North America Botanical Extract Market Analysis and Size

The increase in various botanical extracts such as spice & herb extracts and other ingredients in different food products to enhance the flavor is an important driver for the growth of the North America botanical extract market. The recent trend indicates increasing demand for botanical extracts as investments in public and private food and beverage, pharmaceutical, cosmetics & personal care industries continue to grow. The factors driving the market growth are increasing health awareness among the population and botanical extracts.

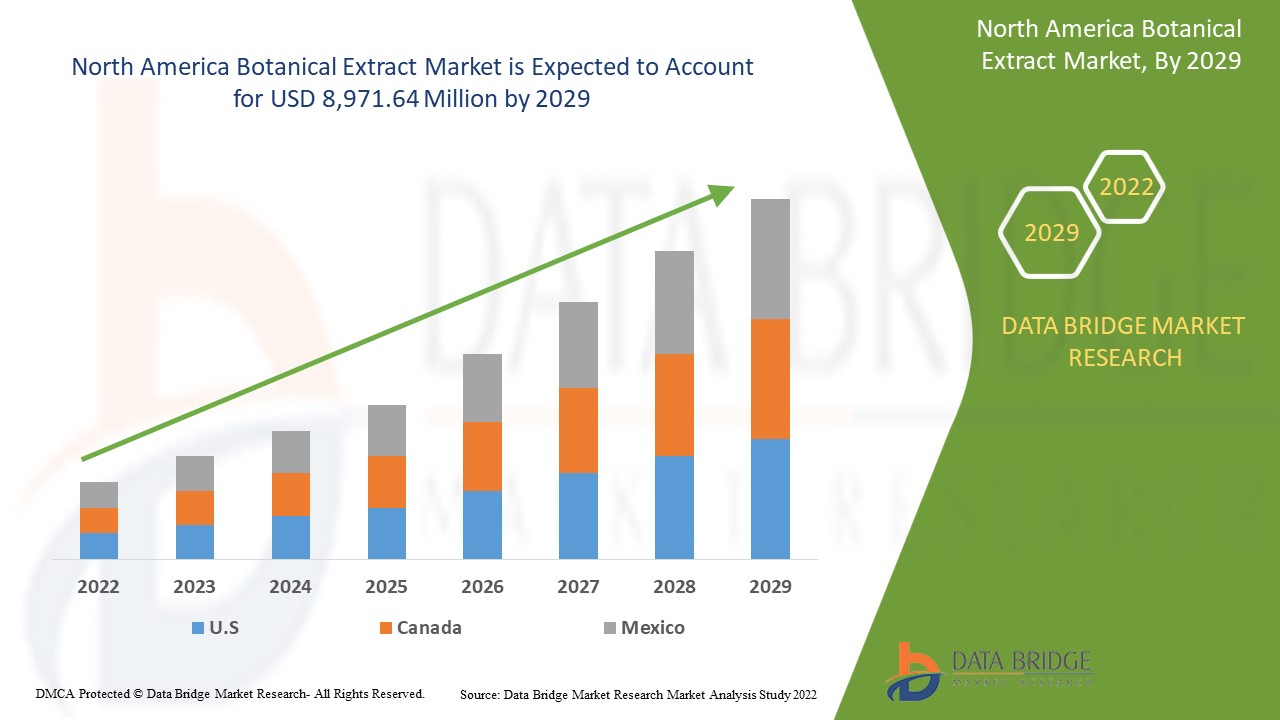

Data Bridge Market Research analyzes that the North America botanical extract market is expected to reach the value of USD 8,971.64 million by the year 2029, at a CAGR of 5.7% during the forecast period. "Nutraceutical" accounts for the most prominent application segment in the respective market owing to the rise in the botanical extract. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Spice Extracts, Herb Extracts, Flower Extracts, Tea Extracts, Fruit Extracts, and Marine Plant Extracts), Form (Liquid, Powder, and Leaf Extract), Product Type (Organic and Conventional), Application (Nutraceutical, Food Products, Pharmaceutical, Personal Care & Cosmetics, Beverages, Aromatherapy, Sport Nutrition, Animal Feed, and Other). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Givaudan, Kerry Group plc, DSM, Sensient Technologies Corporation, Ingredion Incorporated, McCormick & Company, Inc., Provital, Martin Bauer Group, Organic Herb Inc, Kalsec Inc., Symrise, Synthite Industries Ltd., International Flavors & Fragrances Inc., Carrubba, Inc, Blue Sky Botanics, DÖHLER GmbH, Bio Botanica, Inc., Bio-gen Extracts Private Limited, Plantnat, and Native Extracts Pty Ltd. |

Market Definition

Botanical extracts are extracted from natural sources such as spices, herbs, flowers, fruits, tea, and others. Botanical extracts are used as ingredients in the food & beverage industry to modify flavor, Aroma, or nutritive quality. Botanical extracts also impart properties such as enhanced flavor and extended shelf life and also reduce microbial spoilage. They are extracted from the tissue of a plant, usually by treating it with a solvent such as alcohol or water.

Market Dynamics of the North America Botanical Extract Market

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers/Opportunities

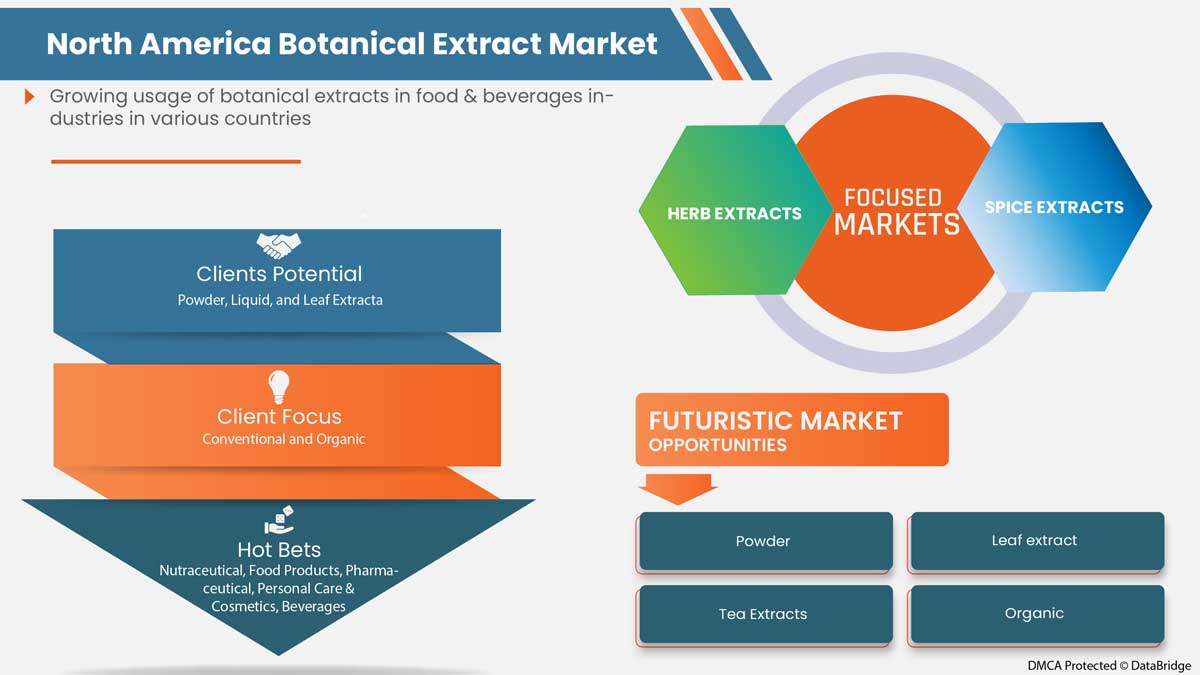

- Growing usage of botanical extract in food & beverages industries

An increase in awareness among consumers about the health benefits of the botanical extract that could build up immunity, which is much more required in COVID-19 will help to boost the market growth. The rise in the usage of botanical extract due to the demand for natural flavor-based food and beverages among consumers is likely to stimulate market growth. The botanical extract contains natural sugars, vitamins, and minerals and is added to food and beverages to substitute synthetic ingredients. Thus, the growing demand for botanical extract in the food and beverage industry is expected to drive market growth.

- Rising usage of botanical extract in pharmaceutical and personal care & cosmetics industries

The floral extracts are extensively applied in personal care products such as lotion, anti-aging creams, and lip balm enriched with natural vitamins responsible for healthy skin. There is an increasing awareness among consumers regarding the harmful effects of chemical-added beauty products. Thus, there is significant demand for herbal extract-based beauty products. Owing to such trends, the personal care industry & cosmetics manufacturers are incorporating botanical extracts in their products. Similarly, botanical extracts have a significant role in the pharmaceutical industry. The herbal extracts have antioxidant and anti-inflammatory properties to enhance the qualities of a drug. This has resulted in the extensive usage of herbal extracts in the pharmaceutical industry.

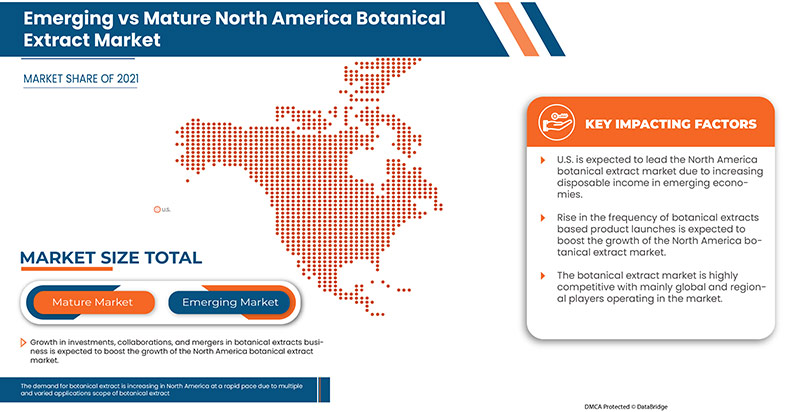

- Increasing disposable income in emerging economies

Consumers are opting mostly for naturally flavored food products and beverages in the market. Several manufacturers are adding botanical extracts and the main ingredients to their products to satisfy the growing needs of consumers. Moreover, the increased disposable income in emerging economies raises botanical extract across the world, such as a rise in disposable income coupled with rising customer inclination for naturally sourced products. The growing usage of botanical extracts is highly used in emerging countries due to the high disposable income and increasing expenditure on food & beverages made from natural ingredients. This is expected to drive market growth.

- Increasing demand for clean-label products

The demand for clean labels or natural products is on the rise among consumers. The rising customer awareness of naturally functional ingredients increases the need for clean-label products in the market. Moreover, the lifestyle of consumers across the globe is changing as they are becoming healthier and environmentally conscious, which paves the way for the natural ingredients used in every product they are using daily. Moreover, the botanical extracts are chemical residue-free, making them the prior choice for vegan consumers.

- Growing demand for the dietary supplements

According to the WHO, about 80% of Asian and African consumers consume herbal medicine as their daily dietary supplements. Moreover, the side effects caused by the botanical extracts are significantly less compared to the synthetic ingredients. This resulted in the high consumption of botanical extracts as dietary supplements in the North America market. Therefore, the growing consumption and demand for nutritional supplements are expected to provide an opportunity for the market.

Restraints/Challenges

- Stringent government regulations on botanical extract

Botanical extracts are the most popular flavors and natural ingredients globally and the demand is rising exponentially. On the other hand, the need for botanical extract is exceeding production. Thus, the manufacturers are focused on producing botanical extract in conventional and organic ways to meet consumer demand. However, the stringent government regulations on botanical extract are expected to restrain the market growth.

- Continuous fluctuation in prices of raw materials

Severe disruption of the supply chain of raw materials due to the COVID-19 pandemic and lack of labor to transport the raw materials resulted in the fluctuation of prices of raw materials. This sudden occurrence of the pandemic may restrain the market growth. Similarly, consumers are looking for organic and clean-label products. Therefore, the fewer availability of raw materials of botanical extract leads to high price fluctuations of the raw materials. This factor is expected to hamper the market growth.

- High cost of the products

Clean-label products and labeling production require a high capital investment, reflecting the products' outcome. Moreover, the raw materials used to produce botanical extract are to be imported chiefly from other regions, imposing manufacturers' extra costs. These factors ultimately result in the high costs of the botanical extract market, which further is expected to create a significant challenge for the market growth.

Post-COVID-19 Impact on North America Botanical Extract Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the market has experienced a downfall in sales due to the shutdown of retail outlets and the restrictions on customer access over the past few years.

However, the growth of the market post-pandemic period is attributed to increased disposable income. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve their offerings. They are enhancing its market share by exploring different retail channels and expanding into new regions.

This North America botanical extract market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, and technological innovations in the market. To gain more info on the botanical extract market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In September 2022, Givaudan launched New Purple 2364, a vegan pigment for use in make-up formulations. It is made from the extraction by green fractionation from Raphanus Sativus L. This will help the company to increase its product portfolio.

- In March 2020, International Flavors & Fragrances Inc. had a new partnership with Evolva, a Swiss biotech company. This agreement will benefit the company to expand the commercialization of the International Flavors & Fragrances Inc. products and thereby increase sales and revenue.

North America Botanical Extract Market Scope

The North America botanical extract market is segmented into four notable segments based on type, form, product type, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Spice Extracts

- Herb Extracts

- Flower Extracts

- Tea Extracts

- Fruit Extracts

- Marine Plant Extracts

Based on type, the market is segmented into spice extracts, herb extracts, flower extracts, tea extracts, fruit extracts, and marine plant extracts.

Form

- Powder

- Liquid

- Leaf Extracts

Based on form, the market is segmented into powder, liquid, and leaf extracts.

Product Type

- Organic

- Conventional

Based on product type, the market is segmented into organic and conventional.

Application

- Food Products

- Sport Nutrition

- Beverages

- Pharmaceutical

- Nutraceutical

- Personal Care & Cosmetics

- Aromatherapy

- Animal Feed

- Others

Based on application, the market is segmented into food products, sport nutrition, beverages, pharmaceutical, nutraceutical, personal care & cosmetics, aromatherapy, animal feed, and others.

North America Botanical Extract Market Regional Analysis/Insights

The North America botanical extract market is analyzed, and market size insights and trends are provided by country, type, form, product type, and application as referenced above.

The countries covered in this market report are U.S., Canada, and Mexico.

The U.S. is dominating the market due to the high demand for botanical extracts for various end-user industries.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Botanical Extract Market Share Analysis

The North America botanical extract market competitive landscape provides details by a competitor. Details include company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are Givaudan, Kerry Group plc, DSM, Sensient Technologies Corporation, Ingredion Incorporated, McCormick & Company, Inc., Provital, Martin Bauer Group, Organic Herb Inc, Kalsec Inc., Symrise, Synthite Industries Ltd., International Flavors & Fragrances Inc., Carrubba, Inc, Blue Sky Botanics, DÖHLER GmbH, Bio Botanica, Inc., Bio-gen Extracts Private Limited, Plantnat, and Native Extracts Pty Ltd among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BOTANICAL EXTRACT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 IMPORT-EXPORT DATA

2.12 MARKET APPLICATION COVERAGE GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CERTIFICATIONS

4.2 COMPARATIVE ANALYSIS WITH PARENT MARKET

4.3 EXTRACTION PROCESS:

4.4 IMPORT-EXPORT SCENARIO

4.5 LIST OF SUBSTITUTES IN THE MARKET:

4.6 MARKETING STRATEGY

4.7 PRODUCTION AND CONSUMPTION PATTERN

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END-USER

4.9 VALUE CHAIN OF BOTANICAL EXTRACT

4.1 RAW MATERIAL PRICING ANALYSIS:

5 REGULATIONS

5.1 THE WHO TRADITIONAL MEDICINE PROGRAMME

5.2 INTERNATIONAL UNION OF BIOLOGICAL SCIENCES (IUBS)

5.3 THE BRITISH HERBAL MEDICINE ASSOCIATION

5.4 EUROPAM: THE EUROPEAN HERB GROWERS ASSOCIATION

5.5 NATIONAL MEDICINAL PLANTS BOARD

5.6 REGULATION ON HERBAL PRODUCTS USED AS MEDICINE AROUND THE WORLD

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF BOTANICAL EXTRACT IN FOOD & BEVERAGES INDUSTRIES

6.1.2 RISING USAGE OF BOTANICAL EXTRACT IN PHARMACEUTICAL AND PERSONAL CARE & COSMETICS INDUSTRIES

6.1.3 INCREASING DISPOSABLE INCOME IN EMERGING ECONOMIES

6.1.4 INCREASING DEMAND FOR CLEAN LABEL PRODUCTS

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATION OF BOTANICAL EXTRACT

6.2.2 CONTINUOUS FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR THE DIETARY SUPPLEMENTS

6.3.2 RISE IN THE FREQUENCY OF BOTANICAL EXTRACT-BASED PRODUCT LAUNCHES

6.3.3 GROWTH IN INVESTMENTS, COLLABORATIONS AND MERGERS IN BOTANICAL EXTRACT BUSINESS

6.4 CHALLENGES

6.4.1 AVAILABILITY OF EASY SUBSTITUTES

6.4.2 HIGH COST OF THE PRODUCTS

7 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SPICE EXTRACTS

7.2.1 PUNGENT SPICES

7.2.1.1 GINGER

7.2.1.2 CAPSICUM

7.2.1.3 BLACK AND WHITE PEPPER

7.2.1.4 MUSTARD

7.2.1.5 HORSERADISH

7.2.1.6 OTHERS

7.2.2 AROMATIC SPECIES

7.2.2.1 CARDAMOM

7.2.2.2 CORIANDER

7.2.2.3 CUMIN

7.2.2.4 DILL

7.2.2.5 CELERY

7.2.2.6 CASSIA

7.2.2.7 CARAWAY

7.2.2.8 OTHERS

7.2.3 AROMATIC VEGETABLES

7.2.3.1 GARLIC

7.2.3.2 ONION

7.2.3.3 OTHERS

7.2.4 TURMERIC

7.2.5 OTHERS

7.3 HERB EXTRACTS

7.3.1 SAGE

7.3.2 MINT

7.3.3 THYME

7.3.4 BASIL

7.3.5 OREGANO

7.3.6 MARJORAM

7.3.7 OTHERS

7.4 FLOWER EXTRACTS

7.4.1 ROSEMARY

7.4.2 JASMINE

7.4.3 LAVENDER

7.4.4 ORANGE BLOSSOMS

7.4.5 MALLOW

7.4.6 BANABA

7.4.7 OTHERS

7.5 TEA EXTRACTS

7.5.1 GREEN TEA

7.5.2 WHITE TEA

7.5.3 BLACK TEA

7.5.4 OOLONG

7.5.5 ASSAM

7.5.6 DARJEELING

7.5.7 OTHERS

7.6 FRUIT EXTRACTS

7.6.1 RASPBERRY

7.6.2 STRAWBERRY

7.6.3 CRANBERRY

7.6.4 POMEGRANATE

7.6.5 PAPAYA

7.6.6 GRAPEFRUIT

7.6.7 VANILLA

7.6.8 COCOA

7.6.9 COFFEE

7.6.10 OTHERS

7.7 MARINE PLANT EXTRACTS

8 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

8.4 LEAF EXTRACT

9 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD PRODUCTS

10.2.1 DAIRY PRODUCTS

10.2.1.1 ICE- CREAM

10.2.1.2 CHEESE

10.2.1.3 YOGHURT

10.2.1.4 CREAMS

10.2.1.5 SPREAD

10.2.1.6 OTHERS

10.2.2 BAKERY PRODUCTS

10.2.2.1 CAKES & PASTRIES

10.2.2.2 BISCUITS & COOKIES

10.2.2.3 BREADS

10.2.2.4 MUFFINS

10.2.2.5 OTHERS

10.2.3 CHOCOLATE & CONFECTIONARY

10.2.3.1 CANDIES

10.2.3.2 LIQUORICE

10.2.3.3 MARSHMALLOWS

10.2.3.4 CHEWING GUM

10.2.3.5 OTHERS

10.2.4 PROCESSED MEAT PRODUCTS

10.2.4.1 POULTRY

10.2.4.2 BEEF

10.2.4.3 PORK

10.2.4.4 OTHERS

10.2.5 CONVENIENCE FOOD

10.2.5.1 SEASONING & DRESSINGS

10.2.5.2 READY TO EAT PRODUCTS

10.2.5.3 SOUPS & SAUCES

10.2.5.4 NOODLES & PASTA

10.2.5.5 PICKLES

10.2.5.6 OTHERS

10.2.6 PROCESSED FOODS

10.2.7 SEA FOOD PRODUCTS

10.2.8 SNACKS

10.2.9 INFANT FORMULA

10.2.10 OTHERS

10.3 SPORT NUTRITION

10.4 BEVERAGES

10.4.1 ALCOHOLIC BEVERAGES

10.4.1.1 BEER

10.4.1.2 SPIRIT

10.4.1.3 WINE

10.4.1.4 OTHERS

10.4.2 NON- ALCOHOLIC BEVERAGES

10.4.2.1 RTD TEA

10.4.2.2 SOFT DRINKS

10.4.2.3 DAIRY DRINKS

10.4.2.4 FRUIT JUICES

10.4.2.5 RTD COFFEE

10.4.2.6 FLAVORED DRINKS

10.4.2.7 OTHERS

10.5 PHARMACEUTICAL

10.5.1 DIGESTIVE HEALTH

10.5.2 VASCULAR HEALTH

10.5.3 IMMUNE HEALTH

10.5.4 BONE HEALTH

10.5.5 OBESITY

10.5.6 STRESS & ANXIETY

10.5.7 COGNITIVE HEALTH

10.5.8 OTHERS

10.6 NUTRACEUTICALS

10.6.1 LIQUID

10.6.2 POWDER

10.6.3 CAPSULES

10.7 PERSONAL CARE & COSMETICS

10.7.1 SKIN CARE

10.7.2 HAIR CARE

10.7.3 OTHERS

10.8 AROMATHERAPY

10.9 ANIMAL FEED

10.9.1 PET

10.9.2 POULTRY

10.9.3 SWINE

10.9.4 RUMINANTS

10.9.5 AQUACULTURE

10.9.6 OTHERS

10.1 OTHERS

11 NORTH AMERICA BOTANICAL EXTRACT MARKET BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 MEXICO

11.1.3 CANADA

12 NORTH AMERICA BOTANICAL EXTRACT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 MERGER AND ACQUISITION

12.3 EXPANSION

12.4 NEW PRODUCT DEVELOPMENTS

12.5 PARTNERSHIPS

12.6 EXPANSION

12.7 EXHIBITION, CERTIFICATION AND AWARDS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 SENSIENT TECHNOLOGIES CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 GIVAUDAN

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 KERRY GROUP PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 SYMRISE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 INGREDION INCORPORATED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 SYNTHITE INDUSTRIES LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 DÖHLER

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DSM

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 KALSEC INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BLUE SKY BOTANICS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BIO BOTANICA, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 BIO-GEN EXTRACTS PRIVATE LIMITED

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 CARRUBBA INC

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MARTIN BAUER GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 MCCORMICK & COMPANY, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 RECENT FINANCIALS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 NATIVE EXTRACTS PTY LTD

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORGANIC HERBS INC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PLANTNAT

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PROVITAL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF VEGETABLE SAPS AND EXTRACTS (EXCLUDING LIQUORICE, HOPS AND OPIUM); HS CODE - 130219 (USD THOUSAND)

TABLE 2 EXPORT DATA OF VEGETABLE SAPS AND EXTRACTS (EXCLUDING LIQUORICE, HOPS AND OPIUM); HS CODE - 130219 (USD THOUSAND)

TABLE 3 COMPARISON OF BOTANICALS WITH THEIR EXTRACTS PER 100 MG-

TABLE 4 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SPICES EXTRACTS IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PUNGENT SPECIES IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AROMATIC SPECIES IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA AROMATIC VEGETABLES IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA HERB EXTRACTS IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FLOWER EXTRACTS IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TEA EXTRACTS IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA FRUIT EXTRACTS IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA FOOD PRODUCTS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DAIRY PRODUCTS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY PRODUCTS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CHOCOLATE & CONFECTIONARY IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENIENCE FOOD IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BEVERAGES IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON- ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PHARMACEUTICAL IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA NUTRACEUTICALS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PERSONAL CARE & COSMETICS IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ANIMAL FEED IN BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA BOTANICAL EXTRACT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SPICE EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA AROMATIC SPICES IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PUNGENT SPICES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA AROMATIC VEGETABLES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA HERB EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FLOWER EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA TEA EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA FRUIT EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BOTANICAL EXTRACT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FOOD PRODUCTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CONVENIENCE FOOD IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DAIRY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA BAKERY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA NUTRACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PERSONAL CARE & COSMETICS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ANIMAL FEED IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 U.S. BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. SPICE EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. AROMATIC SPICES IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. PUNGENT SPICES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. AROMATIC VEGETABLES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. HERB EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. FLOWER EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. TEA EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. FRUIT EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. BOTANICAL EXTRACT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 64 U.S. BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. FOOD PRODUCTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. CONVENIENCE FOOD IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.S. PROCESSED MEAT PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.S. DAIRY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.S. CHOCOLATE & CONFECTIONERY IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. BAKERY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 U.S. BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. NON-ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.S. PHARMACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 U.S. NUTRACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 U.S. NUTRACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 U.S. ANIMAL FEED IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 MEXICO BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO SPICE EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO AROMATIC SPICES IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO PUNGENT SPICES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO AROMATIC VEGETABLES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO HERB EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO FLOWER EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MEXICO TEA EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO FRUIT EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO BOTANICAL EXTRACT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 89 MEXICO BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 MEXICO FOOD PRODUCTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO CONVENIENCE FOOD IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 MEXICO PROCESSED MEAT PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 MEXICO DAIRY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 MEXICO CHOCOLATE & CONFECTIONERY IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO BAKERY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO NON-ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PHARMACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 MEXICO NUTRACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 MEXICO PERSONAL CARE & COSMETICS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 MEXICO ANIMAL FEED IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 CANADA BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA SPICE EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA AROMATIC SPICES IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA PUNGENT SPICES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA AROMATIC VEGETABLES IN BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA HERB EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA FLOWER EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA TEA EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA FRUIT EXTRACTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA BOTANICAL EXTRACT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 114 CANADA BOTANICAL EXTRACT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 CANADA BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 CANADA FOOD PRODUCTS IN BOTANICAL EXTRACT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA CONVENIENCE FOOD IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 CANADA PROCESSED MEAT PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 CANADA DAIRY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 CANADA CHOCOLATE & CONFECTIONERY IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 CANADA BAKERY PRODUCTS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CANADA BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 CANADA ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 CANADA NON-ALCOHOLIC BEVERAGES IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 CANADA PHARMACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 CANADA NUTRACEUTICAL IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 CANADA PERSONAL CARE & COSMETICS IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 CANADA ANIMAL FEED IN BOTANICAL EXTRACT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA BOTANICAL EXTRACT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BOTANICAL EXTRACT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BOTANICAL EXTRACT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BOTANICAL EXTRACT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BOTANICAL EXTRACT MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BOTANICAL EXTRACT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BOTANICAL EXTRACT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BOTANICAL EXTRACT MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BOTANICAL EXTRACT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA BOTANICAL EXTRACT MARKET: SEGMENTATION

FIGURE 11 INCREASING APPLICATIONS OF BOTANICAL EXTRACTS IN FOOD AND BEVERAGES INDUSTRY IS DRIVING THE NORTH AMERICA BOTANICAL EXTRACT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HERB EXTRACTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BOTANICAL EXTRACT MARKET IN 2022 & 2029

FIGURE 13 EXTRACTION PROCESS

FIGURE 14 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BOTANICAL EXTRACT MARKET

FIGURE 16 THE BELOW GRAPH SHOWS THE GLOBAL MARKET FOR DIETARY SUPPLEMENTS VALUES ACROSS THE WORLD IN 2017- 2018:

FIGURE 17 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY TYPE, 2021

FIGURE 18 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY FORM, 2021

FIGURE 19 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 NORTH AMERICA BOTANICAL EXTRACTS MARKET, BY APPLICATION, 2021

FIGURE 21 NORTH AMERICA BOTANICAL EXTRACT MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA BOTANICAL EXTRACT MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA BOTANICAL EXTRACT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA BOTANICAL EXTRACT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA BOTANICAL EXTRACT MARKET: BY TYPE (2022 & 2029)

FIGURE 26 NORTH AMERICA BOTANICAL EXTRACT MARKET: COMPANY SHARE 2021 (%)

North America Botanical Extracts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Botanical Extracts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Botanical Extracts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.