North America Dental Aligners Market

Market Size in USD Billion

CAGR :

%

USD

3.03 Billion

USD

9.07 Billion

2025

2033

USD

3.03 Billion

USD

9.07 Billion

2025

2033

| 2026 –2033 | |

| USD 3.03 Billion | |

| USD 9.07 Billion | |

|

|

|

|

North America Dental Aligners Market Size

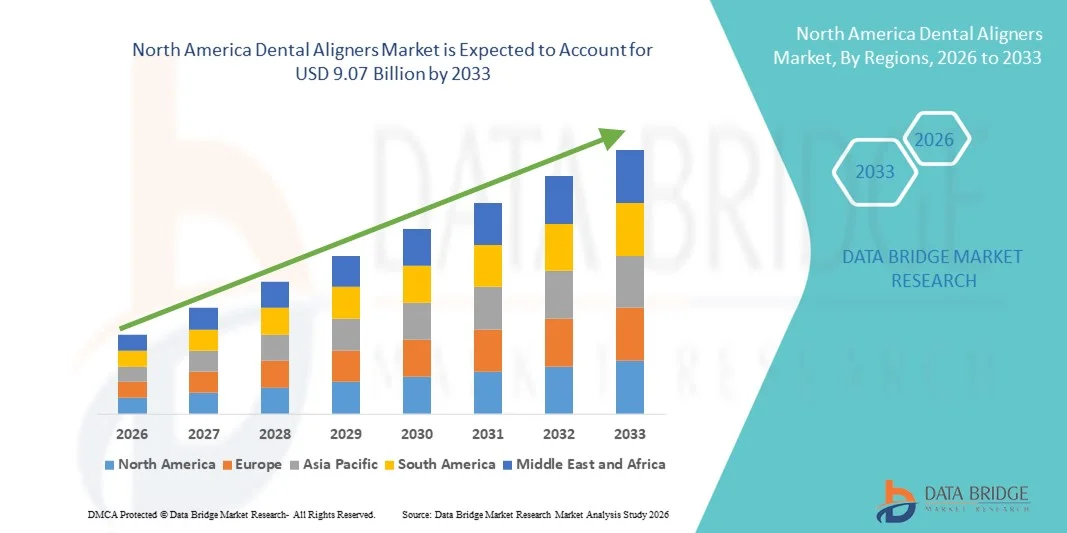

- The North America dental aligners market size was valued at USD 3.03 billion in 2025 and is expected to reach USD 9.07 billion by 2033, at a CAGR of 14.70% during the forecast period

- The market growth is largely fueled by rising adoption of dental aesthetic solutions, increasing consumer awareness of orthodontic treatments, and expanding digital dental technologies that streamline treatment planning and patient experience

- Furthermore, growing demand for clear, comfortable, and removable orthodontic options that integrate seamlessly with modern lifestyles coupled with strong dental care infrastructure and favorable reimbursement policies are driving widespread uptake of dental aligners across both adult and teen populations, significantly boosting the region’s market expansion

North America Dental Aligners Market Analysis

- Dental aligners, offering clear, removable, and digitally designed orthodontic solutions, are increasingly vital components of modern dental care in both adult and teen populations due to their enhanced comfort, aesthetic appeal, and seamless integration with digital treatment planning and 3D scanning technologies

- The escalating demand for dental aligners is primarily fueled by rising consumer awareness of oral aesthetics, growing adoption of orthodontic treatments, and a preference for convenient, less visible alternatives to traditional braces

- The U.S. dominated the North America dental aligners market with the largest revenue share of 85.3% in 2025, characterized by advanced dental infrastructure, high disposable incomes, and a strong presence of key industry players, with substantial growth in both in-office and at-home aligner treatments, driven by innovations from established orthodontic companies and startups leveraging AI-based treatment planning and tele-dentistry platforms

- Canada is expected to be the fastest-growing country in the North America dental aligners market in 2025, due to increasing awareness of cosmetic dentistry, rising disposable incomes, and expanding access to dental care services across urban and semi-urban regions

- Adults segment dominated the dental aligners market with the largest share of 67.2% in 2025, driven by higher spending capacity, growing interest in cosmetic dentistry, and the effectiveness of aligners in addressing common issues such as malocclusion, crowding, and excessive spacing

Report Scope and North America Dental Aligners Market Segmentation

|

Attributes |

North America Dental Aligners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Dental Aligners Market Trends

Rising Adoption of Digital Orthodontics and AI-Enabled Treatment Planning

- A significant and accelerating trend in the North America dental aligners market is the increasing integration of digital orthodontics, including AI-driven treatment planning, 3D scanning, and tele-dentistry platforms. This integration is significantly enhancing treatment accuracy and patient convenience

- For instance, Invisalign’s iTero scanner allows precise 3D imaging of teeth, enabling customized aligner fabrication and remote treatment monitoring, improving both clinician workflow and patient experience

- AI integration enables features such as automated treatment simulation, predictive tooth movement analysis, and alerts for potential compliance issues, enhancing overall treatment outcomes. For instance, SmileDirectClub utilizes AI to optimize aligner fit and monitor progress virtually

- The seamless integration of dental aligners with digital platforms facilitates centralized treatment management, allowing orthodontists to plan, monitor, and adjust treatment remotely through a single interface

- This trend toward more accurate, data-driven, and convenient orthodontic solutions is fundamentally reshaping patient expectations for dental care. For instance, companies such as Byte are leveraging AI-enabled at-home aligner programs with virtual monitoring and predictive treatment timelines

- The demand for digitally optimized aligners is growing rapidly across both adult and teen populations, as patients increasingly prioritize comfort, aesthetics, and remote monitoring capabilities

- Integration with mobile apps for treatment tracking, reminders, and virtual consultations is enhancing patient engagement and compliance. For instance, several aligner brands now offer app-based progress tracking and direct communication with orthodontists

North America Dental Aligners Market Dynamics

Driver

Increasing Awareness and Preference for Aesthetic Orthodontic Solutions

- The rising awareness of oral aesthetics and growing preference for discreet orthodontic solutions is a significant driver for the heightened demand for dental aligners

- For instance, in March 2025, Align Technology reported a surge in Invisalign adoption among adults seeking clear aligners for cosmetic and corrective purposes, reflecting growing consumer preference

- As patients seek comfortable, removable, and invisible alternatives to traditional braces, dental aligners offer advanced features such as gradual tooth movement, remote monitoring, and shorter treatment durations, providing a compelling upgrade over metal braces

- Furthermore, the expansion of tele-dentistry and digital dental platforms is making aligners more accessible and convenient for patients, offering virtual consultations, scans, and treatment plans

- The convenience of at-home treatment options, coupled with the ability to manage appointments and progress through mobile applications, is key to propelling the adoption of dental aligners in both urban and suburban markets

- Growing marketing efforts by aligner companies to target adult and teenage consumers are increasing awareness and accelerating adoption. For instance, campaigns emphasizing aesthetics and comfort are driving interest in clear aligners

- Advances in dental materials, such as thermoplastic polyurethanes (TPU) and polyethylene terephthalate glycol (PETG), improving aligner durability and comfort, are enhancing patient experience and encouraging preference. For instance, newer aligners offer smoother edges and stronger fit to reduce discomfort during treatment

Restraint/Challenge

Compliance, Cost, and Regulatory Hurdles

- Concerns regarding patient compliance, treatment effectiveness, and regulatory requirements pose significant challenges to broader market penetration. As aligners require consistent wear and follow-ups, some patients may experience delayed outcomes, raising anxieties about the investment

- For instance, reports of non-compliance among teenagers and adults have highlighted the need for monitoring solutions to ensure treatment success

- Addressing these concerns through AI-based compliance tracking, patient education, and clear regulatory guidelines is crucial for building trust. Companies such as SmileDirectClub and Align Technology emphasize virtual monitoring and guidance to improve adherence

- In addition, the relatively high cost of aligner treatments compared to traditional braces can be a barrier for price-sensitive patients, particularly in smaller cities or underserved regions. While some providers offer flexible payment options, premium features such as customized 3D scanning and accelerated treatment plans often carry higher prices

- Overcoming these challenges through patient education, affordable treatment models, and effective compliance solutions will be vital for sustained market growth

- Limited access to dental specialists in remote areas may delay treatment initiation or follow-ups, restraining market penetration. For instance, rural patients may face difficulty accessing clinics offering advanced digital aligners

- Regulatory and certification requirements for at-home aligner treatments continue to vary across states, creating hurdles for nationwide adoption. For instance, compliance with state dental boards is essential for providers offering remote or at-home aligner services

North America Dental Aligners Market Scope

The market is segmented on the basis of product & services, age groups, raw material, application, treatment plan, end user, and distribution channel.

- By Product & Services

On the basis of product and services, the market is segmented into products and services. The Products segment dominated the market in 2025, accounting for the largest revenue share. This is due to the increasing preference for pre-fabricated clear aligners and customized orthodontic solutions among clinics and individual users. Products include the aligners themselves, trays, and accessories required for treatment. The strong adoption is fueled by awareness about dental aesthetics and the increasing number of private dental clinics in Saudi Arabia, UAE, and South Africa. Patients prefer tangible products that can be directly used for treatment under professional supervision. In addition, companies are continually innovating products with enhanced materials and digital customization, which adds to the segment’s dominance.

The Services segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for professional orthodontic consultations, remote monitoring services, and tele-dentistry support. Services such as virtual scanning, treatment planning, and follow-up consultations allow dental clinics to cater to patients remotely, particularly teenagers and adults who prefer convenience. The expansion of services also supports at-home treatment plans, creating new opportunities for service-based revenue models. Clinics offering bundled products and services are gaining a competitive edge, enhancing patient satisfaction and treatment outcomes.

- By Age Groups

On the basis of age groups, the market is segmented into adults, teenagers, and children. The adults segment dominated the market in 2025 with a revenue share of 67.2%, driven by higher disposable incomes, increased awareness of cosmetic dentistry, and the growing social emphasis on aesthetics and professional appearance. Adult patients often prefer clear aligners due to their discreet appearance and the convenience of removable treatment options. The adoption among adults is further supported by flexible in-office and at-home treatment plans that allow treatment alongside busy professional schedules. Adults also tend to invest in premium aligner solutions featuring AI-based monitoring and predictive treatment outcomes. Orthodontists see adults as a key demographic for upselling additional services such as attachments and digital monitoring. The convenience of remote monitoring and reduced clinic visits also attracts adults with time constraints.

The teenagers segment is expected to witness the fastest growth at a CAGR of around 23% from 2026 to 2033, driven by the increasing use of aligners in adolescent orthodontics due to aesthetic concerns and parental preference for removable, less intrusive solutions. Teen-specific programs with compliance tracking and gamified mobile apps are boosting adoption. Orthodontists are targeting teens through schools and online campaigns. Mobile reminders and app-based treatment supervision increase adherence. Social media awareness also encourages adoption among teenagers. Parents prefer aligners over traditional braces to avoid visible orthodontic appliances.

- By Raw Material

On the basis of raw material, the market is segmented into polyethylene terephthalate (PET), polyethylene terephthalate glycol (PETG), thermoplastic polyurethanes (TPU), polycarbonate (PC), and others. The PETG segment dominated the market in 2025 due to its optimal balance of flexibility, transparency, and strength, making it ideal for precise tooth movement while ensuring patient comfort. Clinics favor PETG aligners for their durability and ability to withstand wear during extended treatment periods. In addition, PETG material is widely used in both in-office and at-home aligner production due to its compatibility with 3D printing technologies. The material also allows for consistent quality control across batches, reducing treatment errors. Patients report improved comfort and smoothness with PETG aligners. The adoption of PETG is further supported by its resistance to discoloration over prolonged use.

The TPU segment is expected to witness the fastest growth at a CAGR of approximately 21% from 2026 to 2033, fueled by its superior elasticity, comfort, and resistance to cracking, which enhances patient satisfaction. TPU aligners are increasingly adopted in premium treatment plans and digitally optimized products. Clinics prefer TPU for complex cases requiring high flexibility. TPU material allows better fit and easier insertion and removal. Patients find TPU aligners more comfortable during extended wear. TPU is also compatible with AI-driven fabrication technologies, ensuring precise aligner customization.

- By Application

On the basis of application, the market is segmented into malocclusion, crowding, excessive spacing, and others. The crowding segment dominated the market in 2025, accounting for 40% of revenue, driven by the high prevalence of dental crowding in both adults and teenagers. Aligners offer precise control for gradual tooth movement in crowded dentition, reducing the need for extractions or invasive procedures. Orthodontists prefer aligners for crowding cases due to the ease of monitoring and adjusting treatment digitally. The popularity of clear aligners in cosmetic-focused treatments further enhances adoption. Treatment planning software allows virtual simulation of teeth movement for crowded cases. Patients with mild to moderate crowding often achieve results faster with aligners than with braces.

The malocclusion segment is expected to witness the fastest growth at a CAGR of around 22% from 2026 to 2033, due to rising awareness of the impact of bite irregularities on oral health, coupled with the availability of AI-driven treatment planning to address complex cases. Treatment of malocclusion with aligners reduces the risk of jaw issues and improves oral function. Early diagnosis combined with digital simulation enhances treatment outcomes. Orthodontists can remotely adjust treatment plans for malocclusion cases. Malocclusion treatment adoption is supported by tele-dentistry follow-ups. Patients are increasingly aware of cosmetic and functional benefits.

- By Treatment Plan

On the basis of treatment plan, the market is segmented into in-office aligners and at-home aligners. The in-office aligners segment dominated in 2025 with the largest revenue share of 60%, owing to direct supervision by orthodontists, precise customization using digital scans, and higher trust among patients. In-office aligners are preferred for complex cases requiring clinical interventions and for adults seeking high-precision cosmetic outcomes. Clinics benefit from offering in-office solutions as they allow monitoring, adjustments, and follow-ups that improve treatment success rates. AI-assisted treatment simulations optimize results. In-office programs provide patients with attachments and auxiliary devices if needed. Patients are reassured by professional supervision throughout the treatment.

The at-home aligners segment is expected to witness the fastest growth at a CAGR of 25% from 2026 to 2033, driven by the convenience of remote treatment, lower costs, and growing acceptance of tele-dentistry platforms. At-home aligners are particularly popular among tech-savvy adults and teenagers. Remote monitoring apps provide guidance and alerts. Patients appreciate the flexibility of at-home programs without frequent clinic visits. Online consultations reduce logistical barriers for rural patients. At-home programs increasingly integrate AI for progress tracking and treatment adjustments.

- By End User

On the basis of end user, the market is segmented into dental clinics, hospitals, orthodontic clinics, and others. The orthodontic clinics segment dominated in 2025 with a revenue share of 55%, owing to specialized expertise in aligner treatments, digital infrastructure, and dedicated patient management systems. Orthodontic clinics often integrate AI-based treatment planning and monitoring software, improving efficiency and outcomes. These clinics also provide customized scanning, attachments, and retention solutions, which enhance overall service quality. Orthodontic clinics maintain high compliance rates through regular follow-ups. Patients prefer specialized clinics for complex or cosmetic-focused treatments. Orthodontic clinics also invest in marketing and patient engagement programs to drive adoption.

The dental clinics segment is expected to witness the fastest growth at a CAGR of 21% from 2026 to 2033, fueled by the increasing number of multi-specialty clinics incorporating orthodontic services and rising patient demand in suburban regions. Dental clinics are increasingly adopting digital scanning and AI tools. Growth is supported by flexible payment options and bundled services. Tele-dentistry platforms allow dental clinics to serve broader geographies. Clinics are training staff for aligner-specific workflows. Rising patient awareness of aesthetics drives dental clinic adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and third-party distributors. The direct sales segment dominated the market in 2025, with a share of 62%, due to the preference of manufacturers to sell directly to orthodontic clinics and patients, ensuring better margins and stronger brand recognition. Direct sales also allow companies to offer bundled services, personalized treatment plans, and digital monitoring subscriptions. Manufacturers can maintain product quality and compliance control. Direct interactions allow education and guidance on aligner usage. Clinics value direct sales for consistent supply and customer support. Direct sales foster brand loyalty among patients and clinics.

The third-party distributors segment is expected to witness the fastest growth at a CAGR of 19% from 2026 to 2033, driven by partnerships with local dental supply chains and e-commerce platforms that increase reach to remote areas and smaller clinics. Third-party distribution also supports tele-dentistry and at-home aligner models by facilitating logistics and delivery. Distributors help expand brand visibility in untapped regions. E-commerce platforms allow convenient purchase for patients. Third-party channels reduce logistical burden for manufacturers. Increasing collaboration with distributors accelerates market penetration.

North America Dental Aligners Market Regional Analysis

- The U.S. dominated the North America dental aligners market with the largest revenue share of 85.3% in 2025, characterized by advanced dental infrastructure, high disposable incomes, and a strong presence of key industry players, with substantial growth in both in-office and at-home aligner treatments

- Consumers in the region highly value the convenience, aesthetic appeal, and precision offered by clear aligners, along with AI-enabled treatment planning, remote monitoring, and 3D scanning technologies

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and growing preference for at-home and in-office digital orthodontic solutions, establishing dental aligners as a preferred choice for both adult and teenage patients

The U.S. Dental Aligners Market Insight

The U.S. dental aligners market captured the largest revenue share of 85.3% in 2025 within North America, fueled by the rapid adoption of digital orthodontic technologies and increasing awareness of cosmetic dentistry. Consumers are increasingly prioritizing aesthetic and convenient orthodontic solutions, such as clear aligners, over traditional braces. The growing preference for in-office and at-home treatment plans, combined with the integration of AI-based treatment planning, remote monitoring, and 3D scanning, further propels the dental aligners industry. Moreover, rising disposable incomes and widespread availability of orthodontic clinics are significantly contributing to the market’s expansion.

Canada Dental Aligners Market Insight

The Canada dental aligners market is expected to grow at the fastest CAGR in North America during the forecast period, driven by increasing awareness of cosmetic dentistry, expanding dental clinic networks, and growing adoption of tele-dentistry and at-home aligner treatment options. Canadian consumers are increasingly prioritizing comfort, aesthetics, and convenience, while government initiatives promoting oral healthcare and digital solutions support market growth. The rising availability of AI-enabled treatment planning and virtual consultations is further enhancing adoption among both adults and teenagers.

Mexico Dental Aligners Market Insight

The Mexico dental aligners market is poised for steady growth, primarily driven by increasing urbanization, rising disposable incomes, and growing awareness of orthodontic aesthetics in key cities. Mexican consumers are increasingly opting for clear aligners due to their removable, comfortable, and discreet nature. The adoption of digital scanning and tele-dentistry services is facilitating access to orthodontic care, particularly in urban areas. In addition, partnerships between local dental clinics and international aligner providers are expanding the availability of premium aligner solutions across the country.

North America Dental Aligners Market Share

The North America Dental Aligners industry is primarily led by well-established companies, including:

- Align Technology, Inc. (U.S.)

- AccuAligners (Saudi Arabia)

- Smartee Denti Technology Co., Ltd (China)

- ParisAline (UAE)

- SA Aligner (Saudi Arabia)

- ClearCorrect (Switzerland)

- SparkAligners (U.S.)

- Angelalign Technology Inc. (China)

- AlignerCo (U.S.)

- OrthoFX (U.S.)

- NewSmileUSA (U.S.)

- Reveal Clear Aligners (U.S.)

- CandidPro (U.S.)

- SureSmile (U.S.)

- SMILE2IMPRESS (Spain)

- BASMA (U.K.)

- Essix (U.S.)

- uLab Systems (U.S.)

- Byte (U.S.)

- 3M (U.S.)

What are the Recent Developments in North America Dental Aligners Market?

- In April 2025, Align Technology announced the commercial availability of the Invisalign® System with mandibular advancement featuring occlusal blocks for Class II skeletal and dental correction, expanding clinical treatment options for kids and teens in the U.S. and Canada with integrated mandibular advancement technology

- In April 2025, Align Technology publicly agreed to a USD 31.7 million consumer settlement over a long‑running litigation alleging anti‑competitive practices related to its aligner market strategy, pending judicial approval highlighting legal pressures on leading aligner manufacturers

- In April 2025, a U.S. federal court judge blocked a proposed price‑fixing settlement involving Align Technology, rejecting authorization of a USD 27.5 million settlement linked to allegations of pricing coordination, keeping the industry’s competitive and legal landscape in focus

- In December 2023, telehealth orthodontic provider SmileDirectClub announced the shutdown of its global operations after filing for Chapter 11 bankruptcy, leaving millions of clear‑aligner customers without service or ongoing support and signaling major disruption in the direct‑to‑consumer aligner segment

- In February 2023, SmileDirectClub introduced CarePlus, a new premium aligner treatment combining in‑person dental consultations with remote management and concierge‑level care, offering greater flexibility and higher‑touch service through its Partner Network marking a strategic shift in its service model before its eventual shutdown

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.