North America Electric Vehicle Charging Stations Market

Market Size in USD Billion

CAGR :

%

USD

630.07 Billion

USD

14,193.29 Billion

2022

2030

USD

630.07 Billion

USD

14,193.29 Billion

2022

2030

| 2023 –2030 | |

| USD 630.07 Billion | |

| USD 14,193.29 Billion | |

|

|

|

North America Electric Vehicle Charging Stations Market Analysis and Size

The market for electronic charging is expanding along with the demand for electric vehicles (EVs). The cost of putting in the charging stations has been covered by governments from all over the world. Governmental agencies are likely to actively support the level 3 charging station market during the forecast period. Electric vehicles (EVs) are becoming more and more popular on a global scale. The popularity of sustainable fuel sources will also support the growth trajectory of electric vehicle charging stations. As more electric charging stations and low-emission vehicles are used, residential buildings close to transportation hubs are at higher risk from vehicle emissions linked to cardiac and respiratory issues.

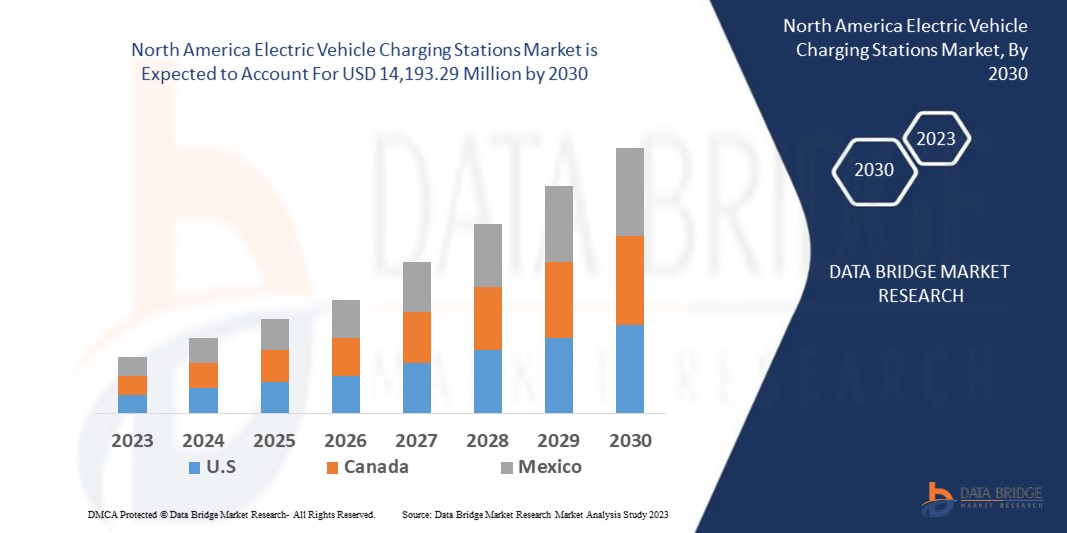

Data Bridge Market Research analyses that the electric vehicle charging stations market, valued at USD 6,30.07 million in 2022, will reach USD 14,193.29 million by 2030, growing at a CAGR of 47.60% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

North America Electric Vehicle Charging Stations Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Charging Stations (AC Charging/ Normal Charging Station, DC Charging/ Super Charging Station, Others), Charger Type (Portable Charger, Fixed Charger), Charging Type (Off Board Top Down Pantograph, On Board Bottom Up Pantograph, Charging Via Connector), Charging Services (EV Charging Services, Battery Swapping Service), Mode Of Charging (Plug In Charging, Wireless Charging), Connectivity Type (Non-Connected Charging Stations, Smart Connected Charging Stations, Pantograph, Connectors, Combined Charging Systems, Chademo, Others), Charging Infrastructure (Normal Charging, Type 2, CCS, Chademo, Tesla SC, GB/T Fast), Vehicle Type (Passengers Cars, Commercial Cars, Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicles (PHEV), Two Wheelers and Scooters, Hybrid Electric Vehicles (HEV)), Installation Type (Individual Houses, Commercial, Apartments, Others), Connecting Phase (Single Phase, Three Phase), Technology (Level 1, Level 2, Level 3), Operations (Mode 1, Mode 2, Mode 3, Mode 4), Components (Hardware, Software, Services), Application (Public, Semi-Public, Private), End User (Residential, Commercial) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

ChargePoint, Inc. (U.S.), ABB (Switzerland), Webasto Group (Germany), Shell International B.V. (Netherlands), Schneider Electric (France), Renault Group (France), Phihong USA Corp. (U.S.), EV Safe Charge Inc. (U.S.), Tesla (U.S.), Mercedes-Benz Group AG. (Germany), Siemens (Germany), TATA Power (India), Magenta EV Solutions Private Limited (India), Fortum (Finland), Volttic EV Charging (India), Ather Energy (India), Infineon Technologies AG (Germany), Amara Raja Group (India), Exicom (India), Griden Technologies Pvt. Ltd. (India) |

|

Market Opportunities |

|

Market Definition

Electric cars, community electric vehicles, and plug-in hybrids can all be recharged at an apparatus known as an electric vehicle charging station. Smart meters, cellular functionality, and network connectivity are available in contrast to some charging stations, which have more elementary features. Under the name "electric vehicle supply equipment" (EVSE), electric utility companies or private businesses offer charging stations in retail shopping areas or open parking lots. The connectors offered by these charging stations are distinctive and meet the requirements of different electrical connector standards. Plug-in electric vehicles (EVs), such as neighborhood EVs, electric cars, and hybrids, receive power from electric vehicle charging stations, also referred to as electric vehicle supply equipment (EVSE). The facility meter, software, energy conversion system, and energy controller are all wired into the power grid.

Electric Vehicle Charging Stations Market Dynamics

Drivers

- Governmental initiatives are escalating the market

Governments all over the world are taking action to reduce carbon footprints by encouraging the use of electric bikes, vehicles, and bicycles in response to the growing awareness of the negative effects of operating fossil fuel-powered vehicles. Additionally, forcing automakers to invest in the development of electric vehicles will motivate them to reduce carbon emissions from burning diesel fuel and address greenhouse gas emissions. To promote the purchase of electric vehicles, tax credits, and other financial incentives are being offered. Electric vehicles are also exempt from highway tolls in a select few countries. The Indian government, for instance, intends to reduce the GST on them from 12% to 5% to encourage the use of electric vehicles. To encourage the development and purchase of electric vehicles, the government provides tax credits, subsidies, and incentives. As a result, electric vehicles become more necessary.

- The demand for EVs is being driven by rising fuel costs

Around the world, the price of fuel has been rising, with gasoline seeing the biggest increases. Diesel is significantly more expensive, typically costing $5.05 per gallon. A liter of gasoline could cost as much as INR 110.04 ($1.47) in India. An electric vehicle's battery has a lifespan of at least eight years, and the monthly cost of charging is significantly lower than the monthly cost of fuel. Fuel prices in India are already high due to high taxes, and they could go up even more. Due to price increases, industrial fuel vehicles also disrupt the supply. India's import costs are also significantly increased by oil imports. The government has already started promoting e-transport by gradually replacing fossil fuel-powered public vehicles in some cities with electric vehicles (EVs). As a result of the rise in fuel prices, it is anticipated that more people will switch to EVs, which will increase the demand for electric vehicle charging stations.

Opportunities

- Increasing use of EVs has generated profitable growth opportunities

Through their effectiveness and environmental friendliness, electric vehicles have gained popularity recently. This has increased the demand for fast-charging infrastructure and opened up lucrative market opportunities. For instance, there were 2.1 million electric vehicle charging stations installed globally in 2019. By 2030, China, the US, and the EU are expected to have a combined 120 million electric vehicles on the road. An estimated 20 billion kilowatt-hours of energy will be needed to charge electric vehicles. Electric vehicle commuting over long distances and in urban areas is anticipated. Because the majority of EVs currently available have a range of less than 100 miles, fast-charging options are required.

- Improving power plant technology creates a market surge

Electric mobility companies regularly invest in the development of quick-charging technologies. The best way to promote the widespread use of battery-electric vehicles in Europe and China may be public fast-charging stations. Leading charging network operators have made plans to set up fast charging stations. Rapid charging stations can accommodate more battery-electric vehicles than Level 2 public charging stations. For instance, major cities in China are deploying fast-charging stations, like Level 2 chargers, to meet the needs of EV drivers who do not have designated chargers and rely on public charging stations. The demand for fast-charging stations increases as battery electric vehicle sales as a percentage of all new vehicles sold globally rise.

Restraints/Challenges

- Market expansion is hampered by a lack of standards

To create a supportive environment and boost sales of electric vehicles, governments must standardize charging infrastructure. The government changed the rules and permitted charging station developers to use the strategy even though this mandate raised the cost of installing charging stations. Tesla, an American manufacturer of electric vehicles, uses high-performance superchargers that are exclusive to Tesla and incompatible with other electric vehicles. As a result, the installation of charging stations may be hampered and the market for them may grow only to a certain extent due to country-to-country variation.

- The market is constrained by reliance on fossil fuels and their scarcity

The expansion of EVs may be hampered by the reliance on fossil fuels for the generation of electricity. The environmental advantages of electric vehicles are still influenced by the power sources that are used to charge them. The environmental advantages of EVs may be limited in areas where fossil fuels are heavily used to generate electricity. This could discourage the expansion of the EV charging station market and increase consumer interest in EV adoption.

This electric vehicle charging stations market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the electric vehicle charging stations market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2023, At CES 2023, the premier technology trade show in the world, ABB E-mobility debuted its ground-breaking terra home charging solution. With its distinctive design and ability to enable users to optimize their use of renewable energy, terra homes will likely be available for purchase by the middle.

- In 2022, A leading supplier of charging infrastructure solutions for commercial electric vehicles, Schaltbau Holding AG, completed the acquisition of SBRS GmbH, a wholly-owned subsidiary of Shell Deutschland GmbH, a wholly-owned subsidiary of Shell. The acquisition expands Shell's portfolio of lower-carbon solutions for fleet solutions and commercial road transport customers by adding significant expertise in electric bus charging and a substantial pipeline in electric truck charging.

- In 2022, Launch of Mobilize Fast Charge, an ultrafast charging network, was announced by Mobilize and Renault dealerships. Most of the stations will be at Renault dealerships that are no more than five minutes' drive from an exit on an expressway or highway.

- In 2022, The E- Superior Electric Cargo Loader, E- Supreme Electric Delivery Van, and E- Smart Electric Passenger Vehicle three-wheeled auto in the L5 category, as well as EV charging stations, have all been introduced, according to Erisha E Mobility, a subsidiary of Rana Group.

- In 2022, In order to ensure accurate sighting of EV charging stations, the Delhi Government and MapmyIndia Mappls signed an agreement to create a web application that will act as a geospatial decision-making tool. A citywide network of connected and accessible EV charging stations will be planned and implemented with the help of the tool.

- In 2022, In order to broaden its selection of user-friendly energy management technologies, ABB formed a strategic partnership with Tallarna ltd. The solution uses AI-powered data analytics to make decarbonization projects for sizable real estate portfolios and performance infrastructure more manageable.

- In 2022, The CP6000 charger was launched by hunger point. This all-encompassing charging solution meets the requirements of fleets and businesses in Europe and gives them the resources they need to switch to electric mobility. To provide a seamless experience, it combines station and hardware, network software, and customer support. The Cpc6000 is built to be scalable, flexible, trustworthy, and to deliver an excellent experience.

- In 2022, Eaton expanded its contracts with the general service administration to cover electric vehicle supply equipment (EVSE) related services. This more s crucial in achieving the U.S. goal of reaching net zero emissions by 2050 and advancing the development of EV charging infrastructure.

- In 2022, Tata Power and Hyundai entered into a strategic partnership to establish a strong EV charging infrastructure and hasten the adoption of EVs throughout India.

North America Electric Vehicle Charging Stations Market Scope

The electric vehicle charging stations market is segmented on the basis of charging stations, charger type, charging type, charging services, mode of charging, connectivity type, charging infrastructure, vehicle type, installation type, connecting phase, technology, operations, components, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Charging Stations

- AC Charging/ Normal Charging Station

- DC Charging/ Super Charging Station

- Slow DC (<49 KW)

- Fast DC (50-149 KW)

- Level 1 Ultra-Fast DC (150-349 KW)

- Level 2 Ultra-Fast DC (<349 KW)

- Inductive Charging Station

- Others

- Wall Mount

- Pedestal Mount

- Ceiling Mount

Charger Type

- Portable Charger

- Fixed Charger

Charging Type

- Off Board Top Down Pantograph

- On Board Bottom Up Pantograph

- Charging via Connector

Charging Services

- EV Charging Services

- Battery Swapping Service

Mode of Charging

- Plug in Charging

- Wireless Charging

- Static Wireless EV Charging

- Dynamic Wireless EV Charging

Connectivity Type

- Non-Connected Charging Stations

- Smart Connected Charging Stations

- Pantograph

- Connectors

- Combined Charging Systems

- Chademo

- Others

Charging Infrastructure

- Normal Charging

- Type 2

- IEC 621196

- CCS

- CHAdeMO

- Tesla SC

- GB/T Fast

Vehicle Type

- Passengers Cars

- Commercial Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicles (PHEV)

- Two Wheelers and Scooters

- Hybrid Electric Vehicles (HEV)

Installation Type

- Individual Houses

- Commercial

Commercial Public EV Charging Stations

- On-Road Charging

- Parking Spaces

- Destination Chargers

Commercial Private EV Charging Stations

- Fleet Charging

- Captive Charging

- Apartments

- Others

Connecting Phase

- Single Phase

- Three Phase

Technology

- Level 1

- Level 2

- Level 3

Operations

- Mode 1

- Mode 2

- Mode 3

- Mode 4

Components

- Hardware

- Electric Vehicle Supply Equipment (EVSE)

- Electrical Distribution Systems

- Cable Management Systems

- Software

- Charging Station Management Systems (CSMS)

- Interoperability Solutions

- Open Charge Point Protocol (OCPP)

- Smartphone Applications

- Services

- Maintenance Services

- Systems Integration and Installation Services

Application

- Public

- Semi-Public

- Private

End User

- Residential

- Commercial

Electric Vehicle Charging Stations Regional Analysis/Insights

The electric vehicle charging stations market is analysed and market size insights and trends are provided by country, charging stations, charger type, charging type, charging services, mode of charging, connectivity type, charging infrastructure, vehicle type, installation type, connecting phase, technology, operations, components, application and end user as referenced above.

The countries covered in the electric vehicle charging stations market report are U.S., Canada and Mexico in North America.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Electric Vehicle Charging Stations Market Share Analysis

The electric vehicle charging stations market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to electric vehicle charging stations.

Some of the major players operating in the electric vehicle charging stations market are:

- ChargePoint, Inc. (U.S.)

- ABB (Switzerland)

- Webasto Group (Germany)

- Shell International B.V. (Netherlands)

- Schneider Electric (France)

- Renault Group (France)

- Phihong USA Corp. (U.S.)

- EV Safe Charge Inc. (U.S.)

- Tesla (U.S.)

- Mercedes-Benz Group AG. (Germany)

- Siemens (Germany)

- TATA Power (India)

- Magenta EV Solutions Private Limited (India)

- Fortum (Finland)

- Volttic EV Charging (India)

- Ather Energy (India)

- Infineon Technologies AG (Germany)

- Amara Raja Group (India)

- Exicom (India)

- Griden Technologies Pvt. Ltd. (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.