North America Audio Critical Communication Market Analysis and Size

Audio critical communication solutions are a mode of communication used in critical situations such as emergencies, disasters, and failures. Critical communication systems and technologies have gained immense popularity among consumers in recent times as growing importance of securing the cities, organizations and critical sites of heritage from criminal activities, emergencies, disasters and others. Critical communication plays a vital role in catering to such demands from the consumer. This one of the major reasons for the growth.

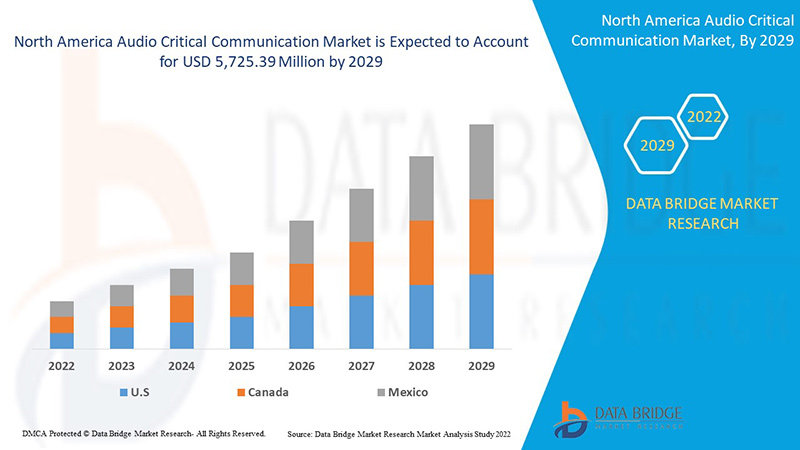

Data Bridge Market Research analyses that the audio critical communication market is expected to reach the value of USD 5,725.39 million by 2029, at a CAGR of 7.3% during the forecast period. "Hardware" accounts for the largest system segment in the audio critical communication market. The Audio Critical Communication market report also covers pricing analysis, case studies and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Values in USD Million |

|

Segments Covered |

By Product Type (Hardware and Services), Connectivity (Wireless and Wired), End-Use (Public Safety, Transportation, Mining, Utilities and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

Motorola Solutions, Inc., L3Harris Technologies, Inc., Hytera Communications Corporation Limited, EFJohnson Technologies., Leonardo S.p.A., Zenitel Group, Flottweg SE, Telstra, Ascom Holding AG, Nokia, Mentura Group Oy, Tait Communications, Secure Land Communications (Airbus / S.L.C.), Simoco Wireless Solutions, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T, Z.T.E. Corporation, Cobham Satcom, Inmarsat North America Limited among others |

Market Definition

Audio critical communication solutions are a mode of communication used in critical situations such as emergencies, disasters, and failures. Critical communications include mobile, radio telecommunication systems and other devices that provide reliable and secure communication in all situations. There are various modes of critical communications such as business critical, mission-critical, safety critical and security critical depending on your organization various modes are used. Critical communications can be vital in a wide range of safety-critical tasks and activities such as lifting operations, emergency response and coordination between different parties.

Audio Critical Communication Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Inclination Towards Mission Critical IoT & Digitization Of The Sector

There has been a progressive shift in the IoT ecosphere in recent years. This ecosphere is served by various standard electronic parts that is the hardware integrated with various software. , The importance of utilizing such technologies in the IoT era, is an absolute necessity driving the North America audio critical communication market. With technological advancement, companies are also shifting towards digitization to cater to the consumer's growing demand for advanced capabilities in the communication sector.

- Increase In Penetration Of Smartphones, Tablets And Laptops In Critical Communication

Modern digital wireless handsets have to perform and function as a real communication hub that brings a wide range of smart features to the cellular industry. These include web browsing, e-mail, wireless PDA, voice memo, two-way paging, answering machine and North America positioning system (GPS) in a single entity.

- Protected Satellite Communication Solutions For Critical Communication

Satellite communication is a type of modern telecommunications where artificial satellites provide communication links between various points on earth. Satellite communications plays an important role in multiple industries for business continuity and emergency management in various business sectors such as oil and gas, IoT, healthcare, government, maritime, mining and more. Moreover, satellite communications are various commercial, governmental and military applications. According to World Economic Forum in 2020, 2,666 operational satellites are circling the earth, out of which 1,007 satellites are used for communication services alone and 446 are used for earth observation & 97 for navigation/ GPS purposes.

- Cyber Security & Privacy Threats In Critical Communication

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security is a weakness which hackers exploit to perform unauthorized actions within a system. According to the recent Maritime Cybersecurity Survey by Safety at Sea and BIMCO, in the 12 months prior to February 2020, 31% of organizations fell victim to cyberattacks, which is a 9% increase compared to 2019. According to another report published by Robert Rizika, head of North American operations at Naval Dome, reported that cyberattacks on maritime industry's operational technology (OT) have increased by 900%, from 50% in 2017, to 120% and 310% in the year 2018 and 2019 respectively.

- Lack Of Available Spectrum Capacity For Critical Communication Service

Spectrum refers to the invisible radio frequency ranges that wireless signals travel over a given medium. Those signals due to allotted signals allow us to make calls from our mobile devices, tag our friends on social media platform, and pull up directions to a destination and location on mobile devices. The frequencies that we use for wireless communications are a part electromagnetic spectrum. The full electromagnetic spectrum ranges from 3 Hz to 300 EHz. The portion used for wireless communication sits in the ranges from about 20 KHz to 300 GHz

Post COVID-19 Impact on Audio Critical Communication Market

COVID-19 created a major impact on the audio critical communication market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

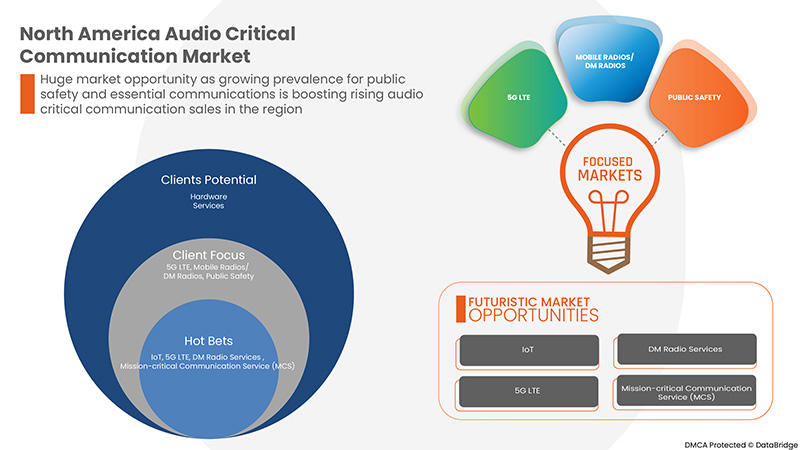

The growth of the audio critical communication market is rising due to the government policies to boost international trade post covid. Also the increasing concern for public safety and government investment is rising the demand for audio critical communication market in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the Audio Critical Communication market. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Development

- In June 2022, Motorola Solutions, Inc. launched MXP7000 an all-in-one mission-critical communications portable device. The key feature of this device was its unified TETRA and 4G LTE voice and data communications to enhance situational awareness, safety and productivity for the military and public safety. Through this company gained the trust of its consumer by offering innovative products

- In June 2021, L3Harris Technologies, Inc. launched critical communications solutions XL Extreme 400 P25 Radio. Key feature of this radio set was its durability as it was specifically designed to withstand the most rigorous standards ever subjected to handheld radios. This company expanded its market shares and gained the trust of its consumer.

North America Audio Critical Communication Market Scope

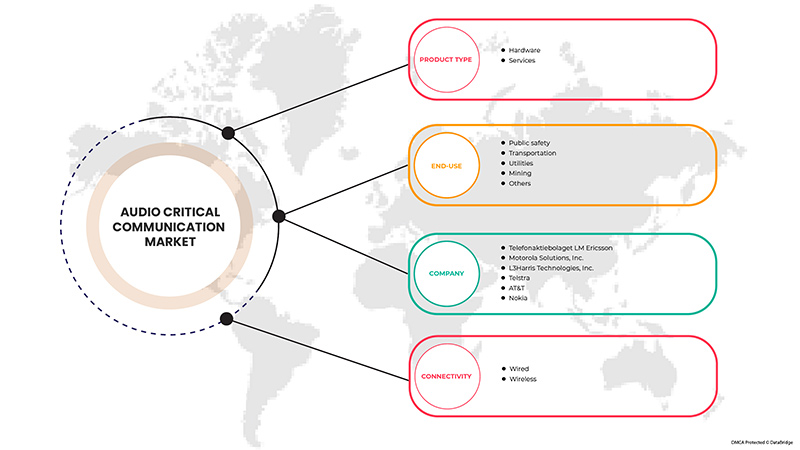

The audio critical communication market is segmented on the basis of by product type, connectivity and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Hardware

- Services

On the basis of product type, the North America audio critical communication market is segmented into hardware and services.

By Connectivity

- Wireless

- Wired

On the basis of by connectivity, the North America audio critical communication market has been segmented into wireless and wired.

By End-Use

- Public Safety

- Transportation

- Mining

- Utilities

- Others

On the basis of end-use, the North America audio critical communication market has been segmented into public safety, transportation, mining, utilities and others.

Audio Critical Communication Market Regional Analysis/Insights

The audio critical communication market is analysed and market size insights and trends are provided by country, product type, connectivity and end-use as referenced above.

The countries covered in the audio critical communication market report are U.S., Canada and Mexico in North America.

U.S. dominates the audio critical communication market and is likely to be the fastest-growing North America audio critical communication market. The U.S. audio critical communication market is expected to be the fastest-growing in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Audio Critical Communication Market Share Analysis

The audio critical communication market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to audio critical communication market.

Some of the major players operating in the audio critical communication market are Motorola Solutions, Inc., L3Harris Technologies, Inc., Hytera Communications Corporation Limited, EFJohnson Technologies., Leonardo S.p.A., Zenitel Group, Flottweg SE, Telstra, Ascom Holding AG, Nokia, Mentura Group Oy, Tait Communications, Secure Land Communications (Airbus / S.L.C.), Simoco Wireless Solutions, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T, Z.T.E. Corporation, Cobham Satcom, Inmarsat Global Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDY

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 VALUE CHAIN ANALYSIS

4.5 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCLINATION TOWARDS MISSION CRITICAL IOT & DIGITIZATION OF THE SECTOR

5.1.2 INCREASE IN PENETRATION OF SMARTPHONES, TABLETS AND LAPTOPS IN CRITICAL COMMUNICATION

5.1.3 PROTECTED SATELLITE COMMUNICATION SOLUTIONS FOR CRITICAL COMMUNICATION

5.1.4 EMERGENCE OF 4G/5G LTE BROADBAND CONNECTIVITY

5.1.5 ADVENT OF AI IN CRITICAL COMMUNICATION SERVICES

5.2 RESTRAINTS

5.2.1 CYBER SECURITY & PRIVACY THREATS IN CRITICAL COMMUNICATION

5.2.2 LACK OF AVAILABLE SPECTRUM CAPACITY FOR CRITICAL COMMUNICATION SERVICE

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR MISSION-CRITICAL COMMUNICATION SERVICE (MCS) FOR BUSINESS

5.3.2 GROWING PREVALENCE FOR PUBLIC SAFETY AND ESSENTIAL COMMUNICATIONS

5.3.3 INCREASING DEMAND FOR DM RADIO SERVICES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN SYSTEMS INCORPORATING TRUNKING AND DIGITAL CAPABILITIES

5.4.2 LATENCY & ACCESSIBILITY ISSUES FACED IN MISSION-CRITICAL COMMUNICATION SERVICE

6 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 INFRASTRUCTURE EQUIPMENT

6.2.2 COMMAND AND CONTROL SYSTEMS

6.2.3 END-USE DEVICES

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 INTEGRATION SERVICES

6.3.2.2 MAINTENANCE AND SUPPORT SERVICES

6.3.2.3 CONSULTING SERVICES

7 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 WIRELESS

7.3 WIRED

8 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 PUBLIC SAFETY

8.2.1 HARDWARE

8.2.1.1 INFRASTRUCTURE EQUIPMENT

8.2.1.2 COMMAND AND CONTROL SYSTEMS

8.2.1.3 END-USE DEVICES

8.2.2 SERVICES

8.2.2.1 MANAGED SERVICES

8.2.2.2 PROFESSIONAL SERVICES

8.2.2.2.1 INTEGRATION SERVICES

8.2.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.2.2.2.3 CONSULTING SERVICES

8.3 TRANSPORTATION

8.3.1 HARDWARE

8.3.1.1 INFRASTRUCTURE EQUIPMENT

8.3.1.2 COMMAND AND CONTROL SYSTEMS

8.3.1.3 END-USE DEVICES

8.3.2 SERVICES

8.3.2.1 MANAGED SERVICES

8.3.2.2 PROFESSIONAL SERVICES

8.3.2.2.1 INTEGRATION SERVICES

8.3.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.3.2.2.3 CONSULTING SERVICES

8.4 MINING

8.4.1 HARDWARE

8.4.1.1 INFRASTRUCTURE EQUIPMENT

8.4.1.2 COMMAND AND CONTROL SYSTEMS

8.4.1.3 END-USE DEVICES

8.4.2 SERVICES

8.4.2.1 MANAGED SERVICES

8.4.2.2 PROFESSIONAL SERVICES

8.4.2.2.1 INTEGRATION SERVICES

8.4.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.4.2.2.3 CONSULTING SERVICES

8.5 UTILITIES

8.5.1 HARDWARE

8.5.1.1 INFRASTRUCTURE EQUIPMENT

8.5.1.2 COMMAND AND CONTROL SYSTEMS

8.5.1.3 END-USE DEVICES

8.5.2 SERVICES

8.5.2.1 MANAGED SERVICES

8.5.2.2 PROFESSIONAL SERVICES

8.5.2.2.1 INTEGRATION SERVICES

8.5.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.5.2.2.3 CONSULTING SERVICES

8.6 OTHERS

9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY GEOGRAPHY

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 TELEFONAKTIEBOLAGET LM ERICSSON

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCTS PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 MOTOROLA SOLUTIONS, I.N.C.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCTS PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 L3HARRIS TECHNOLOGIES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 SOLUTIONS PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 TELSTRA

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCTS PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 AT&T

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCTS PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 NOKIA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 SOLUTIONS PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 HUAWEI TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT & SOLUTION PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 LEONARDO S.P.A.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCTS PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 ZTE CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCTS PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 ASCOM HOLDING AG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 SOLUTIONS PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 COBHAM SATCOM

12.11.1 COMPANY SNAPSHOT

12.11.2 SOLUTION PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 EFJOHNSON TECHNOLOGIES.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCTS PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 HYTERA COMMUNICATIONS CORPORATION LIMITED

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCTS PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 INMARSAT NORTH AMERICA LIMITED

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCTS PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 MENTURA GROUP OY

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCTS PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 SECURE LAND COMMUNICATIONS (AIRBUS / SLC)

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCTS PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SIMOCO WIRELESS SOLUTIONS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCTS PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TAIT COMMUNICATIONS

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCTS PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 ZENITEL GROUP

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCTS PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 VARIOUS AUDIO CRITICAL COMMUNICATION REGULATORY STANDARDS.

TABLE 2 FREQUENCY ALLOCATION

TABLE 3 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WIRELESS IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA WIRED IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 62 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 63 U.S. PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 84 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 85 CANADA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 106 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DBMRMARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 11 EMERGENCE OF 4G/5G LTE BROAD BAND CONNECTIVITY IS EXPECTED TO DRIVE NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 TECHNOLOGICAL TRENDS IN AUDIO CRITICAL COMMUNICATIONS

FIGURE 15 VALUE CHAIN FOR AUDIO CRITICAL COMMUNICATION MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET

FIGURE 17 ADVANTAGES OF ADOPTING IOT TECHNOLOGIES IN CRITICAL COMMUNICATIONS BUSINESS

FIGURE 18 TOP 10 COUNTRIES WITH SMARTPHONE (IN MILLIONS)

FIGURE 19 TOTAL NUMBER OF ACTIVE COMMERCIAL SATELLITES IN EARTH'S ORBIT

FIGURE 20 ADVANTAGE OF 5G COMMUNICATION

FIGURE 21 ADVANTAGE OF AI CRITICAL COMMUNICATION CONSULTING SERVICES

FIGURE 22 ADVANTAGE OF AI CRITICAL COMMUNICATION CONSULTING SERVICES

FIGURE 23 MISSION CRITICAL SERVICES SCENARIO

FIGURE 24 OPTIMUM SCENARIO LATENCY IN 5G, 4G

FIGURE 25 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2021

FIGURE 26 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2021

FIGURE 27 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2021

FIGURE 28 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: COMPANY SHARE 2021 (%)

North America Audio Critical Communication Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Audio Critical Communication Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Audio Critical Communication Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.