North America Forestry Equipment Market

Market Size in USD Billion

CAGR :

%

USD

3.09 Billion

USD

4.74 Billion

2025

2033

USD

3.09 Billion

USD

4.74 Billion

2025

2033

| 2026 –2033 | |

| USD 3.09 Billion | |

| USD 4.74 Billion | |

|

|

|

|

What is the North America Forestry Equipment Market Size and Growth Rate?

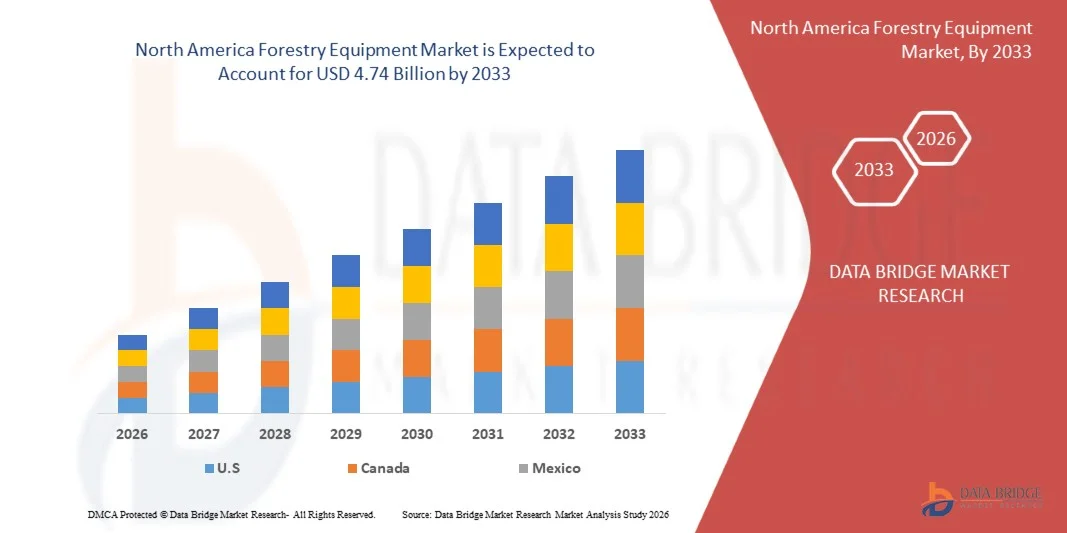

- The North America forestry equipment market size was valued at USD 3.09 billion in 2025 and is expected to reach USD 4.74 billion by 2033, at a CAGR of 5.5% during the forecast period

- The high production of round wood requires forestry equipment for the purpose of cutting, processing, lifting and loading, thus increasing the growth of the forestry equipment market

- The high cost put in the harvesting is increased majorly because of the initial cost put in for buying the machinery. These machineries are heavy duty vehicles and require high maintenance cost. The increased cost to the overall production is thus limiting the growth of the forestry equipment market

What are the Major Takeaways of Forestry Equipment Market?

- Technical developments in forest equipment have led to improved productivity in forestry facilities. This has helped in increasing the productivity and reducing the cost which is acting as a major window of opportunity for the growth of the forestry equipment market

- The increase in cost due to hydraulic system leakage is highly challenging for the companies and thus acts as major challenge for the growth of the forestry equipment market.

- U.S. dominated the North America Forestry Equipment market with a 36.2% revenue share in 2025, supported by widespread adoption of mechanized forestry solutions, advanced timber harvesting technologies, and expansion of commercial plantations across the country

- Canada Sweden is projected to register the fastest CAGR of 9.9% from 2026 to 2033, fueled by mechanization of logging operations, adoption of high-precision equipment, and government-backed sustainable forestry programs

- The Felling Equipment segment dominated the market with a revenue share of 53.69% in 2025, driven by rising demand for precision and efficient tree harvesting in natural and plantation forests

Report Scope and Forestry Equipment Market Segmentation

|

Attributes |

Forestry Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Forestry Equipment Market?

“Rising Demand for Sustainable and High-Performance Forestry Equipment”

- The forestry equipment market is witnessing a key trend of increasing adoption of eco-friendly, energy-efficient, and technologically advanced machinery. This trend is driven by growing global awareness of sustainable forestry practices, operational efficiency, and environmental compliance, especially in North America and North America.

- For instance, companies such as Komatsu Forest and Waratah are developing energy-efficient harvesters and forwarders equipped with hybrid engines and telematics to reduce fuel consumption and carbon emissions

- Rising demand for machinery that improves operational productivity, precision, and safety is accelerating adoption

- Manufacturers are integrating advanced automation, IoT-enabled monitoring, and operator-assist technologies into forestry equipment to enhance performance

- Increasing R&D on lightweight materials, durable components, and precision hydraulic systems is fostering product innovation

- As forestry operators prioritize sustainability, safety, and efficiency, modern forestry equipment is expected to remain central to industry modernization

What are the Key Drivers of Forestry Equipment Market?

- Rising global emphasis on sustainable logging, reduced deforestation, and compliance with environmental regulations is a major growth driver

- For instance, in 2025, Komatsu Forest and CRANAB AB introduced smart harvesters and forwarders equipped with advanced telematics to optimize fuel use and reduce emissions

- Growing demand for high-productivity, multi-functional machinery is driving adoption across North America, North America, and North America

- Technological advancements in automation, GPS-assisted harvesting, and robotic arms are enabling manufacturers to produce more precise and efficient equipment

- Increased integration of machinery with real-time monitoring, predictive maintenance, and fleet management systems further supports market expansion

- With continued investment in R&D, sustainable design, and operator-focused innovations, the forestry equipment market is expected to maintain strong growth momentum in the coming years

Which Factor is Challenging the Growth of the Forestry Equipment Market?

- High capital investment required for advanced forestry machinery limits adoption, especially among small-scale operators

- For instance, during 2024–2025, fluctuations in the cost of hydraulic systems, telematics components, and hybrid engines affected production and procurement volumes

- Regulatory compliance for emissions, safety, and forest sustainability standards increases operational complexity and costs

- Limited awareness and training on advanced forestry machinery in emerging markets hinder adoption, particularly for technologically sophisticated equipment

- Competition from used or refurbished machinery and low-cost imports creates pricing pressure and affects market penetration

- To overcome these challenges, manufacturers are investing in cost-efficient production, operator training programs, financing options, and sustainable design to ensure high-quality, environmentally responsible forestry equipment offerings

How is the Forestry Equipment Market Segmented?

The market is segmented on the basis of type, product, power source, material, forest type, system type, technique, and distribution channel.

• By Type

On the basis of type, the Forestry Equipment market is segmented into Felling Equipment, Extracting Equipment, On-Site Processing Equipment, Cutting and Loading Equipment, and Other Equipment. The Felling Equipment segment dominated the market with a revenue share of 53.69% in 2025, driven by rising demand for precision and efficient tree harvesting in natural and plantation forests. These machines, including feller bunchers and chainsaws, enhance operational speed, safety, and productivity.

Extracting Equipment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing adoption of forwarders, skidders, and cable yarders that optimize timber transport and reduce labor intensity. Continuous innovation in automation, hydraulic systems, and telematics further supports market expansion.

• By Product

Based on product, the market is segmented into Delimbers, Feller Bunchers, Stump Grinders, Mulchers, Yarders, Forwarders, Log Loaders, Harvesters, Skidders, Timber Transport Trucks, Chippers for Energy-Wood, and Others. The Harvesters segment dominated the market with a 46.5% revenue share in 2025, due to high adoption in large-scale timber operations across North America and North America.

Chippers for Energy-Wood are projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for biomass energy and renewable fuel sources. Advanced mechanization and high-capacity models are enabling efficient timber processing and reducing environmental impact.

• By Power Source

On the basis of power source, the market is segmented into Petrol, Battery, Electric Corded, Cordless, and Others. The Petrol segment dominated with 55.2% revenue share in 2025, as internal combustion engines provide reliability, high torque, and long operational hours for heavy-duty forestry operations.

Battery-powered and electric machinery is projected to grow at the fastest CAGR from 2026 to 2033, supported by innovations in hybrid and fully electric systems that reduce carbon emissions, noise pollution, and maintenance costs, especially in eco-sensitive forests.

• By Material

Based on material, the market is segmented into Metal, Plastic, Wood, Recycled Plastics, Synthetic Resin, and Others. The Metal segment dominated with a 42.1% revenue share in 2025, owing to durability, high strength, and longevity of steel and alloy components in heavy forestry machinery.

Recycled Plastics are projected to grow at the fastest CAGR from 2026 to 2033, driven by sustainability initiatives and integration of lightweight, high-performance polymer composites in protective cabins, covers, and non-structural components.

• By Forest Type

On the basis of forest type, the market is segmented into Natural, Man-Made, and Tree Plantations. Natural forests dominated the market with 53.6% revenue share in 2025, as they account for the largest timber extraction globally.

Tree Plantations are projected to grow at the fastest CAGR during 2026–2033, fueled by government initiatives for sustainable forestry, increasing reforestation projects, and growing commercial plantation acreage for paper, pulp, and timber industries.

• By System Type

Based on system type, the market is segmented into Full-Tree Systems, Short Wood Systems, and Tree-Length Systems. The Short Wood Systems segment dominated with 50.8% revenue share in 2025, due to ease of handling, reduced log breakage, and compatibility with mechanized extraction equipment.

Full-Tree Systems are projected to grow at the fastest CAGR from 2026 to 2033, driven by their efficiency in large-scale operations and integration with modern chipping and biomass processing units.

• By Technique

On the basis of technique, the market is segmented into Tree Felling, Topping and Debranching, Debarking, Extraction, Log Making/Cross-Cutting, Scaling, Sorting and Piling, Loading, and Others. Tree Felling dominated with 37.7% revenue share in 2025, owing to the critical role of felling in overall productivity.

Loading and Sorting techniques are projected to grow at the fastest CAGR during 2026–2033, driven by automation, robotics, and telematics solutions for faster, safer, and more accurate timber handling and processing.

• By Distribution Channel

Based on distribution channel, the market is segmented into Third Party Distributors, B2B/Direct Sales, E-Commerce, Brand Websites, Specialty Stores, and Others. B2B/Direct Sales dominated with 57.5% revenue share in 2025, as manufacturers supply machinery directly to large forestry operators, ensuring customization, after-sales support, and training.

E-Commerce and online platforms are projected to grow at the fastest CAGR from 2026 to 2033, particularly for small-scale operators and spare parts procurement, supported by digitalization, faster delivery, and remote support services.

Which Region Holds the Largest Share of the Forestry Equipment Market?

- U.S. dominated the North America Forestry Equipment market with a 36.2% revenue share in 2025, supported by widespread adoption of mechanized forestry solutions, advanced timber harvesting technologies, and expansion of commercial plantations across the country

- Government incentives for sustainable forest management, investment in R&D, and growing demand for timber, pulp, and biomass products drive regional leadership. Key players are leveraging innovations in automated felling, forwarders, and processing machinery to enhance productivity and operational efficiency

- Rising urbanization, industrial demand, and focus on eco-friendly and precision forestry practices contribute to higher adoption

Canada Forestry Equipment Market Insight

Canada Sweden is projected to register the fastest CAGR of 9.9% from 2026 to 2033, fueled by mechanization of logging operations, adoption of high-precision equipment, and government-backed sustainable forestry programs. Operators deploy modern harvesters, skidders, and loaders to improve productivity and maintain environmental compliance. Expansion of commercial plantations and focus on eco-friendly practices drives long-term market growth.

Which are the Top Companies in Forestry Equipment Market?

The forestry equipment industry is primarily led by well-established companies, including:

- Komatsu Forest (Japan)

- Waratah (Finland)

- CRANAB AB (Sweden)

- Rotobec (Canada)

- Log Max AB (Sweden)

- Konrad Forsttechnik GmbH (Germany)

- Penz crane GmbH (Austria)

- INDUSTRIAS GUERRA, SA (Spain)

- Palmse Mehaanikakoda (Estonia)

- Southstar Equipment (U.S.)

- JSC AMKODOR, holding managing company (Belarus)

- SP Maskiner (Sweden)

What are the Recent Developments in North America Forestry Equipment Market?

- In May 2025, Forico, a leading Tasmanian forestry firm, deployed AI-powered wildfire detection cameras across its plantations, enabling real-time triangulation of fire signatures for early warning and rapid response, enhancing fire resilience and setting a benchmark for digital risk management in the forestry sector

- In February 2025, researchers introduced a reinforcement learning–based system for autonomous crane manipulation in forestry operations, training the AI model in simulated environments to identify and grasp timber logs with 96% accuracy, representing a significant advancement in automation, labor reduction, and operational safety in remote forestry sites

- In June 2023, Volvo Construction Equipment (Volvo CE) announced the launch of its new Compact Business Unit, establishing a dedicated division for its compact equipment machines and solutions to drive growth and profitability, strengthening its market position in the expanding compact equipment segment

- In May 2023, Caterpillar launched the MH3050, a new material handler designed for superior performance, reliability, and premium cab comfort, featuring an advanced electrohydraulic system to optimize power efficiency and cycle times, further expanding Caterpillar’s material handler offerings for industrial applications and enhancing profit potential

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Forestry Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Forestry Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Forestry Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.