North America Electric Vehicle Lithium-Ion Battery Recycling Market, By Process (Pyrometallurgical, Hydrometallurgical, Others), Application (Passenger Car, Commercial Vehicle), Country (U.S., Canada, Mexico), Industry Trends and Forecast To 2029

Market Analysis and Insights: North America Electric Vehicle Lithium-Ion Battery Recycling Market

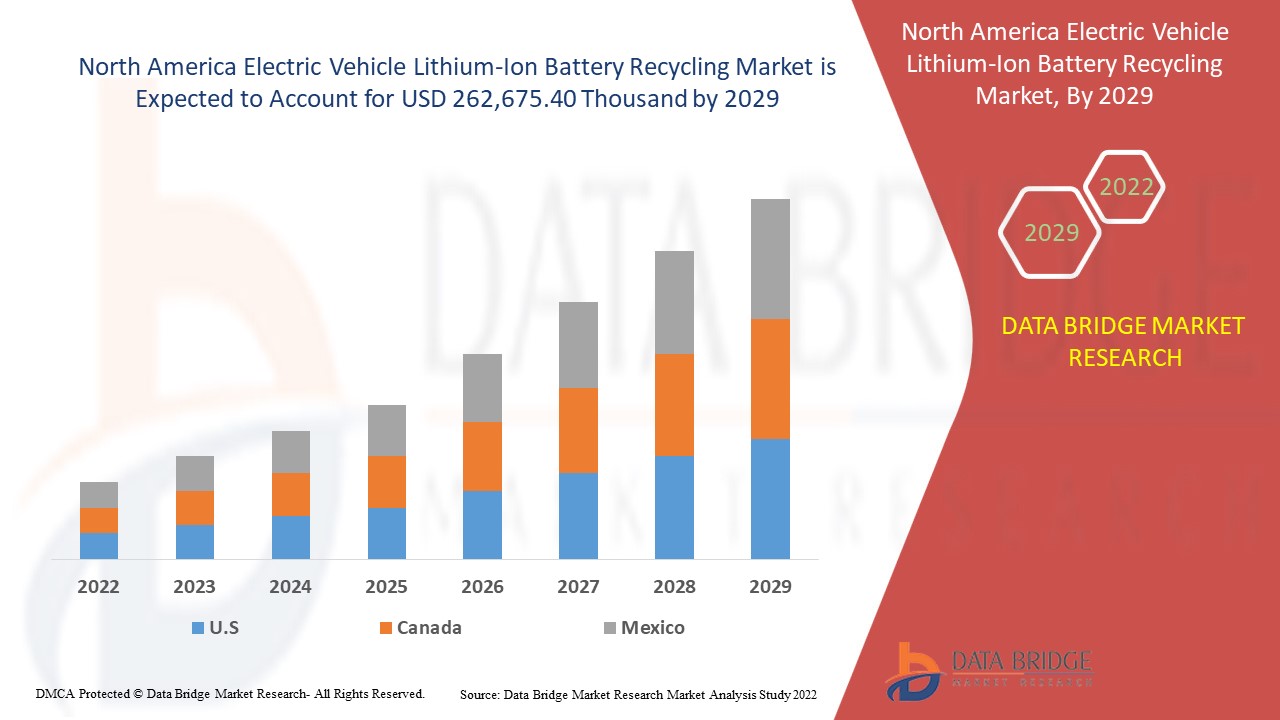

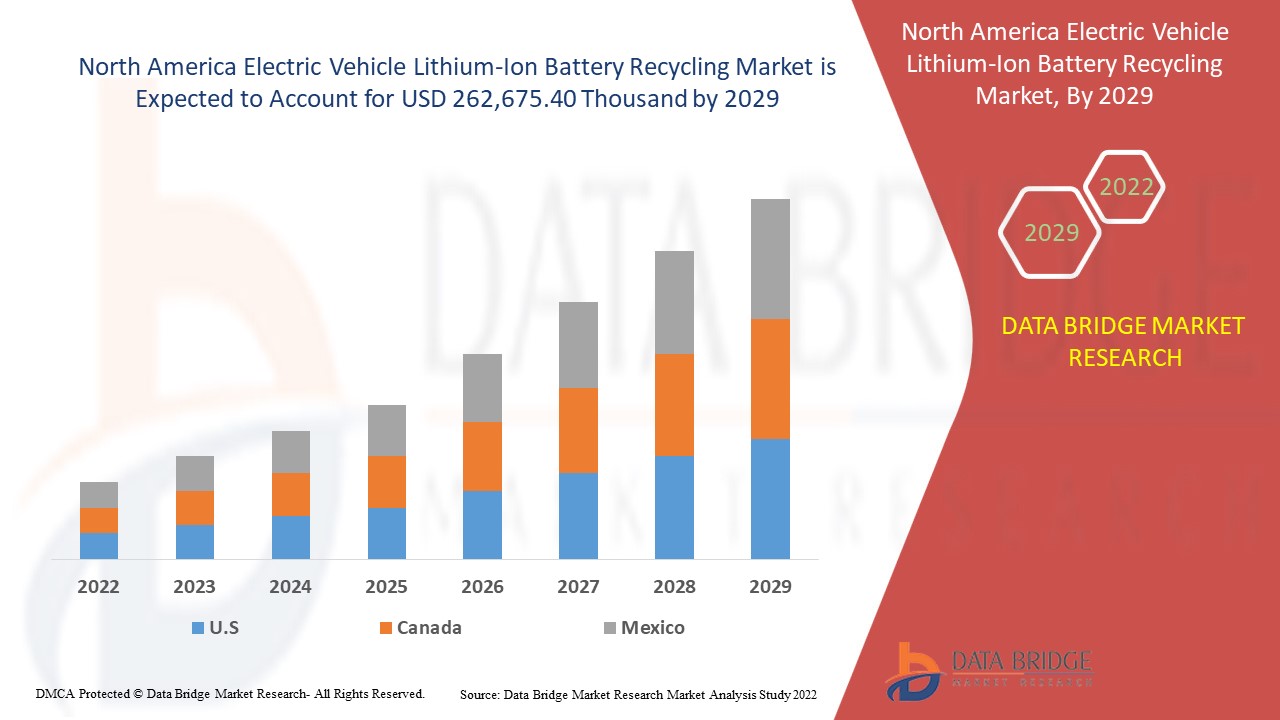

North America electric vehicle lithium-ion battery recycling market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing at a CAGR of 21.2% in the forecast period of 2022 to 2029 and is expected to reach USD 262,675.40 Thousand by 2029.

Lithium-ion (Li-ion) batteries are rechargeable batteries used in electric vehicles. Methods used for the recycling of lithium-ion batteries are pyrometallurgical and hydrometallurgical.

The number of electric vehicles is increasing due to improved battery technologies and low maintenance requirements for these lithium-ion batteries. Moreover, the improvements in battery recycling techniques and government economic stimulus policies in battery recycling methods are expected to boost the electric vehicle lithium-ion battery recycling market. On the other hand, the lack of awareness among the people for electric vehicle battery recycling may restrain the growth of the North America electric vehicle lithium-ion battery recycling market.

Growing environmental awareness and conservation of natural resources is providing opportunities in the electric vehicle lithium-ion battery recycling market. However, accessible installation of batteries while utilizing minimum space may act as a challenge to the North America electric vehicle lithium-ion battery recycling market.

This North America electric vehicle lithium-ion battery recycling market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

North America Electric Vehicle Lithium-Ion Battery Recycling Market Scope and Market Size

North America electric vehicle lithium-ion battery recycling market is segmented on the basis of process and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of process, the North America electric vehicle lithium-ion battery recycling market is segmented into pyrometallurgical, hydrometallurgical, and others. In 2022, the pyrometallurgical segment is expected to dominate the North America electric vehicle lithium-ion battery recycling market as the pyrometallurgical process allows a short-process chain and less environmental impact, thereby increasing its demand. In North America, the demand for pyrometallurgical segment is increasing due to the low capital cost of the process.

- On the basis of application, the North America electric vehicle lithium-ion battery recycling market is segmented into passenger car and commercial vehicle. In 2022, the passenger car segment is expected to dominate the electric vehicle lithium-ion battery recycling market due to prominent electric vehicle technologies that contribute to reducing air pollution.

North America Electric Vehicle Lithium-Ion Battery Recycling Market Country Level Analysis

North America market is analyzed, and market size information is provided by process and application.

The countries covered in the North America electric vehicle lithium-ion battery recycling market report are the U.S., Canada, and Mexico. The U.S. is expected to dominate the North America electric vehicle lithium-ion battery recycling market due to the rise in the adoption of zero-emission electric vehicles. Mexico is expected to dominate the North America electric vehicle lithium-ion battery recycling market due to the growing demand for low emission commuting and governments supporting policies. Canada is expected to dominate the North America electric vehicle lithium-ion battery recycling market due to technological advancements and the mass production of electric vehicle batteries.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growth in the North America electric vehicle lithium-ion battery recycling market

North America electric vehicle lithium-ion battery recycling market t also provides you with detailed market analysis for every country's growth in the installed base of different kinds of products for the market, the impact of technology using lifeline curves and changes in infant formula regulatory scenarios, and their impact on the electric vehicle lithium-ion battery recycling market. The data is available for the historical period 2010 to 2020.

Competitive Landscape and North America electric vehicle lithium-ion battery recycling market Share Analysis

North America electric vehicle lithium-ion battery recycling market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the North America electric vehicle lithium-ion battery recycling market

Some of the major players covered in the report are Umicore, Retrieve technologies, American Manganese Inc., Li-Cycle corps, Neometals Ltd., Glencore, Brunp recycle technology Co.Ltd. (A subsidiary of CATL), Tata Chemicals Ltd., Lithion Recycling Inc., ECOBAT, GanfengLithium, among others

DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In March 2021, American Manganese Inc., with its patented lithium-ion battery cathode recycling process - RecycLiCo signed a Memorandum of Understanding with Italvolt. They will together develop a commercial recycling plant alongside Italvolt's planned Gigafactory in Scarmagno, Italy

SKU-