Market Analysis and Size

Machine-to-Machine (M2M) technology is becoming more popular in warehouse management because it allows machines or devices to exchange information and perform functions independently. M2M technology allows a warehouse management system to connect to and receive data from instruments such as conveyors, picking equipment, and assembly lines.

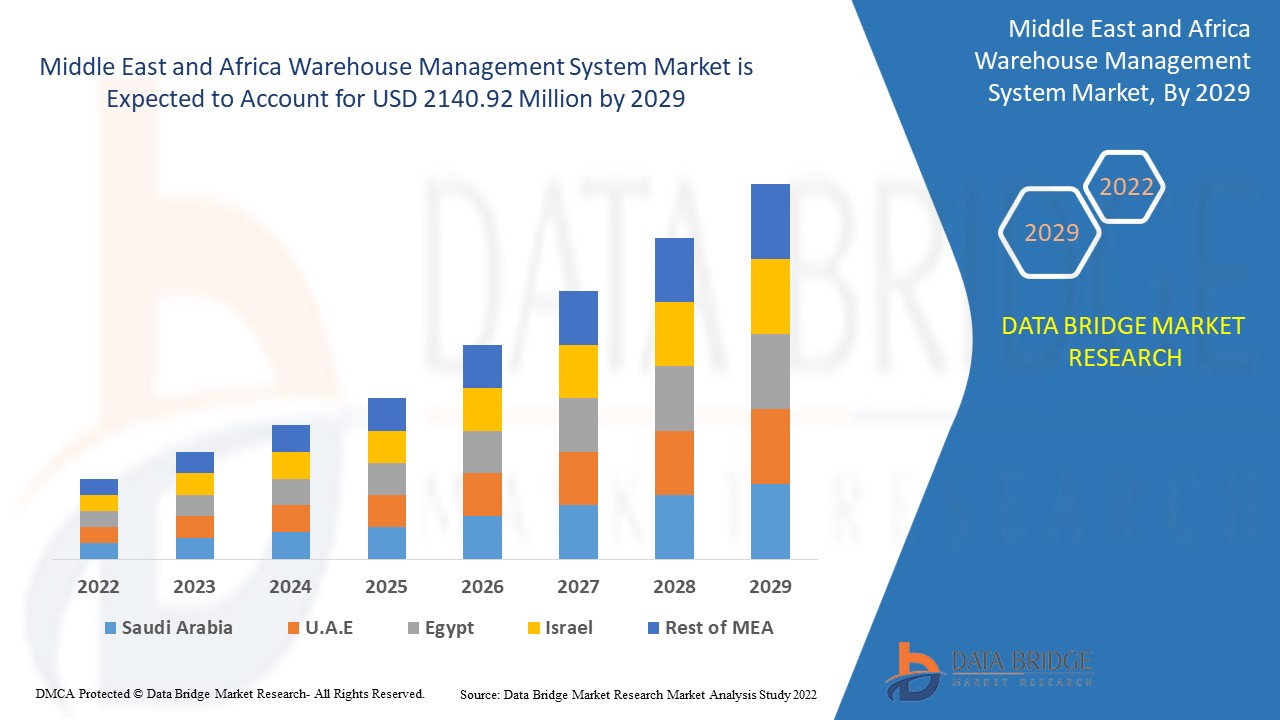

Data Bridge Market Research analyses that the warehouse management system market was valued at 695.02 is expected to reach the value of USD 2140.92 million by 2029, at a CAGR of 15.1% during the forecast period of 2022-2029.

Market Definition

By moving into a network that any commodity server can potentially handle under the network operator's control, the warehouse management system market is working to simplify the network and its administration. The network operation can be flexible, resulting in a slew of advantages for the target audience that adopts its new services. The widespread use of v-CPE by network providers can result in the simplification and acceleration of service delivery, as well as configuration and device management from remote locations.

Report scope and market segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Hardware, Software and Services), Deployment (Cloud-Based and On-Premise), Type of Tier (Advanced, Intermediate and Basic), Distribution Channel (Online and Offline), End-User (Food and Beverage, E-Commerce, Automotive, Third-Party Logistics, Healthcare, Electrical & Electronics, Metals and Machinery, Chemicals, Others) |

|

Countries Covered |

UAE, Israel, Saudi Arabia, Egypt, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

Oracle (US), Manhattan Associates. (US), THE DESCARTES SYSTEMS GROUP INC (Canada), CTSI-GLOBAL (US), Alpega Group (Belgium), BluJay Solutions Ltd. (US), Metro Infrasys Pvt. Ltd. (India), Software Group (Bulgaria), 3GTMS (US), Infor. (US), C.H. Robinson Worldwide, Inc (US), THE DESCARTES SYSTEMS GROUP INC (Canada), BluJay Solutions Ltd. (US), MercuryGate (US), Omnitracs (US), Next Generation Logistics, Inc (US) |

|

Opportunities |

|

Warehouse Management System Market Dynamics

Drivers

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Rapid growth in e-commerce

The rapid growth of digitalization and wider consumer adoption of e-commerce industries in their daily activities is propelling the warehouse management system market. The market is developing a growing need for mobility, and there is an increased quantum of demand for virtual solutions and services in the networking area. There is an emergence of varying traffic demands, and all of these factors are accelerating market demand.

- Increased in software advancements

The warehouse management system improves inventory accuracy, reduces lead and fulfilment time, maximises space utilisation, improves customer service, and optimises warehouse productivity. All of these factors are causing an increase in the global warehouse management system market.

Opportunity

There is an increase in varying traffic demands, and all of these factors are accelerating market demand by the end of the Middle East and Africa forecast.

Restraints

Lack of awareness about warehouse management systems in small and medium-sized enterprises can pose a challenge for various manufacturers in the market. A warehouse system necessitates a significant initial investment in order to withstand market growth in the near future.

This warehouse management system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the warehouse management system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Warehouse Management System Market

Despite the initial chaos caused by the COVID-19 pandemic, rapid growth in the e-commerce industry and increased user awareness of the benefits of WMS allowed this market to expand steadily. Furthermore, the crisis has hastened the industry's adoption of warehouse automation tools like WMS. In addition, automation will be accelerated to protect businesses from future supply chain disruptions. WMS market growth is being driven by industries such as e-commerce, 3PL, healthcare, and food & beverages. On the other hand, companies are experiencing severe cash flow issues as a result of the imposition of lockdown across various countries. Middle East and Africaly, the halting or slowing of production in the automotive, metals and machinery, and other industries has resulted in a drop in demand.

Recent Development

- In May 2020, Manhattan Associates, Inc. will introduce the Manhattan Active Warehouse Management Solution. It is the world's first cloud-native enterprise-class warehouse management system (WMS) that integrates all aspects of distribution and does not require maintenance.

- In April 2019, HighJump (Körber) released HighJump CLASS, its latest solution for warehousing and logistics simulation and design. HighJump CLASS enables businesses worldwide to remain competitive and connected to the future supply chain.

- JDA Luminate was released in May 2019 by JDA Software. JDA Luminate is built on an open, connected, and cognitive platform that embraces digital edge technology such as software-as-a-service (SaaS), AI, and advanced analytics.

Middle East and Africa Warehouse Management System Market Scope

The warehouse management system market is segmented on the basis of component, deployment, type of tier, distribution channel and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Components

- Software

- Hardware

- Services

On the basis of component, the Middle East and Africa warehouse management system market is segmented into hardware, software and services. In 2020, the software segment is dominating the market because most developed and developing nations prefer using online software as they are feasible in usage.

Deployment

- Cloud based

- On-premise

On the basis of deployment, the Middle East and Africa warehouse management system market is segmented into cloud-based and on-premise. In 2020, on premise segment is dominating the market as it hosts on its own servers and purchase licenses which increase the accuracy of work and also reduced the chances of disaster.

Tier

- advanced

- intermediate

- basic

On the basis of type of tier, the Middle East and Africa warehouse management system market is segmented into advanced, intermediate and basic. In 2020, the advanced segment is dominating the market as they protects the consumers time by providing the distribution center managers with powerful inventory and logistics capabilities with tools to schedule, track and coordinate daily activity which reduces the chances of failure and disasters.

Distribution channel

- Online

- Offline

On the basis of distribution channel, the Middle East and Africa warehouse management system market is segmented into online and offline. In 2020, the offline segment is dominating the market growth as they are the most effective use of labor and space, which is also very feasible for the customers.

End user

- food and beverages

- healthcare

- automotive

- e-commerce

- electrical & electronics

- third-party logistics

- metals and machinery

- chemicals

- others

On the basis of end user, the Middle East and Africa warehouse management system market is segmented into food and beverages, healthcare, automotive, e-commerce, electrical & electronics, third-party logistics, metals and machinery, chemicals and others. In 2020, food & beverages segment is dominating due to the highest demand from developed as well as developing economics that need a proper warehouse management shipped to ensure proper dispatch on time without any breakage, leakage and spoiling of food.

Warehouse Management System Market Regional Analysis/Insights

The warehouse management system market is analysed and market size insights and trends are provided by country, component, deployment, type of tier, distribution channel and end user as referenced above.

The countries covered in the warehouse management system market report are UAE, Israel, Saudi Arabia, Egypt, South Africa, Rest of Middle East and Africa.

North America dominates the warehouse management system market. The United States dominates the North America region due to the strong presence of ERP vendors, which drives the warehouse management market growth. The country has a high demand for a wide variety of food and beverages, which necessitates a continuous supply from warehouses because it adds efficiency, consistency, and quality control to the process by assisting manufacturers in moving goods at maximum speed as per consumer demand. While in Europe, Germany dominates the market due to the region's and Asia-Pacific region's increasing adoption of multi-channel warehouse management systems.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Warehouse Management System Market Share Analysis

The warehouse management system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to warehouse management system market.

Some of the major players operating in the warehouse management system market are:

- Oracle (US)

- Manhattan Associates. (US)

- THE DESCARTES SYSTEMS GROUP INC (Canada)

- CTSI-GLOBAL (US)

- Alpega Group (Belgium)

- BluJay Solutions Ltd. (US)

- Metro Infrasys Pvt. Ltd. (India)

- Software Group (Bulgaria)

- 3GTMS (US)

- Infor. (US)

- C.H. Robinson Worldwide, Inc (US)

- THE DESCARTES SYSTEMS GROUP INC (Canada)

- BluJay Solutions Ltd. (US)

- MercuryGate (US)

- Omnitracs (US)

- Next Generation Logistics, Inc (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

6 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 BILLING & YARD MANAGEMENT

6.2.2 ANALYTICS & OPTIMIZATION

6.2.3 LABOR MANAGEMENT SYSTEM

6.3 HARDWARE

6.3.1 CRANE

6.3.2 AUTOMATED STORAGE AND RETRIEVAL SYSTEM (ASRS)

6.3.3 ROBOT

6.3.4 CONVEYOR AND SORTATION SYSTEM

6.3.5 AUTOMATED GUIDED VEHICLE (AGV)

6.4 SERVICES

6.4.1 SUPPORT AND MAINTENANCE

6.4.2 INTEGRATION AND MIGRATION

6.4.3 TRAINING AND EDUCATION

6.4.4 CONSULTING

7 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT

7.1 OVERVIEW

7.2 ON-PREMISE

7.3 CLOUD-BASED

8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER

8.1 OVERVIEW

8.2 ADVANCED

8.3 INTERMEDIATE

8.4 BASIC

9 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.3 E-COMMERCE

10.4 AUTOMOTIVE

10.5 THIRD-PARTY LOGISTICS

10.6 HEALTHCARE

10.7 ELECTRICAL & ELECTRONICS

10.8 METALS AND MACHINERY

10.9 CHEMICALS

10.1 OTHERS

11 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 ISRAEL

11.1.3 SAUDI ARABIA

11.1.4 EGYPT

11.1.5 SOUTH AFRICA

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 COMPANY PROFILE

13.1 SAP SE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 ORACLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 IBM CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 PSI LOGISTICS GMBH (A SUBSIDIARY OF PSI SOFTWARE AG)

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SOLUTION PORTFOLIO

13.4.5 RECENT UPDATE

13.5 MANHATTAN ASSOCIATES

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATE

13.6 BASTIAN SOLUTIONS, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 BLUE YONDER GROUP, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 SOLUTION PORTFOLIO

13.7.3 RECENT UPDATES

13.8 CODEWORKS, LLC

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATE

13.9 DATAPEL.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 EPICOR SOFTWARE CORPORATION

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 HAL SYSTEMS.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 HIGHJUMP (A SUBSIDIARY OF KÖRBER AG)

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

13.13 INFOR

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 DASAULT SYSTEMES (IQMS)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATE

13.15 MAGAYA CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 SOLUTION PORTFOLIO

13.15.3 RECENT UPDATES

13.16 PRIMA SOLUTIONS LTD.

13.16.1 COMPANY SNAPSHOT

13.16.2 SOLUTION PORTFOLIO

13.16.3 RECENT UPDATE

13.17 PTC

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT UPDATE

13.18 SOFTEON

13.18.1 COMPANY SNAPSHOT

13.18.2 SOLUTION PORTFOLIO

13.18.3 RECENT UPDATES

13.19 SYNERGY LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATES

13.2 TECSYS INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 SOLUTION PORTFOLIO

13.20.4 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY SOFTWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY SERVICES COMPONENT, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ON-PREMISE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA CLOUD-BASED IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA ADVANCED IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA INTERMEDIATE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA BASIC IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA OFFLINE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ONLINE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA E-COMMERCE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA AUTOMOTIVE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA THIRD-PARTY LOGISTICS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA HEALTHCARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA ELECTRICAL & ELECTRONICS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA METALS AND MACHINERY IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA CHEMICALS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 37 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 U.A.E SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 U.A.E HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 40 U.A.E SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 41 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 42 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 43 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 44 U.A.E WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 45 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 ISRAEL SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 ISRAEL HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 ISRAEL SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 50 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 51 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 52 ISRAEL WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 53 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 SAUDI ARABIA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 SAUDI ARABIA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 56 SAUDI ARABIA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 57 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 58 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 59 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 60 SAUDI ARABIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 61 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 EGYPT SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 EGYPT HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 EGYPT SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 66 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 67 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 68 EGYPT WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 69 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA SOFTWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 SOUTH AFRICA HARDWARE IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY HARDWARE COMPONENT, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA SERVICES IN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY END-USER, 2018-2027 (USD MILLION)

TABLE 77 REST OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: SEGMENTATION

FIGURE 10 MIDDLE EAST AND AFRICAIZATION OF THE DISTRIBUTION AND SUPPLY CHAIN NETWORK IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 SOFTWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEMS MARKET

FIGURE 13 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY COMPONENT, 2019

FIGURE 14 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY DEPLOYMENT, 2019

FIGURE 15 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY TYPE OF TIER, 2019

FIGURE 16 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 17 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM MARKET: BY END-USER, 2019

FIGURE 18 MIDDLE EAST AND AFRICA WAREHOUSE MANAGEMENT SYSTEM: COMPANY SHARE 2019 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.