Middle East Submarine Cable System Market

Market Size in USD Million

CAGR :

%

USD

895.00 Million

USD

1,693.75 Million

2024

2032

USD

895.00 Million

USD

1,693.75 Million

2024

2032

| 2025 –2032 | |

| USD 895.00 Million | |

| USD 1,693.75 Million | |

|

|

|

|

Middle East Submarine Cable System Market Size

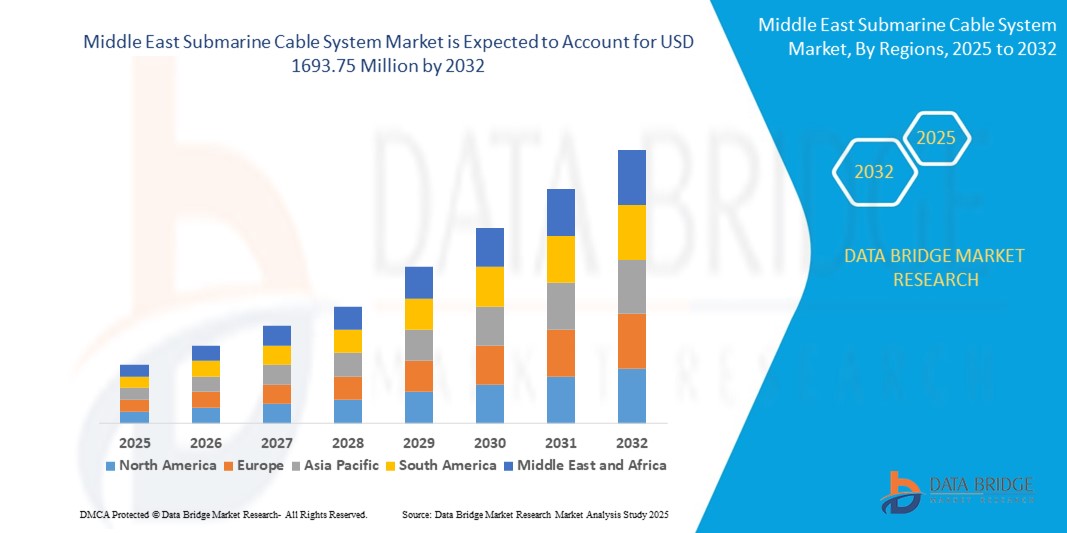

- The Middle East submarine cable system market size was valued at USD 895.00 million in 2024 and is expected to reach USD 1693.75 million by 2032, at a CAGR of 8.3% during the forecast period

- The market growth is largely fueled by the increasing global demand for high-speed data transfer, growing internet penetration, and the rapid expansion of cloud services, which are driving investments in transcontinental submarine cable infrastructure

- Furthermore, the rising need for low-latency international communication, hyperscale data center interconnectivity, and secure, high-capacity bandwidth is accelerating the deployment of advanced submarine cable systems, thereby significantly boosting the industry's growth

Middle East Submarine Cable System Market Analysis

- Submarine cable systems are underwater fiber optic cables used to transmit telecommunications and power signals across seas and oceans, forming the backbone of global internet and data infrastructure

- The escalating demand for these systems is primarily fueled by the growth in international data traffic, the rising number of hyperscale cloud providers, and increasing investments by governments and telecom operators to strengthen global connectivity and digital infrastructure

- Saudi Arabia dominated the submarine cable system market in 2024, due to large-scale investments in digital infrastructure, increasing demand for high-capacity international bandwidth, and the nation's strategic role as a regional connectivity hub linking Asia, Europe, and Africa

- U.A.E. is expected to be the fastest growing region in the submarine cable system market during the forecast period due to strong demand for international connectivity, rising investments in digital trade infrastructure, and increasing reliance on cloud computing and hyperscale data exchange

- Communication cables segment dominated the market with a market share of 72.9% in 2024, due to the surge in global internet usage, streaming services, and international cloud computing operations. These cables form the backbone of global data transfer, supporting over 95% of international digital communication

Report Scope and Middle East Submarine Cable System Market Segmentation

|

Attributes |

Middle East Submarine Cable System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Middle East Submarine Cable System Market Trends

Growing Private Tech Involvement in Undersea Cable Ownership

- The submarine cable system market is experiencing a paradigm shift as major technology firms and private entities become increasingly prominent investors, owners, and operators of undersea cable infrastructure, driven by surging data transfer needs and desire for independent global connectivity

- For instance, tech giants such as Google, Meta (Facebook), Amazon, and Microsoft are directly funding, owning, or co-owning new intercontinental cable routes—Google owns or leases significant submarine cable miles, while projects such as JUPITER (a Facebook and Amazon partnership) and Google’s Curie cable have set new benchmarks in private sector involvement

- Content providers and cloud companies are investing in unique, high-capacity cables to ensure reliable, low-latency routes for hyperscale data centers, often bypassing conventional telecom consortium models for greater control and cost efficiency

- The rise in “open cable” architecture and participation in cable consortia is enabling faster construction, lower costs, and shared maintenance, further accelerating the pace of new cable installations

- Strategic investments by telecom operators, energy firms, and private equity groups are aligning with the ongoing expansion of 5G networks, offshore energy, and digital economy infrastructure, blending private and public capital sources

- Geopolitical considerations around cable ownership, cybersecurity, and network resiliency are motivating both private and state-backed entities to diversify landing points, routes, and control over key submarine systems

Middle East Submarine Cable System Market Dynamics

Driver

Growing Demand for High-Speed Internet Connectivity

- Unprecedented growth in global internet traffic, 5G rollout, video streaming, cloud computing, IoT, and international trade is fueling demand for robust, ultra-fast submarine cable systems capable of carrying massive data volumes across continents

- For instance, hyperscalers and telecom leaders such as SubCom, NEC Corporation, Alcatel Submarine Networks, and Prysmian Group are launching next-generation fiber optic cables with terabit-level capacities and ultra-low latency to serve the bandwidth needs of cloud platforms, data centers, and multinational enterprises

- Emerging economies, particularly in Asia Pacific, the Middle East, and Africa, are investing in submarine cable deployments to drive national broadband, digital transformation, and smart city initiatives, positioning these regions for rapid internet penetration and economic growth

- Regulatory and government support for digital economy initiatives, including investments in cable landing stations, spectrum allocation, and cross-border cooperation, are enabling swift system deployment and market entry

- The convergence of telecommunications, media, and technology ecosystems around rapid data exchange and content delivery is continually pushing the limits of cable system design, requiring ongoing upgrades and expansions

Restraint/Challenge

High Capital Investment

- The substantial costs associated with manufacturing, laying, repairing, and maintaining submarine cable systems—including engineering, marine surveys, and specialized vessels—represent significant barriers to entry and expansion for many stakeholders

- For instance, a single intercontinental cable system typically requires investments of hundreds of millions of dollars, with lead investors such as Google, Facebook, and consortium members committing large sums and specialized expertise to navigate regulatory, technical, and geopolitical risks

- Cable installation involves complex planning, long project timelines, and coordination between multiple countries, often leading to lengthy permitting processes and potential delays

- Ongoing operating expenses, such as repairs (which can cost millions per fault), security, and technology upgrades, require continuous capital outlays to sustain network reliability and competitiveness

- Economic and political instability in key regions, as well as rapid technological advances that lower product lifecycles, add further uncertainty to the return on investment for submarine cable projects

Middle East Submarine Cable System Market Scope

The market is segmented on the basis of product, voltage, fibre class, cable types, armor type, depth, and application.

- By Product

On the basis of product, the submarine cable system market is segmented into wet plant products and dry plant products. The wet plant products segment dominated the largest market revenue share in 2024 due to its essential role in long-distance underwater cable installations, encompassing repeaters, branching units, and submerged cables that transmit signals across continents. These components are fundamental to ensuring low signal loss and uninterrupted transmission over thousands of kilometers, making them indispensable in global communications infrastructure.

The dry plant products segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for advanced signal processing and network management equipment located at the landing stations. These systems offer enhanced monitoring, power feeding, and integration with terrestrial networks, which are critical as more nations expand internet coverage and seek scalable backhaul solutions.

- By Voltage

On the basis of voltage, the market is segmented into medium voltage, high voltage, and extra high voltage. The high voltage segment accounted for the largest market share in 2024, owing to its ability to efficiently transmit electricity and data across extended ocean distances with minimal energy loss. It is widely used in transcontinental and inter-island deployments where voltage levels must be sustained over long stretches.

The extra high voltage segment is expected to register the fastest growth through 2032, fueled by the rising development of cross-border power interconnectors and offshore wind farms that require transmission at higher voltages to maximize energy transfer and reduce transmission costs over long underwater routes.

- By Fibre Class

Based on fibre class, the market is divided into unrepeatered and repeatered segments. The repeatered segment held the highest revenue share in 2024, due to its use in ultra-long-haul submarine cable systems that require signal amplification every 80 to 100 kilometers. Repeatered systems are essential for intercontinental connections where maintaining signal integrity is critical.

Conversely, the unrepeatered segment is projected to grow at the fastest CAGR from 2025 to 2032, largely due to increasing demand for low-cost solutions in regional and short-distance offshore communication systems. These cables are often preferred for oil rigs, island connectivity, and coastal installations where distances are manageable without signal boosting.

- By Cable Types

On the basis of cable types, the market is categorized into loose tube cables, ribbon cables, and others. The loose tube cables segment dominated the market in 2024, owing to their robust design, water-blocking capabilities, and suitability for harsh marine environments. They are widely adopted in both repeatered and unrepeatered systems.

The ribbon cables segment is expected to witness the fastest growth from 2025 to 2032 due to the increasing need for high fiber count cables in data-intensive applications such as hyperscale data centers and high-frequency trading routes. Their compact size and parallel splicing capabilities make them attractive for fast and scalable installations.

- By Armor Type

On the basis of armor type, the market is segmented into light weight armor, single armor, double armor, and rock armor. Single armor held the largest share in 2024 due to its optimal balance between protection and flexibility, making it suitable for a wide range of seabed conditions. It is widely used in deployments where cables are exposed to moderate external stresses.

The rock armor segment is projected to grow at the fastest rate through 2032, driven by rising installations in rocky and abrasive seabed terrains. These cables are specially engineered to withstand intense external pressure and physical impact, which is crucial in areas prone to tectonic activity or heavy anchoring.

- By Depth

On the basis of depth, the market is segmented into 0 to 500 M, 500 M to 1000 M, 1000 M to 5000 M, and others. The 1000 M to 5000 M depth range segment accounted for the largest revenue share in 2024, as the majority of transoceanic submarine cable routes traverse these mid-ocean depths. This segment benefits from established installation technologies and reliable marine survey capabilities.

The 500 M to 1000 M segment is expected to grow at the fastest rate from 2025 to 2032 due to increased deployments in shallower regional seas such as the Mediterranean, South China Sea, and North Sea. This depth range supports a balance between installation ease and strategic geographic connectivity.

- By Application

On the basis of application, the market is divided into power cables and communication cables. The communication cables segment held the largest market share of 72.9% in 2024, underpinned by the surge in global internet usage, streaming services, and international cloud computing operations. These cables form the backbone of global data transfer, supporting over 95% of international digital communication.

The power cables segment is anticipated to register the fastest growth from 2025 to 2032, propelled by offshore wind projects, inter-island energy transmission, and increasing investments in renewable energy infrastructure. Submarine power cables are critical for enabling cross-border electricity exchange and the integration of remote energy sources into national grids.

Middle East Submarine Cable System Market Regional Analysis

- Saudi Arabia dominated the submarine cable system market with the largest revenue share in 2024, driven by large-scale investments in digital infrastructure, increasing demand for high-capacity international bandwidth, and the nation's strategic role as a regional connectivity hub linking Asia, Europe, and Africa

- Demand is particularly strong for repeatered cables, extra high voltage systems, and rock-armored cables designed for harsh marine conditions and long-haul routes supporting the Kingdom’s Vision 2030 digital transformation goals

- The market is further supported by Saudi Arabia's growing data center ecosystem, expansion of hyperscale connectivity projects, and government-led initiatives promoting subsea cable landings and integrated digital corridors

Oman Submarine Cable System Market Insight

Oman’s submarine cable system market is projected to grow steadily through 2032, supported by its strategic coastal location and status as a key landing point for numerous international submarine cable networks. The country’s focus on becoming a regional telecom hub, coupled with investments in data centers and cable landing infrastructure, is enhancing its role in global data traffic flow and boosting demand for advanced submarine cable technologies.

U.A.E. Submarine Cable System Market Insight

The U.A.E. is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, supported by strong demand for international connectivity, rising investments in digital trade infrastructure, and increasing reliance on cloud computing and hyperscale data exchange. Ongoing projects to expand cable landings, enhance bandwidth resilience, and support the nation's position as a digital gateway between Asia and Europe are accelerating market growth.

Middle East Submarine Cable System Market Share

The submarine cable system industry is primarily led by well-established companies, including:

- TE Connectivity (Switzerland)

- NEC Corporation (Japan)

- Huawei Marine Networks Co. Ltd. (China)

- Saudi Ericsson (Saudi Arabia)

- Prysmian Group (Italy)

- Nexans (France)

- ZTT (China)

- SubCom (U.S.)

- Nokia (Finland)

- HENGTONG GROUP CO. LTD. (China)

- NKT A/S (Denmark)

- Sumitomo Electric Industries Ltd. (Japan)

- Corning Incorporated (U.S.)

- TFKable (Poland)

- FUJITSU (Japan)

- Hellenic Cables S.A. (Greece)

- The Okonite Company (U.S.)

- Apar Industries Ltd. (India)

- AFL (U.S.)

- Hexatronic (Sweden)

Latest Developments in Middle East Submarine Cable System Market

- In October 2023, PRYSMIAN S.p.A. manufactured cables for the 3 GW interconnection between Egypt and Saudi Arabia, marking the first significant link between the Middle East and North Africa. This achievement, under a USD 233.57 thousands contract, demonstrates Prysmian's commitment to advancing regional energy connectivity and sustainability. The project is set to enhance electricity exchange in the region and promote greater energy security

- In April 2023, HENGTONG GROUP CO.,LTD. invested USD 500.00 thousands in a subsea internet cable network linking Asia, the Middle East, and Europe to compete with a U.S.-backed project. This move signals the escalation of a technology rivalry between China and the U.S. with potential implications for global internet connectivity

- In July 2022, NEXANS announced the winning of new project by EuroAsia interconnector Limited to develop European electricity interconnection linking the national grids of Israel, Cyprus and Greece (Crete). This project helped the company to provide technology for deep water subsea power cables utilizing Nexans long term developments for 3,000 m ultradeep waters together with the installation capabilities which will be recognised in the market

- In February 2021, Nexans secured a substantial purchase order for the provision of 180 km of 230 kV cables for the expansive offshore Marjan increment development mega-project on the eastern Arabian Gulf coast. The order included two 90 km lengths of 230kV HVAC three-core submarine power cables featuring an internal fiber optical element. This helped the company by strengthening the company position in the market

- In June 2020, Okonite successfully expanded its Compound Plant and added a new Logistical Building just before the onset of the COVID-19 pandemic. The increased space eased logistical challenges and enhanced material handling, benefiting both raw materials reception and finished compounds shipment. Okonite's team has seamlessly transitioned to their new facilities, and future customer tours will offer a more extensive insight into the company's dedication to capital improvement, product quality, and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East Submarine Cable System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East Submarine Cable System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East Submarine Cable System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.