North America Dental Implants And Prosthetics Market

Market Size in USD Billion

CAGR :

%

USD

2.33 Billion

USD

4.16 Billion

2024

2032

USD

2.33 Billion

USD

4.16 Billion

2024

2032

| 2025 –2032 | |

| USD 2.33 Billion | |

| USD 4.16 Billion | |

|

|

|

|

Dental Implants and Prosthetics Market Size

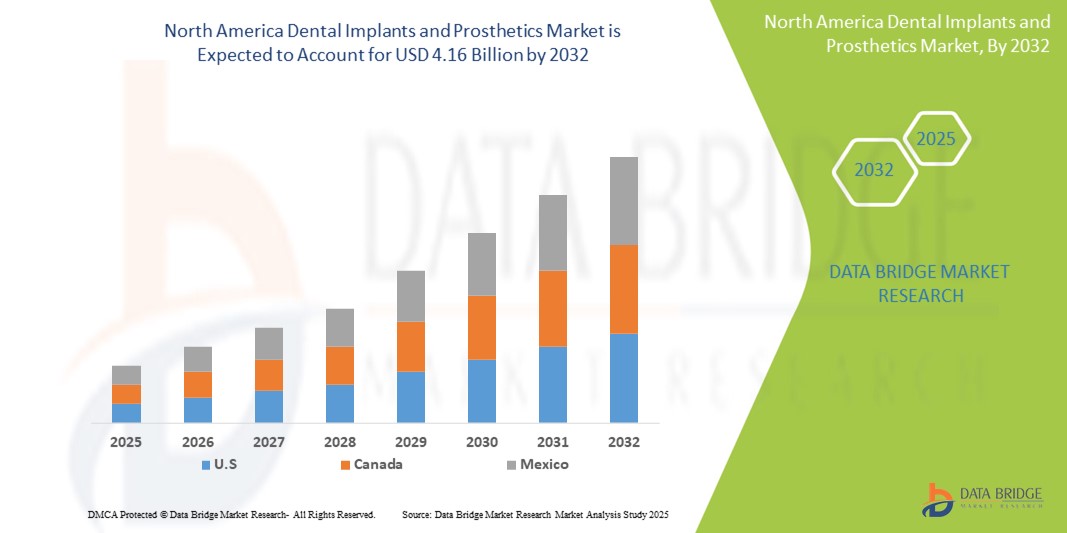

- The North America Dental Implants and Prosthetics market size was valued at USD 2.33 billion in 2024 and is expected to reach USD 4.16 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market's growth is largely fueled by the increasing aging population, the rising prevalence of dental diseases, and the growing demand for cosmetic dentistry. Technological advancements in dental materials and surgical techniques, coupled with increasing awareness of the benefits of dental implants and prosthetics, are also driving market expansion.

- These converging factors are accelerating the uptake of dental restoration solutions, thereby significantly boosting the industry's growth.

Dental Implants and Prosthetics Market Analysis

- The North America dental implants and prosthetics market involves the design, manufacturing, and sales of devices and materials used to replace missing teeth. This includes dental implants, abutments, crowns, bridges, dentures, and related products. These products enhance aesthetics, improve oral function, and contribute to overall patient health.

- The escalating demand for dental implants and prosthetics is primarily fueled by the increasing geriatric population, the rising incidence of edentulism, and the growing demand for minimally invasive dental procedures across the U.S. and Canada.

- The U.S. dominates the Dental Implants and Prosthetics market in North America with the largest revenue share of 84.31%in 2024, characterized by a high volume of dental procedures, advanced healthcare infrastructure, and the presence of key market player.

- The U.S. is expected to be the fastest-growing country in the North America Dental Implants and Prosthetics market during the forecast period, driven by the increasing preference for minimally invasive outpatient dental procedures, a rising geriatric population with a high prevalence of edentulism, and a robust presence of key market players investing in advanced implant and prosthetic technologies. Additionally, the growing awareness of oral health and aesthetics, along with improved access to dental insurance and financing options, is further accelerating market adoption.

- Dental Implants is expected to dominate the North America Dental Implants and Prosthetics market with a market share of 31.2% in 2025, driven by rising clinical success rates of dental implants, their long-term cost-effectiveness, and their growing use as a preferred solution for permanent tooth replacement. Technological advancements in implant materials, such as titanium and zirconia, and the increasing use of computer-aided design/manufacturing (CAD/CAM) in prosthetic fabrication are also fueling this trend.

Report Scope and Dental Implants and Prosthetics Market Segmentation

|

Attributes |

Dental Implants and Prosthetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Implants and Prosthetics Market Trends

“Adoption of digital dentistry technologies”

- Growing demand for digital dentistry: The integration of digital technologies such as CAD/CAM, 3D printing, and intraoral scanning is revolutionizing dental implantology and prosthetics by improving the precision, efficiency, and speed of dental restoration procedures.

- For instance, CAD/CAM systems enable the design and fabrication of custom-made prosthetics with high accuracy, while 3D printing allows for the rapid production of dental models and surgical guides.

- The development of minimally invasive surgical techniques, such as guided implant surgery, is also enhancing patient comfort and reducing recovery time. Furthermore, the use of advanced imaging technologies like cone-beam computed tomography (CBCT) is improving treatment planning and implant placement accuracy.

- This trend towards digital dentistry is fundamentally reshaping dental practices and driving market growth, with companies like Dentsply Sirona and Straumann Group leading the development of integrated digital solutions. The demand for digital workflows is growing rapidly across dental clinics and laboratories.

- The rising popularity of cosmetic dentistry and the increasing focus on aesthetics are driving the demand for high-quality, natural-looking dental prosthetics

Dental Implants and Prosthetics Market Dynamics

Driver

“Prevalence of edentulism and periodontal diseases”

- Rising prevalence of edentulism and periodontal diseases: The increasing incidence of tooth loss due to factors such as aging, gum disease, and dental caries is a significant driver for the heightened demand for dental implants and prosthetics

- For instance, according to the CDC, approximately 1 in 5 adults aged 65 and older have lost all of their natural teeth. Similarly, periodontal disease affects a significant portion of the adult population, often leading to tooth loss and the need for restorative solutions

- As the population ages, the prevalence of these conditions is expected to rise, further driving the demand for effective and long-lasting tooth replacement options.

- The growing awareness of the benefits of dental implants and prosthetics, coupled with increasing disposable incomes and improved access to dental care, is also fueling market growth

Restraint/Challenge

“High treatment costs”

- High cost of dental implant procedures and reimbursement issues: The high cost of dental implant procedures and the complexities associated with insurance reimbursement pose a significant challenge to broader market adoption, particularly among price-sensitive patients and those with limited insurance coverage.

- For instance, the cost of a single dental implant, including the implant, abutment, and crown, can range from USD 3,000 to USD 5,000 or more, depending on the location, complexity of the case, and materials used.

- The lack of comprehensive dental insurance coverage for many patients and the variations in reimbursement policies among different insurance providers can create financial barriers and limit the affordability of dental implant treatment.

- Addressing these challenges requires collaborative efforts among dental professionals, insurance companies, and government agencies to develop more affordable treatment options and improve insurance coverage for dental implants and prosthetics

Dental Implants and Prosthetics Market Scope

The market is segmented on the basis material, stage, product type, price, design, type and type of facility.

- By Material

On the basis of material, the North America dental implants and prosthetics market is segmented into titanium, zirconium, PFM and all ceramics. The titanium segment dominates the largest market revenue share of 38.5% in 2025, due to its high biocompatibility, strength, corrosion resistance, and long-term success in osseointegration. Its versatility across various implant designs and surgical protocols makes it the preferred choice for dental professionals.

The zirconium segment is anticipated to witness the fastest growth rate of 7.54% from 2025 to 2032, fueled by rising demand for metal-free and aesthetically superior alternatives. Zirconium implants appeal to patients with metal allergies and those prioritizing natural tooth appearance, especially in anterior restorations.

- By Stage

On the basis of stage, the North America dental implants and prosthetics market is segmented into WO stage and single stage. The two-stage (WO stage) segment held the largest market revenue share in 2025, due to its widespread use in complex cases requiring bone healing before prosthetic attachment. It provides enhanced stability and is preferred in cases of poor bone quality or grafting.

The single-stage segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for shorter treatment times and minimally invasive techniques. Single-stage implants reduce patient visits and are ideal for suitable candidates with adequate bone support.

- By Product Type

On the basis of product type, the North America dental implants and prosthetics market is segmented into dental implants, dental prosthetics. The Dental implants segment accounted for the largest market revenue share in 2025 due to the growing number of patients suffering from partial or complete tooth loss and the increasing preference for permanent restorative solutions.

The Bioburden Testing segment is projected to witness the fastest CAGR from 2025 to 2032, driven by cosmetic dentistry trends, the rise in minimally invasive procedures, and growing access to digital technologies that ensure precision-fitted restorations.

- By Design

On the basis of design, the North America dental implants and prosthetics market is segmented into tapered dental implants and parallel-walled dental implants. The tapered dental implants segment accounted for the largest market revenue share in 2025 due to their anatomical compatibility, enhanced initial stability, and suitability for immediate loading protocols. These implants replicate the natural tooth root shape, promoting better integration and patient outcomes.

The Parallel-walled implants segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasingly used in dense bone structures, where uniform surface contact ensures stability. Their standardized geometry appeals to clinicians seeking predictable outcomes. From 2025 to 2032, growth in parallel-walled implants is expected as they become more accessible and are supported by evolving surgical technique.

- By Price

On the basis of price, the North America dental implants and prosthetics market is segmented into premium implants, value implants and discounted implants. The Premium implants segment attributed to their precision engineering, superior clinical performance, and wide adoption in high-end practices. They offer advanced surface treatments, comprehensive product portfolios, and extensive clinician training.

The value and discounted implants crowns segment is projected to witness the fastest CAGR from 2025 to 2032, gaining traction, especially in community practices and cost-conscious settings. Their affordability, improved manufacturing quality, and rising acceptance among general dentists are driving growth. Value and discounted segments are projected to grow steadily, fueled by insurance expansion and market penetration in underserved regions.

- By Type

On the basis of type, the North America dental implants and prosthetics market is segmented into root-form dental implants and plate-form dental implants. The Root-form implants segment accounted for the largest market revenue share in 2025 are considered the gold standard due to their superior integration with bone and suitability for most patients. Their cylindrical or tapered design supports predictable placement and long-term outcomes.

The Plate-form implants segment is projected to witness the fastest CAGR from 2025 to 2032, as designed for patients with narrow jawbones or limited vertical bone height, is expected to grow steadily. These implants allow for less invasive placement in anatomically challenging areas, making them increasingly attractive as alternatives to bone grafting in complex cases.

- By Type of Facility

On the basis of type of facility, the North America dental implants and prosthetics market is segmented into hospitals and clinics, dental laboratories and other facilities. The hospitals and clinics segment holds the largest market revenue share in 2025, due to their comprehensive care capabilities, experienced dental professionals, and access to integrated diagnostic and surgical tools. These settings are preferred for complex procedures requiring multidisciplinary expertise.

The Dental laboratories segment is expected to witness the fastest growth from 2025 to 2032, supported by increased demand for personalized restorations and advancements in CAD/CAM and 3D printing technologies. As digital dentistry becomes mainstream, laboratories play a pivotal role in producing high-precision prosthetics that enhance both functional and aesthetic outcomes.

Dental Implants and Prosthetics Market Regional Analysis

- U.S. dominates the Dental Implants and Prosthetics market with the largest revenue share of 84.31% in 2024, driven by the increasing aging population, high prevalence of edentulism, and growing demand for cosmetic dentistry.

- The presence of a large number of dental clinics and advanced healthcare infrastructure, coupled with favorable reimbursement policies, also contributes to market growth in the U.S.

- Additionally, the increasing focus on research and development activities and the presence of leading dental implant manufacturers in the U.S. further fuel market expansion

Canada Dental Implants and Prosthetics Market Insight

The Canada Dental Implants and Prosthetics market is projected to expand at a substantial CAGR throughout the forecast period, driven by factors such as the rising geriatric population, increasing awareness of oral health, and the availability of advanced dental care services. The Canadian healthcare system, with its emphasis on quality and accessibility, supports the adoption of modern dental restoration techniques. Additionally, the increasing number of dental specialists and the growing demand for cosmetic dentistry contribute to market expansion in Canada

Mexico Dental Implants and Prosthetics Market Insight

The Mexico Dental Implants and Prosthetics market is anticipated to grow at a noteworthy CAGR during the forecast period driven by improving healthcare infrastructure, increasing dental tourism, and rising disposable incomes. The growing awareness of the importance of oral health and the increasing demand for advanced dental treatments, including implant-based restorations, are fueling market growth in Mexico. Government initiatives to improve access to dental care and the increasing number of dental clinics offering specialized services also contribute to the market's growth.

Dental Implants and Prosthetics Market Share

The Dental Implants and Prosthetics industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Dentsply Sirona (U.S.)

- Straumann Group (Switzerland)

- Henry Schein, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Envista Holdings Corporation (U.S.)

- Osstem Implant Co., Ltd. (South Korea)

- GC Corporation (Japan)

- 3M Company (U.S.)

Latest Developments in North America Dental Implants and Prosthetics Market

- In March 2024, Dentsply Sirona launched a new digital dentistry solution that integrates implant planning, surgical guidance, and prosthetic design into a seamless workflow. This innovation aims to improve the efficiency and accuracy of dental implant procedures.

- In February 2024, Straumann Group received FDA approval for a novel dental implant material with enhanced osseointegration properties. This material is designed to promote faster healing and improve the long-term stability of dental implants.

- In January 2024, Zimmer Biomet announced a partnership with a leading dental laboratory to expand the availability of custom-made dental prosthetics using advanced CAD/CAM technology. This collaboration aims to provide patients with more personalized and aesthetically pleasing restoration options.

- In December 2023, Henry Schein launched a new educational program for dental professionals on the latest advancements in implant dentistry and prosthetic rehabilitation. This initiative aims to enhance the knowledge and skills of dentists and improve the quality of care provided to patients.

- In November 2023, Envista Holdings Corporation introduced a new line of dental implants with a simplified surgical protocol, designed to reduce the complexity and duration of implant placement procedures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.