North America Containerized Data Center Market

Market Size in USD Billion

CAGR :

%

USD

7.71 Billion

USD

31.24 Billion

2025

2033

USD

7.71 Billion

USD

31.24 Billion

2025

2033

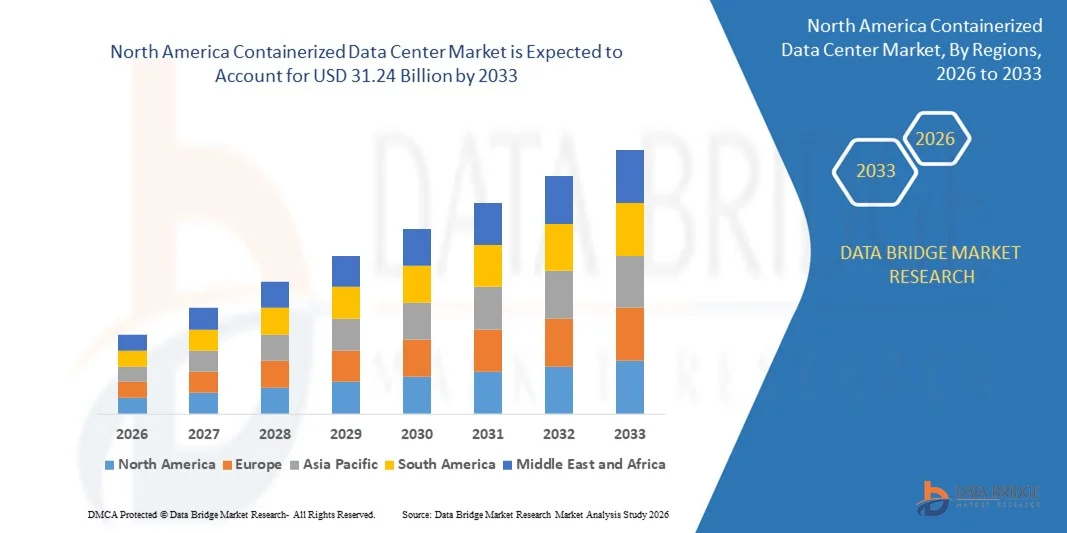

| 2026 –2033 | |

| USD 7.71 Billion | |

| USD 31.24 Billion | |

|

|

|

|

North America Containerized Data Center Market Size

- The North America containerized data center market size was valued at USD 7.71 billion in 2025 and is expected to reach USD 31.24 billion by 2033, at a CAGR of 19.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for scalable, modular, and rapidly deployable data center solutions across enterprises and cloud service providers

- Rising adoption of edge computing and high-performance computing (HPC) solutions is driving the deployment of containerized data centers closer to end users

North America Containerized Data Center Market Analysis

- Containerized data centers offer modularity, faster deployment, and flexibility compared to traditional brick-and-mortar data centers, making them ideal for expanding digital and cloud services

- Increasing investments by enterprises, telecom operators, and cloud service providers in edge computing, AI, and IoT infrastructure are accelerating market adoption

- U.S. containerized data center market captured the largest revenue share in 2025 within North America, fueled by strong adoption of cloud services, edge computing, and high-performance computing applications

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America containerized data center market due to increasing investments in digital infrastructure, growing adoption of cloud and edge computing, supportive government initiatives for data sovereignty, and rising demand for energy-efficient and modular data center solutions

- The hardware segment held the largest market revenue share in 2025, driven by strong demand for prefabricated IT infrastructure components such as servers, storage, networking, power, and cooling systems. Hardware-based containerized data centers are widely preferred due to faster deployment, scalability, and reduced construction costs

Report Scope and North America Containerized Data Center Market Segmentation

|

Attributes |

North America Containerized Data Center Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

North America Containerized Data Center Market Trends

Rising Demand for Scalable and Modular Data Center Solutions

- The growing focus on modular, portable, and rapidly deployable IT infrastructure is significantly shaping the North America containerized data center market, as enterprises and cloud service providers increasingly seek flexible solutions to meet surging data demands. Containerized data centers are gaining traction due to their ability to reduce deployment time, lower operational costs, and support edge computing, encouraging vendors to innovate with new designs and cooling technologies

- Increasing adoption of cloud services, high-performance computing (HPC), and data-intensive applications has accelerated the deployment of containerized data centers across telecom, finance, healthcare, and government sectors. Organizations are actively seeking energy-efficient, space-optimized, and secure IT solutions to support digital transformation initiatives

- Modularity, rapid deployment, and sustainability trends are influencing purchasing and investment decisions, with companies emphasizing energy-efficient cooling, transparent operational metrics, and compliance with green building and data center standards. These factors are helping providers differentiate offerings in a competitive market and build client trust, while also driving adoption of eco-friendly certifications

- For instance, in 2024, Vertiv in the U.S. and Schneider Electric in Canada expanded their containerized data center solutions with integrated cooling and monitoring technologies. These launches were introduced in response to rising enterprise and cloud provider demand for scalable, high-density IT infrastructure, with deployment across corporate campuses, colocation facilities, and remote edge locations

- While demand for containerized data centers is growing, sustained market expansion depends on continuous R&D, cost-effective manufacturing, and maintaining reliability and security comparable to traditional data centers. Providers are also focusing on enhancing modularity, improving supply chain efficiency, and developing solutions that balance performance, energy efficiency, and operational flexibility for broader adoption

North America Containerized Data Center Market Dynamics

Driver

Growing Demand for Scalable, Portable, and Energy-Efficient IT Infrastructure

- Rising enterprise and cloud service provider demand for modular and containerized data centers is a major driver for the North America market. Organizations are increasingly replacing traditional brick-and-mortar facilities with containerized solutions to meet rapid deployment needs and reduce operational overhead

- Expanding applications in edge computing, high-density computing, telecom, and enterprise IT infrastructure are supporting market growth. Containerized data centers help optimize space, reduce energy consumption, and improve IT resilience while supporting the adoption of emerging technologies

- Data center providers and technology vendors are actively promoting containerized solutions through innovation, integration with monitoring software, and compliance with energy efficiency and green standards. These efforts are supported by increasing digitalization, data traffic growth, and demand for secure, flexible, and cost-effective IT infrastructure

- For instance, in 2023, HPE in the U.S. and Vertiv in Canada reported expanded deployment of containerized data center solutions for enterprise and cloud applications. This followed higher adoption of edge computing and HPC environments, driving repeat deployments and enhanced operational efficiency

- Although rising demand for scalable and modular infrastructure supports growth, wider adoption depends on cost optimization, component availability, and standardized deployment practices. Investment in energy-efficient designs, advanced cooling systems, and secure IT management will be critical for meeting regional demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Limited Awareness Compared To Traditional Data Centers

- The relatively higher cost of containerized data center solutions compared to conventional data centers remains a key challenge, limiting adoption among smaller enterprises. High component and integration costs, coupled with advanced cooling and monitoring requirements, contribute to elevated pricing

- Awareness among organizations, particularly in mid-sized and small businesses, remains limited. Limited understanding of functional benefits and deployment advantages restricts adoption across certain sectors, slowing innovation uptake in less tech-savvy industries

- Supply chain, deployment, and operational challenges also impact market growth, as containerized solutions require certified suppliers, specialized installation, and adherence to strict safety and IT security standards. Logistical complexities and integration with existing IT infrastructure can increase implementation costs

- For instance, in 2024, enterprises in Mexico and Brazil deploying containerized solutions reported slower uptake due to higher prices and limited understanding of operational and energy efficiency benefits compared to conventional data centers. These factors also influenced vendors’ decisions to focus on large-scale enterprise and cloud customers

- Overcoming these challenges will require cost-efficient production, expanded distribution networks, and focused educational initiatives for IT managers and decision-makers. Collaboration with technology partners, data center operators, and certification bodies can help unlock the long-term growth potential of the North America containerized data center market. Furthermore, developing cost-competitive and energy-efficient solutions will be essential for widespread adoption

North America Containerized Data Center Market Scope

The market is segmented on the basis of offering, ownership, container size, container type, organization size, application, and end-user.

- By Offering

On the basis of offering, the North America containerized data center market is segmented into hardware and services. The hardware segment held the largest market revenue share in 2025, driven by strong demand for prefabricated IT infrastructure components such as servers, storage, networking, power, and cooling systems. Hardware-based containerized data centers are widely preferred due to faster deployment, scalability, and reduced construction costs.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for installation, integration, monitoring, maintenance, and managed services. Growing deployment across edge locations and remote sites is encouraging enterprises to rely on specialized service providers for operational efficiency.

- By Ownership

On the basis of ownership, the market is segmented into lease/outsource and purchase. The purchase segment held the largest revenue share in 2025, supported by large enterprises and cloud providers seeking long-term control over infrastructure, data security, and customization.

The lease/outsource segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising preference for flexible deployment models, lower upfront investment, and reduced operational responsibility. This model is gaining popularity among small and medium organizations and enterprises with fluctuating capacity requirements.

- By Container Size

On the basis of container size, the market is segmented into 20 ft., 40 ft., and 60 ft. containers. The 40 ft. container segment accounted for the largest market share in 2025, owing to its balanced capacity, ease of transportation, and suitability for a wide range of enterprise and edge computing applications.

The 60 ft. container segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for high-density computing, large-scale deployments, and centralized modular data center installations.

- By Container Type

On the basis of container type, the market is segmented into customized container, compact all-in-one container, and standalone container. The customized container segment held the largest revenue share in 2025, as enterprises increasingly demand tailored solutions to meet specific power, cooling, and workload requirements.

The compact all-in-one container segment is expected to witness the fastest growth rate from 2026 to 2033, driven by demand for fully integrated, plug-and-play solutions that enable rapid deployment, particularly for edge and remote applications.

- By Organization Size

On the basis of organization size, the market is segmented into large organization and small & medium organization. The large organization segment dominated the market in 2025, supported by high data processing needs, large IT budgets, and extensive adoption of cloud, AI, and high-performance computing workloads.

The small & medium organization segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing digital transformation, rising data generation, and growing adoption of cost-effective, modular IT infrastructure solutions.

- By Application

On the basis of application, the market is segmented into greenfield, brownfield, and upgrade & consolidation. The greenfield segment held the largest market share in 2025, driven by new data center deployments and expansion of digital infrastructure across enterprises and cloud service providers.

The upgrade & consolidation segment is expected to witness the fastest growth rate from 2026 to 2033, as organizations modernize legacy data centers, improve energy efficiency, and consolidate workloads using modular containerized solutions.

- By End-User

On the basis of end-user, the market is segmented into banking, financial services and insurance (BFSI), healthcare, IT & telecom, retail & ecommerce, energy & utilities, government, media & entertainment, education, military & defense, and others. The IT & telecom segment accounted for the largest revenue share in 2025, driven by rapid growth in data traffic, cloud adoption, and deployment of edge computing infrastructure.

The healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of digital health solutions, electronic health records, telemedicine platforms, and the need for secure, scalable, and compliant data infrastructure.

North America Containerized Data Center Market Regional Analysis

- U.S. containerized data center market captured the largest revenue share in 2025 within North America, fueled by strong adoption of cloud services, edge computing, and high-performance computing applications

- Enterprises are increasingly prioritizing modular data center deployments to support rapid scalability, disaster recovery, and remote operations

- The presence of major cloud service providers, technology vendors, and colocation operators, combined with rising investments in AI and IoT infrastructure, is significantly contributing to market expansion

Canada Containerized Data Center Market Insight

The Canada containerized data center market is expected to witness steady growth from 2026 to 2033, driven by increasing demand for scalable, energy-efficient, and rapidly deployable data center solutions. The growing adoption of cloud computing, edge computing, and AI-driven workloads is encouraging enterprises and service providers to invest in containerized data centers to support flexible and localized infrastructure needs. In addition, stringent data sovereignty regulations and rising focus on sustainability and green IT initiatives are prompting organizations to deploy modular data centers within national boundaries. Canada’s strong digital infrastructure development, supported by government initiatives and expanding hyperscale and edge deployments, is expected to continue to stimulate market growth.

North America Containerized Data Center Market Share

The North America containerized data center industry is primarily led by well-established companies, including:

- Vertiv Group Corp. (U.S.)

- IBM Corporation (U.S.)

- Cisco (U.S.)

- American Portwell Technology, Inc. (U.S.)

- PCX Corporation, LLC (U.S.)

- IBM Corporation (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Dell Technologies (U.S.)

- Cisco Systems, Inc. (U.S.)

- Vertiv Holdings Co (U.S.)

- Schneider Electric (U.S.)

- Rittal GmbH & Co. KG (Canada)

- Eaton Corporation (U.S.)

- Delta Electronics, Inc. (U.S.)

- CommScope (U.S.)

- BMarko Structures (U.S.)

- PCX Corporation (U.S.)

- Compass Datacenters (Canada)

- Vapor IO (U.S.)

- EdgeMicro (U.S.)

Latest Developments in North America Containerized Data Center Market

- In July 2025, Dell Technologies announced a strategic partnership with CoreWeave to deliver liquid-cooled PowerEdge XE9712 servers integrated with IR7000 racks. The development focuses on enabling AI-driven cloud environments powered by NVIDIA Grace CPUs and Blackwell GPUs. This initiative enhances high-performance computing efficiency and thermal management for large-scale AI workloads. The partnership supports advanced AI model training and inference while modernizing data center infrastructure. It is expected to accelerate the adoption of liquid-cooled, AI-optimized containerized and modular data center solutions

- In May 2025, Nutanix announced its Cloud Native AOS solution, extending its enterprise data platform to Kubernetes environments. The development enables seamless disaster recovery and cloud-native mobility for containerized applications. It improves operational resilience across hybrid and multi-cloud infrastructures. By supporting containerized workloads, the solution enhances application portability and scalability. This move strengthens the software ecosystem supporting containerized data center deployments

- In April 2025, Axiom Space announced plans to launch orbital data center nodes into low-Earth orbit by the end of 2025. These nodes aim to provide secure, cloud-enabled data storage and AI/ML capabilities for national security and commercial users. The initiative introduces a novel approach to data center deployment beyond terrestrial limitations. It enhances data security, resilience, and global accessibility. This innovation expands the conceptual scope of containerized and modular data center markets

- In April 2025, Kyndryl launched AI Private Cloud services designed to support enterprise-grade AI deployments. The offering includes consulting and managed services for containerized AI workloads across sectors such as financial services, healthcare, technology, and manufacturing. It enables organizations to deploy AI securely within private cloud environments. The service improves governance, performance, and scalability of AI infrastructure. This development boosts demand for containerized data center solutions supporting private AI ecosystems

- In March 2025, AWS unveiled new Outposts rack and server offerings tailored for telecommunications providers. The solutions enable deployment of 5G Core and RAN workloads with enhanced security and automated management. They support low-latency, on-premise processing requirements for telecom networks. The launch strengthens edge and distributed computing capabilities. It positively impacts the containerized data center market by expanding telecom-focused use cases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.