North America Anti Friction Coating Market

Market Size in USD Million

CAGR :

%

USD

259.71 Million

USD

459.75 Million

2025

2033

USD

259.71 Million

USD

459.75 Million

2025

2033

| 2026 –2033 | |

| USD 259.71 Million | |

| USD 459.75 Million | |

|

|

|

|

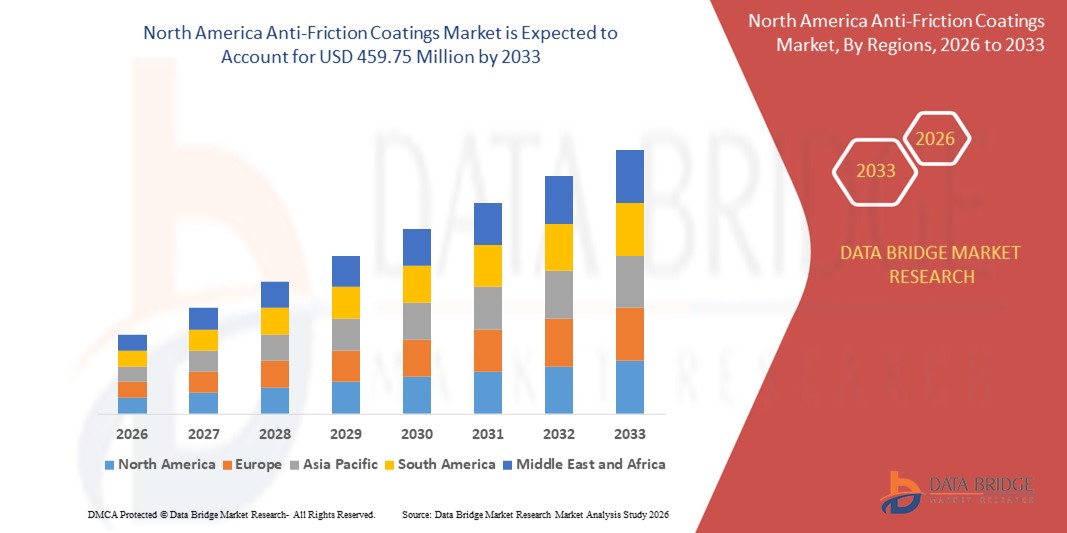

What is the North America Anti-Friction Coatings Market Size and Growth Rate?

- The North America anti-friction coatings market size was valued at USD 259.71 million in 2025 and is expected to reach USD 459.75 million by 2033, at a CAGR of 7.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for wear-resistant and energy-efficient coatings across automotive, aerospace, and industrial machinery sectors

- Rising adoption of advanced surface engineering technologies to improve equipment performance and reduce maintenance costs is further driving market expansion

What are the Major Takeaways of Anti-Friction Coatings Market?

- The market is witnessing innovations in coating formulations, including dry lubricants, solid film lubricants, and composite coatings, to meet diverse industrial requirements

- Increasing investments in R&D for high-performance, environmentally friendly coatings are encouraging adoption across multiple applications and regions

- The U.S. dominated the North America anti-friction coatings market with an estimated 41.23% revenue share in 2025, driven by robust demand from construction, oil & gas, utilities, manufacturing, and large-scale infrastructure maintenance activities

- Canada is expected to register fastest growth rate of 8.24% during the forecast period, supported by rising infrastructure investments, expanding mining and oil & gas activities, and increasing use of performance coatings in industrial machinery and transportation equipment

- The PTFE segment held the largest market revenue share in 2025, driven by its excellent low-friction properties, chemical resistance, and wide applicability across automotive, industrial, and aerospace components

Report Scope and Anti-Friction Coatings Market Segmentation

|

Attributes |

Anti-Friction Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Anti-Friction Coatings Market?

Rising Adoption of Anti-Friction Coatings in Automotive and Industrial Applications

- The increasing shift toward anti-friction coatings is transforming machinery and automotive components by reducing wear and tear, enhancing durability, and improving energy efficiency. These coatings allow for longer service life of equipment and lower maintenance costs, resulting in improved operational efficiency and reduced downtime. In additionally, they help in minimizing heat generation, which enhances safety and reliability of high-speed machinery, further strengthening operational performance

- The high demand for low-friction, high-performance coatings in engines, gear systems, and industrial machinery is accelerating adoption across manufacturing plants and automotive workshops. These coatings are particularly effective in minimizing frictional losses, thereby improving fuel efficiency and mechanical performance. Moreover, they contribute to extended maintenance intervals and reduced lubricant consumption, which lowers total cost of ownership and enhances productivity

- The versatility and ease of applying modern anti-friction coatings are making them attractive for both small-scale manufacturers and large industrial enterprises. Companies benefit from reduced operational costs and enhanced equipment reliability, boosting overall market penetration. Furthermore, the coatings are compatible with a wide range of substrates and can be customized for specific industrial applications, expanding their usability and market potential

- For instance, in 2023, several automotive component manufacturers in Germany reported reduced engine wear and improved efficiency after implementing advanced anti-friction coatings on critical components, resulting in lower warranty claims and higher customer satisfaction. Similar improvements were observed in heavy industrial equipment in Asia, where coated machinery experienced longer operational cycles and fewer unscheduled breakdowns, enhancing overall operational productivity

- While anti-friction coatings are driving innovation in mechanical efficiency and energy conservation, their impact depends on continued material research, application process optimization, and compliance with environmental regulations. Manufacturers must focus on eco-friendly formulations and cost-effective solutions to fully capitalize on growing market demand. The ongoing adoption of advanced coating technologies also positions companies to gain a competitive edge through improved product quality and performance reliability

What are the Key Drivers of Anti-Friction Coatings Market?

- The rising focus on reducing energy consumption and enhancing operational efficiency is encouraging the adoption of anti-friction coatings across automotive, aerospace, and industrial sectors. These coatings reduce frictional losses, which translates into significant energy savings and lower operational costs. They also extend the lifecycle of critical components, providing businesses with measurable financial benefits over time

- Government regulations promoting fuel efficiency and environmental sustainability are further accelerating market growth. Automotive and industrial players are increasingly investing in advanced coatings to meet emissions standards and improve product longevity. In addition, regulatory incentives for green manufacturing practices are encouraging companies to adopt low-friction, eco-friendly coatings as part of their sustainability initiatives

- The expansion of industrial automation and high-speed machinery also fuels demand, as anti-friction coatings improve equipment performance under high load and temperature conditions. Coatings enable reliable operation in harsh environments, reducing failure rates and downtime. This trend is particularly prominent in sectors such as aerospace and heavy manufacturing, where equipment reliability directly impacts productivity and operational costs

- For instance, in 2022, several U.S.-based industrial equipment manufacturers applied anti-friction coatings on high-speed gearboxes, resulting in improved performance, reduced energy consumption, and extended component lifespan. In additionally, similar applications in European wind turbine components demonstrated enhanced efficiency and decreased maintenance requirements, illustrating the coatings’ cross-industry benefits

- While rising awareness and regulatory support are driving market expansion, continuous R&D, cost optimization, and adoption of eco-friendly materials remain essential for sustained growth. Companies investing in next-generation coating technologies are better positioned to address evolving market demands and capitalize on opportunities in emerging industrial and automotive applications

Which Factor is Challenging the Growth of the Anti-Friction Coatings Market?

- The high cost of advanced anti-friction coatings, such as ceramic and solid-lubricant formulations, limits adoption among small-scale manufacturers and cost-sensitive industries. Specialized materials and surface preparation requirements increase operational expenses and entry barriers. In additionally, fluctuating raw material prices for specialty powders can impact overall manufacturing costs, further constraining smaller players

- In many regions, the application of anti-friction coatings requires skilled personnel and precise process control. The lack of trained workforce and advanced application infrastructure restricts widespread adoption, particularly in emerging markets. Companies may also face challenges in maintaining consistent coating quality across large-scale production, which can affect performance reliability and customer trust

- Supply chain challenges for specialty coating powders and additives can disrupt production schedules and increase costs. Inconsistent availability of raw materials affects scalability and timely delivery of coated products to customers. Furthermore, logistical constraints in transporting temperature-sensitive or hazardous coating materials can lead to production delays and increased operational risks

How is the Anti-Friction Coatings Market Segmented?

The market is segmented on the basis of product, nature, application, and end use.

- By Product

On the basis of product, the market is segmented into MOS2, PTFE, Graphite, FEP, PFA, and Tungsten Disulfide. The PTFE segment held the largest market revenue share in 2025, driven by its excellent low-friction properties, chemical resistance, and wide applicability across automotive, industrial, and aerospace components. PTFE coatings are preferred for enhancing performance, reducing wear, and extending the service life of critical machinery.

The MOS2 segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior load-bearing capacity and high-temperature stability, making it ideal for heavy-duty applications in automotive engines, power transmission items, and industrial machinery. MOS2 coatings are particularly popular for reducing friction under extreme conditions, improving operational efficiency, and minimizing maintenance costs.

- By Nature

On the basis of nature, the market is segmented into solvent based and water based. The water-based segment held the largest share in 2025, fueled by growing environmental regulations and preference for eco-friendly coating solutions. Water-based coatings offer reduced VOC emissions, improved workplace safety, and compliance with sustainability standards.

The solvent-based segment is expected to witness the fastest growth from 2026 to 2033, driven by its strong adhesion, high performance under harsh conditions, and suitability for critical industrial and automotive applications. Solvent-based coatings continue to be favored where durability and extreme operational resistance are required.

- By Application

On the basis of application, the market is segmented into automotive parts, power transmission items, bearings, ammunition components, valve components & actuators, and others. The automotive parts segment held the largest market share in 2025 due to increasing demand for lightweight, high-performance components and stringent automotive efficiency standards. Anti-friction coatings improve fuel efficiency, reduce wear, and enhance the reliability of automotive systems.

The power transmission items segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing industrial automation and demand for high-efficiency gearboxes and machinery. Coatings reduce friction, improve energy efficiency, and minimize downtime, making them crucial in modern industrial operations.

- By End Use

On the basis of end use, the market is segmented into automotive, aerospace, marine, construction, healthcare, and others. The automotive segment held the largest revenue share in 2025, propelled by growing vehicle production, adoption of fuel-efficient technologies, and focus on reducing maintenance costs. Anti-friction coatings enhance engine performance, component lifespan, and overall vehicle efficiency.

The aerospace segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing need for lightweight, high-performance components capable of withstanding extreme temperatures and stresses. Coatings provide superior lubrication, wear resistance, and energy efficiency, which are critical for aerospace applications.

Which Region Holds the Largest Share of the Anti-Friction Coatings Market?

- The U.S. dominated the North America anti-friction coatings market with an estimated 41.23% revenue share in 2025, driven by robust demand from construction, oil & gas, utilities, manufacturing, and large-scale infrastructure maintenance activities. Increasing emphasis on operational efficiency, equipment durability, reduced wear, and compliance with industrial performance standards continues to support market growth

- Strong presence of heavy industrial operations, large commercial construction projects, and advanced manufacturing facilities is accelerating the adoption of anti-friction coatings to minimize mechanical losses, extend component life, and reduce maintenance costs across sectors

- Continuous focus on improving asset reliability, lowering downtime, enhancing energy efficiency, and meeting stringent industrial quality standards further reinforces the U.S.’s leadership in the regional anti-friction coatings market

Canada Anti-Friction Coatings Market Insight

Canada is expected to register fastest growth rate of 8.24% during the forecast period, supported by rising infrastructure investments, expanding mining and oil & gas activities, and increasing use of performance coatings in industrial machinery and transportation equipment. Growing awareness of lifecycle cost reduction and sustainability is strengthening demand across the country.

Mexico Anti-Friction Coatings Market Insight

Mexico is witnessing moderate growth in the anti-friction coatings market, driven by expanding automotive manufacturing, industrial production, and foreign investments in infrastructure and energy projects. Increasing adoption of advanced surface protection solutions and improving industrial standards are contributing to sustained market expansion.

Which are the Top Companies in Anti-Friction Coatings Market?

The Anti-Friction Coatings industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Parker Hannifin Corp (U.S.)

- CARL BECHEM GMBH (Germany)

- ASV Mutichemie Private Limited (India)

- Whitmore Manufacturing LLC (U.S.)

- FUCHS LUBRITECH GmbH (Germany)

- Lubrizol Corporation (U.S.)

- Klüber Lubrication (Germany)

- Royal DSM N.V. (Netherlands)

- Evonik Industries AG (Germany)

What are the Recent Developments in North America Anti-Friction Coatings market?

- In May 2021, DuPont launched MOLYKOTE G-1079 grease, a noise-reducing anti-friction coating specifically designed for sliding-contact applications in actuators, including next-generation electric vehicles. The new formulation enhances performance under both high-load fast movements and low-load slow movements, improving operational efficiency and component longevity. This innovation strengthens DuPont’s product portfolio and is expected to boost market sales by meeting the growing demand for advanced, high-performance lubricants in the automotive and industrial sectors

- In April 2021, Whitmore Manufacturing, LLC introduced Lustor, a scalable lubrication storage and dispensing system. The compact and durable unit extends the life of lubricants while fitting into nearly any industrial location, offering improved efficiency and ease of use. This development supports operational optimization for industrial clients and enhances Whitmore Manufacturing’s market presence, contributing positively to revenue growth and adoption of advanced lubrication solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Anti Friction Coating Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Anti Friction Coating Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Anti Friction Coating Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.