North America Electric Vehicle Thermal Management System Market Analysis and Size

Electric vehicles are a promising renewable substitute to gasoline power-based vehicles to protect the environment. Many governments are taking initiatives to promote electric vehicles and are providing tax rebates and redemption. The rise in the electric vehicles market is because the technology is upgrading at a fast rate, making the demand for electric vehicle thermal management systems in the market. The Asia-Pacific electric vehicle thermal management system market is growing rapidly due to the rise in demand for electric vehicles. The companies are even launching new products to gain a larger market share.

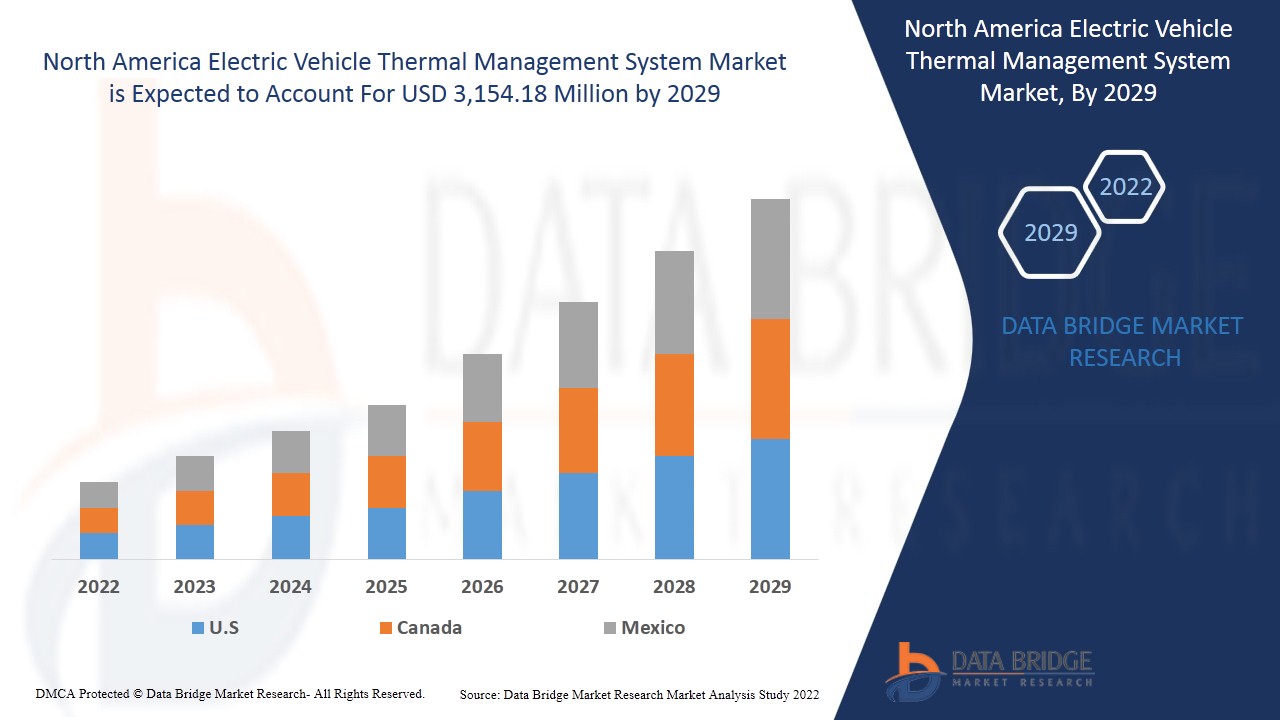

Data Bridge Market Research analyses that the North America electric vehicle thermal management system market is expected to reach the value of USD 3,154.18 million by 2029, at a CAGR of 23.9% during the forecast period. "BEV" accounts for the most prominent propulsion type segment as they are energy efficient, turning 80% of their energy input into propelling the car, and they have a regenerative braking system that collects energy and returns it to the battery when a car stops. The North America electric vehicle thermal management system market report also covers pricing analysis, patent analysis, and technological advancements in depth.

North America Electric Vehicle Thermal Management System Market Definition

The thermal management system in an electric vehicle is the solution that helps in managing the heat generated during the electrochemical processes occurring in cells, allowing the battery to operate safely and efficiently. Effective thermal management systems are required in electric vehicles to keep battery temperatures in the correct range and prevent the temperature from fluctuating inside the battery pack. Thus, thermal management systems play a vital role in the control of the battery thermal behavior.

The adoption of electric vehicles is rising globally due to their zero-emission and high tank-to-wheels efficiency. This has necessitated a proper battery management system to reach maximum performance when operating under various conditions. In addition, the rising trend towards increasing charging rates, which would allow faster charging and longer trips, has raised the demand for more efficient thermal management in EVs.

|

Report Metric |

Details |

|

Base Year |

2021 |

|

Forecast Period |

2022 - 2029 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Propulsion Type (BEV, PHEV, HEV, and FCV), Technology (Active and Passive), Battery Type (Conventional and Solid-State), Battery Capacity (30-60 Kwh, 60-90 Kwh, Below 30 Kwh, and Above 90 Kwh), Vehicle Type (Passenger and Commercial), System Type (Battery Thermal Management, HVAC, Powertrain and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

MAHLE GmbH, Dana Limited, Hanon Systems, Marelli Holdings Co., Ltd., Robert Bosch GmbH, BorgWarner Inc. Continental AG, VOSS Automotive GmbH, Kendrion N.V., LG Chem, NORMA Group, MODINE MANUFACTURING COMPANY, GENTHERM, A. KAYSER AUTOMOTIVE SYSTEMS GmbH, Ymer Technology, Grayson, Valeo, DENSO Corporation, among others |

North America Electric Vehicle Thermal Management System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

- Increasing Demand for Electric Vehicle

The automotive industry has been showing enormous growth due to the rising demand for luxurious electric vehicles. Some of the factors driving the sales of electric vehicles include stringent government regulations towards vehicles emissions, increasing demand for fuel-efficient, high performance, and low emission vehicles.

- Incentives & Subsidies by the Government for Electric Vehicles

An increase in pollution and scarcity of resources, particularly in the automotive sector, has enabled the government to take environmental protection actions, leading the shift of trends in the automotive industry from normal motorized vehicles to electric hybrid vehicles for environmental protection. Many national governments have taken action for providing incentives over the adoption of electric vehicles rather than normal vehicles, such as providing purchase rebates, tax exemptions, tax credits, and a few others.

- Rising Demand for Thermal Cooling Solution

The rise in the demand for electric vehicles has led to the advancement in battery making to deliver more power and require less frequent charges, but with this, there is also a need for an effective cooling system to keep the battery safe from overheating. Discharging of the battery generates heat; the faster the battery is discharged, the more heat is generated. This heat might lead to the failure of devices. So to keep the battery and vehicle safe, the need for a proper thermal management system has become necessary to raise its demand in the market.

- High Upfront Cost

Electric vehicles are best suitable for transportation as well as they will have less impact on the environment as they would help control the air pollution. However, the initial cost of electric vehicles is higher as compared to that of gasoline-powered engine vehicles because it includes technologically upgraded components that have no harm to the environment. In contrast, the operational costs of electric vehicles are cheaper than gasoline-powered engine vehicles. Thus, the initial upfront cost of electric vehicles may restrict the market's growth.

- Battery Performance in Different Environmental Conditions

The battery is an electrochemical system that involves reactions and the transportation of ions and electrons. The battery's charging/discharging rate or degradation mechanism is affected by the change in the temperature. For instance, a high environmental temperature allows a relatively high charging rate, but it also increases the SEI (solid electrolyte interface) growth rate, which shortens the battery's lifespan. While on the other hand, low environmental temperature slows down SEI growth, but this promotes lithium plating. As a result, batteries can be optimized for either high or low temperatures, but maintaining the same performance at different temperatures can be problematic. Thus these factors may act as a major challenge for the North America electric vehicle thermal management system market.

Post COVID-19 Impact on North America Electric Vehicle Thermal Management System Market

COVID-19 created a major impact on the electric vehicle thermal management system market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the electric vehicle thermal management system market is rising due to the government policies designed to support EV growth. Also, increased concerns about sustainability and environmental issues are increasing the demand for electric vehicles in the market. Thus the government regulations and incentives will likely propel the market growth. However, factors such as the high initial cost of the electric vehicle and complexity in designing the thermal management solution are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the electric vehicle thermal management system. With this, the companies will bring advanced and accurate controllers to the market. In addition, the government initiatives for the adoption of electric vehicle has led to the market's growth

Recent Development

- In February, Robert Bosch GmbH announced plans to invest in creating new production space and the necessary clean-room facilities between now and 2025. This investment is more than a quarter of a billion euros. Thus through this investment, the company will be able to increase production

North America Electric Vehicle Thermal Management System Market Scope

The North America electric vehicle thermal management system market is segmented on the basis of propulsion type, technology, battery type, battery capacity, vehicle type, and system type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Propulsion Type

- BEV

- PHEV

- HEV

- FCV

On the basis of propulsion type, the North America electric vehicle thermal management system market is segmented into BEV, PHEV, HEV, and FCV.

Technology

- Active

- Passive

On the basis of technology, the North America electric vehicle thermal management system market has been segmented into active and passive.

Battery Type

- Conventional

- Solid-State

On the basis of battery type, the North America electric vehicle thermal management system market has been segmented into conventional and solid-state.

Battery Capacity

- 30-60 Kwh

- 60-90 Kwh

- Below 30 Kwh

- Above 90 Kwh

On the basis of battery capacity, the North America electric vehicle thermal management system market has been segmented into 30-60 kWh, 60-90 kWh, below 30 kWh, and above 90 kWh.

Vehicle Type

- Passenger

- Commercial

On the basis of vehicle type, the North America electric vehicle thermal management system market has been segmented into passenger and commercial.

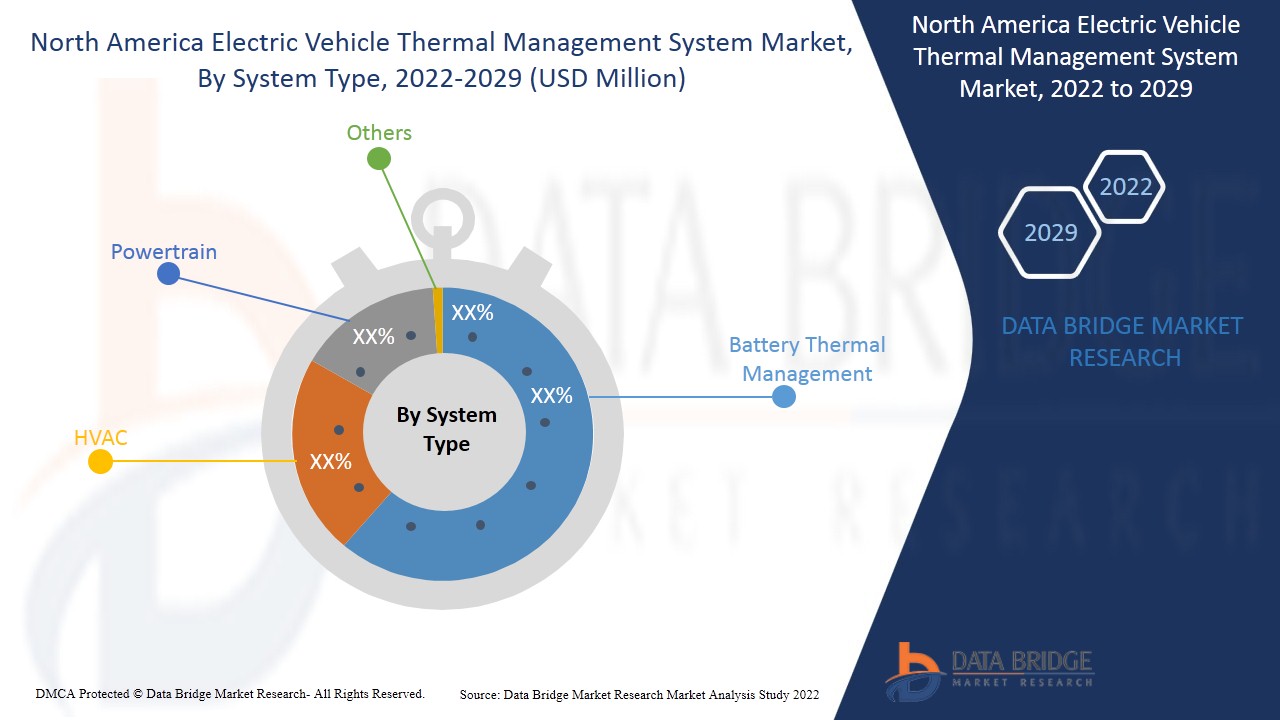

System Type

- Battery Thermal Management

- HVAC

- Powertrain

- Others

On the basis of system type, the North America electric vehicle thermal management system market has been segmented into battery thermal management, HVAC, powertrain, and others.

North America Electric Vehicle Thermal Management System Market Regional Analysis/Insights

North America electric vehicle thermal management system market is analyzed, and market size insights and trends are provided by country, propulsion type, technology, battery type, battery capacity, vehicle type, and system type as referenced above.

The countries covered in the North America electric vehicle thermal management system market report are the U.S., Canada, and Mexico.

The U.S. is likely to be the fastest-growing country in the North America electric vehicle thermal management system market. The rising infrastructure, commercial, and industrial developments in emerging countries such as Canada and Mexico are credited with the market's dominance. The U.S is expected to dominate the North American region due to the high manufacturing and outsourced manufacturing capacities of battery products and high adoption of electric vehicles.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electric Vehicle Thermal Management System Market Share Analysis

The North America electric vehicle thermal management system market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points are only related to the companies' focus on the North America electric vehicle thermal management system market.

Some of the Major Players Operating in the North America Electric Vehicle Thermal Management System Market are:

- MAHLE GmbH

- Valeo

- Dana Limited

- Hanon Systems

- Marelli Holdings Co., Ltd.

- Robert Bosch GmbH

- BorgWarner Inc.

- Continental AG

- VOSS Automotive GmbH

- Kendrion N.V.

- LG Chem

- DENSO Corporation

- NORMA Group

- MODINE MANUFACTURING COMPANY

- GENTHERM

- A. KAYSER AUTOMOTIVE SYSTEMS GmbH

- Ymer Technology

- Grayson

Research Methodology: North America Electric Vehicle Thermal Management System Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The stage includes the obtainment of market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, North America versus Regional and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE CHALLENGE MATRIX MARKET

2.9 MULTIVARIATE MODELING

2.1 PROPULSION TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BATTERY COOLING LINES FOR ELECTRIC AND HYBRID VEHICLES (MATERIAL)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR ELECTRIC VEHICLES

5.1.3 INCREASING ENVIRONMENTAL CONCERNS

5.1.4 RISING DEMAND FOR THERMAL COOLING SOLUTIONS

5.1.5 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT COST

5.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

5.3.2 ADOPTION OF NEW TECHNOLOGIES IN LITHIUM-ION BATTERIES

5.4 CHALLENGES

5.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

5.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

6 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE

6.1 OVERVIEW

6.2 BEV

6.3 PHEV

6.4 HEV

6.5 FCV

7 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE

7.3 PASSIVE

8 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 SOLID-STATE

9 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

9.1 OVERVIEW

9.2 30-60 KWH

9.3 60-90 KWH

9.4 BELOW 30 KWH

9.5 ABOVE 90 KWH

10 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER

10.2.1 BEV

10.2.2 PHEV

10.2.3 HEV

10.2.4 FCV

10.3 COMMERCIAL

10.3.1 BEV

10.3.2 PHEV

10.3.3 HEV

10.3.4 FCV

11 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE

11.1 OVERVIEW

11.2 BATTERY THERMAL MANAGEMENT SYSTEM

11.3 HVAC

11.4 POWERTRAIN

11.5 OTHERS

12 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MAHLE GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DANA LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 HANON SYSTEMS

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MARELLI HOLDINGS CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 A. KAYSER AUTOMOTIVE SYSTEMS GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BORGWARNER INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTINENTAL AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 DENSO CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 GENTHERM

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 GRAYSON

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KENDRION N.V.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LG CHEM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 NORMA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH GMBH

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 VOSS AUTOMOTIVE GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 YMER TECHNOLOGY

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 2 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PHEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HEV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA FCV IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ACTIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PASSIVE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CONVENTIONAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SOLID-STATE IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA 30-60 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA 60-90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BELOW 30 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ABOVE 90 KWH IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 NORTH AMERICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BATTERY THERMAL MANAGEMENT SYSTEM IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HVAC IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 NORTH AMERICA POWERTRAIN IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 NORTH AMERICA OTHERS IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 28 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 41 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 45 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 49 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 54 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2020-2029 (USD MILLION)

TABLE 57 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO PASSENGER IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 MEXICO COMMERCIAL IN ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 BEV PROPULSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 14 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE 2021

FIGURE 15 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 16 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY TYPE, 2021

FIGURE 17 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2021

FIGURE 18 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY SYSTEM TYPE, 2021

FIGURE 20 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION TYPE (2022-2029)

FIGURE 25 NORTH AMERICA ELECTRIC VEHICLE THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.