North America Dandruff Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

3.10 Billion

2024

2032

USD

1.65 Billion

USD

3.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 3.10 Billion | |

|

|

|

|

North America Dandruff Treatment Market Size

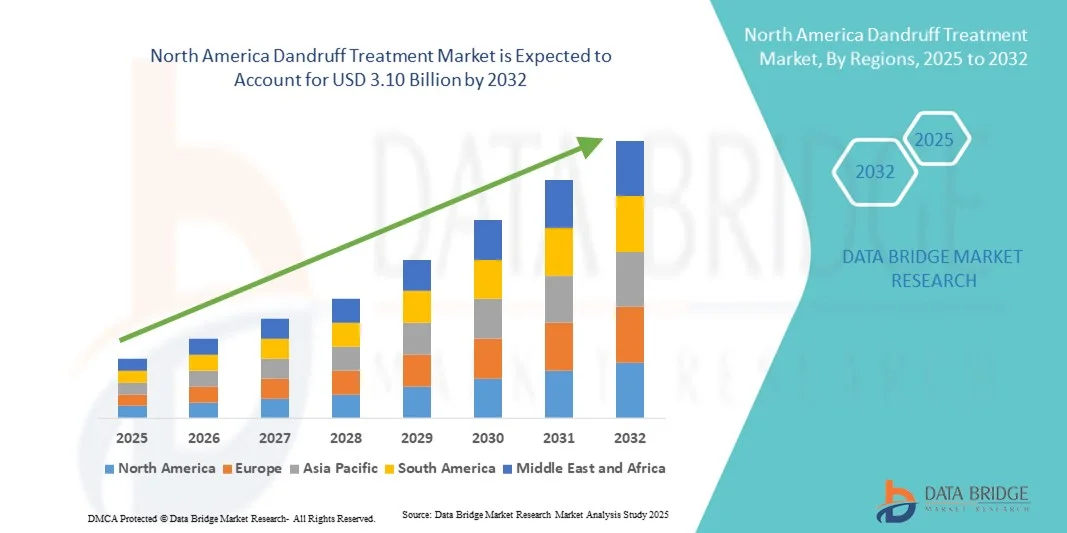

- The North America dandruff treatment market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 3.10 billion by 2032, at a CAGR of 8.19% during the forecast period

- The market growth is largely driven by increasing awareness of scalp health, rising prevalence of dandruff, and growing consumer preference for over-the-counter and prescription anti-dandruff solutions

- Furthermore, the rising adoption of natural and clinically proven formulations, along with innovations in shampoos, conditioners, and leave-on treatments, is reinforcing dandruff treatments as a key segment within hair care. These factors are collectively boosting market demand and accelerating industry growth in North America

North America Dandruff Treatment Market Analysis

- Dandruff treatments, including medicated and non-medicated solutions, are becoming essential components of personal care routines in both residential and professional settings due to their effectiveness in controlling flaking, itching, and scalp irritation

- The rising demand for dandruff treatments is primarily fueled by increasing awareness of scalp health, growing prevalence of dandruff among different age groups, and a preference for clinically proven, convenient, and easy-to-use hair care solutions

- U.S. dominated the North America dandruff treatment market with the largest revenue share of 42% in 2024, driven by high consumer awareness, strong purchasing power, and a well-established hair care industry. Consumers are increasingly seeking innovative formulations, including antifungal and dry skin-related dandruff solutions, supported by both major personal care brands and emerging niche players

- Canada is expected to be the fastest-growing country in the North America dandruff treatment market during the forecast period due to rising urbanization, increasing disposable incomes, and growing adoption of OTC dandruff products

- Fungal dandruff segment dominated the North America dandruff treatment market by type with a market share of 48.2% in 2024, owing to its high prevalence, proven treatment efficacy, and preference among consumers for clinically validated antifungal formulations

Report Scope and North America Dandruff Treatment Market Segmentation

|

Attributes |

North America Dandruff Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Dandruff Treatment Market Trends

Rising Popularity of Clinically Proven and Natural Formulations

- A significant and accelerating trend in the North America dandruff treatment market is the increasing adoption of products that combine clinically proven antifungal ingredients with natural or herbal components, offering both efficacy and reduced scalp irritation

- For instance, Nizoral Anti-Dandruff Shampoo combines ketoconazole with mild conditioning agents, providing effective dandruff control while minimizing dryness. Similarly, Head & Shoulders Citrus Fresh incorporates zinc pyrithione with botanical extracts to improve scalp health

- Formulations with added benefits such as moisturizing, soothing, or strengthening the hair are gaining traction, as consumers increasingly seek multifunctional hair care products. Furthermore, growing awareness of scalp-friendly and chemical-free ingredients is driving product innovation

- These advanced formulations cater to diverse consumer needs, including those with sensitive scalps, oily or dry skin-related dandruff, and those preferring non-medicated or natural solutions, enhancing user satisfaction and loyalty

- The trend towards more personalized, effective, and gentle dandruff treatments is shaping consumer expectations in North America, prompting companies such as Selsun Blue to develop products targeting specific dandruff types with clinically validated ingredients

- The demand for innovative, safe, and multi-benefit dandruff treatments is rising across both adult and pediatric consumers, as awareness of scalp health and hair wellness grows

North America Dandruff Treatment Market Dynamics

Driver

Growing Awareness of Scalp Health and Increasing Prevalence of Dandruff

- The rising concern for personal grooming and scalp health, coupled with increasing incidence of dandruff among various age groups, is a significant driver for the heightened demand for dandruff treatments

- For instance, Nioxin Scalp Recovery products are marketed to address dandruff and improve scalp condition, promoting consistent usage among consumers with recurring issues. Such initiatives by leading brands are expected to drive market growth in the forecast period

- As consumers become more conscious of dandruff symptoms such as flaking and itching, anti-dandruff solutions provide reliable treatment and prevention options, offering a strong upgrade over general hair care products

- Furthermore, the popularity of OTC anti-dandruff solutions and prescription products is increasing, driven by convenience, accessibility, and proven efficacy in controlling fungal and dry skin-related dandruff

- The preference for easy-to-use shampoos, conditioners, and leave-on treatments that can be incorporated into daily routines is propelling adoption in both homecare and professional dermatology settings

Restraint/Challenge

Irritation Concerns and Regulatory Compliance Hurdles

- Concerns surrounding potential scalp irritation or allergic reactions due to active ingredients such as ketoconazole, zinc pyrithione, or selenium sulfide pose a challenge to broader market adoption. As dandruff treatments interact directly with the skin, sensitivity issues can reduce repeat purchases and consumer confidence

- For instance, reports of scalp dryness or redness after prolonged use have made some consumers hesitant to adopt certain medicated shampoos or leave-on solutions

- Addressing these concerns through hypoallergenic formulations, consumer education on proper usage, and dermatologically tested products is crucial for building trust. Companies such as Neutrogena emphasize gentle and clinically tested ingredients to reassure potential buyers. In addition, regulatory compliance related to ingredient concentrations, labeling, and marketing claims can pose barriers for both established and emerging brands

- While natural and non-medicated solutions are gaining popularity, the perceived limited efficacy compared to medicated products can also hinder adoption among consumers seeking fast results

- Overcoming these challenges through safer formulations, clear labeling, and compliance with regional regulations will be vital for sustained market growth

North America Dandruff Treatment Market Scope

The market is segmented on the basis of type, mode of prescription, product, drug type, age group, gender, end user, and distribution type.

- By Type

On the basis of type, the North America dandruff treatment market is segmented into fungal dandruff, dry skin-related dandruff, oily scalp-related dandruff, and disease-related dandruff. The fungal dandruff segment dominated the market with the largest revenue share of 48.2% in 2024, driven by the high prevalence of Malassezia-induced scalp conditions and strong consumer preference for clinically proven antifungal solutions. Products targeting fungal dandruff, including medicated shampoos and conditioners, are widely available through OTC and prescription channels, contributing to sustained market demand. Consumers perceive antifungal treatments as effective for long-term dandruff control, leading to repeat purchases. In addition, key personal care brands focus on innovation in this segment with multi-benefit formulations, such as anti-itch and moisturizing properties. Dermatology centers frequently recommend fungal dandruff solutions, further bolstering adoption. The segment’s dominance is also supported by its compatibility with both adult and pediatric usage, enhancing its broad market appeal.

The dry skin-related dandruff segment is anticipated to witness the fastest growth rate of 19.5% from 2025 to 2032, fueled by increasing awareness of scalp hydration and gentle formulations. Dry scalp issues are often linked to seasonal changes and harsh hair care practices, prompting consumers to seek non-irritating medicated and non-medicated solutions. The growing demand for natural and herbal ingredients in dry scalp treatments further drives market expansion. Social media and influencer-driven education on scalp care are increasing consumer interest in targeted solutions. Products addressing dry skin-related dandruff often come with added moisturizing benefits, appealing to a health-conscious consumer base. The segment’s growth is also supported by rising adoption among pediatrics and adults with sensitive scalps.

- By Mode of Prescription

On the basis of mode of prescription, the North America dandruff treatment market is segmented into OTC and prescription products. The OTC segment dominated the market with the largest revenue share of 62.4% in 2024, driven by easy availability, affordability, and growing consumer preference for self-care solutions. OTC anti-dandruff products are widely distributed through pharmacies, retail stores, and online platforms, enhancing accessibility. Frequent promotions, product bundling, and brand loyalty programs contribute to sustained sales. OTC products also cater to both adult and pediatric populations, making them a versatile choice for homecare and dermatology center use. In addition, consumer confidence in OTC medicated shampoos for minor dandruff encourages repeat purchases. The segment benefits from continuous product innovation, such as 2-in-1 shampoo and conditioner formulations.

The prescription segment is expected to witness the fastest growth rate of 17.8% from 2025 to 2032, driven by rising dermatologist awareness and increasing cases of severe or disease-related dandruff. Prescription products are favored for their higher efficacy, targeted formulations, and stronger antifungal or anti-inflammatory ingredients. These solutions are often recommended for patients who do not respond to OTC treatments, boosting adoption. Growing awareness of scalp conditions among adults and pediatrics increases demand for professional consultation. Prescription products are also increasingly integrated into dermatology treatment plans, supporting market growth. Teledermatology services further facilitate access to prescription treatments, accelerating growth in this segment.

- By Product

On the basis of product, the North America dandruff treatment market is segmented into medicated and non-medicated products. The medicated segment dominated the market with the largest revenue share of 55.6% in 2024, driven by the high effectiveness of active ingredients such as ketoconazole, zinc pyrithione, and selenium sulfide in controlling dandruff and preventing recurrence. Medicated shampoos, conditioners, and leave-on treatments are recommended by dermatologists and frequently used in homecare routines. Consumer trust in clinically tested products sustains repeat purchases, while innovation in multi-benefit formulations adds convenience. Medicated products cater to fungal, oily, and disease-related dandruff, enhancing their versatility. Their dominance is further supported by widespread availability through OTC, pharmacy, and online channels. Marketing campaigns highlighting efficacy and dermatologist endorsements strengthen consumer preference.

The non-medicated segment is expected to witness the fastest growth rate of 18.9% from 2025 to 2032, fueled by rising consumer interest in natural, herbal, and chemical-free solutions. Non-medicated products appeal to health-conscious and sensitive-skin consumers seeking gentle dandruff control. Innovative formulations combining soothing botanicals with scalp care benefits enhance adoption. Social media education and influencer promotion of natural alternatives further drive awareness. Non-medicated products are particularly popular among pediatrics and adults with mild dandruff or dry skin-related scalp issues. The growing trend of DIY hair care and preference for sustainable ingredients supports accelerated growth.

- By Drug Type

On the basis of drug type, the North America dandruff treatment market is segmented into branded and generics. The branded segment dominated the market with the largest revenue share of 63.2% in 2024, driven by strong brand recognition, consumer trust, and extensive marketing by leading hair care companies. Branded products benefit from research-backed formulations and dermatologist endorsements, creating preference over generics. Availability across pharmacies, retail stores, and online channels strengthens market penetration. Brand loyalty among adult and pediatric consumers ensures repeat purchases. Continuous innovation, such as combining anti-dandruff action with hair strengthening or moisturizing properties, enhances consumer retention. Branded offerings also leverage influencer campaigns and awareness programs to educate consumers on proper usage and benefits.

The generics segment is expected to witness the fastest growth rate of 16.7% from 2025 to 2032, fueled by cost-conscious consumers seeking effective alternatives to branded products. Generics offer similar active ingredients at lower prices, appealing to a wide demographic. Rising availability through pharmacies and e-commerce platforms enhances accessibility. Consumer awareness about the efficacy of generics is growing through digital campaigns and professional recommendations. Generics also cater to OTC and prescription segments, further expanding market reach. Increasing healthcare cost sensitivity and demand for value-for-money solutions drive growth in this segment.

- By Age Group

On the basis of age group, the North America dandruff treatment market is segmented into adults, pediatrics, and neonates. The adults segment dominated the market with the largest revenue share of 68.5% in 2024, driven by high prevalence of dandruff, increasing personal grooming awareness, and preference for professional-grade treatments. Adult consumers are more such likely to invest in medicated and branded solutions, contributing to sustained revenue. Frequent social media influence and professional recommendations guide product selection. Adults also benefit from easy access to OTC products, dermatology advice, and online purchasing channels. The segment covers both male and female consumers, further expanding its reach. Marketing campaigns focusing on lifestyle, convenience, and multi-benefit products strengthen adoption.

The pediatrics segment is expected to witness the fastest growth rate of 20.3% from 2025 to 2032, fueled by rising awareness of scalp health in children and parental preference for gentle, safe, and clinically tested products. Pediatric-specific formulations with mild antifungal agents and hypoallergenic ingredients are increasingly adopted. Growing e-commerce penetration and product availability in supermarkets and pharmacies enhance accessibility. Pediatric dermatology awareness campaigns and pediatrician recommendations further drive adoption. The segment also benefits from innovation in tear-free and fragrance-free formulations.

- By Gender

On the basis of gender, the North America dandruff treatment market is segmented into male and female. The male segment dominated the market with the largest revenue share of 54.1% in 2024, driven by higher prevalence of dandruff among men and strong marketing of targeted anti-dandruff solutions. Male consumers frequently prefer convenient, multi-benefit shampoos and hair care solutions, contributing to repeat purchases. OTC and prescription products are widely accessible, ensuring consistent usage. Professional recommendations and online educational campaigns increase awareness and adoption. Male-focused product innovations, including scalp-specific medicated shampoos, further strengthen dominance. Brand campaigns highlighting male grooming and confidence enhance market share.

The female segment is expected to witness the fastest growth rate of 19.2% from 2025 to 2032, fueled by growing awareness of hair and scalp care, increasing disposable income, and preference for gentle and multi-benefit formulations. Women increasingly adopt non-medicated and natural products alongside medicated solutions. Social media, influencer, and dermatologist recommendations drive awareness and trial. Female consumers also value cosmetic benefits, such as shine, softness, and fragrance, integrated with dandruff control. The expanding female e-commerce customer base supports rapid adoption.

- By End User

On the basis of end user, the North America dandruff treatment market is segmented into homecare, dermatology centers, specialty clinics, and others. The homecare segment dominated the market with the largest revenue share of 61.8% in 2024, driven by convenience, affordability, and widespread availability of OTC products. Consumers prefer using shampoos, conditioners, and leave-on treatments in their daily routines for consistent dandruff management. Online stores and retail outlets further enhance accessibility. Homecare adoption spans adults, pediatrics, and neonates, broadening market coverage. Marketing campaigns emphasizing ease of use and multi-benefit formulations support sustained growth. The homecare segment also benefits from influencer and social media-driven product awareness.

The dermatology centers segment is expected to witness the fastest growth rate of 18.5% from 2025 to 2032, fueled by increasing dermatologist awareness, rising prevalence of severe dandruff cases, and recommendations for prescription-strength products. Dermatology centers provide professional guidance for optimal treatment selection, ensuring better compliance and results. Teledermatology services and clinic partnerships with brands expand reach. The segment is particularly important for fungal and disease-related dandruff treatment. Consumer trust in professional advice drives repeat visits and product adoption.

- By Distribution Type

On the basis of distribution type, the North America dandruff treatment market is segmented into supermarkets/hypermarkets, convenience stores, pharmacies, retail stores, online stores, and others. The pharmacies segment dominated the market with the largest revenue share of 44.7% in 2024, driven by easy accessibility of both OTC and prescription products, professional guidance, and strong pharmacist recommendations. Pharmacies serve as a trusted point of sale for adults, pediatrics, and neonates, enhancing purchase confidence. Promotional campaigns, product bundling, and in-store visibility strengthen sales. Product availability across multiple price points ensures broad consumer reach. Strong presence of branded and generics reinforces adoption.

The online stores segment is expected to witness the fastest growth rate of 21.1% from 2025 to 2032, fueled by rising e-commerce penetration, convenience of doorstep delivery, and increasing digital awareness. Consumers can access a wide range of branded, generics, medicated, and non-medicated products. Subscription models, discounts, and home delivery services encourage repeat purchases. Online reviews, influencer recommendations, and product comparisons support informed decisions. The segment benefits from growing adoption among tech-savvy adults and caregivers of pediatric consumers.

North America Dandruff Treatment Market Regional Analysis

- U.S. dominated the North America dandruff treatment market with the largest revenue share of 42% in 2024, driven by high consumer awareness, strong purchasing power, and a well-established hair care industry

- Consumers in the region prioritize effective, clinically proven treatments that are convenient, safe, and suitable for daily use, including shampoos, conditioners, and leave-on solutions targeting fungal and dry skin-related dandruff

- This widespread adoption is further supported by high disposable incomes, easy access to pharmacies and online stores, and strong presence of key personal care brands. Dermatology recommendations and influencer-led awareness campaigns also contribute to the popularity of anti-dandruff products among adults and pediatrics, establishing dandruff treatments as a preferred solution in both homecare and professional settings

U.S. North America Dandruff Treatment Market Insight

The U.S. dandruff treatment market captured the largest revenue share of 81% in 2024 within North America, fueled by growing awareness of scalp health and the rising prevalence of dandruff among adults and pediatrics. Consumers are increasingly prioritizing clinically proven solutions, including OTC and prescription shampoos, conditioners, and leave-on treatments, to effectively manage flaking, itching, and scalp irritation. The growing preference for gentle, multi-benefit formulations that combine antifungal action with moisturizing or soothing properties further propels the market. Moreover, the widespread availability of products through pharmacies, online stores, and retail outlets, alongside dermatologist recommendations, significantly contributes to market expansion. Continuous innovation by key brands, coupled with marketing and awareness campaigns, reinforces consumer adoption and loyalty.

Canada Dandruff Treatment Market Insight

The Canada dandruff treatment market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by increasing consumer focus on personal grooming and scalp care. Rising awareness of product efficacy and safety, coupled with demand for natural and non-medicated formulations, fosters the adoption of dandruff treatments. The market sees growing usage across adults and pediatric populations, supported by professional guidance from dermatologists and availability in retail, pharmacy, and online channels. Government regulations and safety standards for hair care products also encourage consumer confidence. Moreover, the market benefits from increasing e-commerce penetration, enabling convenient access to both branded and generic products.

Mexico Dandruff Treatment Market Insight

The Mexico dandruff treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising urbanization, increasing disposable incomes, and enhanced awareness of hair and scalp health. Consumers are seeking effective yet affordable solutions to manage dandruff, including OTC shampoos and conditioners targeting fungal and dry skin-related dandruff. The expanding retail infrastructure, including supermarkets, pharmacies, and online platforms, facilitates product accessibility. Furthermore, marketing campaigns by leading personal care brands and the availability of pediatric-friendly formulations contribute to increased adoption. Consumer preference for convenient homecare solutions further supports market growth.

North America Dandruff Treatment Market Share

The North America Dandruff Treatment industry is primarily led by well-established companies, including:

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- L'Oréal (France)

- Henkel AG & Co. KGaA (Germany)

- Church & Dwight Co., Inc. (U.S.)

- Shiseido Co., Ltd. (Japan

- BEIERSDORF (Germany)

- Kao Corporation (Japan)

- Himalaya Wellness Company (India)

- Jupiter (U.S.)

- Numé Hair (U.S.)

- Better Scalp Company (Canada)

- Hadley Dermatology (U.S.)

- Dermatology Associates (U.S.)

- Advanced Dermatology & Skin Cancer Specialists (U.S.)

- Forefront Dermatology (U.S.)

What are the Recent Developments in North America Dandruff Treatment Market?

- In July 2025, OLAPLEX launched its Pro Scalp Rebalancing Concentrate, a professional-only scalp treatment designed to reduce signs of scalp stress caused by everyday factors or salon services. The product helps fight accelerated scalp aging and promotes an environment for healthy hair, offering a specialized solution for dandruff and scalp health

- In June 2025, Briogeo's Scalp Treatment Drops were highlighted as a top dry scalp treatment. These drops effectively hydrate and soothe the scalp, providing relief from dryness and itchiness associated with dandruff. Their popularity underscores the growing demand for targeted scalp care solutions in the North American market

- In June 2025, Head & Shoulders introduced its Scalp Elixir Treatment, a product designed to address scalp dryness and itchiness. The treatment combines the brand's anti-dandruff efficacy with soothing ingredients, catering to consumers seeking relief from scalp discomfort

- In April 2025, Unilever's premium professional anti-dandruff brand, CLEAR, introduced its first-ever SCALPCEUTICALS PRO RANGE globally at TANK Shanghai. This series embodies the brand’s 50 years of scientific research and unites the efforts of five global labs and over 200 dermatologists. The range targets oil, flakes, and scalp sensitivity, marking a significant advancement in anti-dandruff solutions

- In November 2024, French pharmacy brand Vichy launched its Dercos haircare line in the United States. The line addresses common scalp issues such as dandruff and dryness, featuring a 3-step system that includes Selenium Sulfide Anti-Dandruff Shampoo, Hair + Scalp Moisturizing Conditioner, and Salicylic Acid Anti-Dandruff Serum. These products offer salon-quality results at drugstore prices, expanding the availability of effective dandruff treatments in the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.