North America Carpets And Rugs Market

Market Size in USD Billion

CAGR :

%

USD

17.16 Billion

USD

26.54 Billion

2024

2032

USD

17.16 Billion

USD

26.54 Billion

2024

2032

| 2025 –2032 | |

| USD 17.16 Billion | |

| USD 26.54 Billion | |

|

|

|

|

North America Carpets and Rugs Market Size

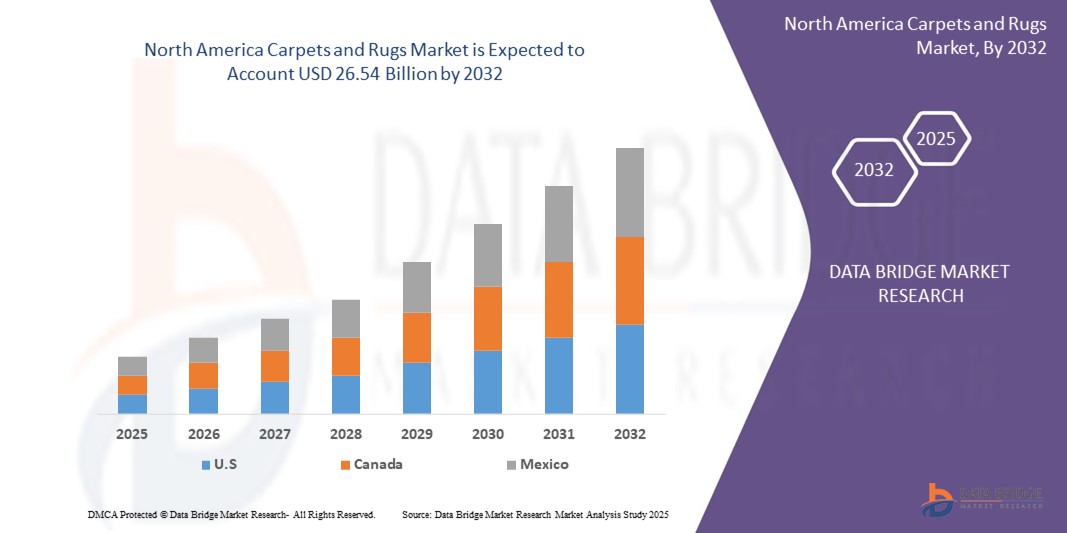

- The North America carpets and rugs market size was valued at USD 17.16 billion in 2024 and is expected to reach USD 26.54 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is primarily driven by increasing demand for aesthetically appealing and functional home decor, rising residential and commercial construction activities, and advancements in sustainable and durable carpet manufacturing technologies

- Growing consumer preference for eco-friendly materials, such as natural fibers, and the rise of online retail platforms for home furnishings are further accelerating market expansion

North America Carpets and Rugs Market Analysis

- Carpets and rugs are essential elements of interior design, providing aesthetic appeal, comfort, and functionality in both residential and commercial settings. Their versatility, coupled with advancements in design and materials, has made them integral to modern home and office spaces

- The demand for carpets and rugs is fueled by increasing urbanization, rising disposable incomes, and a growing focus on sustainable and customizable interior solutions

- The U.S. is dominated the North America carpets and rugs market, holding the largest revenue share of 33.9% in 2024, driven by high consumer spending on home improvement, a robust real estate market, and the presence of leading manufacturers and retailers

- Canada is expected to be the fastest growing region in the North America carpets and rugs market during the forecast period driven by increasing demand for cozy and aesthetically pleasing flooring in residential settings

- The carpet segment held the largest market revenue share of 60% in 2024, driven by the rising demand for wall-to-wall carpeting in residential and commercial spaces, particularly for its insulation properties and aesthetic appeal

Report Scope and America Carpets and Rugs Market Segmentation

|

Attributes |

North America Carpets and Rugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Carpets and Rugs Market Trends

“Increasing Integration of Smart Technology and Sustainable Materials”

- The North America carpets and rugs market is experiencing a significant trend toward the integration of smart technology and sustainable materials

- Smart technology, such as voice-activated or heat-enabled carpets, allows for innovative features such as automatic rolling and temperature regulation, enhancing user convenience and comfort

- Sustainable materials, including recycled fibers and natural fibers such as wool, cotton, and jute, are gaining traction due to growing consumer demand for eco-friendly and biodegradable products

- For instances, companies such as Interface and Bentley Mills are introducing low-carbon-footprint carpet tiles and products made from recycled PET and plant-based fibers to meet sustainability goals

- These advancements improve the functionality and environmental appeal of carpets and rugs, making them more attractive to both residential and commercial consumers

- Smart and sustainable carpets are also being designed to align with modern interior design trends, offering customizable patterns and enhanced durability for high-traffic areas

North America Carpets and Rugs Market Dynamics

Driver

“Rising Demand for Home Renovation and Aesthetic Interior Design”

- The increasing consumer focus on home renovation and interior aesthetics is a major driver for the North America carpets and rugs market

- Carpets and rugs enhance the visual appeal and comfort of living spaces, offering insulation, noise reduction, and customizable design options for residential and commercial applications

- Government incentives and rising disposable incomes, particularly in the U.S., are fueling demand for stylish and functional flooring solution

- The proliferation of e-commerce platforms and the growth of the construction and real estate sectors are further enabling market expansion, providing easier access to a wide range of carpet and rug products

- Manufacturers are increasingly offering customizable and factory-fitted carpet solutions to meet consumer expectations for unique designs and high-quality materials

- The U.S. is expected to dominate the market due to its strong focus on home decor trends and robust construction activities

Restraint/Challenge

“High Cost of Sustainable Materials and Competition from Hard Flooring”

- The high initial costs associated with producing and purchasing sustainable carpets, particularly those made from natural or recycled fibers, can be a significant barrier to adoption, especially in cost-sensitive markets

- Integrating smart technology into carpets, such as embedded heating or automation systems, adds to the complexity and expense of production and installation

- In addition, competition from alternative flooring options, such as hardwood, laminate, vinyl, and tiles, poses a major challenge. These materials are often preferred for their durability, low maintenance, and modern aesthetic appeal

- Data from industry reports indicates that hard flooring options are gaining popularity in high-traffic commercial spaces and minimalist residential designs, potentially limiting carpet and rug market growth

- Consumer concerns about maintenance, such as cleaning and allergen trapping in carpets, further complicate adoption in regions with high awareness of hygiene and ease of upkeep

- The fragmented regulatory landscape regarding environmental standards and recycling requirements across North America can also complicate operations for manufacturers and deter market expansion

North America Carpets and Rugs market Scope

The market is segmented on the basis of type, product, raw material, application, and distribution channel.

- By Type

On the basis of type, the North America carpets and rugs market is segmented into carpet and rugs. The carpet segment held the largest market revenue share of 60% in 2024, driven by the rising demand for wall-to-wall carpeting in residential and commercial spaces, particularly for its insulation properties and aesthetic appeal. Carpets are favored for their ability to enhance comfort and reduce energy costs, especially in regions with colder climates.

The rug segment is anticipated to witness the fastest growth rate of 6.2% from 2025 to 2032, fueled by increasing consumer interest in customizable, movable floor coverings that add decorative elements to specific areas. The rise in home renovation projects and the influence of interior design trends on social media further accelerate adoption.

- By Product

On the basis of product, the North America carpets and rugs market is segmented into tufted, woven, needle-punched, flat-weave, hooked, knotted, and others. The tufted segment dominated with a revenue share of 62.3% in 2024, attributed to its cost-effective production process and versatility in design, making it suitable for both residential and commercial applications. Tufted carpets and rugs are highly customizable, offering a range of patterns, colors, and textures that cater to diverse consumer preferences.

The knotted segment is expected to experience the fastest growth rate of 4.9% from 2025 to 2032, driven by growing demand for artisanal and handcrafted decor. Knotted carpets, often made from premium materials such as wool and silk, appeal to affluent consumers seeking luxurious, high-quality flooring solutions.

- By Raw Material

On the basis of raw material, the North America carpets and rugs market is segmented into synthetic fiber and natural fiber. The synthetic fiber segment held the largest market revenue share of 65.8% in 2024. This dominance is due to the durability, stain resistance, and affordability of synthetic fibers, making them ideal for high-traffic areas in both residential and commercial settings.

The natural fiber segment, comprising wool, cotton, jute, and silk, is projected to witness significant growth from 2025 to 2032. Increasing consumer preference for eco-friendly and sustainable materials, coupled with the superior comfort and aesthetic appeal of natural fibers, drives this segment’s growth, particularly in the luxury market.

- By Application

On the basis of application, the North America carpets and rugs market is segmented into residential and commercial. The residential segment accounted for 72% of the market revenue share in 2024, driven by rising spending on home renovation and the growing popularity of carpets and rugs for enhancing interior aesthetics and comfort. Wall-to-wall carpeting is particularly favored for its insulation benefits in residential settings.

The commercial segment is anticipated to grow at a robust rate of 6.5% from 2025 to 2032, fueled by increasing demand for durable, low-maintenance, and aesthetically pleasing flooring solutions in offices, hotels, and retail spaces. Advancements in stain-resistant and eco-friendly materials further support adoption in commercial environments.

- By Distribution Channel

On the basis of distribution channel, the North America carpets and rugs market is segmented into offline and online. The offline segment, including specialty stores, department stores, and supermarkets/hypermarkets, held the largest market revenue share of 68.4% in 2024. This is driven by consumer preference for physically evaluating the texture, quality, and color of carpets and rugs before purchase, particularly in local shops and exhibitions.

The online segment is expected to witness the fastest growth rate of 8.3% from 2025 to 2032, driven by the convenience and variety offered by e-commerce platforms such as Amazon, Wayfair, and manufacturer websites. The expansion of digital commerce and increasing consumer comfort with online purchasing of home decor products are key growth drivers.

North America Carpets and Rugs Market Regional Analysis

- The U.S. is expected to dominate the North America carpets and rugs market, holding the largest revenue share of 33.9% in 2024, driven by high consumer spending on home improvement, a robust real estate market, and the presence of leading manufacturers and retailers

- Consumers prioritize carpets and rugs for enhancing interior comfort, improving acoustics, and adding aesthetic appeal, particularly in regions with diverse climatic conditions requiring durable and versatile flooring

- Growth is supported by advancements in manufacturing technologies, such as eco-friendly synthetic and natural fiber options, alongside rising adoption in both residential and commercial applications through offline and online distribution channels

U.S. America Carpets and Rugs Market Insight

The U.S. is expected to dominate the North America carpets and rugs market with the highest revenue share of 62.67% in 2024, fueled by strong demand in residential and commercial sectors and growing consumer awareness of sustainable and stylish flooring options. The trend towards home renovation and interior customization further boosts market expansion. The availability of diverse products, including tufted, woven, needle-punched, flat-weave, hooked, and knotted carpets and rugs, complements both offline and online sales, creating a robust market ecosystem.

Canada Carpets and Rugs Market Insight

The Canada carpets and rugs market is expected to witness significant growth, driven by increasing demand for cozy and aesthetically pleasing flooring in residential settings. Consumers seek products that offer thermal insulation and durability, with a preference for sustainable materials such as natural fibers. Growth is prominent in urban areas, supported by rising construction activities and the popularity of online distribution channels for convenient purchasing.

North America Carpets and Rugs Market Share

The North America carpets and rugs industry is primarily led by well-established companies, including:

- MOHAWK INDUSTRIES, INC.(U.S.)

- Shaw Industries Group, Inc. (U.S.)

- Mannington Mills, Inc. (U.S.)

- Interface, Inc. (U.S.)

- The Dixie Group, Inc. (U.S.)

- Tarkett(France)

- ORIENTAL WEAVERS(Egypt)

- Belysse(Belgium)

- Floor Coverings International(U.S.)

- Bentley Mills(U.S.)

- Engineered Floors(U.S.)

- InJ&J Flooring terface(U.S.)

- Stark Carpet(U.S.)

- Milliken & Company(U.S.)

- Masland Carpets (U.S.)

What are the Recent Developments in North America Carpets and Rugs Market?

- In March 2025, Interface allocated USD 45 million to expand modular carpet tile production at its Georgia facility. This investment focuses on enhancing manufacturing capacity and integrating advanced equipment tailored for 100% recycled nylon. The initiative aligns with Interface’s sustainability goals, reinforcing its commitment to eco-friendly flooring solutions. By increasing output, the company aims to meet growing market demand while promoting circular economy practices. The expansion is expected to strengthen Interface’s position in the commercial flooring sector

- In January 2025, Oriental Weavers will showcase its latest area rugs and carpets at the Heimtextil trade exhibition in Frankfurt, Germany. The company will highlight its green collections, natural fiber products, and its award-winning foldable and washable rugs, designed for easy cleaning in a standard washing machine. Oriental Weavers' 2025 lineup draws inspiration from Egypt’s rich history, blending classic patterns with contemporary designs. The exhibition will take place from January 14-17, with Oriental Weavers presenting its innovations at Stand B80 in Hall 5.1, part of the growing Carpet & Rugs section

- In February 2024, Shaw Floors introduced six new Pet Perfect+ carpet styles, designed specifically for pet-friendly households. These carpets feature LifeGuard Spill-Proof technology, ensuring enhanced durability, stain resistance, and easy maintenance. The innovation aims to provide homeowners with flooring solutions that withstand pet-related messes, offering comfort, style, and long-lasting protection. The collection includes varied textures and patterns, catering to different aesthetic preferences while maintaining high-performance standards. Shaw Floors continues to prioritize pet-friendly innovations, reinforcing its commitment to quality and sustainability

- In March 2023, Mohawk Industries, Inc. introduced its PetProof carpet collection, featuring enhanced stain and odor resistance technology. This innovation was designed to meet the growing demand for pet-friendly flooring solutions, ensuring durability, easy maintenance, and long-lasting protection against pet accidents. The collection incorporates Mohawk’s proprietary EasyClean™ technology, which provides superior resistance to stains and soil, making cleanup effortless

- In November 2022, Tarkett S.A. introduced the Desso Origin carpet tile collection, featuring 100% recycled yarn and the lowest circular carbon footprint in Europe. The collection includes Recharge and Retrace designs, both containing up to 61.1% recycled content. Tarkett emphasizes closed-loop recycling, ensuring these tiles can be disassembled and repurposed into new products. The launch aligns with Tarkett’s commitment to sustainability, utilizing 100% green energy in manufacturing

- In March 2025, Interface allocated USD 45 million to expand modular carpet tile production at its Georgia facility. This investment focuses on enhancing manufacturing capacity and integrating advanced equipment tailored for 100% recycled nylon. The initiative aligns with Interface’s sustainability goals, reinforcing its commitment to eco-friendly flooring solutions. By increasing output, the company aims to meet growing market demand while promoting circular economy practices. The expansion is expected to strengthen Interface’s position in the commercial flooring sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CARPETS AND RUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELLING

2.8 TYPE TIMELINE CURVE

2.9 APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING FOCUS ON INTERIOR DESIGN AND AESTHETICS IN COMMERCIAL SPACES

5.1.2 RECYCLABILITY AND REUSABILITY OF CARPET

5.1.3 EASY AND SPEEDY INSTALLATION

5.1.4 INCREASING PREFERENCE OVER OTHER FLOORING MATERIAL IN DEVELOPING COUNTRIES

5.2 RESTRAINTS

5.2.1 INCREASING RAW MATERIAL PRICE

5.2.2 HIGH MAINTENANCE COST

5.3 OPPORTUNITIES

5.3.1 RISE IN ECO-FRIENDLY CARPETS & RUGS

5.3.2 INCREASE IN E-COMMERCE AND ONLINE SALES

5.3.3 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

5.4 CHALLENGE

5.4.1 HIGHLY SUSCEPTIBLE TO ALLERGENS

5.4.2 STRINGENT REGULATIONS REGARDING LEED CERTIFICATION

6 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARPET

6.2.1 CUT PILE CARPET

6.2.2 LOOP PILE CARPET

6.2.3 CUT LOOP CARPET

6.2.4 SHAG CARPET

6.2.5 OTHERS

6.3 RUGS

6.3.1 DISTRESSED RUGS

6.3.2 COASTAL RUGS

6.3.3 CHEVRON RUGS

6.3.4 BORDER RUGS

6.3.5 FLORAL RUGS

6.3.6 IKAT RUGS

6.3.7 ANIMAL PRINT RUGS

6.3.8 OTHERS

7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 TUFTED

7.3 WOVEN

7.4 NEEDLE-PUNCHED

7.5 FLAT-WEAVE

7.6 HOOKED

7.7 KNOTTED

7.8 OTHERS

8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL

8.1 OVERVIEW

8.2 SYNTHETIC FIBER

8.2.1 NYLON

8.2.2 POLYESTER

8.2.3 POLYPROPYLENE

8.2.4 OTHERS

8.3 NATURAL FIBER

8.3.1 WOOL

8.3.2 COTTON

8.3.3 SISAL

8.3.4 SEAGRASS

8.3.5 JUTE

8.3.6 COIR

8.3.7 OTHERS

9 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RESIDENTIAL

9.2.1 SINGLE-FAMILY HOMES

9.2.2 CONDOMINIUMS

9.2.3 TOWNHOUSE

9.2.4 MULTI-FAMILY HOME

9.2.5 OTHERS

9.3 COMMERCIAL

9.3.1 COMMERCIAL BUILDINGS

9.3.2 PUBLIC BUILDINGS

9.3.3 RETAIL

9.3.4 LEISURE & HOSPITALITY

9.3.5 HEALTHCARE

9.3.6 EDUCATION

9.3.7 OTHERS

10 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALTY STORES

10.2.2 SUPERMARKET/HYPERMARKETS

10.2.3 HOME CENTERS

10.2.4 OTHERS

10.3 ONLINE

11 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MOHAWK INDUSTRIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 SHAW INDUSTRIES GROUP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENTS

14.3 MANNINGTON MILLS, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 INTERFACE, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 THE DIXIE GROUP, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMER RUGS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AXMINSTER CARPETS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BEAULIEU INTERNATIONAL GROUP

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BELYSSE

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BRINTONS CARPETS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLOOR COVERINGS INTERNATIONAL

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAIMA GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 HOUSE OF TAI PING

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 INTER IKEA SYSTEMS B.V.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 MILLIKEN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 ORIENTAL WEAVERS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 STEVENS OMNI

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TARKETT

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 VICTORIA PLC

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 RECYCLED CONTENT FOR CARPET

TABLE 2 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 4 NORTH AMERICA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 8 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 10 NORTH AMERICA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA CARPETS AND RUGS MARKET, BY COUNTRY, 2022-2031 (MILLION SQ FT)

TABLE 19 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 20 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 21 U.S. CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 22 U.S. CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 23 U.S. RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 24 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 25 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 26 U.S. CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 27 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 28 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 29 U.S. CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 30 U.S. SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 32 U.S. CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 U.S. RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 34 U.S. COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 35 U.S. CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 36 U.S. OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 37 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 38 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 39 CANADA CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 40 CANADA CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 41 CANADA RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 42 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 43 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 44 CANADA CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 45 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 46 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 47 CANADA CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 48 CANADA SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 49 CANADA NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 50 CANADA CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 51 CANADA RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 52 CANADA COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 53 CANADA CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 54 CANADA OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 55 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 56 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (MILLION SQ FT)

TABLE 57 MEXICO CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 58 MEXICO CARPET IN CARPETS AND RUGS MARKET, BY CARPET TYPE, 2022-2031 (USD MILLION)

TABLE 59 MEXICO RUGS IN CARPETS AND RUGS MARKET, BY RUGS TYPE, 2022-2031 (USD MILLION)

TABLE 60 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 61 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (MILLION SQ FT)

TABLE 62 MEXICO CARPETS AND RUGS MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 63 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (USD MILLION)

TABLE 64 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (MILLION SQ FT)

TABLE 65 MEXICO CARPETS AND RUGS MARKET, BY RAW MATERIAL, 2022-2031 (ASP)

TABLE 66 MEXICO SYNTHETIC FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 67 MEXICO NATURAL FIBER IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 68 MEXICO CARPETS AND RUGS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 MEXICO RESIDENTIAL FIBER IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 70 MEXICO COMMERCIAL IN CARPETS AND RUGS MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 71 MEXICO CARPETS AND RUGS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 72 MEXICO OFFLINE IN CARPETS AND RUGS MARKET, BY TYPE, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CARPETS AND RUGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CARPETS AND RUGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CARPETS AND RUGS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CARPETS AND RUGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CARPETS AND RUGS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CARPETS AND RUGS MARKET: MULTIVARIATE MODELLING

FIGURE 9 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE TIMELINE CURVE

FIGURE 10 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA CARPETS AND RUGS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR INTERIOR IN COMMERCIAL SPACE IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA CARPETS AND RUGS MARKET IN THE FORECAST PERIOD

FIGURE 13 CARPET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CARPETS AND RUGS MARKET FROM 2024 AND 2031

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CARPETS AND RUGS MARKET

FIGURE 15 NORTH AMERICA CARPETS AND RUGS MARKET: TYPE, 2023

FIGURE 16 NORTH AMERICA CARPETS AND RUGS MARKET: PRODUCT, 2023

FIGURE 17 NORTH AMERICA CARPETS AND RUGS MARKET: RAW MATERIAL, 2023

FIGURE 18 NORTH AMERICA CARPETS AND RUGS MARKET: APPLICATION, 2023

FIGURE 19 NORTH AMERICA CARPETS AND RUGS MARKET: DISTRIBUTION CHANNEL, 2023

FIGURE 20 NORTH CARPETS AND RUGS MARKET: SNAPSHOT (2023)

FIGURE 21 NORTH AMERICA CARPETS AND RUGS MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.