North America Footwear Market

Market Size in USD Billion

CAGR :

%

USD

64.27 Billion

USD

98.63 Billion

2024

2032

USD

64.27 Billion

USD

98.63 Billion

2024

2032

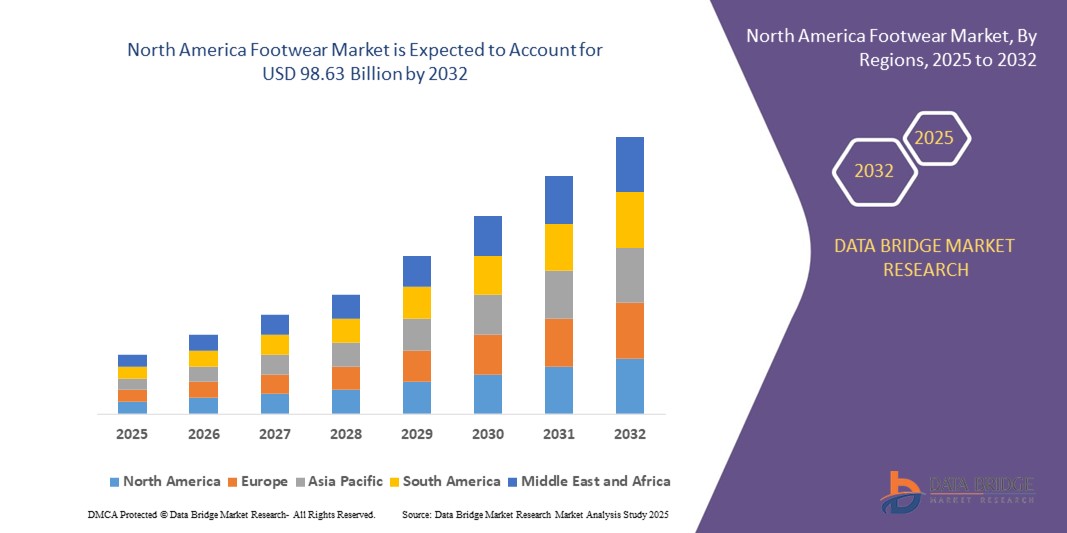

| 2025 –2032 | |

| USD 64.27 Billion | |

| USD 98.63 Billion | |

|

|

|

|

North America Footwear Market Size

- The North America footwear market size was valued at USD 64.27 billion in 2024 and is expected to reach USD 98.63 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the rising demand for premium and customized footwear, increasing health awareness promoting athletic shoe sales, and expanding e-commerce channels that offer convenience and variety to consumers

- Technological advancements such as 3D printing, smart insoles, and AI-driven design customization are further enhancing product innovation and consumer engagement across the footwear industry in the region

North America Footwear Market Analysis

- The market is witnessing a strong shift towards sustainable and eco-friendly footwear options, driven by consumer preferences for ethical fashion and regulatory support for greener production practices

- Growing disposable incomes, fashion-conscious urban populations, and celebrity-driven brand endorsements continue to influence purchasing patterns across the region, especially in categories such as sportswear, sneakers, and luxury footwear

- U.S. footwear market captured the largest revenue share of 87% in 2024 within North America, driven by strong consumer spending, rapid fashion cycles, and growing health-consciousness. The market benefits from high demand across both performance and lifestyle footwear segments, including running shoes, sneakers, and premium casual styles

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America footwear market due to rising disposable income, increasing participation in outdoor activities, and growing demand for comfort-focused and sustainable footwear options

- The athletics segment dominated the market with the largest market revenue share in 2024, driven by increasing fitness awareness, outdoor activity participation, and the rising popularity of athleisure. Consumers continue to prioritize comfort, performance, and brand identity in sports footwear, pushing brands to expand and innovate in this segment

Report Scope and North America Footwear Market Segmentation

|

Attributes |

North America Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• Nike, Inc. (U.S.) • Caleres, Inc. (U.S.) |

|

Market Opportunities |

• Expansion Of Sustainable and Recyclable Footwear Products |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Footwear Market Trends

Rise of Sustainable and Tech-Integrated Footwear

- The increasing consumer shift toward eco-conscious purchasing is driving demand for sustainable footwear made from recycled materials and biodegradable components. Brands are innovating with plant-based leather, ocean plastics, and renewable textiles to align with growing environmental values and meet regulatory expectations

- Advancements in wearable technology are fueling the development of smart footwear integrated with features such as activity tracking, temperature regulation, and gait analysis. These innovations are particularly popular in the athletic and healthcare segments, offering enhanced functionality and personalization

- Consumers are showing a rising preference for brands that demonstrate transparency in sourcing and ethical production. As a result, companies investing in traceable supply chains and carbon-neutral operations are gaining competitive advantage and consumer trust

- For instance, in 2023, a leading U.S. sportswear brand launched a fully recyclable running shoe made from a single material that could be returned and remanufactured, significantly reducing waste. Another instance includes the introduction of self-lacing smart shoes by a major athletic brand, which offer personalized fit controlled via smartphone apps

- While sustainable and tech-integrated footwear is reshaping the market, widespread adoption depends on balancing innovation with affordability and consumer education. Brands must also address longevity, comfort, and performance expectations to succeed in this evolving landscape

North America Footwear Market Dynamics

Driver

Growing Health Awareness and Demand for Performance Footwear

• Increasing health consciousness across demographics is pushing demand for performance-enhancing footwear, especially in the athletic and casual wear categories. Consumers are prioritizing comfort, support, and functionality, driving sales of walking, running, and cross-training shoes

• The popularity of home workouts, fitness apps, and outdoor recreational activities has further expanded the target consumer base, encouraging footwear brands to develop activity-specific lines that cater to diverse fitness preferences and needs

• Evolving work and lifestyle trends are also contributing to the casualization of footwear, where comfort is prioritized over formal aesthetics. This has significantly boosted demand for versatile sneakers and hybrid athletic-casual footwear, particularly in urban areas

• For instance, in 2022, leading brands reported double-digit sales growth in their sports footwear categories, attributing the rise to increased engagement in wellness-focused lifestyles and the resurgence of walking clubs, gym memberships, and outdoor events

• While the demand for performance footwear continues to surge, success will rely on continuous product innovation, brand differentiation, and accessibility through diverse retail channels, including direct-to-consumer platforms and mobile apps

Restraint/Challenge

High Production Costs and Supply Chain Disruptions

• The cost of raw materials such as leather, rubber, and synthetic fabrics has been steadily increasing, resulting in elevated production costs for footwear manufacturers. Ethical sourcing, environmental compliance, and labor regulations further add to the financial strain, particularly for mid-size and emerging brands

• Disruptions in the global supply chain, including port delays, shipping container shortages, and geopolitical tensions, have impacted inventory flow and delivery timelines. These challenges are particularly significant in North America, where many brands rely on imports from Asia

• Small retailers and direct-to-consumer startups are more vulnerable to these disruptions, often facing stockouts or price increases that hinder competitiveness and customer satisfaction. Inflationary pressures have also impacted consumer spending habits, with some shifting toward budget-friendly alternatives

• For instance, in 2023, several North American footwear brands publicly acknowledged reduced margins and delayed product launches due to factory shutdowns in manufacturing hubs and rising transportation costs

• Addressing these challenges requires strategic diversification of sourcing locations, investments in local manufacturing, and adoption of digital supply chain tools to enhance agility and minimize long-term operational risks

North America Footwear Market Scope

The market is segmented on the basis of type, shoe material, soling material, distribution channel, and end-user.

- By Type

On the basis of type, the North America footwear market is segmented into loafers, shoes, sandal/flip-flops, ballerinas, boots, wedges, athletics, healthcare shoes, and others. The athletics segment dominated the market with the largest market revenue share in 2024, driven by increasing fitness awareness, outdoor activity participation, and the rising popularity of athleisure. Consumers continue to prioritize comfort, performance, and brand identity in sports footwear, pushing brands to expand and innovate in this segment.

The healthcare shoes segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for orthopedic and therapeutic footwear. Increasing prevalence of foot-related conditions and a growing elderly population are driving interest in healthcare shoes designed for foot alignment, cushioning, and diabetic care.

- By Shoe Material

On the basis of shoe material, the North America footwear market is segmented into plastic, leather, rubber, textile, and others. The leather segment accounted for the largest market revenue share in 2024 due to its traditional appeal, durability, and continued demand for premium and formal footwear across male and female demographics.

The textile segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing use of lightweight, breathable materials in casual and sports shoes. The growing demand for sustainable, vegan, and recyclable materials is also encouraging footwear brands to adopt textiles as a core material choice.

- By Soling Material

On the basis of soling material, the North America footwear market is segmented into plastics, rubber, leather, and others. The rubber segment dominated the market with the highest market revenue share in 2024, driven by its superior grip, shock-absorbing properties, and long-lasting wear across all major footwear types.

The plastics segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its low production cost and adaptability for use in various sole types, particularly in fashion and mass-market footwear.

- By Distribution Channel

On the basis of distribution channel, the North America footwear market is segmented into e-commerce, specialty-store, supermarkets-hypermarkets, convenience store, and others. The e-commerce segment held the largest revenue share in 2024, supported by convenience, fast delivery, availability of multiple brands, and easy price comparison. Online platforms have also enabled consumers to access international brands and limited-edition products.

The specialty-store segment is expected to witness the fastest growth rate from 2025 to 2032, driven by consumers seeking in-person fittings, expert advice, and curated selections tailored to specific needs or activities.

- By End-User

On the basis of end-user, the North America footwear market is segmented into women, men, and children. The women segment dominated the market with the largest revenue share in 2024, supported by wide-ranging product categories and frequent style updates driven by fashion trends and seasonal demand.

The children segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to increasing focus on foot health, demand for comfortable and safe footwear, and rising birth rates coupled with growing expenditure on children’s apparel and accessories.

North America Footwear Market Regional Analysis

- U.S. footwear market captured the largest revenue share of 87% in 2024 within North America, driven by strong consumer spending, rapid fashion cycles, and growing health-consciousness. The market benefits from high demand across both performance and lifestyle footwear segments, including running shoes, sneakers, and premium casual styles

- The presence of major global brands, combined with widespread retail networks and a mature e-commerce infrastructure, further accelerates market growth

- In addition, the increasing popularity of sustainable and tech-integrated footwear is contributing to a shift in consumer preferences and purchasing behavior

Canada Footwear Market Insight

The Canada footwear market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising disposable incomes, evolving fashion trends, and increasing participation in outdoor activities. Consumers are showing a growing interest in comfort-driven designs and sustainable products, driving demand for casual and athleisure footwear. The expansion of online retail and increasing penetration of international footwear brands are further enabling access to a wide product range, contributing to the market’s robust growth outlook

North America Footwear Market Share

The North America Footwear industry is primarily led by well-established companies, including:

• Nike, Inc. (U.S.)

• Adidas America, Inc. (U.S.)

• Skechers U.S.A., Inc. (U.S.)

• Under Armour, Inc. (U.S.)

• Wolverine World Wide, Inc. (U.S.)

• Caleres, Inc. (U.S.)

• Crocs, Inc. (U.S.)

• Deckers Outdoor Corporation (U.S.)

• Steven Madden, Ltd. (U.S.)

• Genesco Inc. (U.S.)

Latest Developments in North America Footwear Market

- In March 2024, Nike introduced a product innovation with the launch of the Air Max Dn, the first shoe to feature its new Dynamic Air technology. This development aims to enhance heel-to-toe transition, delivering a smooth and responsive feel with every step. The launch expands Nike’s classic footwear lineup with advanced performance features, appealing to both lifestyle and athletic consumers, and is expected to boost demand in the premium sportswear segment

- In December 2022, Asics unveiled the GEL-RESOLUTION 9, a high-performance tennis shoe designed to support dynamic footwork and lateral stability. This product innovation enhances kinetic stability during fast-paced matches, offering athletes improved performance on the court. By catering to professional and serious tennis players, Asics strengthens its position in the specialized athletic footwear market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.