North America Ambulatory Infusion Pumps Market Analysis and Insights

Major factors driving the growth of this market are the increasing geriatric population, the expanding prevalence of chronic diseases such as cancer and diabetes, and positive patient outcomes in a less-expensive home setting. Ongoing technology developments and newer applications of ambulatory pumps in the home are driving an increase in their use. Recently, ambulatory pumps have been used to deliver various medications to treat various diseases and conditions, from diabetes to chronic pain. This mode of delivery typically involves using a needle or catheter under the skin to administer medications, blood products, nutrition, or hydrating solutions via the IV, subcutaneous, epidural/intrathecal, percutaneous, intrawound, intrahepatic, or other parenteral routes.

The main factors that may hamper the market's growth are the high cost associated with ambulatory infusion pump systems.

The ambulatory infusion pumps market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

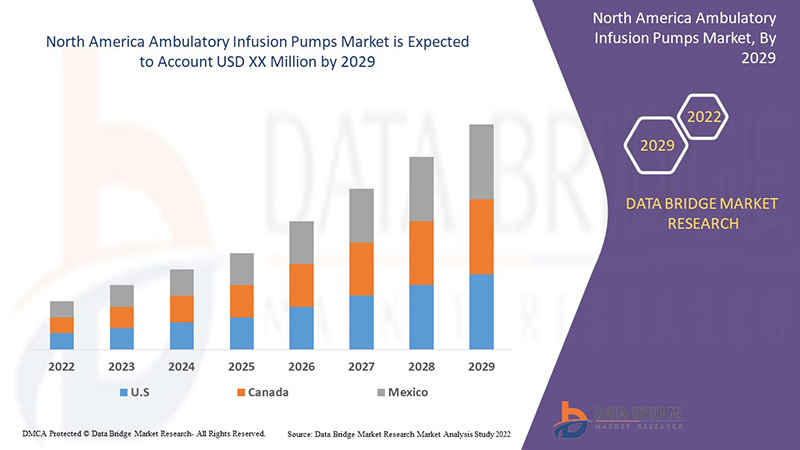

Data Bridge Market Research analyses that ambulatory infusion pumps market will grow at a CAGR of 10.7% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

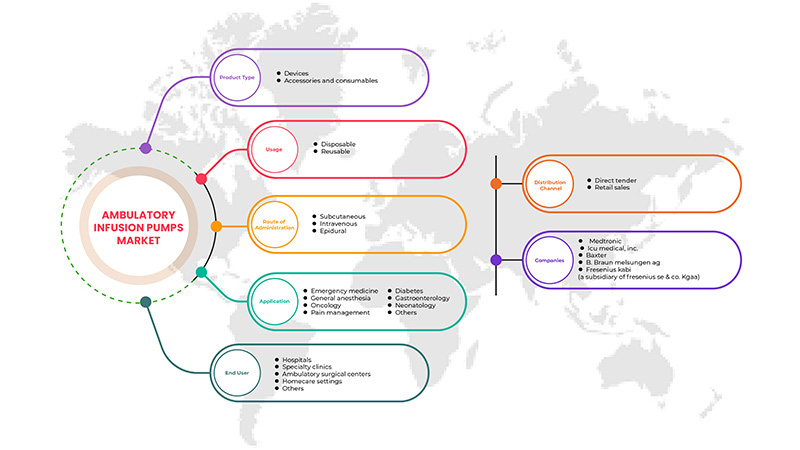

By Product Type (Devices, and Accessories and Consumables), Usage (Disposable and Reusable), Route of Administration (Subcutaneous, Intravenous and Epidural), Application (Emergency Medicine, General Anaesthesia, Pain Management, Oncology, Diabetes, Gastroenterology, Neonatology, Others), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Home Care Settings and Others), Distribution Channel (Direct Tender and Retail Sales) |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (a subsidiary of Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, among others. |

Market Definition

A medical device that delivers fluids, such as nutrients and medications, into a patient’s body in controlled amounts. Infusion pumps are in widespread use in clinical settings such as hospitals, nursing homes, and in the home. An infusion pump is operated by a trained user, who programs the rate and duration of fluid delivery through a built-in software interface. Infusion pumps offer significant advantages over manual administration of fluids, including the ability to deliver fluids in very small volumes, and the ability to deliver fluids at precisely programmed rates or automated intervals. They can deliver nutrients or medications, such as insulin or other hormones, antibiotics, chemotherapy drugs, and pain relievers.

Infusion pump systems are an active treatment aiming to monitor the medication in small amounts in different settings such as hospitals, clinics, and even at home. It is used to supply a controlled amount of drugs very slowly into the bloodstream over a period of time. It can be used in stationary and mobile environments to administer pain medication, antibiotics, chemotherapy medication, and hydrating fluids.

Ambulatory Infusion Pump Market Dynamics

Drivers

- Increase in the geriatric population

With the increasing age comes a reciprocal increase in the elderly patients admitted to the hospitals due to the rising prevalence of the chronic disease. Age is a severe risk factor for any disease progression, since age is an essential parameter that affects fundamental biological mechanisms. Chronic diseases such as cancer enormously occur in the geriatric population, with nearly 60% of cancers occurring in the geriatric populace age group older than 65. Cancer disease is very challenging in the geriatric populace, as due to age factors geriatric populace is already suffering from numerous health-related problems. This indicates the growing demand of infusion pumps from the geriatric populace.

With the ability to deliver fluids in a very small amount in a controlled environment directly to the bloodstream, the demand for infusion pump systems is rising in the healthcare system globally. The increasing need for proper treatment proportionally surges the demand for care, services, and technologies for preventing and treating conditions, including cardiovascular diseases, stroke, cancer, chronic respiratory diseases, and other complications. With the increasing age and rising prevalence of chronic diseases, the demand for early diagnosis of the diseases are also increasing. The demand for care, services, and technologies is rising to treat chronic conditions in old age. Thus, the increase in the geriatric population is expected to drive the growth of the ambulatory infusion pumps market.

- Growing technological advancements in infusion pumps system

The contribution of technological advancements in healthcare and clinical services is being taken out of the confines and made it more accessible. Technological developments in infusion pump results in prevention of medication errors and reduction of patient harm. These advancements result in improving clinical outcomes with a patient monitoring technology to inform and guide clinicians' treatment decisions.

Technology diversifies and plays a role in almost all processes in the healthcare industry, such as the possibility of medication errors exists due to an increase in disease burden, patient registration for data management, and laboratory testing for self-care equipment, making it the next boosting factor for infusion pump systems, accessories, and software market. The innovation and advancement in technology have upgraded the infusion pump systems in all prospects, including advanced features like increased accuracy, mobility, flexibility, and different choice smooth automatic multi-channel. The advancement in technologies brings many advantages towards the efficiency of procedures leading to increased patient safety. Hence, growing technological advancements in infusion pump systems are expected to drive the ambulatory infusion pumps market.

Opportunities

- Increasing incidences of chronic diseases

The high prevalence of chronic diseases due to the rapidly increasing population and infections can be seen globally. Individual risk factors, environmental factors, lack of physical activities, and human lifestyles are the major factors that further contribute to rising incidences of diseases. The evaluation of disorders will further lead to high demand for clinical studies through different routes of administration of drug deliveries in the human body. The rise in the incidence of diseases such as cardiovascular and cancer has led to an increase in demand for intravenous infusion pump devices.

Restraints/Challenges

- Side-effects associated with infusion pumps system

The rising use of infusion pumps with the advancement in technology has become standard practice in hospitals to administer critical fluids to patients. However, there are still limited research studies for reducing errors and improving infusion pump use that lead to adverse events in the system. The various problems associated with it can be software errors or human errors.

The side –effects associated with infusion pump systems include Software problems, Inadequate user interface design, Broken components, Alarm errors, Battery failures, and Charring, or shocks.

- High cost linked with infusion pumps system

Patients with chronic diseases such as acute respiratory distress syndrome must have long hospitalizations with regular monetarization and ventilation usage, leading to a significant amount of healthcare resources, due to which most patients who cannot afford long-term stay and get discharged in the initial stages of treatment. But this increases the possibilities and susceptibilities for new complications in infections which demands additional healthcare resources and treatment.

The high cost of the treatment is due to the various checkpoints of the treatment along with the use of high-tech modalities to perform such treatment procedures. The hospital care further adds to the cost of the infusion pump interventions. As the cost of innovative and advanced infusion pumps is high, the cost of the treatment proportionally gets escalated, due to which high cost associated with the use of the infusion pumps systems is expected to restrain the ambulatory infusion pumps market.

Recent Developments

- In March 2022, Fresenius Kabi, announced that the company has acquired Ivenix, Inc., a medical technology company specializing in advanced technologies infusion system. This help in accelerating strategic growth in biopharmaceuticals and Medtech that results in expanding the large and growing infusion therapy market.

- In February 2022, ICU Medical, Inc., Plum 360 Infusion System once again receives best in KLAS honour as top-performing smart pump EMR-integrated. This Best in KLAS designation is based on feedback from thousands of healthcare providers throughout the United States and Canada and results from in depth side-by-side comparisons of IV smart pump performance in multiple categories, including culture, loyalty, operations, product, relationship, and value.

Ambulatory Infusion Pumps Market Segmentation

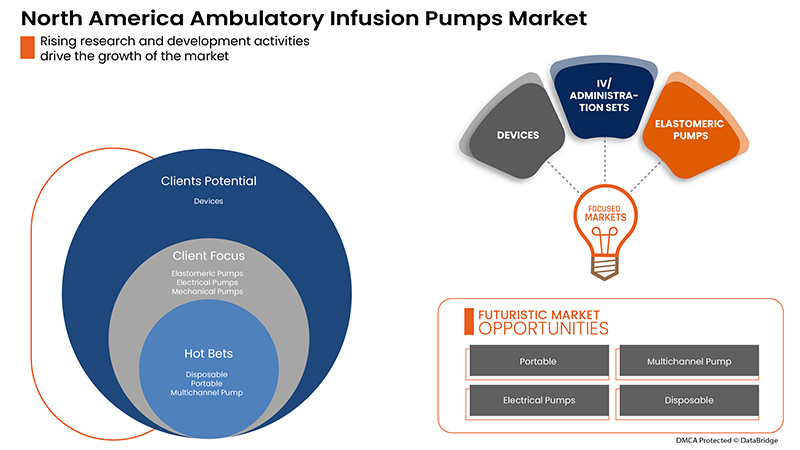

The ambulatory infusion pumps market is categorized into six notable segments which are based on product type, usage, route of administration, application, end user and distribution channel. The growth among segments helps you analyses niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product Type

- Devices

- Accessories & Consumables

On the basis of product type, the ambulatory infusion pumps market is segmented into devices, accessories and consumables.

Usage

- Disposable

- Reusable

On the basis of usage, the ambulatory infusion pumps market is segmented into disposable and reusable.

Route of Administration

- Intravenous

- Subcutaneous

- Epidural

On the basis of route of administration, the ambulatory infusion pumps market is segmented into intravenous, subcutaneous, and epidural.

Application

- Pain Management

- Diabetes

- Oncology

- Neonatology

- Gastroenterology

- General Anaesthesia

- Emergency Medicine

- Others

On the basis of application, the ambulatory infusion pumps market is segmented into pain management, diabetes, oncology, neonatology, gastroenterology, general anaesthesia, emergency medicine, and others.

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- others

On the basis of end-user, the global ambulatory infusion pumps market is segmented into hospitals, home care settings, ambulatory surgical centers, specialty clinics, and others.

Distribution Channel

- Direct Tender

- Retail Sales

On the basis of distribution channels, the ambulatory infusion pumps market is segmented into direct tender and retail sales.

Ambulatory Infusion Pumps Regional Analysis/Insights

The ambulatory infusion pumps is analysed and market size insights and trends are provided by product type, usage, route of administration, application, end user and distribution channel as referenced above.

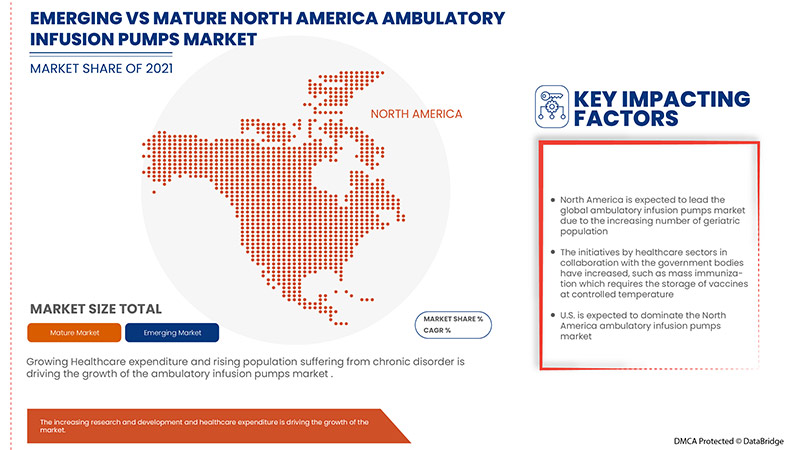

The countries covered in the ambulatory infusion pumps report are U.S., Canada, Mexico

North America is expected to dominate the market due to the growing technological advancements in infusion pumps system. The U.S. is expected to dominate the market due to high prevalence of various chronic and acute disorders among people in the U.S.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ambulatory Infusion Pumps Share Analysis

The ambulatory infusion pumps competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on ambulatory infusion pumps market.

Some of the prominent players operating in this market are B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (a subsidiary of Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE GERIATRIC POPULATION

6.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN INFUSION PUMPS SYSTEM

6.1.3 RISING DEMAND FOR AMBULATORY PUMPS IN HOME CARE SETTINGS

6.1.4 INCREASE IN THE NUMBER OF SURGERIES

6.2 RESTRAINS

6.2.1 HIGH COST LINKED WITH INFUSION PUMPS SYSTEM

6.2.2 SIDE-EFFECTS ASSOCIATED WITH INFUSION PUMPS SYSTEM

6.3 OPPORTUNITIES

6.3.1 INCREASING INCIDENCE OF CHRONIC DISEASES

6.3.2 RISING ARTIFICIAL INTELLIGENCE TO AUTOMATE DRUG INFUSIONS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.3.4 INCREASED REIMBURSEMENT POLICIES

6.4 CHALLENGE

6.4.1 LACK OF SKILLED HEALTHCARE PROFESSIONALS

6.4.2 STRINGENT GOVERNMENT REGULATION

7 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DEVICES

7.2.1 BY PRODUCT

7.2.1.1 ELASTOMERIC PUMPS

7.2.1.1.1 MULTICHANNEL PUMP

7.2.1.1.2 SINGLE CHANNEL PUMP

7.2.1.2 ELECTRICAL PUMPS

7.2.1.2.1 MULTICHANNEL PUMP

7.2.1.2.2 SINGLE CHANNEL PUMP

7.2.1.3 MECHANICAL PUMPS

7.2.1.3.1 MULTICHANNEL PUMP

7.2.1.3.2 SINGLE CHANNEL PUMP

7.2.1.4 OTHER PUMPS

7.2.2 BY MODALITY

7.2.2.1 PORTABLE

7.2.2.2 WEARABLE

7.3 ACCESSORIES AND CONSUMABLES

7.3.1 IV/ADMINISTRATION SETS

7.3.2 TUBING & EXTENSION

7.3.3 INFUSION CATHETERS

7.3.4 INSULIN RESERVOIR OR CARTRIDGES

7.3.5 CANNULAS

7.3.6 NEEDLELESS CONNECTORS

7.3.7 BATTERY

7.3.8 OTHERS

8 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE

8.1 OVERVIEW

8.1.1 DISPOSABLE

8.1.2 DEVICES

8.1.3 ACCESSORIES AND CONSUMABLES

8.2 REUSABLE

8.2.1 DEVICES

8.2.2 ACCESSORIES AND CONSUMABLES

9 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 INTRAVENOUS

9.3 SUBCUTANEOUS

9.4 EPIDURAL

10 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 PAIN MANAGEMENT

10.2.1 DEVICES

10.2.2 ACCESSORIES AND CONSUMABLES

10.3 DIABETES

10.3.1 DEVICES

10.3.2 ACCESSORIES AND CONSUMABLES

10.4 ONCOLOGY

10.4.1 DEVICES

10.4.2 ACCESSORIES AND CONSUMABLES

10.5 NEONATOLOGY

10.5.1 DEVICES

10.5.2 ACCESSORIES AND CONSUMABLES

10.6 GASTROENTEROLOGY

10.6.1 DEVICES

10.6.2 ACCESSORIES AND CONSUMABLES

10.7 GENERAL ANESTHESIA

10.7.1 DEVICES

10.7.2 ACCESSORIES AND CONSUMABLES

10.8 EMERGENCY MEDICINE

10.8.1 DEVICES

10.8.2 ACCESSORIES AND CONSUMABLES

10.9 OTHERS

11 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 HOMECARE SETTINGS

11.4 AMBULATORY SURGICAL CENTERS

11.5 SPECIALTY CLINICS

11.6 OTHERS

12 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MEDTRONIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ICU MEDICAL

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 BAXTER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 B. BRAUN MELSUNGEN AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO.KGAA)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 BD

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACE-MEDICAL

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVNS.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 EITAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 INTRA PUMP INFUSION SYSTEMS.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KORU MEDICAL SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 MOOG INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MICREL MEDICAL DEVICES SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 WALKMED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 WOODLEY EQUIPMENT COMPANY LTD

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 12 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA INTRAVENOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SUBCUTANEOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA EPIDURAL IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HOSPITALS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HOMECARE SETTINGS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SPECIALTY CLINICS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIRECT TENDER IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL SALES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 50 NORTH AMERICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 U.S. AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 73 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 74 U.S. ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 U.S. ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 U.S. MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 78 U.S. ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 80 U.S. ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 81 U.S. AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 U.S. DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 83 U.S. REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 84 U.S. AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 U.S. AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 CANADA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 98 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 99 CANADA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 CANADA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 CANADA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 103 CANADA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 105 CANADA ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 106 CANADA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 107 CANADA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 108 CANADA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 109 CANADA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 CANADA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 CANADA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 123 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 124 MEXICO ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 MEXICO ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 MEXICO MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 MEXICO ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME 2020-2029 (UNITS)

TABLE 130 MEXICO ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 131 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 MEXICO DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 139 MEXICO NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 144 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 10 THE RISING PREVALENCE OF CHRONIC DISEASES, AS WELL AS GROWING GERIATRIC POPULATION, IS DRIVING THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND, CHALLENGES OF NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET

FIGURE 13 RECENT YEAR HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 14 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2021

FIGURE 19 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 23 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2021

FIGURE 31 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.