North America Biological Safety Cabinet Market

Market Size in USD Million

CAGR :

%

USD

73.98 Million

USD

136.93 Million

2024

2032

USD

73.98 Million

USD

136.93 Million

2024

2032

| 2025 –2032 | |

| USD 73.98 Million | |

| USD 136.93 Million | |

|

|

|

|

North America Biological Safety Cabinet Market Size

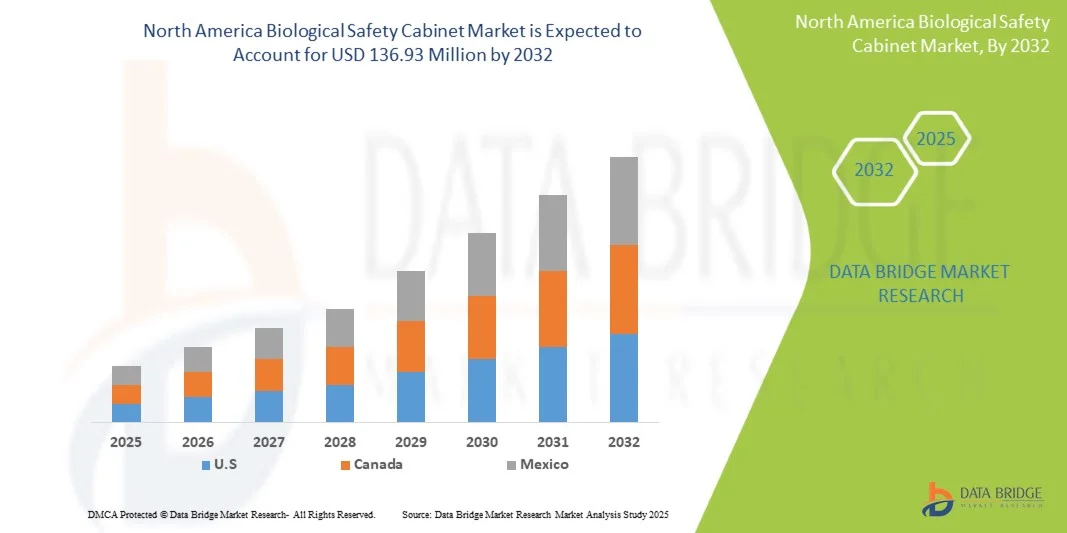

- The North America biological safety cabinet market size was valued at USD 73.98 million in 2024 and is expected to reach USD 136.93 million by 2032, at a CAGR of 8.0% during the forecast period

- The market growth is primarily driven by increasing investments in biotechnology, pharmaceutical R&D, and clinical laboratory infrastructure, alongside stricter biosafety regulations across the U.S. and Canada to ensure laboratory containment and contamination control

- Moreover, the rising incidence of infectious diseases and heightened focus on research involving pathogens and cell cultures are boosting the adoption of advanced containment solutions. These factors collectively reinforce the expansion of biological safety cabinet installations across academic, clinical, and industrial research facilities in the region

North America Biological Safety Cabinet Market Analysis

- Biological safety cabinets (BSCs), designed to provide containment and protection for laboratory personnel, samples, and the environment, are increasingly essential in biotechnology, pharmaceutical, and diagnostic laboratories due to their critical role in maintaining biosafety standards and preventing cross-contamination during sensitive research and production processes

- The growing demand for biological safety cabinets is primarily driven by the expanding biopharmaceutical sector, rising focus on infectious disease research, and stringent regulatory guidelines by agencies such as the CDC, NIH, and OSHA emphasizing laboratory safety compliance

- The U.S. dominated the North America biological safety cabinet market with the largest revenue share of 78.5% in 2024, supported by strong investments in life sciences research, a well-established healthcare infrastructure, and the presence of leading manufacturers and research institutions focusing on biosafety innovation and automation

- Canada is expected to be the fastest-growing market during the forecast period, fueled by increasing government funding for healthcare research, rising biosafety awareness, and growing establishment of new laboratories in the biopharma and academic sectors

- Class II cabinets dominated the largest market share of 65.2% in 2024, attributed to their widespread adoption in pharmaceutical manufacturing, clinical testing, and microbiological research due to their dual protection for personnel and samples

Report Scope and North America Biological Safety Cabinet Market Segmentation

|

Attributes |

North America Biological Safety Cabinet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Biological Safety Cabinet Market Trends

“Adoption of Smart Monitoring and Energy-Efficient Technologies”

- A significant and accelerating trend in the North America biological safety cabinet market is the integration of advanced digital monitoring, automation, and energy-efficient airflow systems, enhancing safety, performance, and compliance across research and healthcare laboratories

- For instance, Thermo Fisher Scientific introduced its latest A2 biological safety cabinet line with integrated airflow sensors and digital touchscreens, enabling real-time monitoring of cabinet performance and filter status. Similarly, Esco Lifesciences developed energy-efficient cabinets with adaptive airflow control for reduced energy consumption

- IoT-enabled and sensor-based systems in biological safety cabinets enable continuous data logging, predictive maintenance, and real-time alerts to laboratory personnel in case of operational anomalies. For instance, Germfree’s connected cabinets allow users to remotely track performance and maintenance schedules through a centralized dashboard

- The seamless integration of these cabinets with laboratory information management systems (LIMS) supports digital workflow optimization and ensures traceable biosafety compliance, promoting data-driven decision-making in laboratories handling infectious materials

- This trend toward intelligent, automated, and environmentally sustainable containment systems is reshaping biosafety operations across the region. Consequently, leading manufacturers such as Labconco and Baker Company are focusing on incorporating smart sensors, energy-efficient motors, and digital interfaces in their next-generation cabinets

- The demand for biological safety cabinets featuring advanced monitoring, energy efficiency, and digital connectivity is expanding rapidly across pharmaceutical, academic, and biotechnological facilities in North America

North America Biological Safety Cabinet Market Dynamics

Driver

“Rising Biosafety Demands from Expanding Biopharmaceutical and Diagnostic Sectors”

- The rapid growth of the biopharmaceutical and diagnostic industries in North America, coupled with heightened biosafety requirements, is a key driver accelerating the demand for biological safety cabinets

- For instance, in February 2024, Baker Company launched a new Class II cabinet line designed for advanced cell therapy labs, emphasizing enhanced operator protection and compliance with NSF/ANSI 49 standards. Such product developments by major manufacturers are propelling market growth

- As laboratories engage in higher volumes of research involving infectious materials, vaccines, and biologics, the need for containment-grade equipment that ensures sample integrity and personnel safety continues to rise

- Furthermore, the ongoing expansion of biotechnology startups, government-funded infectious disease programs, and hospital-based testing centers is increasing the number of laboratory setups across the region

- The growing emphasis on sustainable infrastructure, energy efficiency, and advanced containment technology in research facilities is further boosting the adoption of modern biological safety cabinets. The integration of ergonomically designed, user-friendly systems is enhancing operational safety and compliance rates

- Increasing investments from public health agencies such as NIH and CDC for pandemic preparedness are fueling demand for high-containment laboratories equipped with Class II and Class III cabinets

- Moreover, rising focus on biomanufacturing and personalized medicine is expanding the use of BSCs in upstream and downstream bioprocessing, supporting long-term market growth across North America

Restraint/Challenge

“High Equipment Costs and Maintenance Complexity”

- The substantial initial investment required for advanced biological safety cabinets, along with recurring costs for certification, maintenance, and HEPA filter replacement, poses a restraint to market growth

- For instance, laboratory budgets in smaller research institutions or diagnostic centers may limit upgrades to newer models with smart monitoring features, slowing down modernization efforts

- In addition, compliance with evolving biosafety standards such as NSF/ANSI 49 and BMBL guidelines necessitates frequent inspections and documentation, increasing operational complexity and cost

- Installation and maintenance challenges, including the need for trained technicians and periodic airflow validation, further complicate adoption for resource-constrained facilities

- While technological advancements are improving durability and reducing energy consumption, the high cost of ownership remains a barrier, particularly for small-scale laboratories and academic research centers

- Addressing these challenges through modular cabinet designs, cost-efficient manufacturing, and government-supported biosafety infrastructure programs will be crucial for sustaining market expansion

- Another limitation arises from supply chain constraints for specialized HEPA filters and sensors, leading to maintenance delays and downtime in high-demand facilities

- Furthermore, limited technical training programs for biosafety equipment maintenance in smaller institutions restricts proper utilization and longevity of installed cabinets

North America Biological Safety Cabinet Market Scope

The market is segmented on the basis of type, filter, and end user.

- By Type

On the basis of type, the North America biological safety cabinet market is segmented into Class I, Class II, and Class III. The Class II segment dominated the market with the largest revenue share in 2024, accounting for 65.2%, owing to its dual protection design that safeguards both personnel and samples from contamination. These cabinets are extensively used in pharmaceutical manufacturing, academic laboratories, and clinical diagnostics for handling pathogens and sterile processes. Their compliance with international safety standards such as NSF/ANSI 49 and CDC guidelines has reinforced adoption across the U.S. and Canada. The segment’s leadership is also driven by continuous product innovation, including energy-efficient airflow systems, touch-screen controls, and advanced HEPA filtration. As research activity in biotechnology and microbiology expands, demand for Class II cabinets remains consistently strong.

The Class III segment is projected to witness the fastest growth from 2025 to 2032 due to the rising number of high-containment laboratories (BSL-3 and BSL-4) handling hazardous pathogens. These fully enclosed, gas-tight cabinets provide maximum protection for personnel and the environment during research involving infectious agents such as SARS-CoV-2 and other emerging viruses. Increased funding for pandemic preparedness and biosecurity initiatives in North America is further propelling the demand for Class III systems. Their advanced containment capabilities make them indispensable in specialized research institutions and government biosafety programs.

- By Filter

On the basis of filter type, the market is segmented into high efficiency particulate air (HEPA) filters and ultra low penetration air (ULPA) filters. The HEPA filter segment dominated the market in 2024 with a major share due to its proven efficiency in capturing 99.97% of particles ≥0.3 microns, offering reliable contamination control in laboratories and manufacturing facilities. Widely integrated into Class I and Class II cabinets, HEPA filters are preferred for their balance of cost-effectiveness, durability, and regulatory compliance. The segment’s dominance is also supported by increasing use across pharmaceutical cleanrooms and quality control labs that require precise contamination management. HEPA filters continue to be the industry standard, particularly due to their compatibility with both existing and new biosafety cabinet designs.

The ULPA filter segment is expected to record the fastest CAGR during the forecast period, driven by rising demand for ultra-clean environments in cell therapy, nanobiotechnology, and semiconductor applications. ULPA filters can trap 99.999% of particles ≥0.12 microns, making them ideal for high-purity laboratory settings. Their adoption is gaining momentum in advanced research labs focused on genetic engineering and precision medicine, where the highest contamination control is required. Increasing technological advancements and manufacturer initiatives toward hybrid filtration systems are further promoting ULPA filter adoption across North American facilities.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biopharmaceutical companies, diagnostic and testing laboratories, academic and research institutions, industrial, and others. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2024, driven by expanding biomanufacturing capacity and increased production of vaccines, biologics, and gene therapies. These facilities rely heavily on biological safety cabinets to ensure aseptic conditions and protect both operators and products during sensitive handling processes. The growing adoption of cell culture, viral vector, and monoclonal antibody technologies further strengthens segment dominance. In addition, stringent FDA and Health Canada biosafety guidelines are encouraging pharmaceutical firms to invest in modern, compliant biosafety equipment. Continuous technological upgrades and a focus on cGMP-certified facilities are further reinforcing demand in this segment.

The diagnostic and testing laboratories segment is anticipated to grow at the fastest pace from 2025 to 2032, supported by increasing diagnostic testing volumes, rising awareness of biosafety standards, and growing public health surveillance programs. The COVID-19 pandemic accelerated the establishment of new molecular and microbiological testing labs across the U.S. and Canada, many of which require certified biological safety cabinets for sample handling. Ongoing investments in infectious disease diagnostics, genomic sequencing, and hospital-based laboratories are expected to sustain strong growth. Moreover, integration of digital monitoring and airflow management systems in BSCs is making them increasingly attractive to diagnostic labs seeking operational efficiency and compliance assurance.

North America Biological Safety Cabinet Market Regional Analysis

- The U.S. dominated the North America biological safety cabinet market with the largest revenue share of 78.5% in 2024, supported by strong investments in life sciences research, a well-established healthcare infrastructure, and the presence of leading manufacturers and research institutions focusing on biosafety innovation and automation

- The region’s leadership is reinforced by stringent biosafety regulations set by agencies such as the CDC, NIH, and OSHA, which mandate the use of certified containment equipment in laboratories handling infectious or biohazardous materials

- This robust demand is further supported by substantial investments in biotechnology, academic research, and clinical diagnostics, along with the growing emphasis on laboratory automation and worker safety, establishing North America as a global hub for biological safety cabinet innovation and adoption

U.S. Biological Safety Cabinet Market Insight

The U.S. biological safety cabinet market captured the largest revenue share of 78.5% in 2024 within North America, driven by the country’s robust biotechnology and pharmaceutical sectors and high research investments in infectious disease control. The increasing number of biosafety level (BSL) laboratories, coupled with strict regulatory oversight from organizations such as the CDC and NIH, continues to boost demand for advanced containment equipment. Rising R&D activities in vaccine development, biomanufacturing, and cell therapy are further propelling market growth. Moreover, the integration of smart monitoring systems and energy-efficient cabinet designs by leading manufacturers is enhancing operational safety and compliance across research and clinical facilities.

Canada Biological Safety Cabinet Market Insight

The Canada biological safety cabinet market is projected to grow at a substantial CAGR throughout the forecast period, supported by expanding biotechnology infrastructure, growing healthcare research funding, and increasing awareness of biosafety standards. The country’s emphasis on developing domestic biomanufacturing capabilities and pandemic preparedness programs is fostering cabinet installations in both public and private laboratories. In addition, the rise in diagnostic testing centers and partnerships between universities and research institutes are accelerating adoption. Canadian facilities are increasingly investing in energy-efficient, low-noise cabinet models that align with sustainability goals and occupational safety regulations.

Mexico Biological Safety Cabinet Market Insight

The Mexico biological safety cabinet market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s expanding pharmaceutical production capacity and growing number of diagnostic laboratories. The government’s initiatives to strengthen public health infrastructure and biosafety compliance are encouraging laboratory modernization efforts. Rising demand for quality-controlled environments in biopharmaceutical and academic research facilities is contributing to increased adoption of certified Class II cabinets. Furthermore, collaborations with North American biosafety equipment manufacturers are improving product accessibility and local technical support, strengthening Mexico’s position as an emerging market for biosafety solutions.

North America Biological Safety Cabinet Market Share

The North America Biological Safety Cabinet industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Labconco (U.S.)

- NuAire, Inc. (U.S.)

- The Baker Company (U.S.)

- Esco Micro Pte. Ltd. (Singapore)

- Kewaunee Scientific Corporation (U.S.)

- Germfree Laboratories, Inc. (U.S.)

- Air Science USA (U.S.)

- Airclean Systems (U.S.)

- Flow Sciences, Inc. (U.S.)

- Terra Universal, Inc. (U.S.)

- Across International (U.S.)

- Biobase (China)

- Erlab (France)

- PHCbi (Panasonic Healthcare Co., Ltd.) (Japan)

- FASTER S.r.l. (Italy)

- Bigneat Containment Technology (U.K.)

- TopAir Systems, Inc. (U.S.)

- HEMCO Corporation (U.S.)

- Sentry Air Systems (U.S.)

What are the Recent Developments in North America Biological Safety Cabinet Market?

- In May 2025, Thermo Fisher Scientific introduced its new “1500 Series Class II, Type A2 Biological Safety Cabinet” designed for academic, biotech, pharmaceutical, and routine laboratories. The cabinet incorporates advanced features including SmartFlow™ Plus airflow control and Digital Airflow Verification (DAVe™ Plus) that continuously monitor and adjust inflow/downflow to maintain containment

- In September 2024, the publication of the standard NSF/ANSI 49‑2024 for biosafety cabinets was announced, updating design and performance criteria for Class II cabinets and influencing manufacturers and labs in North America

- In August 2024, Labconco Corporation launched its redesigned “Logic” Biological Safety Cabinet featuring a new touchscreen interface, energy-saving blowers (up to 30% reduction in energy consumption), quieter performance and extended filter life

- In September 2023, Air Science USA LLC announced that its Purair BIO biological safety cabinet (BSC) models (AS-AHA-193 and related 4 ft/6 ft variants) earned certification under NSF/ANSI 49, thereby bringing the number of listed models to four. This certification confirms that the cabinets meet rigorous airflow and containment standards for Class II, Type A2 cabinets aimed at biosafety levels 1–3

- In September 2022, the U.S. government issued an Executive Order on Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe and Secure American Bioeconomy, which explicitly launched a Biosafety & Biosecurity Innovation Initiative to strengthen biosafety oversight including equipment such as biosafety cabinets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTAL ANALYSIS

5.2 PORTER’S FIVE FORCES

5.3 KEY STRATEGIC INITIATIVES

5.4 TECHNOLOGICAL INOVATIONS

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMWORK

8 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 CLASS I BIOLOGICAL SAFETY CABINET (BSC)

8.2.1 MARKET VALUE (USD MN)

8.2.2 MARKET VOLUME (UNITS)

8.2.3 AVERAGE SELLINF PRICE (USD)

8.3 CLASS II BIOLOGICAL SAFETY CABINET (BSC)

8.3.1 CLASS II TYPE A

8.3.1.1. CLASS II TYPE A1

8.3.1.1.1. MARKET VALUE (USD MN)

8.3.1.1.2. MARKET VOLUME (UNITS)

8.3.1.1.3. AVERAGE SELLINF PRICE (USD)

8.3.1.2. CLASS II TYPE A2

8.3.1.2.1. MARKET VALUE (USD MN)

8.3.1.2.2. MARKET VOLUME (UNITS)

8.3.1.2.3. AVERAGE SELLINF PRICE (USD)

8.3.2 CLASS II TYPE B

8.3.2.1. CLASS II TYPE B1

8.3.2.1.1. MARKET VALUE (USD MN)

8.3.2.1.2. MARKET VOLUME (UNITS)

8.3.2.1.3. AVERAGE SELLINF PRICE (USD)

8.3.2.2. CLASS II TYPE B2

8.3.2.2.1. MARKET VALUE (USD MN)

8.3.2.2.2. MARKET VOLUME (UNITS)

8.3.2.2.3. AVERAGE SELLINF PRICE (USD)

8.4 CLASS III BIOLOGICAL SAFETY CABINET (BSC)

8.4.1 MARKET VALUE (USD MN)

8.4.2 MARKET VOLUME (UNITS)

8.4.3 AVERAGE SELLINF PRICE (USD)

9 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 INDUSTRIAL

9.2.1 CLASS I BIOLOGICAL SAFETY CABINET

9.2.2 CLASS II BIOLOGICAL SAFETY CABINET (BSC)

9.2.3 CLASS III BIOLOGICAL SAFETY CABINET (BSC)

9.3 ACADEMIC

9.3.1 CLASS I BIOLOGICAL SAFETY CABINET

9.3.2 CLASS II BIOLOGICAL SAFETY CABINET (BSC)

9.3.3 CLASS III BIOLOGICAL SAFETY CABINET (BSC)

9.4 RESEARCH

9.4.1 CLASS I BIOLOGICAL SAFETY CABINET

9.4.2 CLASS II BIOLOGICAL SAFETY CABINET (BSC)

9.4.3 CLASS III BIOLOGICAL SAFETY CABINET (BSC)

10 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, BY END USER

10.1 OVERVIEW

10.2 ACADEMIC & RESEARCH INSTITUTIONS

10.3 DIAGNOSTIC AND TESTING LABORATORIES

10.4 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

10.5 OTHERS

11 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, BY GEOGRAPHY

NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.1.1. U.S. BIOLOGICAL SAFETY CABINET MARKET, BY PRODUCT TYPE

12.1.1.2. U.S. BIOLOGICAL SAFETY CABINET MARKET, BY APPLICATION

12.1.1.3. U.S. BIOLOGICAL SAFETY CABINET MARKET, BY END USER

12.1.1.4. U.S. BIOLOGICAL SAFETY CABINET MARKET, BY DISTRIBUTION CHANNEL

12.1.2 CANADA

12.1.3 MEXICO

12.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, SWOT AND DBMR ANALYSIS

14 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGERS & ACQUISITIONS

14.3 NEW PRODUCT DEVELOPMENT & APPROVALS

14.4 EXPANSIONS

14.5 REGULATORY CHANGES

14.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 NORTH AMERICA BIOLOGICAL SAFETY CABINET MARKET, COMPANY PROFILE

15.1 ESCO MICRO PTE LTD.

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 NUAIRE

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 THERMO FISHER SCIENTIFIC

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 AIRCLEAN SYSTEMS, INC.

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 STERICOX INDIA PRIVATE LIMITED

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 LABCONCO

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 BAKER

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 BIGNEAT LTD.

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 TERRA UNIVERSAL. INC.

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 KEWAUNEE INTERNATIONAL GROUP

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 GERMFREE LABORATORIES, INC.

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 TELSTAR (AZBIL GROUP)

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 TOPAIR SYSTEMS

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 IGENE LABSERVE PRIVATE LIMITED

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 BIONICS SCIENTIFIC TECHNOLOGIES (P) LTD.

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 STERILE TECH INDIA

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 ALPHA LINEAR

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 SKAN AG

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 PHC CORPORATION

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 ENVIRCO

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 HAMILTON HEALTH SCIENCES

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 LABOGENE

15.22.1 COMPANY OVERVIEW

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 CRUMA

15.23.1 COMPANY OVERVIEW

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST Conclusion

16 RELATED REPORTS

17 CONCLUSION

18 QUESTIONNAIRE

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.