North America Drive Shaft Market

Market Size in USD Billion

CAGR :

%

USD

5.05 Billion

USD

7.69 Billion

2024

2032

USD

5.05 Billion

USD

7.69 Billion

2024

2032

| 2025 –2032 | |

| USD 5.05 Billion | |

| USD 7.69 Billion | |

|

|

|

|

North America Drive Shaft Market Size

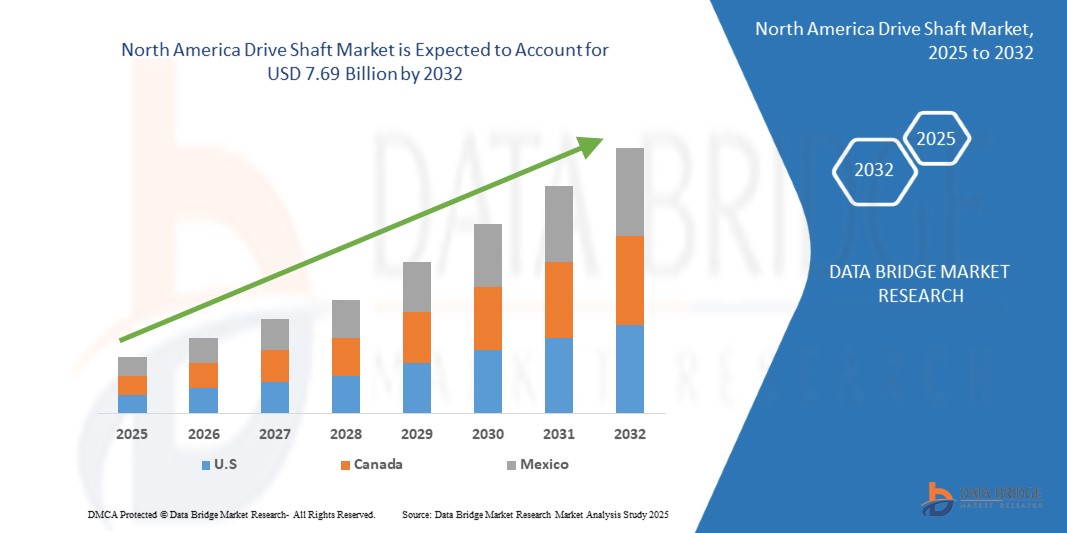

- The global North America drive shaft Market size was valued at USD 5.05 Billion in 2024 and is expected to reach USD 7.69 Billion by 2032, at a CAGR of 5.40% during the forecast period

- Market growth is primarily driven by increased vehicle production, the shift toward lightweight automotive components for improved fuel efficiency, and the growing demand for all-wheel-drive (AWD) and four-wheel-drive (4WD) systems in passenger and commercial vehicles

- In addition, advancements in materials such as carbon fiber and aluminum, alongside rising consumer expectations for vehicle performance and reduced emissions, are enhancing drive shaft design and durability, thereby fueling long-term market expansion

North America Drive Shaft Market Analysis

- The drive shaft market in North America, essential for transmitting torque and rotation in vehicles, plays a crucial role in automotive performance, particularly in commercial vehicles, passenger cars, and off-highway applications, owing to its efficiency, durability, and ability to support high-performance drivetrains

- The growth of the North American drive shaft market is primarily driven by rising vehicle production, increasing demand for lightweight and fuel-efficient components, and the accelerating shift toward electric and hybrid vehicles that require specialized drive shaft solutions

- The U.S. dominated the North America Drive Shaft Market with the largest revenue share of 76.12% in the North American drive shaft market in 2024, driven by high demand for SUVs, trucks, and performance vehicles equipped with complex drivetrains

- Canada’s drive shaft market is projected to grow at a fastest CAGR of 6.08% the forecast period, supported by a strong automotive trade relationship with the U.S. under USMCA and a growing preference for light commercial vehicles in urban logistics

- The slip yokes segment dominated the market with the largest revenue share of 38.4% in 2024, owing to their widespread usage in accommodating drive shaft movement during suspension travel and their critical role in ensuring smooth power transmission

Report Scope and Drive Shaft Market Segmentation

|

Attributes |

Drive Shaft Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Drive Shaft Market Trends

Lightweight Materials and Advanced Manufacturing for Enhanced Performance

- A notable and growing trend in the North America drive shaft market is the shift towards lightweight materials such as aluminum and carbon fiber—combined with precision manufacturing techniques to enhance fuel efficiency, performance, and durability in vehicles. This trend is being accelerated by regulatory pressure to reduce emissions and by OEMs' pursuit of improved vehicle dynamics

- For instance, Dana Incorporated offers advanced carbon fiber drive shafts that are up to 70% lighter than traditional steel variants, helping automakers meet fuel economy targets without compromising strength. Similarly, American Axle & Manufacturing (AAM) has developed high-performance aluminum drive shafts used in a range of light trucks and performance vehicles across North America

- The integration of precision engineering and computer-aided design (CAD) has enabled manufacturers to optimize shaft geometry, improve balance, and reduce vibrations, leading to smoother rides and lower NVH (noise, vibration, and harshness) levels

- These innovations are particularly significant in North America, where SUVs and light trucks dominate the vehicle market. Automakers are increasingly selecting advanced drive shafts to support higher torque outputs from electric and hybrid powertrains without sacrificing weight or reliability

- The trend is also reshaping the aftermarket sector, with performance enthusiasts and fleet operators alike seeking upgraded drive shaft systems for better efficiency and power transmission

- As OEMs and Tier-1 suppliers continue to invest in R&D to meet evolving standards, the use of advanced materials and manufacturing technologies is set to become a defining feature of the region’s drive shaft industry over the coming years

North America Drive Shaft Market Dynamics

Driver

Increased Vehicle Production and Demand for AWD/4WD Systems

- The consistent rise in vehicle production particularly of SUVs, crossovers, and trucks—across North America, coupled with the growing consumer preference for all-wheel-drive (AWD) and four-wheel-drive (4WD) systems, is a major driver of the drive shaft market

- As consumers prioritize versatility, off-road capability, and safety in varied driving conditions, manufacturers are equipping a greater number of vehicles with advanced drivetrain systems, all of which require durable and efficient drive shafts

- For instance, Ford and General Motors have expanded their AWD and 4WD offerings in newer SUV and pickup models, directly contributing to increased demand for both OEM and aftermarket drive shafts

- In addition, the growth of the light commercial vehicle (LCV) segment, used heavily for logistics and e-commerce deliveries, is further fueling drive shaft requirements due to frequent usage and the need for reliable power transmission

- Alongside rising consumer expectations, regulatory mandates for improved fuel efficiency are prompting automakers to redesign drive shafts with lighter, more efficient materials—boosting replacement and innovation rates within the sector

- Overall, the combination of growing production volumes, drivetrain enhancements, and technological innovation continues to strengthen the North American drive shaft market

Restraint/Challenge

Raw Material Price Volatility and Integration Challenges in EVs

- One of the key challenges for the North America drive shaft market is the volatility in raw material prices, particularly steel, aluminum, and carbon fiber composites, which can significantly impact production costs and profit margins

- For instance, fluctuations in global commodity markets exacerbated by trade tensions and supply chain disruptions—often lead to inconsistent pricing for essential materials, affecting both OEMs and Tier-1 suppliers in their ability to scale cost-effective solutions

- In addition, the growing shift toward electric vehicles (EVs), which typically have different drivetrain architectures such as in-wheel motors or fewer moving components, poses integration challenges for traditional drive shaft designs

- While some EV platforms still utilize drive shafts (particularly in dual-motor or AWD configurations), many new electric powertrain designs eliminate the need for conventional systems, potentially reducing long-term demand in specific vehicle segments

- Manufacturers are thus under pressure to adapt by innovating drive shaft solutions compatible with EV layouts, while simultaneously controlling production costs amid rising material prices

- Addressing these constraints through forward-looking design strategies, vertical integration for better material sourcing, and investments in EV-compatible components will be critical for sustaining competitiveness in the evolving North American automotive landscape

North America Drive Shaft Market Scope

The automotive drive shaft market is segmented into seven notable segments based on component, design type, drive shaft type, position type, material type, vehicle type, and sales channel.

- By Component

On the basis of component, the market is segmented into slip yokes, yoke shafts, end yokes, companion flanges, flange yokes, weld yokes, center yokes, splined slip stubs, midship stubs, and others. The slip yokes segment dominated the market with the largest revenue share of 38.4% in 2024, owing to their widespread usage in accommodating drive shaft movement during suspension travel and their critical role in ensuring smooth power transmission. Slip yokes are highly preferred in both passenger cars and light commercial vehicles for durability and cost efficiency.

The flange yokes segment is projected to record the fastest CAGR of 8.9% from 2025 to 2032, driven by rising demand in heavy-duty trucks, off-highway vehicles, and commercial fleets. Their ability to withstand high torque loads and provide stable joint connections makes them essential in modern driveline systems where performance and reliability are paramount.

- By Design Type

On the basis of design type, the market is segmented into hollow shaft and solid shaft. The hollow shaft segment dominated the market with a 53.5% revenue share in 2024, primarily due to its lightweight structure, reduced inertia, and superior fuel efficiency benefits. Automakers prefer hollow shafts in passenger vehicles and EVs to enhance overall vehicle performance while meeting regulatory emission norms.

The solid shaft segment is anticipated to witness the fastest CAGR of 7.6% during 2025–2032, fueled by its increasing adoption in heavy-duty applications requiring higher strength and torque capacity. Solid shafts are particularly popular in trucks, buses, and industrial vehicles where robustness and load-bearing capacity outweigh weight reduction.

- By Drive Shaft Type

On the basis of drive shaft type, the market is segmented into Hotchkiss drive shaft, torque tube drive shaft, flexible drive shaft, and slip-in-tube drive shaft. The Hotchkiss drive shaft dominated with a 31.7% revenue share in 2024, owing to its extensive use in rear-wheel drive passenger cars and light trucks. Its simple design, cost efficiency, and proven reliability drive its strong market presence.

The flexible drive shaft segment is expected to register the fastest CAGR of 9.3% from 2025 to 2032, supported by rising demand in EVs, hybrid vehicles, and specialized industrial machinery. Flexible shafts enable smoother torque transmission, improved vibration absorption, and compact design integration, making them ideal for lightweight automotive applications.

- By Position Type

On the basis of position type, the market is segmented into front axle and rear axle. The rear axle segment dominated the market with a 48.2% revenue share in 2024, driven by the strong prevalence of rear-wheel-drive configurations in light trucks, SUVs, and commercial vehicles. Rear axles require robust drive shafts for efficient torque transfer over longer distances.

The front axle segment is projected to grow at the fastest CAGR of 8.1% during 2025–2032, largely due to the increasing adoption of all-wheel-drive and front-wheel-drive vehicles across passenger cars. Rising consumer demand for enhanced stability, fuel efficiency, and traction in compact cars and crossovers is boosting demand for front axle drive shafts.

- By Material Type

On the basis of material type, the market is segmented into carbon steel, aluminum, stainless steel, composite materials, carbon fiber, and others. The carbon steel segment accounted for the largest revenue share of 56.9% in 2024, favored for its strength, durability, and cost-effectiveness across passenger and commercial vehicles. Carbon steel drive shafts remain a standard choice in traditional ICE vehicles.

The carbon fiber segment is expected to expand at the fastest CAGR of 10.4% between 2025 and 2032, propelled by growing adoption in high-performance cars, luxury vehicles, and EVs. Its lightweight and superior strength-to-weight ratio make it ideal for improving fuel efficiency and reducing emissions, aligning with global sustainability goals.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger car segment dominated the market with a revenue share of 51.4% in 2024, driven by the rising production of sedans, SUVs, and hatchbacks worldwide. Increasing urbanization, disposable income, and the shift toward connected vehicles further support adoption.

The commercial vehicle segment is forecasted to register the fastest CAGR of 7.8% from 2025 to 2032, as the global logistics and construction industries expand. Heavy-duty trucks and buses demand durable, high-performance drive shafts capable of withstanding high torque loads and long operational hours.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and aftermarket. The OEM segment dominated the market with 58.7% revenue share in 2024, attributed to rising global automobile production and manufacturers’ preference for integrating advanced, lightweight drive shafts during initial assembly. OEM supply ensures consistent quality, regulatory compliance, and warranty assurance for end users.

The aftermarket segment is projected to record the fastest CAGR of 8.6% during 2025–2032, driven by increasing vehicle aging, higher replacement rates, and customization demand. Commercial fleets and individual vehicle owners are turning to aftermarket solutions for cost efficiency and availability of specialized components.

North America Drive Shaft Market Regional Analysis

- The U.S. dominated the North America Drive Shaft Market with the largest revenue share of 76.12% in the North American drive shaft market in 2024, driven by high demand for SUVs, trucks, and performance vehicles equipped with complex drivetrains

- Rising production of AWD/4WD models, combined with increased interest in off-road and utility vehicles, is propelling market growth. In addition, investments in EV platforms and lightweight composite materials are encouraging domestic manufacturers to upgrade drive shaft technologies

- A well-developed aftermarket sector and rising fleet replacement rates further contribute to sustained growth

Canada Drive Shaft Market Insight

Canada’s drive shaft market is projected to grow at a fastest CAGR of 6.08% the forecast period, supported by a strong automotive trade relationship with the U.S. under USMCA and a growing preference for light commercial vehicles in urban logistics. Harsh winter conditions and rugged terrains also drive demand for AWD and 4WD vehicles, reinforcing the need for durable, high-performance drive shafts. In addition, growing interest in electric and hybrid vehicles is prompting increased investment in lightweight drive shaft solutions.

Mexico Drive Shaft Market Insight

Mexico is emerging as a key player in North America’s drive shaft market, with rapid growth anticipated through 2032. As a major manufacturing hub for global automakers, the country benefits from cost-effective production and skilled labor. Strong OEM activity, particularly in vehicle assembly and parts export, fuels local demand for drive shafts. Continued expansion of automotive production facilities, coupled with infrastructure investments and trade advantages, is expected to significantly boost Mexico’s contribution to the regional market.

North America Drive Shaft Market Share

Drive Shaft Market Leaders Operating in the Market are:

- Johnson Power, Ltd. (U.S.)

- ACPT Inc. (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- D&F Propshafts (U.K.)

- Cummins Inc. (U.S.)

- Neapco Inc. (U.S.)

- Nexteer Automotive (U.S.)

- Dorman Products (U.S.)

- HYUNDAI WIA CORP (South Korea)

- JTEKT Corporation (Japan)

- THE TIMKEN COMPANY (U.S.)

- Hitachi Astemo, Ltd. (Japan)

- GSP EUROPE GmbH (Germany)

- TUNGALOY CORPORATION (Japan)

- GKN Automotive Limited (U.K.)

Latest Developments in Global North America Drive Shaft Market

- In April 2023, Dana Incorporated, a leading U.S.-based drivetrain and e-propulsion systems manufacturer, announced the expansion of its lightweight drive shaft production facility in Ohio to meet rising demand from electric vehicle (EV) and hybrid vehicle manufacturers. The new facility focuses on advanced aluminum and composite drive shafts, supporting OEM efforts to improve fuel efficiency and reduce vehicle weight. This expansion reinforces Dana’s strategic position in supplying next-generation drive shafts across North America.

- In March 2023, American Axle & Manufacturing (AAM) introduced a new line of modular drive shaft systems designed specifically for electrified and hybrid drivetrains. The systems provide improved torque handling and reduced NVH (noise, vibration, and harshness), making them suitable for both light-duty EVs and performance vehicles. The innovation highlights AAM’s commitment to aligning its product portfolio with the automotive industry’s transition toward electrification.

- In March 2023, Neapco Holdings LLC, a prominent drivetrain supplier headquartered in Michigan, unveiled its newly developed carbon fiber-reinforced polymer (CFRP) drive shafts at a major automotive expo in Detroit. These drive shafts, aimed at the luxury and performance vehicle market, offer enhanced durability, reduced rotational mass, and better fuel efficiency. This launch marks Neapco’s continued focus on premium material integration and lightweight solutions.

- In February 2023, GKN Automotive expanded its North American engineering center in Auburn Hills, Michigan, to support R&D efforts in developing advanced drive shaft technologies for electric and AWD vehicles. The expansion includes testing facilities for thermal management and durability simulation, reflecting the company’s investment in future-ready drivetrain solutions tailored to evolving OEM needs.

- In January 2023, Spicer Drivetrain (a Dana brand) launched a performance-focused aftermarket drive shaft series for Jeep and off-road vehicle owners across North America. The new line includes heavy-duty steel and aluminum drive shafts designed for lifted suspensions and high-stress terrain, targeting off-road enthusiasts and the growing demand for customized drivetrain upgrades in the aftermarket segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.