Market Analysis and Insights : North America Clinical Trial Supplies Market

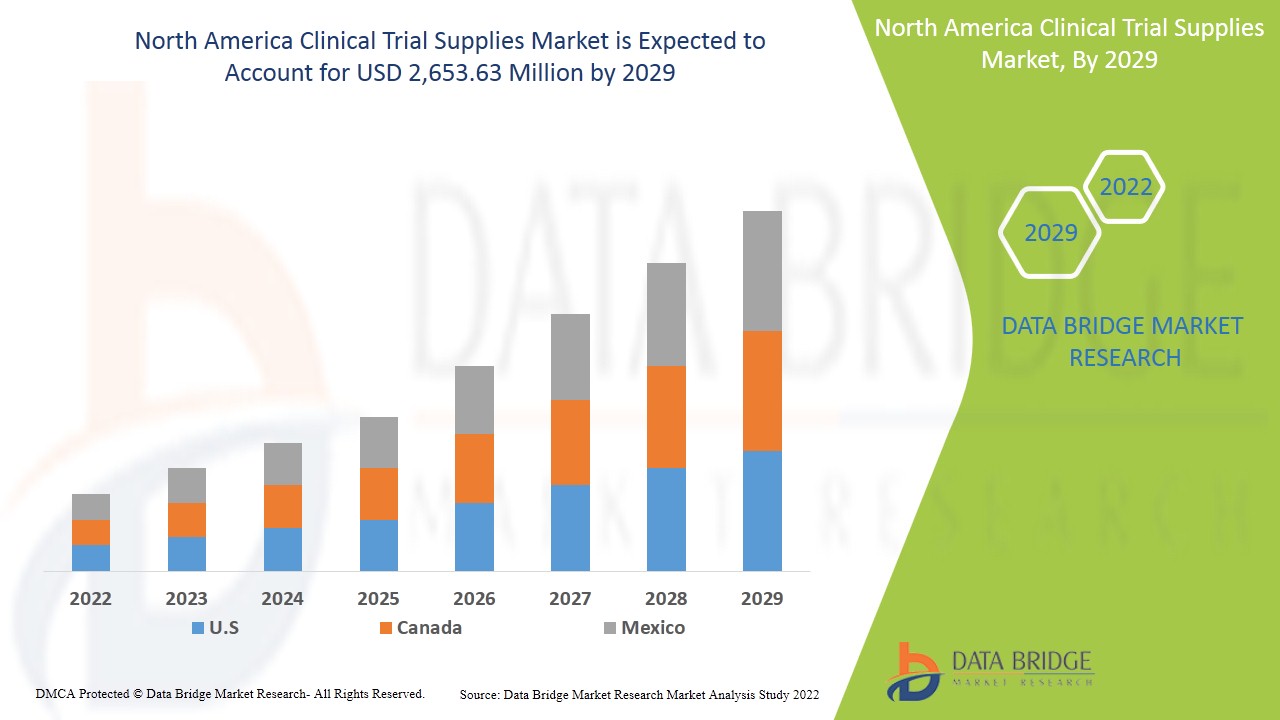

North America clinical trial supplies Market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.5% in the forecast period of 2022 to 2029 and is expected to reach USD 2,653.63 million by 2029. The major factor driving the growth of the clinical trial supplies market are rising of demand in clinical trial worldwide, increasing incidences of diseases, government funds to R&D investments and development of new treatments such as personalized medicine leading the clinical trial supplies market to grow in future.

The clinical trial is a research study that determines whether a medical strategy, treatment, or device is safe, effective and useful for humans use. These studies help in find which medical approaches experiment is best for certain diseases. A clinical trial provides the best data for health care decision-making purposes.

The purpose of clinical trial is to study strict scientific standards. These standards protect patients and help in producing reliable study results.

Clinical trial are last stage in drug development in a long and careful research process that is carried out by scientists or researchers for a particular disease, whether drug or medical device. The process drug development often begins in a lab, where scientists first develop and test new ideas related to treatment of disease.

The North America clinical trial supplies market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Services (Storage, Manufacturing, Packaging And Labelling), Clinical Phase (Phase III, Phase II, Phase IV, Phase I), Therapeutic Uses (Oncology, Cardiovascular Diseases, Dermatology, Metabolic Disorders, Infectious Diseases, Respiratory Diseases, CNS And Mental Disorders, Blood Disorders, Others), End User (Contract Research Organizations, Pharmaceutical And Biotechnology Companies) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Movianto (U.S.), Sharp (U.S.),Thermo Fisher Scientific Inc.,(U.S.), Catalent, Inc (U.S.), PCI Pharma Services (U.S.), Almac Group (U.K.), PAREXEL International Corporation (U.S.), Bionical Ltd. (U.K.), Alium Medical Limited (U.K.), Myonex (U.K.), Clinigen Group plc (U.K.), Ancillare, LP (U.S.), SIRO Clinpharm (India) CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (U.S.) Biocair (U.K.) and among others. |

Clinical Trial Supplies Market Dynamics

Drivers

- Rising demand for clinical trial worldwide

The rising demand for clinical trial has been 82% alone in developing countries such as North America, Global, and Asia. These drugs are available in the market after clinical trial, so all the companies mostly carry out clinical trial depending on the type of drug or device machine and hence act as a major driver that will result in the expansion of the growth rate of the treatment market.

- Increasing incidence of chronic diseases

The high prevalence of chronic diseases due to the rapidly increasing population and infections among people can be seen globally. These diseases contribute a major role in the clinical trial field for the development of drugs. The drug has to pass all the standard clinical phase to be available before human consumption. Thus, to treat these chronic diseases for humans, the drug has to be safe.

- Government funds in R&D investments

The instruments, workforce, medical management in case of harm to researchers, insurance, transportation, ethics committee fee, data processing, and other consumables lead to major cost involvement in clinical trial. Clinical trial are the evaluation of diseases prevention and treatment ideas will further enhance the growth of treatment market.

Opportunities

- Increasing new drug development trial in emerging countries

Clinical trial for drug efficacy is the primary key for drugs development for diseases treatment before launching in the market for human consumption. Additionally, the new drugs have to meet license extensions and international standards before selling and distribution. Increasing the prevalence and incidence of diseases and the rise in the patient’s numbers are the factors leading to emerging trends of clinical trial for drug development in developing countries over the past period.

Also, governments in emerging markets (China, Brazil, Russia, India, and South Africa) reform public healthcare and grant more accessible access to medicine. These two factors working in unison mean greater freedom for market developments and increased innovation in clinical research in emerging markets.

Restraints/Challenges

Adverse drug reactions are the unwanted or harmful effects that can be experienced after the administration of a drug under normal conditions of use in humans. The drug reactions generally occur in jaundice, anaemia, rashes and lead to a decrease in the white blood cell count, damaged kidney, and nerve injury that caused impaired vision or hearing.

Many of the adverse effects may be ascertained from physical examinations during the clinical phase of testing. Thus, reporting adverse effects during clinical trial is the major leading restraints factor for the supplies market. Despite high time and cost investments for developing biologics and new drugs, it is estimated that lower procedure time and rate for approval of drug is creating a biggest challenge for the market, which may hamper the market growth.

This clinical trial supplies market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on clinical trial supplies market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In February 2022, Thermo Fisher Scientific has announced partnership with Medidata to optimize clinical research site selection and speed patient enrollment in clinical trial. This improves clinical trial planning and execution to accelerate clinical trial in which datasets have been generated from 26,000 clinical trial and nearly 8 million patients in more than 140 countries across the globe

North America Clinical Trial Supplies Market Scope

North America clinical trial supplies market is categorized based on services, clinical phase, therapeutic uses and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Services

- Manufacturing

- Distribution

- Storage

- Packaging and Labelling

On the basis of services the North America clinical trial supplies market is segmented into manufacturing, distribution, storage, and packaging and labelling.

Clinical Phase

- Phase I

- Phase II

- Phase III

- Phase IV

On the basis of clinical phase the North America clinical trial supplies market is segmented into phase I, phase II, phase III and phase IV.

Therapeutic Uses

- Oncology

- CNS

- Mental Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Respiratory Diseases

- Blood Disorder

- Dermatology

- Others

On the basis of therapeutic uses, the North America clinical trial supplies market is segmented into oncology, CNS and mental disorders, cardiovascular diseases, infectious disease, respiratory diseases, metabolic disorders, blood disorders, dermatology and others.

End User

- Contract research organizations

- Pharmaceutical and biotechnology companies

On the basis of end user, the North America clinical trial supplies market is segmented into contract research organizations and pharmaceutical and biotechnology companies.

Clinical Trial Supplies Market Regional Analysis/Insights

North America clinical trial supplies market is further segmented into major countries such as the U.S., Canada, and Mexico.

U.S. dominates the North America clinical trial supplies market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period of 2022-2029. This is due to the presence of major key players and well-developed healthcare infrastructure in this region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Clinical Trial Supplies Market Share Analysis

North America clinical trial supplies market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trial pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. sThe above data points provided are only related to the companies’ focus related to clinical trial supplies market.

The major prominent participants operating in the North America clinical trial supplies market are Movianto (U.S.), Sharp (U.S.),Thermo Fisher Scientific Inc.,(U.S.), Catalent, Inc (U.S.), PCI Pharma Services (U.S.), Almac Group (U.K.), PAREXEL International Corporation (U.S.), Bionical Ltd. (U.K.), Alium Medical Limited (U.K.), MYODERM (U.K.), Clinigen Group plc (U.K.), Ancillare, LP (U.S.), SIRO Clinpharm (India) CLINICAL SUPPLIES MANAGEMENT HOLDINGS, INC. (U.S.) Biocair (U.K.) and among others.

Research Methodology: North America Clinical Trial Supplies Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global vs regional and vendor share analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICES LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE

6.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

6.1.3 GOVERNMENT FUNDS IN R&D INVESTMENTS

6.1.4 ADVANCEMENT OF TECHNOLOGY IN CLINICAL TRIALS SUPPLIES

6.2 RESTRAINTS

6.2.1 ADVERSE EFFECTS OF CLINICAL TRIALS

6.2.2 TRANSPORTATION ISSUE IN CLINICAL TRIAL SUPPLIES

6.2.3 HIGH COST ASSOCIATED WITH THE CLINICAL TRIALS

6.3 OPPORTUNITIES

6.3.1 INCREASING NEW DRUG DEVELOPMENT TRIALS IN EMERGING COUNTRIES

6.3.2 INCREASING DEMAND FOR INNOVATIVE SOLUTIONS IN CLINICAL TRIALS SERVICES

6.3.3 EVOLUTION IN SUPPLY CHAIN MANAGEMENT FOR CLINICAL TRIALS

6.4 CHALLENGES

6.4.1 LOWER PROCEDURE TIME OF CLINICAL TRIALS APPROVAL

6.4.2 LACK OF SKILLED PERSON TO OPERATE DEVICES DURING CLINICAL TRIALS

7 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES

7.1 OVERVIEW

7.2 STORAGE

7.3 MANUFACTURING

7.4 PACKAGING AND LABELLING

7.5 DISTRIBUTION

8 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASES

8.1 OVERVIEW

8.2 PHASE III

8.3 PHASE II

8.4 PHASE IV

8.5 PHASE I

9 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE

9.1 OVERVIEW

9.2 ONCOLOGY

9.3 CARDIOVASCULAR DISEASES

9.4 DERMATOLOGY

9.5 METABOLIC DISORDERS

9.6 INFECTIOUS DISEASES

9.7 RESPIRATORY DISEASES

9.8 CNS AND MENTAL DISORDERS

9.9 BLOOD DISORDERS

9.1 OTHERS

10 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY END USER

10.1 OVERVIEW

10.2 CONTRACT RESEARCH ORGANIZATIONS

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

11 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.1.5.1 PARTNERSHIP

14.2 ALMAC GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 CATALENT INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.3.5.1 SERVICE EXPANSION

14.4 CLINIGEN GROUP PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.4.5.1 PARTNERSHIP

14.5 MOVIANTO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 SERVICE PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.5.4.1 ACQUISITION

14.6 PCI PHARMA SERVICES

14.6.1 COMPANY SNAPSHOT

14.6.2 SERVICE PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 SHARP

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 ALIUM MEDICAL LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICE PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANCILLARE, LP

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICE PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 BIOCAIR

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BIONICAL LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICE PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.11.3.1 SERVICE LAUNCH

14.12 CLINICAL SUPPLIES MANAGEMENT HOLDINGS,INC

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICE PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KLIFO

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICE PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.13.3.1 ACQUISTION

14.14 MYONEX

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICE PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PAREXEL INTERNATIONAL CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICE PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.15.3.1 COLLABORATION

14.16 SIRO CLINPHARM PRIVATE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 LOCATIONS OF REGISTERED STUDIES

TABLE 2 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA STORAGE IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA MANUFACTURING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PACKAGING AND LABELLING IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DISTRIBUTION IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PHASE III IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA PHASE II IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PHASE IV IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHASE I IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ONCOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CARDIOVASCULAR DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DERMATOLOGY IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA METABOLIC DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA INFECTIOUS DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA RESPIRATORY DISEASES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CNS AND MENTAL DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BLOOD DISORDERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CONTRACT RESEARCH ORGANIZATIONS IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN CLINICAL TRIAL SUPPLIES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 U.S. CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 31 U.S. CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 32 U.S. CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 33 U.S. CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 CANADA CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 35 CANADA CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 36 CANADA CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 37 CANADA CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 MEXICO CLINICAL TRIAL SUPPLIES MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 39 MEXICO CLINICAL TRIAL SUPPLIES MARKET, BY CLINICAL PHASE, 2020-2029 (USD MILLION)

TABLE 40 MEXICO CLINICAL TRIAL SUPPLIES MARKET, BY THERAPEUTIC USE, 2020-2029 (USD MILLION)

TABLE 41 MEXICO CLINICAL TRIAL SUPPLIES MARKET, BY END USER, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA CLINICAL TRIAL SUPLLIES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CLINICAL TRIAL SUPLLIES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING DEMAND FOR CLINICAL TRIALS WORLDWIDE AND INCREASING INCIDENCES OF DISEASES IS DRIVING THE NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 STORAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET

FIGURE 14 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2021

FIGURE 15 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES, LIFELINE CURVE

FIGURE 18 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2021

FIGURE 19 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY CLINICAL PHASE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2021

FIGURE 23 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY THERAPEUTIC USE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: BY SERVICES (2022-2029)

FIGURE 35 NORTH AMERICA CLINICAL TRIAL SUPPLIES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.