Market Analysis and Insights

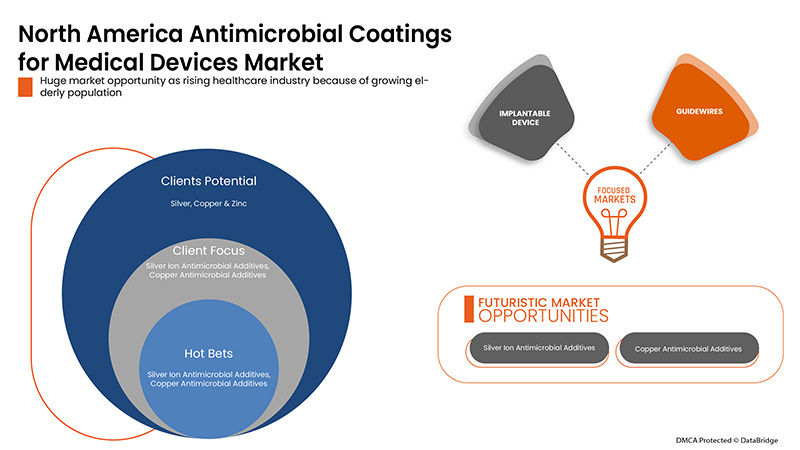

Nowadays, healthcare providers are continually tasked with improving patient health while reducing the risk of infection. The prominence of hospital acquired infections has fuelled the need for strategies and products that actively reduce the risk of patient infections. As such, the incorporation of antimicrobial additives into healthcare furnishings and medical equipment is increasingly being viewed as part of the solution to infection prevention and control in healthcare environments. Moreover, the rising demand for implantable devices has surged also surged the demand for antimicrobial coating for medical devices. However, the limitations of silver ion coating may hamper the growth of market to some extent.

Growing technological advancement in antimicrobial coating are creating an opportunity for the growth of North America antimicrobial coating for medical devices market whereas adverse effect of antimicrobial coating on human health may create challenge for the growth of the market.

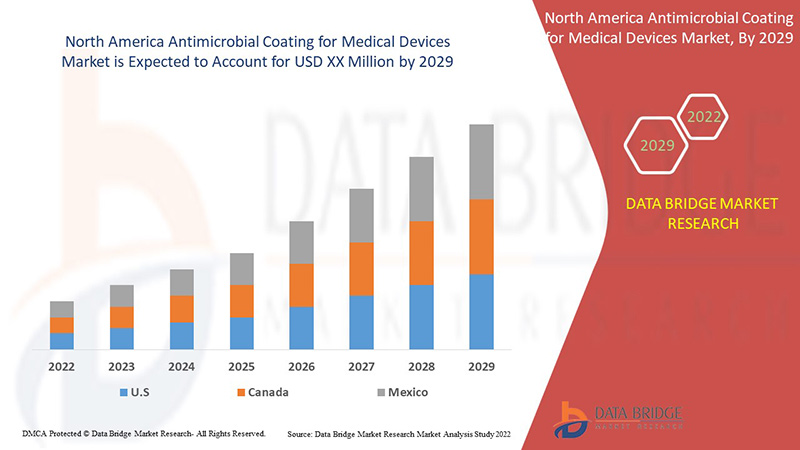

Increasing use of antimicrobial coating for medical devices coupled with growing awareness regarding hospital acquired infections has surged its demand. Data Bridge Market Research analyses that the antimicrobial coating for medical devices market will grow at a CAGR of 12.7% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

By Product Type (Silver Antimicrobial Coating, Copper Antimicrobial Coating, Others), Coating (Silver, Chitosan, Titanium Dioxide, Aluminum, Copper, Zinc, Gallium, Others), Type (Escherichia Coli, Pseudomonas, Listeria, Others), Additives (Silver Ion Antimicrobial Additives, Organic Antimicrobial Additives, Copper Antimicrobial Additives, Zinc Antimicrobial Additives), Material (Graphene Materials, Silver Nanoparticles, Polycationic Hydrogel, Polymer Brushes, Dendrimers, Others), Resin Type (Epoxy, Acrylic, Polyurethane, Polyester, Others), Form (Liquid, Powder, Aerosol), Application (Surgical Instruments, Implantable Devices, Guidewires, Mandrels & Molds, Catheters, Others) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

DSM, PPG Industries, Inc., Akzo Nobel N.V., Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited amongst others |

Antimicrobial Coating for Medical Devices Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rise in awareness regarding hospital-acquired infections

Rising incidences of hospital-acquired infection have increased the burden on the healthcare system rising concerns for the healthcare industry. The increasing number of hospital infected diseases has relatively increased the burden on the healthcare sector. The antimicrobial coating help reduce hospital-acquired infections as they have various properties such as biocompatibility

- Rise in demand for implantable devices North Americaly

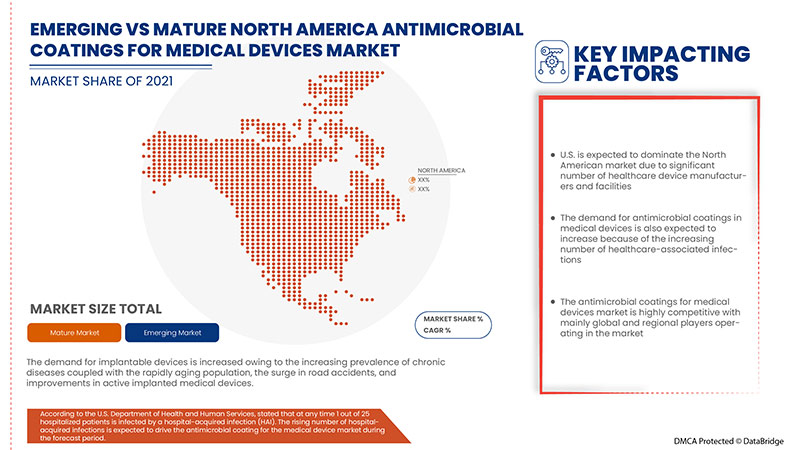

The demand for implantable devices is increased owing to the increasing prevalence of chronic diseases coupled with the rapidly aging population, the surge in road accidents, and improvements in active implanted medical devices. According to the Association for Safe International Road Travel, approximately 4.4 million are injured seriously enough to require medical attention.

Opportunities

- The rising healthcare sector in emerging economies

The rising healthcare sector in emerging economies such as India and China is anticipated to create the opportunity for antimicrobial coating products demand in medical devices. Factors such as the growing population, changed lifestyles, rising elderly population, especially in China, and increasing medical tourism are some of the major factors behind driving the growth of the healthcare sector. According to the article published by India Brand Equity Foundation (IBEF), in March 2022, About 6, 97,300 foreign tourists came to India for medical treatment in the year 2019 and also revealed that India holds 10th rank out of 46 destinations in Medical Tourism Index (MTI) for the 2020-2021 year.

Restraints/Challenges

However, the limitation of silver ion coating, and unfavourable U.S. health refoms the market growth rate. Low production capacity of emerging economies will also pose a major challenge.

This antimicrobial coating for medical devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on antimicrobial coating for medical devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Antimicrobial Coating for Medical Devices Market

Coronavirus disease (COVID-19) is an infectious disease caused by a newly discovered SARS-CoV-2 virus while a large pool of the population is affected by the COVID-19 virus. The people affected with the COVID-19 virus will experience mild-to-moderate respiratory illness and recover without requiring special treatment. However, coronavirus (COVID-19) spread is expanding North Americaly for the last few months and the patient population is hugely boomed.

For instance,

- According to the World Health Organization (WHO) till 31st March 2022, 481,756,671 confirmed cases of COVID-19 have been found including 6,127,981 deaths. Whereas, Europe has a high pace of COVID-19 spread in comparison to other regions. Till 31st March 2022, there have been 199,889,200 confirmed cases of COVID-19 in Europe

The pandemic of COVID-19 has adversely affected supply chain and manufacturing activities. Additionally, as the world came to a standstill and transportation services were halted across the globe, the borders were sealed to prevent the spread of the virus. The trade practices also faced significant challenges during the pandemic. Consequently, the supply of implants, their import, export, and local transportation, and supply of raw materials were gravely affected.

Recent Developments

- In September 2021, BioCote Limited, showcased innovative antimicrobial coating technology, including their latest developments for plastic antimicrobial coating products. This enhanced the company’s annual revenue

- In January 2022, the company has inaugurated its second manufacturing plant located in Costa Rica. The plant will involve in manufacturing medical device solution for extrusion, injection molding, micromachining metals processing, and final assembly processes in cleanrooms. This move was taken to meet the increasing demand for medical device solution in the market

- In May 2021, Hydromer has announced that it has been selected as a key coating and services partner for the company name Avinger, Inc. This move helps the company to propel its growth in the market

North America Antimicrobial Coating for Medical Devices Market Scope

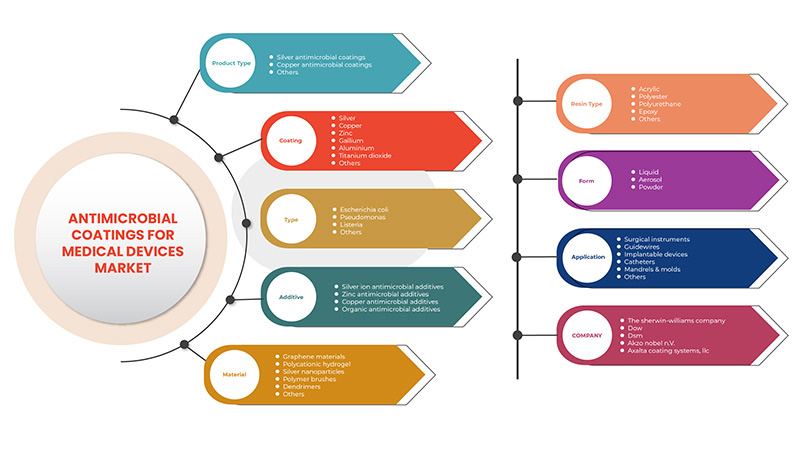

The antimicrobial coating for medical devices market is segmented into product type, coating, type, additives, materials, resin type, form, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Silver Antimicrobial Coating

- Copper Antimicrobial Coating

- Others

On the basis of product type, the North America antimicrobial coating for medical devices market is segmented into silver antimicrobial coating, copper antimicrobial coating, and others.

Coating

- Silver

- Copper

- Zinc

- Gallium

- Aluminium

- Titanium Dioxide

- Others

On the basis of coating, the North America antimicrobial coating for medical devices market is segmented into silver, copper, zinc, gallium, aluminium, titanium dioxide, and others.

Type

- Escherichia Coli

- Pseudomonas

- Listeria

- Others

On the basis of type, the North America antimicrobial coating for medical devices market is segmented into escherichia coli, pseudomonas, listeria, and others.

Additive

- Small Size Silver ion antimicrobial additives

- Zinc antimicrobial additives

- Copper antimicrobial additives

- Organic antimicrobial additives

On the basis of additive, the North America antimicrobial coating for medical devices market is segmented into silver ion antimicrobial additives, zinc antimicrobial additives, copper antimicrobial additives, and organic antimicrobial additives.

Material

- Graphene materials

- Polycationic hydrogel

- Silver nanoparticles

- Polymer brushes

- Dendrimers

- Others

On the basis of materials the North America antimicrobial coating for medical devices market is segmented into graphene materials, polycationic hydrogel, silver nanoparticles, polymer brushes, dendrimers, and others.

Resin Type

- Acrylic

- Polyester

- Polyurethane

- Epoxy

- Others

On the basis of resin type, the North America antimicrobial coating for medical devices market is segmented into acrylic, polyester, polyurethane, epoxy, and others.

Form

- Liquid

- Aerosol

- Powder

On the basis of form, the North America antimicrobial coating for medical devices market is segmented into liquid, aerosol, and powder.

Application

- Surgical instruments

- Guidewires

- Implantable devices

- Catheters

- Mandrels & molds

- Others

On the basis of application, the North America antimicrobial coating for medical devices market is segmented into surgical instruments, guidewires, implantable devices, catheters, mandrels & molds, and others.

Antimicrobial Coating for Medical Devices Market Regional Analysis/Insights

The antimicrobial coating for medical devices market is analysed and market size insights and trends are provided by country, product type, coating, material, additives, type, resin type, type, and application.

The regions covered in the antimicrobial coating for medical devices market report are the U.S., Canada, and Mexico.

The U.S. dominates the antimicrobial coating for medical devices market during the forecast period. This is attributed to the increased consumption of antimicrobial coating in medical devices due to the region's significant presence of medical devices products.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Antimicrobial Coating for Medical Devices Market Share Analysis

The antimicrobial coating for medical devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on antimicrobial coating for medical devices market.

Some of the major players operating in the antimicrobial coating for medical devices market are DSM, PPG Industries, Inc., Akzo Nobel N.V., Specialty Coating Systems Inc, Covalon Technologies Ltd., AST Products, Inc., Hydromer, Sciessent LLC, Microban International, Axalta Coating Systems, LLC, Biointeractions Ltd, Sika, Harland Medical Systems, Inc., Biomerics, BioCote Limited, and amongst others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In adition, market share analysis and key trend analysis are the major success factors in the market report.. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE

4.2 PESTEL ANALYSIS

4.2.1 POLITICS

4.2.2 ECONOMY

4.2.3 SOCIAL

4.2.4 TECHNOLOGY

4.2.5 ENVIRONMENTAL:

4.2.6 LEGAL

4.3 PORTER ANALYSIS

4.3.1 THREATS OF NEW ENTRANTS

4.3.2 POWER OF SUPPLIERS

4.3.3 BARGAINING POWER OF BUYERS

4.3.4 THREATS OF SUBSTITUTE PRODUCTS

4.3.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.4 REGULATION

4.4.1 FDA

4.5 PRODUCTION AND CONSUMPTION ANALYSIS

4.6 RAW MATERIAL ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 PRICE TREND ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN AWARENESS REGARDING HOSPITAL-ACQUIRED INFECTIONS (HAI)

5.1.2 RISE IN GOVERNMENT INITIATIVES FOR RESEARCH & FUNDING

5.1.3 RISE IN DEMAND FOR IMPLANTABLE DEVICES NORTH AMERICALY

5.1.4 INCREASE IN THE BURDEN OF CARDIOVASCULAR DISEASES ACROSS THE GLOBE

5.2 RESTRAINTS

5.2.1 LIMITATIONS OF SILVER ION COATING

5.2.2 UNFAVORABLE HEALTHCARE REFORMS IN THE U.S.

5.3 OPPORTUNITIES

5.3.1 THE RISING HEALTHCARE SECTOR IN EMERGING ECONOMIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN THE ANTIMICROBIAL COATING

5.3.3 ANTIMICROBIAL COATINGS HAVE SHOWN GREAT POTENTIAL AGAINST NOSOCOMIAL INFECTIONS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUT TO COVID-19 PANDEMIC OUTBREAK

5.4.2 THE ADVERSE EFFECTS OF ANTIMICROBIAL COATINGS ON THE ENVIRONMENT

6 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SILVER ANTIMICROBIAL COATING

6.3 COPPER ANTIMICROBIAL COATING

6.4 OTHERS

7 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING

7.1 OVERVIEW

7.2 SILVER

7.3 CHITOSAN

7.4 TITANIUM DIOXIDE

7.5 ALUMINUM

7.6 COPPER

7.7 ZINC

7.8 GALLIUM

7.9 OTHERS

8 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE

8.1 OVERVIEW

8.2 ESCHERICHIA COLI

8.3 PSEUDOMONAS

8.4 LISTERIA

8.5 OTHERS

9 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE

9.1 OVERVIEW

9.2 SILVER ION ANTIMICROBIAL ADDITIVES

9.3 ORGANIC ANTIMICROBIAL ADDITIVES

9.4 COPPER ANTIMICROBIAL ADDITIVES

9.5 ZINC ANTIMICROBIAL ADDITIVES

10 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 GRAPHENE MATERIALS

10.3 SILVER NANOPARTICLES

10.4 POLYCATIONIC HYDROGEL

10.5 POLYMER BRUSHES

10.5.1 FUNCTIONALIZED POLYMER BRUSHES

10.5.2 FUNCTIONALIZED POLYMER BRUSHES

10.5.3 BRUSHES COMPRISING BACTERIAL POLYMERS

10.6 DENDRIMERS

10.7 OTHERS

11 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE

11.1 OVERVIEW

11.2 EPOXY

11.3 ACRYLIC

11.4 POLYURETHANE

11.5 POLYESTER

11.6 OTHERS

12 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

12.4 AEROSOL

13 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 SURGICAL INSTRUMENTS

13.3 IMPLANTABLE DEVICES

13.4 GUIDEWIRES

13.5 MANDRELS & MOLDS

13.6 CATHETERS

13.7 OTHERS

14 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PPG INDUSTRIES, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 SIKA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT UPDATE

17.3 AKZO NOBEL N.V

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 AXALTA COATING SYSTEMS, LLC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUS ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AST PRODUCTS, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BIOCOTE LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOINTERACTIONS LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOMERICS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 COVALON TECHNOLOGIES LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUS ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 HARLAND MEDICAL SYSTEMS, INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HYDROMER

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 MICROBAN INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SCIESSENT LLC

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SPECIALTY COATING SYSTEMS INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION OF COPPER FROM 2017-TO 2021, THOUSAND METRIC TONS

TABLE 2 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 4 NORTH AMERICA SILVER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA COPPER ANTIMICROBIAL COATING IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SILVER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CHITOSAN IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TITANIUM DIOXIDE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ALUMINUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA COPPER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ZINC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GALLIUM IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ESCHERICHIA COLI IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PSEUDOMONAS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA LISTERIA IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SILVER ION ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ORGANIC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA COPPER ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ZINC ANTIMICROBIAL ADDITIVES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA GRAPHENE MATERIALS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SILVER NANOPARTICLES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA POLYCATIONIC HYDROGEL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA DENDRIMERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA EPOXY IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA ACRYLIC IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA POLYURETHANE IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA POLYESTER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA LIQUID IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA POWDER IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA AEROSOL IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SURGICAL INSTRUMENTS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA IMPLANTABLE DEVICES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA GUIDEWIRES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 48 NORTH AMERICA MANDRELS & MOLDS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA CATHETERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 50 NORTH AMERICA OTHERS IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 65 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 66 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 68 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 69 U.S. POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 U.S. ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 75 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 76 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 78 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 CANADA POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 80 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 82 CANADA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (KILO TONS)

TABLE 85 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2020-2029 (USD MILLION)

TABLE 86 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVES, 2020-2029 (USD MILLION)

TABLE 88 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 MEXICO POLYMER BRUSHES IN ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 90 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 MEXICO ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET AND ASIA-PACIFIC GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 RISING AWARENESS REGARDING HOSPITAL ACQUIRED INFECTION IS DRIVING THE NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SILVER ANTIMICROBIAL COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET, BY PRODUCTION (USD MILLION)

FIGURE 14 CONSUMPTION OF ANTIMICROBIAL COATING IN MEDICAL DEVICES, BY REGION (USD MILLION)

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET

FIGURE 16 GROWTH TREND OF HEALTHCARE SECTOR IN INDIA, USD BILLION

FIGURE 17 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY COATING, 2021

FIGURE 19 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY ADDITIVE, 2021

FIGURE 21 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY RESIN TYPE, 2021

FIGURE 23 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY FORM, 2021

FIGURE 24 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA ANTIMICROBIAL COATING FOR MEDICAL DEVICES MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA ANTIMICROBIAL COATINGS FOR MEDICAL DEVICES MARKET: COMPANY SHARE 2021 (%)

North America Antimicrobial Coatings Medical Devices Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Antimicrobial Coatings Medical Devices Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Antimicrobial Coatings Medical Devices Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.