Market Analysis and Insights

Rising disposable income, growing consumption per capita, and changing the dietary style of consumers across the globe are the major factors fostering the growth of the North America cannabidiol (CBD) vape juice market. Changing lifestyle and rising awareness about cannabidiol (CBD) vape juice's health benefits are other factors that may act as market growth determinants. Increasing demand for e-liquid and e-cigarettes will further create lucrative opportunities for growth in the North America cannabidiol (CBD) vape juice market.

However, the availability of low-cost alternative vape juices may hamper the market growth rate. Also, stringent government regulations will further restrain the market growth rate. Health risks of CBD vape juice, such as lung injury, may pose a major challenge for the market growth.

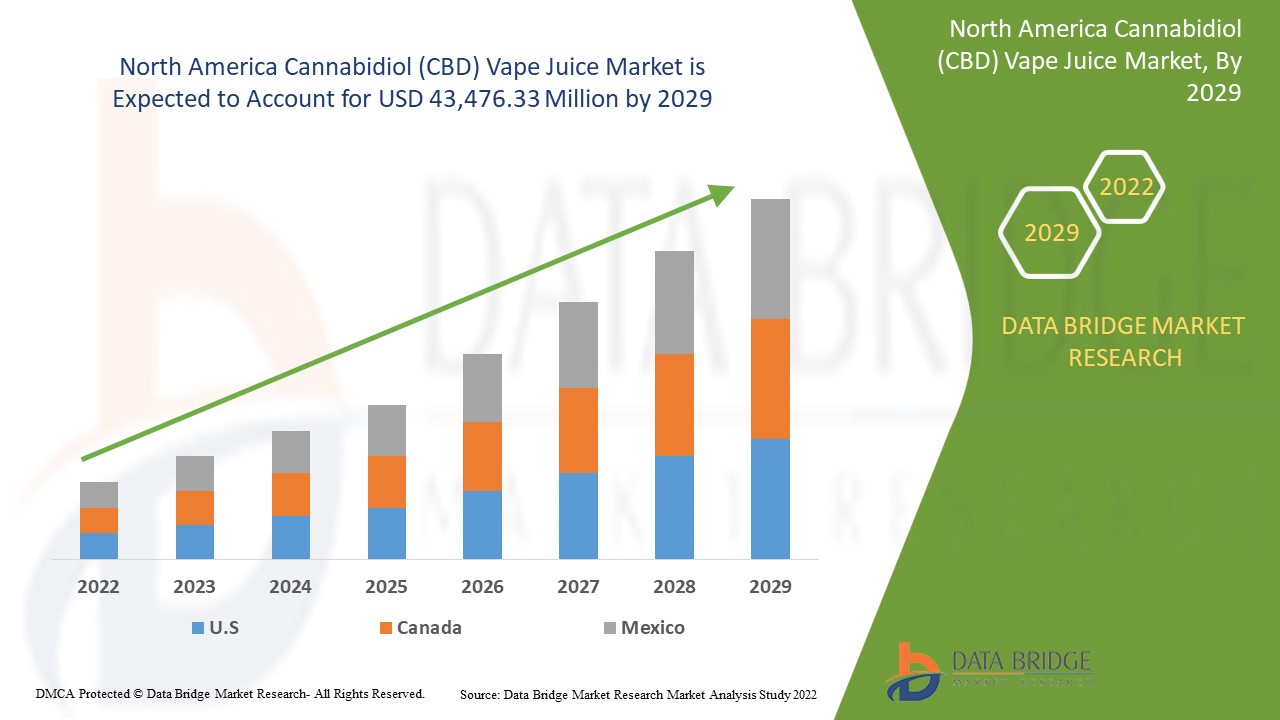

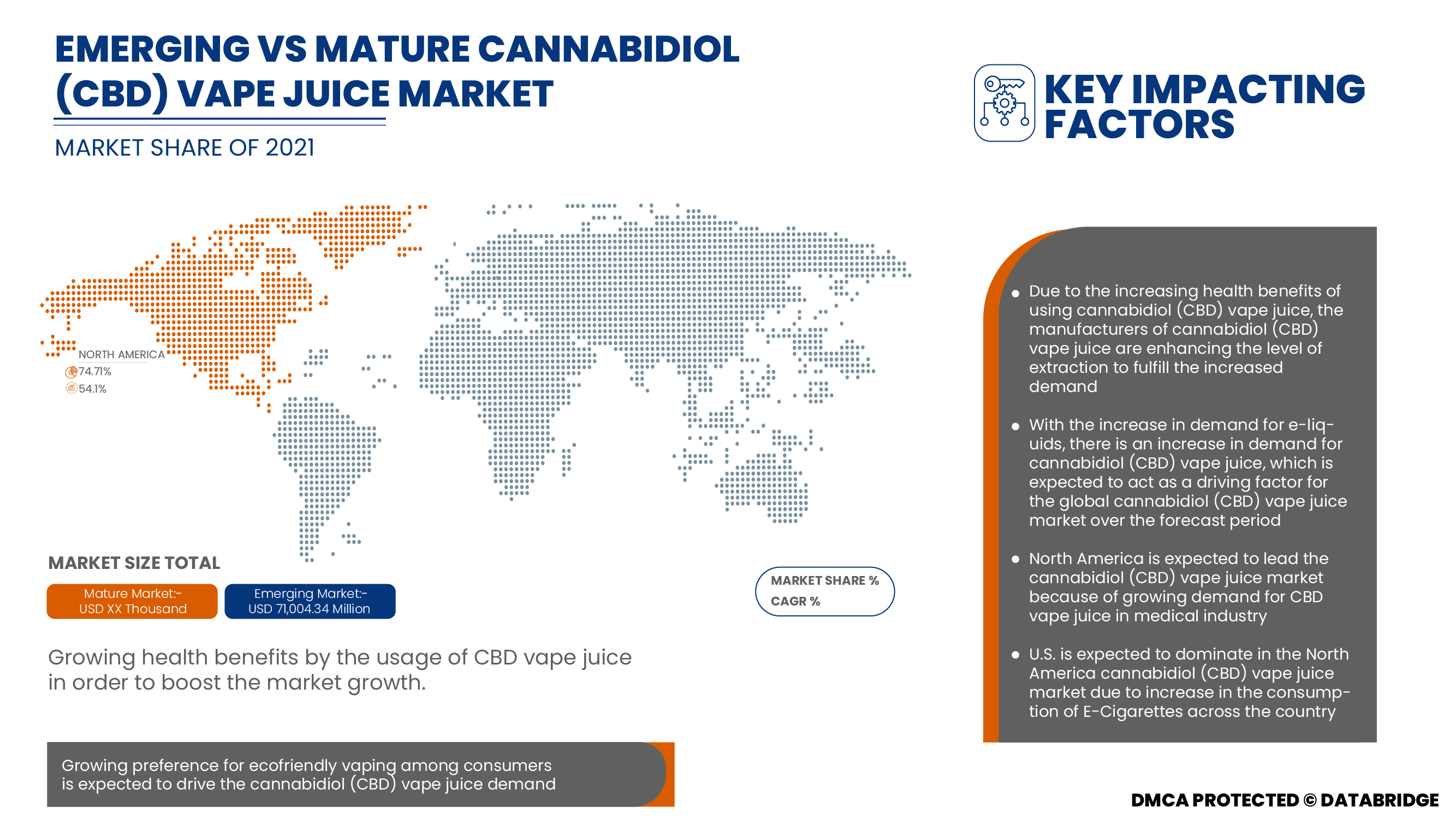

Data Bridge Market Research analyses that the North America cannabidiol (CBD) vape juice market is estimated to reach USD 43,476.33 million in 2029 and will grow at a CAGR of 54.1% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

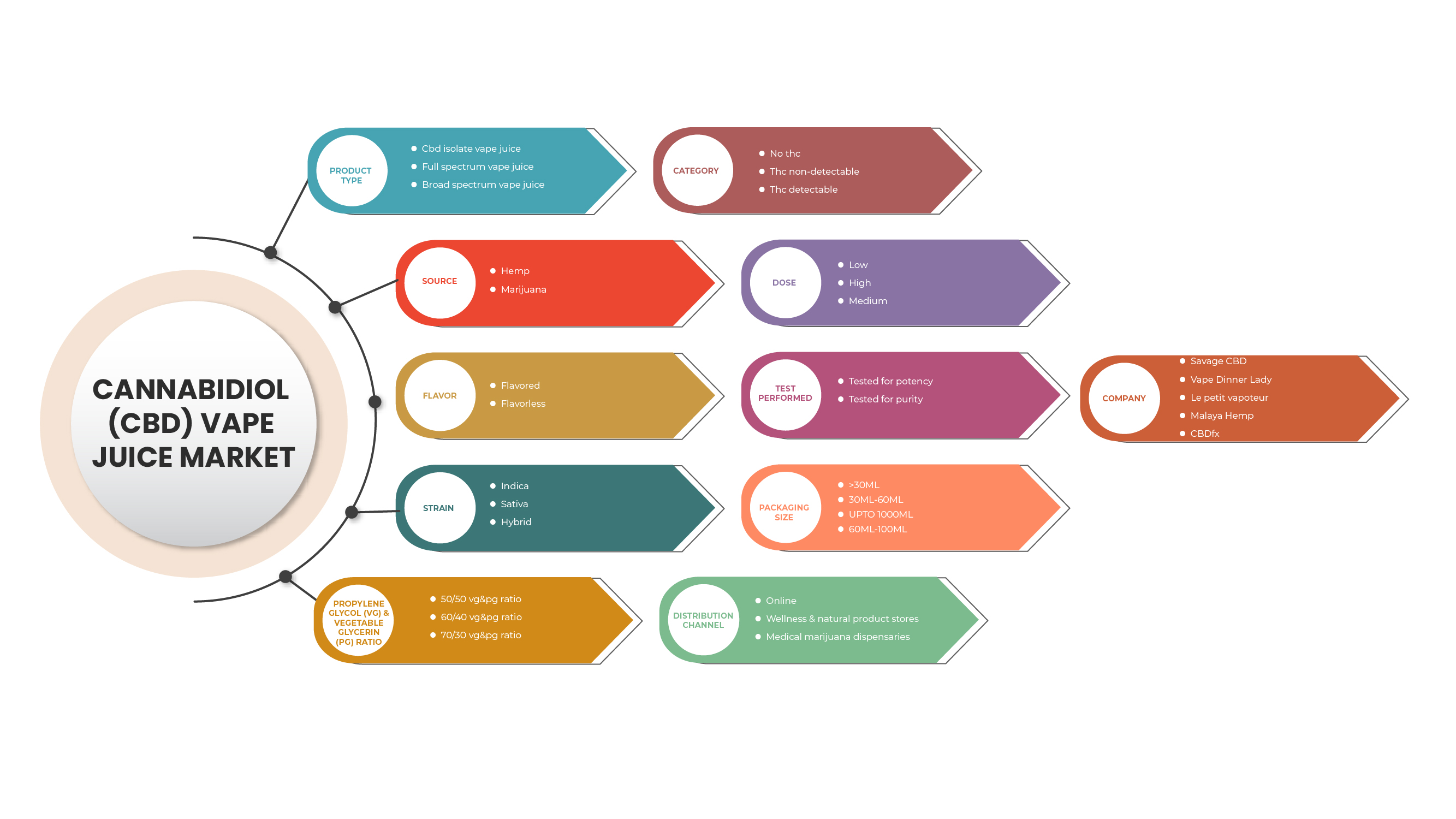

Product Type (Full Spectrum Vape Juice, Broad Spectrum Vape Juice, CBD Isolate Vape Juice), Source (Hemp and Marijuana), Strain (Indica, Sativa And Hybrid), Propylene Glycol (VG) & Vegetable Glycerin (PG) Ratio (50/50 VG&PG Ratio, 60/40 VG&PG Ratio, 70/30 VG&PG Ratio), Category (THC Detectable, THC Non-Detectable, and No THC), Dose (High, Medium and Low), Flavour (Flavoured and Flavourless), Test Performed (Tested For Potency and Tested For Purity), Packaging Size (>30ML, 30ML-60ML, 60ML-100ML, UPTO 1000ML), Distribution Channel (Online, Wellness & Natural Product Stores and Medical Marijuana Dispensaries) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

CBDfx, HempBombs, Koi CBD, Savage CBD, ERTH WELLNESS, Hemplucid, VaporFi, JustCBD, NU-X CBD, Pure CBD Vapors, Vape Dinner Lady, CBD GENESIS, Malaya Hemp, Blue Moon Hemp, FUSION CBD PRODUCTS, among others |

Market Definition:

CBD vape juices, also known as CBD e-liquid or CBD vape oil, are liquids containing CBD used in e-cigarettes. These liquids are vaporized by the e-cigarette. When consumers inhale the vape juice, cannabidiol (CBD) enters their lungs, infusing the CBD into the bloodstream. CBD vape juices contain a few simple ingredients such as PG (propylene glycol), VG (vegetable glycerin), CBD extract, and the flavors used in e-liquids.

North America Cannabidiol (CBD) Vape Juice Market Dynamics

Drivers

-

Increasing health benefits by the usage of cannabidiol (CBD) vape juice

The cannabidiol (CBD) vape juice is manufactured from the non-intoxicating extract of marijuana or hemp, which is mainly prescribed for relief from intractable pain. Along with this, cannabidiol (CBD) vape juice helps treat the anxiety problems that have become among human beings nowadays due to the increased level of stress. The recreational benefits of the marijuana plants from which the cannabidiol (CBD) vape juice is extracted help improve the quality of the cannabidiol (CBD) vape juice.

Due to the increasing health benefits of using cannabidiol (CBD) vape juice, the manufacturers of cannabidiol (CBD) vape juice are enhancing the level of extraction to fulfill the increased demand.

-

Growing demand for cannabidiol (CBD) vape juice in the medical industry

Cannabidiol (CBD) vape juice has been considered the most advanced product in the treatment of epilepsy. The CBD is also used for anxiety, pain, and muscle disorders called dystonia, Parkinson's, Crohn's, and many other conditions. The therapeutic benefit of cannabidiol (CBD) vape juice involves the potential of terpenes and other cannabis phytochemicals, which provides various health benefits. The medical agencies are studying the natural benefits of CBD. As the cannabidiol (CBD) vape juice is considered a natural remedy that is considered to be powerful and safe for the treatment of various health issues.

Opportunities

- Growing incidence of psychological disorders

There is an increase in incidences of psychological disorders such as anxiety disorders, including panic disorder, obsessive-compulsive disorder phobias, and depression.

Psychological disorders are characterized by loss of interest or pleasure, sadness, feelings of guilt or low self-worth, poor concentration, disturbed sleep or appetite, and tiredness. People with depression may also have multiple physical complaints with no apparent physical cause. Depression can be recurrent or long-lasting. Also, depression can adversely affect people's ability to function at school or work and cope with daily life. At its most severe, depression can lead to suicide.

For instance,

- According to the World Health Organization (WHO), globally, an estimated 264 million people are affected by depression. More women are affected than men

- Technological innovations in vaping

Since the beginning, the vaping industry has had regular innovations that allow manufacturers to launch or develop new products. Modern vaping technology now creates the smoothest vaping experiences with enhancements such as Bluetooth, voice activation, and better batteries. Product manufacturers and industry leaders have aimed to improve the vaping experience consistently.

Following are some of the most recent innovations in vaping technology:

Pod vaping - Pod vaping has emerged as the biggest trend in the vaping industry, with new pod vape devices being produced by manufacturers, catalyzing the intake of cannabidiol (CBD) vape juice.

Restraints/Challenges

- Health risks of e-cigarettes

E-cigarettes produce several dangerous chemicals harmful to the human body, including acetaldehyde, acrolein, and formaldehyde. These aldehydes can cause lung disease, as well as cardiovascular (heart) disease

E-cigarettes also contain acrolein, an herbicide primarily used to kill weeds. It can cause acute lung injury and chronic obstructive pulmonary disease (COPD). COPD is a chronic inflammatory lung disease that causes obstructed airflow from the lungs. Also, it may cause asthma and lung cancer.

Thus, the adverse effects of regular use of e-cigarettes may challenge the North America cannabidiol (CBD) vape juice market.

- Vaping-related severe lung injury

The health concerns about vaping have escalated to an unprecedented level worldwide over the past few years. Since August 2019, the Centers for Disease Control and Prevention (CDC), the U.S. Food and Drug Administration (FDA), state and local health departments, and other clinical and public health partners have been dealing with vaping-associated pulmonary injury (VAPI), also called e-cigarette or vaping product use associated lung injury (EVALI), is an acute or subacute respiratory illness characterized by a spectrum of clinicopathologic findings mimicking various pulmonary diseases.

Thus, in conclusion, due to the increase in the vaping-related severe lung injury, e-cigarette or vaping product use associated lung injury (EVALI) will hamper the growth of the CBD vape juice in the North America CBD vape juice market.

Post COVID-19 Impact on North America Cannabidiol (CBD) Vape Juice Market

Post the pandemic, the demand for cannabidiol (CBD) vape juice has increased as there won't be any more restrictions on movement, so the supply of products would be easy. In addition, the growing trend of trying new flavors for E-cigarettes, especially among the young population, will propel the market's growth.

Recent Developments

- In December 2021, Pure CBD Vapors acquired Cloud9Hemp.com, a Nashville-based brand that specializes in CBD (cannabidiol) products. This acquisition has helped the company to widen its product portfolio

- In October 2021, Koi CBD launched a new full spectrum and delta 8 lines of world-class hemp products lines. The products are tinctures, gummies, as well as vape juices. This launch has helped the company to widen its product portfolio

North America Cannabidiol (CBD) Vape Juice Market Scope

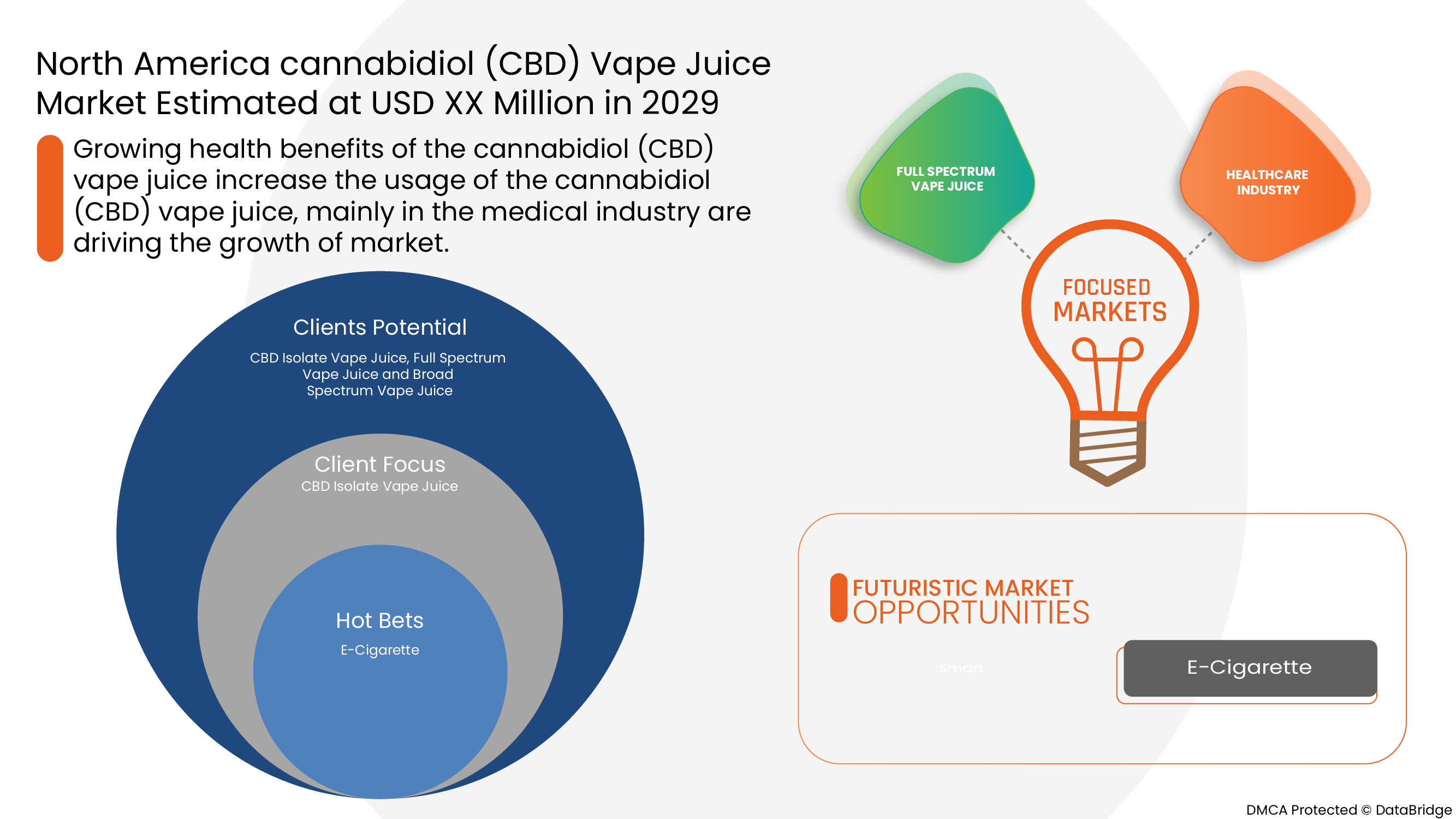

The North America cannabidiol (CBD) vape juice market is segmented into product type, source, flavor, strain, propylene glycol (VG) & vegetable glycerin (PG) ratio, category, dose, tests performed, packaging size, and distribution channel. The growth amongst these segments will help you analyse meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Full Spectrum Vape Juice

- Broad Spectrum Vape Juice

- CBD Isolate Vape Juice

Based on product type, the North America cannabidiol (CBD) vape juice market is segmented into the full spectrum vape juice, broad spectrum vape juice, CBD isolate vape juice.

Source

- Hemp

- Marijuana

Based on source, the North America cannabidiol (CBD) vape juice market is segmented into the hemp and marijuana.

Strain

- Indica

- Sativa

- Hybrid

Based on strain, the North America cannabidiol (CBD) vape juice market is segmented into the indica, sativa and hybrid.

Propylene Glycol (VG) & Vegetable Glycerin (PG) Ratio

- 50/50 VG&PG Ratio

- 60/40 VG&PG Ratio

- 70/30 VG&PG Ratio

Based on propylene glycol (VG) & vegetable glycerin (PG) ratio, the North America cannabidiol (CBD) vape juice market is segmented into 50/50 VG&PG ratio, 60/40 VG&PG ratio, 70/30 VG&PG ratio.

Category

- THC Detectable

- THC Non-Detectable

- No THC

Based on category, the North America cannabidiol (CBD) vape juice market is segmented into the THC detectable, THC non-detectable and no THC.

Dose

- High

- Medium

- Low

Based on dose, the North America cannabidiol (CBD) vape Juice market is segmented into high, medium and low.

Flavor

- Flavoured

- Flavorless

Based on flavor, the North America cannabidiol (CBD) vape juice market is segmented into the flavored and flavorless.

Tests Performed

- Tested for Potency

- Tested for Purity

Based on tests performed, the North America cannabidiol (CBD) vape juice market is segmented into the tested for potency and tested for purity.

Packaging Size

- >30ML

- 30ML-60ML

- 60ML-100ML

- UPTO 1000ML

Based on packaging size, the North America cannabidiol (CBD) vape juice market is segmented into the >30ML, 30ML-60ML, 60ML-100ML, UPTO 1000ML.

Distribution Channel

- Online

- Wellness & Natural Product Stores

- Medical Marijuana Dispensaries

Based on distribution channel, the North America cannabidiol (CBD) vape juice market is segmented into the online, wellness & natural product stores, and medical marijuana dispensaries.

North America Cannabidiol (CBD) Vape Juice Market Regional Analysis/Insights

North America cannabidiol (CBD) vape juice market is analyzed, and market size insights and trends are provided by country, product type, source, flavor, strain, propylene glycol (PG) & vegetable glycerin (VG) ratio, category, dose, test performed, packaging size, and distribution channel as referenced above.

Some of the countries covered in the North America cannabidiol (CBD) vape juice market are the U.S., Canada and Mexico.

The U.S. is expected to dominate the North America cannabidiol (CBD) vape juice market in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the growing usage of E-cigarettes among the population.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Cannabidiol (CBD) Vape Juice Market Share Analysis

North America cannabidiol (CBD) vape juice market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus on the North America cannabidiol (CBD) vape juice market.

Some of the major players operating in the North America cannabidiol (CBD) vape juice market are CBDfx, HempBombs, Koi CBD, Savage CBD, ERTH WELLNESS, Hemplucid, VaporFi, JustCBD, NU-X CBD, Pure CBD Vapors, Vape Dinner Lady, CBD GENESIS, Malaya Hemp, Blue Moon Hemp, FUSION CBD PRODUCTS, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER LEVEL TREND

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF CANNABIDIOL CBD VAPE JUICE MARKET

4.5.1 INDUSTRY TRENDS

4.6 FUTURE PERSPECTIVE

4.7 MEETING CONSUMER REQUIREMENT

4.8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: NEW PRODUCT LAUNCH STRATEGY

4.8.1 NEW LAUNCHES EMPHASIZING THE HEALTH BENEFITS OF CBD VAPE JUICE

4.8.2 NEW LAUNCHES BY CBD PRODUCTS BY REFINING-

4.8.3 NEW LAUNCHES BY EMPHASIZING NEW VAPING TECHNOLOGIES-

4.8.4 NEW LAUNCHES BY EMPHASIZING DIFFERENT FLAVORS-

4.8.5 NEW LAUNCHES BY LINE EXTENSION-

4.8.6 LAUNCHES-

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: PROMOTIONAL ACTIVITIES

4.10.1 PROMOTING BY EMPHASIZING HEALTH BENEFITS OF CBD VAPE JUICE

4.10.2 PROMOTING BY CREATING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH

4.10.3 PROMOTING BY EMPHASIZING NEW VAPING TECHNOLOGIES-

4.10.4 PROMOTING BY EMPHASIZING DIFFERENT FLAVORS-

4.10.5 PROMOTING THROUGH CBD SEO (SEARCH ENGINE OPTIMIZATION) -

4.11 SUPPLY CHAIN OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

4.11.1 RAW MATERIAL PROCUREMENT

4.11.2 MANUFACTURING

4.11.3 MARKETING AND DISTRIBUTION

4.11.4 END USERS

4.12 FACTORS INFLUENCING PURCHASE DECISION

4.12.1 SHOPPING BEHAVIOUR AND DYNAMICS

4.12.2 HEALTH BENEFITS-

4.12.3 RESEARCH

4.12.4 IMPULSIVE

4.12.5 ONLINE ADVERTISEMENT

5 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: REGULATIONS

5.1 REGULATIONS IN EUROPE

5.1.1 UNITED KINGDOM

5.1.2 DENMARK:

5.1.3 SPAIN:

5.1.4 SWEDEN:

5.1.5 AUSTRIA:

5.1.6 FRANCE:

5.1.7 ITALY:

5.2 REGULATIONS IN NORTH AMERICA

5.2.1 U.S.

5.2.2 CANADA

5.2.3 MEXICO

5.3 REGULATIONS IN SOUTH AMERICA

5.3.1 BRAZIL

5.3.2 ARGENTINA

5.4 REGULATIONS IN MIDDLE EAST AFRICA

5.4.1 SOUTH AFRICA

5.4.2 ISRAEL

5.5 REGULATIONS IN ASIA-PACIFIC

5.5.1 CHINA

5.5.2 INDIA

5.5.3 JAPAN

5.5.4 SOUTH KOREA

5.5.5 HONG KONG

5.5.6 MALAYSIA

5.5.7 PHILIPPINES

5.5.8 THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING HEALTH BENEFITS BY THE USAGE OF CANNABIDIOL (CBD) VAPE JUICE

6.1.2 GROWING DEMAND FOR CANNABIDIOL (CBD) VAPE JUICE IN THE MEDICAL INDUSTRY

6.1.3 RISING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH

6.1.4 SURGING DEMAND FOR E-LIQUID

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 VAPING-RELATED SEVERE LUNG INJURY

6.2.3 LEGALIZATION OF CBD VAPE JUICE IN SEVERAL EUROPEAN COUNTRIES

6.3 OPPORTUNITIES

6.3.1 INCREASING AWARENESS, EFFICIENT DISTRIBUTION CHANNEL, AND EASY AVAILABILITY

6.3.2 GROWING INCIDENCE OF PSYCHOLOGICAL DISORDERS

6.3.3 GROWING PREFERENCE FOR ECO-FRIENDLY VAPING AMONG CONSUMERS

6.3.4 TECHNOLOGICAL INNOVATIONS IN VAPING

6.4 CHALLENGES

6.4.1 HIGH COST OF CBD VAPE PRODUCTS

6.4.2 HEALTH RISKS OF E-CIGARETTES

7 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CBD ISOLATE VAPE JUICE

7.2.1 CBD ISOLATE VAPE JUICE, BY SOURCE

7.2.1.1 HEMP

7.2.1.2 MARIJUANA

7.2.2 CBD ISOLATE VAPE JUICE, BY FLAVOR

7.2.2.1 FLAVORED

7.2.2.1.1 FRUIT FLAVORS

7.2.2.1.2 OTHER FLAVORS

7.2.2.2 FLAVORLESS

7.3 FULL SPECTRUM VAPE JUICE

7.3.1 FULL SPECTRUM VAPE JUICE, BY SOURCE

7.3.1.1 HEMP

7.3.1.2 MARIJUANA

7.3.2 FULL SPECTRUM VAPE JUICE, BY FLAVOR

7.3.2.1 FLAVORED

7.3.2.1.1 FRUIT FLAVORS

7.3.2.1.2 OTHER FLAVORS

7.3.2.2 FLAVORLESS

7.4 BROAD SPECTRUM VAPE JUICE

7.4.1 BROAD SPECTRUM VAPE JUICE, BY SOURCE

7.4.1.1 HEMP

7.4.1.2 MARIJUANA

7.4.2 BROAD SPECTRUM VAPE JUICE, BY FLAVOR

7.4.2.1 FLAVORED

7.4.2.1.1 FRUIT FLAVORS

7.4.2.1.2 OTHER FLAVORS

7.4.2.2 FLAVORLESS

8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN

9.1 OVERVIEW

9.2 INDICA

9.3 SATIVA

9.4 HYBRID

10 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO

10.1 OVERVIEW

10.2 50/50 VG&PG RATIO

10.3 60/40 VG&PG RATIO

10.4 70/30 VG&PG RATIO

11 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 NO THC

11.3 THC NON-DETECTABLE

11.4 THC DETECTABLE

12 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE

12.1 OVERVIEW

12.2 LOW

12.3 HIGH

12.4 MEDIUM

13 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 FRUIT FLAVORS

13.2.1.1 WATERMELON

13.2.1.2 MANGO

13.2.1.3 STRAWBERRY

13.2.1.4 BLUEBERRY

13.2.1.5 PINEAPPLE

13.2.1.6 APPLE

13.2.1.7 RASPBERRY

13.2.1.8 PEACH

13.2.1.9 LIME

13.2.1.10 BANANA

13.2.1.11 COCONUT

13.2.1.12 OTHERS

13.2.2 OTHER FLAVORS

13.2.2.1 MINT

13.2.2.2 TOBACCO

13.2.2.3 KUSH

13.2.2.4 CHOCOLATE

13.2.2.5 CHESSECAKE

13.2.2.6 LEMONADE

13.2.2.7 TOFFEE

13.2.2.8 PINA COLADA

13.2.2.9 VANILLA

13.2.2.10 OTHERS

13.3 FLAVORLESS

14 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED

14.1 OVERVIEW

14.2 TESTED FOR POTENCY

14.3 TESTED FOR PURITY

15 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE

15.1 OVERVIEW

15.2 >30ML

15.3 30ML-60ML

15.4 UPTO 1000ML

15.5 60ML-100ML

16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 ONLINE

16.3 WELLNESS & NATURAL PRODUCT STORES

16.4 MEDICAL MARIJUANA DISPENSARIES

17 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 COMPANY LANDSCAPE: NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 SAVAGE CBD

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 VAPE DINNER LADY

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 LE PETIT VAPOTEUR

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 MALAYA HEMP

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 CBDFX

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 BLUE MOON HEMP

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CBD GENESIS

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 ERTH WELLNESS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 FUSION CBD PRODUCTS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 HEMPBOMBS

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 HEMPLUCID

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 JUSTCBD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 KOI CBD

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 MARRY JANE

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 NU-X CBD

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 PASO

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 PURE CBD VAPORS

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 VAPORFI

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 LIST OF EUROPEAN COUNTRIES WITH LEGALITY STATUS OF CANNABIDIOL (CBD) VAPE JUICE

TABLE 2 PRICES OF THE CANNABIDIOL (CBD) VAPE JUICE

TABLE 3 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HEMP IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MARIJUANA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA INDICA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SATIVA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HYBRID IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 50/50 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA 60/40 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA 70/30 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA NO THC IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA THC NON-DETECTABLE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA THC DETECTABLE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA LOW IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HIGH IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIUM IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA FRUIT FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA FLAVORLESS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TESTED FOR POTENCY IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA TESTED FOR PURITY IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA >30ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA 30ML-60ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA UPTO 1000ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA 60ML-100ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ONLINE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA WELLNESS & NATURAL PRODUCT STORES IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MEDICAL MARIJUANA DISPENSARIES IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 78 U.S. FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 U.S. BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 81 U.S. BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 82 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 84 U.S. CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 85 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 86 U.S. NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 87 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 88 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 89 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 91 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 92 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 U.S. FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 96 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 97 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 100 CANADA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 101 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 102 CANADA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 103 CANADA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 104 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 106 CANADA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 107 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 CANADA NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 109 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 110 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 111 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 113 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 CANADA FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 CANADA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 118 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 119 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 123 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 124 MEXICO BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 126 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 MEXICO NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 132 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 133 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 134 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 136 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 137 MEXICO FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 138 MEXICO OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 139 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 140 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SEGMENTATION

FIGURE 9 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 10 GROWING HEALTH BENEFITS FROM THE USAGE OF CBD VAPE JUICE AND RISING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH ARE EXPECTED TO LEAD TO THE GROWTH OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET IN THE FORECAST PERIOD

FIGURE 11 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

FIGURE 15 SYMPTOMS OF DEPRESSION AMONG ADULTS IN U.S. (IN %), 2020

FIGURE 16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY SOURCE, 2021

FIGURE 18 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY STRAIN, 2021

FIGURE 19 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2021

FIGURE 20 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY CATEGORY, 2021

FIGURE 21 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY DOSE, 2021

FIGURE 22 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY FLAVOR, 2021

FIGURE 23 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY TESTS PERFORMED, 2021

FIGURE 24 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PACKAGING SIZE, 2021

FIGURE 25 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 31 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: COMPANY SHARE 2021 (%)

North America Cbd Vape Juice Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Cbd Vape Juice Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Cbd Vape Juice Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.