North America Confectionery Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.32 Billion

USD

3.70 Billion

2024

2032

USD

2.32 Billion

USD

3.70 Billion

2024

2032

| 2025 –2032 | |

| USD 2.32 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Confectionery Processing Equipment Market Size

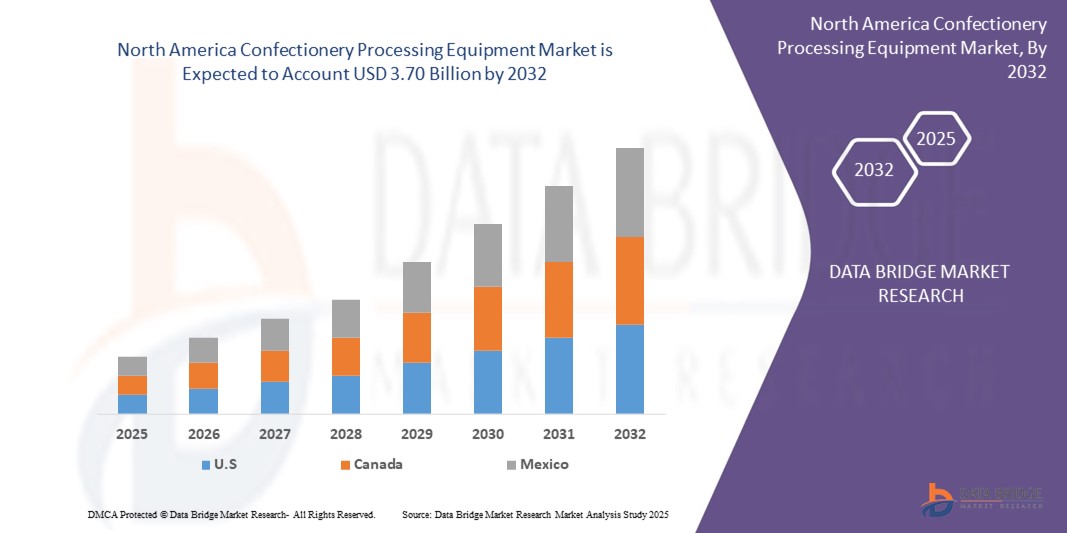

- The North America Confectionery Processing Equipment Market size was valued at USD 2.32 billion in 2024 and is expected to reach USD 3.70 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by rising demand for confectionery products, advancements in automated processing technologies, increasing health-conscious consumer preferences, expansion of organized retail, and the need for efficient, high-capacity equipment to meet diverse and evolving product requirements.

- Furthermore, increasing investments in food processing infrastructure, stringent hygiene and safety regulations, and growing demand for customized confectionery drive innovation in equipment design. Manufacturers are also adopting energy-efficient, automated systems to enhance productivity, reduce operational costs, and maintain product consistency.

Confectionery Processing Equipment Market Analysis

- The confectionery processing equipment market is driven by increasing global consumption of chocolates, candies, and gums. Advancements in automation and precision technologies enable manufacturers to produce high-quality products efficiently, meeting the growing consumer demand for variety and quality.

- Stringent food safety regulations and the rising preference for clean-label, low-sugar products are pushing manufacturers to invest in advanced, compliant equipment. Additionally, demand for customized and artisanal confectionery products is encouraging innovation in flexible, scalable processing solutions.

- North America dominates the Confectionery Processing Equipment Market with the largest revenue share of 37% in 2025, driven by advanced food processing infrastructure, high consumer demand, strong industry presence, and well-established suppliers, maintaining its leadership in the global market.

- The Asia Pacific (APAC) region is expected to be the fastest-growing market for confectionery processing equipment, driven by rising urbanization, increasing disposable incomes, a growing middle class, and strong demand for diverse confectionery products. Western influence and cost-effective manufacturing also boost investments in advanced processing technologies.

- Hard Candies segment is expected to dominate the market with a 35% share in 2025, driven by its long shelf life, diverse flavor, rising consumer demand, and advancements in processing technology that enhance production efficiency and product quality.

Report Scope and Confectionery Processing Equipment Market Segmentation

|

Attributes |

Confectionery Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Confectionery Processing Equipment Market Trends

“Rising demand for energy-efficient and sustainable equipment solutions”

- Manufacturers are increasingly adopting energy-efficient equipment to reduce utility expenses and optimize production costs. Sustainable machinery lowers power consumption, resulting in significant long-term savings while maintaining high output quality, making operations more economically viable in competitive markets.

- Stricter government regulations and environmental policies worldwide compel confectionery producers to implement sustainable equipment. Compliance with emission controls, waste reduction, and energy usage standards drives the adoption of green technologies, minimizing environmental impact and avoiding costly fines or operational disruptions.

- Growing consumer awareness about environmental sustainability encourages confectionery companies to invest in eco-friendly processing equipment. Using sustainable machinery aligns with brand values, helps meet consumer expectations for green products, and enhances corporate social responsibility initiatives, positively influencing market reputation.

- Advancements in technology and materials enable the development of energy-efficient confectionery equipment with enhanced durability and performance. Innovations like variable frequency drives, smart sensors, and optimized heating systems contribute to reduced energy consumption and improved sustainability without sacrificing productivity.

For Instance,

- In April 2025, Kennedy’s Confection highlights the growing importance of energy-efficient machinery in the confectionery industry. Companies like CHOCOTECH and Agriflex are leading the way by integrating process automation, smart ingredient handling, and energy recovery into their systems, resulting in significant energy savings and reduced environmental impact. Their approach emphasizes simplicity and effectiveness, proving that thoughtful engineering can lead to substantial improvements in energy efficiency without compromising product quality. This trend reflects a broader shift towards sustainability in manufacturing practices.

- Alignment with global sustainability goals such as the UN’s Sustainable Development Goals (SDGs) motivates manufacturers to prioritize energy efficiency. Industry trends emphasize circular economy principles, resource conservation, and waste minimization, encouraging widespread adoption of sustainable confectionery processing solutions.

Confectionery Processing Equipment Market Dynamics

Driver

“Simple designs enhance reliability and ease of maintenance”

- Simple machine designs have fewer components, which decreases the chances of mechanical failure. This improves overall reliability, minimizing unexpected downtime and ensuring consistent production output in confectionery processing environments.

- With straightforward layouts, maintenance teams can quickly identify and resolve issues. Simplified access to parts and fewer complicated mechanisms reduce repair time, leading to faster equipment turnaround and less disruption to manufacturing schedules.

- Simplified machinery is easier to understand and operate, requiring less specialized training for staff. This enables quicker onboarding, reduces operator errors, and promotes safer, more effective equipment handling in production lines.

- Fewer parts and less intricate designs reduce the number and cost of spare parts needed. Routine maintenance becomes more manageable and affordable, supporting better budget control for confectionery manufacturers.

- Simple mechanical systems tend to endure wear and tear better than complex ones. By minimizing unnecessary components, machines experience less strain, extending their operational life and providing a better return on investment over time.

Restraint/Challenge

“High initial investment limits adoption of advanced processing equipment”

- The high upfront cost of advanced confectionery processing machinery can deter small and medium manufacturers from investing, restricting their ability to upgrade technology and compete with larger players who can afford modern equipment.

- Expensive equipment often requires extended periods to recover costs through improved efficiency or output, causing hesitation among manufacturers wary of delayed returns, especially in volatile or low-margin confectionery markets.

- Companies in developing regions may struggle with limited financial resources, making it difficult to justify large investments in new technology, slowing the market penetration of energy-efficient and automated processing solutions.

- Rapid advancements in confectionery machinery technology can make costly equipment obsolete quickly, leading manufacturers to hesitate before committing to expensive upgrades due to concerns about future-proofing their investments.

- Many confectionery manufacturers face challenges securing loans or favorable financing terms for costly equipment purchases, further restricting their ability to adopt advanced processing technologies despite potential long-term benefits.

Confectionery Processing Equipment Market Scope

The market is segmented on the basis of product, type, mode of operation and application.

- By Product

On the basis of product, the Confectionery Processing Equipment Market is segmented into Hard Candies, Chocolates, Soft Confectionery, Chewing Gums, Gummies and Jellies, Others. The Hard Candies segment dominates the largest market revenue share of 35% in 2025, driven by its long shelf life, wide flavor variety, increasing consumer demand, and advancements in processing technologies that enhance production efficiency and product quality.

The Gummies and Jellies segment is anticipated to witness the fastest growth rate of 7.2% from 2025 to 2032, fueled by rising consumer preference for healthier, fruit-flavored snacks, innovative product formulations, and increasing demand for gluten-free and vegan confectionery options.

- By Type

On the basis of type, the Confectionery Processing Equipment Market is segmented in to weighing and dissolving equipment, mixers, blenders, cutters, thermal equipment, tempering equipment, forming and depositing equipment, cooling equipment, extrusion equipment, coating equipment, rolling equipment, others. The Weighing and Dissolving Equipment held the largest market revenue share in 2025 driven by its critical role in ensuring precise ingredient measurement, enhancing product consistency, reducing waste, and supporting automation in confectionery manufacturing processes.

The Tempering Equipment segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for premium chocolate products, advancements in precise temperature control technology, and increasing automation to improve product quality and manufacturing efficiency.

- By Mode of Operation

On the basis of mode of operation, the Confectionery Processing Equipment Market is segmented into semi-automatic and automatic. The Semi-Automatic segment held the largest market revenue share in 2025, driven by its cost-effectiveness, ease of operation, flexibility for small to medium-scale production, and growing demand from artisanal and specialty confectionery manufacturers seeking efficient yet affordable processing solutions.

The Semi-Automatic segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its balance of affordability and efficiency, adaptability to varied production scales, lower maintenance costs, and growing preference among small and medium confectionery manufacturers.

- By Application

On the basis of application, the Confectionery Processing Equipment Market is segmented into weighing and dosing, mixing and refining, conching, tempering, enrobing, moulding, cooling, decorating. The Weighing and Dosing segment accounted for the largest market revenue share in 2024, driven by the critical need for precise ingredient measurement, enhanced product consistency, reduced material waste, and increasing adoption of automated systems in confectionery manufacturing processes.

The Weighing and Dosing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for high-precision ingredient control, advancements in automation technology, and increasing focus on reducing waste and improving product quality in confectionery production.

Confectionery Processing Equipment Market Regional Analysis

- U.S. dominates the Confectionery Processing Equipment Market with the largest revenue share of 40% in 2024, driven by its well-established confectionery industry, high consumer demand, advanced manufacturing technologies, and continuous investment in automation and sustainable processing solutions.

- The U.S. benefits from strong R&D capabilities and presence of key market players, fostering innovation in confectionery equipment, which boosts production efficiency and product quality, reinforcing its leadership position in the market.

- Growing consumer preference for premium and specialty confectionery products in the U.S. drives demand for advanced processing equipment, enabling manufacturers to meet diverse tastes and regulatory standards efficiently.

Confectionery Processing Equipment Market Share

The confectionery processing equipment industry is primarily led by well-established companies, including:

- John Bean Technologies Corporation (U.S.)

- Heat and Control, Inc. (U.S.)

- Tomric Systems, Inc. (U.S.)

- A.M.P-Rose (U.S.)

- Schubert North America (U.S.)

- Charles Ross & Son Company (U.S.)

- TNA Solutions (U.S.)

- Vortx Manufacturing (U.S.)

- Baker Perkins North America (U.S.)

- Bosch Packaging Technology North America (U.S.)

- Aequs (Canada)

- Multitek Solutions (Canada)

- Tecma (Mexico)

- Equipos y Sistemas (Mexico)

Latest Developments in North America Confectionery Processing Equipment Market

- In March 2025, Syntegon introduced the FGCT count feeder at the iba 2025 trade fair in Düsseldorf. This innovative handling solution gently groups sandwich cookies in the desired quantity and places them on-edge in trays or directly into the infeed of a flow wrapping machine, ensuring efficient packaging and optimal presentation.

- In March 2025, At the iba 2025 trade fair, GEA showcased the Minitart machine, designed for the bakery industry's need for a compact pie and tart processing line that operates at high production capacity without compromising on precision or quality.

- In May 2025, Bühler launched the OptiBake oven, revolutionizing wafer baking with exceptional flexibility and up to 50% energy savings. This advanced oven significantly boosts production efficiency while promoting sustainability by reducing energy consumption, helping manufacturers meet increasing demand for high-quality wafers with lower environmental impact.

- In November 2024, Hebenstreit expanded its capabilities by acquiring innovative puffing technology from Cerex. This acquisition broadens Bühler’s product offerings, providing enhanced solutions to address the growing demand for healthier and more diverse food options, including in the confectionery sector.

- In February 2025, GEA collaborated with McCain Appetizers Europe to develop the new MaxiFormer II, revolutionizing their Rilland facility with innovative drum forming technology. This partnership showcases the future of food production with exceptional productivity and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Confectionery Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Confectionery Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Confectionery Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.