North America Automotive Battery Thermal Management System Market Analysis and Insights

Electric vehicles are the promising renewable substitute to gasoline power-based vehicles for protecting the environment. Many governments take initiatives to promote electric vehicles and offer redemption tax rebates. The rise in the market of electric vehicles in the European and American markets as the technology is rapidly upgrading is increasing the demand for the North America automotive battery thermal management system market.

Some of the factors anticipated to propel the market growth are increasing demand for electric vehicles, incentives and subsidies by the government for electric vehicles, and increasing environmental concerns among others. However, high upfront costs and design complexities of the components are the restraints that may hamper the market's growth. Adopting new technologies such as solid-state batteries may act as market growth opportunities. Battery performance in different environmental conditions may challenge market growth.

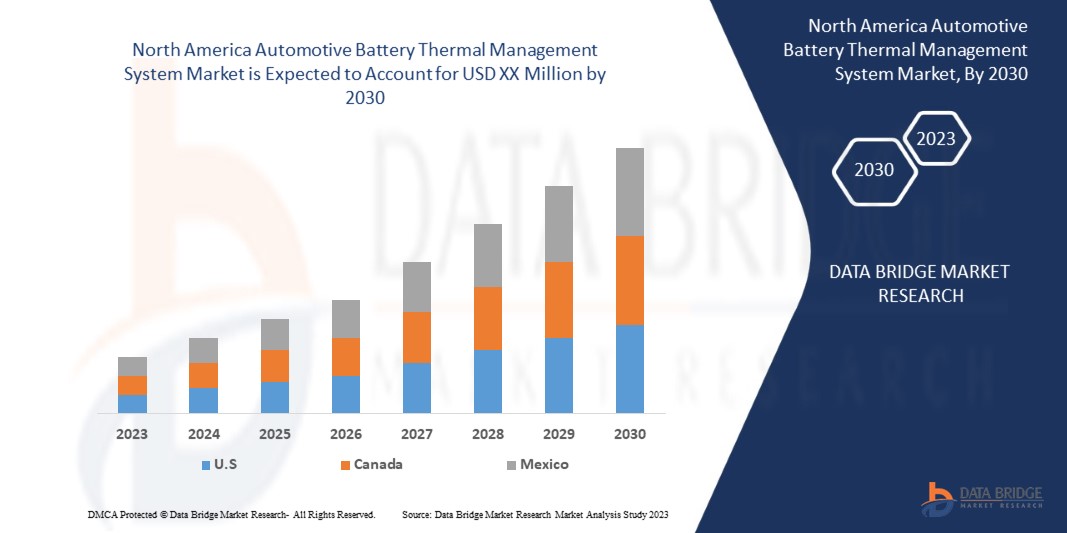

Data Bridge Market Research analyses that the North America automotive battery thermal management system market will grow at a CAGR of 24.4% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2020-2016) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Battery Capacity (Less Than 100 kWh, 100 to 200 kWh, and More Than 200 kWh), Type (Liquid Cooling and Heating, PCM, and Air Cooling and Heating), Propulsion (Hybrid Electric Vehicle, Battery Electric Vehicle, PHEV & FCV), Technology (Active, Passive), Vehicle Type (Automotive, Military, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Infineon Technologies AG, STMicroelectronics, Sensata Technologies, Inc., Renesas Electronics Corporation, Panasonic Holdings Corporation, LEM International SA, Orion BMS, Continental AG, VOSS Automotive GmbH, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, LG Energy Solution, DENSO Corporation among others |

Market Definition

The thermal management system in an automotive battery is the solution that helps in managing the heat generated during the electrochemical processes occurring in cells, allowing the battery to operate safely and efficiently. An electric vehicle requires effective thermal management systems to keep battery temperatures in the correct range and prevent the temperature from fluctuating inside the battery pack. Thus, thermal management systems play a vital role in a vital role in the control of the battery's thermal behavior.

The adoption of electric vehicles is rising North America due to their zero-emission and high tank-to-wheels efficiency. This has made it necessary to have a proper battery management system to reach maximum performance when operating under various conditions. In addition, the rising trend towards increasing charging rates, which would allow faster charging and longer trips, has raised the demand for more efficient thermal management in EVs.

North America Automotive Battery Thermal Management System Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

INCREASE IN DEMAND FOR ELECTRIC VEHICLES

The automotive industry has grown enormously due to the rising demand for luxurious electric vehicles. Some of the factors driving the sales of electric vehicles include stringent government regulations towards vehicle emissions and increasing demand for fuel-efficient, high-performance, and low-emission vehicles.

-

INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR THERMAL BATTERIES IN ELECTRIC VEHICLES

An increase in pollution and scarcity of resources, particularly in the automotive sector, has enabled the government to take action for environmental protection. This is leading to the shift of trends in the automotive industry from normal motorized vehicles to electric hybrid vehicles for environmental protection.

Opportunity

-

INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

Strategic decisions such as partnerships and investments help companies to work toward the desired goal. As the marketplace is changing and evolving, customers are consistently looking for newly developed and advanced products.

Restraint/Challenge

- HIGH UPFRONT COST

Thermal batteries are best suited for electric vehicles as they have a less environmental impact and help control air pollution. However, the initial cost of thermal batteries used in automotive industries is higher than others because it includes technologically upgraded components that do not harm the environment. In contrast, the operational costs of thermal batteries in electric vehicles are cheaper than normal battery engine vehicles.

Recent Development

- In June 2021, GENTHERM announced they are the lead investor in Carrar, an Israel-based technology developer of advanced thermal management systems for the electric mobility market. The investment will help the company to expand its Battery Performance Solutions portfolio with a technology that can improve EV safety, performance, and charging speed.

North America Automotive Battery Thermal Management System Market Scope

The North America automotive battery thermal management system market is segmented based on battery capacity, type, propulsion, technology, and vehicle type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Battery Capacity

- Less than 100 kWh

- 100 to 200 kWh

- More than 200 kWh

On the basis of battery capacity, the North America automotive battery thermal management system market is segmented into less than 100 kWh, 100 to 200 kWh, and more than 200 kWh.

Type

- Liquid Cooling and Heating

- PCM

- Air Cooling and Heating

On the basis of type, the North America automotive battery thermal management system market is segmented into liquid cooling and heating, PCM, and air cooling and heating.

Propulsion

- Hybrid Electric Vehicle

- Battery Electric Vehicle

- PHEV & FCV

On the basis of propulsion, the North America automotive battery thermal management system market is segmented into hybrid electric vehicle, battery electric vehicle, and PHEV & FCV.

Technology

- Active

- Passive

On the basis of technology, the North America automotive battery thermal management system market is segmented into active and passive.

Vehicle Type

- Automotive

- Military

- Others

On the basis of vehicle type, the North America automotive battery thermal management system market is segmented into automotive, military, and others.

North America Automotive Battery Thermal Management System Market Regional Analysis/Insights

The North America automotive battery thermal management system market is analyzed, and market size insights and trends are provided by country, battery capacity, type, propulsion, technology, and vehicle type.

Some countries covered in the North America automotive battery thermal management system market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate in the North American region as it has developed as a technology hub for EV battery manufacturing.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Automotive Battery Thermal Management System Market Share Analysis

The North America automotive battery thermal management system market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the North America automotive battery thermal management system market.

Some of the major players operating in the North America automotive battery thermal management system market are MAHLE GmbH, Valeo, Dana Limited, Hanon Systems, Robert Bosch GmbH, Infineon Technologies AG, STMicroelectronics, Sensata Technologies, Inc., Renesas Electronics Corporation, Panasonic Holdings Corporation, LEM International SA, Orion BMS, Continental AG, VOSS Automotive GmbH, MODINE MANUFACTURING COMPANY, GENTHERM, Grayson, LG Energy Solution, DENSO Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE MARKET CHALLENGE MATRIX

2.9 MULTIVARIATE MODELING

2.1 BATTERY CAPACITY TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VOLUME (REGION-WISE)

4.2 PRICING ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 SUPPLY CHAIN OF NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

4.5 REGULATORY STANDARDS

4.6 TECHNOLOGICAL ADVANCEMENTS

4.7 STRENGTH OF PRODUCT PORTFOLIO

4.8 BUSINESS STRATEGY EXCELLENCE

4.9 CASE STUDIES

4.9.1 CHALLENGES

4.9.2 ANSYS PRODUCTS USED

4.9.3 ENGINEERING SOLUTION

4.9.4 BENEFITS

4.9.5 CONCLUSION

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR ELECTRIC VEHICLES

6.1.2 INCENTIVES AND SUBSIDIES BY THE GOVERNMENT FOR THERMAL BATTERIES IN ELECTRIC VEHICLES

6.1.3 INCREASE IN ENVIRONMENTAL CONCERNS

6.1.4 RISE IN DEMAND FOR PHASE CHANGE MATERIAL (PCM) IN THE AUTOMOTIVE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH UPFRONT COST

6.2.2 DESIGN COMPLEXITIES OF THE COMPONENTS

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS BY THE COMPANIES

6.3.2 ADOPTION OF NEW TECHNOLOGIES SUCH AS SOLID-STATE BATTERY

6.4 CHALLENGES

6.4.1 BATTERY PERFORMANCE IN DIFFERENT ENVIRONMENTAL CONDITIONS

6.4.2 LACK OF CHARGING INFRASTRUCTURE FOR ELECTRIC VEHICLES IN UNDERDEVELOPED COUNTRIES

7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION

7.1 OVERVIEW

7.2 HYBRID ELECTRIC VEHICLE

7.3 BATTERY ELECTRIC VEHICLE

7.4 PHEV & FCV

8 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ACTIVE

8.3 PASSIVE

9 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE

9.1 OVERVIEW

9.2 LIQUID COOLING AND HEATING

9.3 PCM

9.4 AIR COOLING AND HEATING

10 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 100 KWH

10.3 100 TO 200 KWH

10.4 MORE THAN 200 KWH

11 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 PASSENGER CAR

11.2.1.1 SUV

11.2.1.2 SEDAN

11.2.1.3 HATCHBACK

11.2.1.4 MPV

11.2.1.5 CROSSOVER

11.2.1.6 COUPE

11.2.1.7 CONVERTIBLE

11.2.1.8 OTHERS

11.3 LCV

11.3.1 VANS

11.3.1.1 PASSENGER VANS

11.3.1.2 CARGO VANS

11.3.1.3 PICK UP VANS

11.3.2 MINI BUS

11.3.3 COACHES

11.3.4 OTHERS

11.4 HCV

11.4.1 BUSES

11.4.2 TRUCKS

11.4.2.1 DUMP TRUCK

11.4.2.2 TOW TRUCK

11.4.2.3 CEMENT TRUCK

11.5 MILITARY

11.6 OTHERS

12 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 VALEO

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 LG ENERGY SOLUTION

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 SAMSUNG SDI CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 GENTHERM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GRAYSON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HANON SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 INFINEON TECHNOLOGIES AG

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LEM INTERNATIONAL SA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MAHLE GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MODINE MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 ORION BMS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PANASONIC HOLDINGS CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 RENESAS ELECTRONICS CORPORATION.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 STMICROELECTRONICS

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SENSATA TECHNOLOGIES, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VOSS AUTOMOTIVE GMBH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 VARIOUS AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEMS' REGULATORY STANDARDS ARE AS GIVEN BELOW:

TABLE 2 LEVEL OF PRESENCE OF AIR POLLUTANTS IN MAJOR CITIES OF THE WORLD

TABLE 3 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HYBRID ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BATTERY ELECTRIC VEHICLE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PHEV & FCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ACTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA PASSIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA LIQUID COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PCM IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AIR COOLING AND HEATING IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA LESS THAN 100 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA 100 TO 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA MORE THAN 200 KWH IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MILITARY IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 41 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 43 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 44 U.S. AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.S. AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.S. PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 47 U.S. LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.S. HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 52 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 54 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 55 CANADA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CANADA PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY BATTERY CAPACITY, 2021-2030 (USD MILLION)

TABLE 63 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY PROPULSION, 2021-2030 (USD MILLION)

TABLE 65 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 MEXICO AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO AUTOMOTIVE IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO PASSENGER CAR IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO LCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO VANS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HCV IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 MEXICO TRUCKS IN AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR ELECTRIC VEHICLES IS EXPECTED TO DRIVE THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 11 LESS THAN 100 KWH SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET IN 2023 & 2030

FIGURE 12 VALUE CHAIN FOR NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 13 TECHNOLOGICAL TRENDS IN AUTOMOTIVE BATTERY MANAGEMENT

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET

FIGURE 15 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY PROPULSION, 2022

FIGURE 16 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TECHNOLOGY, 2022

FIGURE 17 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY TYPE, 2022

FIGURE 18 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY, 2022

FIGURE 19 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY VEHICLE TYPE, 2022

FIGURE 20 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022)

FIGURE 22 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2023 & 2030)

FIGURE 23 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY REGION (2022 & 2030)

FIGURE 24 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: BY BATTERY CAPACITY (2023-2030)

FIGURE 25 NORTH AMERICA AUTOMOTIVE BATTERY THERMAL MANAGEMENT SYSTEM MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.