North America Electronic Medical Records (EMR) Market Analysis and Insights

The growing demand for EMR across hospitals and various clinics around the globe is helping to boost overall market growth. The rising technological advancements in EMR software and services are also contributing to the market's growth. The major market players are highly focused on various new launches. In addition, the low maintenance and wider accessibility of EMRs also contribute to the rising market demand.

The North America electronic medical records (EMR) market is growing in the forecast year due to the rise in market players and the availability of various EMR brands in the market. Along with this, manufacturers are engaged in producing different products in the market. The increasing government funding in the healthcare sector is further boosting market growth. However, the high cost associated with EMR services and data safety and privacy security issues might hamper the growth of the North America electronic medical records (EMR) market in the forecast period.

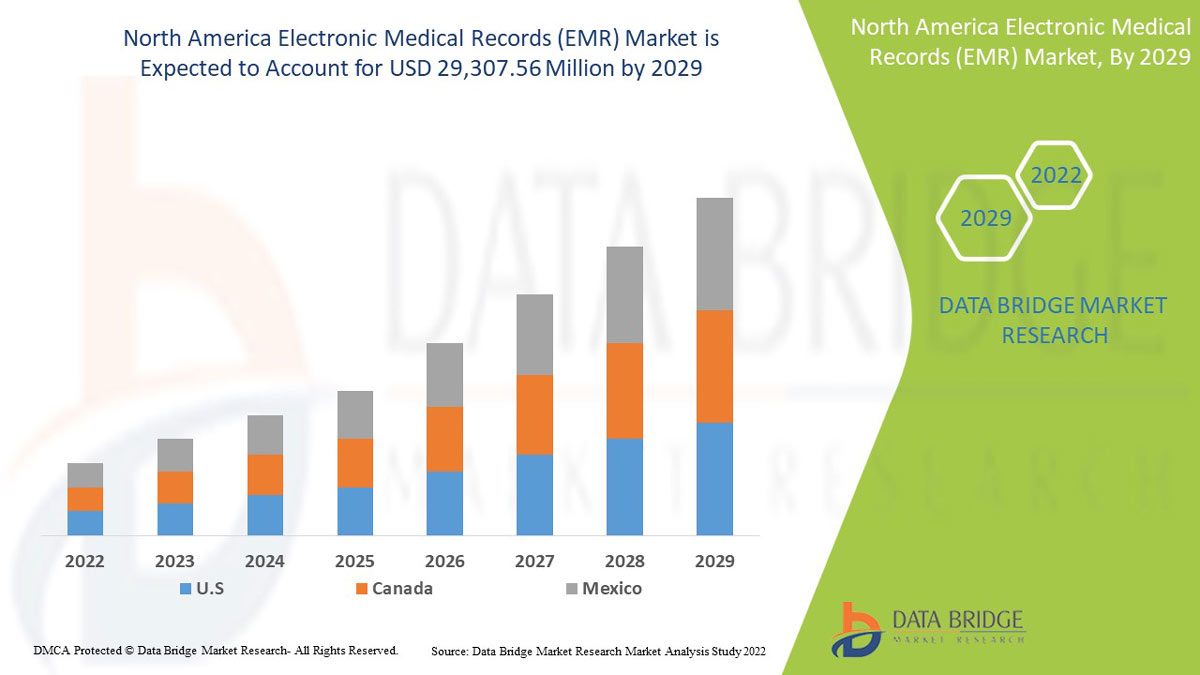

Data Bridge Market Research analyzes that the North America electronic medical records (EMR) market is expected to reach a value of USD 29,307.56 million by 2029, at a CAGR of 7.5% during the forecast period. Components account for the largest diagnostic type segment in the market due to rising technological advancements and low maintenance, and wider accessibility in North America. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020-2016) |

|

Quantitative Units |

Revenue in Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Component (Software and Services), Type (Traditional EMR, Speech Enabled EMR, Interoperable EMR, and Others), Application (Specialty Application and General Application), End User (Hospitals, General Physician Clinics, Specialized Clinics, Ambulatory Surgical Centres, and Others), Delivery Mode (Client Based Setups, Cloud Based Setups, and Hybrid Setups). |

|

Countries Covered |

U.S., Canada, and Mexico. |

|

Market Players Covered |

Epic Systems Corporation, Greenway Health LLC, NXGN Management, LLC, Experity, InSync Healthcare Solutions, InterSystems Corporation, eClinical Works, Oracle, Allscripts Healthcare, LLC, Athenahealth, Medical Information Technology Inc., Health Catalyst, Carecloud Inc., Medhost, CureMD Healthcare, Infor-Med Inc., PracticeSuite Inc., PatientNow, and WebPT among others. |

Market Definition

An electronic medical record (EMR) is a digital version of all the information you'd typically find in a provider's paper chart: medical history, diagnoses, medications, immunization dates, allergies, lab results, and doctor's notes. EMRs are online medical records of the standard medical and clinical data from one provider's office, mostly used by providers for diagnosis and treatment. Comprehensive and accurate documentation of a patient's medical history, tests, diagnosis, and treatment in EMRs ensures appropriate care throughout the provider's clinic.

EMRs are more than just a replacement for paper records. They effectively allow communication and coordination among healthcare team members for optimal patient care.

North America Electronic Medical Records (EMR) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising technological advancements

An electronic medical record is a digital representation of a patient's paper-based medical information. The goal of these electronic medical records is to improve the overall quality of care. Clinical, financial, demographic, and coded healthcare data are part of electronic medical records.

Thus, the rising technological advancement in the globe is expected to boost the growth of the North America electronic medical records (EMR) market.

- Low maintenance and wider accessibility

In general, EMR software captures all the data from the point-of-care and documents them, and serves as the best platform to infer whenever required. Health analyses are made to find the best practice method, the process can be altered to improve projects, new practice-level interventions can be created, and informative studies are prepared to assist educational purposes.

The wider use of healthcare information systems and the easier integration and sharing of patient clinical information can facilitate wider access to medical records. EMR can bring several advantages in terms of security solutions as well as improving the correctness and completeness of patient records, which is expected to boost the growth of the North America electronic medical records (EMR) market.

Restraint

- High cost associated with EHR service

The maintenance cost of on-premise solutions and the cost of EHR service is very high, which can hinder market growth in the coming years.

Financial obstacles prevent hospitals and doctors from adopting and implementing an EHR. These obstacles include adoption and implementation expenses, ongoing maintenance costs, revenue loss due to temporary loss of productivity, and revenue decreases. Investing in and setting up hardware and software, converting paper charts to electronic ones, and providing end users with training are all costs associated with adopting and implementing an EHR. Also, hardware must be replaced, and software must be upgraded on a regular basis which may hinder the market growth in the coming years.

Medical staff and providers' workflows are disrupted by EHR, which results in momentary productivity losses. As end users are still getting used to the new system, there will be a decrease in productivity, which could result in revenue losses which can hinder the market growth in the coming years.

Opportunity

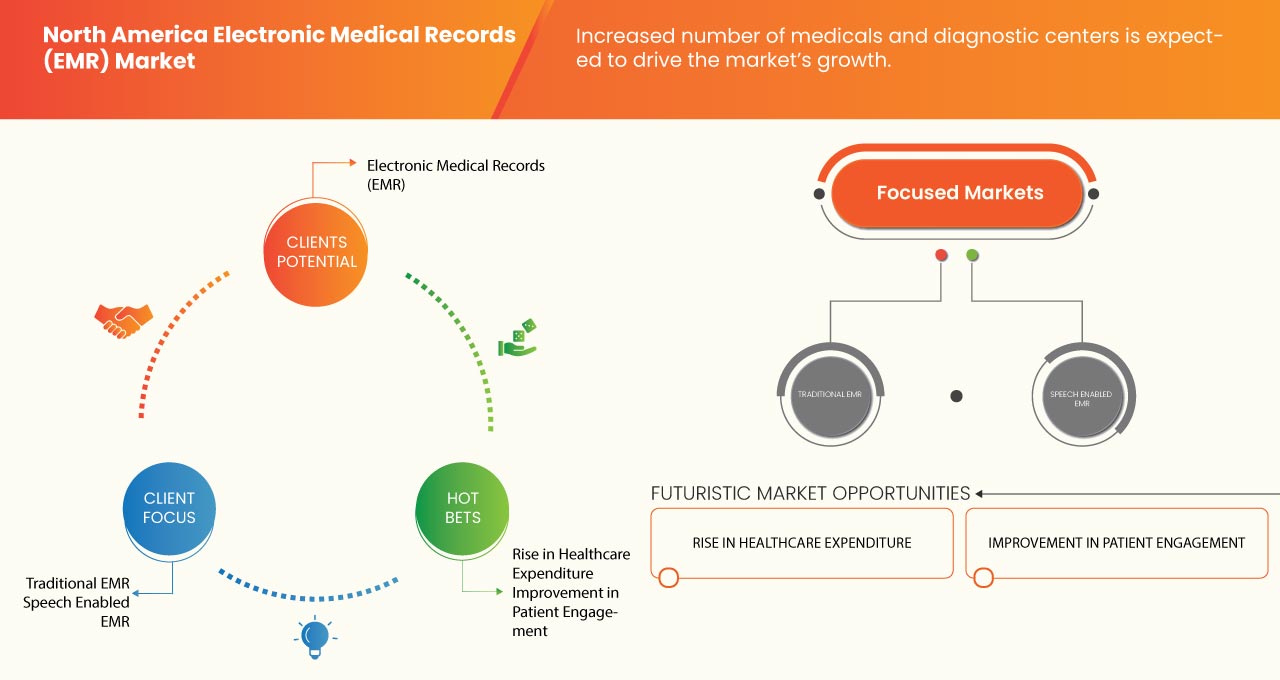

- Increased number of medicals & diagnostic centers

A digital version of a chart containing all the patient information stored in a computer is called electronic medical record (EMR). It can be managed and consulted by authorized clinicians and staff within one healthcare organization. The growing demand for healthcare facilities and awareness among people are the key factors in the increased number of medical and diagnostic centers.

Hence, the number of medical and testing laboratories is increasing vastly especially after the COVID-19 pandemic, and the electronic medical record industry is rising together to fulfill the demands in less time and error-free manner. Technological advancement has made the industry grow rapidly in all aspects.

Challenge

- Software incompatibility issues due to varying data standards

EMR software compatibility refers to a single EMR software's ability to communicate and share data with other EMR software and medical systems. The incompatibility issue is not too prevalent within the same organization. But, it becomes a significant stop gap for patient care once help from outside that organization is needed. For instance, incompatibility may arise when a patient is discharged from the hospital, and later, they need to seek out specialized care from a doctor or physical therapist who uses different EMR software.

The software used for EMR are different from organization to organization, and it causes incompatibility issues when the patient's recorded data is shared between them for further care. Hence, it is a major challenge for the EMR market where medical information is very important.

Post-COVID-19 Impact on North America Electronic Medical Records (EMR) Market

Healthcare firms are ramping up efforts for the treatment of COVID-19 patients. However, with the surge in the number of cases, it is challenging for hospitals to manage patient information precisely. Healthcare IT vendors are thriving to provide healthcare organizations with tools to manage a case, analyze the information, as well as assess the patients remotely. In light of this pandemic, electronic heath record/electronic medical record (EHR-EMR) vendors are trying to augment their existing systems for smooth functionality and coping with this crisis.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technological advancement in the EMR market.

Recent Developments

- In October 2022, Greenway Health LLC, a leading health information technology services provider, announced its newest partnership with Associates in Resource Management (ARM), a one-source partner for Rural Health Centers (RHC), Federal Qualified Health Centers (FQHC), and Private Practices in the states of Kentucky, Tennessee, and Alabama.

- In September 2022, Epic Systems Corporation announced the release of its Life Sciences program, expanding its work to bring together the disconnected parts of healthcare. The program is built to help providers, pharmaceutical companies, and medical device manufacturers recruit research participants, expand clinical trial access to underrepresented communities, and speed up the development of new therapies.

North America Electronic Medical Records (EMR) Market Scope

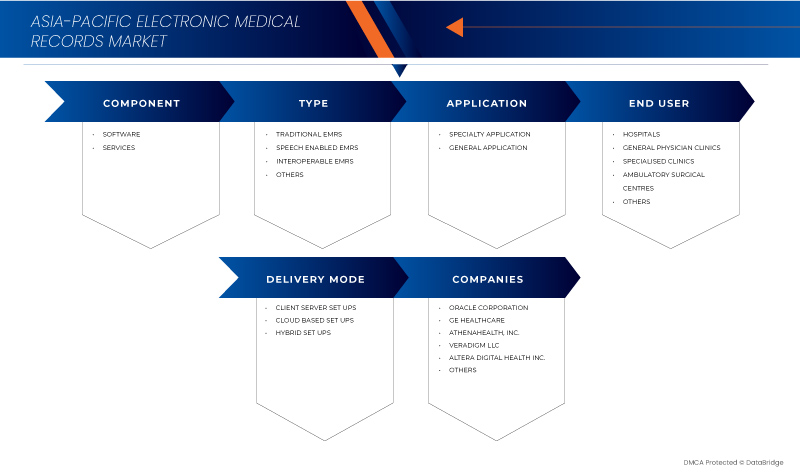

North America electronic medical records (EMR) market is segmented into component, type, application, end user, and delivery mode. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY COMPONENT

- Software

- Services

On the basis of component, the market is segmented into software and services.

BY TYPE

- Traditional EMR

- Speech enabled EMR

- Interoperable EMR

- Others

On the basis of type, the market is segmented into traditional EMR, speech enabled EMR, interoperable EMR, and others.

BY APPLICATION

- Specialty application

- General application

On the basis of application, the market is segmented into specialty application and general application.

BY END USER

- Hospitals

- General physician clinics

- Specialized clinics

- Ambulatory surgical centers

- Others

On the basis of end user, the market is segmented into hospitals, general physician clinics, specialized clinics, ambulatory surgical centers, and others.

BY DELIVERY MODE

- Client Based Setups

- Cloud Based Setups

- Hybrid Setups

On the basis of delivery mode, the market is segmented into client based setups, cloud based setups, and hybrid setups.

North America Electronic Medical Records (EMR) Market Regional Analysis/Insights

The North America electronic medical records (EMR) market is analyzed, and market size information is provided by component, type, application, end user, and delivery mode.

The countries covered in this market report U.S., Canada, and Mexico.

- In 2022, U.S. dominated North America due to the presence of key market players in the largest consumer market with high GDP and due to its latest advanced cancer diagnostic technology and inventions in electronic medical records (EMR).

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electronic Medical Records (EMR) Market Share Analysis

North America electronic medical records (EMR) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus on the North America Electronic medical records (EMR) market.

Some of the major players operating in the North America electronic medical records (EMR) market are Epic Systems Corporation, Greenway Health LLC, NXGN Management, LLC, Experity, InSync Healthcare Solutions, InterSystems Corporation, eClinical Works, Oracle, Allscripts Healthcare, LLC, Athenahealth, Medical Information Technology Inc., Health Catalyst, Carecloud Inc., Medhost, CureMD Healthcare, Infor-Med Inc., PracticeSuite Inc., PatientNow, and WebPT among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPONENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING TECHNOLOGICAL ADVANCEMENTS

6.1.2 LOW MAINTENANCE AND WIDER ACCESSIBILITY

6.1.3 GROWING INVESTMENT IN HEALTHCARE BY THE GOVERNMENT AND PRIVATE SECTOR

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EHR SERVICE

6.2.2 DATA SAFETY ISSUES

6.3 OPPORTUNITIES

6.3.1 INCREASED NUMBER OF MEDICALS & DIAGNOSTIC CENTRES

6.3.2 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 SOFTWARE INCOMPATIBILITY ISSUES DUE TO VARYING DATA STANDARDS

6.4.2 INSUFFICIENT INFRASTRUCTURE

6.4.3 LACK OF SKILLED PROFESSIONALS

7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE

7.2.1 INTEROPERABLE EMR

7.2.2 TRADITIONAL EMR

7.2.3 SPEECH ENABLED EMR

7.2.4 OTHERS

7.3 SERVICES

8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE

8.1 OVERVIEW

8.1.1 INTEROPERABLE EMR

8.1.2 TRADITIONAL EMR

8.1.3 SPEECH ENABLED EMR

8.1.4 OTHERS

9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SPECIALTY APPLICATION

9.2.1 CARDIOLOGY

9.2.1.1 SOFTWARE

9.2.1.2 SERVICES

9.2.2 OBSTERICS & GYNECOLOGY

9.2.2.1 SOFTWARE

9.2.2.2 SERVICES

9.2.3 DERMATOLOGY

9.2.3.1 SOFTWARE

9.2.3.2 SERVICES

9.2.4 ONCOLOGY

9.2.4.1 SOFTWARE

9.2.4.2 SERVICES

9.2.5 NEUROLOGY

9.2.5.1 SOFTWARE

9.2.5.2 SERVICES

9.2.6 RADIOLOGY

9.2.6.1 SOFTWARE

9.2.6.2 SERVICES

9.2.7 OTHERS

9.3 GENERAL APPLICATION

9.3.1 SOFTWARE

9.3.2 SERVICES

10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 SMALL AND MEDIUM SIZED HOSPITALS

10.2.2 LARGE HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 SPECIALIZED CLINICS

10.5 GENERAL PHYSICIAN CLINICS

10.6 OTHERS

11 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE

11.1 OVERVIEW

11.2 CLOUD BASED SETUPS

11.3 HYBRID SETUPS

11.4 CLIENT BASED SETUPS

12 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EPIC SYSTEMS CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ORACLE CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ECLINICALWORKS

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 ATHENAHEALTH

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 INTERSYSTEMS CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALLSCRIPTS HEALTHCARE, LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CARECLOUD, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CUREMD HEALTHCARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EXPERITY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GREENWAY HEALTH LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 HEALTH CATALYST

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 INFOR-MED INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 INSYNC HEALTHCARE SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDHOST

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MEDICAL INFORMATION TECHNOLOGY,INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NXGN MANAGEMENT, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PATIENTNOW

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PRACTICESUITE INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 WEBPT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 U.S. SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 U.S. HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 47 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 CANADA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CANADA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 CANADA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 MEXICO HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 11 THE GROWING TECHNOLOGICAL ADVANCEMENTS IN EMR SOFTWARES AND RISING MEDICALS AND DIAGNOSTIC CENTRES ARE EXPECTED TO DRIVE THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

FIGURE 14 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2021

FIGURE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021

FIGURE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPONENT (2022-2029)

FIGURE 39 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.