North America Denim Jeans Market

Market Size in USD Billion

CAGR :

%

USD

27.50 Billion

USD

47.61 Billion

2025

2033

USD

27.50 Billion

USD

47.61 Billion

2025

2033

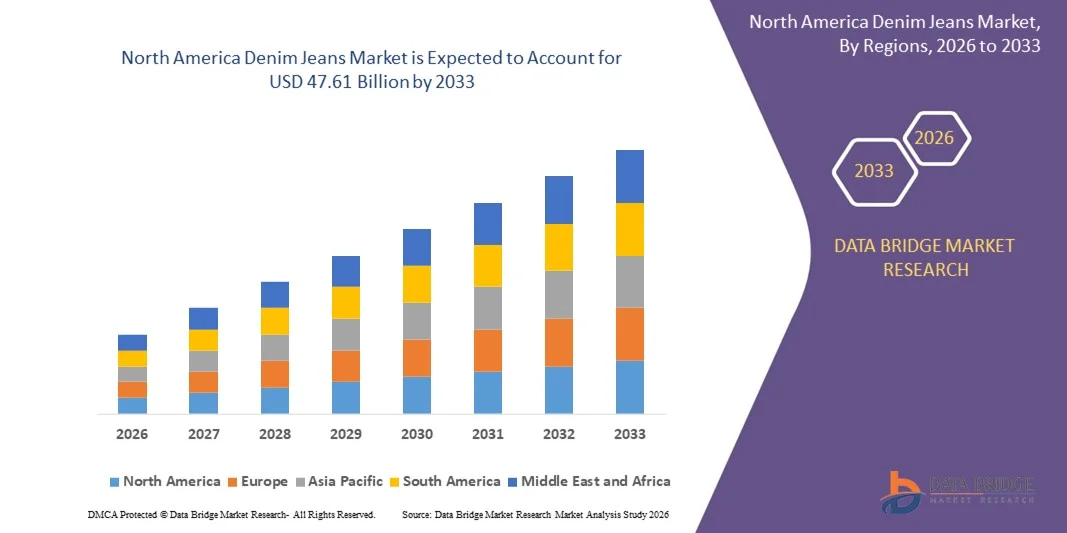

| 2026 –2033 | |

| USD 27.50 Billion | |

| USD 47.61 Billion | |

|

|

|

|

North America Denim Jeans Market Size

- The North America denim jeans market size was valued at USD 27.50 billion in 2025 and is expected to reach USD 47.61 billion by 2033, at a CAGR of 7.10% during the forecast period

- The market growth is largely fuelled by rising global demand for casual and versatile apparel driven by changing lifestyles and workplace fashion trends

- Increasing influence of fashion trends, celebrity endorsements, and social media platforms encouraging frequent wardrobe updates

North America Denim Jeans Market Analysis

- The market is characterised by continuous product innovation, including sustainable fabrics, stretchable materials, and improved durability to enhance consumer comfort and performance

- Strong brand competition and frequent product launches are shaping consumer preferences, with manufacturers focusing on design, fit, and customization options

- U.S. denim jeans market captured the largest revenue share in 2025 within North America, supported by continuous product innovation, strong penetration of global and domestic brands, and consistent demand for casual and workwear apparel. Consumers increasingly prioritize comfort-focused fits, inclusive sizing, and sustainable materials

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America denim jeans market due to rising fashion awareness, increasing preference for premium and sustainable denim, expanding e-commerce penetration, and growing adoption of casual workplace attire

- The stretch denim segment held the largest market revenue share in 2025 driven by rising consumer preference for comfort, flexibility, and everyday wear. Stretch denim is widely adopted across casual, work, and athleisure-inspired apparel due to its enhanced fit and ease of movement

Report Scope and North America Denim Jeans Market Segmentation

|

Attributes |

North America Denim Jeans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Denim Jeans Market Trends

Rising Demand For Casual, Sustainable, And Fashion-Forward Apparel

- The growing shift toward casual wear and comfort-oriented clothing is significantly shaping the denim jeans market, as consumers increasingly prefer versatile apparel suitable for everyday use, work-from-home settings, and social occasions. Denim jeans continue to gain traction due to their durability, adaptability across age groups, and ability to align with evolving fashion trends, strengthening their demand across mass and premium segments

- Increasing awareness around sustainability, ethical fashion, and responsible consumption has accelerated demand for eco-friendly denim jeans made using organic cotton, recycled fibers, and water-saving production techniques. Consumers are actively seeking brands that emphasize reduced environmental impact, prompting manufacturers to adopt sustainable sourcing, cleaner dyeing processes, and transparent supply chains

- Fashion trends and digital influence play a critical role in purchasing decisions, with brands leveraging social media, influencer marketing, and celebrity endorsements to promote new fits, washes, and styles. Customization, inclusive sizing, and innovative designs are helping brands differentiate themselves in a highly competitive market while enhancing consumer engagement and brand loyalty

- For instance, leading denim brands introduced collections featuring sustainable materials, stretchable fabrics, and contemporary fits in response to rising consumer preference for comfort-driven and eco-conscious fashion. These product launches were supported by strong online and offline retail presence, helping brands expand reach and improve repeat purchases

- While demand for denim jeans remains strong, sustained market growth depends on continuous design innovation, balancing affordability with sustainability, and adapting quickly to fast-changing fashion cycles. Manufacturers are focusing on improving production efficiency, trend responsiveness, and inventory management to maintain competitiveness

North America Denim Jeans Market Dynamics

Driver

Growing Preference For Casual Wear And Sustainable Fashion

- Rising consumer inclination toward casual, durable, and stylish apparel is a major driver for the denim jeans market. Denim jeans offer versatility across occasions and demographics, encouraging consistent demand and repeat purchases. Manufacturers are responding by launching diverse product lines that cater to comfort, aesthetics, and functionality

- Expanding adoption of sustainable fashion practices is influencing market growth, with brands increasingly incorporating eco-friendly materials, low-impact dyes, and responsible manufacturing processes. These initiatives help align products with consumer expectations while strengthening brand image and regulatory compliance

- Apparel brands are actively promoting denim jeans through product innovation, seasonal collections, and digital marketing campaigns. These efforts are supported by strong consumer interest in trend-driven and ethically produced clothing, encouraging collaborations between designers, fabric suppliers, and retailers to enhance product appeal

- For instance, major denim manufacturers reported increased demand for stretch denim, relaxed fits, and sustainably produced jeans, driven by changing lifestyle patterns and heightened awareness of environmental impact. Marketing strategies highlighting comfort, durability, and sustainability contributed to improved sales performance and customer retention

- Although favorable lifestyle and fashion trends support market expansion, long-term growth depends on managing production costs, responding to rapid trend changes, and maintaining consistent product quality across price categories

Restraint/Challenge

Price Sensitivity And Fluctuating Raw Material Costs

- Price sensitivity among consumers remains a key challenge in the denim jeans market, particularly as production costs rise due to higher prices of cotton, sustainable fibers, and energy-intensive manufacturing processes. These factors can limit adoption of premium and eco-friendly denim products in cost-conscious segments

- Intense competition and fast fashion dynamics create pressure on manufacturers to offer trendy designs at competitive prices, often impacting profit margins. Rapidly changing consumer preferences also increase the risk of inventory obsolescence, requiring efficient demand forecasting and supply chain agility

- Supply chain complexities, including sourcing quality raw materials and ensuring consistent production standards, further impact market stability. Delays, cost volatility, and compliance with sustainability standards add operational challenges for manufacturers

- For instance, several denim brands faced margin pressure due to rising input costs and frequent discounting strategies to remain competitive. Balancing affordability with quality and sustainability emerged as a critical concern affecting pricing strategies and profitability

- Addressing these challenges will require cost optimization, improved supply chain efficiency, and strategic investment in technology and sustainable innovation. Strengthening brand differentiation, enhancing operational flexibility, and aligning products closely with consumer expectations will be essential for long-term growth in the global denim jeans market

North America Denim Jeans Market Scope

The market is segmented on the basis of type, consumer type, distribution channel, and price range.

- By Type

On the basis of type, the North America denim jeans market is segmented into Cotton Denim/100% Cotton Denim, Stretch Denim, Raw Denim/Dry Denim, Crushed Denim, Cotton Serge Denim, Waxed Reverse Denim, Printed Denim, Washed Denim/Acid Wash Denim, Colored Denim, Selvedge Denim, ECRU Denim, Sanforized Denim, Bubblegum Denim, Poly Denim, Bull Denim, Thermo Denim, Ramie Cotton Denim, Slub Denim, Vintage Denim, Fox Fiber Denim, Marble Denim, Reverse Denim, Ring Spun Denim/Dual Ring Spun Denim, and Others. The stretch denim segment held the largest market revenue share in 2025 driven by rising consumer preference for comfort, flexibility, and everyday wear. Stretch denim is widely adopted across casual, work, and athleisure-inspired apparel due to its enhanced fit and ease of movement.

The raw denim/dry denim segment is expected to witness strong growth from 2026 to 2033, supported by increasing demand for premium, durable, and long-lasting denim products. Consumers seeking authentic aesthetics and personalized wear patterns are increasingly opting for raw denim, particularly in the premium and fashion-conscious consumer base.

- By Consumer Type

On the basis of consumer type, the market is segmented into men, women, and kids. The men segment accounted for the largest market share in 2025 owing to consistent demand for denim jeans as a staple wardrobe item across age groups and usage occasions. High product availability, wide style options, and strong brand loyalty further support segment dominance.

The women segment is expected to grow at the fastest rate from 2026 to 2033, driven by evolving fashion trends, increasing workforce participation, and rising demand for diverse fits, styles, and sustainable denim options tailored to female consumers.

- By Distribution Channel

Based on distribution channel, the market is segmented into direct sales/B2B/wholesale, e-commerce, specialty store, supermarket/hypermarket, convenience stores, and others. Specialty stores held the largest revenue share in 2025 due to strong brand presence, personalized shopping experience, and availability of a wide range of denim styles and fits.

The e-commerce segment is expected to grow at the fastest rate from 2026 to 2033, supported by increasing online apparel purchases, convenience of home delivery, flexible return policies, and growing use of digital marketing and influencer-driven promotions by denim brands.

- By Price Range

On the basis of price range, the market is segmented into economy, mid, and premium. The mid-price segment dominated the market in 2025, driven by its balance of quality, durability, and affordability, making it accessible to a broad consumer base.

The premium segment is expected to grow at the fastest rate from 2026 to 2033, fuelled by rising demand for high-quality fabrics, sustainable production, brand value, and unique designs among fashion-conscious and higher-income consumers.

North America Denim Jeans Market Regional Analysis

- U.S. denim jeans market captured the largest revenue share in 2025 within North America, supported by continuous product innovation, strong penetration of global and domestic brands, and consistent demand for casual and workwear apparel. Consumers increasingly prioritize comfort-focused fits, inclusive sizing, and sustainable materials

- The rapid expansion of online retail, influencer-driven fashion trends, and frequent product launches continues to strengthen market leadership and brand loyalty

Canada Denim Jeans Market Insight

The Canada denim jeans market is expected to grow at the fastest rate from 2026 to 2033, driven by rising fashion awareness, growing preference for premium and sustainable apparel, and increasing adoption of casual workplace clothing. Strong demand for ethically produced denim, combined with expanding e-commerce penetration and cross-border brand availability, is supporting accelerated market growth.

North America Denim Jeans Market Share

The North America denim jeans industry is primarily led by well-established companies, including:

- Levi Strauss & Co. (U.S.)

- VF Corporation (U.S.)

- Gap Inc. (U.S.)

- Kontoor Brands, Inc. (U.S.)

- PVH Corp. (U.S.)

- Ralph Lauren Corporation (U.S.)

- American Eagle Outfitters, Inc. (U.S.)

- Abercrombie & Fitch Co. (U.S.)

- Carhartt, Inc. (U.S.)

- True Religion Brand Jeans (U.S.)

- Guess?, Inc. (U.S.)

- Wrangler (U.S.)

- Lee (U.S.)

- Citizens of Humanity Group (U.S.)

- AG Adriano Goldschmied (U.S.)

Latest Developments in North America Denim Jeans Market

- In May 2024, Levi Strauss & Co. launched an expanded sustainable denim line in North America as part of a product innovation initiative focused on eco-conscious consumers. The collection features jeans made with organic cotton and water-saving finishing techniques, helping strengthen Levi’s sustainability credentials, enhance brand loyalty, and support growing demand for environmentally responsible denim in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.