North America Automotive DC-DC Converters Market Analysis and Size

The introduction of power semiconductors and integrated circuits made it economically viable by use of technique. Although by 1976 transistor car radio receivers did not require high voltages, some radio operators continued to use vibrator supplies and dynamotors for mobile transceivers requiring high voltages although transistorized power supplies were available. Since then, the market demand for increased power density has driven the developments of many DC-DC converters to convert a source of direct current (DC) from one voltage level to another. The adoption of DC-DC converters has increased in the past three years with the increasing adoption of IoT, increasing demand for enhanced power density, and the increasing adoption of smart grids, energy storage systems, & electric automobiles. The introduction and implementation of advanced technologies is expected to propel the demand for DC-DC converters. As a result, the DC-DC converter market is expected to exhibit higher growth rate during the forecast period.

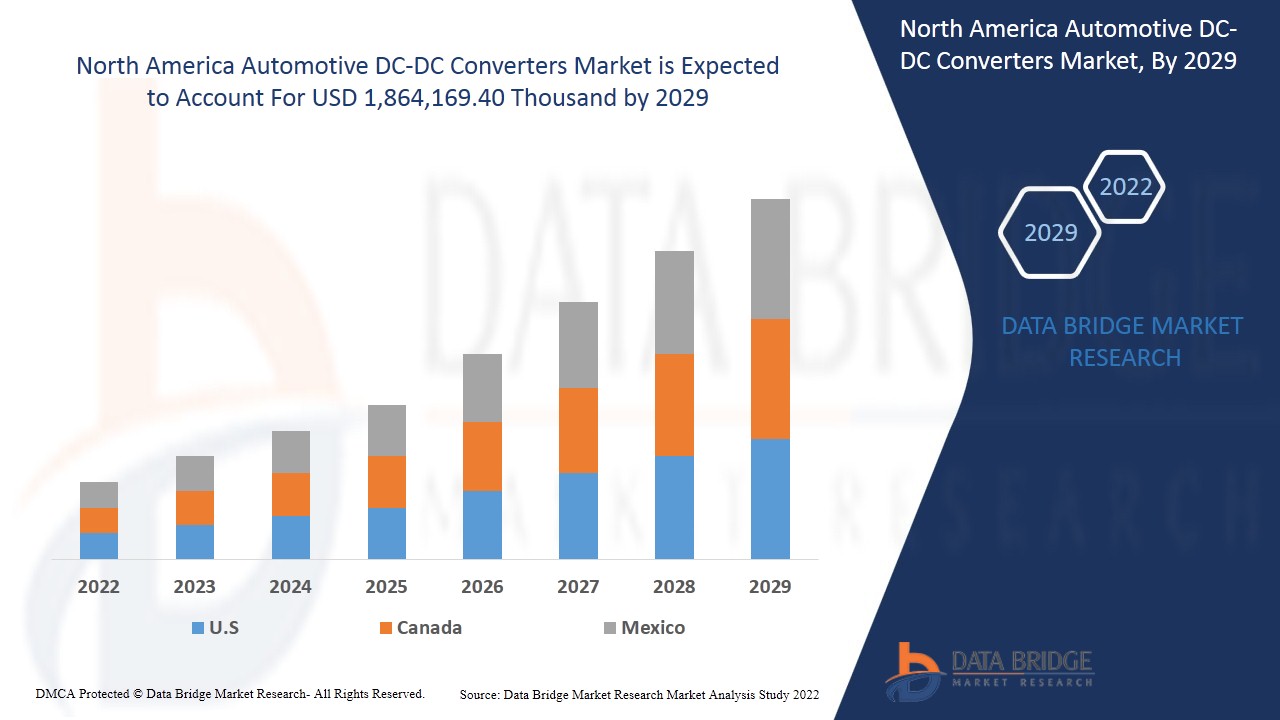

Data Bridge Market Research analyses that the North America automotive DC-DC converters market is expected to reach the value of USD 1,864,169.40 thousand by 2029, growing at a CAGR of 28.7% in the forecast year of 2022-2029. The automotive DC-DC converters market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

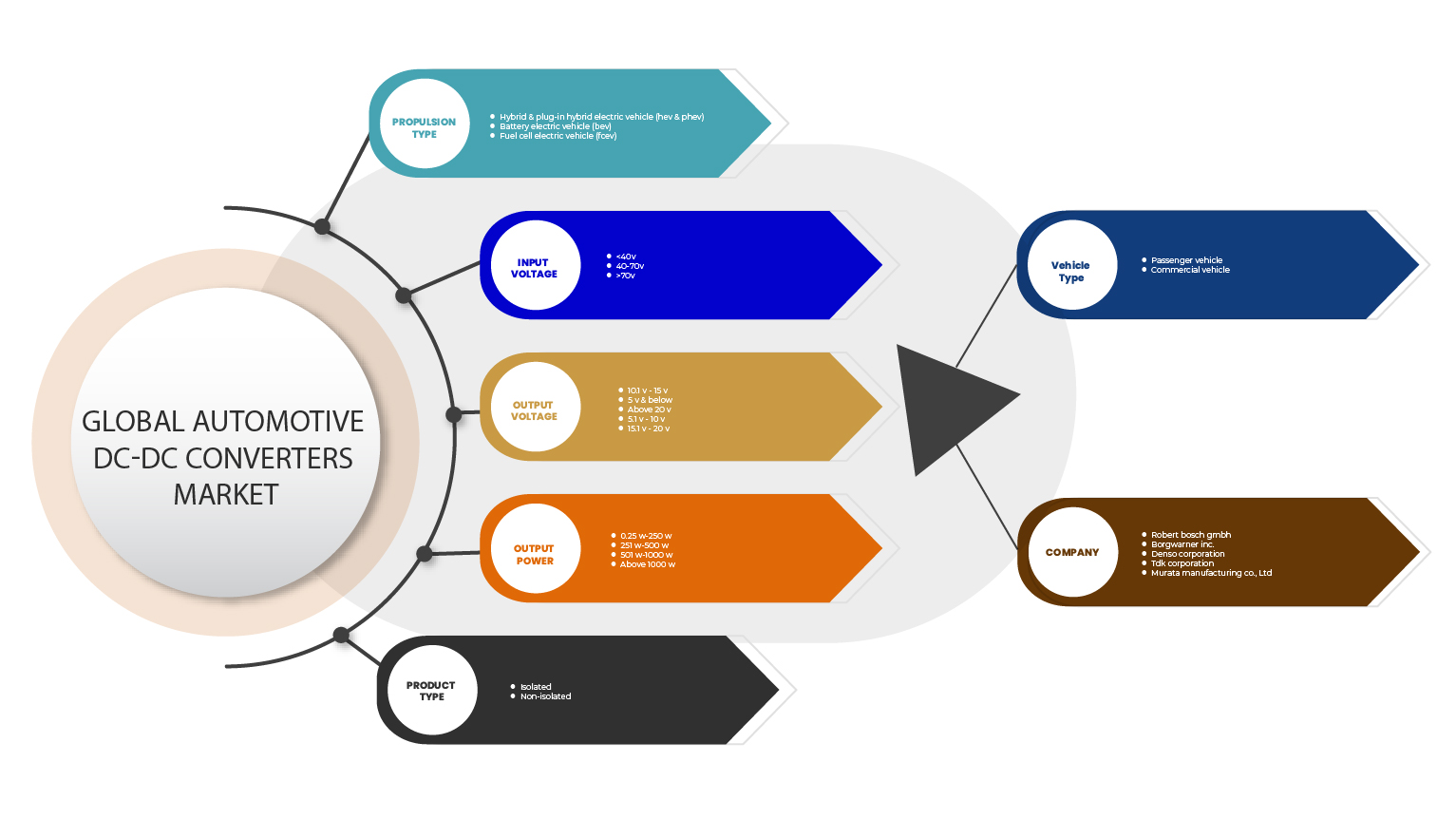

By Product Type (Isolated, Non-Isolated), Input Voltage (Below 40 V, 40 V - 70 V, Above 70 V), Output Voltage (10.1 V - 15 V, 5 V & Below, 5.1 V - 10 V, 15.1 V - 20 V, Above 20 V), Output Power (0.25 W - 250 W, 251 W - 500 W, 501 W - 1000 W, Above 1000 W),Propulsion Type (Hybrid & Plug-In Hybrid Electric Vehicle (HEV & PHEV), Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV)), Vehicle Type (Passenger Vehicle, Commercial Vehicle) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

MORNSUN Guangzhou Science & Technology Co.,Ltd, Robert Bosch GmbH, Continental AG, Sinpro Electronics Co., Ltd, Texas Instruments Incorporated, Infineon Technologies AG, DENSO CORPORATION, Vicor Corporation, RECOM Power GmbH, TDK Corporation, Vitesco Technologies, Deutronic Elektronik GmbH, Murata Manufacturing Co., Ltd, STMicroelectronics, Semiconductor Components Industries, LLC, TOYOTA INDUSTRIES CORPORATION, Inmotion, SHINDENGEN ELECTRIC MANUFACTURING CO., LTD, BorgWarner Inc., & Skyworks Solutions Inc., among others. |

Market Definition

Automotive DC-DC converter comprises inductors, microcontroller units (MCUs), and magnetic core components that are encompassed in a block design for integration into vehicles. The DC-DC converter is attached to an automobile's ignition system to effectively control the engine's restart and shutdown in order to cut emissions. A DC-DC converter runs within a set voltage range to power a myriad of onboard electronic equipment, since the integrated infotainment system aboard an automobile requires a steady supply of electricity of roughly 12V delivered by the powertrain.

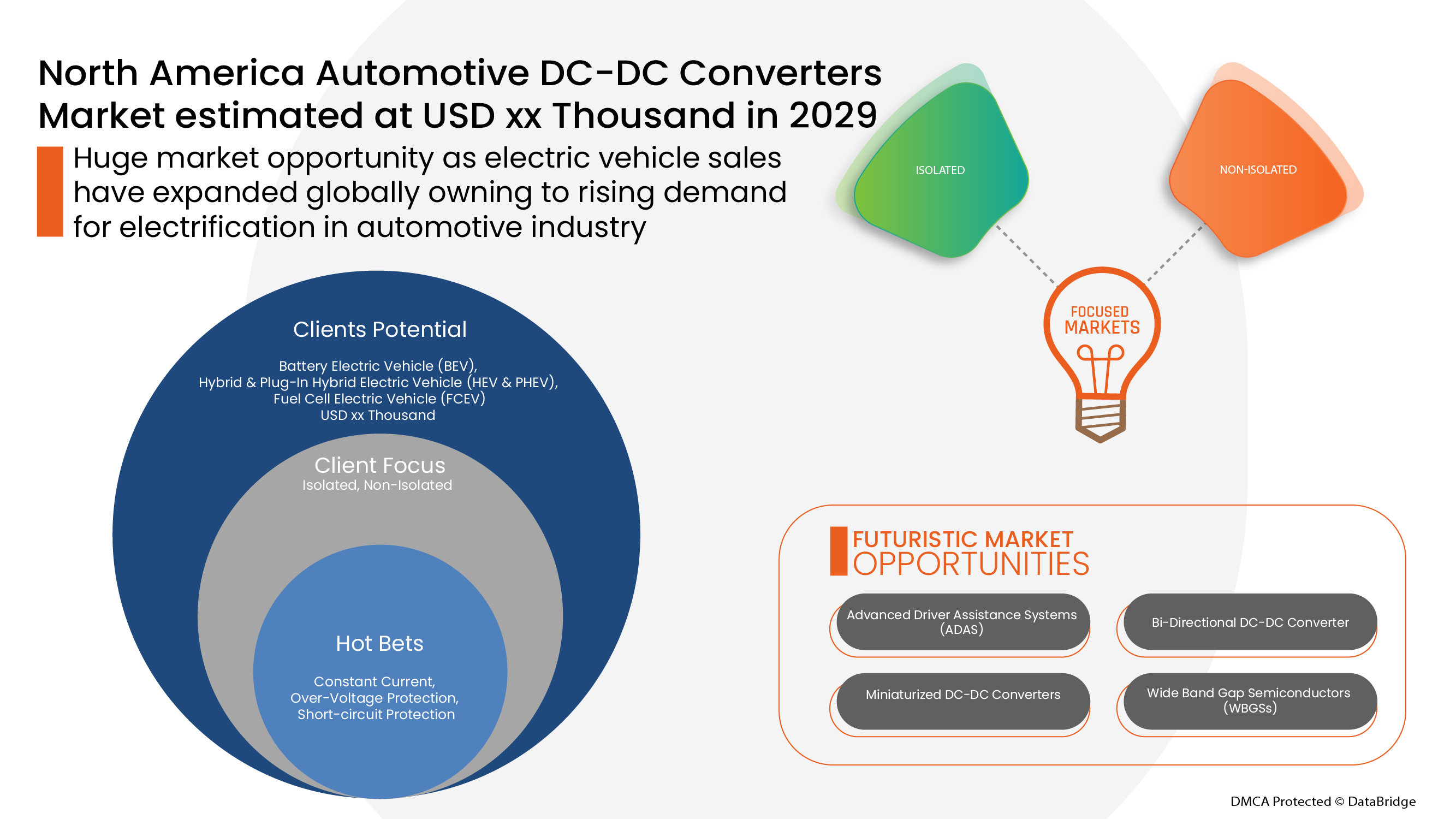

DC-DC converters mainly play an important role in isolation and voltage conversion. The proliferation of advanced driver-assistance systems (ADAS) and in-cabin infotainment has turned vehicles into complex electronic systems on wheels that require multi-level, and noise-free DC-DC converters are fueling the growth of the market to an extent.

Automotive DC-DC Converters Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increase in Sales of Electric Vehicle Across the Region

The automotive industry is showing an enormous growth over the years owing to rising demand for luxurious electric vehicles. Some of the factors driving the sales of the electric vehicles include stringent government regulations towards vehicles emissions, increasing demand for high performance and low emission. It is reported by IEA (international Energy Agency) that consumers had spent USD 120 billion on electric car purchases in 2020, a 50% increase from 2019, which breaks down to a 41% increase in sales of electric cars. This resulted in increased demand for DC-DC converters in EVs.

- Rise in Popularity of Mobility as a service (MaaS) Model

The concept of Mobility as a Service (MaaS) has been gaining popularity within the electric automotive sector. Increasing number of manufacturers, Service providers, companies, policy makers and the public were focusing their attention on electric mobility for convenience.

Mobility-as-a-Service describes a shift away towards mobility provided as a service from personally-owned modes of transportation due to various factors like increasing pollution levels, rapid urbanization, maintenance cost of vehicles and unavailability and restrictions of parking space in big cities around the world.

- R&D Efforts to Integrate DC-DC Converters into Commercial Vehicles

The global adoption of stringent emission norms for electric vehicles is motivating the automotive OEMs (Original equipment manufacturers) to integrate advanced technologies in their vehicle offerings to enhance their fuel efficiency. This has resulted in the development of electric drivetrain for medium and heavy commercial vehicles (M&HCVs). The electric drivetrain needs the integration of a DC-DC converter to ensure higher efficiency and better vehicle performance. Furthermore, the increase in sales of commercial vehicles has driven component manufacturers to upgrade their product offerings.

- Higher Cost of Electronic Component in Electric Vehicle

The electric vehicles are best suitable for transportation and also for the environment as it would help to control the pressure over the air pollution. But the initial cost of electric vehicles are higher as compared to that of gasoline powered engine vehicles because it includes technologically upgraded components which has no harm to the environment, however the operational costs of the electric vehicles are cheaper than the gasoline powered engine vehicles.

- Design Complications in DC-DC Converters

Generally, vehicle electrification is focused on the powertrain driven by electricity and its auxiliary systems such as on-board and off-board charging systems. In addition, an increasing electrical content and complexity coupled with shorter design cycles requires an optimum design team to continually improve the design methods.

Post COVID-19 Impact on Automotive DC-DC Converters Market

COVID-19 created a major impact on the automotive DC-DC converters market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the automotive DC-DC converters market is attributed to the increasing adoption of electrification of automotive industry across all regions and countries. Although automotive industry faced major issues during pandemic, the electric vehicle sales jumped to higher levels in post pandemic scenario.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the DC-DC converters. With this, the companies will bring advanced technologies to the market. In addition, government initiatives for usage of electric vehicle has led to the market's growth

Recent Development

- In February 2022, RECOM Power GmbH introduced new product range of fully custom, semi-custom, and modified-standard AC/DC and DC/DC converters from low power up to a kilowatt.

- In January 2022, Continental AG has enhanced user experience in the new BMW iX with high computing power and the large-scale display landscape in the vehicle. This had further helped the company to bridge the gap between integrated and centralized vehicle architecture of the future

North America Automotive DC-DC Converters Market Scope

The automotive DC-DC converters market is segmented on the basis of product type, input voltage, output voltage, output power, propulsion type and vehicle type. The growth amongst these segments will help you analyze growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Isolated

- Non-Isolated

On the basis of product type, the North America automotive DC-DC converters market is segmented into isolated and non-isolated.

Input Voltage

- Below 40 V

- 40 V - 70 V

- Above 70 V

On the basis of input voltage, the North America automotive DC-DC converters market has been segmented into below 40 V, 40 V - 70 V, above 70 V.

Output Voltage

- 10.1 V - 15 V

- 5 V & Below

- 5.1 V - 10 V

- 15.1 V - 20 V

- Above 20 V

On the basis of output voltage, the North America automotive DC-DC converters market has been segmented into 10.1 V - 15 V, 5 V & below, 5.1 V - 10 V, 15.1 V - 20 V, above 20 V.

Output Power

- 0.25 W - 250 W

- 251 W - 500 W

- 501 W - 1000 W

- Above 1000 W

On the basis of output power, the North America automotive DC-DC converters market has been segmented into 0.25 W - 250 W, 251 W - 500 W, 501 W - 1000 W, above 1000 W.

Propulsion Type

- Hybrid & Plug-In Hybrid Electric Vehicle (HEV & PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

On the basis of propulsion type, the North America automotive DC-DC converters market has been segmented into hybrid & plug-in hybrid electric vehicle (HEV & PHEV), battery electric vehicle (BEV), fuel cell electric vehicle (FCEV).

Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

On the basis of vehicle type, the North America automotive DC-DC converters market has been segmented into passenger vehicle, commercial vehicle.

Automotive DC-DC Converters Market Regional Analysis/Insights

The North America automotive DC-DC converters market is analyzed and market size insights and trends are provided by country, product type, input voltage, output voltage, output power, propulsion type and vehicle type as referenced above.

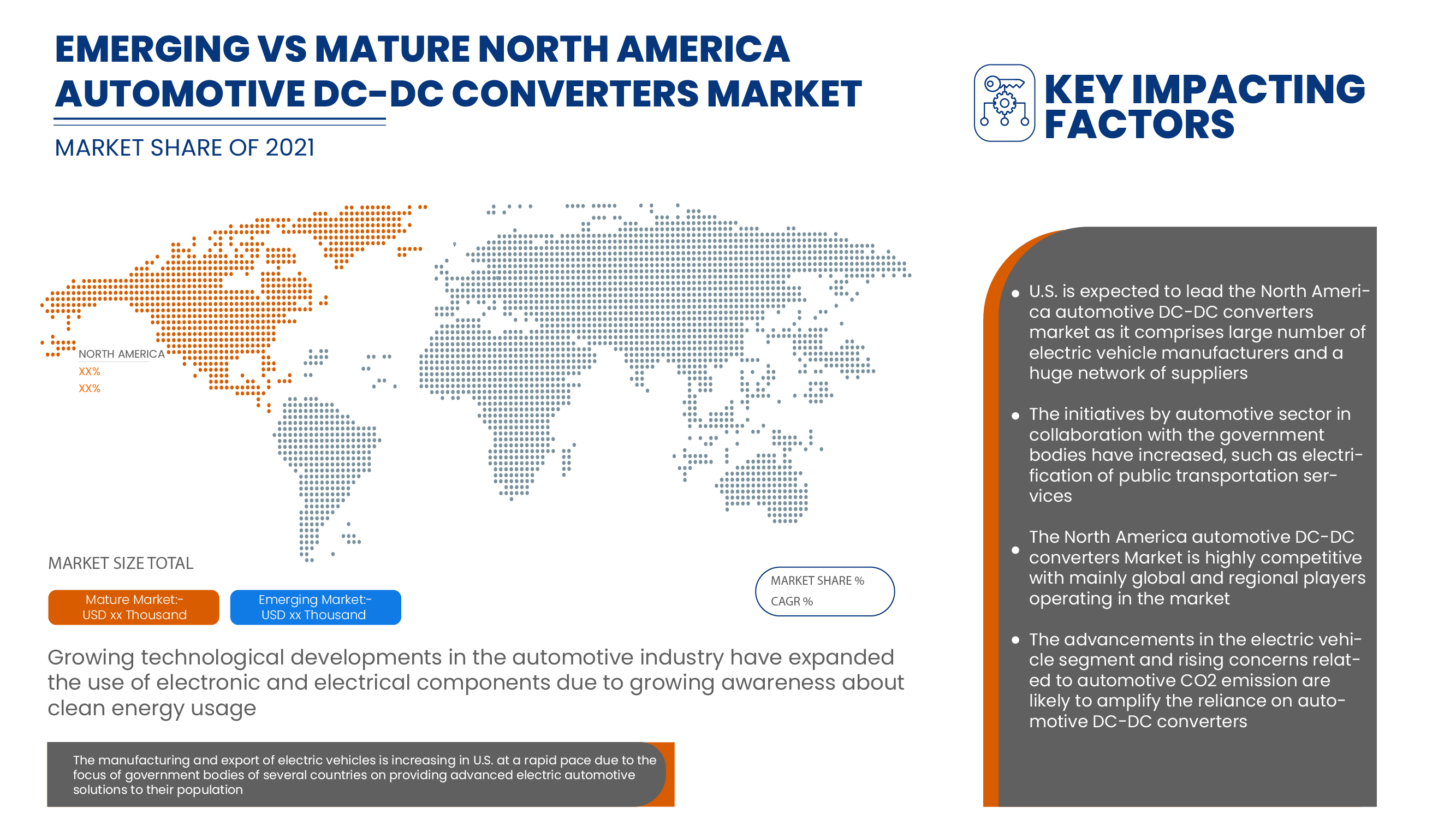

The countries covered in the automotive DC-DC converters market report are the U.S., Canada and Mexico in North America.

The U.S. dominates the North America automotive DC-DC converters market, major reason behind this is rise in electrification of automotive industry which contributes to significant growth in demand for electrical and electronics components, including DC-DC converters.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive DC-DC Converters Market Share Analysis

The North America automotive DC-DC converters market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America automotive DC-DC converters market.

Some of the major players operating in the North America automotive DC-DC converters market are Robert Bosch GmbH, BorgWarner Inc., DENSO Corporation, TDK Corporation, Murata Manufacturing Co., Ltd., TOYOTA INDUSTRIES CORPORATION, Vitesco Technologies Group AG, Infineon Technologies AG, STMicroelectronics, Skyworks Solutions, Inc., MORNSUN Guangzhou Science & Technology Co. Ltd., SHINDENGEN ELECTRIC MANUFACTURING CO., LTD., Vicor Corporation, Texas Instruments Incorporated, Continental AG, Semiconductor Components Industries, LLC, Inmotion Technologies AB, Deutronic Elektronik GmbH, Sinpro Electronics Co., Ltd., RECOM Power GmbH, among othersX'.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MARKET CHALLENGE MATRIX

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 MARKET PRODUCT TYPE COVERAGE GRID

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN SALES OF ELECTRIC VEHICLES WORLDWIDE

5.1.2 RISE IN POPULARITY OF MOBILITY AS A SERVICE (MAAS) MODEL

5.1.3 GROWING ADOPTION OF ENERGY-EFFICIENT VEHICLES TO PROMOTE LOW CO2 EMISSION

5.1.4 RISE IN EXPANSION OF ADVANCED DRIVING ASSISTANCE SYSTEMS (ADAS)

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATORY COMPLIANCE AND SAFETY STANDARDS FOR AUTOMOBILE INDUSTRIES

5.2.2 HIGHER COST OF ELECTRONIC COMPONENTS IN ELECTRIC VEHICLE

5.3 OPPORTUNITIES

5.3.1 RISE IN ACQUISITION AND PARTNERSHIP FOR VARIOUS PRODUCT DEVELOPMENT AMONG ORGANIZATIONS

5.3.2 R&D EFFORTS TO INTEGRATE DC-DC CONVERTERS INTO COMMERCIAL VEHICLES

5.3.3 HIGHER FLUCTUATION IN FUEL PRICES IS INSISTING CONSUMERS TO OPT FOR ELECTRIC VEHICLE

5.3.4 DEVELOPMENT OF MINIATURIZED LIGHT WEIGHT DC-DC CONVERTERS

5.4 CHALLENGES

5.4.1 DESIGN COMPLICATIONS IN DC-DC CONVERTERS

5.4.2 AVAILABILITY OF LOW QUALITY OF DC-DC CONVERTERS ON GREY MARKET

6 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ISOLATED

6.3 NON-ISOLATED

7 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE

7.1 OVERVIEW

7.2 40 V-70 V

7.3 BELOW 40 V

7.4 ABOVE 70 V

8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE

8.1 OVERVIEW

8.2 10.1 V - 15 V

8.3 5 V & BELOW

8.4 ABOVE 20 V

8.5 5.1 V-10 V

8.6 15.1 V-20 V

9 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER

9.1 OVERVIEW

9.2 0.25 W-250 W

9.3 251 W-500 W

9.4 501 W-1000 W

9.5 ABOVE 1000 W

10 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE

10.1 OVERVIEW

10.2 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

10.3 BATTERY ELECTRIC VEHICLE (BEV)

10.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

11 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER VEHICLE

11.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.3 COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 LIGHT COMMERCIAL VEHICLE

11.3.1.2 MEDIUM & HEAVY COMMERCIAL VEHICLE

11.3.2 BY PROPULSION TYPE

11.3.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.3.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

12 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVLOPMENT

15.2 BORGWARNER INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVLOPMENTS

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 TDK CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MURATA MANUFACTURING CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DEUTRONIC ELEKTRONIK GMBH

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 INFINEON TECHNOLOGIES AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INMOTION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RECOM POWER GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 SINPRO ELECTRONICS CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SKYWORKS SOLUTIONS INC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVLOPMENTS

15.16 STMICROELECTRONICS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 TEXAS INSTRUMENTS INCORPORATED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TOYOTA INDUSTRIES CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 VICOR CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VITESCO TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA NON-ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA 40 V-70 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA BELOW 40 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA ABOVE 70 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA 10.1 V - 15 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA 5 V & BELOW IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA ABOVE 20 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA 5.1 V - 10 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA 15.1 V - 20 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA 0.25 W-250 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA 251 W-500 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 501 W-1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ABOVE 1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 41 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 42 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 43 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 U.S. PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 50 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 51 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 52 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CANADA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 59 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 60 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 61 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 MEXICO PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 MEXICO COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MEXICO COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: PRODUCT TYPE COVERAGE GRID

FIGURE 7 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN SALES OF ELECTRIC VEHICLES ACROSS THE REGION IS EXPECTED TO DRIVE THE NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET

FIGURE 15 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 16 CHANGES IN VEHICLE DATA IN-LINE WITH THE MOBILITY SERVICES

FIGURE 17 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY INPUT VOLTAGE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT VOLTAGE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT POWER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PROPULSION TYPE, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.