North America Flotation Reagents Market

Market Size in USD Billion

CAGR :

%

USD

2.89 Billion

USD

3.75 Billion

2024

2032

USD

2.89 Billion

USD

3.75 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 3.75 Billion | |

|

|

|

|

Flotation Reagents Market Size

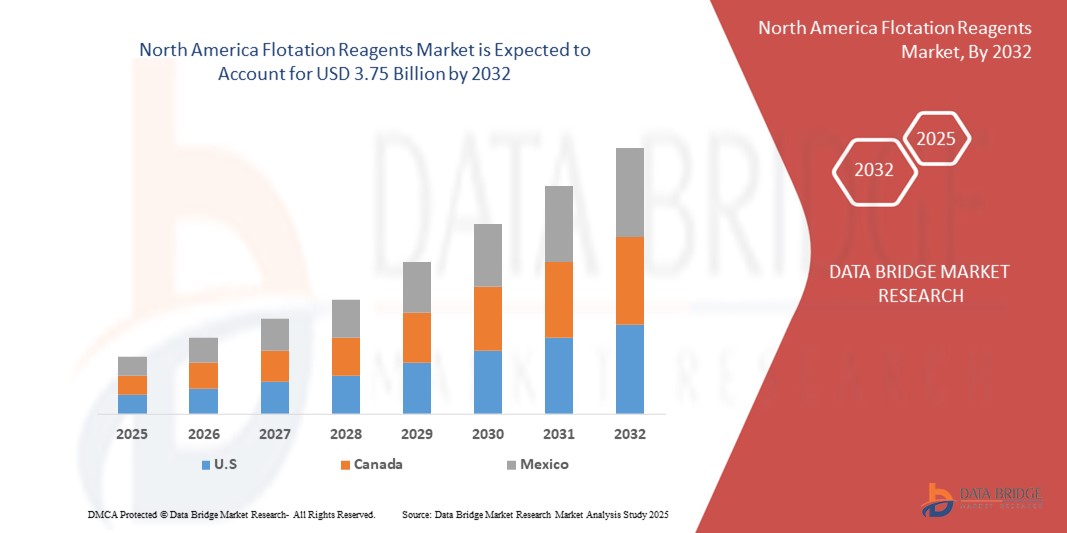

- The North America Flotation Reagents Market size was valued at USD 2.89 Billion in 2024 and is expected to reach USD 3.75 Billion by 2032, at a CAGR of 3.34% during the forecast period

- The market growth is primarily driven by increasing mining activities and rising demand for minerals such as copper, gold, and iron ore, particularly in the U.S. and Canada

- Additionally, growing investments in mineral processing infrastructure, stringent regulations promoting sustainable mining practices, and the development of eco-friendly reagents are enhancing the efficiency and environmental compatibility of flotation processes. These factors collectively contribute to the strong growth trajectory of the North America Flotation Reagents Market

Flotation Reagents Market Analysis

- Flotation reagents, including collectors, frothers, dispersants, activators, and depressants, play a vital role in enhancing the selectivity and recovery of valuable minerals in ore processing, significantly contributing to the efficiency of mining operations across various metal and non-metal industries

- The increasing demand for flotation reagents is primarily driven by the rising consumption of base and precious metals such as copper, zinc, and gold, coupled with expanding mining activities and mineral exploration across North America

- The U.S. holds the largest share in the North America flotation reagents market in 2025, supported by the presence of a mature mining sector, advancements in mineral processing technologies, and regulatory initiatives promoting sustainable and efficient mining practices

- Canada is expected to witness the fastest growth in the region during the forecast period, owing to growing investments in mining exploration, increasing production of critical minerals, and government support for eco-friendly mineral extraction technologies

- The collectors segment is projected to dominate the flotation reagents market with a market share of approximately 38.2% in 2025, attributed to their essential role in improving the hydrophobicity of target minerals and optimizing the separation process in sulfide and non-sulfide ores

Report Scope and Flotation Reagents Market Segmentation

|

Attributes |

Flotation Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Flotation Reagents Market Trends

“Sustainable Mining and Technological Advancements Transform Reagent Innovation”

- A major and growing trend in the North America Flotation Reagents Market is the increasing demand for eco-friendly and high-performance reagents, driven by stringent environmental regulations, rising sustainability goals, and the need to improve mineral recovery efficiency in complex ore bodies

- Manufacturers are focusing on developing biodegradable and non-toxic reagents to minimize the environmental footprint of mineral processing while maintaining or enhancing flotation performance, aligning with industry-wide shifts toward greener mining practices

- The use of customized reagent formulations is gaining popularity, particularly in dealing with low-grade ores and finely disseminated mineral deposits, allowing for improved selectivity and reduced reagent consumption

- Automation and digitalization of flotation circuits are supporting this trend by enabling real-time reagent dosage optimization and process control, thereby increasing operational efficiency and reducing waste

- Innovations in frother and collector chemistry, including nanotechnology and surfactant-based systems, are enhancing froth stability, mineral hydrophobicity, and overall recovery rates—paving the way for improved productivity in copper, gold, and rare earth element (REE) extraction.

Flotation Reagents Market Dynamics

Driver

“Rising Mining Activities and Demand for Strategic Minerals”

- The increasing demand for base and precious metals, such as copper, gold, zinc, and lithium, is a major driver of the North America Flotation Reagents Market, fueled by expanding infrastructure projects, renewable energy initiatives, and the growth of electric vehicles (EVs) and battery technologies

- Growing investments in mining exploration and mineral processing facilities across the U.S. and Canada are leading to a higher demand for efficient and selective flotation reagents to improve mineral recovery from low-grade and complex ores.

- The adoption of advanced reagent formulations that optimize recovery rates while reducing environmental impact aligns with industry goals for sustainable and cost-effective mining operations

- This heightened focus on resource security and domestic production of strategic minerals is expected to sustain market growth for flotation reagents in the region

Restraint/Challenge

“Stringent Environmental Regulations and Volatile Raw Material Prices”

- A significant challenge in the North America Flotation Reagents Market is the increasing pressure from stringent environmental regulations that limit the use of certain chemical formulations due to their ecological and health risks

- Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Canada's Environment and Climate Change Department are enforcing stricter standards on reagent toxicity, disposal, and emissions, necessitating costly reformulations and compliance measures

- In addition, the market faces volatility in raw material prices, particularly for petrochemical-based reagents, which can disrupt supply chains and affect pricing strategies for manufacturers

- For example, price fluctuations in key input chemicals like xanthates and dithiophosphates can impact production costs and profitability, especially for smaller reagent suppliers

- Overcoming these challenges requires sustained R&D in green chemistry, the development of bio-based reagents, and increased focus on circular economy principles to minimize environmental impact while maintaining reagent efficacy

Flotation Reagents Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Flotation Reagents market is segmented into Flocculant, Frothers, Collectors, Dispersants, Regulators, Solvent Extractors, Modifiers, Others. The Collectors segment dominates the largest market revenue share of 38.2% in 2025, owing to its essential role in enhancing the hydrophobic properties of target minerals, enabling efficient separation and recovery during flotation processes. Collectors are especially critical in the processing of sulfide ores, including copper, lead, and zinc, which are abundant across mining operations in the U.S. and Canada.

The Frothers segment is anticipated to witness the fastest growth rate of 7.5% from 2025 to 2032, driven by increased use in the flotation of finely ground ores and complex mineral mixtures. Frothers improve bubble formation and froth stability, enabling better recovery efficiency, particularly in operations utilizing automated and high-capacity flotation cells.

- By Application

On the basis of installation, the Flotation Reagents market is segmented into Mining, Mineral Processing, Water and Wastewater Treatment, Leaching and Abrasive Blasting, Explosives and Drilling, Others. The Mining segment held the largest market revenue share in 2025, driven by the robust demand for flotation reagents in base metal and precious metal extraction processes across North America. The resurgence of mining activities for copper, gold, and lithium, particularly in the U.S., continues to drive reagent consumption at large-scale mining sites.

The Water and Wastewater Treatment segment is expected to witness the fastest CAGR from 2025 to 2032, supported by growing environmental concerns and stricter discharge regulations that require efficient chemical treatment solutions. Flotation reagents are increasingly being used in dissolved air flotation (DAF) and other separation processes to remove contaminants and improve water quality in both municipal and industrial applications.

Flotation Reagents Market Regional Analysis

- U.S. dominates the Flotation Reagents Market with the largest revenue share of 40.01% in 2024, driven by the presence of a mature and technologically advanced mining sector, along with increasing demand for critical minerals such as lithium, copper, and rare earth elements

- The region’s strong focus on domestic mineral production, especially in the U.S. and Canada, is fueling the demand for high-performance flotation reagents used in mineral beneficiation and ore concentration processes

- Additionally, favorable government policies aimed at securing critical mineral supply chains, coupled with rising investments in green energy infrastructure, are promoting sustainable mining practices and the adoption of eco-friendly flotation reagents

- U.S. is also witnessing increased research and innovation in reagent formulation, particularly in bio-based and low-toxicity chemicals, driven by strict environmental regulations and growing industry emphasis on sustainability

- The presence of key players such as Solvay, Clariant, and Arkema in the region supports the rapid commercialization of novel flotation reagents, enhancing process efficiency, environmental compliance, and market penetration across mining-intensive regions like Nevada, Ontario, and British Columbia

U.S. Flotation Reagents Market Insight

The U.S. flotation reagents market captured the largest revenue share of 78% within North America in 2025, driven by a surge in domestic mining operations and the growing demand for strategic and industrial minerals, including copper, gold, lithium, and rare earth elements. In addition, the implementation of government initiatives to strengthen critical mineral supply chains and promote sustainable mining practices is encouraging the use of environmentally friendly and high-performance flotation reagents.

Flotation Reagents Market Share

The Flotation Reagents industry is primarily led by well-established companies, including:

- Solvay S.A. (Belgium)

- Clariant AG (Switzerland)

- Chevron Phillips Chemical Company LLC (U.S.)

- BASF SE (Germany)

- Arkema Group (France)

- Huntsman Corporation (U.S.)

- Cytec Industries Inc. (U.S.)

- Dow Inc. (U.S.)

- SNF Holding Company (U.S.)

- Kemira Oyj (Finland)

- ArrMaz Products, L.P. (U.S.)

- Ecolab Inc. (U.S.)

- Nalco Water (U.S.)

- Orica Limited (Australia)

- Nasaco International LLC (U.S.)

Latest Developments in North America Flotation Reagents Market

- In March 2024, Solvay S.A. introduced a new line of eco-friendly flotation reagents designed to enhance mineral recovery rates while reducing environmental impact. The reagents leverage bio-based surfactants and biodegradable components, addressing stricter environmental regulations and sustainability targets within the North American mining industry.

- In January 2024, Clariant AG launched an advanced collector reagent tailored for complex sulfide ores, improving selectivity and recovery efficiency in base metal flotation processes. This innovation supports the growing demand for optimized processing of low-grade and mixed ores in U.S. and Canadian mining operations.

- In November 2023, Nalco Water, a U.S.-based water treatment company, acquired Flottec for an undisclosed amount. This strategic acquisition aims to broaden Nalco Water's flotation product range and strengthen its commitment to serving the mining and metal production industry throughout the entire process.

- On November 8, 2022, BASF SE, a prominent worldwide chemical corporation, and Moleaer Inc., a global frontrunner in nanobubble technology, unveiled an exclusive collaboration. This strategic partnership will leverage their collective knowledge in mineral processing, hydrometallurgy, gas transfer, and nanobubble technology to create cutting-edge mining processes.

- In September 2021, Ecolab’s water and process management business, Nalco Water, announced the launch of Flotation 360, a solution combining collector and frother chemistry with technical expertise, predictive analytics, and digital innovation to achieve superior flotation optimization. This integrated approach aims to enhance mineral processing efficiency and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Flotation Reagents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Flotation Reagents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Flotation Reagents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.