North America Agriculture Nets Market Analysis and Insights

The North America agriculture nets market is fragmented in nature, as it consists of many players such as Garware Technical Fibres Limited, and Thrace Group. The presence of these companies produce best agriculture nets products for various applications to farmers and other users at regional and international level. These manufacturers and suppliers of agriculture nets offer products for all budget range with various characteristics.

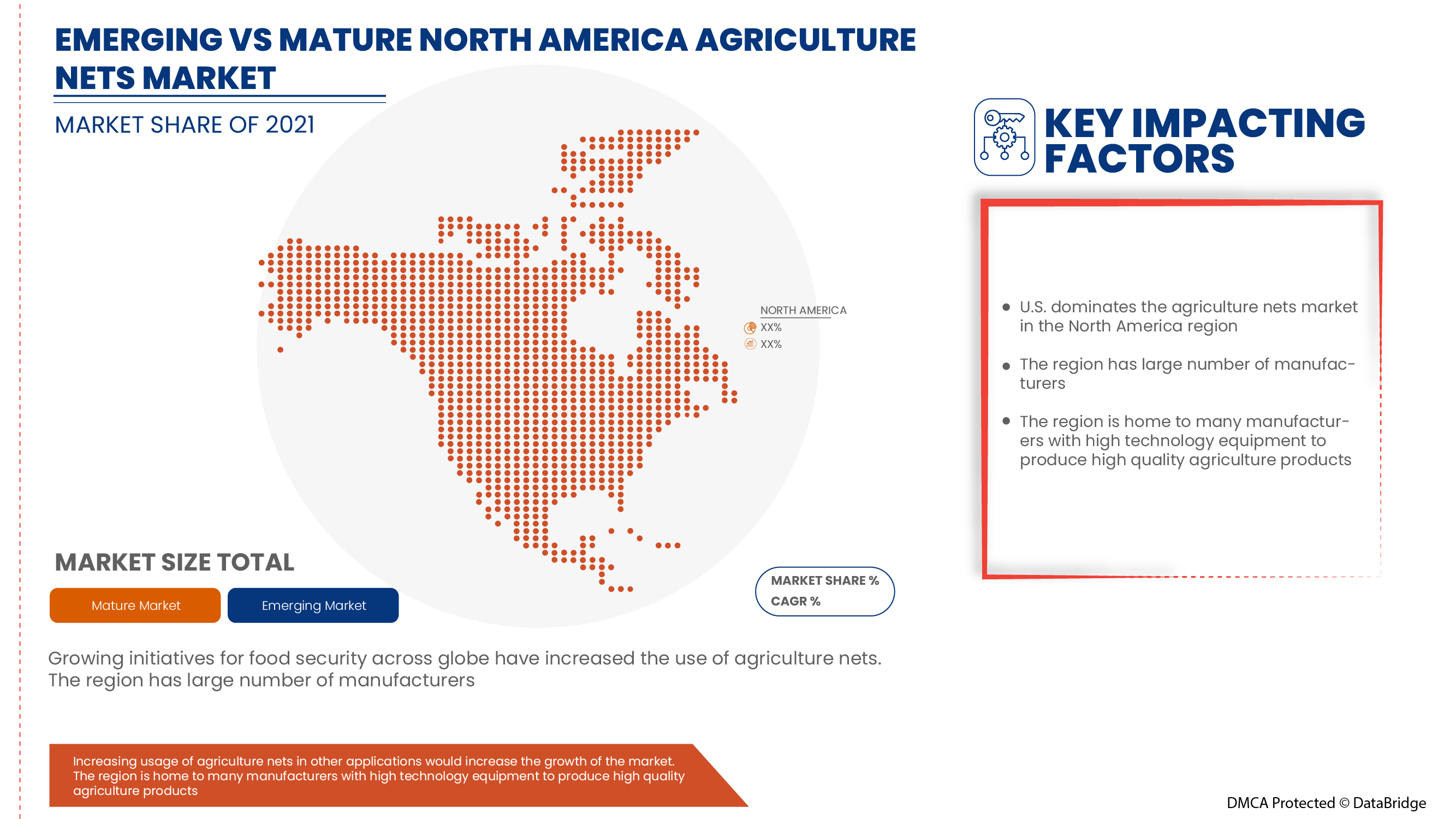

Growing initiatives for food security across the region and increasing usage of agriculture net in horticulture and floriculture is driving the North America agriculture nets market as these nets enable the farmers to produce more farm output. However, increasing agriculture plastic pollution and environmental concerns regarding use of plastic agriculture nets is expected to act as a restraint for the market growth. But, the increasing agriculture subsidies by various nation governments and increasing practice of terrace or rooftop agriculture is expected to provide an opportunity to widen the application and use of agriculture nets.

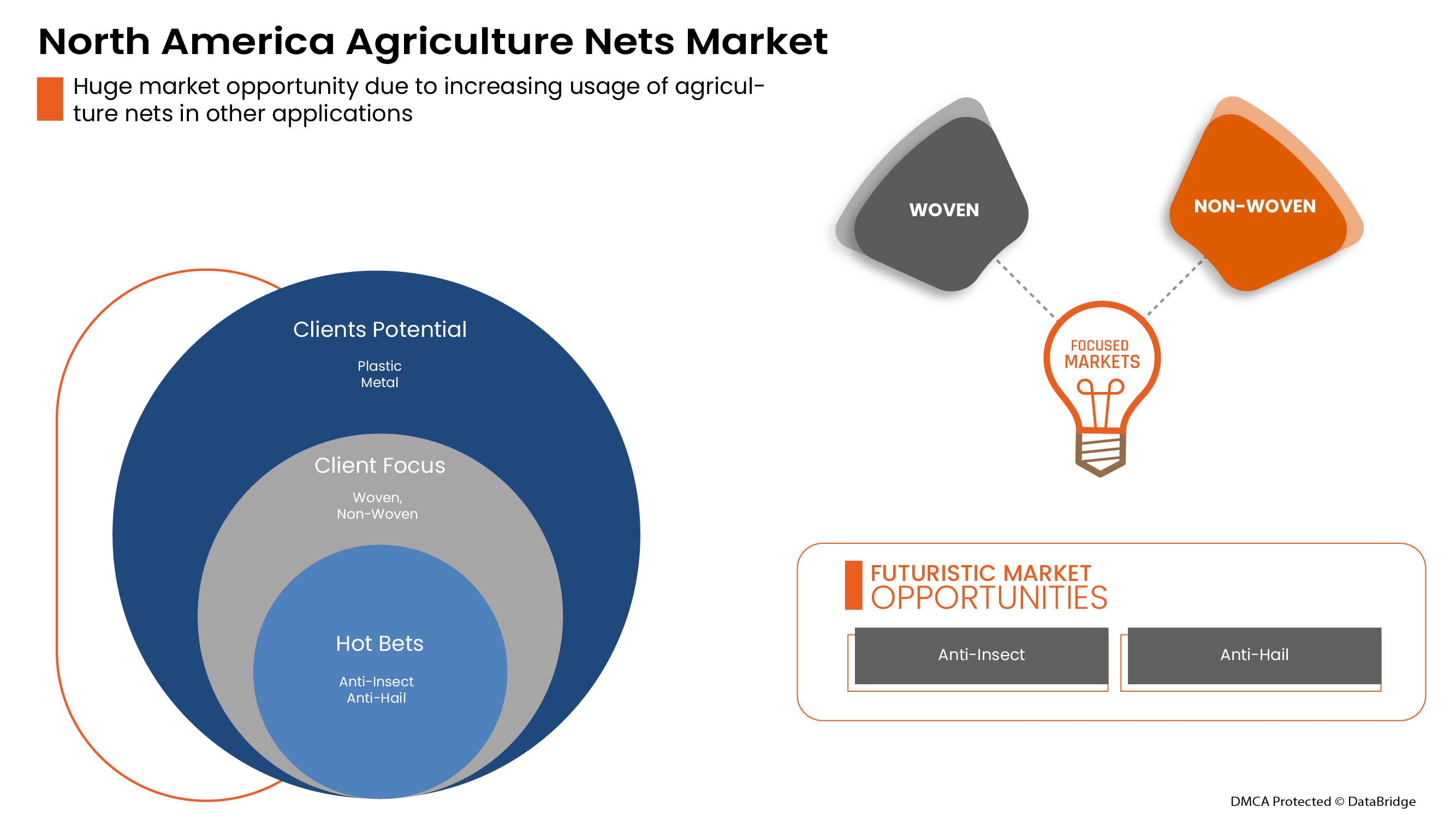

Moreover, the development of the agro textile and increasing usage of agriculture nets in other applications such as forestry is expected to boost the North America agriculture nets market growth in future.

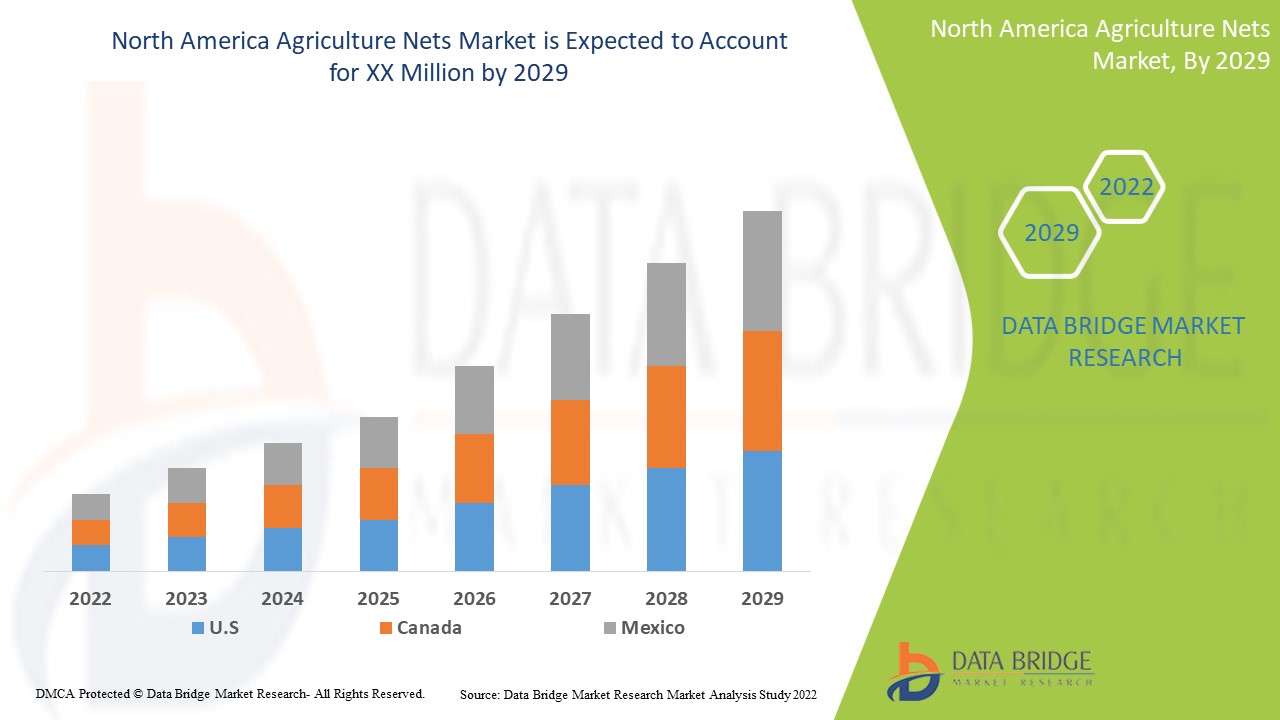

Data Bridge Market Research analyzes that the North America agriculture nets market will grow at a CAGR of 6.1% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

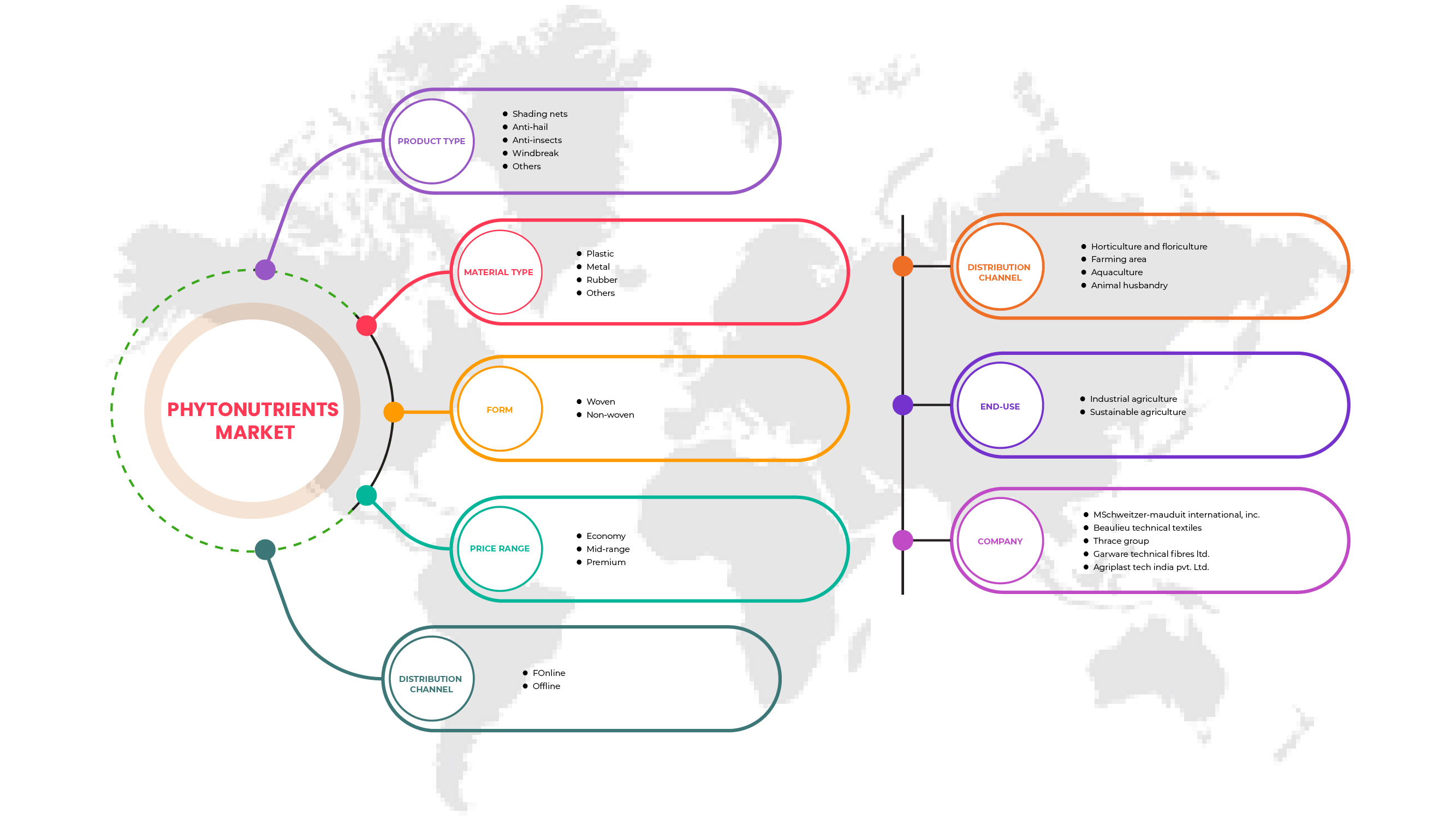

By Product Type (Shading Nets, Anti-Hail, Anti-Insects, Windbreak and Others), Material Type (Plastic, Rubber, Metal and Others), Form (Woven and Non-Woven), Price Range (Economy, Mid-Range and Premium), Distribution Channel (Offline and Online), Application (Horticulture and Floriculture, Farming Area, Animal Husbandry and Aquaculture), End Use (Industrial Agriculture and Sustainable Agriculture) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Belton Industries., Smart Net Systems Ltd., Diatex, Garware Technical Fibres Limited, Thrace Group, U.S. Netting, Inc., Schweitzer-Mauduit International, Inc, Zhongshan Hongjun Nonwovens Co. Ltd., Beaulieu Technical Textiles |

Market Definition

Agriculture nets are made of materials such as rubber, metals, fabrics or high-density polyethylene, also known as HDPE. The agriculture nets are majorly used in the farming industry to protect plants from solar radiations, UV rays and harsh weather conditions. Major advantages provided by agriculture nets are protection from UV rays and ability to create micro-environment for the crops. They are used in the non-woven and woven form. Apart from agriculture, these nets are also used in floriculture, horticulture, and animal husbandry. They have widespread application in household and commercial sectors for construction of provisional fences, car parking, fishing nets, window sheds, and scaffolding. Length and width of the nets vary from 1 m to 20 m and 25 m to 300 m depending on application. Increasing applications of these nets in agriculture and allied sectors and in other sectors such as construction, household is boosting the North America agriculture nets market.

North America Agriculture Nets Market Dynamics

Drivers

- Increasing usage of agriculture net in horticulture and floriculture

The agriculture nets are becoming more useful and important in horticulture as they provide shade for the crops and prevent crops from excessive heat. The anti-hail nets also help to prevent crops from hails and improve the micro-environments that can boost the productivity and yield of the cultivation. The agriculture nets are used in horticulture and floriculture sectors for many applications and functions such as radiation scattering, photo selectivity. The horticulture segment productivity is highly dependent on the shadings and nets used in the practice, making agriculture nets one of the essential components in the practice.

Thus, with the increasing practices of horticulture and floriculture across the region, the demand of agriculture nets is increasing rapidly which is acting as a driver for the growth of the North America agriculture nets market.

- Growing initiatives for food security across the region

In present times, the North America region governments have been trying to increase their national food self-efficiency and food security by various initiatives since green revolution. Additionally, in past few decades with the increasing population and growing food demands, various nations have increased their focus on national food security. This has acted as the driving factor for the North America agriculture nets market, as these initiatives focus on increasing the agriculture production and ways through which local farmers can achieve it, thus as a result the demand for agriculture nets has increased.

Opportunity

-

Increasing practice of terrace or rooftop agriculture

Rooftop agriculture practices are increasing rapidly especially in the urban areas as people are using blank space of roof for producing fresh vegetables, herbs, fruits, edible flowers. Productive green roofs combine food production with ecological sustainability, such as reduced rainwater run-off, provide temperature benefits such as potential reduction of heating and cooling requirements (resulting in reduced emissions), improved aesthetic value and air quality. The increasing practice of terrace agriculture has resulted in rise of demands in shading nets, anti-insect nets and wind break nets across North America, providing a growth opportunity for the North America agriculture nets market.

Restraint/Challenge

- Environmental concerns regarding use of agriculture nets

The agriculture nets are used in the agriculture, horticulture, aquaculture, and animal husbandry for various applications. Agriculture nets are used to protect cultivated crops from birds, insects, little animals, and other factors such as UV radiations and harsh weather conditions. The materials that these agriculture nets are made up of are mainly plastic, rubber, and metals. As the plastic nets are less costly with respect to other materials, they are produced on mass scale. The sustainability of plastic nets is causing environmental concerns as bio based plastic nets are easily biodegradable but conventional plastic nets such as High-Density Polyethylene (HDPE), Polyethylene (PE), and polyvinyl chloride are not eco-friendly. Thus, the non-ecofriendly feature of agriculture nets may hamper the market's growth.

Post-COVID-19 Impact on North America Agriculture Nets Market

The COVID-19 pandemic has affected the North America agriculture nets market significantly. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply the raw products to the manufacturers, initially decreasing the production rate of agriculture nets. However, post-COVID-19, the demand for agriculture nets has increased significantly owing to increased awareness about the agriculture nets benefits and the rise of horticulture and floriculture sectors. Consumers are trying to use the nets to boost yields and produce profit from the agriculture and allied sectors. Thus, post-COVID-19 the North America agriculture nets market is expected to bloom due to increasing initiatives for food security across the region and increasing usage of agriculture nets in other applications.

Recent Development

- In May 2022, Schweitzer-Mauduit International, Inc. and Neenah, Inc. announced a partnership under which both companies will form a team for future developments. This step intends to use both companies' potential to produce technical products in the textile industry. The company aims to offer new, technically advanced products in the North America agriculture nets market with this partnership

North America Agriculture Nets Market Scope

The North America agriculture nets market is segmented on the basis of product type, material type, form, price range, distribution channel, application, and end use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Shading Nets

- Anti-Hail

- Anti-Insects

- Windbreak

- Others

On the basis of product type, the North America agriculture nets market is segmented into shading nets, anti-hail, anti-insects, windbreak and others.

Material Type

- Plastic

- Metal

- Rubber

- Others

On the basis of material type, the North America agriculture nets market is segmented into plastic, rubber, metal and others.

Form

- Woven

- Non-Woven

On the basis of form, the North America agriculture nets market is segmented into woven and non-woven.

Price Range

- Economy

- Mid-Range

- Premium

On the basis of price range, the North America agriculture nets market is segmented into economy, mid-range and premium.

Distribution Channel

- Online

- Offline

On the basis of distribution channel, the North America agriculture nets market is segmented into offline and online.

Application

- Horticulture And Floriculture

- Farming Area

- Animal Husbandry

- Aquaculture

On the basis of application, the North America agriculture nets market is segmented into horticulture and floriculture, farming area, animal husbandry and aquaculture.

End Use

- Industrial Agriculture

- Sustainable Agriculture

On the basis of end use, the North America agriculture nets market is segmented into industrial agriculture and sustainable agriculture.

North America Agriculture Nets Market Regional Analysis/Insights

The North America agriculture nets market is analyzed and market size insights and trends are provided by country, product type, material type, form, price range, distribution channel, application and end use as referenced above.

The countries covered in the North America agriculture nets market report are U.S., Canada and Mexico.

The U.S. is expected to dominate the North America agriculture nets market regarding market share and revenue. It is estimated to maintain its dominance during the forecast period due to the rising trend of horticulture and floriculture.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Agriculture Nets Market Share Analysis

The North America agriculture nets market competitive landscape details the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the North America agriculture nets market.

Some of the major players operating in the North America agriculture nets market are Belton Industries., Diatex, Garware Technical Fibres Limited, Thrace Group, U.S., Schweitzer-Mauduit International, Inc, Zhongshan Hongjun Nonwovens Co. Ltd., Beaulieu Technical Textiles among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AGRICULTURE NETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION-CONSUMPTION ANALYSIS

4.2 IMPORT EXPORT SCENARIO

4.3 PRICE TREND ANALYSIS

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 LIST OF KEY BUYERS

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 VENDOR SELECTION CRITERIA

4.9 PESTEL ANALYSIS

4.1 REGULATIONS COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING INITIATIVES FOR FOOD SECURITY ACROSS GLOBE

6.1.2 RISING DEMAND FOR AGRICULTURE NETS DUE TO INCREASING INTEREST IN GARDENING

6.1.3 USE OF AGRICULTURE NETS IN AQUACULTURE AND ANIMAL HUSBANDRY

6.1.4 INCREASING USAGE OF AGRICULTURE NET IN HORTICULTURE AND FLORICULTURE

6.2 RESTRAINTS

6.2.1 LESS LIFE SPAN OF NETS

6.2.2 ENVIRONMENTAL CONCERNS REGARDING THE USE OF AGRICULTURE NETS

6.2.3 INCREASING AGRICULTURE PLASTIC POLLUTION

6.3 OPPORTUNITIES

6.3.1 THE DEVELOPMENT OF THE AGRO TEXTILE

6.3.2 NORTH AMERICALY INCREASING PRACTICE OF TERRACE OR ROOFTOP AGRICULTURE

6.3.3 INCREASING USAGE OF AGRICULTURE NETS IN OTHER APPLICATIONS

6.3.4 INCREASING AGRICULTURE SUBSIDIES BY VARIOUS NATION GOVERNMENTS

6.4 CHALLENGES

6.4.1 THE VARYING COSTS OF THE RAW MATERIALS USED IN AGRO-TEXTILE

6.4.2 GEOGRAPHICAL SHORTCOMING OF AGRICULTURE NETS

7 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SHADING NETS

7.3 WINDBREAK

7.4 ANTI-INSECT

7.5 ANTI-HAIL

7.6 OTHERS

8 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 METAL

8.4 RUBBER

8.5 OTHERS

9 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 ECONOMY

9.3 MID-RANGE

9.4 PREMIUM

10 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM

10.1 OVERVIEW

10.2 WOVEN

10.3 NON-WOVEN

11 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.3 ONLINE

12 NORTH AMERICA AGRICULTURE NETS MARKET , BY APPLICATION

12.1 OVERVIEW

12.2 HORTICULTURE AND FLORICULTURE

12.3 FARMING AREA

12.4 AQUACULTURE

12.5 ANIMAL HUSBANDRY

13 NORTH AMERICA AGRICULTURE NETS MARKET, BY END USE

13.1 OVERVIEW

13.1.1 INDUSTRIAL AGRICULTURE

13.1.1.1 SHADING NETS

13.1.1.2 WINDBREAK

13.1.1.3 ANTI-INSECTS

13.1.1.4 ANTI-HAIL

13.1.1.5 OTHERS

13.1.2 SUSTAINABLE AGRICULTURE

13.1.2.1 SHADING NETS

13.1.2.2 WINDBREAK

13.1.2.3 ANTI-INSECTS

13.1.2.4 ANTI-HAIL

13.1.2.5 OTHERS

14 NORTH AMERICA AGRICULTURE NETS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (2021)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 BEAULIEU TECHNICAL TEXTILES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 THRACE GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 GARWARE TECHNICAL FIBRES LIMITED (2021)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 AGRIPLAST TECH INDIA PVT. L.T.D.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 ALPHATEX

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 B&V AGRO IRRIGATION CO.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BELTON INDUSTRIES.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CITTADINI S.P.A

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DIATEX

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FIBERWEBINDIA LTD. (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 NETKING

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHAKTI POLYWEAVE PVT. LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SHREE TARPAULIN INDUSTRIES

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SMART NET SYSTEMS LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SUNSAFE AGROTEXTILES PVT. L.T.D.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 TUFLEX INDIA.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 U.S. NETTING, I.N.C.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WELLCOINDUSTRIES

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ZHONGSHAN HONGJUN NONWOVENS CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 DIFFERENT TYPES OF AGRO-TEXTILE PRODUCTS WITH CONSTITUENT FIBER

TABLE 2 COST VARIATION AS PER MATERIAL USED

TABLE 3 SET OF ITALIAN STANDARD REGARDING AGRICULTURAL NETS

TABLE 4 CLASSIFICATION OF AGRO-TEXTILES PRODUCT WITH THE FABRIC TYPE

TABLE 5 ROOFTOP FARMS ACROSS THE GLOBE

TABLE 6 INSTANCES OF SUITABLE PLANTS FOR DIFFERENT ROOFTOP AGRICULTURE SYSTEMS

TABLE 7 LIGHT SCATTERING UNDER COLORED SHADE NETS COMPARED WITH NO NET

TABLE 8 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA SHADING NETS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDBREAK IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTI-INSECT IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA ANTI-HAIL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA PLASTIC IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA METAL IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA RUBBER IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA ECONOMY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA MID-RANGE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA PREMIUM IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA NON-WOVEN IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA OFFLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA ONLINE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND))

TABLE 30 NORTH AMERICA HORTICULTURE AND FLORICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA FARMING AREA IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AQUACULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA ANIMAL HUSBANDRY IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA AGRICULTURE NETS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CANADA AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 MEXICO AGRICULTURE NETS MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO AGRICULTURE NETS MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO AGRICULTURE NETS MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AGRICULTURE NETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO AGRICULTURE NETS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO AGRICULTURE NETS MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO INDUSTRIAL AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO SUSTAINABLE AGRICULTURE IN AGRICULTURE NETS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGRICULTURE NETS MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGRICULTURE NETS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGRICULTURE NETS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGRICULTURE NETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AGRICULTURE NETS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AGRICULTURE NETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AGRICULTURE NETS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AGRICULTURE NETS MARKET: SEGMENTATION

FIGURE 11 GROWING INITIATIVES FOR FOOD SECURITY ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA AGRICULTURE NETS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SHADING NETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGRICULTURE NETS MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AGRICULTURE NETS MARKET

FIGURE 14 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA AGRICULTURE NETS MARKET : BY MATERIAL TYPE, 2021

FIGURE 16 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRICE RANGE, 2021

FIGURE 17 NORTH AMERICA AGRICULTURE NETS MARKET: BY FORM, 2021

FIGURE 18 NORTH AMERICA AGRICULTURE NETS MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 NORTH AMERICA AGRICULTURE NETS MARKET : BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA AGRICULTURE NETS MARKET : BY END USE, 2021

FIGURE 21 NORTH AMERICA AGRICULTURE NETS MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA AGRICULTURE NETS MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA AGRICULTURE NETS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA AGRICULTURE NETS MARKET : BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA AGRICULTURE NETS MARKET : BY PRODUCT TYPE (2022-2029)

FIGURE 26 NORTH AMERICA AGRICULTURE NETS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.