Market Analysis and Insights: North America Distributed Energy Resources Management System (DERMS) Market

Market Analysis and Insights: North America Distributed Energy Resources Management System (DERMS) Market

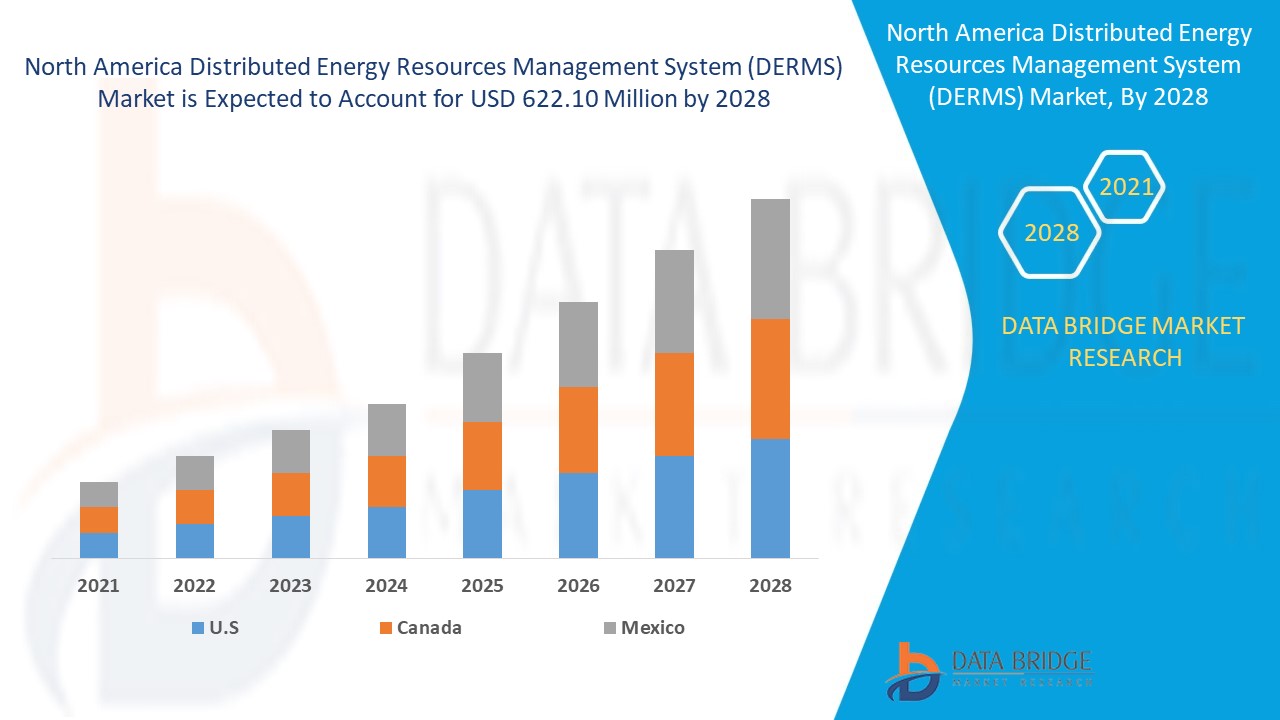

North America distributed energy resources management system (DERMS) market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.9% in the forecast period of 2021 to 2028 and is expected to reach USD 622.10 million by 2028. Increasing demand for DERMS for cost reduction is boosting the market.

A distributed energy resources management system (DERMS) is a platform that helps distribution system operators (DSO) to manage their grids which are based on distributed energy resources (DER). In addition, it is a software platform used to organize the operation of the aggregated DER within a power grid. The usual DERMS application is found at the distribution grid level. The system typically requires a more full-fledged integration of various other systems such as a distribution management system (DSM) for integrating it with a utility. Furthermore, an outage management system (OMS) or a supervisory control and data acquisition (SCADA) system is usually needed to provide all DERMS functionality.

The growing demand for renewable energy generation is the major that is expected to drive the market. On the other hand, regulatory issues related to DERs may act as restraining factors. The growing awareness for clean energy and renewables proves to be an opportunity. However, the threat to utilities from reductions in revenue could prove to be a challenge.

The distributed energy resources management system (DERMS) market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the distributed energy resources management system (DERMS) market scenario contact Data Bridge Market Research for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

North America Distributed Energy Resources Management System (DERMS) Market Scope And Market Size

North America Distributed Energy Resources Management System (DERMS) Market Scope And Market Size

North America distributed energy resources management system (DERMS) market is segmented based on the technology, software, and end-user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of technology, the distributed energy resources management system (DERMS) market is segmented into solar PV, wind, CHP (combined heat & power), energy storage, and others. In 2021, the solar PV segment is expected to dominate the distributed energy resources management system (DERMS) market as it converts sunlight into electricity and is pollution-free. In addition, it is available in flexible sizes, and government regulations supporting it are driving the solar PV segment's growth.

- On the basis of software, the distributed energy resources management system (DERMS) market is segmented into analytics, virtual power plants, and management & control. In 2021, the analytics segment is expected to dominate the distributed energy resources management system (DERMS) market as it is used to forecast the demand of energy needed in a particular area and know the sources from which this energy is generated.

- On the basis of end-user, the distributed energy resources management system (DERMS) market is segmented into infrastructure, power, oil & gas, automotive, aerospace, mining, marine, water & wastewater, food & beverages, semi-conductors, pulp & paper, CPG, HPC, entertainment, life sciences, and others. In 2021, the infrastructure segment is expected to dominate the distributed energy resources management system (DERMS) market as solar PV is easier to install on infrastructures and has relatively low maintenance.

North America Distributed Energy Resources Management System (DERMS) Market Country Level Analysis

North America distributed energy resources management system (DERMS) market is segmented based on the technology, software, and end-user.

The countries covered in North America distributed energy resources management system (DERMS) market report are the U.S., Canada, and Mexico. U.S. dominates the market due to the high demand and major players present for distributed energy resources management systems (DERMS).

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Demand For Renewable Energy Generation Is Boosting The Market Growth Of the North America Distributed Energy Resources Management System (DERMS) Market.

North America distributed energy resources management system (DERMS) market also provides you with detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players' strategy and their geographical presence. The data is available for the historic period 2010 to 2019.

Competitive Landscape and North America Distributed energy resources management system (DERMS) Market Share Analysis

Distributed energy resources management system (DERMS) market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to Distributed energy resources management system (DERMS) market.

The major companies which are dealing in the Distributed energy resources management system (DERMS) are General Electric, Siemens, Hitachi ABB Power Grids, COPA-DATA GmbH, Enel X S.r.l. (A subsidiary of Enel Spa), Accenture, AutoGrid Systems, Inc., Doosan GridTech (A subsidiary of Doosan Heavy Industries & Construction Co., Ltd.), ENBALA Power Networks, a Generac company, EnergyHub, ENGIE, Itron Inc., MACH Energy Inc., Open Access Technology International, Inc., Open Systems International, Inc. (A Subsidiary of Emerson Electric Co.), Opus One Solutions, Oracle, PXiSE Energy Solutions (A Subsidiary of Sempra Energy), Schneider Electric, Smarter Grid Solutions, Spirae, LLC, Sunverge Energy Inc., Viridity Energy Solutions Inc. (a Subsidiary of Ormat) and other in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which are also accelerating the Distributed energy resources management system (DERMS) market.

For instance,

- In November 2020, Hitachi ABB Power Grids announced that they had signed a 5-year contract with Dubai Electricity and Water Authority (DEWA) to provide energy solutions. Under this agreement, the company will supply, install, test, and commission 15 new substations and refurbish and upgrade 18 existing substations across Dubai. Thus, the company will supply its MicroSCADA solution helping to protect, control, measure and supervise power system

- In October 2020, Snohomish County PUD (SnoPUD) collaborated with Doosan GridTech to integrate two electric vehicle-to-grid chargers within its DERMS. The V2G stations can charge the vehicle and allow for the energy stored to flow back to the grid also provide support during an outage. With this, the company will help customers to maximize the value of owning an electric vehicle.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

FIGURE 1 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SEGMENTATION FIGURE 2 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DATA TRIANGULATION FIGURE 3 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DROC ANALYSIS FIGURE 4 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS FIGURE 5 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: COMPANY RESEARCH ANALYSIS FIGURE 6 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: INTERVIEW DEMOGRAPHICS FIGURE 7 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DBMR MARKET POSITION GRID FIGURE 8 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: VENDOR SHARE ANALYSIS FIGURE 9 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: MARKET APPLICATION COVERAGE GRID FIGURE 10 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SEGMENTATION FIGURE 11 INCREASING DEMAND FOR DERMS FOR COST REDUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET IN THE FORECAST PERIOD OF 2021 TO 2028 FIGURE 12 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET IN 2021 & 2028 FIGURE 13 THE BELOW FIGURE SHOWS THE GENERATION CAPACITY OF WIND ENERGY WORLDWIDE FROM 2011 TO 2020 FIGURE 14 THE BELOW FIGURE SHOWS THE GENERATION CAPACITY OF SOLAR ENERGY WORLDWIDE FROM 2011 TO 2020 FIGURE 15 THE INSTALLED CAPACITY OF THE CHP IS IN A CONSTANT RISE IN THE U.S., AS SEEN FROM THE FIGURE BELOW FIGURE 16 NORTH AMERICA FIGURE 17 LATIN AMERICA FIGURE 18 EMEA FIGURE 19 ASIA-PACIFIC FIGURE 20 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET FIGURE 21 CHANGE IN PRIMARY ENERGY DEMAND BY FUEL IN 2020 RELATIVE TO 2019 FIGURE 22 CHANGE IN PRIMARY ENERGY DEMAND BY FUEL FIGURE 23 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY TECHNOLOGY, 2020 FIGURE 24 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY SOFTWARE, 2020 FIGURE 25 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY END-USER, 2020 FIGURE 26 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SNAPSHOT (2020) FIGURE 27 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2020) FIGURE 28 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2021 & 2028) FIGURE 29 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2020 & 2028) FIGURE 30 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY TECHNOLOGY (2021-2028) FIGURE 31 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: COMPANY SHARE 2020 (%)

List of Table

TABLE 1 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA SOLAR PV IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA WIND IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA ENERGY STORAGE IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA ANALYTICS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA VIRTUAL POWER PLANTS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA MANAGEMENT & CONTROL IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA INFRASTRUCTURE IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA POWER IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA OIL & GAS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA AUTOMOTIVE IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA AEROSPACE IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA MINING IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA MARINE IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA WATER & WASTE WATER IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD & BEVERAGES IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 NORTH AMERICA SEMI-CONDUCTORS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA PULP & PAPER IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA CPG IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA HPC IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA ENTERTAINMENT IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA LIFE SCIENCES IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 34 U.S. DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 35 U.S. CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 U.S. DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE, 2019-2028 (USD MILLION)

TABLE 37 U.S. DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 38 CANADA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 39 CANADA CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 40 CANADA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE, 2019-2028 (USD MILLION)

TABLE 41 CANADA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER, 2019-2028 (USD MILLION)

TABLE 42 MEXICO DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 43 MEXICO CHP (COMBINED HEAT & POWER) IN DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 44 MEXICO DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY SOFTWARE, 2019-2028 (USD MILLION)

TABLE 45 MEXICO DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET, BY END-USER, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR DERMS FOR COST REDUCTION IS EXPECTED TO DRIVE THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET IN 2021 & 2028

FIGURE 13 THE BELOW FIGURE SHOWS THE GENERATION CAPACITY OF WIND ENERGY WORLDWIDE FROM 2011 TO 2020

FIGURE 14 THE BELOW FIGURE SHOWS THE GENERATION CAPACITY OF SOLAR ENERGY WORLDWIDE FROM 2011 TO 2020

FIGURE 15 THE INSTALLED CAPACITY OF THE CHP IS IN A CONSTANT RISE IN THE U.S., AS SEEN FROM THE FIGURE BELOW

FIGURE 16 NORTH AMERICA

FIGURE 17 LATIN AMERICA

FIGURE 18 EMEA

FIGURE 19 ASIA-PACIFIC

FIGURE 20 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET

FIGURE 21 CHANGE IN PRIMARY ENERGY DEMAND BY FUEL IN 2020 RELATIVE TO 2019

FIGURE 22 CHANGE IN PRIMARY ENERGY DEMAND BY FUEL

FIGURE 23 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY TECHNOLOGY, 2020

FIGURE 24 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY SOFTWARE, 2020

FIGURE 25 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY END-USER, 2020

FIGURE 26 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: SNAPSHOT (2020)

FIGURE 27 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2020)

FIGURE 28 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 29 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 30 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: BY TECHNOLOGY (2021-2028)

FIGURE 31 NORTH AMERICA DISTRIBUTED ENERGY RESOURCES MANAGEMENT SYSTEM (DERMS) MARKET: COMPANY SHARE 2020 (%)

North America Distributed Energy Resources Management System Derms Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Distributed Energy Resources Management System Derms Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Distributed Energy Resources Management System Derms Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.