North America Bio Based Lubricants Market

Market Size in USD Million

CAGR :

%

USD

653.19 Million

USD

836.49 Million

2024

2032

USD

653.19 Million

USD

836.49 Million

2024

2032

| 2025 –2032 | |

| USD 653.19 Million | |

| USD 836.49 Million | |

|

|

|

|

Bio-Based Lubricants Market Size

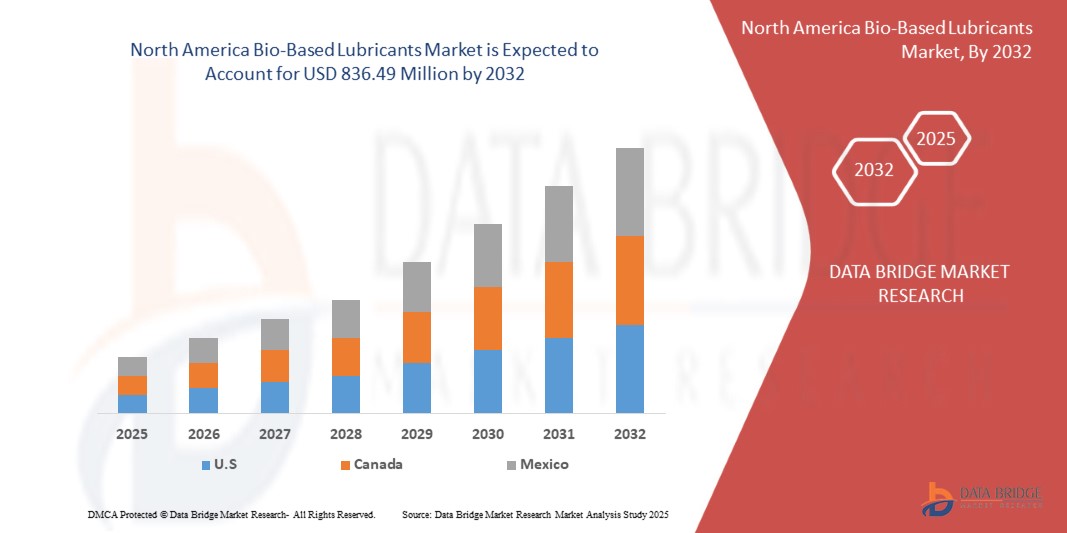

- The North America Bio-based Lubricants Market size was valued at USD 653.19 Million in 2024 and is expected to reach USD 836.49 Million by 2032, at a CAGR of 3.14% during the forecast period

- The market growth is largely fueled by rising of customers’ awareness about the profits of natural and organic ingredients in bio-based lubricants products

- Furthermore, the growing knowledge about personal grooming both in men and women. Because of the noticeable increase in the count of fashion aware people around the region are further anticipated to propel the growth of the bio-based lubricants market

Bio-Based Lubricants Market Analysis

- Bio-based lubricants are the lubricants that are manufactured by using biological ingredients and components.

- The bio-based lubricants are manufactured by chemical modification of plant-based oils and are used by a wide range of industry verticals.

- Like any other lubricant, the bio-based lubricants are used to reduce the frictions between the surfaces and further exhibit non-toxic and eco-friendly properties.

- U.S. dominates the bio-based lubricants market with the largest revenue share of 80.01% in 2025, characterized by strict environmental regulations and a growing preference for sustainable industrial solutions.

- Mexico is expected to be the fastest growing region in the Bio-based lubricants market during the forecast period due to rapid industrialization, increasing environmental awareness, and supportive policies in emerging economies

- The plant oil segment is expected to dominate the Bio-based lubricants market with a market share of 71.4% in 2025, driven by its superior lubricity, biodegradability, and low toxicity. Vegetable oils such as rapeseed, soybean, and sunflower are widely adopted due to their renewability and compatibility with environmental regulations

Report Scope and Bio-based lubricants market Segmentation

|

Attributes |

Bio-based lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bio-based lubricants market Trends

“Technological Advancements Enhancing Performance and Sustainability”

- A significant trend in the bio-based lubricants market is the continuous technological advancement aimed at improving product performance and sustainability.

- Innovations in bio-based formulations, including synthetic esters and vegetable oil derivatives, are enhancing product quality and expanding applications.

- These advancements are pivotal in expanding their application range, making them a viable option in more demanding and diverse industrial applications.

- Such innovations are making bio-lubricants more competitive with conventional alternatives, thereby fueling market growth.

Bio-based lubricants market Dynamics

Driver

“Stringent Environmental Regulations and Sustainability Goals”

- Governments worldwide are implementing strict environmental laws to lower pollution and promote sustainability, which is a major factor driving the growth of the bio-lubricants market.

- For instance, the renewable energy directive of the U.S. government promotes the use of bio-based products to meet climate goals.

- In the U.S., the USDA BioPreferred Program focuses on increasing the production and use of bio-based products, boosting demand for sustainable products, including bio-lubricants.

- With rising energy prices, many companies are shifting toward bio-lubricants to align with sustainability objectives and reduce environmental impact.

Restraint/Challenge

“High Production Costs and Limited Raw Material Availability”

- The cost of producing bio-lubricants is significantly higher than traditional petroleum-based lubricants due to expensive raw materials and complex refining processes.

- Obtaining certifications adds to the financial burden for manufacturers, further increasing production costs.

- Limited availability of raw materials like vegetable oils, rapeseed, soybean, and palm oil, which are susceptible to seasonal fluctuations and geopolitical conflicts, hinders market growth.

- Increased competition from the biofuel industry's high usage of these oils makes it more challenging for lubricant producers to obtain reasonably priced raw materials, affecting long-term pricing and production planning.

North America Bio-based Lubricants Market Scope

The market is segmented on the basis of raw material, application, and end user industry.

- By Raw Material

On the basis of raw material, the Bio-based Lubricants Market is segmented into plant oil, animal oil, and others. The plant oil segment dominates the largest market revenue share of 71.4% in 2025, driven by its superior lubricity, biodegradability, and low toxicity. Vegetable oils such as rapeseed, soybean, and sunflower are widely adopted due to their renewability and compatibility with environmental regulations. Their excellent oxidative stability and thermal performance support broad industrial and automotive adoption.

The animal oil segment is anticipated to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by improved refining techniques and circular economy initiatives. Derived from beef tallow and fish oils, these lubricants are gaining acceptance in niche industrial applications. Rising demand for cost-effective and biodegradable alternatives and expanding R&D into novel animal oil derivatives drive adoption across sectors such as machinery maintenance and marine applications.

- By Application

On the basis of application, the Bio-based Lubricants Market is segmented into hydraulic oil, metal working fluids, penetrating oils, grease, transformer oil, crankcase oils, engine oils, elevator hydraulic fluid, bar and chain oil, firearm lubricant, and others. The hydraulic oil segment held the largest market revenue share in 2025, attributed to high-volume consumption in industrial, construction, and agricultural equipment. Bio-based hydraulic oils provide excellent wear protection, corrosion resistance, and thermal stability, helping companies comply with sustainability standards and reduce environmental risk.

The metal working fluids segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increased use in automotive and manufacturing processes. Bio-based metalworking fluids offer reduced skin irritation, lower VOC emissions, and enhanced tool life. These benefits are prompting a shift from petroleum-based fluids to plant-derived alternatives, especially in the U.S., where worker safety and environmental impact are highly prioritized.

- By End User Industry

On the basis of end-user industry, the Bio-based Lubricants Market is segmented into power generation, automotive and other transportation, heavy equipment, food and beverage, metallurgy and metalworking, chemical manufacturing, and other end-user industries. The automotive and other transportation segment captured the largest market revenue share in 2025, driven by stringent CO₂ emission regulations, OEM mandates, and increased EV manufacturing. Bio-based lubricants are increasingly used in engine oils, transmission fluids, and gear oils to support sustainable mobility goals.

The heavy equipment segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by robust demand from construction, mining, and agriculture sectors. Bio-based lubricants minimize environmental contamination, especially in sensitive ecosystems. Their high viscosity index and biodegradability make them ideal for outdoor machinery and remote operations. Government initiatives promoting green lubricants and industry pressure to lower carbon footprints are accelerating adoption in this sector.

Bio-based lubricants market Analysis

- Consumers and industries in the region prioritize eco-friendly alternatives, prompting the substitution of conventional petroleum-based lubricants with bio-based options in automotive, industrial machinery, and marine applications.

- This growth is further supported by advancements in feedstock processing technologies, favorable government policies such as the EPA’s EPP program, and a strong focus on corporate sustainability goals among leading manufacturers and end users.

U.S. Bio-based lubricants market Insight

The U.S. Bio-based lubricants market captured the largest revenue share of 83.15% within North America in 2025, fueled by increasing industrial automation and the use of high-performance, biodegradable lubricants in agriculture, transport, and military sectors. Federal incentives and the USDA’s BioPreferred Program are playing a crucial role in adoption. Moreover, the U.S. automotive sector’s push toward sustainability, coupled with consumer awareness around carbon reduction, is spurring demand for engine oils, greases, and hydraulic fluids derived from renewable sources.

North America Bio-based Lubricants Market Players

The Bio-based lubricants Industry is primarily led by well-established companies, including:

- Shell (U.K.)

- BP (U.K.)

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- CASTROL LIMITED (U.K.)

- FUCHS (Germany)

- Total (France)

- Green Earth Technologies, Inc. (U.S.)

- Magna International Pte Ltd. (Singapore)

- Polnox Corp. (U.S.)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (India)

- MMXIX DSI Ventures, Inc. (U.S.)

- Biosynthetic Technologies (U.S.)

- Carl Bechem Lubricants India Private Limited (India/Germany)

- CITGO Petroleum Corporation (U.S.)

- ROCOL (U.K.)

- RSC Bio Solutions (U.S.)

- Albemarle Corporation (U.S.)

- Emery Oleochemicals (Malaysia/U.S.)

- PANOLIN AG (Switzerland)

Latest Developments in North America Bio-based Lubricants Market

- In April 2023, Exxon Mobil announced plans to invest USD 110 million in establishing a lubricant manufacturing facility in India. This plant, set to become operational by the end of 2025, will have the capacity to produce up to 159 million liters of lubricants annually. It aims to meet increasing demand across a variety of industries, including manufacturing, steel, power, mining, construction, and both commercial and passenger vehicle sectors.

- In July 2022, Chevron Corporation introduced a new synthetic grease that meets the 2013 Vessel General Permit (VGP) requirements for environmentally acceptable lubricants. This biodegradable grease is designed for broad applicability and features excellent flow properties, making it well-suited for centralized lubrication systems and supporting sustainability efforts.

- In December 2020, Axel Christiernsson launched ALASSCA 762 BD, a biodegradable heavy-duty grease that adheres to both the VGP regulations and the Swedish Standard 155470.0, providing a greener option for demanding industrial applications.

- In November 2020, Chevron and Novvi LLC revealed the production of their first fully renewable base oil at Novvi’s Deer Park facility in Houston, Texas. By upgrading processing systems and removing bottlenecks, the facility now operates independently, enabling the manufacture of entirely clean and sustainable base oils.

- In May 2020, FUCHS partnered with BASF to develop environmentally responsible lubricant solutions. As part of their collaboration, the companies conducted an Eco-Efficiency Analysis on mineral oil-based hydraulic fluids to support data-driven sustainability assessments. Their joint effort focuses on creating lubricants that support ecological stewardship.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Bio Based Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Bio Based Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Bio Based Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.