North America Edible Oils Market

Market Size in USD Million

CAGR :

%

USD

8,104.55 Million

USD

13,615.83 Million

2021

2029

USD

8,104.55 Million

USD

13,615.83 Million

2021

2029

| 2022 –2029 | |

| USD 8,104.55 Million | |

| USD 13,615.83 Million | |

|

|

|

Market Analysis and Size

Edible oil has made a significant place in the food and beverage sector around the world. It is being consumed everyday by millions of people in restaurants, cafeterias, and hotels, among others. Manufacturers are working on developing these oils to offer healthier options to the consumers.

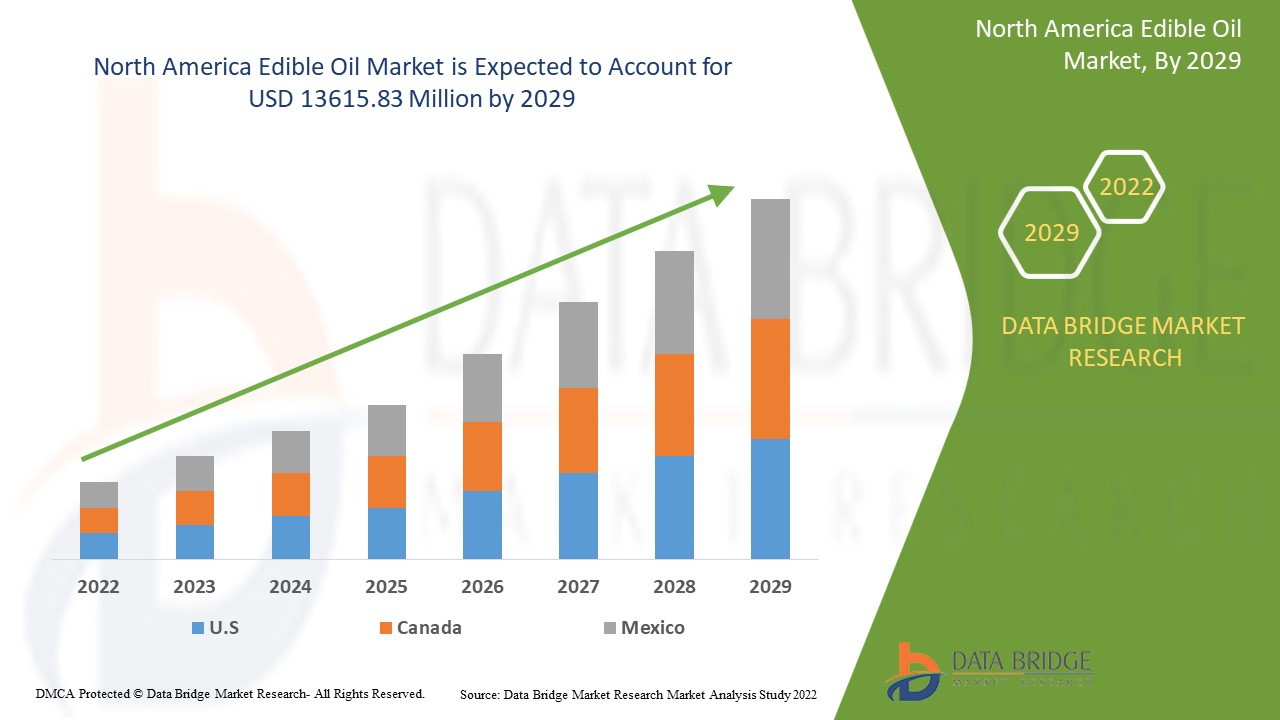

North America Edible Oil Market was valued at USD 8,104.55 million in 2021 and is expected to reach USD 13615.83 million by 2029, registering a CAGR of 6.70% during the forecast period of 2022-2029. Domestics accounts for the largest end user segment owing to the high consumption for household purposes. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Market Definition

Edible oil refers to a liquid that is extracted from plants, vegetables and seeds. These type of oils possess fatty acid, anti-antioxidants and phospholipids, among others. The edible oil is widely consumed among humans and food processing industry. This oil is known to have low fats, calories and cholesterol.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Palm Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Peanut Oil, Specialty Blended Oil, Olive Oil, Corn Oil, Flaxseed Oil, Avocado Oil, Walnut Oil, Pumpkin Seed Oil, Grapeseed Oil, Others), Package Type (Tinplate Containers, HDPE (High Density Polyethylene) Containers, PVC (Poly Vinyl Chloride) Bottles, PET (Polyethylene Terephthalate) Bottles, Glass Bottles, Semi – Rigid Containers, Flexible Plastic Pouches, Others), Distribution Channel (Direct, Indirect), End User (Domestics, Industrial, Food Service, Others) |

|

Countries Covered |

U.S., Canada, Mexico in North America |

|

Market Players Covered |

Bunge Limited (US), ADM (US), Cargill, Incorporated (US), ACH Food Companies, Inc. (US), Adani Group (India), SALAD OILS INTERNATIONAL CORPORATION (US), American Vegetable Oils, Inc. (US), BORGES INTERNATIONAL GROUP, S.L. (Spain), Hebany Group (UAE), NGO CHEW HONG EDIBLE OIL PTE LTD (Singapore), TITAN OILS Inc., (Canada) Ragasa - Derechos Reservados (Mexico), SOVENA (Thailand), and Sunora Foods (Canada), among others |

|

Market Opportunities |

|

North America Edible Oil Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Inclination towards Healthy Lifestyle

The increase in the consumer preference for dietary improvements acts as one of the major factors driving the growth of edible oil market. The rise in trend of leading a healthy lifestyle among all age groups shifting to healthy and innovative approach have a positive impact on the industry.

- Prevalence of Obesity

The increase in the prevalence of obesity among population further influences the market. People reaching out to dieticians and nutritionists providing customized diet plans with the aim of losing weight helps in the market growth.

- Awareness Regarding Healthy Lifestyle

The rise in the awareness regarding the importance of leading a healthy lifestyle, accelerate the market growth. The prevalence of various chronic diseases, such as diabetes, and cardiovascular diseases, among others is encouraging people to adopt edible oil.

- Increase in Demand for Functional Foods

The increase in the functional food products further influence the market growth. Also, increase in consumers seeking healthy and sustainable food options along with growing number of sports and gym enthusiasts assist in the expansion of the market.

Additionally, change in lifestyle, increase in the disposable income and rise in awareness regarding the benefits of the nutrition plan positively affect the edible oil market.

Opportunities

Furthermore, rise in demand for clean edible oil products extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Also, research and development activities will further expand the market.

Restraints/Challenges

On the other hand, high cost associated with the products and limited availability of raw materials are expected to obstruct market growth. Also, use of artificial/synthetic ingredients in various applications resulting in health hazards and lack of consistency in regulations are projected to challenge the edible oil market in the forecast period of 2022-2029.

This edible oil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on edible oil market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Edible Oil Market

COVID-19 had a negative impact on several industries. However, edible oil market witnessed a significant growth during this period. During the lockdown imposed by the government for restricting the spread of the coronavirus disease, most of the population took keen interest in adopting health diets. People are adopting health supplements to increase their immunity with the increasing health complications. The rise in the emphasis on good health is going to keep increasing the growth of the market in the post pandemic scenario.

Recent Developments

- In November 2019, ACH Food Companies, Inc. acquired Anthony’s Goods which offers high quality and organic cooking oils and baked products. This acquisition has helped the company to expand its product portfolio and increase its revenue.

North America Edible Oil Market Scope and Market Size

The edible oil market is segmented on the basis of type, package type, distribution channel and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Palm Oil

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Peanut Oil

- Specialty Blended Oil

- Olive Oil

- Corn Oil

- Flaxseed Oil

- Avocado Oil

- Walnut Oil

- Pumpkin Seed Oil

- Grapeseed Oil

- Others

Package Type

- Tinplate Containers

- HDPE (High Density Polyethylene) Containers

- PVC (Poly Vinyl Chloride) Bottles

- PET (Polyethylene Terephthalate) Bottles

- Glass Bottles, Semi – Rigid Containers

- Flexible Plastic Pouches

- Others

Distribution Channel

- Direct

- Indirect

End User

- Domestics

- Industrial

- Food Services

- Others

North America Edible Oil Market Regional Analysis/Insights

The edible oil market is analysed and market size insights and trends are provided by country, type, package type, distribution channel and end user as referenced above.

The countries covered in the edible oil market report are U.S., Canada, and Mexico in North America.

In North America edible oil market, the U.S. is leading the growth due to the high consumption of and production of soybean oil in indirect segment along with the benefits offered by the e-commerce channels which are expected to create opportunity for the edible oil market in the country. Canada is dominating with the second highest market share due to the increasing organic trend in indirect segment across the world and consumers demand for organic edible oils which is expected to drive the growth of edible oil market in Canada.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Edible Oil Market Share Analysis

The edible oil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to edible oil market.

Some of the major players operating in the edible oil market are

- Bunge Limited (US)

- ADM (US)

- Cargill, Incorporated (US)

- ACH Food Companies, Inc. (US)

- Adani Group (India)

- SALAD OILS INTERNATIONAL CORPORATION (US)

- American Vegetable Oils, Inc. (US)

- BORGES INTERNATIONAL GROUP, S.L. (Spain)

- Hebany Group (UAE)

- NGO CHEW HONG EDIBLE OIL PTE LTD (Singapore)

- TITAN OILS Inc., (Canada

- Ragasa - Derechos Reservados (Mexico)

- SOVENA (Thailand)

- Sunora Foods (Canada)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA EDIBLE OIL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 NORTH AMERICA EDIBLE OIL MARKET: LIST OF SUBSTITUTES

6 NORTH AMERICA EDIBLE OIL MARKET: MARKETING STRATEGIES

7 NORTH AMERICA EDIBLE OIL MARKET: REGULATORY FRAMEWORK

7.1 LABELLING REQUIREMENTS (NORTH AMERICA)

7.2 DOSAGE RECOMMENDATIONS IN DIFFERENT PET ANIMALS

7.3 EDIBLE OILS CERTIFICATIONS

7.3.1 ORGANIC

7.3.2 AGMARK CERTIFICATION

7.3.3 PLANT AND PLANT PRODUCTS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 EASY AVAILABILITY OF RAW MATERIALS

8.1.2 HEALTH BENEFITS ASSOCIATED WITH EDIBLE OILS

8.1.3 INCREASING DEMAND FOR FORTIFIED EDIBLE OILS

8.1.4 OIL PACKAGING INNOVATIONS

8.1.5 INCREASING DEMAND FOR ORGANIC EDIBLE OIL PRODUCTS

8.2 RESTRAINTS

8.2.1 INTERNATIONAL PRICES OF OILSEEDS AND VEGETABLE OILS

8.2.2 ADULTERATION IN EDIBLE OILS

8.2.3 OBESITY AND EDIBLE OILS

8.3 OPPORTUNITIES

8.3.1 INTRODUCTION OF CLEAN LABELLED EDIBLE OIL PRODUCTS

8.3.2 PREMIUM EDIBLE OIL PRODUCTS

8.3.3 E-COMMERCE CONTINUES TO CREATE OPPORTUNITIES

8.4 CHALLENGES

8.4.1 INCREASING COMPETITION

8.4.2 HEALTH ISSUES ASSOCIATED WITH THE CONSUMPTION OF EDIBLE OILS

9 NORTH AMERICA EDIBLE OIL MARKET, BY TYPE

9.1 OVERVIEW

9.2 PALM OIL

9.3 OLIVE OIL

9.4 SOYBEAN OIL

9.5 SUNFLOWER OIL

9.6 SPECIALTY BLENDED OIL

9.7 CORN OIL

9.8 RAPESEED OIL

9.9 FLAXSEED OIL

9.1 AVOCADO OIL

9.11 PUMPKIN SEED OIL

9.12 WALNUT OIL

9.13 PEANUT OIL

9.14 GRAPESEED OIL

9.15 OTHER

10 NORTH AMERICA EDIBLE OIL MARKET, BY PACKAGE TYPE

10.1 OVERVIEW

10.2 TIN PLATE CONTAINERS

10.3 GLASS BOTTLES

10.4 SEMI - RIGID CONTAINERS

10.5 HDPE (HIGH DENSITY POLYETHYLENE CONTAINERS) CONTAINERS

10.6 PET (POLYETHYLENE PTERAPTHALATE) BOTTLES

10.7 PVC (POLY VINYL CHLORIDE) BOTTLES

10.8 FLEXIBLE PLASTIC POUCHES

10.9 OTHERS

11 NORTH AMERICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 GROCERY STORE

11.3.2 SUPERMARKETS/HYPERMARKETS

11.3.3 CONVENIENCE STORES

11.3.4 SPECIALTY STORES

11.3.5 E-COMMERCE

11.3.6 OTHERS

12 NORTH AMERICA EDIBLE OIL MARKET, BY END USER

12.1 OVERVIEW

12.2 DOMESTIC

12.3 FOOD SERVICE

12.3.1 RESTAURANTS

12.3.2 CANTEENS

12.3.3 OTHERS

12.4 INDUSTRIAL

12.5 OTHERS

13 NORTH AMERICA EDIBLE OIL MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 US

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA EDIBLE OIL MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT

16 COMPANY PROFILE

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 BUNGE LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 CARGILL, INCORPORATED.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 ADANI GROUP

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 SOVENA

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 ACH FOOD COMPANIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AMERICAN VEGETABLE OILS, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BORGES INTERNATIONAL GROUP, S.L.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 HEBANY GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 NGO CHEW HONG EDIBLE OIL PTE LTD’S (A SUBSIDIARY OF MEWAH GROUP)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 RAGASA - DERECHOS RESERVADOS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 SALAD OILS INTERNATIONAL CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 SUNORA FOODS

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 TITAN OILS INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 APPROXIMATE FAT CONTENT OF MAJOR EDIBLE OILS

TABLE 2 NORTH AMERICA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA EDIBLE OIL MARKET, BY END USER, 2018– 2027 (USD MILLION )

TABLE 7 NORTH AMERICA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA EDIBLE OIL MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 15 US EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 US EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 17 US EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 18 US INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 19 US EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 20 US FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 21 CANADA EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 22 CANADA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 23 CANADA EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 24 CANADA INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 25 CANADA EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 26 CANADA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 27 MEXICO EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 28 MEXICO EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 29 MEXICO EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 30 MEXICO INDIRECT IN EDIBLE OIL MARKET,BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 31 MEXICO EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 32 MEXICO FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA EDIBLE OIL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA EDIBLE OIL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA EDIBLE OIL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA EDIBLE OIL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA EDIBLE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA EDIBLE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA EDIBLE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA EDIBLE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA EDIBLE OIL MARKET: SEGMENTATION

FIGURE 10 EASY AVAILABILITY OF RAW MATERIALS AND DEMAND FOR ORGANIC EDIBLE OILS PRODUCTS ARE DRIVING THE NORTH AMERICA EDIBLE OIL MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 SOYBEAN OIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA EDIBLE OIL MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA EDIBLE OIL MARKET

FIGURE 13 NORTH AMERICA EDIBLE OIL MARKET, BY TYPE, 2019

FIGURE 14 NORTH AMERICA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2019

FIGURE 15 NORTH AMERICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2019

FIGURE 16 NORTH AMERICA EDIBLE OIL MARKET, BY END USER, 2019

FIGURE 17 NORTH AMERICA EDIBLE OIL MARKET: SNAPSHOT (2019)

FIGURE 18 NORTH AMERICA EDIBLE OIL SMARKET: BY COUNTRY (2019)

FIGURE 19 NORTH AMERICA EDIBLE OIL SMARKET: BY COUNTRY (2020&2027)

FIGURE 20 NORTH AMERICA EDIBLE OIL SMARKET: BY COUNTRY (2019&2027)

FIGURE 21 NORTH AMERICA EDIBLE OIL SMARKET: BY CATEGORY (2020&2027)

FIGURE 22 NORTH AMERICA EDIBLE OIL MARKET: COMPANY SHARE 2019 (%)

North America Edible Oils Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Edible Oils Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Edible Oils Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.