North America Dissolved Gas Analyzer Market Analysis and Insights

Dissolved gas analysis (DGA) is the study of dissolved gases in transformer oil. It's also known as a DGA test. When a transformer is subjected to anomalous thermal and electrical stressors, various gases are created as a result of the degradation of the transformer oil. When the defect is severe, decomposing gases accumulate and are collected in a Buchholz relay. However, suppose the abnormal thermal and electrical stresses are not excessively severe. In that case, the gases produced by the disintegration of transformer insulating oil will have adequate time to dissolve in the oil.

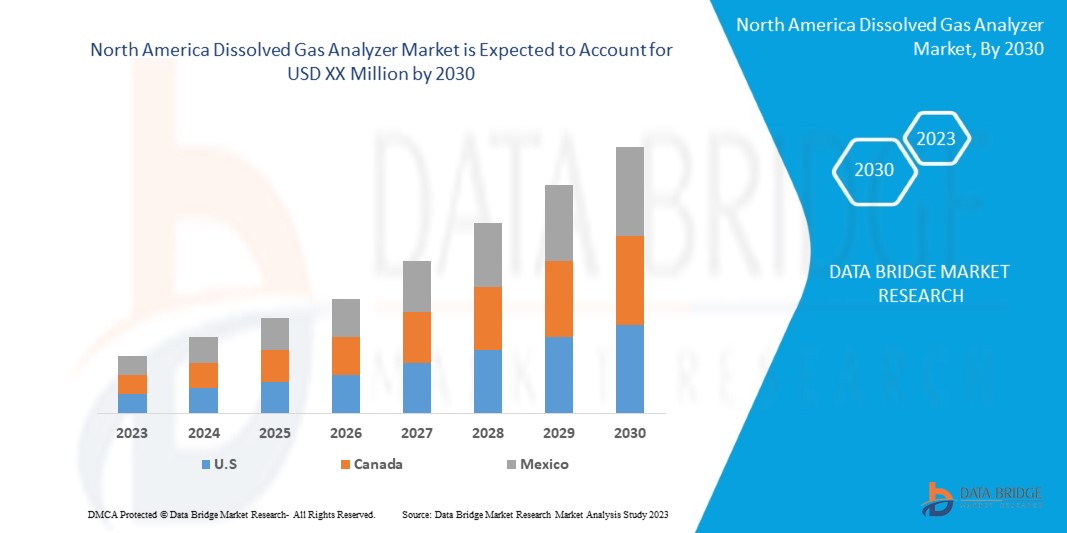

During the forecast period, manufacturers involved in the dissolved gas analyzer market likely benefit significantly from increased awareness of the advantages of dissolved gas analyzers and investments in the construction of utility infrastructure. Data Bridge Market Research analyses that the North America Dissolved gas analyzer Market will grow at a CAGR of 7.9% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Type (Smoke Alarms, Early Warning DGA Monitoring, Comprehensive DGA Monitoring, Laboratory Services, Database Software, And Portable DGA Devices), Gas Type (Single-Gas And Multi-Gas), Technology (Gas Chromatography, Photo Acoustic Spectroscopy, And Others), Product Type (Online, Portable, And Laboratory Use), Extraction Type (Vacuum Extraction Or Rack Method, Headspace Extraction, And Stripper Column Method), And Power Rating (100-500 MVA, 501-800 MVA, and 8001-1200 MVA) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Doble Engineering Company, General Electric Company, Advanced Energy Industries, Inc., Qualitrol Company LLC, Siemens, SDMyers, Vaisala, Weidmann Electrical Technology AG, Camlin Ltd, Hitachi Energy Ltd., SRI Instruments, MM Tech, HV Hipot Electric, MTE Meter Test Equipment AG, Ap2e, Yokogawa Electric Corporation, Sieyuan Electric Co., Ltd., Thermo Fisher Scientific, Drallim Industries Limited, Agilent Technologies among others. |

Dissolved Gas Analyzer Market Definition

Gas analysers from WITT determine gas concentrations in gas mixtures quickly and precisely and are highly versatile. State-of-the-art sensors and intuitive controls allow easy handling of the gas analysers, guarantee exact analysis results and ensure the quality of your processes. Depending on the type of application, the gas analysers can be supplied separately or integrated into gas mixing systems.

North America Dissolved Gas Analyzer Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail below:

Drivers

-

INCREASING CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

The construction industry is an important sector that contributes more to the economic growth of the country. The construction business is also stated to be an investment-driven industry in which the government shows high interest. They enter into contracts with the construction industry to build infrastructure in the health, transportation, and education sectors.

-

TECHNOLOGICAL ADVANCEMENTS IN TRANSFORMER/ GRID PROTECTION

Dissolved gas analysis (DGA) is one of the most effective technologies available to asset managers for determining the health of their transformers. It is can be used to discover problems early on and manage them as the condition progresses. The quantity and relative composition of gases measured can be used to classify developing issues. Overheating of paper (cellulosic materials), overheating of the dielectric liquid (mineral oil or other), partial discharge activity or arcing are examples of issues. In recent times many companies are coming up with their latest and high-end grid solution, transformer protection and monitoring.

-

INCREASING ELECTRICITY DEMAND ACROSS EMERGING NATIONS ON ACCOUNT OF RAPID URBANIZATION

High levels of air pollution are forcing people inside to consume more electricity, subsequently causing even greater environmental problems by increasing greenhouse gas emissions. Electricity demand is set to increase further because of rising household incomes, with the electrification of transport and heat, and growing demand for digitally connected devices and air conditioning. Moreover, rising electricity demand was one of the key reasons why North America CO2 emissions from the power sector reached a high record in the past few years. The electricity demand follows two unique trajectories. Improvements in energy efficiency substantially counter future growth in advanced economies connected to increased digitization and electrification. Rising earnings, greater industrial output, and a growing services sector are all boosting demand for electricity in developing economies.

Opportunities

-

RISE IN DEMAND FOR ZERO POWER DOWNTIME AND POWER FLUCTUATION

Unexpected power interruptions not only cause machine losses in productivity but may also cause unforeseen damages with serious consequences. Various problems happen due to transformer failure because of the unavailability of a dissolved gas analyzer. This leads to the lack of zero power downtime in various sectors.

-

STRATEGIC ALLIANCES & PARTNERSHIPS BETWEEN ORGANIZATIONS

Coordinating and integrating various technologies is essential for achieving sustained environments in various industries. For this reason, the government is also striving through partnerships and acquisitions to accelerate the appropriate use of existing technologies like Dissolved Gas Analyzers (DGA) and transformer-monitoring systems. This not only helps to make awareness and profit of the organization but also creates scope for a sustainable environment. Furthermore, this helps both companies to be recognized in the premium market. Therefore, an increase in merger and acquisitions between organizations are creating many opportunities for the dissolved gas analyzer market to grow extensively.

-

VERY HIGH INSTALLATION COST

The most expensive aspect of a dissolve gas analyzer is the installation section, which can cost as much as or more than the installed technology. While some companies handle much of this in-house, there are still labor costs, supplies, and operational delays to consider. In addition, most systems require an ongoing software maintenance agreement (SMA).

Challenges

- DISRUPTION IN THE SUPPLY CHAIN INDUSTRY

The war for semiconductors, specifically contested by Information and Communications Technology (ICT), is one of the biggest North America issues affecting supply chains in specialized industries. The Covid-19 pandemic, which shut down auto manufacturing while skyrocketing North America consumption of domestic electronics, was the conflict's major cause. However, the source of the problem predates the North America lockdown.

- OPERATIONAL CHALLENGES AND MALFUNCTION OF THE DEVICE

Achieving and maintaining continuous, reliable performance in dissolved gas analyzers depends critically upon the proper design, application, operation, and maintenance of the transformer and DGA equipment. While there are many advantages to using DGA, the major problem is that it requires a long time to complete a test and is expensive. The DGA operator faces many other challenges. It also needs frequent calibration with the system and auxiliary gas to perform the task, which costs very high.

Covid-19 Impact on North America Dissolved Gas Analyzer Market

COVID-19 has negatively affected the market. The war for semiconductors, specifically contested by Information and Communications Technology (ICT), is one of the biggest North America issues affecting supply chains in specialized industries.

The Covid-19 pandemic, which shut down auto manufacturing while skyrocketing North America consumption of domestic electronics, was the conflict's major cause. However, the source of the problem predates the North America lockdown.

Manufacturing suddenly decreased in 2020 due to hastily canceled orders and just-in-time procedures when the pandemic lockdown began. However, as customers used more laptop computers, 5G phones, gaming consoles, and other IT devices, demand for silicon chips soared as a result of the epidemic working circumstances. A V-shaped recovery for personal computers, mobile devices, cars, and wireless communications resulted from a fall in semiconductor demand by the end of 2020.

Recent Development

- In January 2020, SDMyers announced a new working relationship with Camlin Power, a remote transformer monitoring equipment manufacturer. This brings the latest 5- and 9- gas monitoring technology. This helped the company to expand its presence in the North American industrial market

North America Dissolved Gas Analyzer Market Scope

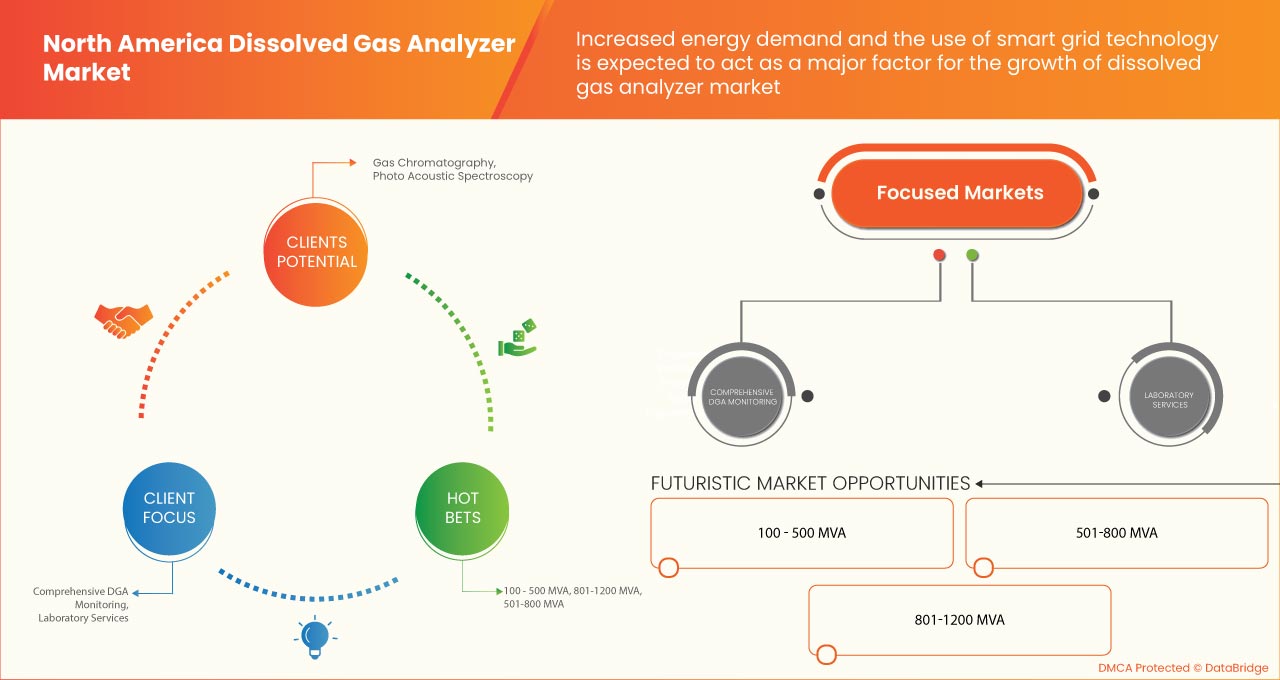

The North America dissolved gas analyzer market is segmented on the basis of by type, gas type, technology, product type, extraction type, and power rating. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Smoke Alarms

- Early Warning DGA Monitoring

- Comprehensive DGA Monitoring

- Laboratory Services

- Database Software

- Portable DGA Devices

On the basis of type, North America dissolved gas analyzer market is segmented into smoke alarms, early warning DGA monitoring, comprehensive DGA monitoring, laboratory services, database software, and portable DGA devices

Gas Type

- Single Gas

- Multi-Gas

On the basis of gas type, North America dissolved gas analyzer market is segmented into single gas, multi-gas

Technology

- Gas Chromatography

- Photo Acoustic Spectroscopy

- Others

On the basis of technology, the North America dissolved gas analyzer market is segmented into gas chromatography, photo acoustic spectroscopy, others

Product Type

- Online

- Portable

- Laboratory Use

On the basis of product type, North America dissolved gas analyzer market is segmented into online, portable, laboratory use

Extraction Type

- Vacuum Extraction Or Rack Method

- Headspace Extraction

- Stripper Column Method

On the basis of extraction type, the North America dissolved gas analyzer market is segmented into vacuum extraction or rack method, headspace extraction, stripper column method

Power Rating

- 100 - 500 MVA

- 501-800 MVA

- 801-1200 MVA

On the basis of power rating, the North America dissolved gas analyzer market is segmented into 100 - 500 MVA, 501-800 MVA, 801-1200 MVA

North America Dissolved Gas Analyzer Market Regional Analysis/Insights

North America dissolved gas analyzer market is analyzed, and market size insights and trends are provided by type, gas type, technology, product type, extraction type, and power rating.

The countries covered in the North America dissolved gas analyzer market report are U.S., Canada, and Mexico.

The U.S. dominates the region due to the market due to growing infrastructure.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brand's impact on sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Dissolved Gas Analyzer Market Share Analysis

North America dissolved gas analyzer market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the North America Dissolved gas analyzer Market.

Some of the major players operating in the North America Dissolved gas analyzer Market are Doble Engineering Company, General Electric Company, Advanced Energy Industries, Inc., Qualitrol Company LLC, Siemens, SDMyers, Vaisala, Weidmann Electrical Technology AG, Camlin Ltd, Hitachi Energy Ltd., SRI Instruments, MM Tech, HV Hipot Electric, MTE Meter Test Equipment AG, Ap2e, Yokogawa Electric Corporation, Sieyuan Electric Co., Ltd., Thermo Fisher Scientific, Drallim Industries Limited, Agilent Technologies among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CONSTRUCTION ACTIVITIES ACROSS THE GLOBE

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN TRANSFORMER/ GRID PROTECTION

6.1.3 INCREASING ELECTRICITY DEMAND ACROSS EMERGING NATIONS ON ACCOUNT OF RAPID URBANIZATION

6.1.4 RAPID GROWTH IN UTILITY INFRASTRUCTURE

6.1.5 INCREASED ENERGY DEMAND AND THE USE OF SMART GRID TECHNOLOGY IN DEVELOPING NATIONS

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 VERY HIGH INSTALLATION COST

6.3 OPPORTUNITIES

6.3.1 RISE IN DEMAND FOR ZERO POWER DOWNTIME AND POWER FLUCTUATION

6.3.2 STRATEGIC ALLIANCES & PARTNERSHIPS BETWEEN ORGANIZATIONS

6.3.3 INCREASING GOVERNMENT INITIATIVES FOR ADVANCED POWER DISTRIBUTION/MONITORING

6.3.4 ADVANCEMENT IN THE SELF-DIAGNOSTIC SYSTEM FOR TRANSFORMERS

6.4 CHALLENGES

6.4.1 DISRUPTION IN THE SUPPLY CHAIN INDUSTRY

6.4.2 OPERATIONAL CHALLENGES AND MALFUNCTION OF THE DEVICE

7 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE

7.1 OVERVIEW

7.2 EARLY WARNING DGA MONITORING

7.3 LABORATORY SERVICES

7.4 COMPREHENSIVE DGA MONITORING

7.5 DATABASE SOFTWARE

7.6 SMOKE ALARMS

7.7 PORTABLE DGA DEVICES

8 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE

8.1 OVERVIEW

8.2 MULTI- GAS

8.3 SINGLE- GAS

9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 GAS CHROMATOGRAPHY

9.3 PHOTO ACOUSTIC SPECTROSCOPY

9.4 OTHERS

10 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE

10.1 OVERVIEW

10.2 LABORATORY USE

10.3 ONLINE

10.4 PORTABLE

11 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE

11.1 OVERVIEW

11.2 HEADSPACE EXTRACTION

11.3 VACUUM EXTRACTION OR RACK METHOD

11.4 STRIPPER COLUMN METHOD

12 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING

12.1 OVERVIEW

12.2 501-800 MVA

12.3 100-500 MVA

12.4 801-1200 MVA

13 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SIEYUAN ELECTRIC CO.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 HITACHI ENERGY LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 WEIDMANN ELECTRICAL TECHNOLOGY AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 THERMO FISHER SCIENTIFIC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADVANCED ENERGY INDUSTRIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AGILENT TECHNOLOGIES, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 AP2E

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CAMLIN LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DOBLE ENGINEERING COMPANY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DRALLIM INDUSTRIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 HV HIPOT

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MM TECH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MTE METER TEST EQUIPMENT AG

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 QUALITROL COMPANY LLC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SDMYERS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SIEMENS

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SRI INSTRUMENTS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VAISALA

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 YOKOGAWA ELECTRIC CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 EMISSION STANDARDS FOR COAL-FIRED POWER PLANTS

TABLE 2 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA EARLY WARNING DGA MONITORING IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LABORATORY SERVICES IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA COMPREHENSIVE DGA MONITORING IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA DATABASE SOFTWARE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SMOKE ALARMS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PORTABLE DGA DEVICES IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA MULTI-GAS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SINGLE-GAS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA GAS CHROMATOGRAPHY IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PHOTO ACOUSTIC SPECTROSCOPY IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA LABORATORY USE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ONLINE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PORTABLE IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA HEADSPACE EXTRACTION IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA VACUUM EXTRACTION OR RACK METHOD IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA STRIPPER COLUMN METHOD IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA 501-800 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA 100-500 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA 801-1200 MVA IN DISSOLVED GAS ANALYZER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 47 MEXICO DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 50 MEXICO DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SEGMENTATION

FIGURE 11 INCREASING CONSTRUCTION ACTIVITIES ACROSS THE GLOBE ARE BOOSTING THE GROWTH OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 12 EARLY WARNING DGA MONITORING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DISSOLVED GAS ANALYZER MARKET IN 2023 - 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA DISSOLVED GAS ANALYZER MARKET

FIGURE 14 KEY COAL CAPACITY CONTRIBUTORS IN ASIA-PACIFIC REGION, 2017-18

FIGURE 15 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY GAS TYPE, 2022

FIGURE 17 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY TECHNOLOGY, 2022

FIGURE 18 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY EXTRACTION TYPE, 2022

FIGURE 20 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET, BY POWER RATING, 2022

FIGURE 21 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: BY SOURCE (2023-2030)

FIGURE 26 NORTH AMERICA DISSOLVED GAS ANALYZER MARKET: COMPANY SHARE 2022 (%)

North America Dissolved Gas Analyzer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Dissolved Gas Analyzer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Dissolved Gas Analyzer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.