North America Digital Scent Technology Market Analysis and Size

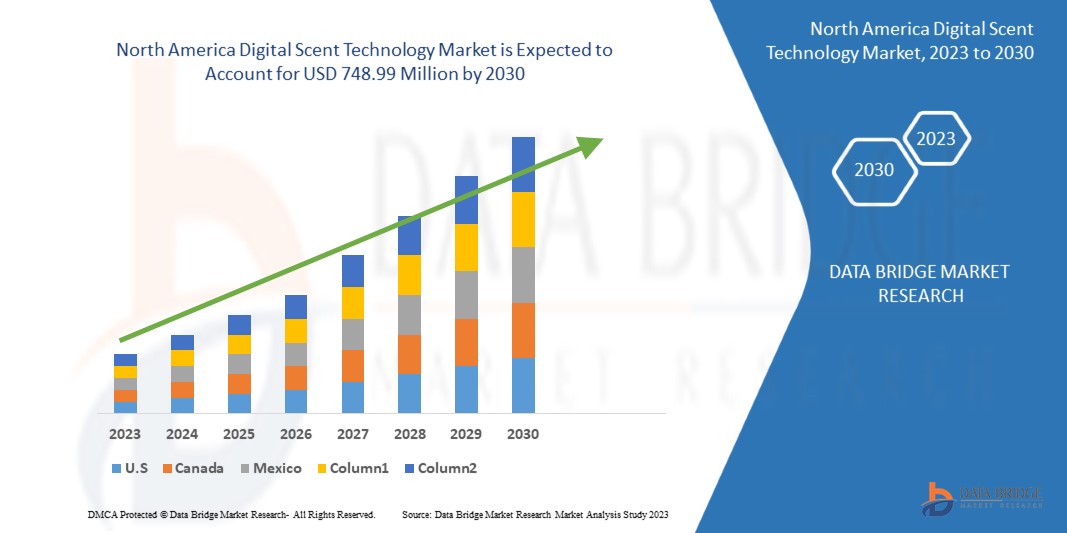

The North America digital scent technology market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.9% in the forecast period of 2023 to 2030 and is expected to reach USD 748.99 million by 2030. The major factor driving the growth of digital scent technology is the increasing usage of e-nose in the food industry to ensure product quality and the rising application of e-nose in clinical diagnosis.

Using hardware elements like an e-nose and a scent synthesiser, digital scent technology is a technique for transmitting, receiving, and smelling scented digital material. A set of gas sensors known as an "e-nose" is a device that can recognize and identify different odours. Electronic gadgets like TVs, phones, and tablets all release aromas using a mechanism called a scent synthesiser.

The North America digital scent technology market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (E-Nose and Scent Synthesizer), Product type (Quality Control Product, Smelling Screen, Music & Video Game, Mobile Phone, Medical Diagnostics Product, Explosives Detector, and Others), Application (Entertainment, Marketing, Food & Beverage, Communication, Healthcare, Military & Defense, and Education)

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Alpha MOS, Electronic Sensor Technology, The eNose Company, Sensigent, Aromajoin Corporation, AIRSENSE Analytics GmbH, Owlstone Inc., Smiths Detection Group Ltd., ScentSational Technologies LLC., Teledyne FLIR LLC, Aryballe technologies, Inhalio, Inc., E-Nose Pty Ltd, MUI Robotics Co., Ltd., OVR Technology, Olorama Technology Ltd., AerNos, Inc., OW Smell Made Digital, SmartNanotubes Technologies GmbH, and Breathomix, among others |

Market Definition

Digital scent technology is a method of transmitting, receiving, and smelling scented digital media using hardware components such as an e-nose and a scent synthesizer. An e-nose is a collection of gas sensors that can be used to detect and sense various odors. A device known as a scent synthesizer emits scents from electronic devices, including TVs, cell phones, and tablets. Digital smell technology is employed in various applications by many end-user industries, including military & defense, food & beverage, medical, marketing, entertainment, environment monitoring, and others, such as communication, agriculture, public security, transportation, and R&D.

North America Digital Scent Technology Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Emerging recent research and development projects to create an e-nose to detect covid-19

Digital scent and associated e-nose is a technique for digital media that can detect, send, and receive scents. The main use of e-nose is in digital smell technologies. The smell may now be detected, sent, and received online. Recent research and development in this technology have enabled the scientific community to utilize this technology in diagnostic fields. Since this technology is continuously emerging and evolving, it has a lot of potential and scope to be met in the forecast period.

The era of pandemic caused by covid-19 gave this market a chance to get involved with the field of diagnostic technology as well. Certain research and developments are going on by which digital technology can be applied to detect covid-19. One of the most relevant digital scent technology devices is the e-nose (an electronic nose). This e-nose technology has been proven to be useful in covid-19 detection.

Opportunities

- Opportunities for e-noses to expand in environmental monitoring

The electronic nose truly operates under the same principles as a bionic simulation of the human olfactory system. The idea of detecting smells was put forth 100 years ago by the well-known inventor Bell, but it wasn't until 50 years later that significant development in the field was made. In the 1980s of the previous century, Europe and the United States started to create useful odour detection technologies and goods. Currently, the electronic nose is used in various disciplines, including environmental monitoring, security, traffic safety, and medicine, among others.

In addition, in today’s world, environmental monitoring is necessary to learn more about it and determine how well it supports the preservation of collections. There are continuous recording devices (data loggers and hygro-thermographs) and spot readers that merely show the present conditions that make temperature and humidity monitoring easier (thermometers, hygrometers, and humidity indicator strips). Finding and controlling dangerous chemical emissions in the atmosphere has become a top priority for many nations worldwide. Many organic and inorganic pollutants are emitted into the air, land, and water, posing serious health risks to people, plants, and animals. To ensure the quality of human life and the sustainability of the world, environmental pollutants must therefore be monitored. Applying digital scent technology and e-nose in environmental monitoring is creating another opportunity for the market to grow.

Restraints/Challenges

- Side effects caused by chemicals associated with scent/fragrance

Scent and fragrance products or products associated with scent and perfume are produced using various organic chemicals and synthetic chemicals as raw materials. Chemicals used in the scent and perfumes can cause fatal side effects, which can further turn into diseases for short-term or chronic. The pandemic of COVID-19 made the public and government highly aware of health consciousness in developed countries such as the United States, Japan, China, Brazil, and Saudi Arabia, among others. Side effects caused by normal scented products can also affect the market of digital scent technology North America. Since consumers are becoming aware of their health safety day by day, the prevalence of side effects caused by scent and perfume products can make the market decline for the forecast period.

Post COVID-19 Impact on Digital Scent Technology

Covid-19 has had a negative impact on practically every business and industry. However, the digital scent technology market gained some benefits from the pandemic as well. The commercial circumstances that Covid-19 has created are unprecedented, and various organizations are scrambling to react to that situation, creating growth in the e-nose segment due to the covid detection ability of electronic noses.

Covid-19's influence on digital scent technology is broad and multifaceted. Many electronic nose and digital scent technology firms took undertaking changes to suit its consequences. They focused on technological innovations in developing e-noses that can detect coronavirus. The e-nose and digital scent technology sector is extremely fortunate to be able to operate digitally, allowing the firms to continue to operate with minimal health and safety risks for employees.

However, this does not imply that the digital scent technology industry adjustments have been simple to implement. Not every segment of digital scent technology was built to allow team members to work remotely. In truth, the majority of the firms operate physically with dedicated equipment, software, hardware, and laboratories.

Digital scent technology firms have implemented a number of technological and digital innovations in order to maintain excellent virtual performance.

Recent Developments

- In January 2023, Teledyne FLIR LLC e-commerce is about to make shopping for test and measurement customers much simpler. With the merger of the Extech online store and website into FLIR.com, all professional test and measurement needs may now be met in a single spot with access to product information, supplementary materials, downloads, and additional customer assistance.

- In January 2023, Aryballe technologies released a new cloud-based tool called the Digital Olfaction Hub to enable quicker and easier odor analysis. The most recent addition to Aryballe's range of olfaction solutions is already available and allows teams to access olfaction data with a complete set of analytical capabilities.

North America Digital Scent Technology Market Scope

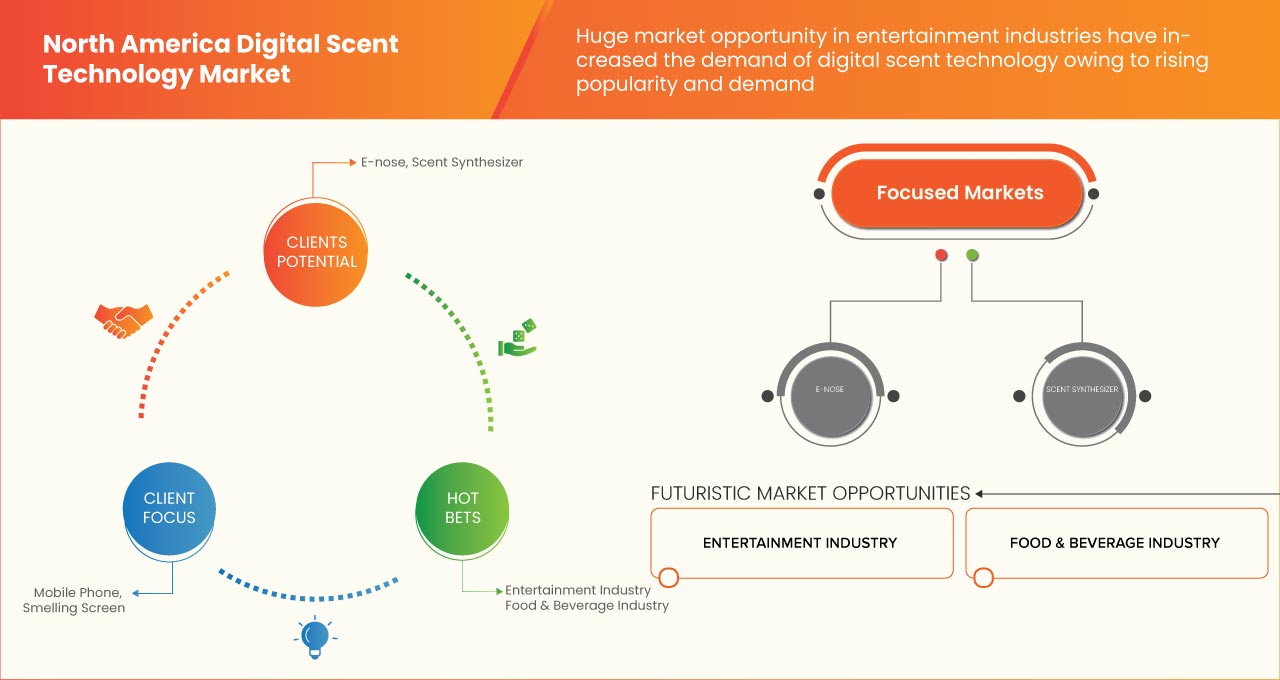

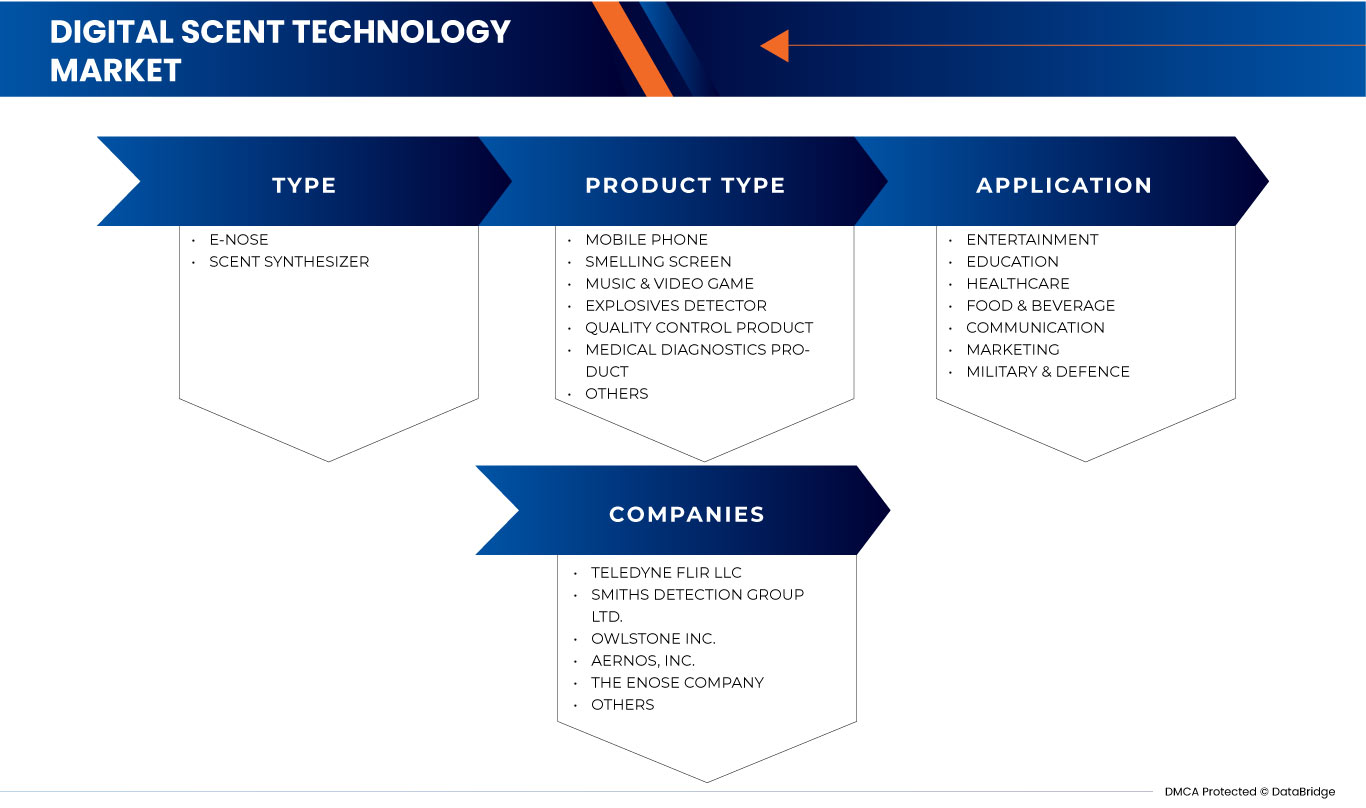

The North America digital scent technology market is categorized based on type, product type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY TYPE

- E-Nose

- Scent Synthesizer

On the basis of type, the North America digital scent technology market is classified into two segments, e-nose and scent synthesizer.

BY PRODUCT TYPE

- Quality Control Product

- Smelling Screen

- Music & Video Game

- Mobile Phone

- Medical Diagnostics Product

- Explosives Detector

- Others

On the basis of product type, the North America digital scent technology market is classified into seven segments, quality control products, smelling screens, music & video game, mobile phone, medical diagnostics product, explosives detectors, and others.

BY APPLICATION

- Entertainment

- Marketing

- Food & Beverage

- Communication

- Healthcare

- Military & Defense

- Education

On the basis of application, the North America digital scent technology market is classified into seven segments entertainment, marketing, food & beverage, communication, healthcare, military & defense, and education.

North America Digital scent technology Market Regional Analysis/Insights

The North America digital scent technology market is segmented on the basis of type, product type, and application.

The countries in the North America digital scent technology market are the U.S., Canada, and Mexico.

The U.S dominates in the North America region due to growing awareness regarding the applicability of digital scent technology products.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Digital Scent Technology Market Share Analysis

The North America digital scent technology market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America digital scent technology market.

Some of the prominent participants operating in the North America digital scent technology market are Alpha MOS, Electronic Sensor Technology, The eNose Company, Sensigent, Aromajoin Corporation, AIRSENSE Analytics GmbH, Owlstone Inc., Smiths Detection Group Ltd., ScentSational Technologies LLC., Teledyne FLIR LLC, Aryballe technologies, Inhalio, Inc., E-Nose Pty Ltd, MUI Robotics Co., Ltd., OVR Technology, Olorama Technology Ltd., AerNos, Inc., OW Smell Made Digital, SmartNanotubes Technologies GmbH, and Breathomix, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DIGITAL SCENT TECHNOLOGY MACHINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

4.2 FACTORS INFLUENCING THE PURCHASE DECISION OF END USERS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.5 IMPORT-EXPORT ANALYSIS

4.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6.1 RISING TRENDS IN THE FOOD AND BEVERAGE INDUSTRY

4.6.2 BUSINESS EXPANSIONS

4.7 PRICING INDEX

4.8 SUPPLY CHAIN ANALYSIS

4.9 TECHNOLOGICAL INNOVATION

4.1 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EMERGING RECENT RESEARCH AND DEVELOPMENT PROJECTS TO CREATE AN E-NOSE TO DETECT COVID-19

6.1.2 INCREASING USAGE OF E-NOSE IN THE FOOD INDUSTRY TO ENSURE PRODUCT QUALITY

6.1.3 RISING APPLICATION OF E-NOSE IN CLINICAL DIAGNOSIS

6.1.4 TECHNOLOGICAL ADVANCEMENTS IN DIGITAL SCENT TECHNOLOGY

6.2 RESTRAINT

6.2.1 HIGH COST ASSOCIATED WITH DIGITAL SCENT TECHNOLOGY

6.3 OPPORTUNITIES

6.3.1 APPLICATION OF E-NOSE IN THE DEFENCE SECTOR

6.3.2 OPPORTUNITIES FOR E-NOSES TO EXPAND IN ENVIRONMENTAL MONITORING

6.4 CHALLENGES

6.4.1 SIDE EFFECTS CAUSED BY CHEMICALS ASSOCIATED WITH SCENT/FRAGRANCE

6.4.2 INSUFFICIENT FAMILIARITY WITH PRODUCTS UTILIZING DIGITAL SCENT TECHNOLOGY

7 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE

7.1 OVERVIEW

7.2 E-NOSE

7.2.1 E-NOSE, BY PRODUCT TYPE

7.2.1.1 QUALITY CONTROL PRODUCT

7.2.1.2 SMELLING SCREEN

7.2.1.3 MUSIC & VIDEO GAME

7.2.1.4 MOBILE PHONE

7.2.1.5 MEDICAL DIAGNOSTICS PRODUCT

7.2.1.6 EXPLOSIVES DETECTOR

7.2.1.7 OTHERS

7.3 SCENT SYNTHESIZER

7.3.1 SCENT SYNTHESIZER, BY PRODUCT TYPE

7.3.1.1 QUALITY CONTROL PRODUCT

7.3.1.2 SMELLING SCREEN

7.3.1.3 MUSIC & VIDEO GAME

7.3.1.4 MOBILE PHONE

7.3.1.5 MEDICAL DIAGNOSTICS PRODUCT

7.3.1.6 EXPLOSIVES DETECTOR

7.3.1.7 OTHERS

8 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 QUALITY CONTROL PRODUCT

8.3 SMELLING SCREEN

8.4 MUSIC & VIDEO GAME

8.5 MOBILE PHONE

8.6 MEDICAL DIAGNOSTICS PRODUCT

8.7 EXPLOSIVES DETECTOR

8.8 OTHERS

9 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ENTERTAINMENT

9.3 MARKETING

9.4 FOOD & BEVERAGE

9.5 COMMUNICATION

9.6 HEALTHCARE

9.7 MILITARY & DEFENSE

9.8 EDUCATION

10 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 TELEDYNE FLIR LLC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY PROFILE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SMITHS DETECTION GROUP LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY PROFILE

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 OWLSTONE INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY PROFILE

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 AERNOS, INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY PROFILE

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 THE ENOSE COMPANY

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY PROFILE

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AIRSENSE ANALYTICS GMBH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ALPHA MOS

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 AROMAJOIN CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ARYBALLE TECHNOLOGIES

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 BREATHOMIX

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 ELECTRONIC SENSOR TECHNOLOGY

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 E-NOSE PTY LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 INHALIO, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 MUI ROBOTICS CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 OLORAMA TECHNOLOGY LTD.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 OVR TECHNOLOGY

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 OW SMELL MADE DIGITAL

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SCENTSATIONAL TECHNOLOGIES LLC.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SENSIGENT LLC.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SMARTNANOTUBES TECHNOLOGIES GMBH

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS; HS CODE OF PRODUCT: 902710 (UNITS)

TABLE 2 IMPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS; HS CODE OF PRODUCT: 902710 (TONS)

TABLE 3 EXPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS; HS CODE OF PRODUCT: 902710 (UNITS)

TABLE 4 EXPORT DATA OF GAS OR SMOKE ANALYSIS APPARATUS; HS CODE OF PRODUCT: 902710 (TONS)

TABLE 5 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA QUALITY CONTROL PRODUCT IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SMELLING SCREEN IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA MUSIC & VIDEO GAME IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA MOBILE PHONE IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA MEDICAL DIAGNOSTICS PRODUCT IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA EXPLOSIVES DETECTOR IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ENTERTAINMENT IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA MARKETING IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD & BEVERAGE IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA COMMUNICATION IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HEALTHCARE IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MILITARY & DEFENSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA EDUCATION IN DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 U.S. DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 35 U.S. DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 36 U.S. DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 CANADA DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 CANADA E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 CANADA SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 CANADA DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 CANADA DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 MEXICO DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO E-NOSE IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 MEXICO SCENT SYNTHESIZER IN DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND FOR E-NOSE IN CLINICAL DIAGNOSIS IS DRIVING THE GROWTH OF NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 E-NOSE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET IN 2023 & 2030

FIGURE 12 PORTER'S FIVE FORCES

FIGURE 13 VALUE CHAIN OF NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET:

FIGURE 15 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: BY SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: BY TYPE (2023-2030)

FIGURE 23 NORTH AMERICA DIGITAL SCENT TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.