North America B2b Air Care Market

Market Size in USD Billion

CAGR :

%

USD

1,830,395.30 Billion

USD

2,591,955.35 Billion

2022

2030

USD

1,830,395.30 Billion

USD

2,591,955.35 Billion

2022

2030

| 2023 –2030 | |

| USD 1,830,395.30 Billion | |

| USD 2,591,955.35 Billion | |

|

|

|

North America B2B Air Care Market Analysis and Size

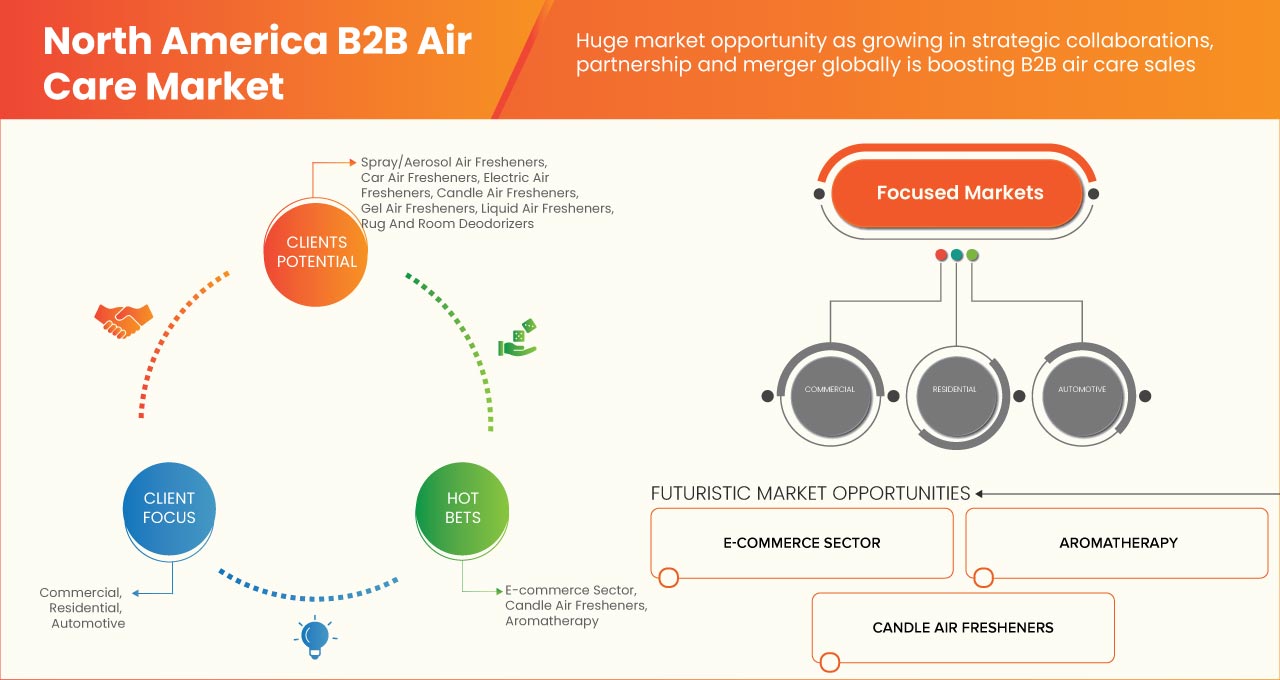

In the recent years, there has been an explosion in the many products offered in the North America B2B air care market, with novel and new delivery systems. They influence the aromatherapy sector and put much more emphasis on creating the perfect atmosphere for all occasions. The development of freshener sprays, both non-aerosol and aerosol, along with air-liquid wick-type products or freshener gels, offer a variety to different kinds of consumers or industrial products that can provide long-term fragrance distribution.

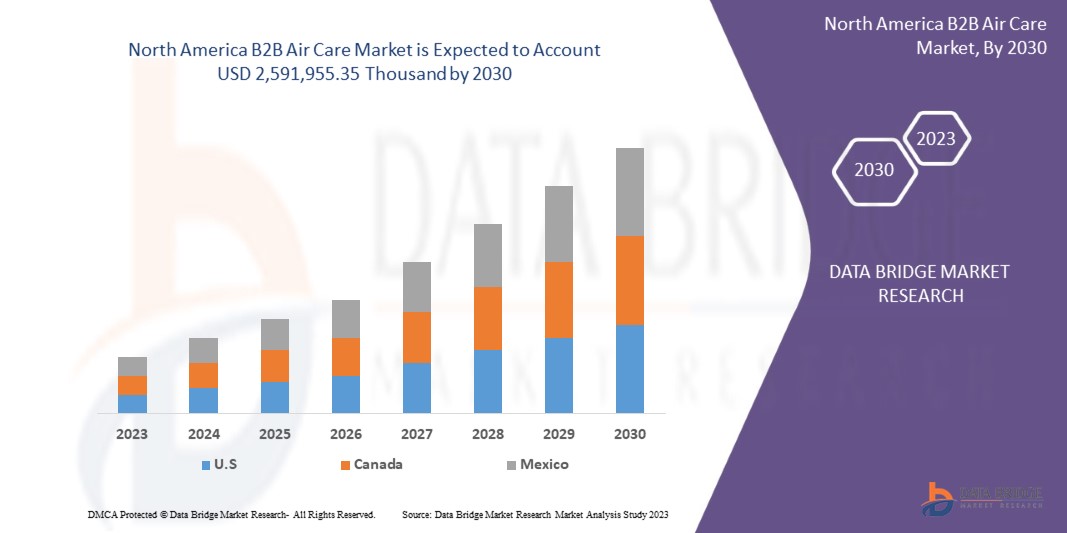

Data Bridge Market Research analyses that the North America air care market was valued at USD 1,830,395.30 thousand in 2022 and is expected to reach USD 2,591,955.35 thousand by 2030, registering a CAGR of 4.5% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Electric Air Fresheners, Candle Air Fresheners, Liquid Air Fresheners, Gel Air Fresheners, Spray/Aerosol Air Fresheners, Rug and Room Deodorizers, Car Air Fresheners and Others), Fragrance (Floral, Fruity, Vanilla, Spices & Herbs and Others), Price (Low, Medium and High), End User (Residential, Commercial, Automotive and Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

S.C. Johnson & Son Inc., CAR-FRESHNER, Air Delights, Inc., Rexair LLC, BEAUMONT PRODUCTS, INC., BALEV CORPORATION EOOD, Procter & Gamble, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, WD-40 Company., Newell Brands, Hamilton Beach Brands Holding Company., and Godrej Consumer Products Limited |

Market Definition

Air care products span various forms, such as diffusers, gels, candles, scented aerosol sprays, pump sprays, and plug-ins. These products are used to remove indoor malodours and to deliver pleasant scent experiences. An air freshener is a major product that typically emits fragrance to remove unpleasant odours in a room. It consists of several ingredients such as propellants, fragrances, and solvents such as glycol ethers, mineral oil, and 2-butoxyethanol that help neutralize an unpleasant odour.

North America B2B Air Care Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- RAPID URBANIZATION GLOBALLY

Urbanization is increasing rapidly and creating a sustainable demand for air care products. Due to the increase in population, the number of consumers also increases. World Bank data shows that 4.4 billion inhabitants live in cities across the globe. Due to increased awareness regarding air care products in the city population, the demand for air care products is increased significantly; hence, it is expected to act as a major driving factor for the growth of the North America b2b air care market.

In this era of urbanization, the world faces contaminated and impure air issues. There is always a need to have clean and pleasant air to smell, which is increasing as pollution levels rise across various parts of the globe. As such, demand for household air care products is also expected to rise steadily.

- INCREASING ADOPTION OF AIR CARE PRODUCTS IN AUTOMOTIVE SECTOR

There is increase in demand of auto mobile sector especially the XUV segment. There is always a need for odour eliminator in any vehicle. As the demand for automobile sector increases, it ultimately increases the demand for odour eliminators in cars and is expected to positively impact the growth of the North America b2b air care market.

In October 2022, India Brand Equity Foundation (IBEF) released a report regarding the increasing demand for the automobile sector. In this report, they mentioned that, in India, the total production of passenger vehicles, three wheelers, and two wheelers was 2,191,090 units. This proves that the penetration of the automobile sector is increasing daily in developing countries and is expected to make positive growth for North America b2b air care market

Restraints

- EFFECTS OF AIR CARE PRODUCTS ON THE ENVIRONMENT

If there are direct emissions from air fresheners combined with elements (such as ozone) already in the air can contribute to volatile organic compounds (VOCs). For example, this air freshener or odour eliminator, which creates emissions, can mix with naturally present indoor air molecules like ozone to create pollutants. Furthermore, fragranced items have been linked to environmental pollution, which is expected to restrain the North America b2b air care market. In another report by the University of Massachusetts Amherst, they specified that some air freshener products are described as "green" (such as organic or all-natural), but these terms lack regulatory or chemical definitions when used with air fresheners. They have referred to some studies comparing emissions of different air fresheners, which founds that all air fresheners, regardless of "green" claims, emit potentially hazardous compounds. Moreover, emissions from "green" air fresheners were not found to be significantly different from other fresheners.

Opportunity

- RAPID GROWTH IN THE COMMERCIAL AND RESIDENTIAL SECTOR

There is phenomenal growth in commercial and residential sector. Air fresheners and odour eliminators used in residential buildings. More growth in residential sector ultimately enhances the growth of the North America b2b air care market. ESRB, an organization responsible for macro prudential policy concerning the financial system of the European Union (EU), released a report in November 2018 regarding vulnerabilities in the EU commercial real estate sector. In this report, they mentioned that several EU countries are experiencing a combination of double-digit price growth in residential sector. Another report of international energy agency (IEA) mentioned that in 2021 the operation of buildings accounted for 30%. This states that the growth in residential sector is immense and is expected to be a reason for the growth of the North America b2b air care market.

Challenge

- LACK OF AWARENESS AMONG CONSUMERS TOWARDS AIR CARE PRODUCTS IN THE ASIA-PACIFIC REGION

There is lack of awareness among customers related to air care products and indoor pollution. In 2014, Jimma University release a case study regarding a survey on awareness of consumers about health problems of air fresheners. In this case study they have mentioned there is a lack of awareness among consumers about air care products, which tends to long-term indoor pollution. They also added that there is a lack of information about air care products and their ingredients, which implies health issues. This states that lack of awareness related to air care products among consumers is expected to challenge the growth of the North America b2b air care market.

Post-COVID-19 Impact on North America B2B Air Care Market

The North America B2B air care industry noted a gradual decrease in demand due to lockdown and COVID-19 governmental laws, as manufacturing facilities and services were closed. Even private and public development was called off. Moreover, the industry was also affected by halt of supply chain especially of raw materials used in the manufacturing process of air care products. Stringent government regulations for different industries, restrictions on trade & transportation were some of the top factors that had cause dent towards the growth of the market for B2B air care around the world in 2020 and in first two quarters of 2021. As the B2B air care production slowed down owing to the restrictions by the governments across the globe, the production was not meeting the demand in the first three quarters of 2020. Moreover, high demand/requirement for the B2B air care products in automotive and residential segment has been witnessed. However, as governing authorities begin to uplift these imposed lockdowns, the North America B2B air care market is anticipated to recover accordingly.

Recent Development

- In June 2022, SC Johnson & Son Inc. announced a partnership with North America Fund. This partnership helped the company boost its financials and ultimately positively impact the growth of the North America B2B air care market

- In August 2020, CAR–FRESHENER Corporation collaborated with Julius Sämann Ltd. This collaboration helped the company improve its finances and ultimately positively impact the growth of the North America B2B air care market

North America B2B Air Care Market Scope

North America B2B air care market is segmented on the basis of product type, fragrance, price and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Electric Air Fresheners

- Candle Air Fresheners

- Liquid Air Fresheners

- Gel Air Fresheners

- Spray/Aerosol Air Fresheners

- Rug and Room Deodorizers

- Car Air Fresheners

- Others

On the basis of product type, the North America B2B air care market is segmented into electric air fresheners, candle air fresheners, liquid air fresheners, gel air fresheners, spray/aerosol air fresheners, rug and room deodorizers, car air fresheners and others.

By Fragrance

- Floral

- Fruity

- Vanilla

- Spices & Herbs

- Others

On the basis of Fragrance, the North America B2B air care market is segmented into floral, fruity, vanilla, spices & herbs and others

By Price

- Low

- Medium

- High

On the basis of price, the North America B2B air care market is segmented into low, medium and high.

By End User

- Residential

- Commercial

- Automotive

- Others

On the basis of the end user, the North America B2B air care market is segmented into residential, commercial, automotive and others.

North America B2B Air Care Market Regional Analysis/Insights

North America B2B air care market is analysed, and market size insights and trends are provided by region, product, distribution channel, demographics, and price range, as referenced above.

North America B2B air care market is further segmented into U.S., Canada and Mexico.

U.S. dominates in the North America region due to high demand of air care products. Additionally, rapid growth in the commercial and residential sector is expected to act as a driving factor for the growth of the market.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America B2B Air Care Market Share Analysis

North America B2B air care Market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America B2B air care Market.

Some of the major players operating in the North America B2B air care market are S.C. Johnson & Son Inc., CAR-FRESHNER, Air Delights, Inc., Rexair LLC, BEAUMONT PRODUCTS, INC., BALEV CORPORATION EOOD, Procter & Gamble, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, WD-40 Company., Newell Brands, Hamilton Beach Brands Holding Company., and Godrej Consumer Products Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA B2B AIR CARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 PRODUCT TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.2 GOVERNMENT’S ROLE

4.2.1 ANALYST RECOMMENDATIONS

4.3 PESTEL ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 LEGAL FACTORS

4.3.5 TECHNOLOGICAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 RAW MATERIAL COVERAGE

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.7.1 PRODUCTION CONSUMPTION

4.7.2 PRODUCTION CAPACITY

4.8 IMPORT-EXPORT SCENARIO

4.9 PRICE INDEX

4.1 PORTER'S FIVE FORCES ANALYSIS

4.11 VENDOR SELECTION CRITERIA

4.12 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID URBANIZATION NORTH AMERICALY

5.1.2 INCREASING ADOPTION OF AIR CARE PRODUCTS IN THE AUTOMOTIVE SECTOR

5.1.3 RISING DEMAND FOR CANDLE AIR FRESHENERS

5.1.4 INCREASING DISPOSAL INCOME OF CONSUMERS

5.1.5 INCREASING INNOVATIONS IN AIR FRESHENERS

5.2 RESTRAINTS

5.2.1 EFFECTS OF AIR CARE PRODUCTS ON THE ENVIRONMENT

5.2.2 HIGH PRODUCTION COST OF AIR CARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RAPID GROWTH IN THE COMMERCIAL AND RESIDENTIAL SECTOR

5.3.2 SURGE IN STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND MERGER

5.3.3 RISING DEMAND FOR THE E-COMMERCE SECTOR

5.3.4 RISE IN CONSUMER PREFERENCE TOWARD AROMATHERAPY

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS TOWARDS AIR CARE PRODUCTS IN THE ASIA-PACIFIC REGION

5.4.2 HEALTH PROBLEMS ASSOCIATED WITH AIR CARE PRODUCTS

6 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SPRAY/AEROSOL AIR FRESHENERS

6.2.1 FLORAL

6.2.2 VANILLA

6.2.3 FRUITY

6.2.4 SPICES AND HERBS

6.2.5 OTHERS

6.3 CAR AIR FRESHENERS

6.3.1 FLORAL

6.3.2 VANILLA

6.3.3 FRUITY

6.3.4 SPICES AND HERBS

6.3.5 OTHERS

6.4 ELECTRIC AIR FRESHENERS

6.4.1 FLORAL

6.4.2 VANILLA

6.4.3 FRUITY

6.4.4 SPICES AND HERBS

6.4.5 OTHERS

6.5 CANDLE AIR FRESHENERS

6.5.1 FRUITY

6.5.2 SPICES AND HERBS

6.5.3 VANILLA

6.5.4 FLORAL

6.5.5 OTHERS

6.6 GEL AIR FRESHENERS

6.6.1 FRUITY

6.6.2 VANILLA

6.6.3 FLORAL

6.6.4 SPICES AND HERBS

6.6.5 OTHERS

6.7 LIQUID AIR FRESHENERS

6.7.1 FLORAL

6.7.2 VANILLA

6.7.3 FRUITY

6.7.4 SPICES AND HERBS

6.7.5 OTHERS

6.8 RUG AND ROOM DEODORIZERS

6.8.1 FLORAL

6.8.2 VANILLA

6.8.3 FRUITY

6.8.4 SPICES AND HERBS

6.8.5 OTHERS

6.9 OTHERS

7 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE

7.1 OVERVIEW

7.2 FLORAL

7.3 VANILLA

7.4 FRUITY

7.5 SPICES & HERBS

7.6 OTHERS

8 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA B2B AIR CARE MARKET, BY END USER

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 OFFICES

9.2.2 BUILDINGS

9.2.3 OTHERS

9.3 RESIDENTIAL

9.3.1 BEDROOMS

9.3.2 WASHROOMS

9.3.3 OTHERS

9.4 AUTOMOTIVE

9.4.1 PRIVATE CARS

9.4.2 COMMERCIAL CARS

9.5 OTHERS

10 NORTH AMERICA B2B AIR CARE MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA B2B AIR CARE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILINGS

13.1 RECKITT BENCKISER GROUP PLC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 BRAND PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 S.C. JOHNSON & SON INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 BRAND PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 PROCTOR & GAMBLE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 BRAND PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NEWELL BRANDS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 BRAND PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 HENKEL AG & CO. KGAA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 BRAND PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AIR DELIGHT

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BALEV CORPORATION EOOD

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BEAUMONT PRODUCTS, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 BRAND PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CAR-FRESHNER

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 GODREJ CONSUMER PRODUCTS LIMITED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HAMILTON BEACH BRANDS HOLDING COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 BRAND PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 REXAIR LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 WD-40 COMPANY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 BRAND PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 AIR FRESHENER IMPORT DATA AND ITS HS CODE FOR THE U.S.

TABLE 2 AIR FRESHENER IMPORT DATA AND ITS HS CODE FOR INDIA

TABLE 3 AIR FRESHENER EXPORT DATA AND ITS HS CODE FOR INDIA

TABLE 4 PRICE RANGE OF THE AIR CARE PRODUCTS

TABLE 5 VARIOUS B2B AIR CARE REGULATORY STANDARDS ARE AS FOLLOWS:

TABLE 6 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 8 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 9 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 11 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 14 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 17 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 20 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 23 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 26 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RUG AND ROOM DEODORIZER IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 29 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 32 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA FLORAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA FLORAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 35 NORTH AMERICA VANILLA IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA VANILLA IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 37 NORTH AMERICA FRUITY IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA FRUITY IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 39 NORTH AMERICA SPICES & HERBS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA SPICES & HERBS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 41 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 43 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA LOW IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEDIUM IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA HIGH IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 49 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 52 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 55 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 61 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNIT)

TABLE 63 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 64 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 66 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 67 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 76 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 77 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 80 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 81 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 86 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 87 U.S. SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 96 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 97 U.S. B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 100 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 101 U.S. COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 106 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 107 CANADA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 110 CANADA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 111 CANADA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 112 CANADA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 113 CANADA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 114 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 115 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 116 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 117 CANADA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 118 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 119 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 120 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 121 CANADA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 CANADA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 CANADA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 126 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 127 MEXICO SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 129 MEXICO ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 130 MEXICO CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 131 MEXICO GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 132 MEXICO LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 133 MEXICO RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 134 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 135 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 136 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 137 MEXICO B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 138 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 139 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 140 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 141 MEXICO COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA B2B AIR CARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA B2B AIR CARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA B2B AIR CARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA B2B AIR CARE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA B2B AIR CARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA B2B AIR CARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA B2B AIR CARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA B2B AIR CARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA B2B AIR CARE MARKET: SEGMENTATION

FIGURE 10 RAPID URBANIZATION IS EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA B2B AIR CARE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 ELECTRIC AIR FRESHENERS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA B2B AIR CARE MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA B2B AIR CARE MARKET

FIGURE 13 NORTH AMERICA B2B AIR CARE MARKET: BY PRODUCT TYPE, 2022

FIGURE 14 NORTH AMERICA B2B AIR CARE MARKET: FRAGRANCE, 2022

FIGURE 15 NORTH AMERICA B2B AIR CARE MARKET: BY PRICE, 2022

FIGURE 16 NORTH AMERICA B2B AIR CARE MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA B2B AIR CARE MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA B2B AIR CARE MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 22 NORTH AMERICA B2B AIR CARE MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.