Market Analysis and Insights: Middle East Silicon Carbide (SiC) Market

Market Analysis and Insights: Middle East Silicon Carbide (SiC) Market

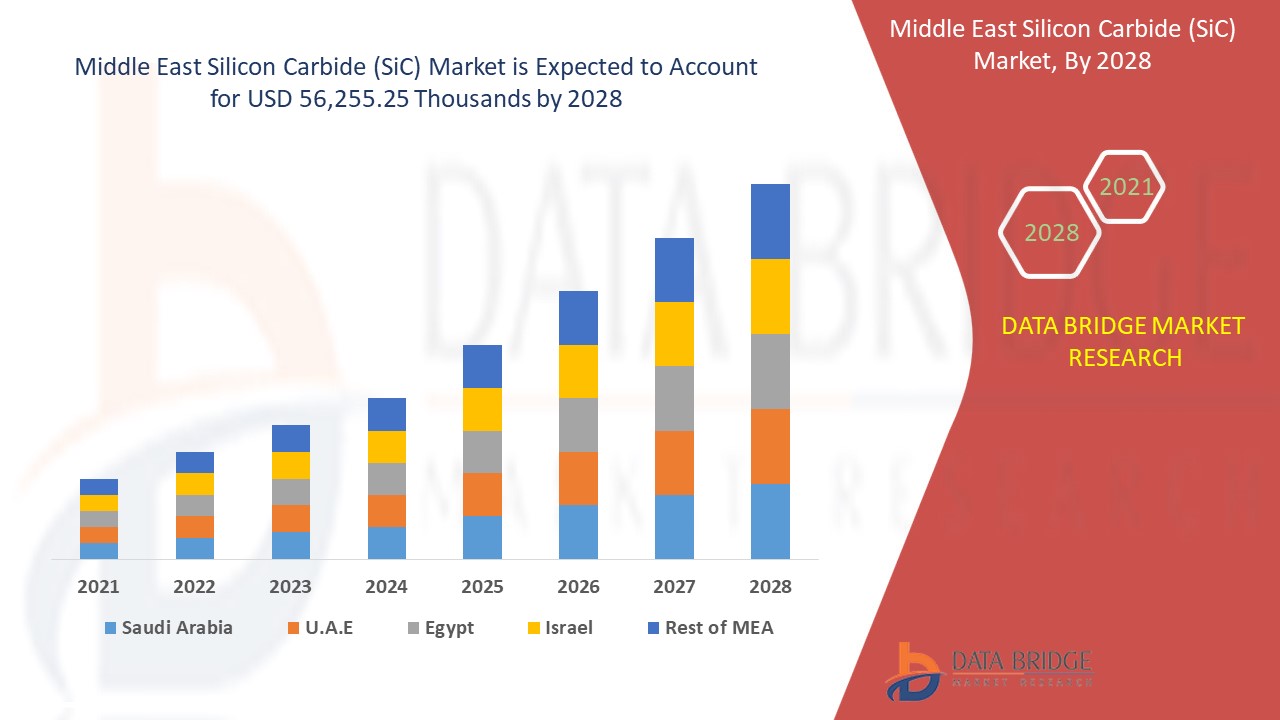

Middle East Silicon Carbide (SiC) Market is expected to gain significant growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyzes that the market is growing at a CAGR of 10.6% in the forecast period of 2021 to 2028 and expected to reach USD 56,255.25 thousand by 2028.

Silicon carbide elements are used in glass and non-ferrous metal melting, metal heat treating, float glass manufacturing, ceramic and electronic component manufacturing, and gas heater ignition flaming lighters. They are also used in refractory linings and heating elements for industrial furnaces in wear-resistant parts for pumps and rocket motors and semiconductor substrates for light-emitting diodes.

Increasing demand for silicon carbide (SiC) in the production of e-vehicles rise in adoption of fast-charging batteries have had a significant impact on the expansion of the market for Silicon carbide (SiC). Rapid increase in the number of R&D initiatives for improving battery chemistry, growing implementation of SiC devices in automotive and power devices, rising demand for efficient lithium-ion batteries in electric vehicles, and other consumer electronic devices are key determinants favoring the growth of the silicon carbide (SiC) market during the forecast period.

However, high cost of manufacturing silicon carbide products, and various challenges associated with the production of Li metal batteries, and inability to produce high quality graphene on a large scale at a low cost are expected to restrain the market growth. Whereas, availability of other substitutes, such as gallium nitride and rapid increase and degradation of silicon anodes are expected to challenge the growth of the Silicon carbide (SiC) market during the forecast period.

Middle East Silicon Carbide (SiC) Market Scope and Market Size

Middle East Silicon Carbide (SiC) Market Scope and Market Size

Middle East Silicon Carbide (SiC) Market is segmented on the basis of product, application, and end use. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

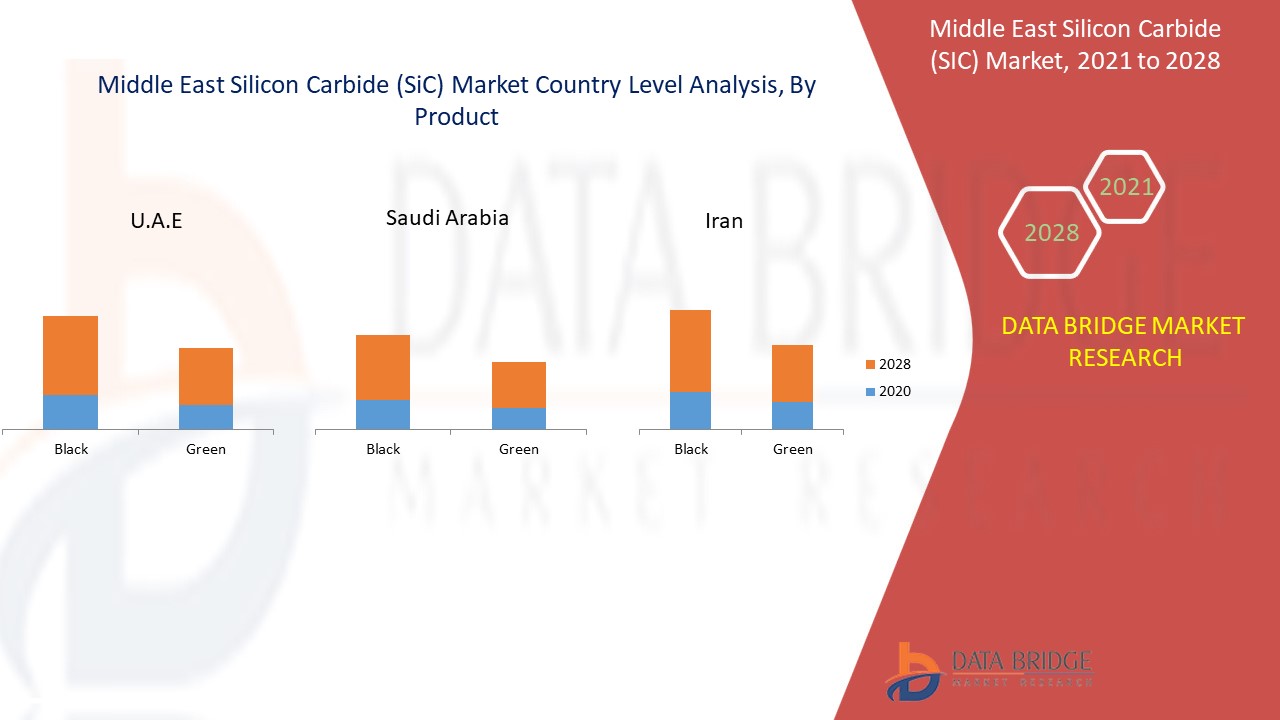

- On the basis of product, the Middle East Silicon Carbide (SiC) Market is segmented into black and green. In 2021, the black segment is expected to dominate the market as black SiCs are light weight and have high resistance power, which increases its demand in ME.

- On the basis of application, the Middle East Silicon Carbide (SiC) Market is segmented into metallurgy, abrasives, refractory, electrical & electronics, and other. In 2021, the abrasives segment is expected to dominate the market as abrasives are mostly used in the automobile sector.

- On the basis of end use, the Middle East Silicon Carbide (SiC) Market is segmented into automotive, aerospace, military & defense, heavy engineering, consumer electronics, healthcare, and others. In 2021, automotive sector is expected to dominate the market due to increase in the production of e-vehicles in the region.

Middle East Silicon Carbide (SiC) Market Country Level Analysis

Middle East Silicon Carbide (SiC) Market Country Level Analysis

Middle East Silicon Carbide (SiC) Market is analyzed and market size information is provided based on product, application, and end user.

The countries covered in the ME Silicon Carbide report are United Arab Emirates, Saudi Arabia, Iran, Israel, Kuwait, Qatar and Rest of Middle East.

- In ME, the UAE is the largest country in the manufacturing of silicon carbide (SiC) used for various applications, which increases the demand for silicon carbide (SiC) in automotive sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Positive outlook of silicon carbide (sic) towards semiconductor industry

Silicon carbide-based semiconductors offer greater thermal conductivity, higher electron mobility, and lower power dissipation. SiC diodes and transistors can also be activated at higher frequencies and temperatures without sacrificing reliability. The core uses for SiC devices, such as Schottky diodes and FET /MOSFET transistors, include converters, inverters, power supplies, battery chargers, and motor control systems.

Power devices, mainly MOSFETs, have to bear extremely high voltages. SiC semiconductors can bear high voltages, extending from 600 V to several thousand volts. SiC has higher fixing concentrations than silicon and consist of very thin drift layers. Theoretically, at high voltage, the resistance of the drift layer per unit area can be reduced to 1/300 of the silicon resistance.

Competitive Landscape and Silicon Carbide Share Analysis

Middle East Silicon Carbide (SiC) Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Middle East Silicon Carbide (SiC) Market.

Major market players engaged in the ME, India and ME Silicon carbide(SiC) market are Infineon Technologies AG, Saint-Gobain, Entegris, CUMI EMD, ESD-SIC bv, Ferrotec (USA) Corporation, WASHINGTON MILLS, Sublime Technologies, abrasivegrit, SNAM Abrasives Pvt Ltd among others.

For instance,

- In October 2021, Infineon Technologies AG collaborated with PIONIERKRAFT for enabling self-produced solar energy among the different households. This collaboration has in turn helped the company to adapt innovative solutions for energy generation and thus improving its position among the local consumers.

- In October 2021, Saint-Gobain invested nearly €10 thousand to acquire the largest low-carbon electric furnace in ME (for ductile iron pipes) in France. This investment was made in order to reduce environmental impact, inherent to industrial production.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST SILICON CARBIDE (SIC) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OPPORTUNITIES FOR SILICON CARBIDE IN ELECTRICAL & ELECTRONICS SECTORS

4.2 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, PRICE ANALYSIS

4.2.1 OVERVIEW

5 ME, INDIA AND EUROPE SILICON CARBIDE (SIC) MARKET, REGIONAL AND COUNTRY SUMMARY

5.1 MIDDLE EAST

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FROM THE STEEL INDUSTRY FOR VARIOUS APPLICATIONS

6.1.2 INCREASE IN IMPLEMENTATION OF SIC DEVICES IN AUTOMOTIVE AND POWER DEVICES

6.1.3 GROW IN DEMAND FOR SMART CONSUMER ELECTRONICS

6.1.4 POSITIVE OUTLOOK OF SILICON CARBIDE (SIC) TOWARDS SEMICONDUCTOR INDUSTRY

6.2 RESTRAINT

6.2.1 HIGH COST FOR MANUFACTURING SILICON CARBIDE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 HUGE ADOPTION OF SILICON CARBIDE (SIC) IN THE HEALTH SECTOR

6.3.2 GROW IN DEMAND FOR SMALL DEVICES TO ENABLE SIZE-REDUCTION

6.3.3 RISE IN DEMAND FOR HYBRID AND ELECTRIC CARS

6.4 CHALLENGE

6.4.1 AVAILABILITY OF OTHER SUBSTITUTES SUCH AS GALLIUM NITRIDE, GRAPHENE, AND PEROVSKITES

7 IMPACT OF COVID-19 ON THE MIDDLE EAST, INDIA, AND EUROPE SILICON CARBIDE (SIC) MARKET

7.1 AFTERMATH OF COVID-19, BY SEGMENT

7.1.1 METALLURGY

7.1.2 ABRASIVES

7.1.3 REFRACTORIES

7.2 STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID-19 TO GET COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BLACK

8.3 GREEN

9 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ABRASIVES

9.3 ELECTRICAL & ELECTRONICS

9.4 METALLURGY

9.5 REFRACTORY

9.6 OTHERS

10 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY END-USER

10.1 OVERVIEW

10.2 AUTOMOTIVE

10.3 HEAVY ENGINEERING

10.4 CONSUMER ELECTRONICS

10.5 AEROSPACE

10.6 MILITARY & DEFENSE

10.7 HEALTHCARE

10.8 OTHERS

11 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY REGION

11.1 MIDDLE EAST

11.1.1 UAE

11.1.2 SAUDI ARABIA

11.1.3 IRAN

11.1.4 ISRAEL

11.1.5 KUWAIT

11.1.6 QATAR

11.1.7 REST OF MIDDLE EAST

12 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST

12.2 MERGER & ACQUISITIONS, COLLABORATIONS

12.3 EXPANSION

12.4 NEW PRODUCT DEVELOPMENTS

13 SWOT

14 COMPANY PROFILES

14.1 SAINT-GOBAIN

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 INFINEON TECHNOLOGIES AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATES

14.3 ENTEGRIS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 CUMI EMD

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATE

14.5 WASHINGTON MILLS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 ESD-SIC BV

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 ABRASIVEGRIT

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 FERROTEC (USA) CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 SNAM ABRASIVES PVT LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 SUBLIME TECHNOLOGIES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF CARBIDES OF SILICON, WHETHER OR NOT CHEMICALLY DEFINED, HS CODE - 284920 (USD THOUSAND)

TABLE 2 EXPORT DATA CARBIDES OF SILICON, WHETHER OR NOT CHEMICALLY DEFINED, HS CODE - 284920 (USD THOUSAND)

TABLE 3 ALLOY CONTENT IN STEEL MANUFACTURING

TABLE 4 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 5 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 6 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 7 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 8 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 9 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY COUNTRY, 2019-2028 (TONS)

TABLE 10 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 11 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 12 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 13 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 14 UAE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 15 UAE SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 16 UAE SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 17 UAE SILICON CARBIDE (SIC) MARKET, BY END USER, 2019-2028 (USD THOUSAND)

TABLE 18 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 19 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 20 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 21 SAUDI ARABIA SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 22 IRAN SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 23 IRAN SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 24 IRAN SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 25 IRAN SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 26 ISRAEL SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 27 ISRAEL SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 28 ISRAEL SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 29 ISRAEL SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 30 KUWAIT SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 31 KUWAIT SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 32 KUWAIT SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 33 KUWAIT SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 34 QATAR SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 35 QATAR SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

TABLE 36 QATAR SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 37 QATAR SILICON CARBIDE (SIC) MARKET, BY END USER 2019-2028 (USD THOUSAND)

TABLE 38 REST OF MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (USD THOUSAND)

TABLE 39 REST OF MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2019-2028 (TONS)

List of Figure

FIGURE 1 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST SILICON CARBIDE(SIC) MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST SILICON CARBIDE (SIC) MARKET AND WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 THE GROWING IMPLEMENTATION OF SIC DEVICES IN AUTOMOTIVE AND POWER DEVICES IS EXPECTED TO DRIVE THE MIDDLE EAST SILICON CARBIDE (SIC) MARKET FROM 2021 TO 2028

FIGURE 16 THE BLACK SIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST SILICON CARBIDE(SIC) MARKET IN 2021 & 2028

FIGURE 17 GLOBAL SEMICONDUCTOR INDUSTRY SALES (USD BILLION) (2019-2020)

FIGURE 18 PRICE OF SILICON CARBIDE (SIC) IN SAUDI ARABIA, 2019-2020 (TONS)

FIGURE 19 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF MIDDLE EAST SILICON CARBIDE (SIC) MARKET

FIGURE 20 EFFICIENCY CURVE OF SIC BASED SEMICONDUCTORS (%)

FIGURE 21 U.K. EV SIC DEVICE DEMAND (USD MILLIONS)

FIGURE 22 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY PRODUCT, 2020

FIGURE 23 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY APPLICATION, 2020

FIGURE 24 MIDDLE EAST SILICON CARBIDE (SIC) MARKET, BY END-USER, 2020

FIGURE 25 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: SNAPSHOT (2020)

FIGURE 26 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2020)

FIGURE 27 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2021 & 2028)

FIGURE 28 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: BY COUNTRY (2020 & 2028)

FIGURE 29 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: BY PRODUCT (2021-2028)

FIGURE 30 MIDDLE EAST SILICON CARBIDE (SIC) MARKET: COMPANY SHARE 2020 (%)

Middle East Silicon Carbide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East Silicon Carbide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East Silicon Carbide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.