North America Cardiac Computed Tomography Cct Market

Market Size in USD Million

CAGR :

%

USD

966.62 Million

USD

1,599.75 Million

2025

2033

USD

966.62 Million

USD

1,599.75 Million

2025

2033

| 2026 –2033 | |

| USD 966.62 Million | |

| USD 1,599.75 Million | |

|

|

|

|

North America Cardiac Computed Tomography (CCT) Market Size

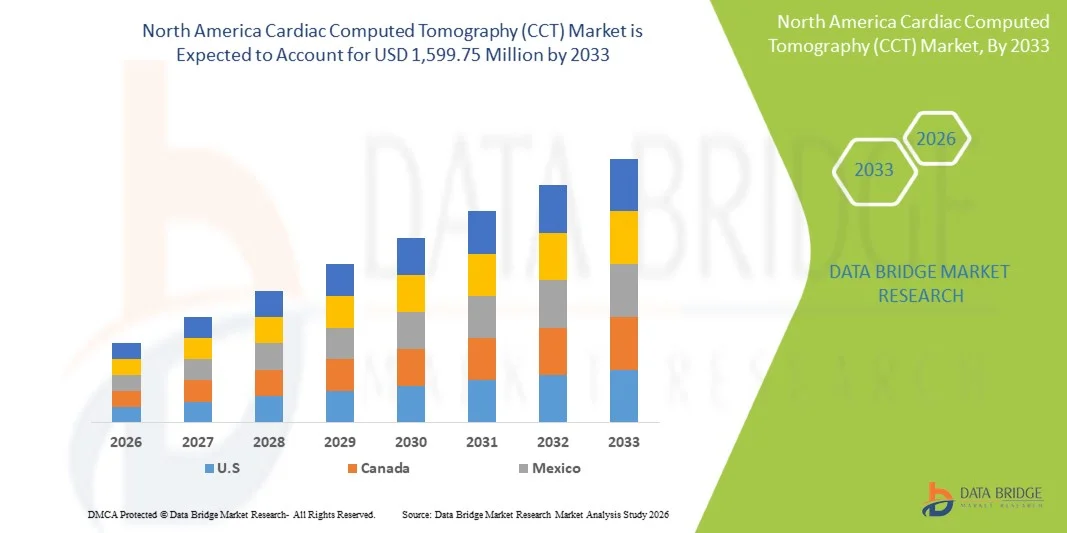

- The North America Cardiac Computed Tomography (CCT) market size was valued at USD 966.62 million in 2025 and is expected to reach USD 1,599.75 million by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases, increasing adoption of advanced imaging technologies, and growing integration of AI and machine learning in cardiac diagnostics, which enhance imaging accuracy and workflow efficiency

- Furthermore, expanding healthcare infrastructure, favorable reimbursement policies, and growing awareness among clinicians and patients regarding non-invasive cardiac imaging are driving the demand for CCT solutions. These factors are collectively promoting the adoption of cardiac CT systems, thereby significantly boosting the market’s growth

North America Cardiac Computed Tomography (CCT) Market Analysis

- Cardiac CT systems, providing non-invasive imaging and advanced visualization of coronary arteries, are becoming increasingly essential in modern cardiovascular diagnostics and risk assessment in both hospitals and outpatient clinics due to their high accuracy, speed, and integration with AI-assisted imaging platforms

- The escalating demand for cardiac CT is primarily driven by the rising prevalence of cardiovascular diseases, growing awareness of early diagnosis benefits, and increasing adoption of advanced imaging technologies in clinical practice

- The United States dominated the North America Cardiac Computed Tomography (CCT) market with the largest revenue share of 80.2% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key imaging equipment manufacturers, with substantial growth in CCT installations in cardiac specialty centers and multi-hospital networks, driven by innovations in high-resolution scanners and AI-enabled diagnostic tools

- Canada is expected to be the fastest-growing country in the North America Cardiac Computed Tomography (CCT) market during the forecast period due to increasing healthcare investments, expanding hospital networks, and rising awareness of non-invasive cardiac imaging benefits

- Coronary CT angiography segment dominated the North America Cardiac Computed Tomography (CCT) market with a market share of 45.1% in 2025, driven by its superior ability to detect coronary artery disease and guide clinical decision-making

Report Scope and North America Cardiac Computed Tomography (CCT) Market Segmentation

|

Attributes |

North America Cardiac Computed Tomography (CCT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Cardiac Computed Tomography (CCT) Market Trends

“Advancements Through AI and High-Resolution Imaging”

- A significant and accelerating trend in the North America cardiac CT market is the integration of artificial intelligence (AI) and high-resolution imaging technologies, enhancing diagnostic accuracy and workflow efficiency in cardiac care

- For instance, the latest Siemens SOMATOM Force scanners integrate AI-assisted image reconstruction to reduce scan times while maintaining high image quality, improving patient throughput in clinical settings

- AI integration in cardiac CT enables features such as automated plaque quantification, coronary artery segmentation, and prediction of cardiovascular risk, allowing clinicians to make more informed decisions. For instance, Canon Medical’s Aquilion ONE uses AI to enhance cardiac functional assessment and provide advanced diagnostic insights

- The seamless integration of cardiac CT systems with hospital PACS and EMR platforms facilitates centralized data management, enabling radiologists and cardiologists to review, share, and analyze cardiac images more efficiently across multiple departments

- This trend towards more intelligent, precise, and interoperable imaging systems is reshaping clinical expectations for cardiac diagnostics. Consequently, companies such as GE Healthcare are developing AI-enabled cardiac CT solutions with features such as automated reporting and dose optimization

- The demand for cardiac CT systems offering AI-assisted high-resolution imaging is growing rapidly across both hospital and outpatient clinic settings, as clinicians increasingly prioritize speed, accuracy, and comprehensive cardiac assessment

- Collaborations between imaging companies and software developers to integrate predictive analytics and cloud-based solutions are enhancing remote diagnostics and multi-site cardiac workflow efficiency, further driving the trend

North America Cardiac Computed Tomography (CCT) Market Dynamics

Driver

“Rising Cardiovascular Disease Prevalence and Adoption of Advanced Imaging”

- The increasing incidence of cardiovascular diseases, coupled with the adoption of advanced imaging technologies, is a significant driver for the growing demand for cardiac CT systems

- For instance, in March 2025, Canon Medical announced the launch of the Aquilion ONE Prism Edition with enhanced AI capabilities for coronary imaging, expected to drive adoption in clinical cardiac diagnostics

- As clinicians prioritize early detection and risk stratification, cardiac CT offers non-invasive imaging with high accuracy, enabling precise diagnosis and better treatment planning

- Furthermore, the growing integration of cardiac CT in preventive cardiology and multi-modality imaging workflows is making these systems essential for hospital and clinic operations, improving patient outcomes

- The ability to perform rapid, non-invasive coronary assessments, functional evaluation, and plaque characterization, combined with user-friendly software, is propelling adoption across cardiology centers and multi-specialty hospitals

- Government initiatives and favorable reimbursement policies for advanced cardiac imaging in the United States are further supporting the adoption of cardiac CT systems in both public and private healthcare facilities

- Increasing awareness among clinicians and patients about the benefits of non-invasive imaging over traditional invasive procedures is motivating more hospitals to adopt cardiac CT technology

Restraint/Challenge

“Radiation Exposure Concerns and High Equipment Costs”

- Concerns regarding radiation exposure from repeated cardiac CT scans pose a significant challenge to broader market adoption, especially among risk-averse patients and pediatric populations

- For instance, reports highlighting cumulative radiation doses in frequent imaging have made some clinicians cautious in prescribing cardiac CT for routine follow-ups

- Addressing these concerns through dose-reduction technologies, low-dose scanning protocols, and educational initiatives is crucial for wider adoption. Companies such as Siemens and GE emphasize dose optimization in their marketing to reassure clinicians and patients

- In addition, the relatively high cost of advanced cardiac CT scanners compared to conventional imaging modalities can be a barrier for smaller clinics and budget-sensitive hospitals, limiting market penetration in certain areas

- While equipment costs are gradually decreasing and financing options are available, the perceived premium of advanced cardiac CT technology can hinder widespread adoption, particularly in community hospitals or outpatient imaging centers

- Overcoming these challenges through improved dose management, cost-effective solutions, and clinician education will be vital for sustained market growth

- Limited availability of trained radiologists and technologists skilled in cardiac CT imaging in smaller healthcare centers is a constraint, affecting the rate of adoption and utilization of advanced systems

- Regulatory compliance and evolving FDA guidelines for AI-assisted imaging solutions can create implementation delays and require additional investment in validation and training before deployment

North America Cardiac Computed Tomography (CCT) Market Scope

The market is segmented on the basis of offerings, product type, application, end user, and distribution channel.

- By Offerings

On the basis of offerings, the North America CCT market is segmented into systems, services, and software. The systems segment dominated the market with the largest revenue share in 2025, driven by the high demand for advanced CT scanners in hospitals and specialty centers. Hospitals prioritize system purchases due to the need for high-resolution imaging, non-invasive diagnostics, and multi-functional cardiac assessment capabilities. The segment benefits from the continuous technological advancements, including AI-assisted imaging, low-dose protocols, and dual-source CT technology. In addition, established healthcare institutions often prefer system purchases to maintain control over equipment performance, service quality, and integration with hospital PACS and EMR systems. System segment dominance is further reinforced by government reimbursements and hospital investments in state-of-the-art cardiac imaging.

The software segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing adoption of AI-enabled image processing, cloud-based analytics, and automated reporting solutions. Software solutions help optimize workflow efficiency, reduce reporting errors, and provide predictive cardiac risk assessments. Smaller clinics and diagnostic centers often prefer software upgrades to enhance existing hardware capabilities without significant capital expenditure. Cloud integration allows remote access to imaging data, enabling telecardiology and multi-site collaboration. Continuous updates and AI-based feature enhancements make the software segment a key growth driver across hospitals and specialty centers.

- By Product Type

On the basis of product type, the market is segmented into single-source CT, dual-source cardiac CT, and spectral CT. The dual-source cardiac CT segment dominated the market in 2025 due to its superior temporal resolution and ability to perform high-speed imaging, even in patients with arrhythmias. Dual-source scanners are preferred in hospitals for accurate coronary artery evaluation, calcium scoring, and functional assessment without motion artifacts. These systems provide comprehensive diagnostic data in a single scan, reducing the need for repeat procedures. Hospitals and specialty centers value dual-source CT for its versatility in multi-modality imaging and integration with advanced cardiac software. Market adoption is further driven by technological advancements such as AI-based reconstruction and dose reduction features.

The spectral CT segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing clinical demand for tissue characterization, plaque composition analysis, and enhanced cardiac risk stratification. Spectral CT allows simultaneous acquisition of multiple energy levels, enabling better differentiation of calcified and non-calcified plaques. Its growth is fueled by rising adoption in research hospitals and specialty cardiac centers seeking more precise diagnostics. The technology also facilitates personalized treatment planning and improved patient outcomes. Rising awareness among cardiologists and patients about advanced imaging benefits further accelerates spectral CT adoption.

- By Application

On the basis of application, the market is segmented into calcium scoring, coronary CT angiography, device implantation, pulmonary vein isolation, and left atrial appendage occlusion. The coronary CT angiography (CCTA) segment dominated the market in 2025 with the largest market share of 45.1%, driven by its non-invasive capability to detect coronary artery disease with high accuracy. CCTA is widely used in hospitals and specialty cardiac centers for early diagnosis, risk stratification, and treatment planning. Its growing preference is supported by advancements such as AI-assisted plaque quantification and automated reporting, which streamline workflow and improve diagnostic confidence. CCTA adoption is further encouraged by favorable reimbursement policies and increasing patient awareness of non-invasive diagnostic options. The segment’s dominance is reinforced by the ability to perform rapid and reliable imaging, reducing the need for invasive catheter-based procedures.

The pulmonary vein isolation (PVI) application segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing prevalence of atrial fibrillation and the rising adoption of image-guided ablation procedures. PVI procedures rely on accurate cardiac CT imaging to map the left atrium and pulmonary veins prior to catheter ablation. The growth is supported by hospitals and electrophysiology centers investing in advanced imaging to improve procedural safety and efficacy. Increasing awareness of minimally invasive cardiac therapies among patients and clinicians is also fueling demand for PVI-focused imaging. Technological advancements such as AI-guided pre-procedural planning further enhance the utility of cardiac CT in PVI procedures.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty centers, diagnostic & imaging centers, and others. The hospitals segment dominated the market in 2025 due to large-scale investments in advanced cardiac imaging infrastructure and high patient volumes requiring non-invasive cardiac diagnostics. Hospitals often prioritize dual-source and high-resolution CT systems to provide comprehensive cardiac care, including coronary artery evaluation, device implantation planning, and calcium scoring. The dominance is reinforced by the availability of skilled radiologists, integration with hospital EMR/PACS systems, and supportive reimbursement policies. Hospitals also invest in continuous staff training and AI-based software tools to maximize imaging efficiency and diagnostic accuracy. The segment benefits from the increasing burden of cardiovascular diseases and growing demand for preventive cardiac care.

The specialty centers segment is expected to witness the fastest growth from 2026 to 2033, driven by dedicated cardiac centers and outpatient clinics adopting advanced CT imaging for focused diagnostics and interventional planning. Specialty centers prefer compact and high-performance scanners to optimize throughput and patient experience. Increasing patient awareness and demand for early cardiac diagnosis in outpatient settings fuel market growth. Partnerships with imaging equipment vendors for AI-enabled upgrades further enhance the appeal of specialty centers. Rising adoption of preventive cardiology programs and minimally invasive procedures also supports the rapid expansion of this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and third-party distributors. The direct tender segment dominated the market in 2025 due to the preference of large hospitals and healthcare networks to purchase advanced imaging systems directly from manufacturers for better pricing, after-sales support, and service guarantees. Direct purchases also allow hospitals to negotiate customized solutions, including AI integration, software upgrades, and maintenance contracts. Major equipment vendors actively promote direct sales to maintain strong client relationships and ensure smooth deployment of high-end cardiac CT systems. The segment benefits from long-term service agreements and training programs that enhance adoption confidence. Hospitals and specialty centers prefer direct tender due to assured authenticity and compliance with regulatory standards.

The third-party distributor segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption among smaller clinics, outpatient centers, and diagnostic imaging chains seeking flexible procurement options. Distributors provide access to refurbished or cost-effective CT systems, bundled service packages, and financing solutions that reduce upfront capital expenditure. Growing awareness of AI-enabled upgrades and cloud-based software solutions available through distributors further drives adoption. Third-party channels also facilitate faster penetration in emerging urban areas and remote healthcare facilities, accelerating market expansion.

North America Cardiac Computed Tomography (CCT) Market Regional Analysis

- The United States dominated the North America Cardiac Computed Tomography (CCT) market with the largest revenue share of 80.2% in 2025, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key imaging equipment manufacturers

- Hospitals and specialty cardiac centers in the U.S. prioritize high-resolution and AI-enabled CT scanners for accurate coronary artery assessment, calcium scoring, and pre-procedural planning, increasing market adoption

- This dominance is further supported by favorable reimbursement policies, high healthcare expenditure, a strong presence of key imaging equipment manufacturers, and growing awareness among clinicians and patients about the benefits of early and precise cardiac diagnosis

The U.S. Cardiac Computed Tomography (CCT) Market Insight

The U.S. cardiac CT market captured the largest revenue share of 80.2% in 2025 within North America, driven by the widespread adoption of non-invasive imaging for early detection of cardiovascular diseases. Hospitals and specialty cardiac centers are investing in high-resolution CT scanners with AI-assisted imaging to enhance diagnostic accuracy and workflow efficiency. Growing awareness among clinicians and patients about the benefits of early diagnosis, combined with favorable reimbursement policies, is further propelling market growth. In addition, the integration of cardiac CT with hospital PACS and EMR systems supports seamless data management, enhancing adoption in large healthcare networks. Technological advancements, such as dual-source and spectral CT, and increased use of outpatient cardiac imaging are also contributing to the market expansion.

Canada Cardiac Computed Tomography (CCT) Market Insight

The Canada cardiac CT market is projected to grow at a substantial CAGR during the forecast period, fueled by increasing investments in advanced healthcare infrastructure and rising prevalence of cardiovascular diseases. The growing adoption of non-invasive cardiac imaging in hospitals and diagnostic centers is enhancing early detection and preventive care. Canadian healthcare providers are increasingly incorporating AI-assisted imaging and software solutions to improve diagnostic precision and patient management. In addition, government healthcare programs and favorable reimbursement policies are supporting the procurement of advanced cardiac CT systems. The demand for minimally invasive diagnostic procedures and the rising awareness of coronary artery disease risk are expected to drive further growth.

Mexico Cardiac Computed Tomography (CCT) Market Insight

The Mexico cardiac CT market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased hospital infrastructure development and rising demand for advanced cardiac diagnostic tools. Growing awareness of cardiovascular disease management and preventive diagnostics among patients and healthcare providers is encouraging adoption. Key hospitals and specialty centers are investing in dual-source and spectral CT systems to improve imaging accuracy and procedural planning. The increasing penetration of private healthcare facilities, along with government initiatives to improve access to advanced diagnostics, is expected to support market expansion. Technological advancements and training programs for radiologists further stimulate adoption.

North America Cardiac Computed Tomography (CCT) Market Share

The North America Cardiac Computed Tomography (CCT) industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Neusoft Medical Systems Co., Ltd. (China)

- United Imaging Healthcare (China)

- Shimadzu Corporation (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- FUJIFILM Healthcare Corporation (Japan)

- Hitachi High-Tech Corporation (Japan)

- Mindray Medical International Limited (China)

- Shenzhen Anke High-Tech Co., Ltd. (China)

- Carestream Health (U.S.)

- Analogic Corporation (U.S.)

- NeuroLogica Corp. (U.S.)

- Agfa HealthCare (Belgium)

- Planmed Oy (Finland)

- Cybermed Inc. (South Korea)

- Unison Healthcare Group (Taiwan)

- Shanghai United Imaging Healthcare Co., Ltd. (China)

What are the Recent Developments in North America Cardiac Computed Tomography (CCT) Market?

- In December 2025, Siemens Healthineers announced the launch of the Syngo.CT Coronary Cockpit software at RSNA 2025, a new AI‑driven solution that enhances coronary CT imaging by automating plaque analysis and assisting in clinical decision‑making for coronary artery disease. This software integrates with dual‑source and photon‑counting CT scanners to support risk assessment and procedural planning, potentially reducing invasive procedures

- In March 2025, Caristo Diagnostics received FDA 510(k) clearance for its CaRi‑Plaque AI technology, an AI‑assisted image analysis tool that helps cardiologists detect and quantify coronary plaque in CT scans, improving early diagnosis of coronary artery disease and expanding options for non‑invasive cardiac risk assessment across U.S. healthcare systems

- In December 2024, Philips launched the CT 5300 system in North America at RSNA 2024, a next‑generation CT scanner combining advanced hardware and AI‑enabled workflow automation. The system is designed to improve diagnostic confidence, streamline cardiac and other imaging workflows, and reduce radiation dose for patients, supporting broader adoption of cardiac CT imaging

- In October 2024, the FDA cleared updated HealthCCSng V2.0 AI software for automated coronary artery calcium (CAC) scoring on CT scans, enabling more precise numerical assessment and categorization of calcium levels, which aids cardiologists in evaluating cardiovascular risk and tailoring preventive care strategies

- In December 2023, Siemens Healthineers announced FDA clearance of the SOMATOM Pro.Pulse dual‑source CT scanner, an advanced and more affordable dual‑source system designed to deliver high temporal resolution and workflow efficiencies, helping expand cardiac CT access in hospitals and outpatient imaging centers across the U.S.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.