North America Clinical Microscopes Market

Market Size in USD Billion

CAGR :

%

USD

1.10 Billion

USD

1.80 Billion

2025

2033

USD

1.10 Billion

USD

1.80 Billion

2025

2033

| 2026 –2033 | |

| USD 1.10 Billion | |

| USD 1.80 Billion | |

|

|

|

|

North America Clinical Microscopes Market Size

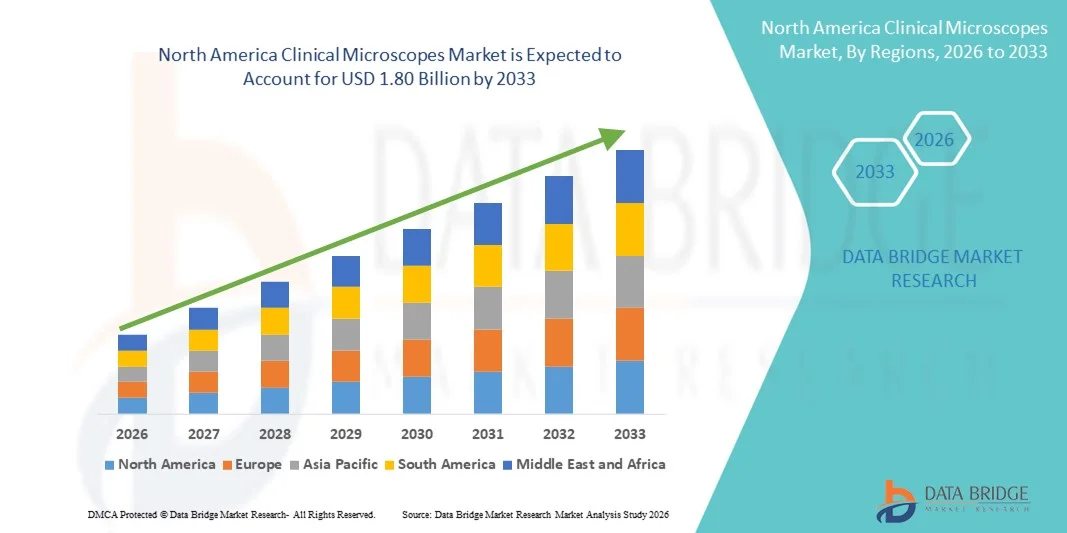

- The North America clinical microscopes market size was valued at USD 1.10 billion in 2025 and is expected to reach USD 1.80 billion by 2033, at a CAGR of 6.4% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced diagnostic technologies and continuous technological advancements in optical and digital microscopy across hospitals, diagnostic laboratories, and research institutions

- Furthermore, rising demand for accurate disease diagnosis, growing prevalence of chronic and infectious diseases, and expanding investments in healthcare infrastructure are establishing clinical microscopes as essential tools in modern medical practice. These converging factors are accelerating the adoption of clinical microscopy solutions, thereby significantly boosting the market’s growth

North America Clinical Microscopes Market Analysis

- Clinical microscopes, providing high-resolution visualization for medical diagnostics, pathology, and research applications, are increasingly vital tools in modern healthcare systems across hospitals, diagnostic laboratories, and academic institutions due to their precision, reliability, and integration with digital imaging and workflow solutions

- The escalating demand for clinical microscopes is primarily driven by the rising burden of chronic and infectious diseases, growing emphasis on early and accurate diagnosis, and continuous advancements in optical, fluorescence, and digital microscopy technologies

- The United States dominated the North America clinical microscopes market with the largest revenue share of 78.5% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of technologically advanced diagnostic equipment across hospitals, reference laboratories, and research institutions

- Canada is expected to be the fastest growing country during the forecast period, driven by increasing investments in healthcare infrastructure, expansion of diagnostic laboratories, and rising demand for advanced medical diagnostic technologies

- Optical microscopes segment dominated the North America clinical microscopes market with a market share of about 46.8% in 2025, attributed to their widespread use in routine clinical diagnostics, cost-effectiveness, and broad applicability across pathology, microbiology, and hematology laboratories

Report Scope and North America Clinical Microscopes Market Segmentation

|

Attributes |

North America Clinical Microscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Clinical Microscopes Market Trends

Integration of Digital Imaging and AI-Enabled Diagnostics

- A significant and accelerating trend in the North America clinical microscopes market is the increasing integration of digital imaging, automation, and artificial intelligence (AI) into conventional optical microscopy, enhancing diagnostic accuracy, workflow efficiency, and data management across clinical laboratories

- For instance, several advanced clinical microscopes now incorporate AI-assisted image analysis and digital pathology capabilities, enabling pathologists to detect cellular abnormalities more efficiently and reduce manual interpretation errors

- AI integration in clinical microscopes supports features such as automated cell counting, pattern recognition, and anomaly detection, improving diagnostic consistency and turnaround time. For instance, certain AI-enabled systems can highlight suspicious regions on slides and assist clinicians in prioritizing critical cases

- The seamless integration of clinical microscopes with laboratory information systems (LIS) and hospital information systems (HIS) allows centralized data storage, remote consultations, and improved collaboration among clinicians, pathologists, and researchers

- This shift toward smarter, digitally connected microscopy solutions is reshaping diagnostic workflows in North America. Consequently, leading manufacturers are developing advanced clinical microscopes with AI-driven analysis, high-resolution digital cameras, and cloud-based data sharing functionalities

- The demand for digitally integrated and AI-assisted clinical microscopes is rising steadily across hospitals, diagnostic laboratories, and research institutions, as healthcare providers increasingly prioritize efficiency, accuracy, and data-driven clinical decision-making

- Continuous improvements in fluorescence, confocal, and multimodal microscopy technologies are enhancing visualization capabilities, supporting more precise and comprehensive clinical diagnostics

North America Clinical Microscopes Market Dynamics

Driver

Rising Demand for Advanced Diagnostics and Expanding Healthcare Infrastructure

- The increasing prevalence of chronic diseases, infectious conditions, and age-related disorders, combined with the growing emphasis on early and accurate diagnosis, is a major driver for the rising demand for clinical microscopes in North America

- For instance, ongoing investments by hospitals and diagnostic laboratories in advanced pathology and microbiology infrastructure are accelerating the adoption of high-performance clinical microscopes across the region

- As healthcare providers focus on improving diagnostic precision and reducing diagnostic errors, clinical microscopes offer high-resolution visualization, advanced contrast techniques, and digital enhancements that surpass traditional diagnostic tools

- Furthermore, the expansion of research activities, academic medical centers, and clinical trials in North America is reinforcing the demand for reliable and technologically advanced microscopy solutions

- The growing adoption of automated and digital laboratory workflows, along with favorable reimbursement frameworks and strong healthcare spending, continues to propel the uptake of clinical microscopes across hospitals, laboratories, and research institutions

- Increasing government and private funding for biomedical research is supporting the procurement of advanced clinical microscopy systems

- The rising number of diagnostic laboratories and outpatient testing centers is further driving sustained demand for routine and specialized clinical microscopes

Restraint/Challenge

High Equipment Costs and Regulatory Compliance Complexity

- The high cost associated with advanced clinical microscopes, particularly those equipped with digital imaging, fluorescence, and AI-based features, presents a significant challenge to widespread adoption, especially for small and mid-sized laboratories

- For instance, the substantial capital investment required for premium microscopy systems can delay purchasing decisions among budget-constrained healthcare facilities

- Compliance with stringent regulatory standards and quality assurance requirements for clinical diagnostic equipment further adds to the complexity, increasing approval timelines and operational costs for manufacturers and end users

- In addition, the need for skilled personnel to operate advanced microscopy systems and interpret complex digital outputs can limit adoption in facilities facing workforce shortages

- Overcoming these challenges through cost-effective product development, streamlined regulatory pathways, user training programs, and scalable digital solutions will be critical for sustaining long-term growth in the North America clinical microscopes market

- Ongoing maintenance, calibration, and software upgrade requirements can increase total cost of ownership for healthcare providers

- Variability in regulatory and accreditation requirements across laboratories can further complicate procurement and deployment decisions

North America Clinical Microscopes Market Scope

The market is segmented on the basis of product, ergonomics, modality, application, end-user, and distribution channel.

- By Product

On the basis of product, the North America clinical microscopes market is segmented into optical microscopes, electron microscopes, scanning probe microscopes, and others. The optical microscopes segment dominated the market with the largest revenue share of 46.8% in 2025, driven by their extensive use in routine clinical diagnostics across hospitals and diagnostic laboratories. These microscopes are widely applied in pathology, microbiology, and hematology for daily diagnostic workflows. Their relatively lower cost, ease of use, and minimal training requirements make them highly suitable for high-volume testing environments. Optical microscopes also offer strong compatibility with digital cameras and laboratory information systems, supporting gradual digital adoption. In addition, their widespread use in academic training reinforces consistent demand. Continuous advancements in illumination, contrast techniques, and optical resolution further sustain their market leadership.

The electron microscopes segment is expected to be the fastest growing during the forecast period, driven by increasing demand for ultra-high-resolution imaging in advanced diagnostics and clinical research. These microscopes enable detailed visualization of cellular and subcellular structures that are not visible using optical systems. Rising investments in oncology, virology, and neuroscience research are significantly boosting adoption. Improvements in automation and sample preparation are making electron microscopes more accessible to clinical laboratories. Growing emphasis on precision medicine is further accelerating demand. Expansion of translational and biomedical research activities across North America continues to support strong growth.

- By Ergonomics

On the basis of ergonomics, the market is segmented into inverted microscopes and upright microscopes. The upright microscopes segment dominated the market in 2025 due to its widespread use in conventional clinical and diagnostic laboratories. These microscopes are commonly used for examining fixed and stained samples on glass slides. Their robust design and versatility across multiple applications make them a preferred choice in pathology and microbiology. Upright microscopes are easy to maintain and compatible with a wide range of accessories. They are also extensively used in medical education and training programs. Long-standing clinical familiarity and reliability continue to drive dominance.

The inverted microscopes segment is anticipated to witness the fastest growth during the forecast period, driven by rising demand in cell biology and live-cell imaging applications. These systems allow observation of cells in culture vessels without disturbing the sample. Increasing research in regenerative medicine, stem cell therapy, and oncology is boosting adoption. Enhanced ergonomic designs are improving user comfort during prolonged use. Integration with advanced imaging and fluorescence techniques further supports growth. Expanding pharmaceutical and biotechnology research across North America is accelerating segment expansion.

- By Modality

On the basis of modality, the market is segmented into digital and optical. The optical modality segment dominated the market in 2025 due to its established role in routine clinical diagnostics. Optical systems are widely used for primary disease detection and laboratory analysis. Their affordability compared to digital systems supports widespread adoption across small and mid-sized facilities. Clinicians and technicians are highly familiar with optical workflows, reducing training barriers. These systems also offer high reliability and low operational complexity. Incremental improvements in optics continue to enhance diagnostic performance.

The digital modality segment is expected to grow at the fastest rate during the forecast period, driven by increasing adoption of digital pathology and automated diagnostics. Digital microscopes enable image capture, storage, and remote sharing, supporting telepathology workflows. Integration with AI-based image analysis tools is improving diagnostic accuracy and efficiency. Growing demand for centralized laboratory operations is boosting adoption. Investments in healthcare digitalization across North America further support growth. Enhanced interoperability with hospital information systems is also accelerating uptake.

- By Application

On the basis of application, the market is segmented into microbiology, cell biology, pathology, neuroscience, and others. The pathology segment dominated the market in 2025 due to the high volume of diagnostic procedures requiring microscopic examination of tissues and biopsies. Clinical microscopes are essential for cancer diagnosis and disease staging. Rising prevalence of chronic diseases and cancer significantly drives demand. Pathology laboratories require reliable and high-resolution microscopy solutions. Increasing adoption of digital pathology enhances workflow efficiency. The critical role of pathology in treatment decision-making sustains long-term dominance.

The cell biology segment is expected to be the fastest growing during the forecast period, driven by expanding research in cellular mechanisms and disease progression. Advanced microscopy is essential for live-cell imaging and cellular interaction studies. Growth in regenerative medicine and personalized therapies supports demand. Increased funding for biomedical research accelerates adoption. Technological advancements in fluorescence and time-lapse imaging further boost growth. Expanding academic and pharmaceutical research pipelines reinforce segment expansion.

- By End-User

On the basis of end-user, the market is segmented into research and academic institutes, hospitals, outpatient facilities, and others. The hospitals segment dominated the market in 2025 due to high patient volumes and continuous diagnostic requirements. Hospitals rely heavily on clinical microscopes for routine and specialized diagnostics. Strong healthcare spending in North America supports equipment upgrades. Integration with hospital laboratory systems enhances efficiency. Adoption of advanced diagnostic technologies further boosts demand. Continuous expansion of hospital laboratory infrastructure sustains dominance.

The research and academic institutes segment is projected to grow at the fastest rate during the forecast period, driven by increasing funding for life sciences research. These institutes require advanced microscopy for education and innovation. Growth in translational and clinical research supports demand. Rising collaborations between academia and industry accelerate equipment adoption. Demand for high-end digital and electron microscopes is increasing. Expansion of biomedical research programs further fuels growth. Online and distributor-based sales models are further enhancing accessibility.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market in 2025, driven by bulk procurement by hospitals and research institutions. This channel enables customized solutions and long-term service contracts. Direct purchasing supports deployment of high-value systems. Government and institutional funding favors tender-based procurement. Strong manufacturer–institution relationships reinforce dominance. This channel ensures consistent demand for advanced microscopy systems.

The retail sales segment is expected to be the fastest growing during the forecast period, supported by the rising demand from small laboratories and outpatient facilities. The retail channels offer faster procurement and easier access. The growth of private diagnostic centers boosting retail sales. The availability of the standardized products supports adoption. The expansion of distributor networks enhances reach. The increasing online and regional sales models further accelerate the growth.

North America Clinical Microscopes Market Regional Analysis

- The United States dominated the North America clinical microscopes market with the largest revenue share of 78.5% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of technologically advanced diagnostic equipment across hospitals, reference laboratories, and research institutions

- Healthcare providers in the region place significant emphasis on diagnostic accuracy, workflow efficiency, and integration of clinical microscopes with digital pathology and laboratory information systems

- This widespread adoption is further supported by high healthcare expenditure, strong investments in medical research and diagnostics, and the presence of leading microscopy manufacturers, establishing clinical microscopes as essential tools across hospitals, diagnostic laboratories, and research institutions

U.S. Clinical Microscopes Market Insight

The U.S. clinical microscopes market captured the largest revenue share within North America in 2025, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong adoption of technologically advanced diagnostic equipment. Healthcare providers increasingly emphasize early and accurate disease diagnosis, supporting sustained demand for clinical microscopes. The presence of leading manufacturers and continuous investments in medical research further strengthen market growth. Widespread adoption of digital pathology and AI-assisted microscopy is improving diagnostic efficiency. Strong funding across hospitals, laboratories, and research institutions continues to support expansion.

Canada Clinical Microscopes Market Insight

The Canada clinical microscopes market is witnessing steady growth, supported by increasing investments in healthcare infrastructure and diagnostic laboratory expansion. Rising demand for accurate diagnostic tools in hospitals and outpatient facilities is driving adoption. Canada’s strong focus on improving healthcare quality and access encourages the use of advanced microscopy systems. Growth in academic and clinical research activities further boosts demand. Government funding for biomedical research continues to support market development.

Mexico Clinical Microscopes Market Insight

The Mexico clinical microscopes market is expected to grow at a notable CAGR during the forecast period, driven by expanding healthcare infrastructure and increasing diagnostic testing volumes. Growing prevalence of chronic and infectious diseases is encouraging hospitals and laboratories to upgrade diagnostic equipment. Public and private investments in healthcare modernization are supporting adoption. Increasing establishment of diagnostic laboratories and outpatient centers is boosting demand. Rising awareness of early disease diagnosis is further contributing to market growth.

North America Clinical Microscopes Market Share

The North America Clinical Microscopes industry is primarily led by well-established companies, including:

- Olympus Corporation (Japan)

- Leica Microsystems (Germany)

- NIKON CORPORATION (Japan)

- Carl Zeiss AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bruker Corporation (U.S.)

- Hitachi High Tech Corporation (Japan)

- JEOL Ltd. (Japan)

- Keyence Corporation (Japan)

- Meiji Techno Co., Ltd. (Japan)

- Motic Microscopes (China)

- Labomed, Inc. (U.S.)

- Vision Engineering Ltd. (U.K.)

- Euromex Microscopen B.V. (Netherlands)

- ACCU SCOPE Inc. (U.S.)

- Optika Srl (Italy)

- Amscope (U.S.)

- Huvitz Co., Ltd. (South Korea)

- CAMECA (France)

- FUJIFILM Corporation (Japan)

What are the Recent Developments in North America Clinical Microscopes Market?

- In October 2025, the University of Alberta unveiled an advanced $8 million Thermo Fisher Titan Krios G4 cryo‑electron microscope, one of only five in Canada and the only one in Alberta, enhancing high‑resolution molecular imaging for disease research and accelerating discoveries in infectious diseases, cancer and drug development at the Alberta Cryo‑EM Facility

- In September 2024, Nikon Instruments Inc. launched the updated ECLIPSE Ui Ver. 1.3 digital imaging microscope that adds advanced digital workflow features such as automatic image capture and enhanced overview displays to streamline pathological observations and support efficient, accurate pathology diagnostics in medical labs

- In July 2025, Nikon released the ECLIPSE Ti2‑I motorized inverted microscope, designed to significantly improve efficiency and accuracy in micro‑insemination (IVF) workflows by reducing operational steps and enhancing control, reflecting increased adoption of specialized microscopes in clinical reproductive medicine

- In July 2025, Thermo Fisher Scientific unveiled two new electron microscopes the Scios™ 3 FIB‑SEM and Talos™ 12 TEM at the Microscopy & Microanalysis (M&M) 2025 conference in Utah, offering enhanced automation, ease of use, and broader accessibility for advanced biological and pathology research across North America

- In January 2021, Olympus Corporation launched the DP28 and DP23 microscope cameras for microscopes with megapixel‑resolution imaging, expanding the product portfolio for clinical and research microscopy and supporting enhanced image capture capabilities in laboratories across North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.