Middle East and Africa Very Small Aperture Terminal (VSAT) Market Analysis and Size

The massive growth in satellite capacity has resulted in a significant price drop, making very small aperture terminals (VSATs) a viable solution for many industries and regions for the first time. Furthermore, there has been an increased adoption of in VSAT technology in industries such as maritime, oil and gas, aviation among others. These systems also provide the required connectivity between users of medical applications, databases, video, and phones at remote locations, and allow communication with remote and mobile sites.

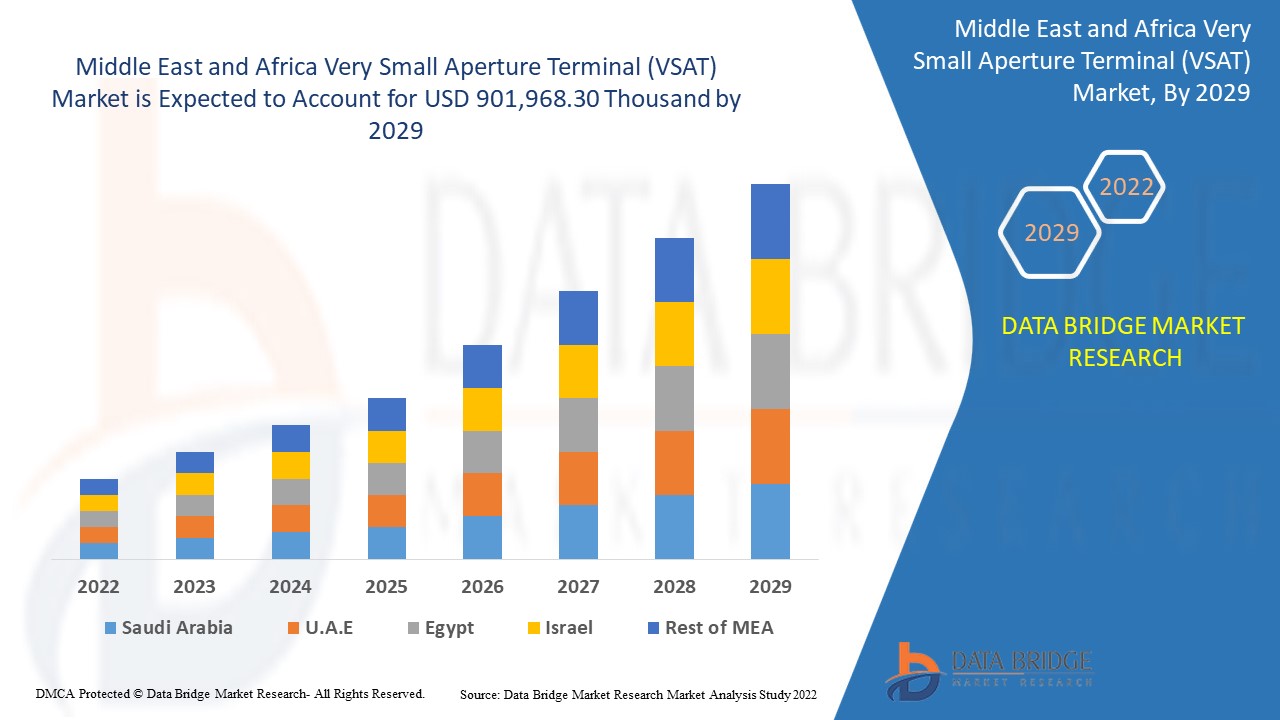

Data Bridge Market Research analyses that Middle East and Africa very small aperture terminal (VSAT) market is expected to reach the value of USD 901,968.30 thousand by 2029, at a CAGR of 7.1% during the forecast period. The very small aperture terminal (VSAT) market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

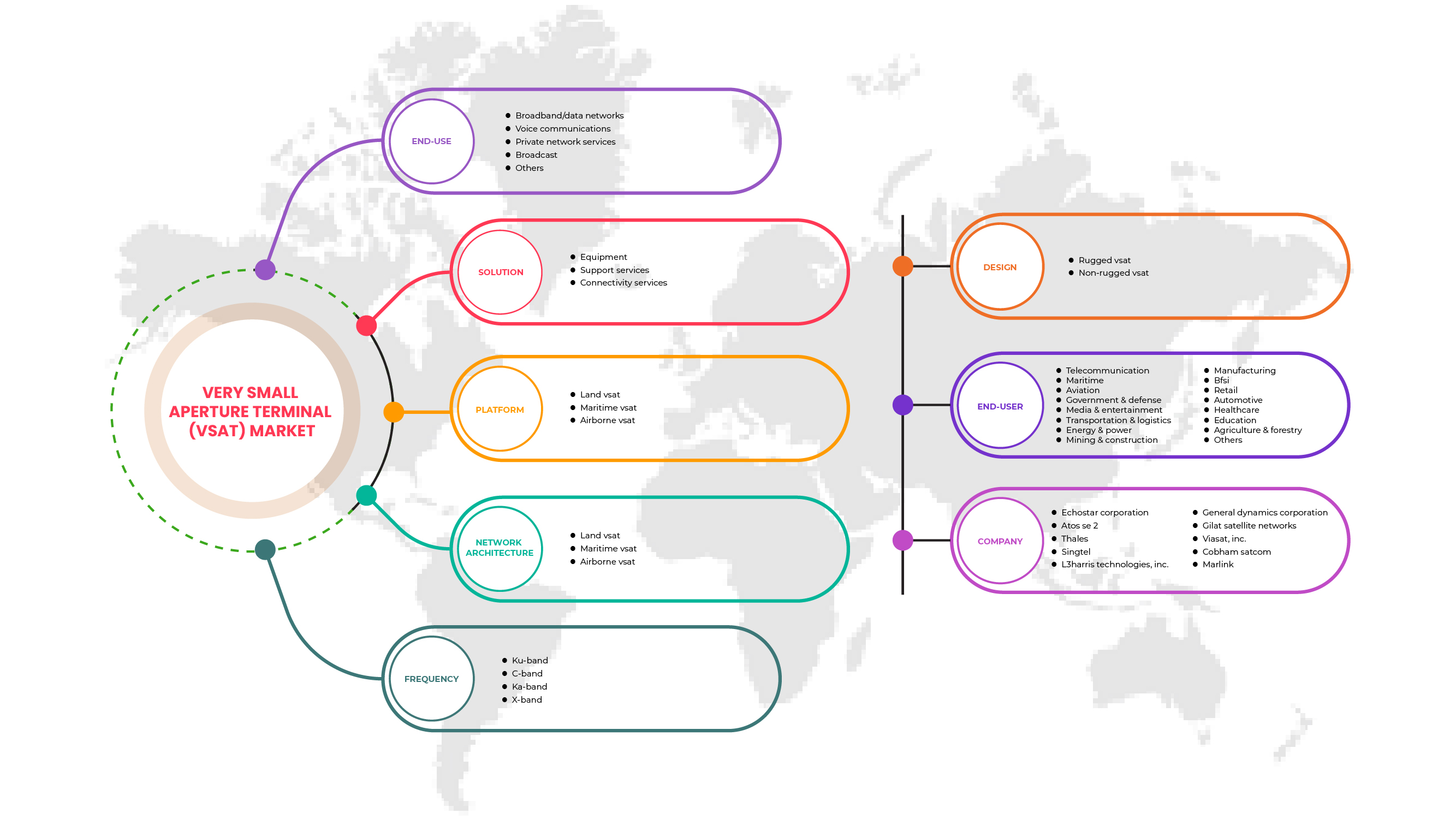

Segments Covered |

By Solution (Equipment, Support Services, Connectivity Services), Platform (Land VSAT, Maritime VSAT, Airborne VSAT), Frequency (Ku-Band, C-Band, Ka-Band, X-Band), Network Architecture (Star Topology, Mesh Topology, Hybrid Topology, Point-To-Point Links), Design (Rugged VSAT, Non-Rugged VSAT), Vertical (Telecommunication, Maritime, Aviation, Government and Defense, Media and Entertainment, Transportation and Logistics, Energy and Power, Mining and Construction, Manufacturing, BFSI, Retail, Automotive, Transportation and Logistics, Healthcare, Education, Agriculture and Forestry, Others), End Use (Broadband/Data Network, Voice Communication, Private Network Service, Broadcast, Others) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Vizocom Company, C-COM Satellite Systems Inc, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLMiddle East and Africa, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, General Dynamics Corporation, Honeywell International Inc., Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., Middle East and Africa Invacom |

Market Definition

A two-way satellite communication system is referred to as a VSAT, or Very Small Aperture Terminal. This system's dish is typically less than 3.8 meters in diameter. A VSAT system's effectiveness may be negatively impacted by the weather. Also, there are three topologies for VSAT networks that are typically used which are star, mesh, or hybrid. Hence, VSAT systems provide the required connectivity between users of medical applications, databases, video, and phones at remote locations, and allow communication with remote and mobile sites.

Middle East and Africa Very Small Aperture Terminal (VSAT) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing demand for secure communication for maritime IoT applications

VSAT technology has become a major deal for the maritime industry. They are used for two-way satellite communications for internet, data and telephony, typically in rural areas and harsh environments. In recent years, there has been a progressive shift in the maritime IoT ecosphere. This ecosphere is served by various standard electronic parts that is the hardware integrated with various software. IoT services via satellite enable businesses to access data from assets in the most affordable way. Therefore, ships at sea are remote, vessels and other discrete entities are adopting digital systems as part of larger IoT networks. Using IoT devices and sensor systems across vessels/fleet helps gain competitive edge, by enabling such technologies companies are able to harness the full potential of data for more effective operations and decision-making.

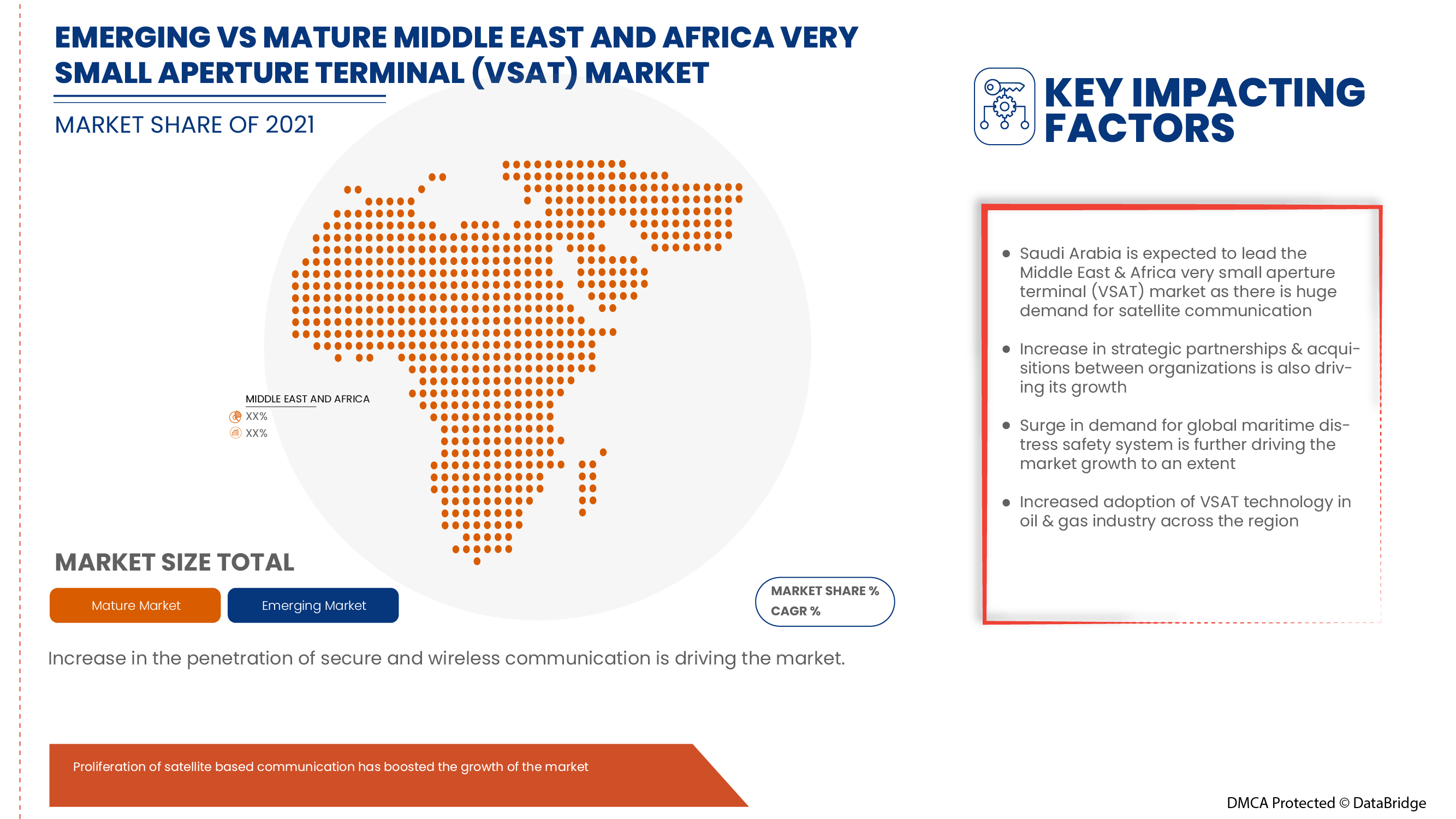

- Increased adoption of VSAT technology in oil and gas industry

Nowadays, the oil and gas sector is undergoing a huge change due to the various digital innovations. There are multiple demands such as safety, security, exploring new areas for oil and increasing visibility between the rig and headquarters, all while keeping operational costs in check. Therefore, rig operators are constantly being pressured to make faster decisions and run operations more efficiently. Also, the oil and gas industry operates in remote onshore and offshore environments where the use of land-based communications is not practical or reliable. Hence, many companies have started implementing VSAT technology so that rig operators can make quick and more informed decisions, which will lower operating costs, raise productivity and provide safer working conditions for crew regardless of location.

Opportunities

- Increasing strategic partnership and aquistion among various organizations

Coordinating and investing in projects is essential for achieving sustained improvements in the very small aperture terminal (VSAT) sector. Due to which the government and other private organizations are striving through partnerships and acquisitions, thereby accelerating the growth of the industries. This helps to build awareness and profit for the organization and thereby creates scope for a new invention in the industry. Also, through partnerships, the company can invest more in advanced technologies to provide more secure and reliable very small aperture terminal (VSAT) services and solutions. Furthermore, this helps both the companies to get recognized in the competitive market, thereby generating profit to an extent.

Restraints/Challenges

- Rising cyber security concerns and data breaches

Cybercrime/hacking and cybersecurity issues have increased by 600% during the pandemic across all sectors. Flaws in network or software security is a weakness which is exploited by hackers to perform unauthorized actions within a system.

According to the recent report published Maritime Cybersecurity Survey by Safety at Sea and BIMCO, in the 12 months prior to February 2020, 31% of organizations fell victim of cyberattacks which is a 9% increase compared to 2019. According to another report published by Robert Rizika, head of North American operations at Naval Dome, reported that cyberattacks on maritime industry’s operational technology (OT) have increased by 900% from 50% in 2017, to 120% and 310% in the year 2018 and 2019 respectively.

- Issues related to reliability of very small aperture terminal (vsat) network during bad weather

Space weather interferes with radio communication between the earth and satellites because it can cause ionosphere disturbances that reflect, refract, or absorb radio waves. Given that satellite signals must travel great distances in the air, satellite internet services for rural users may be vulnerable to severe weather. While wind rarely affects radio signals, it can wobble, vibrate, or even displace equipment like satellite dishes. Latency and rain fade are two particular factors that affect satellites' capacity to send signals. Rain and atmospheric moisture are the main causes of rain fade, which can weaken or degrade the satellite signal at higher Ku and Ka-band frequencies.

Post COVID-19 Impact on Middle East and Africa Very Small Aperture Terminal (VSAT) Market

COVID-19 created a negative impact on the very small aperture terminal (VSAT) market due to lockdown regulations and shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the very small aperture terminal (VSAT) market to an extent in negative manner. However, surge in demand for Middle East and Africa maritime distress safety system across the world has helped the market to grow after the pandemic. Also, the growth has been high after the market has opened after COVID-19, and it is expected that there would be considerable growth in the sector owing to increasing proliferation of satellite based communication in military and defense sector.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the very small aperture terminal (VSAT). With this, the companies will bring advanced technologies to the market. In addition, government initiatives for use of automation technology has led to the market's growth

Recent Development

- In In March 2022, Marlink announced the extension of its partnership with Intelsat to offer increased Ku and C-band satellite connectivity to maritime customers in the cruise and merchant shipping sectors. This helped the companies provide a unique level of coverage in waters as far south as Antarctica and ocean regions around Africa and the Middle East. This enhanced the company's presence in the market.

- In May 2021, Orbit Communications Systems Ltd. launched the product named OceanTRx4 Mil Platform for the Israeli Navy. The OceanTRx 4 Mil system combines RF performance and great system availability for security customers, making it easy to deploy, maintain, and update. Through this company offered innovative solutions based on end consumers' demands.

Middle East and Africa Very Small Aperture Terminal (VSAT) Market Scope

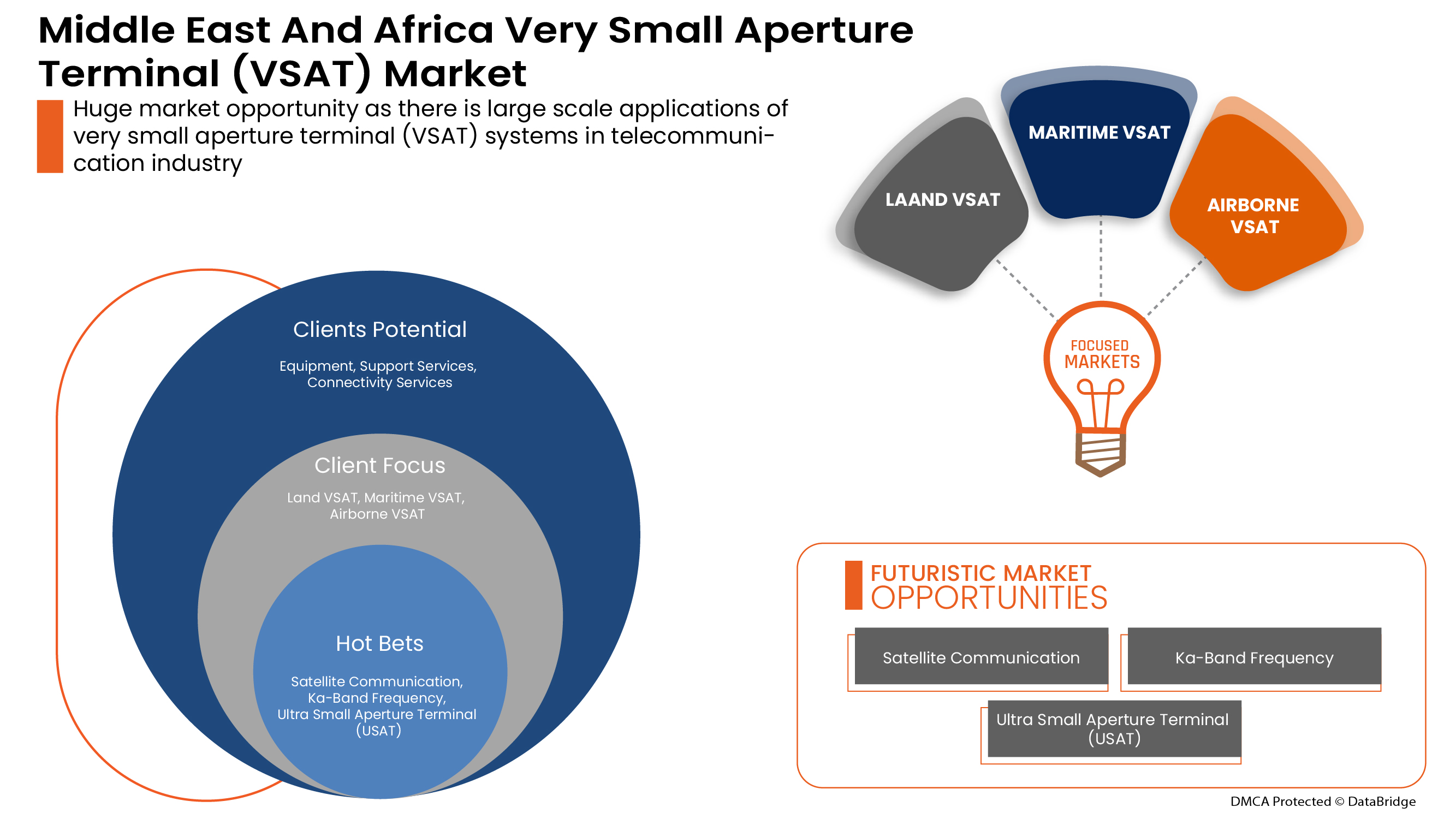

Middle East and Africa very small aperture terminal (VSAT) market is segmented on the basis of by solution, platform, frequency, network architecture, design, vertical, end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Equipment

- Support Services

- Connectivity Services

On the basis of solution, the Middle East and Africa very small aperture terminal (VSAT) market is segmented into equipment, support services, connectivity services.

Platform

- Land VSAT

- Maritime VSAT

- Airborne VSAT

On the basis of platform, the Middle East and Africa very small aperture terminal (VSAT) market has been segmented into land VSAT, maritime VSAT, airborne VSAT.

Frequency

- Ku-Band

- C-Band

- Ka-Band

- X-Band

On the basis of frequency, the Middle East and Africa very small aperture terminal (VSAT) market has been segmented into Ku-band, C-band, Ka-band, X-band.

Network Architecture

- Star Topology

- Mesh Topology

- Hybrid Topology

- Point-To-Point Links

On the basis of network architecture, the Middle East and Africa very small aperture terminal (VSAT) market has been segmented into star topology, mesh topology, hybrid topology, point-to-point links.

Design

- Rugged VSAT

- Non-Rugged VSAT

On the basis of design, the Middle East and Africa very small aperture terminal (VSAT) market is segmented into rugged VSAT, non-rugged VSAT.

Vertical

- Telecommunication

- Maritime

- Aviation

- Government and Defense

- Media and Entertainment

- Transportation and Logistics

- Energy and Power

- Mining and Construction

- Manufacturing

- BFSI

- Retail

- Automotive

- Transportation and Logistics

- Healthcare

- Education

- Agriculture and Forestry

- Others

On the basis of vertical, the Middle East and Africa Very Small Aperture Terminal (VSAT) market is segmented into telecommunication, maritime, aviation, government and defense, media and entertainment, transportation and logistics, energy and power, mining and construction, manufacturing, bfsi, retail, automotive, transportation and logistics, healthcare, education, agriculture and forestry, others.

End Use

- Broadband/Data Network

- Voice Communication

- Private Network Service

- Broadcast

- Others

On the basis of End Use, the Middle East and Africa very small aperture terminal (VSAT) market is segmented into broadband/data network, voice communication, private network service, broadcast, others.

Middle East and Africa Very Small Aperture Terminal (VSAT) Market Regional Analysis/Insights

Middle East and Africa very small aperture terminal (VSAT) market is analyzed, and market size insights and trends are provided by country, material type, manufacturing process, and end-use industry, as referenced above.

The countries covered in the Middle East and Africa very small aperture terminal (VSAT) market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa.

Israel dominates the Middle East and Africa region owing to increasing initiatives for advancing its technology adoptions and satellite communication activities.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Very Small Aperture Terminal (VSAT) Market Share Analysis

Middle East and Africa very small aperture terminal (VSAT) market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the very small aperture terminal (VSAT) market.

Some of the major players operating in the Middle East and Africa very small aperture terminal (VSAT) market are Vizocom Company, C-COM Satellite Systems Inc, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLMiddle East and Africa, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, General Dynamics Corporation, Honeywell International Inc., Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., Middle East and Africa Invacom among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR MIDDLE EAST & AFRICA MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 SOUTH AFRICA

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MIDDLE EAST & AFRICA INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL MIDDLE EAST & AFRICA

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 MIDDLE EAST & AFRICA SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.