARKETS

10.4 ONLINE RETAIL

10.5 OTHERS

11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 INTER IKEA SYSTEMS B.V.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 HAWORTH INC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OKAMURA CORPORATION.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 STEELCASE INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 KOKUYO CO., LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ACTIU BERBEGAL Y FORMAS S.A.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CEKA

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CONEN PRODUCTS GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSET AMERICA

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 FELLOWES INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ERGOMASTER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GISPEN

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NORTH AMERICA FURNITURE GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 HNI CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 KI

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 KIMBALL INTERNATIONAL INC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 KINNARPS AB

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 OFITA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 PALMBERG BÜROEINRICHTUNGEN + SERVICE GMBH

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 RAGNARS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 ROEHR-BUSH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 ROL AB

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 SCHIAVELLO INTERNATIONAL

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TEKNION

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 THE LIST OF SUPPLIERS:

TABLE 2 THE TOP MANUFACTURES SALES PRICES (USD/UNIT) FOR FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES:

TABLE 3 THE TOTAL SALES OF ELECTRICAL HEIGHT-ADJUSTABLE TABLE BASED COMPANIES ARE LISTED BELOW:

TABLE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SINGLE MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 8 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA DUAL MOTOR IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 10 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 12 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 14 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 16 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 18 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 20 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 24 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 26 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 28 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 30 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SPECIALTY STORES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 32 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SUPERMARKETS AND HYPERMARKETS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 34 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE RETAIL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 36 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 38 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 40 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 44 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 46 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 48 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 50 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 52 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 59 U.S. OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 60 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 61 U.S. COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 62 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 63 U.S. INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 64 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 65 U.S. HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 66 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 U.S. FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 68 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 70 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 72 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 73 CANADA OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 74 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 75 CANADA COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 76 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 77 CANADA INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 78 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 79 CANADA HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 80 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 CANADA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 82 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2020-2029 (THOUSAND UNITS)

TABLE 86 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 87 MEXICO OFFICES IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 88 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 89 MEXICO COMMERCIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 90 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 91 MEXICO INDUSTRIAL IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 92 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HOME IN FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SEGMENT, 2020-2029 (THOUSAND UNITS)

TABLE 94 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 MEXICO FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNEL, 2020-2029 (THOUSAND UNITS)

List of Figure

FIGURE 1 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SEGMENTATION

FIGURE 10 THE INCREASED TREND HYBRID WORKING OR WORK FROM HOME CULTURE IS EXPECTED TO DRIVE THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE SINGLE MOTOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET

FIGURE 14 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY TYPE, 2021

FIGURE 15 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET, BY SALES CHANNELS, 2021

FIGURE 17 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT-ADJUSTABLE TABLES MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA FREE STANDING ELECTRICAL HEIGHT ADJUSTABLE TABLES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.