North America Automated Liquid Handling Market

Market Size in USD Million

CAGR :

%

USD

574.94 Million

USD

1,096.11 Million

2025

2033

USD

574.94 Million

USD

1,096.11 Million

2025

2033

| 2026 –2033 | |

| USD 574.94 Million | |

| USD 1,096.11 Million | |

|

|

|

|

North America Automated Liquid Handling Market Size

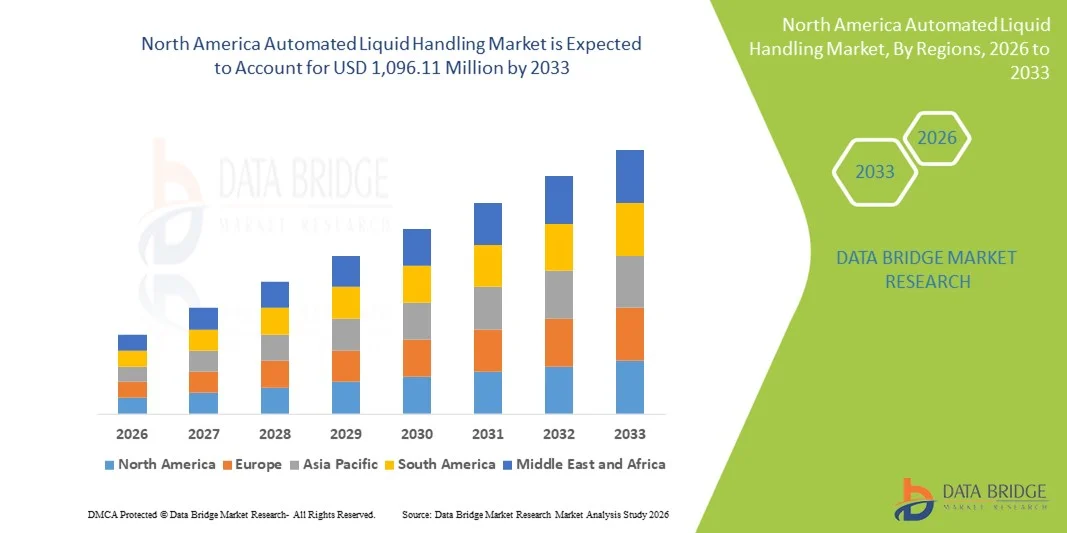

- The North America automated liquid handling market size was valued at USD 574.94 million in 2025 and is expected to reach USD 1,096.11 million by 2033, at a CAGR of 8.4% during the forecast period

- The market growth is largely fueled by increasing adoption of automated liquid handling systems in biotechnology, pharmaceutical R&D, clinical diagnostics, and genomics research. High-throughput workflows, precision requirements, and the need to reduce manual errors are driving investments in advanced liquid handling technologies across laboratories in the United States and Canada

- Furthermore, rising consumer and institutional demand for efficient, reliable, and integrated laboratory automation including automated workstations and consumables is establishing automated liquid handling solutions as essential tools for modern life‑science workflows. These converging factors are accelerating the uptake of automated liquid handlers, thereby significantly boosting the region’s market growth.

North America Automated Liquid Handling Market Analysis

- Automated liquid handling systems, enabling precise, high-throughput handling of liquids in laboratories, are increasingly vital components of modern life-science workflows in both research and clinical settings due to their accuracy, efficiency, and seamless integration with laboratory automation platforms

- The escalating demand for automated liquid handling systems is primarily fueled by the growing adoption of laboratory automation technologies, the need to reduce manual errors, and increasing throughput requirements in procedures such as PCR setup, high-throughput screening, serial dilution, and plate replication

- The United States dominated the automated liquid handling market with the largest revenue share of 90% in 2025, characterized by strong R&D investment, early adoption of advanced laboratory technologies, and a significant presence of key industry players, with substantial growth observed in biotechnology and pharmaceutical industries, research institutes, and diagnostic laboratories, driven by innovations in automated liquid handling workstations, robotic systems, and consumables

- Canada is expected to be the fastest growing country in the North America automated liquid handling market during the forecast period due to increasing biotechnology and pharmaceutical research, rising government support for laboratory automation, and growing demand for high-throughput and precise laboratory workflows

- Automated liquid handling workstations dominated the U.S. market with a market share of 45% in 2025, driven by their precision, flexibility, and ability to support a wide range of procedures across genomics, drug discovery, clinical diagnostics, and proteomics applications

Report Scope and North America Automated Liquid Handling Market Segmentation

|

Attributes |

North America Automated Liquid Handling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Automated Liquid Handling Market Trends

Integration of AI and Robotics for Enhanced Laboratory Efficiency

- A significant and accelerating trend in the North America automated liquid handling market is the integration of AI-driven robotics with automated workstations, enhancing accuracy, throughput, and operational efficiency in laboratory workflows

- For instance, Hamilton Robotics’ STARlet platform integrates AI-assisted pipetting and robotic handling to reduce manual intervention while optimizing sample processing times

- AI integration enables features such as predictive error detection, adaptive workflow optimization, and intelligent scheduling of high-throughput experiments, improving reproducibility and reducing human error

- The seamless combination of robotics with laboratory information management systems (LIMS) allows centralized control over multiple workflows, enabling automated sample tracking, data collection, and reporting through a single interface

- This trend towards smarter, more interconnected liquid handling systems is reshaping expectations for laboratory automation, with companies such as Tecan developing AI-enhanced platforms capable of adaptive liquid handling, integrated analytics, and automated decision-making

- The demand for automated liquid handling systems with AI and robotic integration is growing rapidly across biotechnology, pharmaceutical, and clinical laboratories, as institutions prioritize efficiency, reliability, and precision in sample processing

- Remote monitoring and cloud-enabled connectivity are increasingly integrated, enabling laboratories to track experiments and performance metrics in real time, supporting decentralized and collaborative research workflows

North America Automated Liquid Handling Market Dynamics

Driver

Rising Need for High-Throughput and Accurate Sample Processing

- The increasing need for high-throughput screening and precision in research workflows, coupled with the rising adoption of laboratory automation technologies, is a key driver of market growth

- For instance, in March 2025, Beckman Coulter announced upgrades to its Biomek i-Series to support high-throughput genomics workflows, aiming to reduce manual error and increase laboratory efficiency

- As research and diagnostic labs expand their operations, automated liquid handling systems offer reproducibility, reduced human error, and faster processing times, providing a clear advantage over manual pipetting

- The growing popularity of automated solutions in drug discovery, genomics, and clinical diagnostics is making these systems integral to modern laboratory operations

- Features such as automated PCR setup, plate replication, serial dilutions, and integration with LIMS facilitate hands-free operation and streamline complex workflows, driving adoption across biotechnology, pharmaceutical, and diagnostic laboratories

- For instance, increasing regulatory requirements for standardized and traceable lab processes are prompting laboratories to adopt automated liquid handling systems to ensure compliance and data integrity

- Integration with multi-omics platforms and high-content screening tools provides a unique opportunity to accelerate complex research studies, particularly in personalized medicine and genomics

- For instance, AI-assisted liquid handlers can adapt protocols in real time to variations in sample volume or concentration, reducing reagent waste and improving experimental efficiency

Restraint/Challenge

High Costs and Maintenance Complexity

- The relatively high upfront cost of advanced automated liquid handling systems, along with ongoing maintenance requirements, poses a significant challenge to widespread adoption, particularly for smaller laboratories

- For instance, early-stage biotech startups may hesitate to invest in fully automated workstations due to budget constraints, despite potential long-term efficiency gains

- Complex system setup, calibration, and need for trained personnel can slow deployment, limiting accessibility for some research institutes or diagnostic labs

- While entry-level systems and modular solutions exist, premium platforms with integrated robotics, AI, and consumables remain expensive, making cost a barrier for price-sensitive institutions

- Addressing these challenges through modular, cost-effective solutions, user training, and service support will be critical for broadening market penetration and sustaining growth in North America

- For instance, the need for regular software updates and preventive maintenance can strain internal IT and lab management teams, increasing operational complexity

- Limited interoperability between liquid handling systems from different vendors may hinder workflow standardization and integration with existing lab automation infrastructure

- For instance, small and mid-sized labs may face challenges when integrating new liquid handling platforms with existing robotic arms, LIMS, or analytics software, slowing adoption

North America Automated Liquid Handling Market Scope

The market is segmented on the basis of product, type, procedure, modality, application, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into automated liquid handling workstations, reagents & consumables, and others. The Automated Liquid Handling Workstations segment dominated the market with the largest revenue share of 45% in 2025, driven by their high precision, flexibility, and ability to automate complex laboratory workflows. These workstations are widely adopted across genomics, drug discovery, and clinical diagnostics due to their compatibility with high-throughput screening, PCR setup, and serial dilution processes. Laboratories prefer workstations as they reduce manual errors, increase efficiency, and integrate seamlessly with laboratory information management systems (LIMS). Continuous innovations, such as AI-assisted pipetting and robotic sample handling, further reinforce their dominance. The growing demand for reproducible results and scalability in both academic and commercial labs strengthens the preference for automated workstations. Additionally, the rise of centralized lab automation platforms that can handle multiple procedures simultaneously has boosted the adoption of these systems.

The Reagents & Consumables segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing consumable usage in high-throughput experiments, rising demand for pre-validated kits, and the need for standardized reagents. Consumables such as pipette tips, plates, and tubes are critical for workflow consistency, driving recurring purchases. The expansion of genomics, proteomics, and clinical diagnostics research creates a consistent demand for reagents and consumables, supporting their growth. Rising awareness about quality control and contamination prevention further enhances demand for specialized consumables.

- By Type

On the basis of type, the market is segmented into automated liquid handling systems and semi-automated liquid handling. The Automated Liquid Handling Systems segment dominated the market in 2025, accounting for the largest revenue share due to their ability to handle complex and high-volume workflows with minimal human intervention. These systems are preferred for critical procedures like PCR setup, high-throughput screening, and whole genome amplification, where precision and repeatability are essential. Laboratories benefit from faster turnaround times, reduced error rates, and seamless integration with LIMS and robotics platforms. Continuous improvements in software, AI integration, and workflow optimization have strengthened their adoption. Large pharmaceutical and biotechnology companies increasingly rely on fully automated systems for large-scale drug discovery and genomics research, further consolidating their market leadership.

The Semi-Automated Liquid Handling segment is expected to witness the fastest growth from 2026 to 2033, driven by small to mid-sized laboratories seeking cost-effective automation solutions. Semi-automated systems provide improved efficiency over manual pipetting without the high investment required for fully automated platforms. Their flexibility, user-friendly interface, and modularity allow gradual adoption of automation workflows. Research institutes and academic labs favor semi-automated systems for experimental versatility, making this segment highly attractive in the forecast period.

- By Procedure

On the basis of procedure, the market is segmented into PCR setup, plate replication, serial dilution, high-throughput screening, plate reformatting, cell culture, whole genome amplification, array printing, and others. The High-Throughput Screening segment dominated the market in 2025 due to its critical role in drug discovery, genomics, and proteomics research. Automated liquid handlers accelerate large-scale sample processing, ensuring reproducibility and efficiency. Pharmaceutical companies heavily rely on high-throughput screening to test thousands of compounds rapidly, driving adoption of automated systems. Integration with robotics and AI further enhances screening accuracy and reduces experimental variability. Laboratories prioritize automation for high-throughput applications to reduce labor costs and minimize human error. The demand for accelerated drug development and precision research continues to reinforce this segment’s dominance.

The PCR Setup segment is expected to witness the fastest growth from 2026 to 2033, driven by the rise of genomics, diagnostics, and personalized medicine. Automation in PCR setup reduces pipetting errors, ensures uniform sample handling, and supports high-throughput processing. Academic, clinical, and pharmaceutical labs increasingly rely on automated PCR preparation to meet growing testing demands. The adoption of COVID-19 testing and molecular diagnostics in hospitals and diagnostic labs has further accelerated the need for automated PCR workflows.

- By Modality

On the basis of modality, the market is segmented into disposable tips and fixed tips. The Disposable Tips segment dominated the market in 2025 due to their role in preventing cross-contamination, maintaining sample integrity, and ensuring reproducible results in critical laboratory workflows. Disposable tips are widely used in genomics, clinical diagnostics, and drug discovery to comply with quality and safety standards. They also support automated liquid handling platforms with integrated tip detection and volume calibration. Laboratories increasingly prioritize disposable consumables to reduce the risk of contamination in high-throughput and sensitive procedures. The continuous introduction of pre-sterilized and filtered tips has further boosted adoption in the U.S

The Fixed Tips segment is expected to witness the fastest growth from 2026 to 2033, fueled by their cost-effectiveness, reusability, and integration with semi-automated systems. Fixed tips are gaining traction in academic and research labs where budget optimization and moderate throughput requirements are critical. Growing demand for environmentally sustainable practices also encourages the adoption of reusable fixed tips in routine workflows. Their robustness and durability make them ideal for repetitive experiments. Growing awareness about operational efficiency is expected to drive the segment’s expansion.

- By Application

On the basis of application, the market is segmented into genomics, drug discovery, clinical diagnostics, proteomics, and others. The Drug Discovery segment dominated the market in 2025 due to the widespread use of automated liquid handling in screening compounds, preparing assay plates, and conducting high-throughput experiments. Pharmaceutical companies rely on automation to accelerate R&D timelines, reduce errors, and improve reproducibility. Integration with AI and robotic platforms enhances efficiency and data accuracy in compound testing. The focus on faster drug development and precision medicine has further increased adoption. Continuous investment in R&D and collaboration with biotech companies strengthens the demand for automated liquid handling in drug discovery.

The Genomics segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for sequencing, PCR-based diagnostics, and personalized medicine applications. Automation in genomics reduces manual errors, speeds up sample processing, and supports complex workflows such as whole genome amplification and array printing. Increasing funding for genomics research and government initiatives to expand molecular diagnostics have further boosted adoption. Rising demand for personalized therapeutics further strengthens this segment. Integration with AI and robotic platforms enhances efficiency and workflow standardization

- By End User

On the basis of end user, the market is segmented into biotechnology and pharmaceutical industries, research institutes, hospitals and diagnostic laboratories, academic institutes, and others. The Biotechnology and Pharmaceutical Industries segment dominated the market in 2025 due to heavy reliance on automated liquid handling for drug development, high-throughput screening, and reproducible laboratory processes. Large-scale R&D operations in these industries prioritize speed, accuracy, and scalability, making fully automated systems essential. The integration of AI and robotics further enhances adoption in pharma and biotech laboratories. Continued investments in precision medicine and high-throughput research reinforce this segment’s leadership.

The Research Institutes segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption of automated systems in academic and government-funded laboratories. Research institutes increasingly implement automation to accelerate genomics, proteomics, and molecular biology studies while minimizing manual intervention. Growth is also supported by increasing collaborations with biotechnology firms and grants for laboratory modernization. Growing focus on high-throughput molecular biology experiments further fuels segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and third-party distributor. The Direct Tender segment dominated the market in 2025, accounting for the largest revenue share, as major laboratories and pharmaceutical companies prefer to purchase directly from manufacturers to ensure compliance, warranty support, and after-sales service. Direct procurement also allows for customization of automated liquid handling systems to meet specific workflow needs. The approach strengthens long-term relationships with suppliers, ensuring technical support and regular system upgrades. Bulk purchases for multi-lab networks or institutional setups further reinforce the dominance of direct tender sales.

The Third-Party Distributor segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand from smaller laboratories, academic institutions, and hospitals seeking flexible purchasing options. Third-party distributors provide cost-effective access to automation systems, consumables, and maintenance services, supporting market expansion beyond large-scale laboratories. Flexible service contracts and bundled offerings encourage adoption. Growing demand for remote and smaller lab automation supports distributor expansion

North America Automated Liquid Handling Market Regional Analysis

- The United States dominated the automated liquid handling market with the largest revenue share of 90% in 2025, characterized by strong R&D investment, early adoption of advanced laboratory technologies, and a significant presence of key industry players

- Laboratories in the region highly value the precision, efficiency, and reproducibility offered by automated liquid handling systems, which minimize manual errors and accelerate complex procedures such as PCR setup, high-throughput screening, and drug discovery assays

- This widespread adoption is further supported by robust R&D infrastructure, high investment in laboratory automation, and the presence of major industry players, establishing automated liquid handling systems as a critical solution for both academic and commercial laboratories across the United States

The U.S. Automated Liquid Handling Market Insight

The U.S. automated liquid handling market captured the largest revenue share of 90% within North America in 2025, fueled by the strong presence of biotechnology, pharmaceutical, and clinical research laboratories. Laboratories are increasingly prioritizing high-throughput, precise, and reproducible workflows for applications such as PCR setup, drug discovery, and genomics research. The growing demand for fully automated workstations, robotic integration, and AI-enabled liquid handling systems is further propelling the market. Additionally, government and private investments in life sciences R&D, along with the adoption of lab automation for regulatory compliance and efficiency, are supporting market expansion. The U.S. continues to lead due to its advanced research infrastructure, early technology adoption, and large-scale commercial laboratory operations.

Canada Automated Liquid Handling Market Insight

The Canada automated liquid handling market is expected to grow at the fastest CAGR in North America during the forecast period, driven by increasing investments in biotechnology and pharmaceutical research. Rising government funding for laboratory automation, expansion of academic research facilities, and growing focus on high-throughput molecular biology and genomics workflows are fueling adoption. The demand for semi-automated and modular liquid handling systems is particularly high among smaller research institutes and hospitals. Canadian laboratories are increasingly implementing automation to enhance productivity, reproducibility, and efficiency while reducing manual errors. The growing collaboration between domestic research institutes and global life science companies is further accelerating market growth.

Mexico Automated Liquid Handling Market Insight

The Mexico automated liquid handling market is witnessing gradual growth, supported by expanding pharmaceutical and biotechnology sectors and increased adoption of laboratory automation in clinical and academic research. Growing investments in healthcare infrastructure, rising government initiatives for research modernization, and partnerships with international life science companies are driving adoption. Mexican laboratories are increasingly utilizing automated liquid handling systems for PCR setup, high-throughput screening, and drug discovery workflows to improve accuracy and efficiency. The demand for cost-effective, modular, and semi-automated solutions is particularly high in smaller hospitals and research institutes. The market is expected to grow steadily as awareness of the benefits of automation, reproducibility, and workflow efficiency increases across the country.

North America Automated Liquid Handling Market Share

The North America Automated Liquid Handling industry is primarily led by well-established companies, including:

- Hamilton Company (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Sartorius AG (U.S.)

- Beckman Coulter (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Hudson Lab Automation (U.S.)

- Opentrons Labworks Inc. (U.S.)

- Aurora Biomed, Inc. (Canada)

- Gilson, Inc. (U.S.)

- BioTek Instruments, Inc. (U.S.)

- Brandtech Scientific (U.S.)

- Drummond Scientific Company (U.S.)

- HighRes Biosolutions (U.S.)

- Tomtec Automation (U.S.)

- Mettler Toledo Rainin (U.S.)

- Analytik Jena (U.S.)

- Corning Incorporated (U.S.)

- PerkinElmer, Inc. (U.S.)

What are the Recent Developments in North America Automated Liquid Handling Market?

- In October 2025, Pillar Biosciences announced an automated NGS library preparation solution on the Hamilton Microlab STAR platform designed to accelerate research into myeloproliferative neoplasms and other genomics applications

- In July 2025, Hamilton announced a strategic partnership between Covaris and Hamilton to empower labs with Sonication STAR, enhancing automated workflows by combining Hamilton’s liquid handling automation with advanced sonication technology

- In January 2025, Tecan officially introduced Veya™, a next‑generation automated liquid handling platform that integrates AI‑enhanced automation, real‑time analytics, and prebuilt workflows aimed at simplifying complex laboratory processes and boosting productivity across research and clinical labs

- In June 2024, Thermo Fisher Scientific unveiled the Thermo Scientific™ KingFisher™ PlasmidPro Maxi Processor, a fully automated maxi‑scale plasmid DNA purification system that significantly reduces hands‑on time and accelerates workflows in molecular biology and therapeutic research

- In May 2023, Hamilton Company entered a strategic co‑marketing agreement with Biosero, Inc. to integrate Biosero’s Green Button Go® scheduling and control software with Hamilton’s automated liquid handling platforms, aiming to streamline lab operations and improve workflow efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.